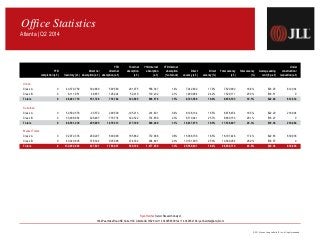

1. YTD

completion (s.f.) Inventory (s.f.)

Direct net

absorption (s.f.)

YTD

direct net

absorption (s.f.)

Total net

absorption

(s.f.)

YTD total net

absorption

(s.f.)

YTD total net

absorption

(% of stock)

Direct

vacancy (s.f.)

Direct

vacancy (%)

Total vacancy

(s.f.)

Total vacancy

(%)

Average asking

rent ($ p.s.f.)

Under

construction /

renovation (s.f.)

Urban

Class A 0 40,379,759 302,869 590,560 291,075 558,347 1.4% 7,242,602 17.9% 7,520,992 18.6% $23.25 612,034

Class B 0 6,111,951 48,857 126,224 52,010 130,232 2.1% 1,480,964 24.2% 1,529,111 25.0% $18.51 0

Totals 0 46,491,710 351,726 716,784 343,085 688,579 1.5% 8,723,566 18.8% 9,050,103 19.5% $22.48 612,034

Suburban

Class A 0 52,592,576 -33,572 299,539 -105,213 214,621 0.4% 8,126,134 15.5% 8,676,454 16.5% $22.20 218,904

Class B 0 33,908,654 329,467 779,774 322,322 774,659 2.3% 8,710,941 25.7% 8,860,153 26.1% $16.27 0

Totals 0 86,501,230 295,895 1,079,313 217,109 989,280 1.1% 16,837,075 19.5% 17,536,607 20.3% $19.36 218,904

Market Totals

Class A 0 92,972,335 269,297 890,099 185,862 772,968 0.8% 15,368,736 16.5% 16,197,446 17.4% $22.65 830,938

Class B 0 40,020,605 378,324 905,998 374,332 904,891 2.3% 10,191,905 25.5% 10,389,264 26.0% $16.57 0

Totals 0 132,992,940 647,621 1,796,097 560,194 1,677,859 1.3% 25,560,641 19.2% 26,586,710 20.0% $20.36 830,938

Office Statistics

Atlanta | Q2 2014

© 2014 Jones Lang LaSalle IP, Inc. All rights reserved.

Ryan Harchar, Senior Research Analyst

3344 Peachtree Road NE Suite 1100 Atlanta GA 30326 tel +1 404 995 6509 fax +1 404 995 2184 ryan.harchar@am.jll.com

2. Urban

YTD

completion (s.f.) Inventory (s.f.)

Direct net

absorption (s.f.)

YTD

direct net

absorption (s.f.)

Total net

absorption

(s.f.)

YTD total net

absorption

(s.f.)

YTD total net

absorption

(% of stock)

Direct

vacancy (s.f.)

Direct

vacancy (%)

Total vacancy

(s.f.)

Total vacancy

(%)

Average asking

rent ($ p.s.f.)

Under

construction /

renovation (s.f.)

Buckhead

Class A 0 14,419,248 76,014 118,558 56,203 75,675 0.5% 2,343,184 16.3% 2,441,624 16.9% $26.09 125,000

Class B 0 1,824,060 11,551 41,433 16,298 47,885 2.6% 320,924 17.6% 326,227 17.9% $18.96 0

Totals 0 16,243,308 87,565 159,991 72,501 123,560 0.8% 2,664,108 16.4% 2,767,851 17.0% $25.29 125,000

Downtown

Class A 0 12,733,018 72,987 197,787 52,498 180,068 1.4% 2,534,928 19.9% 2,650,048 20.8% $18.54 0

Class B 0 2,328,544 9,525 56,253 9,525 55,403 2.4% 601,929 25.9% 604,089 25.9% $17.58 0

Totals 0 15,061,562 82,512 254,040 62,023 235,471 1.6% 3,136,857 20.8% 3,254,137 21.6% $18.38 0

Midtown

Class A 0 13,227,493 153,868 274,215 182,374 302,604 2.3% 2,364,490 17.9% 2,429,320 18.4% $26.08 487,034

Class B 0 1,959,347 27,781 28,538 26,187 26,944 1.4% 558,111 28.5% 598,795 30.6% $19.13 0

Totals 0 15,186,840 181,649 302,753 208,561 329,548 2.2% 2,922,601 19.2% 3,028,115 19.9% $24.53 487,034

Urban Totals

Class A 0 40,379,759 302,869 590,560 291,075 558,347 1.4% 7,242,602 17.9% 7,520,992 18.6% $23.25 612,034

Class B 0 6,111,951 48,857 126,224 52,010 130,232 2.1% 1,480,964 24.2% 1,529,111 25.0% $18.51 0

Totals 0 46,491,710 351,726 716,784 343,085 688,579 1.5% 8,723,566 18.8% 9,050,103 19.5% $22.48 612,034

© 2014 Jones Lang LaSalle IP, Inc. All rights reserved.

Ryan Harchar, Senior Research Analyst

3344 Peachtree Road NE Suite 1100 Atlanta GA 30326 tel +1 404 995 6509 fax +1 404 995 2184 ryan.harchar@am.jll.com

Atlanta Office Statistics - Q2 2014 • 2

3. Suburban

YTD

completion (s.f.) Inventory (s.f.)

