Comparison To Peers

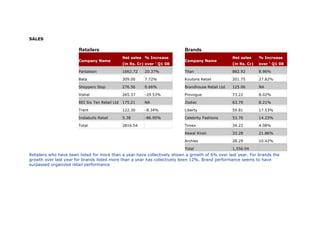

- 1. SALES Retailers Brands Net sales % Increase Net sales % Increase Company Name Company Name (in Rs. Cr) over ' Q1 08 (in Rs. Cr) over ' Q1 08 Pantaloon 1662.72 20.37% Titan 882.92 8.96% Bata 309.00 7.72% Koutons Retail 201.75 27.82% Shoppers Stop 276.56 0.66% Brandhouse Retail Ltd. 125.06 NA Vishal 265.37 -29.53% Provogue 73.22 8.02% REI Six Ten Retail Ltd 175.21 NA Zodiac 63.79 8.21% Trent 122.30 -8.34% Liberty 59.81 17.53% Indiabulls Retail 5.38 -86.95% Celebrity Fashions 53.70 14.23% Total 2816.54 Timex 34.22 4.08% Kewal Kiran 33.28 21.86% Archies 28.29 10.42% Total 1,556.04 Retailers who have been listed for more than a year have collectively shown a growth of 6% over last year. For brands the growth over last year for brands listed more than a year has collectively been 12%. Brand performance seems to have surpassed organized retail performance

- 2. NET PROFIT Retailers Brands Net Profit Net Profit Company Name % of Sale Company Name % of Sale (in Rs. Cr) (in Rs. Cr) Pantaloon 36.49 12.17% Titan 46.04 5.21% Bata 18.35 5.94% Koutons Retail 11.50 5.70% Trent 5.11 4.18% Provogue 6.74 9.21% REI Six Ten Retail Ltd 5.09 2.91% Kewal Kiran 6.28 18.87% Shoppers Stop 2.52 0.91% Zodiac 4.14 6.49% Indiabulls Retail -18.31 -340.61% Brandhouse Retail Ltd. 3.69 2.95% Vishal -90.66 -34.16% Timex 2.43 7.10% Liberty 1.40 2.34% Archies 0.88 3.10% Celebrity Fashions -8.95 -16.67% Cost cutting measures continued through Q1. This accompanied by re-negotiated rents helped brands and retailers manage their operating margins resulting in over two-thirds of the listed brands/ retailers showing a higher profit as against the same quarter last year. Vishal retail showed losses for the 2nd consecutive quarter. The company is reported to be working towards a Corporate Debt Restructuring solution.

- 3. EMPLOYEE COST AS % OF NET SALES Retailers Brands Employee Cost as % Employee Cost as Company Name Company Name of Net Sales % of Net Sales Indiabulls Retail 14.96% Celebrity Fashions 21.28% Bata 13.91% Zodiac 16.26% Vishal 8.83% Kewal Kiran 14.47% Trent 7.35% Archies 14.05% Shoppers Stop 6.36% Timex 10.79% Pantaloon 4.21% Liberty 8.82% REI Six Ten Retail Ltd 3.06% Titan 6.98% Provogue 4.89% Brandhouse Retail Ltd. 3.25% Koutons Retail 1.82% Employee costs were pared down or remained constant with most retailers and brands. Recruitment was at its lowest ebb and confined largely to hiring for new stores and replacement hiring (where essential)

- 4. INTEREST AS % OF NET SALES Retailers Brands Interest as % of Interest as % of Company Name Company Name Net Sales Net Sales Indiabulls Retail 94.72% Koutons Retail 13.27% Vishal 8.64% Celebrity Fashions 9.27% Pantaloon 5.47% Provogue 5.64% Shoppers Stop 1.98% Liberty 4.85% Trent 0.42% Brandhouse Retail Ltd. 2.37% Bata 0.35% Kewal Kiran 1.56% REI Six Ten Retail Ltd. 0.01% Archies 0.87% Titan 0.86% Zodiac 0.52% Timex 0.44% With the stock market being unavailable for funds, a number of retailers and brand have had to resort to borrowing and pledging of shares to acquire funds for expansion resulting in interest costs increasing more than 50% for significant retailers (Shoppers Stop Trent, Timex, Provogue etc)

- 5. 2.0 COMPANY WISE RESULTS Note: All expense figures have been higlighted in blue. A negative variance % in expenses means that expenses have reduced. 2.1 BRANDS Archies

