HSBC James Capel Australia Portfolio Analyser Risk Tool

- 1. HSBC James Capel Australia Member HSBC Group HSBC James Capel: Portfolio research 1 November 1997 Portfolio research Portfolio Analyser Risk analysis of Australian equities The HSBC James Capel Portfolio Analyser is tailored to the unusual structure of the Australian sharemarket – the high concentration of mining companies. It consists of a spreadsheet that analyses the risk of a portfolio of Australian equities. The Portfolio Analyser highlights the overall risk of a portfolio against a number of different benchmarks and, importantly, the sources of this risk in terms of both stocks and sectors. The style views approach enables assessment of the portfolio using more than one paradigm. This allows investors to better allocate stocks to match their views of sector groupings, or the risk of the portfolio. The key benefit of the Portfolio Analyser over rival products is its ability to interrogate the engine, rather than being presented with a “black–box” approach. Contact +61-3-9229+ Ext Colin Ritchie 3572 colin.ritchie@hsbcib.com

- 2. November 1997 Portfolio Analyser 2 HSBC James Capel: Portfolio research Contents Overview – getting to know portfolio risk ....................................................................... 3 Entering a portfolio ........................................................................................................... 4 Summary statistics............................................................................................................ 5 Overall break-down of tracking variance ........................................................................ 6 Sensitivity analysis of tracking variance ......................................................................... 7 Stocks outside the portfolio........................................................................................................9 Stock contributions to tracking variance....................................................................... 10 Tracking error – popular misconceptions ..................................................................... 11 Tracking error & residual error....................................................................................... 13 Beta & residual error ....................................................................................................... 13 Vasicek beta adjustment ...........................................................................................................14 Stock statistics ................................................................................................................. 15 Price-earnings ratio, coefficient of variation & dividend yield...............................................15 Slicing & dicing................................................................................................................ 16 Sector analysis – ASX break-down...........................................................................................16 Size analysis...............................................................................................................................17 Value growth analysis ...............................................................................................................18 Industrial portfolio plot..............................................................................................................18 Cluster analysis..........................................................................................................................19 Pairs .................................................................................................................................. 19 Spearmans correlation.................................................................................................... 21 Style views ....................................................................................................................... 22 Engine............................................................................................................................... 23 Tracking error of portfolio returns relative to a benchmark...................................................23 Estimating the covariance matrix of the residual returns of stocks in the index .................24 Portfolio Analyser – Benchmark menu.....................................................................................25 Australian Research Team contacts .............................................................................. 26 The screen dumps illustrated on page 1 and throughout this document are for illustrative purposes. Data shown is calculated as at the date appearing “on screen”, 30 September 1997.

- 3. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 3 Overview – getting to know portfolio risk The Portfolio Analyser contains a series of worksheets to help equity managers form a new portfolio, or better understand aspects of an existing portfolio. It concentrates on the overall risk of the portfolio that is represented by the beta of the portfolio relative to the benchmark. Not only does the analyser give a break- down of stocks’ contributions to the portfolio beta, it also highlights the impact on tracking variance of stocks selected both within the portfolio, and those excluded from the portfolio – the active portfolio. The beta of the portfolio is the measure of the expected sensitivity to movements in the benchmark – the overall risk of the portfolio. The beta explains most of its expected returns. However, unless the portfolio is identical to the benchmark, a slight tracking deviation exists. The tracking deviation is analysed and attributed between different stocks and sectors. The Portfolio Analyser will, for example, highlight those stocks that make up most of the likely volatility in the excess returns of the portfolio against the benchmark. In particular, this volatility may be due to stocks excluded from the portfolio. (Not only is the inclusion of a stock in a portfolio an active decision, but so too its exclusion.) Industry break-up of the sharemarket Resources 25% Industrials 75% The Australian sharemarket is markedly different to overseas sharemarkets due to its high concentration of resources companies. At the end of September 1997, resources companies represented 24.9% of the market capitalisation of the ASX’s All Ordinaries index. Given that the resources stocks’ relative share price returns tend to move in opposite directions to the industrial stocks’ relative returns, this may lead to unintentional “bets” occurring in the portfolio. Also, companies that may be classified as industrial stocks can display positive covariance with resources stocks. For instance, ICI Australia and Simsmetal both present high correlations with resources stocks due to the nature of the drivers of their respective businesses. In most instances, an experienced equity manager will be aware of the areas or stocks that might generate surprises in the portfolio’s returns. The purpose of the Portfolio Analyser is to highlight unintentional bets that may have emerged in an Australian portfolio. Tracking deviation analysed and attributed to stocks and sectors Resources companies represent 24.9% of the Australian market

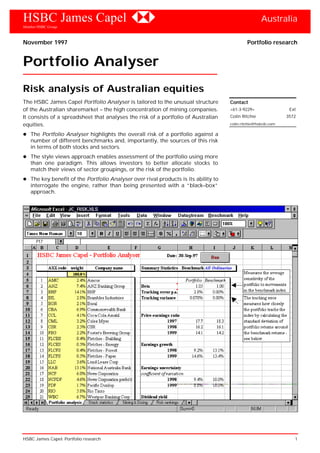

- 4. November 1997 Portfolio Analyser 4 HSBC James Capel: Portfolio research Entering a portfolio The portfolio is entered into the Portfolio analysis worksheet. This can be done manually, or stocks and weightings can be cut and pasted from an existing product. You are also able to start with a base portfolio, clear an existing portfolio ready to enter a new one, or re-base your portfolio stock weights to add to 100% – via the Benchmark menu (see the insert “Portfolio Analyser – Benchmark menu” on page 25 for more details.) The company name column will automatically show whether the stock entered exists in the database. If the portfolio includes some cash, a separate security code can be entered as CASH, accompanied by the appropriate weighting. When you have finished entering the portfolio, select a different benchmark via the Benchmark menu and/or push the [RUN] button. Once the [RUN] button has been pushed all the worksheets will be updated, yielding summary statistics and graphs related to your portfolio. Portfolios can be cut and pasted to/from existing products HSBC James Capel - Portfolio Analyser Date: 30-Sep-97 ASX code weight Company name Summary Statistics - Benchmark All Ordinaries 100.0% 1 AMC 2.4% Amcor Portfolio Benchmark 2 ANZ 7.4% ANZ Banking Group Beta 1.05 1.00 3 BHP 14.1% BHP Tracking error p.a. 2.8% 0.00% 4 BIL 2.8% Brambles Industries Tracking variance 0.078% 0.00% 5 BOR 2.1% Boral - All Ordinaries volatility 13.3% 6 CBA 6.9% Commonwealth Bank 7 CCL 4.1% Coca-Cola Amatil Price-earnings ratio 8 CML 3.2% Coles Myer 1997 17.7 18.3 9 CSR 2.5% CSR 1998 16.2 16.1 10 FBG 2.2% Foster's Brewing Group 1999 14.1 14.2 11 FLCBS 0.4% Fletcher - Building 12 FLCES 0.5% Fletcher - Energy Earnings growth 13 FLCFS 0.4% Fletcher - Forest 1998 9.2% 13.1% 14 FLCPS 0.5% Fletcher - Paper 1999 14.6% 13.4% 15 LLC 3.6% Lend Lease Corp 16 NAB 13.1% National Australia Bank Earnings uncertainty 17 NCP 6.0% News Corporation coefficient of variation 18 NCPDP 4.6% News Corporation preferred 1998 9.4% 10.0% 19 PDP 1.7% Pacific Dunlop 1999 8.8% 10.0% 20 RIO 5.8% Rio Tinto 21 WBC 6.7% Westpac Banking Corp Dividend yield 22 WMC 3.2% WMC 1997 3.4 3.6 23 WOW 2.2% Woolworths 1998 3.7 3.9 24 WPL 3.8% Woodside Petroleum 1999 4.2 4.4 25 26 Dividend growth 27 1998 7.9% 8.9% 28 1999 12.7% 11.4% 29 30 Overall breakdown of Tracking variance 31

