Proceeding of 119th slbc 17.11.2009

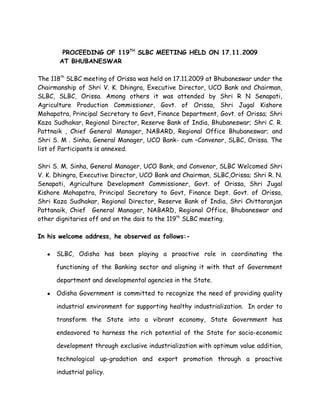

- 1. PROCEEDING OF 119TH SLBC MEETING HELD ON 17.11.2009 AT BHUBANESWAR The 118th SLBC meeting of Orissa was held on 17.11.2009 at Bhubaneswar under the Chairmanship of Shri V. K. Dhingra, Executive Director, UCO Bank and Chairman, SLBC, SLBC, Orissa. Among others it was attended by Shri R N Senapati, Agriculture Production Commissioner, Govt. of Orissa, Shri Jugal Kishore Mohapatra, Principal Secretary to Govt, Finance Department, Govt. of Orissa; Shri Kaza Sudhakar, Regional Director, Reserve Bank of India, Bhubaneswar; Shri C. R. Pattnaik , Chief General Manager, NABARD, Regional Office Bhubaneswar; and Shri S. M . Sinha, General Manager, UCO Bank- cum –Convenor, SLBC, Orissa. The list of Participants is annexed. Shri S. M. Sinha, General Manager, UCO Bank, and Convenor, SLBC Welcomed Shri V. K. Dhingra, Executive Director, UCO Bank and Chairman, SLBC,Orissa; Shri R. N. Senapati, Agriculture Development Commissioner, Govt. of Orissa, Shri Jugal Kishore Mohapatra, Principal Secretary to Govt, Finance Dept. Govt. of Orissa, Shri Kaza Sudhakar, Regional Director, Reserve Bank of India, Shri Chittaranjan Pattanaik, Chief General Manager, NABARD, Regional Office, Bhubaneswar and other dignitaries off and on the dais to the 119th SLBC meeting. In his welcome address, he observed as follows:- ● SLBC, Odisha has been playing a proactive role in coordinating the functioning of the Banking sector and aligning it with that of Government department and developmental agencies in the State. ● Odisha Government is committed to recognize the need of providing quality industrial environment for supporting healthy industrialization. In order to transform the State into a vibrant economy, State Government has endeavored to harness the rich potential of the State for socio-economic development through exclusive industrialization with optimum value addition, technological up-gradation and export promotion through a proactive industrial policy.

- 2. ● Handloom is one of the most important traditional cottage industries of Odisha. Commercial Banks in Orissa have achieved all national parameters except DRI & Advance to Weaker Sections advance as on 30.09.2009. Commercial Banks in Odisha are above the National Parameter with regard to Priority Sector Advance and Advance to Agriculture Sector. ● In CD ratio, although Banks are above the National Parameter, still it is in declining trend. Against the deposit growth of 27.25 per cent and advance growth of 19.40 percent the CD ratio is in declined trend on account of economic slow down. ● It has come to our notice that performance of Banks under PMEGP was good and ranked 5th position in the country. ● It is also observed that the performance under ACP upto the 2nd quarter i.e. quarter ended September 2009 is 87 per cent. ● Flow of credit to MSME sectors also growing at a good pace and the achievement is 249 per cent of the target as of 30th September 2009. However, it is noticed that the flow of credit to Government sponsored scheme is not up to the mark. Challenges 1. CD ratio in on downward trend due to economic slowdown. 2. Emergences of fresh NPAs on account of economic slowdown still persist. 3. There is a weak demand in credit and Bank’s credit port folio is on pressure. Recoveries of Bank loans get affected. 4. Banks are seriously concerned on the credit port folio and management of NPA.