- 6. Quarter Ending June 09 June 08 Var % Sales Income 28.29 25.62 10.42% Other Income 0.12 0.17 -29.52% Total Income 28.41 25.79 10.17% Expenditure -26.12 -23.54 10.97% Operating Profit 2.29 2.25 1.73% Interest -0.25 -0.28 -12.50% Employee Cost -3.98 -4.03 -1.24% Net Profit 0.88 0.79 11.17% OPM (%) 8.08% 8.77% -7.87% NPM (%) 3.10% 3.08% 0.67% Interest as % of Net Sales 0.87% 1.09% -20.76% Employee Cost as % of Net Sales 14.05% 15.71% -10.57% • Sales: Rs 28.29 crores, up 10.42% from last year same quarter • Net Profit: Rs 0.88 crores i.e. 3.10% of sales • Interest Cost: 0.87% of sales • Employee Cost: Rs 3.98 crores i.e. 14.05% of sales

- 7. Brand House Quarter Ending June 09 June 08 Var % Sales Income 125.06 NA NA Other Income 0.01 NA NA Total Income 125.07 NA NA Expenditure -114.38 NA NA Operating Profit 10.69 NA NA Interest -2.97 NA NA Employee Cost -4.06 NA NA Net Profit 3.69 NA NA OPM (%) 8.55% NA NA NPM (%) 2.95% NA NA Interest as % of Net Sales 2.37% NA NA Employee Cost as % of Net Sales 3.25% NA NA • Sales: Rs 125.06 crores • Net Profit: Rs 3.69 crores i.e. 2.95% of sales • Interest Cost: 2.37% of sales • Employee Cost: Rs 4.06 crores i.e. 3.25% of sales Celebrity Fashions Ltd

- 8. Quarter Ending June 09 June 08 Var % Sales Income 53.70 47.01 14.23% Other Income 0.32 0.91 -65.16% Total Income 54.02 47.92 12.73% Expenditure -58.50 -62.88 -6.97% Operating Profit -4.48 -14.96 -70.06% Interest -4.98 -4.11 21.32% Employee Cost -11.43 -11.58 -1.31% Net Profit -8.95 -21.10 57.57% OPM (%) -8.34% -31.82% 73.79% NPM (%) -16.67% -44.88% 62.86% Interest as % of Net Sales 9.27% 8.73% 6.20% Employee Cost as % of Net Sales 21.28% 24.63% -13.61% • Sales: Rs 53.70 crores, up 14.23% from last year same quarter • Net Loss: Rs 8.95 crores i.e. 16.67% of sales • Interest Cost: 9.27% of sales • Employee Cost: Rs 11.43 crores i.e. 21.28% of sales

- 9. Kewal Kiran Clothing Quarter Ending June 09 June 08 Var % Sales Income 33.28 27.31 21.86% Other Income 3.13 1.94 61.34% Total Income 36.41 29.25 24.48% Expenditure -25.02 -25.52 -1.96% Operating Profit 11.39 3.73 205.36% Interest -0.52 -0.74 - 29.73% Employee Cost -4.82 -4.27 12.76% Net Profit 6.28 1.25 402.40% OPM (%) 34.22% 13.66% 150.58% NPM (%) 18.87% 4.58% 312.28% Interest as % of Net Sales 1.56% 2.71% -42.34% Employee Cost as % of Net Sales 14.47% 15.64% -7.46% • Sales: Rs 33.28 crores, up 21.86% from last year same quarter • Net Profit: Rs 6.28 crores i.e. 18.87% of sales • Interest Cost: 1.56% of sales • Employee Cost: Rs 4.82 crores i.e. 14.47% of sales • Net profit figures for KKC are high on account of 'Other Income' of Rs 3 crore in Q1

- 10. Koutons Retail India Ltd. Quarter Ending June 09 June 08 Var % Sales Income 201.75 157.84 27.82% Other Income 0.03 0.87 -96.22% Total Income 201.78 158.71 27.14% Expenditure -153.48 -126.47 21.36% Operating Profit 48.31 32.25 49.81% Interest -26.78 -12.94 106.99% Employee Cost -3.68 -3.66 0.49% Net Profit 11.50 10.84 6.08% OPM (%) 23.94% 20.43% 17.20% NPM (%) 5.70% 6.87% -17.01% Interest as % of Net Sales 13.27% 8.20% 61.94% Employee Cost as % of Net Sales 1.82% 2.32% -21.38% • Sales: Rs 201.75 crores, up 27.82% from last year same quarter • Net Profit: Rs 11.50 crores i.e. 5.70% of sales • Interest Cost: 13.27% of sales • Employee Cost: Rs 3.68 crores i.e. 1.82% of sales • Interest as a percentage of sales has risen to a worrying level of 13.27% of sales. With a weak stock market expansion plans are being supported through borrowings .