- 5. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 5 Summary statistics The first box details the summary risk and valuation statistics. In order they are: Beta: this measures the expected average sensitivity to a movement in the benchmark returns. A figure of 1.10 means that the portfolio is 10% more sensitive to a movement in the benchmark. For example, if the benchmark rises by 10% the portfolio would, on average, rise by 11%. The beta of a portfolio accounts for most of its expected volatility around the index. The beta of the portfolio is derived from the individual stocks’ betas which, in turn, have been adjusted using a Vasicek adjustment (see the insert “Vasicek beta adjustment” on page 14 for more details). Tracking error: although the beta explains most of the volatility of a portfolio around the index, a slight residual error usually remains. This residual error is caused by stock-specific events (say, an operational failure) or specific industry events (eg, the removal of a fuel rebate) that is not related to the overall market effects. The tracking error incorporates this residual error by measuring the standard deviation of the excess returns of the portfolio (for more details on the actual calculation refer to the section titled “Engine” on page 23.) A figure of say, 2%, suggests that the portfolio will display returns, in the majority of instances (65%), in a band of plus or minus 2% around the difference between the mean return of the portfolio and the benchmark. Note: refer to the section titled “Tracking error –popular misconceptions” on page 11. Tracking variance: this figure is the tracking error squared. In analysing the tracking error of the portfolio against the benchmark, the tracking variance is used because mathematically only variance can be added and subtracted – not standard deviations (tracking error). Price-earnings ratio: the current price of each stock is divided by the actual and expected EPS estimates for the calendar years detailed to derive the price- earnings ratio (PE) for each stock. These PE ratios are then market-weighted and portfolio-weighted (by weighting the reciprocal of the PE ratio, the earnings yield) to measure respective PE ratios. Earnings growth: the earnings growth of the market and the portfolio are the implied percentage growth rates in the PE ratio of the portfolio and market. Earnings uncertainty: the standard deviation of the consensus estimates of the mean EPS for each stock is divided by its mean EPS. This has the effect of standardising a level of uncertainty in the EPS estimates for each stock – normally referred to as the coefficient of variation (CV). These CVs are then market and portfolio-weighted for each calendar year. Dividend yield: the dividends of each of the stocks are divided by the current price of each stock to derive their respective dividend yields. These dividend yields are then market-weighted and portfolio-weighted to measure their respective dividend yields. Dividend growth: the dividend growth of the market and the portfolio are the implied percentage growth rates in the dividends of the portfolio and market. Tracking variance is best for manipulating data

- 6. November 1997 Portfolio Analyser 6 HSBC James Capel: Portfolio research Overall break-down of tracking variance In analysing the tracking error of the portfolio against the benchmark, the tracking variance is used because, mathematically, only variances can be added and subtracted. The chart below provides a quick snapshot of the level of extra risk flowing into the portfolio because certain stocks, or groups of stocks, tend to move together – either in the same or opposite directions. This extra risk is referred to as the “sector effect”, and it is a more general in its application than just looking at the sector exposures as defined by the ASX. Overall break-down of tracking variance 0.00% 0.02% 0.04% 0.06% 0.08% Stock specific effect Sector effect Total The remainder is the risk flowing from the respective stock weightings. This is a function of how heavily weighted in the portfolio the stock is relative to the benchmark, and/or the volatility of the stock’s returns relative to the benchmark. The ratio between specific variance and the “sector effect” can be used as a measure of the managers strategy. For instance, if the intended strategy is one of “stock picking”, then the expectation would be for a small fraction of the risk being due to the “sector effect”. Sector effect shows the extra risk in the portfolio – certain stocks tend to move together

- 7. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 7 Sensitivity analysis of tracking variance The chart below shows the sensitivity of the tracking variance to changes in the weightings of stocks in the portfolio. From the total portfolio of stocks the top 10 diversifying stocks and the bottom 10 least-diversifying stocks are displayed. The term “diversifying” means that an increase in the relative weighting of a stock in the portfolio will reduce the tracking variance of the portfolio. Conversely, an increase in weighting of the least-diversifying stocks will increase the tracking variance and, in turn, the tracking error of the portfolio. These sensitivity measures are a helpful guide to index funds or low-tracking funds that need to tightly control the tracking error around the benchmark. As an example of this sensitivity analysis, we’ll assume that the tracking error of the portfolio is too high. Looking at the chart below, the most-diversifying stock in the portfolio is WMC. Buying more WMC will reduce the tracking variance. However, increasing the weighting of one stock means that the weighting of another stock will need to fall. The best pick would be to reduce the weighting of The News Corporation (NCP). -0.0080% -0.0060% -0.0040% -0.0020% 0.0000% 0.0020% 0.0040% 0.0060% 0.0080% WMC RIO BHP FBG PDP FLCFS FLCPS FLCBS FLCES CSR NCP NCPDP WBC WPL ANZ CBA CCL CML NAB LLC Most diversifying Least diversifying The actual calculations would run as follows: Firstly, the current tracking error is a low 2.8%. The tracking variance is 0.078% – this is the term that is used to calculate the new tracking variance and ultimately the tracking error (see the section “Tracking variance” on page 5 for details). Sensitivity analysis highlights the most- diversifying and least- diversifying stocks

- 8. November 1997 Portfolio Analyser 8 HSBC James Capel: Portfolio research A 1% increase in the relative weighting in WMC should decrease the tracking variance by 0.00604% (see the previous chart.) Similarly, a 1% decrease in the weighting of NCP will reduce the tracking variance by 0.00754%. Therefore, the final tracking variance should be 0.07785% minus 0.00604% (the increase in WMC) and minus 0.00754% (the decrease in NCP) which equals 0.06427%. This equates to a tracking error, the standard deviation, of 2.535%. In other words, the changes in the relative weightings of WMC and NCP have reduced the tracking error from 2.790% to 2.535%. Another way to calculate the new tracking error would be to perform the operation on the spreadsheet, as shown below: Summary Statistics - Benchmark All Ordinaries Portfolio Benchmark Beta 1.05 1.00 Tracking error p.a. 2.560% 0.00% Tracking variance 0.066% 0.00% As expected, the tracking error has dropped. But it is a little higher than expected using the numbers derived from the sensitivity analysis. The reason for the slight difference is that the sensitivity analysis uses the “instantaneous” change in the relative weights of each stock. It is roughly equal to a 1% change in the relative weights of each stock in the portfolio. (see the end of the section titled “engine” on page 23 for the calculation of “sensitivity to tracking variance”).

