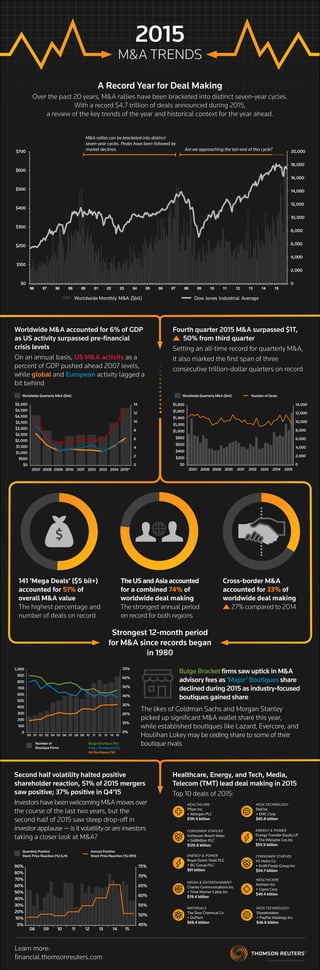

Deal Making Infographic 2015

- 1. 2015 M&A TRENDS Worldwide M&A accounted for 6% of GDP as US activity surpassed pre-financial crisis levels On an annual basis, US M&A activity as a percent of GDP pushed ahead 2007 levels, while global and European activity lagged a bit behind Fourth quarter 2015 M&A surpassed $1T, 50% from third quarter Setting an all-time record for quarterly M&A, it also marked the first span of three consecutive trillion-dollar quarters on record Strongest 12-month period for M&A since records began in 1980 A Record Year for Deal Making Over the past 20 years, M&A rallies have been bracketed into distinct seven-year cycles. With a record $4.7 trillion of deals announced during 2015, a review of the key trends of the year and historical context for the year ahead. 141 ‘Mega Deals’ ($5 bil+) accounted for 51% of overall M&A value The highest percentage and number of deals on record TheUSandAsiaaccounted for a combined 74% of worldwide deal making The strongest annual period on record for both regions Cross-border M&A accounted for 33% of worldwide deal making 27% compared to 2014 $0 $100 $200 $300 $400 $500 $600 $700 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Worldwide Monthly M&A ($bil) Dow Jones Industrial Average Bulge Bracket firms saw uptick in M&A advisory fees as ‘Major’ Boutiques share declined during 2015 as industry-focused boutiques gained share The likes of Goldman Sachs and Morgan Stanley picked up significant M&A wallet share this year, while established boutiques like Lazard, Evercore, and Houlihan Lokey may be ceding share to some of their boutique rivals 0 2 4 6 8 10 12 14 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2007 2008 2009 2010 2011 2012 2013 2014 2015* $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 45% 50% 55% 60% 65% 70% 75% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 08 09 10 11 12 13 14 15 Quarterly Positive Stock Price Reaction (%) (LH) Annual Positive Stock Price Reaction (%) (RH) 2007 2008 2009 2010 2011 2012 2013 2014 2015 0 2 4 6 8 10 12 14 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2007 2008 2009 2010 2011 2012 2013 2014 2015* $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 45% 50% 55% 60% 65% 70% 75% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 08 09 10 11 12 13 14 15 Quarterly Positive Stock Price Reaction (%) (LH) Annual Positive Stock Price Reaction (%) (RH) 2007 2008 2009 2010 2011 2012 2013 2014 2015 Are we approaching the tail-end of this cycle? M&A rallies can be bracketed into distinct seven-year cycles. Peaks have been followed by market declines. 00 151413121110090807060504030201 0% 10% 20% 30% 40% 50% 60% 70% 0 100 200 300 400 500 600 700 800 900 1,000 Number of Boutique Firms Bulge Bracket (%) All Boutique (%) Major Boutique (%) Number of Boutique Firms Bulge Boutique (%) Major Boutiques (%) All Boutiques (%) Second half volatility halted positive shareholder reaction, 51% of 2015 mergers saw positive; 37% positive in Q4’15 Investors have been welcoming M&A moves over the course of the last two years, but the second half of 2015 saw steep drop-off in investor applause — is it volatility or are investors taking a closer look at M&A? Healthcare, Energy, and Tech, Media, Telecom (TMT) lead deal making in 2015 Top 10 deals of 2015: Learn more: financial.thomsonreuters.com HEALTHCARE Pfizer Inc + Allergan PLC $191.5 billion CONSUMER STAPLES Anheuser-Busch Inbev + SABMiller PLC $120.8 billion ENERGY & POWER Royal Dutch Shell PLC + BG Group PLC $81 billion MEDIA & ENTERTAINMENT Charter Communications Inc + Time Warner Cable Inc $78.4 billion MATERIALS The Dow Chemical Co + DuPont $68.4 billion HIGH TECHNOLOGY Dell Inc + EMC Corp $65.8 billion ENERGY & POWER Energy Transfer Equity LP + The Williams Cos Inc $55.9 billion CONSUMER STAPLES HJ Heinz Co + Kraft Foods Group Inc $54.7 billion HEALTHCARE Anthem Inc + Cigna Corp $49.4 billion HIGH TECHNOLOGY Shareholders + PayPal Holdings Inc $46.8 billion 0 2 4 6 8 10 12 14 $0 500 000 500 000 500 000 500 000 500 000 2007 2008 2009 2010 2011 2012 2013 2014 2015* $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 45% 50% 55% 60% 65% 70% 75% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 08 09 10 11 12 13 14 15 Quarterly Positive Stock Price Reaction (%) (LH) Annual Positive Stock Price Reaction (%) (RH) 2007 2008 2009 2010 2011 2012 2013 2014 2015 Worldwide Quarterly M&A ($bil)Worldwide Quarterly M&A ($bil) Number of Deals Quarterly Positive Stock Price Reaction (%) (LH) Annual Positive Stock Price Reaction (%) (RH) © 2015 Thomson Reuters GRC03615/10-15