- 11. Liberty Shoes Ltd Quarter Ending June 09 June 08 Var % Sales Income 59.81 50.89 17.53% Other Income 0.00 0.53 -100.00% Total Income 59.81 51.43 16.31% Expenditure -53.94 -45.57 18.36% Operating Profit 5.87 5.85 0.38% Interest -2.90 -3.11 -6.66% Employee Cost -5.27 -5.05 4.48% Net Profit 1.40 1.02 37.18% OPM (%) 9.82% 11.50% -14.59% NPM (%) 2.34% 2.01% 16.72% Interest as % of Net Sales 4.85% 6.11% -20.58% Employee Cost as % of Net Sales 8.82% 9.92% -11.11% • Sales: Rs 59.81 crores, up 17.53% from last year same quarter • Net Profit: Rs 1.40 crores i.e. 2.34% of sales • Interest Cost: 4.85% of sales • Employee Cost: Rs 5.27 crores i.e. 8.82% of sales

- 12. Provogue Quarter Ending June 09 June 08 Var % Sales Income 73.22 67.78 8.02% Other Income 5.32 2.05 160.34% Total Income 78.55 69.83 12.48% Expenditure -62.49 -57.32 9.01% Operating Profit 16.06 12.51 28.41% Interest -4.13 -2.12 94.49% Employee Cost -3.58 -3.59 -0.42% Net Profit 6.74 6.05 11.56% OPM (%) 21.93% 18.45% 18.88% NPM (%) 9.21% 8.92% 3.28% Interest as % of Net Sales 5.64% 3.13% 80.04% Employee Cost as % of Net Sales 4.89% 5.30% -7.81% • Sales: Rs 73.22 crores, up 8.02% from last year same quarter • Net Profit: Rs 6.74 crores i.e. 9.21% of sales • Interest Cost: 5.64% of sales • Employee Cost: Rs 3.58 crores i.e. 4.89% of sales • The bulk of net profit was accounted for by 'Other Income' of Rs 5.3 crores

- 13. Timex Watches Ltd. June Quarter Ending June 08 Var % 09 Sales Income 34.22 32.88 4.08% Other Income 0.90 0.86 5.13% Total Income 35.12 33.74 4.10% Expenditure -31.47 -29.28 7.48% Operating Profit 3.65 4.46 -18.09% Interest -0.15 -0.05 179.63% Employee Cost -3.69 -3.65 1.12% Advertising Expenses -3.33 -3.19 4.39% Net Profit 2.43 3.23 -24.62% OPM (%) 10.68% 13.57% -21.30% NPM (%) 7.10% 9.81% -27.57% Interest as % of Net Sales 0.44% 0.16% 168.68% Employee Cost as % of Net Sales 10.79% 11.10% -2.84% Advertising Expenses as % of Net Sales 9.73% 9.70% 0.30% • Sales: Rs 34.22 crores, up 4.08% from last year same quarter • Net Profit: Rs 2.43 crores i.e. 7.10% of sales • Interest Cost: 0.44% of sales • Employee Cost: Rs 3.69 crores i.e. 10.79% of sales

- 14. Titan Quarter Ending June 09 June 08 Var % Sales Income 882.92 810.31 8.96% Other Income 0.88 0.83 6.02% Total Income 883.80 811.14 8.96% Expenditure -803.52 -754.25 6.53% Operating Profit 80.28 56.89 41.11% Interest -7.59 -5.21 45.68% Employee Cost -61.64 -51.93 18.70% Advertising Expenses -44.70 -40.70 9.83% Net Profit 46.04 32.22 42.89% OPM (%) 9.09% 7.02% 29.51% NPM (%) 5.21% 3.98% 31.14% Interest as % of Net Sales 0.86% 0.64% 33.70% Employee Cost as % of Net Sales 6.98% 6.41% 8.94% Advertising Expenses as % of Net Sales 5.06% 5.02% 0.80% • Sales: Rs 882.92 crores, up 8.96% from last year same quarter • Net Profit: Rs 46.04 crores i.e. 5.21% of sales • Interest Cost: 0.86% of sales • Employee Cost: Rs 61.64 crores i.e. 6.98% of sales