- 3. Conclusion In view of the foregoing scenario, he appealed to all members & regulator of SLBC to have meaningful participation and deliberation in the meeting and to work in tandem, he, sought cooperation of all concern so as to accelerate flow of credit to desired sectors of economy in order to boost all-round development of the State. HIGHLIGHTS OF THE SPEECH OF SHRI V.K DHINGRA, EXECUTIVE DIRECTOR, UCO BANK, AND CHAIRMAN, SLBC, ORISSA While expressing happiness in attending 119th SLBC meeting of Orissa and extending warm welcome to all to the SLBC meeting he, noticed as follows; ● The global financial situation during last one year has caused a lot of panic and uncertainty all over the world. The economic meltdown had cascading effect on our economy. Due to the stimulus packages of our Central Government and Reserve Bank of India, we could overcome a measure economic disaster and economic depression. ● Our economy is showing signs of recovery due to timely and appropriate measures taken by the Government. However, as per the assessment of our Hon’ble Union Finance Minister, the inflation may reach 6 per cent by March 2010 and therefore, continues to be an area of great concern. To add to its draught situation has pushed up the prices of essential commodities. ● Although, both the Hon’ble Prime Minister and Finance Minister have made repeated announcement that the stimulus packages will continue for till the trend of economic recession is reversed, RBI is compelled to initiate anti inflationary measure like increase of SLR which will affect the liquidity of banking system. Certain measures like bringing back export credit refinance facility to the pre crisis level of 15 per cent from the present level of 50

- 4. per cent, stricter provisioning norms and withdrawal of prepayment charges are likely to affect the bottom lines of banking system. ● Although, during the last few months capital market as per the indices of BSE and NSE is on the up suing, yet there is a lot of volatility and it is expected that the stability will return back by the end of current financial year. ● The industrial output as measured by the index of industrial production (IIP) grew by 9.12 percent in September 2009, decelerating from growth rate of 10.40 percent registered in August 2009. But it was higher than 6 percent in September 2008. ● Nature has endowed every state - some more favorable with its bounties. Odisha is one such most favoured state, the state possess vast resources of iron-ore, coal, manganese-ore, bauxite, chromites, nickel, cropper and graphite. ● In view of large scale industrialization taking place in Odisha, Banks have got ample scope financing industrial units including SME being the 2nd largest employment provider and which has high potential for export. Banks operating in the State are determined to take up viable projects promptly which will definitely take the economy of Odisha to a greater height. Providing timely and adequate finance to SME sector under cluster approach has to be given priority as it offers possibility of reduction in transaction cost and also provides an appropriate scale for improvement in infrastructure. ● As advised by Ministry of Finance, Govt. of India, Special Monthly SLBC meeting is being conducted on monthly to monitor and review the progress of implementation of special stimulus packages by IBA for MSME, Housing and Automobile sectors. It is worthwhile to mention that from December 2008,

- 5. SLBC, Odisha has conducted 8 such meetings. The review reveals that during financial year 2009-10 up to August 2009 i.e form 1/4/2009 to 31/8/2009, Banks in Odisha sanctioned Rs. 1021 crores of working capital under MSME sector and registered 12729 number of MSME accounts, in both new and existing units. ● With respect to coverage under CGTMSE (Credit Guarantee Fund Trust Scheme for Micro & Small Enterprises), in Odisha, up to March 2009, 9534 loan proposals have been approved involving Rs. 194.08 crores cumulatively. It is worthwhile to mention that 2621 proposals have been approved involving Rs. 100.87 crores during 2009-10 i.e. from 1.4.09 to 30.9.09. The achievement under coverage of CGTMSE is really commendable. ● Since the subsidy off-take under CLCSS (Credit Linked Capital Subsidy Scheme) is very low in the State of Odisha, Banks have to finance more and more to MSE (Micro & Small Enterprises) units and take coverage under CLCSS, so that eligible entrepreneurs get benefits out of the scheme. ● BCSBI (Banking Codes and Standards Board of India) code applicable to MSE entrepreneurs should percolate to all MSE entrepreneurs and Banks. ● Banks in Odisha should continue to treat agriculture, MSME (Micro and Small Enterprises), IT, Govt. sponsored schemes such as, PMEGP & SGSY and Women Self Help Groups as thrust areas and endeavor to go all-out to reach the budget in order to strengthen the economy of the State. ● Odisha is predominantly an agrarian State with the agriculture contributing about 26 percent to the net State domestic product (at 1999-2000 prices). It also provides employment to about 65 percent of the total working force. It is not that in agricultural yield front Odisha lags behind only in rice. The yield of pulses and oilseeds in the State is still dismal. The yield rate of pulses in Odisha was 70 per cent and an oilseed was 56 per cent of that of