- 9. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 9 Tracking variance – stocks outside the portfolio The previous example only dealt with the contribution of stocks in the portfolio to the tracking variance. However, stocks within the benchmark, but not in the portfolio, also contribute to variance. Hence, the top 10 most-diversifying stocks and bottom least-diversifying stocks in the benchmark can also be examined. With the press of a button these stocks can be viewed. The chart on the previous page can also be viewed in tabular form. The table below shows the contribution of the top 10 most-diversifying stocks and the bottom 10 least-diversifying stocks from the total benchmark to tracking variance. Sensitivity analysis of tracking variance 115 CRT -0.0156% 114 EMP -0.0153% 113 CRI -0.0148% 112 CMX -0.0132% 111 SVR -0.0128% 110 KGM -0.0124% 109 MMC -0.0122% 108 SBM -0.0120% 107 AWA -0.0118% 106 QNI -0.0117% 1 NCP 0.0075% 2 NCPDP 0.0074% 3 WBC 0.0069% 4 WPL 0.0065% 5 ANZ 0.0060% 6 CBA 0.0055% 7 CCL 0.0054% 8 CML 0.0051% 9 NAB 0.0047% 10 LLC 0.0042% As can be seen from the table above, a 1% increase in Consolidated Rutile (CRT) has a far greater effect on decreasing variance, than the previous example of a 1% increase in WMC. At the same time, NCP remains the least-diversifying stock. Therefore, the final tracking variance should be 0.07785% minus 0.0156% (the increase in CRT) and minus 0.00754% (the decrease in NCP), which equals 0.05474%. This equates to a tracking error of 2.340%. In other words, the changes in the relative weightings of Consolidated Rutile (CRT) and NCP have reduced the tracking error from 2.790% to 2.340%. Showbenchmark stocks

- 10. November 1997 Portfolio Analyser 10 HSBC James Capel: Portfolio research Stock contributions to tracking variance The “Contribution of stocks to the tracking variance” chart displays the contribution of the top 15 stocks to the tracking variance of the portfolio. A smaller portfolio of nine stocks is shown below for clarity. NAB 12% NCP 10% WBC 9% ANZ 9% CBA 7%NCPDP 7% WPL 5% CCL 4% CML 3% Remainder 33% This break-up of the tracking variance is different to the sensitivity of the tracking variance to each stock. A stock may represent a large slice of the overall tracking variance of the portfolio, yet there may be other stocks that can generate a bigger change in the tracking error from a 1% change in their relative weighting in the portfolio. Normally, the two tables are related but there can be instances, such as an overweighting or underweighting in the larger capitalisation stocks, when they differ. Some stocks due to the way they covary with other stocks on the portfolio might subtract tracking variance from the total portfolio. Negative contributions are still highlighted in the pie chart but are displayed near the remainder. Also, only stocks in the portfolio are displayed in the pie chart. It is quite possible that there are other stocks in the market that affect the tracking error more than the companies in the portfolio. For a complete listing of all the stocks in the benchmark and their contribution to the tracking variance refer to the worksheet “Risk rankings”. The table on the next page is an extract from the “Risk ranking” worksheet. Here you can not only see the contribution of tracking variance of stocks within the physical portfolio, but also those within the active portfolio. That is, stocks within the benchmark, that are actively excluded from the portfolio. Of interest, in this example, is the fact that Comalco (CMC) is the seventh-largest positive contributor to tracking variance through its exclusion from the portfolio. The portfolio, in this case, being the 20 Leaders index, against the All Ordinaries as the benchmark. Tracking variance break-up differs from the sensitivity of tracking variance to each stock

- 11. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 11 Contribution of all stocks in the benchmark to Tracking variance Ranking ASX % contribution code 1 NAB 11.6% 2 NCP 9.6% 3 WBC 9.3% 4 ANZ 8.9% 5 CBA 7.4% 6 NCPDP 7.3% 7 CMC 6.4% Not in Portfolio 8 WPL 5.1% 9 CCL 4.2% 366 WFT -1.4% Not in Portfolio 367 SGB -2.6% Not in Portfolio 368 WMC -7.1% 369 RIO -8.3% 370 BHP -14.7% Tracking error – popular misconceptions It is worth discussing some popular misconceptions about tracking errors of portfolios. Tracking errors measure the volatility of the excess returns of a portfolio. They are often viewed as a measure of the potential returns that a fund manager can add to a portfolio. For example, a particularly low tracking error is perceived to flow from a portfolio that closely tracks the index returns. In fact, fund managers running active portfolios are often criticised if their tracking errors are too low. Conversely, fund managers with high tracking errors are perceived to be aggressive, and have the potential to add a significant excess return to the portfolio. But how correct are these notions? Depending upon a critical assumption, they are misleading. The critical assumption is the expected return from the portfolio after taking into account the sensitivity of the portfolio to the market index. The excess returns of a portfolio can be shown to be a function of three elements. Firstly: excess returns = returns of portfolio minus returns of market index. Now the sensitivity of the portfolio against the market, or beta, accounts for the majority of its return. So the returns of the portfolio could be rewritten as: returns of portfolio = a constant return plus beta of the portfolio times returns of the index plus a random residual return. E[r] = rP - rM rP = αα P + ββP *rM + εε