- 15. • According to a filing with the Bombay Stock Exchange, the company adopted the first-in-first-out method of valuing gold inventory from the first quarter against the previously used weighted-average method. This has led to a higher profit before tax. Zodiac Clothing Quarter Ending June 09 June 08 Var % Sales Income 63.79 58.95 8.21% Other Income 0.87 4.52 -80.75% Total Income 64.66 63.47 1.87% Expenditure -56.72 -55.23 2.70% Operating Profit 7.94 8.24 -3.64% Interest -0.33 -0.27 22.22% Employee Cost -10.37 -9.69 7.02% Net Profit 4.14 4.65 -10.97% OPM (%) 12.45% 13.98% -10.95% NPM (%) 6.49% 7.89% -17.72% Interest as % of Net Sales 0.52% 0.46% 12.95% Employee Cost as % of Net Sales 16.26% 16.44% -1.10% • Sales: Rs 63.79 crores, up 8.21% from last year same quarter • Net Profit: Rs 4.14 crores i.e. 6.49% of sales • Interest Cost: 0.52% of sales

- 16. • Employee Cost: Rs 10.37 crores i.e. 16.26% of sales 2.1 RETAILERS Bata Quarter Ending June 09 June 08 Var % Sales Income 309.00 286.85 7.72% Other Income 2.03 1.63 24.45% Total Income 311.02 288.48 7.81% Expenditure -276.21 -260.67 5.96% Operating Profit 34.82 27.81 25.19% Interest -1.07 -1.52 -29.94% Employee Cost -42.99 -45.49 -5.49% Net Profit 18.35 16.20 13.25% OPM (%) 11.27% 9.69% 16.22% NPM (%) 5.94% 5.65% 5.14% Interest as % of Net Sales 0.35% 0.53% -34.96% Employee Cost as % of Net Sales 13.91% 15.86% -12.26%

- 17. • Sales: Rs 309.00 crores, up 7.72% from last year same quarter • Net Profit: Rs 18.35 crores i.e. 5.94% of sales • Interest Cost: 0.35% of sales • Employee Cost: Rs 42.99 crores i.e. 13.91% of sales Indiabulls Retail Quarter Ending June 09 June 08 Var % Sales Income 5.38 41.19 -86.95% Other Income 0.16 0.07 119.44% Total Income 5.53 41.26 -86.59% Expenditure -17.07 -58.49 -70.81% Operating Profit -11.54 -17.23 33.04% Interest -5.09 -4.88 4.30% Employee Cost -0.80 -4.95 -83.75% Net Profit -18.31 -24.35 24.80% OPM (%) -214.62% -41.83% -413.03% NPM (%) -340.61% -59.12% -476.13% Interest as % of Net Sales 94.72% 11.85% 699.12%

- 18. Employee Cost as % of Net Sales 14.96% 12.01% 24.49% • Sales: Rs 5.38 crores, down 86.95% from last year same quarter • Net Loss: Rs 18.31 crores i.e. 340.61% of sales • Interest Cost: 94.72% of sales • Employee Cost: Rs 0.80 crores i.e. 14.96% of sales • Indiabulls Retail has shrunk its retail offer by shutting all but 2 of the stores acquired from Piramyd retail in 2008. The company is scheduled to re-launch the 2 stores – one each in Pune and Nagpur - in Oct. this year. The stores are being re-branded, re-furbished and re-launched. Pantaloon Retail Quarter Ending June 09 June 08 Var % Sales Income 1662.72 1381.38 20.37% Other Income 1.78 0.06 2866.67% Total Income 1664.5 1381.44 20.49% Expenditure -1479.48 -1240.23 19.29% Operating Profit 185.02 141.21 31.02% Interest -90.95 -65.46 38.94% Employee Cost 70.03 67.44 3.84% Net Profit 36.49 32.53 12.17%

- 19. OPM (%) 10.22% 10.22% 0.00% NPM (%) 2.19% 2.35% -6.81% Interest as % of Net Sales 5.47% 4.74% 15.43% Employee Cost as % of Net Sales 4.21% 4.90% -14.11% • Sales: Rs 1662.72 crores, up 20.37% from last year same quarter • Net Profit: Rs 36.49 crores i.e. 2.19% of sales • Interest Cost: 5.47% of sales • Employee Cost: Rs 70.03 crores i.e. 4.21% of sales • Note: Figures for April -June '09 have been computed by reducing Q1-Q3 reported figures from the annual standalone figures. Rei Six ten Retail Ltd. Quarter Ending June 09 June 08 Var % Sales Income 175.21 NA NA Other Income 0.08 NA NA Total Income 175.29 NA NA Expenditure -165.10 NA NA Operating Profit 10.19 NA NA Interest -0.01 NA NA