- 6. the all India averages in 2005-06. Keeping in mind the stagnant crop production over the years and taking into account the suggestions of Planning Commission, a road map of 9 per cent growth for economy as a whole, and agriculture growth target of 4 per cent per annum, the flow of credit to agriculture sector should be enhanced. ● Farmer’s Club are almost non functional in the State. As these Clubs play vital role in creating awareness among farmers, it is required to revitalize them. I request NABARD to initiate necessary steps not only to revitalize the existing Clubs but also to form as many new Clubs as possible, of course, with the help of the Banks. ● NABARD has designed a number of schemes to improve economic viability of agricultural projects and ensure that farmers earn a minimum net income. Banks should take advantage of the schemes formulated by NABARD. ● There is enough scope for food processing industries in the State and financial institutions including Banks should come forward to provide adequate credit support for the purpose. ● He was informed that a sub committee of SLBC has been constituted under the Chairmanship of Commissioner cum Secretary, Agriculture and Food Production, Govt. of Odisha for enhancing credit flow to agriculture sector to boost the agricultural productivity of the State. This is a healthy step in right direction and I am confident that the sub committee will help and guide the banks to reach their goal. ● As most of the farmer population in Odisha belongs to small, marginal and landless laborers, it will be essential for the Banks to finance those farmers on group basis either in JLG (Joint Liability Group) or Tenant Farmer Groups.

- 7. ● The performance of Banks under ACP 2009-10 as on 30/9/2009 is 87 per cent of half yearly target needs improvement. He appealed to all Banks to achieve the target set for 2009-10 which will boost the economy of the State. ● Inspite of economic slowdown, on Y O Y basis the deposit of commercial banks have grown by 27.25 per cent and advances by 19.40 per cent. Sluggishness in flow of credit is because of poor demand due to global meltdown. ● The overall CD ratio stands at 64.12 per cent against the national parameter of 60 percent. The priority sector advance of commercial banks to total advance is 60.65 percent as against National Parameter of 40%. So the Bankers and the Government line Department deserve appreciation for this. ● SGSY (Swarnajayanti Gram Swarojgar Yojana) Scheme aims at establishing a large number of micro enterprises for individuals or Self Help Groups in order to bring every assisted family above the poverty line. It was noticed that performance of Banks in implementing SGSY is not satisfactory during the year 2009-10. Banks are requested to achieve the target set to them for the financial year 2009-10. ● The SJSRY (Swarna Jayanti Sahari Rojgar Yojana) scheme is an urban poverty alleviation programme being monitored by Ministry of Urban & Housing Department, Govt. of India along with the Urban & Housing Department of the State. The performance of Banks needs improvement in implementation of the scheme. ● The SHG movement in Orissa under Mission Shakti has become almost synonymous with economic empowerment of Women. SHG Bank linkage has been growing at rapid pace and undergoing many changes. As of

- 8. 30/09/2009, Banks in Odisha have credit linked more than 4 lakh groups involving Rs. 1452 crores. ● The credit flow to SC/ST sector is to be enhanced. The SC/ST population to the State to total population is around 16.02 and 22.21 percent respectively as per 2001 census. Banks have to finance more and more to the beneficiaries sponsored under OSCSTDFCC Ltd. (Odisha Schedule Caste Schedule Tribe Development Financial Cooperative Corporation Ltd). I would like to inform the House that the last date of financing to the beneficiaries of Rehabilitation of Manual Scavengers has been extended to 28th February 2010 and Banks have to finance the remaining cases sponsored to the banks as early as possible before the stipulated date. ● India lives in villages and he, quoted the writing of Mahatma Gandhi, the Father of the Nation – ● “The village should develop such a high degree of skill that articles prepared by them would command a ready market outside. When our villages are fully developed, there will be no dearth in them of men with high degree of skill and artistic skill. There will be poets, artists, architects, linguists and research workers from villages. In short, there will be nothing in life worth having which will not be had in the village. Today the villages are dung heaps. Tomorrow, they will be like Gardens of Eden, where highly intelligent folk will dwell, whom no one can deceive or exploit.” ● Rural credit has got highest importance and there is enough of opportunities of the Banks in financing in Rural Area as because it is politically powerful and economically viable. ● Bhubaneswar has become the educational hob. There are good numbers of Engineering Colleges set up at Bhubaneswar to provide technical education in