- 12. November 1997 Portfolio Analyser 12 HSBC James Capel: Portfolio research Therefore, the excess returns of the portfolio are: excess returns = a constant return plus (beta of the portfolio – 1) times returns of the index plus a random residual return. In other words, the excess returns of a portfolio against the index are determined by: a constant return (that reflects the return added by a fund manager over time); the beta of the portfolio; and a random residual return due to specific company or industry effects. The average excess return is simply: average excess return = a constant return plus (beta of the portfolio – 1) times average return of the index. (The random residual return disappears given that, on average, it is equal to 0.) Now, the important point is that the tracking error is the standard deviation of the excess returns around this average. To be precise, the tracking variance (the standard deviation squared) is equal to: tracking variance = (beta of the portfolio - 1) 2 times variance of the index returns plus variance of residual returns. For more details on actual calculation refer to the “Engine” spreadsheet. When the beta of the portfolio is equal to 1.0, the same as the market index, the average excess return collapses to the constant return or value-added by the fund manager. Therefore, the tracking variance is the dispersion of returns around this constant return. In theory, a fund manager could exhibit a markedly low tracking error, but an extremely high constant return over the index. In this case, it would be incorrect to assume that a low tracking error equates to an index-type performance, unless, it is assumed that the fund manager’s returns will, on average, be equal to the index. Similarly, a high tracking variance is only one part of the equation. The other part is the average expected returns that are likely to be added by the fund manager. E[r] = αα P + (ββP -1)*rM + εε Average excess return E = αα P + (ββP -1)*rM VP = (ββP -1) 2 *VM + Vεε Tracking variance is one part of the equation – the other is average expected return added by the fund manager

- 13. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 13 Tracking error & residual error How does the tracking error relate to the residual error of the stock and the portfolio? Following on from the previous section, the tracking variance incorporates the measure of the residual variance, plus the beta of the portfolio. The reason that the beta of the portfolio enters into the equation is that the tracking error is defined as the volatility of the excess returns of the portfolio around the benchmark. Whereas the residual variance is the volatility of the portfolio returns around the beta-adjusted benchmark returns (or the line of best fit). If the portfolio displays a beta of 1.0, that is, the same as the benchmark, the residual error and the tracking error are equivalent (VP = (βP -1) 2 *VM + Vε , if βP = 1.0 then VP = Vε). However, as the beta moves away from 1.0 the tracking variance increases above the residual variance. The tracking error could be visualised as the deviation of the stocks or portfolio returns in the graph below, from another line of best fit which has a slope of 1.0 (the benchmark beta). The risk space (either residual or tracking variance) can be selected on the first spreadsheet, “Portfolio analysis”, by choosing the Risk space option under the Benchmark menu. The full Benchmark menu has been detailed in the shaded insert on page 25. -10 -8 -6 -4 -2 0 2 4 6 8 -15 -10 -5 0 5 10 15 Beta =slope of line Stock returns Benchmark returns Residual error = standard deviation of residuals Beta & residual error The beta is calculated using the preceding 48 months of returns of each stock (including dividends) against the accumulation indices of each benchmark. The beta provides a measure of the average sensitivity of each stock to a movement in the benchmark. Note that the beta has been constructed using a Capital Asset Pricing model where the returns from the risk-free rate have been subtracted from the monthly returns of each stock (the 90-day bank bill accumulation index has been used).

- 14. November 1997 Portfolio Analyser 14 HSBC James Capel: Portfolio research Finally, the betas have been adjusted for each stock, using a so-called Bayesian adjustment. This adjustment helps to provide a better estimate of the future beta of the stock. The adjustment is known as a Vasicek adjustment and basically pulls the beta back towards 1.0, (the market beta) if the estimation error in the beta is higher than other stocks’ betas (see the insert “Vasicek beta adjustment” below for more details). The residual error of each stock is the standard deviation of each stock’s returns around the beta-adjusted market returns. The residual error and beta of a stock is graphed on the page opposite. The beta of the stock can be pictured as the line of best fit between the stock returns and the market returns (before the Vasicek adjustment). The more sensitive the stock to the market, the higher the beta and the more steeply inclined is the slope of the line. The residual error is a measure of the dispersion of the “unexplained” part of the returns around the line of best fit (or beta). These errors are assumed to fall in a normal bell-shaped distribution around the line of best fit. The residual error is measured in terms of one standard deviations given that this captures the majority of the residual returns. Vasicek beta adjustment The beta of a stock is an important component in the calculations of the risk-adjusted returns. Originally, beta factors were simply estimated from past data by least-squares regression procedures. The least-squares technique consists of fitting a linear relationship between monthly rates of return of a stock and the market index so that the sum of squared differences between the stock’s actual returns and forecast returns are minimised. The Vasicek beta adjustment provides a better estimate of the future beta of a stock. It does this by incorporating some additional information outside the sample of returns of the stocks and the market index. This additional information is the fact that the beta of the market must be 1.0. This information is combined with the sample estimator, the least-squares estimator of the beta, using Bayesian statistics. The formula for the adjustment is detailed below; Beta`i= 1/m 2 + Betai/s 2 1/m 2 + 1/s 2 where: Beta`i is the Vasicek adjusted beta of stock i Betai is the least squares estimator beta of stock i s is the standard error of Betai m is the market weighted average of all the standard errors of betai For an example, assume a stock’s unadjusted beta is 1.50 with a low degree of accuracy, indicated by a 0.60 standard error. This compares to a market beta and standard error of 1.0 and 0.36, respectively. The adjusted beta would be: Beta`I = (7.7 + 4.2) = 11.9 = 1.13 (7.7 + 2.8) 10.5 In other words, a beta of 1.13 provides a better estimate of the “underlying beta”. For more information refer to "A note on Cross-Sectional Information in Bayesian Estimation of Security Betas", Journal of Finance 28 (December 1973), pp1233-1239. Betas are modified via a Vasicek adjustment

- 15. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 15 Stock statistics This spreadsheet details a number of risk and valuation statistics for each stock. This is a report page and no information needs to be entered on this spreadsheet. HSBC James Capel - Portfolio Analyser ASX code Company name weight Price Index Beta Residual 30-Sep-97 weight error p.a. Total 100.0% Portfolio 54.02% 1.05 2.8% 1 AMC Amcor 2.4% 8.69$ 1.31% 1.106 11.6% 2 ANZ ANZ Bank 7.4% 11.28$ 3.99% 1.010 17.1% 3 BHP BHP 14.1% 16.08$ 7.61% 1.144 13.7% 4 BIL Brambles Industries 2.8% 28.75$ 1.50% 1.084 14.8% 5 BOR Boral 2.1% 4.18$ 1.13% 0.927 14.6% 6 CBA Commonwealth Bank 6.9% 17.04$ 3.72% 0.969 13.5% 7 CCL Coca Cola Amatil 4.1% 14.77$ 2.19% 1.015 25.1% The first table, as shown above, simply lists the stocks entered from the portfolio analysis page. The next table lists the share price, benchmark index weight, the beta and tracking error (see the section “Beta and residual error” on page 13 for more details). Price-earnings ratio, coefficient of variation & dividend yield The remaining tables on the Stock analysis page, shown below, list the price- earnings ratio (PE), the coefficient of variation (CV), and the dividend yield (DY) for each stock in the portfolio. 1997 PE 1998 PE 1999 PE 1998 CV 1999 CV 1997 DY 1998 DY 1999 DY 17.7 16.2 14.1 9.4% 8.8% 3.4 3.7 4.2 21.6 17.8 14.9 7.2% 9.0% 4.4 4.6 4.7 13.1 12.4 11.5 4.6% 6.9% 4.3 5.0 5.6 19.0 16.8 14.4 11.6% 14.2% 3.2 3.2 3.8 26.4 22.8 20.2 3.1% 3.8% 2.6 2.7 2.7 27.0 19.5 15.2 9.6% 8.8% 3.6 3.8 4.3 12.9 12.9 11.9 2.7% 4.1% 6.0 6.5 7.1 44.7 40.6 35.3 9.5% 12.0% 1.3 1.4 1.5 The PE ratio is defined as the current price divided by the estimated earnings per share (EPS) for each calendar year. The CV measures the degree of dispersion of analysts’ estimates around the mean EPS. Low CV figures indicate that analysts’ forecasts are tightly clustered around the mean – implying lower earnings risk. The dividend yield is defined as the estimated dividend per share divided by the current price for each year.