- 20. Employee Cost -5.37 NA NA Net Profit 5.09 NA NA OPM (%) 5.81% NA NA NPM (%) 2.91% NA NA Interest as % of Net Sales 0.01% NA NA Employee Cost as % of Net Sales 3.06% NA NA • Sales: Rs 175.21 crores • Net Profit: Rs 5.09 crores i.e. 2.91% of sales • Interest Cost: 0.01% of sales • Employee Cost: Rs 5.37 crores i.e. 3.06% of sales Shoppers Stop Ltd Quarter Ending June 09 June 08 Var % Sales Income 276.56 274.75 0.66% Other Income 0.00 1.09 -100.00% Total Income 276.56 275.84 0.26% Expenditure -261.41 -275.33 -5.06%

- 21. Operating Profit 15.15 0.51 2876.62% Interest -5.48 -3.56 53.85% Employee Cost -17.59 -23.18 -24.11% Net Profit 2.52 -15.32 116.48% OPM (%) 5.48% 0.19% 2857.08% NPM (%) 0.91% -5.57% 116.37% Interest as % of Net Sales 1.98% 1.30% 52.84% Employee Cost as % of Net Sales 6.36% 8.44% -24.61% • Sales: Rs 276.56 crores, up 0.66% from last year same quarter • Net Profit: Rs 2.52 crores i.e. 0.91% of sales • Interest Cost: 1.98% of sales • Employee Cost: Rs 17.59 crores i.e. 6.36% of sales • The retailer turned profitable in the first quarter of this financial year after posting losses in FY08-09. The benefits of reduced rentals, aggressive cost control measures have paid of. The company is also reported to have changed its depreciation strategy. It will now write off its assets in 7 to 10 years, (depending on the products), instead of the 3 to 5 years till now, which has also contributed to improvement in profits in the June quarter. Trent Quarter Ending June 09 June 08 Var % Sales Income 122.30 133.43 -8.34% Other Income 6.62 11.33 -41.52% Total Income 128.92 144.75 -10.94%

- 22. Expenditure -118.46 -132.52 -10.61% Operating Profit 10.46 12.23 -14.48% Interest -0.51 -0.33 55.32% Employee Cost -8.98 -11.63 -22.74% Advertising Expenses -11.01 -10.58 4.06% Net Profit 5.11 8.23 -37.84% OPM (%) 8.55% 9.17% -6.70% NPM (%) 4.18% 6.16% -32.18% Interest as % of Net Sales 0.42% 0.25% 69.45% Employee Cost as % of Net Sales 7.35% 8.72% -15.72% Advertising Expenses as % of Net 9.00% 7.93% 13.53% Sales • Sales: Rs 122.30 crores, down 8.34% from last year same quarter • Net Profit: Rs 5.11 crores i.e. 4.18% of sales • Interest Cost: 0.42% of sales • Employee Cost: Rs 8.98 crores i.e. 7.35% of sales • In the case of Trent, the scenario continues to be as bad as it was in the quarter before. Benefits of its tie-ups with international retailers like Zara and Tesco have still to show in the sales though operating profit as well as net profit margins has improved. Vishal Quarter Ending June 09 June 08 Var % Sales Income 265.37 376.55 -29.53%

- 23. Other Income 2.64 1.88 40.17% Total Income 268.01 378.43 -29.18% Expenditure -296.73 -327.45 -9.38% Operating Profit -28.72 50.98 -156.33% Interest -22.92 -17.51 30.92% Employee Cost -23.42 -33.36 -29.78% Net Profit -90.66 14.01 -747.03% OPM (%) -10.82% 13.54% -179.93% NPM (%) -34.16% 3.72% -1018.10% Interest as % of Net Sales 8.64% 4.65% 85.77% Employee Cost as % of Net Sales 8.83% 8.86% -0.36% • Sales: Rs 265.37 crores, up -29.53% from last year same quarter • Net Loss: Rs 90.66 crores i.e. 34.16% of sales • Interest Cost: 8.64% of sales • Employee Cost: Rs 23.42 crores i.e. 8.83% of sales • Interest as a percentage of sales has risen to a worrying level of 8.64% of sales.