Metro Atlanta Q310 Market Report (3)

•

0 gefällt mir•79 views

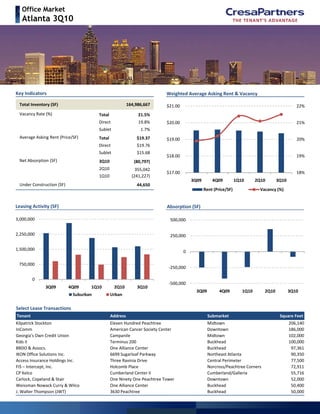

The document summarizes key office market indicators for Atlanta in the third quarter of 2010. It reports that the total Atlanta office inventory was 164.9 million square feet, with an overall vacancy rate of 21.5%, including 19.8% for direct space and 1.7% for sublet space. The average asking rent was $19.37 per square foot for total space, $19.76 for direct space and $15.68 for sublet space. Net absorption (the change in occupied space) was negative 80,797 square feet for the quarter.

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Weitere ähnliche Inhalte

Ähnlich wie Metro Atlanta Q310 Market Report (3)

Ähnlich wie Metro Atlanta Q310 Market Report (3) (20)

C&W-Canadian Office Stats -Q1 2019 - #cre #realestate

C&W-Canadian Office Stats -Q1 2019 - #cre #realestate

Cushman & Wakefield's Canadian Office Statistical Summary Q4 2018

Cushman & Wakefield's Canadian Office Statistical Summary Q4 2018

2222020 Report Pagehttpsww3.capsim.comcgi-bindispla.docx

2222020 Report Pagehttpsww3.capsim.comcgi-bindispla.docx

Cushman & Wakefield Q12018 Canadian Office Statistical Summary

Cushman & Wakefield Q12018 Canadian Office Statistical Summary

Round 2Dec. 31, 2015 C57912AndrewsTracy CalhounVict.docx

Round 2Dec. 31, 2015 C57912AndrewsTracy CalhounVict.docx

Page 1 Front PagePage 2 Stocks & BondsPage 3 Financial Sum.docx

Page 1 Front PagePage 2 Stocks & BondsPage 3 Financial Sum.docx

Page 1 Front PagePage 2 Stocks & BondsPage 3 Financial Sum.docx

Page 1 Front PagePage 2 Stocks & BondsPage 3 Financial Sum.docx

2222020 Report Pagehttpsww3.capsim.comcgi-bindispla.docx

2222020 Report Pagehttpsww3.capsim.comcgi-bindispla.docx

Real Estate and Investments: Property Investment Analysis on The Edge

Real Estate and Investments: Property Investment Analysis on The Edge

Mehr von Blusink

Mehr von Blusink (10)

Metro Atlanta Q310 Market Report (3)

- 1. Office Market Atlanta 3Q10 Key Indicators Weighted Average Asking Rent & Vacancy T t l I t (SF) 164 986 667 19% 20% 21% 22% $18 00 $19.00 $20.00 $21.00 Total Inventory (SF) 164,986,667 Vacancy Rate (%) Total 21.5% Direct 19.8% Sublet 1.7% Average Asking Rent (Price/SF) Total $19.37 Direct $19.76 Sublet $15.68 18% 19% $17.00 $18.00 3Q09 4Q09 1Q10 2Q10 3Q10 Rent (Price/SF) Vacancy (%) Net Absorption (SF) 3Q10 (80,797) 2Q10 355,042 1Q10 (241,227) Under Construction (SF) 44,650 Absorption (SF)Leasing Activity (SF) 0 250,000 500,000 Absorption (SF)Leasing Activity (SF) 1,500,000 2,250,000 3,000,000 ‐500,000 ‐250,000 3Q09 4Q09 1Q10 2Q10 3Q10 0 750,000 3Q09 4Q09 1Q10 2Q10 3Q10 Suburban Urban Select Lease Transactions Tenant Address Submarket Square Feet Kilpatrick Stockton Eleven Hundred Peachtree Midtown 206,140 InComm American Cancer Society Center Downtown 186,000 Georgia's Own Credit Union Campanile Midtown 102,000 Kids II Terminus 200 Buckhead 100,000 BBDO & Assocs. One Alliance Center Buckhead 97,361 IKON Office Solutions Inc. 6699 Sugarloaf Parkway Northeast Atlanta 90,350 Access Insurance Holdings Inc. Three Ravinia Drive Central Perimeter 77,500g , FIS – Intercept, Inc. Holcomb Place Norcross/Peachtree Corners 72,911 CP Kelco Cumberland Center II Cumberland/Galleria 55,716 Carlock, Copeland & Stair One Ninety One Peachtree Tower Downtown 52,000 Weissman Nowack Curry & Wilco One Alliance Center Buckhead 50,400 J. Walter Thompson (JWT) 3630 Peachtree Buckhead 50,000