- 16. November 1997 Portfolio Analyser 16 HSBC James Capel: Portfolio research Slicing & dicing This spreadsheet slices up the tracking variance of the portfolio into different risk perspectives. These risk perspectives may change over time and are a function of how investors view the Australian sharemarket. The advantage of this sort of technique is that we are not bound by a certain risk model or paradigm in analysing the Australian sharemarket. For example, stocks could be classified into a “bottom-up” risk classification, perhaps by balance sheet and earnings risk. However, at other times, style classification may be more important – growth versus value stocks. By using different views of risk we are unlikely to be surprised by the emergence of a new clustering of stocks in the portfolio. The risk perspectives are based on two different techniques – a classification technique and a factor analysis. The first classifies stocks by either membership or non-membership of certain groupings or sectors. There are three different views of the portfolio risk based on this method: ASX sector break-down; small and large-capitalised segmentation; and value and growth views. The other method looks at the correlations of different stocks’ returns. If two stocks display similar return profiles, irrespective of their ASX sector classification, it might suggest that they are being affected by certain common factors. By unravelling the correlations of all the stocks, a number of common factors can be identified as driving the returns of stocks. Using a factor analysis of the correlations of all stocks, the Australian market divides neatly into basically industrial stocks and resources stocks. These sector groupings are different to the ASX break-down – for example ICI tends to display a return profile similar to resources stocks. Further, these sector groupings are not just based on membership or non-membership of the sectors. A loading or sensitivity for each stock is calculated for each factor. An advantage of this factor analysis is that the stocks’ returns reveal potentially new groupings in the Australian market – which would not be evident using a simple classification system based on a certain risk model or paradigm. Sector analysis – ASX break-down The chart opposite compares the portfolio against the ASX sector groupings and weightings. Additionally, the tracking variance is attributed between the different sectors and graphed in the bar chart. If the beta is different to 1.0 then part of the tracking error will be due to the higher or lower sensitivity of the portfolio against the index. This extra risk is classified as “market risk” because a higher or lower beta is equivalent to taking an increased or decreased bet on the market. Another use of this spreadsheet is in analysing the sectors weights in different benchmarks. For example, what are the two largest sector weightings in the ex- ASX 100 index? The answer: Property Trusts and Miscellaneous Industrials! Slicing the tracking variance into different risk perspectives

- 17. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 17 HSBC James Capel - Portfolio Analyser 1. Sector Analysis - ASX breakdown % contribution ASX code Sector Portfolio Index Difference to tracking variance 1 GOLD 0.0% 2.6% -2.6% 9.4% 2 METALS 3.2% 5.3% -2.1% 16.1% 3 DIVRES 19.9% 12.0% 7.9% -20.0% 4 ENERGY 4.4% 5.1% -0.8% 6.9% 5 UTILITIES 0.0% 0.9% -0.9% 0.6% 6 DEVCON 3.6% 3.8% -0.2% 3.5% 7 BLDMAT 5.0% 4.4% 0.5% 4.8% 8 ALCTOB 2.2% 1.8% 0.4% -0.8% 9 FOODHH 4.1% 3.4% 0.6% 2.7% 10 CHEMIC 0.0% 1.1% -1.1% 2.9% 11 ENGIN 0.0% 0.7% -0.7% 0.9% 12 PAPER 3.3% 1.9% 1.4% 0.4% 13 RETAIL 5.4% 3.8% 1.6% 4.1% 14 TRANSP 2.8% 3.0% -0.2% 4.2% 15 MEDIA 10.6% 9.0% 1.6% 19.9% 16 BANKS 34.0% 21.6% 12.5% 35.3% 17 INSUR 0.0% 2.8% -2.8% -1.2% 18 TELECOM 0.0% 0.2% -0.2% 0.3% 19 INVFIN 0.0% 2.0% -2.0% 0.6% 20 PROPTY 0.0% 4.8% -4.8% -3.3% 21 HEALTH 0.0% 1.2% -1.2% 2.4% 22 MISIND 0.0% 1.5% -1.5% 0.9% 23 DIVIND 1.7% 4.5% -2.8% 3.5% 24 TOUR 0.0% 2.6% -2.6% 0.9% cash 0.0% 0.0% 0.0% 0.0% MARKET RISK (for tracking error) 5.0% 1 100.0% 100.0% 100.0% GOLD METALS DIVRES ENERGY UTILITIES DEVCON BLDMAT ALCTOB FOODHH CHEMIC ENGIN PAPER RETAIL TRANSP MEDIA BANKS INSUR TELECOM INVFIN PROPTY HEALTH MISIND DIVIND TOUR -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% GOLD METALS DIVRES ENERGY UTILITIES DEVCON BLDMAT ALCTOB FOODHH CHEMIC ENGIN PAPER RETAIL TRANSP MEDIA BANKS INSUR TELECOM INVFIN PROPTY HEALTH MISIND DIVIND TOUR Risk analysis by sector Size analysis The next view of the risk divides the portfolio into large and small capitalisation stocks. These are further sub-divided into industrials and resources. Again, the tracking variance is attributable across these different sectors. The definition of a small capitalisation is a company classified in the so-called ex-ASX 100 index. Risk Analysis by size % contribution 2. Size Analysis Portfolio Index Difference to tracking variance Industrials Large Top 100 72.6% 64.2% 8.3% 72.9% Industrials Small Ex 100 0.0% 10.8% -10.8% 9.9% Resources Large Top 100 27.4% 22.3% 5.2% 5.3% Resources Small Ex 100 0.0% 2.7% -2.7% 7.0% cash 0.0% 0.0% 0.0% 0.0% MARKET RISK (for tracking error) 5.0% 100.0% 100.0% 100.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% Large Industrials Small Industrials Large Resources Small Resources One area to closely monitor in the Australian market is the risk from the small resources stocks. Many of these companies are gold stocks that can display significant volatility.

