Make Debt Consolidation Simple With This Advice

•

0 likes•179 views

Debt can cripple you when it becomes large. Dealing with it alone can leave you feeling hopeless. Lu...

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Featured

Featured (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Make Debt Consolidation Simple With This Advice

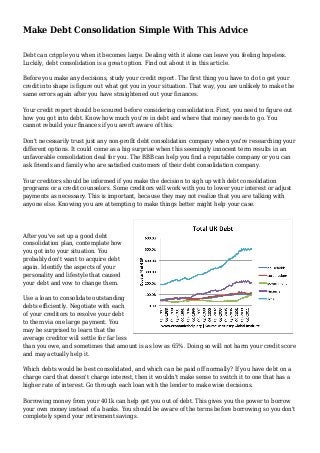

- 1. Make Debt Consolidation Simple With This Advice Debt can cripple you when it becomes large. Dealing with it alone can leave you feeling hopeless. Luckily, debt consolidation is a great option. Find out about it in this article. Before you make any decisions, study your credit report. The first thing you have to do to get your credit into shape is figure out what got you in your situation. That way, you are unlikely to make the same errors again after you have straightened out your finances. Your credit report should be scoured before considering consolidation. First, you need to figure out how you got into debt. Know how much you're in debt and where that money needs to go. You cannot rebuild your finances if you aren't aware of this. Don't necessarily trust just any non-profit debt consolidation company when you're researching your different options. It could come as a big surprise when this seemingly innocent term results in an unfavorable consolidation deal for you. The BBB can help you find a reputable company or you can ask friends and family who are satisfied customers of their debt consolidation company. Your creditors should be informed if you make the decision to sigh up with debt consolidation programs or a credit counselors. Some creditors will work with you to lower your interest or adjust payments as necessary. This is important, because they may not realize that you are talking with anyone else. Knowing you are attempting to make things better might help your case. After you've set up a good debt consolidation plan, contemplate how you got into your situation. You probably don't want to acquire debt again. Identify the aspects of your personality and lifestyle that caused your debt and vow to change them. Use a loan to consolidate outstanding debts efficiently. Negotiate with each of your creditors to resolve your debt to them via one large payment. You may be surprised to learn that the average creditor will settle for far less than you owe, and sometimes that amount is as low as 65%. Doing so will not harm your credit score and may actually help it. Which debts would be best consolidated, and which can be paid off normally? If you have debt on a charge card that doesn't charge interest, then it wouldn't make sense to switch it to one that has a higher rate of interest. Go through each loan with the lender to make wise decisions. Borrowing money from your 401k can help get you out of debt. This gives you the power to borrow your own money instead of a banks. You should be aware of the terms before borrowing so you don't completely spend your retirement savings.

- 2. Negotiate as much as possible to get the best possible deal. For example, ask your credit card company if they will give you a break on your interest rate if you cut up the card and stop using it, moving to a fixed rate plan instead. You can't be sure what they'll offer. If you're trying to find a place that gives you the option to consolidate your debts, be sure you're able to spend the time needed to do some research. Check with the Better Business Bureau and other consumer watchdog groups to ensure that you do not entrust your finances to folks with bad reputations or who have a history of not fulfilling their obligations to clients. Although you may be offered a longer term of payoff, you should strive to have your consolidation loan paid off within 5 years. The longer you wait, the more interest you pay and the less likely you are to pay it off at all, so come up with a five-year plan and stick with it. Agree with a lender's terms first prior to your credit report being pulled. You do not want to have too many people access your credit report, since this can lower your credit score. Ensure that any lenders you talk to understand this. To emerge from debt, patience is key. Debt can be built up much quicker than it may take you to pay everything off. If you want to achieve financial freedom, you have to be invested in the process of paying everything off and finding a solid loan. Debt consolidation can help you get your life back on track. Information is power; you can tackle any problem with the right strategy. Start by trying out the tips discussed here.