Direct net

absorption (s.f.)

YTD

direct net

absorption (s.f.)

Total net

absorption

(s.f.)

YTD total net

absorption

(s.f.)

YTD total net

absorption

(% of stock)

Direct

vacancy (s.f.)

Direct

vacancy (%)

Total vacancy

(s.f.)

Total vacancy

(%)

Average asking

rent ($ p.s.f.)

Under

construction /

renovation (s.f.)

Central Perimeter

Class A 0 17,170,445 -9,818 267,183 -41,941 264,564 1.5% 1,874,129 10.9% 2,079,041 12.1% $24.39 0

Class B 0 4,598,498 196,153 222,634 185,570 216,723 4.7% 1,497,010 32.6% 1,535,132 33.4% $18.42 0

Totals 0 21,768,943 186,335 489,817 143,629 481,287 2.2% 3,371,139 15.5% 3,614,173 16.6% $22.00 0

North Fulton

Class A 0 12,071,916 54,938 103,827 16,662 64,952 0.5% 2,290,439 19.0% 2,416,921 20.0% $21.41 218,904

Class B 0 4,926,149 33,707 67,213 33,707 67,213 1.4% 949,312 19.3% 955,177 19.4% $15.65 0

Totals 0 16,998,065 88,645 171,040 50,369 132,165 0.8% 3,239,751 19.1% 3,372,098 19.8% $19.78 218,904

Northlake

Class A 0 2,719,374 -23,828 67,669 -24,679 75,763 2.8% 238,411 8.8% 344,254 12.7% $20.60 0

Class B 0 6,522,754 17,140 -9,683 43,930 17,107 0.3% 1,487,718 22.8% 1,490,812 22.9% $17.46 0

Totals 0 9,242,128 -6,688 57,986 19,251 92,870 1.0% 1,726,129 18.7% 1,835,066 19.9% $17.87 0

Northeast

Class A 0 5,754,263 93,835 -19,968 89,603 -41,848 -0.7% 1,299,773 22.6% 1,325,521 23.0% $19.65 0

Class B 0 8,298,758 39,425 227,850 17,044 202,827 2.4% 2,487,732 30.0% 2,531,601 30.5% $14.70 0

Totals 0 14,053,021 133,260 207,882 106,647 160,979 1.1% 3,787,505 27.0% 3,857,122 27.4% $16.56 0

Northwest

Class A 0 14,095,815 -166,844 -133,701 -163,003 -163,339 -1.2% 2,188,940 15.5% 2,276,275 16.1% $22.75 0

Class B 0 7,097,245 59,332 294,266 58,361 293,295 4.1% 1,841,702 25.9% 1,898,528 26.8% $16.04 0

Totals 0 21,193,060 -107,512 160,565 -104,642 129,956 0.6% 4,030,642 19.0% 4,174,803 19.7% $19.87 0

South Atlanta

Class A 0 780,763 18,145 14,529 18,145 14,529 1.9% 234,442 30.0% 234,442 30.0% $18.32 0

Class B 0 2,264,218 -15,412 -20,711 -15,412 -20,711 -0.9% 375,252 16.6% 376,688 16.6% $17.45 0

Totals 0 3,044,981 2,733 -6,182 2,733 -6,182 -0.2% 609,694 20.0% 611,130 20.1% $17.73 0

Atlanta Office Statistics - Q2 2014 • 3

Ryan Harchar, Senior Research Analyst

3344 Peachtree Road NE Suite 1100 Atlanta GA 30326 tel +1 404 995 6509 fax +1 404 995 2184 ryan.harchar@am.jll.com

© 2014 Jones Lang LaSalle IP, Inc. All rights reserved.

4. Suburban

YTD

completion (s.f.) Inventory (s.f.)

Direct net

absorption (s.f.)

YTD

direct net

absorption (s.f.)

Total net

absorption

(s.f.)

YTD total net

absorption

(s.f.)

YTD total net

absorption

(% of stock)

Direct

vacancy (s.f.)

Direct

vacancy (%)

Total vacancy

(s.f.)

Total vacancy

(%)

Average asking

rent ($ p.s.f.)

Under

construction /

renovation (s.f.)

West Atlanta

Class A 0 0 0 0 0 0 0.0% 0 0.0% 0 0.0% $0.00 0

Class B 0 201,032 -878 -1,795 -878 -1,795 -0.9% 72,215 35.9% 72,215 35.9% $11.99 0

Totals 0 201,032 -878 -1,795 -878 -1,795 -0.9% 72,215 35.9% 72,215 35.9% $11.99 0

Suburban Totals

Class A 0 52,592,576 -33,572 299,539 -105,213 214,621 0.4% 8,126,134 15.5% 8,676,454 16.5% $22.20 218,904

Class B 0 33,908,654 329,467 779,774 322,322 774,659 2.3% 8,710,941 25.7% 8,860,153 26.1% $16.27 0

Totals 0 86,501,230 295,895 1,079,313 217,109 989,280 1.1% 16,837,075 19.5% 17,536,607 20.3% $19.36 218,904

© 2014 Jones Lang LaSalle IP, Inc. All rights reserved.

Ryan Harchar, Senior Research Analyst

3344 Peachtree Road NE Suite 1100 Atlanta GA 30326 tel +1 404 995 6509 fax +1 404 995 2184 ryan.harchar@am.jll.com

Atlanta Office Statistics - Q2 2014 • 4