- 18. November 1997 Portfolio Analyser 18 HSBC James Capel: Portfolio research Value growth analysis Stocks have also been classified into a value, growth or other category. A “value” stock denotes a company that is selling on a low price relative to its expected earnings, cash flow or net tangible assets. Additionally, these companies tend to sell on persistently low PE multiples – such as the banks. The full list of the stocks included in the value group (and any other grouping) is detailed in the “Style views” spreadsheet. Risk Analysis by style 3. Value|Growth Analysis % contribution Portfolio Index Difference to tracking variance Industrials Value 36.2% 26.4% 9.8% 40.0% Industrials Growth 21.0% 18.9% 2.1% 31.3% Industrials Other 42.8% 54.7% -11.9% 23.7% MARKET RISK (for tracking error) 5.0% 100.0% 100.0% 100.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% Value Industrials Growth Industrials Other Industrials The “growth” label is applied to those stocks which tend to sell on a persistently high share price relative to their current earnings, cash flow or net tangible assets. However, they are not just the opposite of a value stock. Companies may exhibit high PE ratios because current or expected earnings have collapsed. The distinguishing trait of a growth stock is its strong comparative advantage against its competitors – such as Coca-Cola Amatil. Industrial portfolio plot The final chart brings together some of the results of the previous risk tables. 4. Industrial portfolio plot - value|growth & large|small % contribution Risk profile by style and size for industrials Portfolio Index Difference to tracking variance Industrials Large 72.6% 64.2% 8.3% 72.9% Industrials Growth 21.0% 18.9% 2.1% 31.3% Industrials Small 0.0% 10.5% -10.5% 9.8% Industrials Value 36.2% 26.4% 9.8% 40.0% 0.0% 20.0% 40.0% 60.0% 80.0% Large Growth Small Value For the industrial stocks in the portfolio the style is mapped against the capitalisation bias. For example, is most of the risk coming from value and smaller stocks? This analysis is particularly useful in assessing different economic environments. In the Australian market, smaller capitalisation stocks tend to perform better in a strengthening economy. Further, value stocks attract more interest when the economy improves. In times of earnings downgrades and economic uncertainty, a more defensive portfolio would be positioned in the top right-hand quadrant of growth and larger capitalisation stocks.

- 19. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 19 Cluster analysis This table adopts the factor analysis technique and looks at the most important factor in the Australian market – the industrial/resources split A weighted score is provide for the cluster. The more positive the number from the industrial/resources factor, the more “industrial” like is the portfolio. Conversely, a negative figure would indicate a portfolio of stocks that acts like the resources companies. The industrial/resources split has always been the most important decision in the Australian market (at least in terms of the All Ordinaries index) and continues to dominate the correlation of stocks. 4. Cluster analysis Factor exposures Industrials/Resources Portfolio exposure 0.265 Index exposure 0.167 0.098 Positive figures = Industrial type portfolio Negative figures= Resource type portfolio Pairs This page lists all the significant correlations between pairs of different stocks – both significantly positive and negative correlations. This information is useful in looking for arbitrage opportunities in the market. For example, two companies’ share prices and dividend returns might move closely together – perhaps due to a similar sector exposure. If their share price returns move out of sync, for no apparent reason, we have the basis for a possible pairs trading opportunity. Alternatively, pairs correlations might suggest that certain other stocks outside the portfolio would provide a better exposure than the current stock in the portfolio (due to better value fundamentals). Industry Index wgt ASX code ASX code Spearmans correlation Industry Index wgt PROPTY 0.16% APF AAD 0.400 TOUR 0.08% METALS 0.90% CMC AAD 0.429 TOUR 0.08% INVFIN 0.02% EQK AAD 0.542 TOUR 0.08% DEVCON 0.03% MDC AAD 0.455 TOUR 0.08% BLDMAT 0.03% WFI AAD 0.426 TOUR 0.08% METALS 0.07% WSL AAD 0.469 TOUR 0.08% BANKS 0.05% BEN ABC 0.491 BLDMAT 0.07% The key data is in the middle of the table – two columns labelled ASX code and a third column listing the correlation coefficient (Spearmans correlation). The other columns are simply to sort the data by a number of criteria – ASX code, index weight and industry. There are arrows above each column which when selected will list a menu of different sector, ASX codes, or index weights. For example, a listing of bank correlations and stocks above 1% index weight was performed – see overleaf. The more positive the industrial/resources factor, the more “industrial” like the portfolio

- 20. November 1997 Portfolio Analyser 20 HSBC James Capel: Portfolio research Industry Index wgt ASX code ASX code Spearmans correlation Industry Index wgt DIVRES 7.61% BHP ANZ -0.403 BANKS 3.99% BANKS 3.99% ANZ CBA 0.572 BANKS 3.72% BANKS 3.99% ANZ NAB 0.468 BANKS 7.05% DIVRES 3.13% RIO ANZ -0.414 BANKS 3.99% BANKS 3.72% CBA ANZ 0.572 BANKS 3.99% DIVRES 7.61% BHP CBA -0.424 BANKS 3.72% DIVRES 3.13% RIO CBA -0.412 BANKS 3.72% METALS 1.72% WMC CBA -0.612 BANKS 3.72% BANKS 3.72% CBA NAB 0.510 BANKS 7.05% BANKS 7.05% NAB ANZ 0.468 BANKS 3.99% BANKS 7.05% NAB CBA 0.510 BANKS 3.72% DIVRES 3.13% RIO NAB -0.448 BANKS 7.05% METALS 1.72% WMC NAB -0.586 BANKS 7.05% BANKS 3.63% WBC ANZ 0.561 BANKS 3.99% BANKS 3.63% WBC CBA 0.428 BANKS 3.72% Not surprisingly, most of the major banks are highly correlated to each other’s returns (remember, this is after the market effect has been stripped out of the returns for each of the stocks). ANZ Banking Group is positively correlated to Commonwealth Bank of Australia to the tune of 0.572. But just how significant is 0.572? The maximum correlation is +1.0 (stocks move exactly in tandem) and the minimum -1.0 (stocks move in exactly the opposite direction). Only the significant correlation figures have been picked in the sense that there is only a 5% chance that these correlations are a “fluke” or random occurrence. An interesting point from the above table is the strong negative correlation (that is, they move in opposite directions) between many of the larger banks and mining stocks.