- 2. Total Inventory (SF) Qtrly Net Absorption (SF) Direct Vacancy Rate Sublet Vacancy Rate Total Vacancy Rate Direct Avg. Asking Rent (Price/SF) Sublet Avg. Asking Rent (Price/SF) Total Avg. Asking Rent (Price/SF) Urban 52,107,643 283,510 21.8% 1.6% 23.4% $22.12 $16.73 $21.71 Class A 38,929,980 323,520 24.4% 1.9% 26.3% $23.29 $17.14 $22.78 Class B 13,177,663 (40,010) 14.1% 0.6% 14.8% $16.91 $13.50 $16.74 Submarket Statistics Office Market | Atlanta 3Q10 Downtown 18,320,859 27,157 18.0% 1.9% 19.8% $18.72 $15.94 $18.44 Class A 13,116,195 26,950 20.3% 2.6% 22.9% $19.94 $15.97 $19.43 Class B 5,204,664 207 12.0% 0.1% 12.1% $14.97 $12.50 $14.97 Midtown 14,681,256 (1,959) 25.6% 1.6% 27.3% $22.96 $15.78 $22.47 Class A 11,123,345 27,936 29.5% 1.6% 31.1% $23.75 $17.19 $23.39 Class B 3,557,911 (29,895) 13.5% 1.6% 15.2% $17.79 $12.73 $17.04 Midtown West 386,125 2,669 23.9% 2.9% 26.9% $17.78 $16.59 $17.55 Class A 77,104 0 26.7% 0.0% 26.7% $16.26 ‐ $16.26 Class B 309,021 2,669 23.3% 3.6% 26.9% $18.95 $16.59 $18.25 Buckhead 18,719,403 255,643 22.8% 1.3% 24.1% $24.38 $18.75 $24.04 Class A 14,613,336 268,634 24.5% 1.6% 26.1% $25.54 $18.91 $25.08 Class B 4,106,067 (12,991) 16.7% 0.3% 17.0% $18.68 $15.68 $18.62 Suburban 112,320,080 (364,307) 18.7% 1.8% 20.5% $18.63 $15.34 $18.28 Class A 53,426,981 (104,825) 18.0% 2.4% 20.4% $21.23 $16.08 $20.45 Class B 58,893,099 (259,482) 19.4% 1.2% 20.7% $16.02 $13.19 $15.85 Airport/South Atlanta 4,539,451 (49,535) 18.9% 0.9% 19.8% $17.49 $16.13 $17.46 Class A 669,741 3,618 37.2% 2.7% 39.9% $20.29 $16.13 $20.00 Class B 3,869,710 (53,153) 15.7% 0.6% 16.4% $16.00 ‐ $16.00 Central Perimeter 23,705,683 (192,769) 19.6% 1.9% 21.5% $21.28 $16.44 $20.92 Class A 17,622,305 (75,581) 19.5% 1.9% 21.5% $22.49 $17.61 $22.09 Class B 6,083,378 (117,188) 19.9% 1.7% 21.6% $17.97 $11.87 $17.62 Cumberland/Galleria 22,313,346 (22,811) 17.5% 2.1% 19.6% $19.12 $15.60 $18.68 Class A 13,825,491 (35,074) 15.1% 2.9% 18.0% $21.47 $16.30 $20.52 Class B 8,487,855 12,263 21.4% 1.0% 22.4% $16.10 $10.55 $15.88 Decatur 1,850,828 847 12.7% 0.0% 12.7% $20.21 ‐ $20.21 Class A 570,469 