- 21. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 21 Spearmans correlation Variance and correlation provide a measure of linear association. They are sensitive to outliers and may indicate association where none exists. The Pearson’s product moment correlation coefficient uses residual returns. The Spearmans correlation coefficient is based on the ranking of stocks’ returns. This reduces the effect of outliers in the correlation. The correlation measure in the HSBC James Capel Portfolio Analyser is calculated using a Spearmans correlation statistic. To demonstrate the effects of outliers on the Pearson’s correlation coefficient, assume that the following five-monthly returns were exhibited for two stocks. Stock A Stock B 1 1% 2% 2 2% 3% 3 4% 3% 4 5% 4% Correlation statistic 0.8944 The correlation between the stocks is high at 0.89. Further we will assume that this correlation reflects the majority of returns. However, there will always be one unusual return month that upsets the figures. Say stock B exhibits a 10% fall in period 3. The new numbers are displayed below. Stock A Stock B 1 1% 2% 2 2% 3% 3 4% -10% 4 5% 4% Correlation statistic -0.2508 The correlation statistic has now reversed to -0.25. A better way to handle these rogue numbers is to use a more robust technique – the Spearmans correlation coefficient. The Spearmans correlation is based on the ranking of stocks’ returns. Instead of using the returns for each period, a simple ranking is performed from 1 (the lowest) to 4 (the highest). This means that rogue numbers simply affect the ranking of the return not the absolute number. Continuing on the above example (with the rogue minus 10% figure), the ranking of the stocks would be: Stock A Stock B rankings rankings 1 1 2 2 2 3 3 3 1 4 4 4 Correlation statistic 0.4000 The correlation statistic falls, but only to 0.40. When the sample of numbers and rankings are larger, the correlation statistic is not overly disturbed by outlying figures. The Spearmans correlation coefficients are used in the factor analysis for the Slicing & Dicing of the tracking variance. Correlation provides a measure of linear associations between stocks

- 22. November 1997 Portfolio Analyser 22 HSBC James Capel: Portfolio research Style views The “Style views” spreadsheet simply lists every stock in the All Ordinaries index with its categorisation in the ASX sector, small/large capitalisation and value/growth. INDUSTRIAL/RESOURCE SIZE VIEW VALUE/GROWTH VIEWS VIEW INDUSTRIAL RESOURCES INDUSTRIALS LARGE SMALL LARGE SMALL VALUE GROWTH TOP 100 EX 100 TOP 100 EX 100 AAA 0 1 0 0 0 1 0 0 AAD 1 0 0 1 0 0 0 1 ABC 1 0 0 1 0 0 0 0 ABF 0 1 0 0 0 1 0 0 ABG 1 0 0 1 0 0 0 0 ACH 1 0 0 1 0 0 1 0 ADB 1 0 0 1 0 0 1 0 ADZ 1 0 0 1 0 0 0 0 AFF 1 0 0 1 0 0 0 0 A part of the spreadsheet is displayed above. A ‘1’ indicates membership of the particular sector and ‘0’ non-membership. These columns of numbers are then used to pick out the relevant tracking variance contribution on the “Slicing & Dicing” spreadsheet. Apart from listing all the stocks that make up a particular sector, it can also be used as a template to derive other sector perspectives of the Australian sharemarket that more closely follow the investor’s perspective of risk.

- 23. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 23 Engine The engine is where all the calculations are performed. The tracking or residual error is calculated here and the sensitivity and contribution of each stock to the tracking/residual variance. The workings of this sheet is for the aficionados of portfolio analysis. The calculations are based on a so-called “statistical model” which decomposes the market residual covariance matrix into a smaller number of factors – using factor analysis. The covariance matrix is based on a more robust estimator of the correlations – the Spearmans correlation. The tracking variance and residual variance is calculated using the formulae in the shaded boxes below. Tracking error of portfolio returns relative to a benchmark Variance (tracking returnsi) = (wp-βp.wi)` Σ (wp - βp.wi) + (βp-1) 2 . s 2 i (1x1) (1xn) (nxn) (nx1) (1x1) where: n = the number of stocks in the index wp = the weights of each stock in the portfolio – a nx1 vector of weights wi = the weights of each stock in the index – a nx1 vector of weights βp = a scalar representing the beta of the portfolio relative to the index s 2 i = the variance of the index (per annum) – a scalar Σ = the covariance matrix of the residual returns of stocks in the index – an nxn matrix. This is estimated using a factor analysis of the Spearmans correlation matrix. The residual variance drops the last term: Variance (residual returnsi) = (wp-βp.wi)` Σ (wp - βp.wi) (1x1) (1xn) (nxn) (nx1) The tracking error or residual error (the standard deviation) is simply the square root of the above terms. The estimation of the correlation matrix is a critical part of the calculation of the tracking/residual variance. The correlation matrix is decomposed into a smaller number of factors that represent most of the variation in the correlations of the residual returns of stocks. If the correlation matrix is not collapsed into a smaller number of factors the spreadsheet would be overwhelmed by the number of calculations. Using the All Ordinaries index, there are 350-plus different securities which means a matrix of 350 times 350 – that is, 122,500 figures. A principal components analysis of the correlation matrix of the residual returns of every stock in the index reveals that 15 factors capture most of the variation in the matrix – roughly 75%. These 15 factors and the loadings of each stock on each factor are detailed in the middle of the spreadsheet. Covariance matrix is decomposed using factor analysis

- 24. November 1997 Portfolio Analyser 24 HSBC James Capel: Portfolio research In reducing the correlation matrix to these 15 factors, specific risk that presents as covariance is reduced. This leads to a correlation matrix that better reflects the future. That is, it has less noise from past stock specific events than just using a historical covariance matrix. The sensitivity of the tracking/residual variance to a change in each stock’s weighting is calculated by differentiating the tracking variance with respect to each stock’s weighting in the portfolio: Sensitivity of tracking variance = δ δ [( . )` ( . ) ( ) . ]w B w w B w B s w p p i p p i p i p − − + −Σ 1 2 2 Estimating ΣΣ, the covariance matrix of the residual returns, ej , of stocks in the index ej = Rj - Rf - (aj + bj •Ri ) (mx1) (mx1) (mx1) (mx1) where bj= the Vasicek adjusted beta for each company, j, based on a sample of 48 months Ri = the monthly logged returns (including dividends) for the index Rj = the monthly logged returns (including dividends) for each stock Rf = the monthly logged returns of the accumulation index of the 90 day bill rate Correlation (e1 , e2 , e3 .... ,en) = Ω Ω = an nxn Spearmans correlation matrix of residual returns for each stock, e j Using factor analysis – principal components technique, 15 factor loading vectors are extracted from Ω Ω = (λ1λ1` + λ2λ2` + λ3λ3` + ... λ15λ15`) + Ψ (nxn) (nxn) (nxn) where λk = the nx1 eigenvectors scaled by their respective eigenvalues Ψ = the residual matrix However, 15 factor loadings are not enough to specify the full communalities of each stock – only 75% on average is estimated. Therefore, the diagonals of the residual matrix are added to the matrix of multiplied eigenvectors – see below. Ω` = (λ1 λ1 ` + λ2 λ2 ` + λ3 λ3 ` + ... λ15 λ15 `) + Ψ` where Ψ` is a diagonal matrix of the residual terms and Ω` is the estimated correlation matrix. The final step is to convert the estimated correlation matrix, Ω`, into a covariance matrix Σ = σ σ` • Ω` (nxn) (nxn) (nxn) where σ is a vector of nx1 standard deviation of each stock’s residual returns. Fifteen factors capture 75% of the correlation matrix

- 25. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 25 Portfolio Analyser – Benchmark menu The Portfolio Analyser workbook utilises the EXCEL © menu structure for a series of functions. Choosing the Benchmark menu which sits between the Window and Help menu, the following options are available: Table of contents – an unique mechanism for navigating through the Portfolio Analyser. Risk space – changes between displaying tracking error and residual error. See “Tracking error and residual error” on page 13 for more details. Set portfolio – offers you the ability to set a starting portfolio based on the supplied benchmarks. Once you have this opening portfolio, you can change the weights or add and remove stocks to suit your investment strategy. Two additional menu items appear below “Set portfolio”. One allows you to <clear> all stocks and weights, so that you can start a portfolio again. The other is detailed below. Re-base existing stock to 100% – the Portfolio Analyser has been designed to ease the exchange of stocks and weights between itself and other products – such as HSBC James Capel’s Investment Edge © . 1 Hence you may copy a group of stocks and their market capitalisations from another product into the Portfolio Analyser. This menu item will then convert those market capitalisations into percentage weights that add up to 100%. That is, it will re-base the stocks to 100%. Speed – the Portfolio Analyser caters for portfolios that contain all the stocks in the All Ordinaries index. However, most portfolios will be of a much smaller size. This function allows you to reduce the size of data arrays and hence yield performance increases in re-calculations, particularly if you have an older/slower PC. Picking the benchmark This is the most important part of the items in this menu. A series of benchmarks are made available for portfolio comparison. The overall risk of the portfolio is measured in terms of its expected sensitivity to movements in the benchmark, the so-called beta of the portfolio. Once the benchmark is selected, the summary statistics line will change to label the new benchmark (top right-hand corner of spreadsheet under [Run] button). Domestic Benchmarks Overseas benchmarks All Ordinaries All Resources FT Australian index 20 Leaders ASX Top 100 MSCI Australian index 2 50 Leaders Ex-ASX 100 All Industrials Property Trusts 1. Investment Edge© is an evolutionary and detailed database on Australian listed companies. It represents a novel and dynamic approach to analysis of Australia’s major publicly listed companies. 2. The MSCI Australian index is only available as a benchmark through analysis undertaken by HSBC James Capel.

- 26. November 1997 Portfolio Analyser 26 HSBC James Capel: Portfolio research Australian Research Team contacts Melbourne Sydney Brisbane Fax: (03) 9229 3577 Fax: (02) 9255 2555 Fax: (07) 3223 7890 Andrew Dalziel Head of Research (07) 3229 6199 Chris Bedingfield Property Trusts (02) 9255 2676 Justin Blaess Property Trusts (02) 9255 2681 Stephen Burns Property Trusts (02) 9255 2643 Nick Caley Insurance (02) 9255 2473 James Casey Food & Retail (03) 9229 3669 Jeff Emmanuel Banking (03) 9229 3685 Bill Etheridge Gold (02) 9255 2586 Kiera Grant Small Companies (02) 9255 2680 Amos Hill Assistant Economist (03) 9229 3584 Nola Hodgson Media (03) 9229 3658 Michael Kirby Commodities (03) 9229 3607 Peter Lucas Alcohol, Tourism & Leisure (03) 9229 3591 Amanda Miller Small Companies (07) 3229 6199 Andrew Perks Energy (03) 9229 3676 Kate Prendiville Property Trusts (02) 9255 2569 Michael Saba Equity Derivatives (03) 9229 3641 Umit Safak RIO, MIM, NBH, CMC, PAS, ABF, SVR (03) 9229 3560 Kessada Sawyer Small Companies (03) 9229 3665 Mark Skocic Food & Retail (03) 9229 3599 Stuart Smith Energy & Utilities (03) 9229 3570 Adam Spowers Telecommunications & Pay TV (02) 9255 2554 Andrew Sutherland Diversified Industrials, Engineering & Chemicals (03) 9229 3574 John Syropoulo Global Mining (London) (171) 336 4389 Peter Taubman Equity Derivatives (03) 9229 3662 Mario Traviati Energy (03) 9229 3569 Marcus Tuck Strategist & Chief Economist (03) 9229 3589 Cherie Zanette Banking (02) 9229 3686 Colin Ritchie Portfolio Research & Quantitative Analysis (03) 9229 3572 Geoff Thomas Research Data (03) 9229 3687 Martin Summons Research Editor (03) 9229 3609

- 27. November 1997 Portfolio Analyser HSBC James Capel: Portfolio research 27 This research report has been prepared and issued by HSBC James Capel. HSBC James Capel has based this document on information obtained from publicly available sources it believes to be reliable but which it has not independently verified. HSBC James Capel makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion herein are subject to change without notice. This document is not and should not be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment. HSBC James Capel is not aware that any recipient intends to rely on the report or of the manner in which a recipient intends to use it. HSBC James Capel has prepared this report without consideration of the investment objectives, financial situation or particular needs of the individual recipient. All recipients should not act or rely on any recommendation in this report without consulting their financial adviser to determine whether the recommendation is appropriate to their investment objectives, financial situation or particular needs. HSBC James Capel will not be under any liability for loss or damage of any kind whatsoever arising in connection with the contents of this report. In the UK it is intended only for distribution to persons who are authorised persons or exempted persons within the meaning of the Financial Services Act 1986 or any order made thereunder. It may not be reproduced or further distributed or published in whole or part, for any purpose. This document may be distributed in the United States solely to 'major US institutional investors' as defined in Rule 15a-6 of the US Securities Exchange Act of 1934; such recipients should note that any transactions effected on their behalf will be undertaken through HSBC Securities, Inc. in the United States. Each person that receives a copy by acceptance thereof represents and agrees that it will not distribute or provide it to any other person. Disclosure Brokerage or fees may be earned by HSBC James Capel or persons associated with it in respect of any business transacted by it or them in all or any of the securities or classes of securities referred to in this report. HSBC James Capel is the trading name of HSBC James Capel Australia Limited. HSBC James Capel Level 18 101 Collins Street Melbourne VIC 3000 Telephone: +61-3-9229 3666 Fax: +61-3-9229 3580 Level 11 1 O’Connell Street Sydney NSW 2000 Telephone: +61-2-9255 2500 Fax: +61-2-9255 2555

- 28. November 1997 Portfolio Analyser 28 HSBC James Capel: Portfolio research