9,626 15.1% 0.0% 15.1% $22.12 ‐ $22.12 Class B 1,280,359 (8,779) 11.7% 0.0% 11.7% $18.52 ‐ $18.52 East Cobb 1,164,405 (18,106) 16.7% 0.9% 17.6% $14.65 $15.84 $14.70 Class A 0 0 0.0% 0.0% 0.0% $0.00 $0.00 $0.00 Class B 1,164,405 (18,106) 16.7% 0.9% 17.6% $14.65 $15.84 $14.70 I‐20 East/Conyers 1,586,426 (24,356) 13.4% 0.0% 13.4% $16.52 ‐ $16.52 Class A 54,338 0 46.5% 0.0% 46.5% $20.98 ‐ $20.98 Class B 1,532,088 (24,356) 12.2% 0.0% 12.2% $15.97 ‐ $15.97 l‐20West/Douglasville 1,082,523 (4,672) 12.2% 0.3% 12.6% $17.86 $22.00 $17.91 Class A 0 0 0.0% 0.0% 0.0% $0.00 $0.00 $0.00 Class B 1,082,523 (4,672) 12.2% 0.3% 12.6% $17.86 $22.00 $17.91 I‐85/Northeast 7,204,601 (50,990) 12.9% 1.5% 14.4% $17.42 $13.65 $17.03 Class A 1,443,006 14,345 13.7% 0.5% 14.2% $18.64 $15.63 $18.03 Class B 5,761,595 (65,335) 12.7% 1.7% 14.4% $17.14 $12.24 $16.75 l‐85/l‐285/Gwinnett 11,389,155 16,259 20.6% 0.4% 21.0% $17.66 $14.52 $17.49 Class A 3,297,023 (30,999) 27.3% 0.5% 27.8% $20.28 $14.38 $19.77 Class B 8,092,132 47,258 17.1% 0.3% 17.5% $15.46 $15.52 $15.46 Marietta/Kennesaw 4,515,952 17,013 17.1% 1.3% 18.4% $17.14 $15.99 $17.01 Class A 1,204,540 (4,274) 17.0% 2.1% 19.1% $21.18 $15.49 $20.03 Class B 3,311,412 21,287 17.1% 1.1% 18.2% $15.99 $16.37 $16.02 Norcross/Peachtree Corners 7,357,456 (26,324) 28.2% 1.5% 29.7% $15.69 $12.98 $15.37 Class A 2,083,906 (11,574) 20.7% 1.2% 21.8% $19.49 $13.14 $18.53 Class B 5,273,550 (14,750) 31.2% 1.7% 32.8% $14.23 $12.88 $14.09 North Fulton 22,410,933 (8,107) 18.1% 3.3% 21.4% $17.55 $14.25 $17.01 Class A 12,209,337 25,088 15.6% 4.1% 19.7% $20.05 $14.40 $18.78 Class B 10,201,596 (33,195) 21.1% 2.4% 23.5% $15.04 $13.80 $14.92 Northlake/Stone Mountain 3,199,321 (756) 20.4% 0.3% 20.7% $17.44 $14.99 $17.37 Class A 446,825 0 17.9% 1.1% 19.0% $19.59 $15.54 $19.10 Class B 2,752,496 (756) 20.8% 0.2% 21.0% $17.07 $13.75 $17.03 Atlanta 164,427,723 (80,797) 19.8% 1.7% 21.5% $19.76 $15.68 $19.37 Class A 92,356,961 218,695 20.7% 2.2% 22.9% $22.15 $16.38 $21.44 Class B 72,070,762 (299,492) 18.5% 1.1% 19.5% $16.18 $13.24 $16.01 * Costar ‐ Excludes non‐core markets and buildings