- 9. different faculties. In Odisha there are more than 85 Engineering Colleges established at different places and our State produces about 18,000 Engineering Graduates per year. ● Once Pandit Jawaharlal Nehru, the 1st Prime Minister of India said “For growth our country needs a scientific temper ….. only Science, education and the pursuit of knowledge can help our problems of poverty, of superstition, our vast resources running to waste, of a rich country inhabited by poor people, by enabling a renewed, re-energized education sector, we have the potential to transform our country into a true knowledge power and realize a future of prosperity and growth.” ● He appealed the bankers present to sanction Education Loan to the poor need students for pursuing their higher study. ● For policy makers, planner, Financial Inclusion has emerged as a top priority. In Odisha only 13 districts have achieved 100 percent Financial Inclusion. Although the improvement in achievement of Financial Inclusion has been noticed but the progress is not good. I appeal the LDMs those who have not achieved the 100 percent Financial Inclusion should achieve by December 2009 which we have committed. You are quite aware that lot of emphasis is being given to the concept of Financial Inclusion by the Reserve Bank of India and the Govt. of India. Having an account with the Bank may be the beginning of Financial Inclusion. It is not an end in itself. It is a means to an end. Financial Inclusion will reach its ultimate end, when the deprived section inculcate saving habit, generate income by availing Bank credit and improved their life style.

- 10. ● Financial Inclusion is still in its infant stage. There is a long way to go. Action initiated so far is only small steps for a long journey to make for total financial inclusion. Inclusive growth happens when everyone participates in the economy. In this context, MD. YUNUS, the Nobel laureate says – “If we are looking for one single action, which enable the poor to overcome poverty, I would go for credit. Money is power”. He was quite hopeful that meaningful discussion will take place in the SLBC meeting. Banks and Govt. line Departments will strive hard to fulfill the needs of the people in the lower strata of the society. I want to quote the saying of John F. Kennedy – “Our privileges can be no greater than our obligations. The protection of our rights can endure no longer than the performances of our responsibilities”. All have to change their mindsets at all level to help the vulnerable sections of the society and then only, the dreams of Mahatma Gandhi, the Father of our Nation can be fulfilled. He assured the House that Bankers will continue to work hand in hand with their counterparts in the Government to ensure economic growth and development of the State. He was confident that their joint effort will result in converting Odisha into a developed State and bring back its pristine glory. HIGHLIGHTS OF THE SPEECH OF SHRI R. N. SENAPATI. IAS AGRICULTURE PRODUCTION COMMISSIONER, GOVT. OF ORISSA. While telling about the large no of pending applications sponsored to the banks under various Govt. sponsored schemes which includes SME applications sponsored by DIC and Pisciculture applications sponsored by FFDA(Fish Farmers Development Agencies) and decline of C.D ratio of the Bank he, observed as follows;

- 11. ● Some issues are being discussed continuously in every SLBC meetings and he felt that such issues should be sorted out quickly so that faster progress can be achieved. ● One of the indicators to judge the performance of the banks is C D ratio. It is noticed that it is declining which is matter of concern for all, the reason put forth is due to Global recession and C.D ratio is affected. Have the credit need of all is fulfilled? Have the Banks cleared all the pending applications? Banks have to expedite sanction and disbursement of all the pending applications quickly so that C.D ratio of the banks must improve. ● He stated that the state is progressing very fast in recent years & bankers have a very important role to play. ● While giving importance in increasing credit flow to agriculture, he expressed that growth and development will not really be complete unless credit flow to this sector is not increased. As it is an agrarian economy as said by Executive Director, UCO Bank, perceptive growth will not be possible unless the growth occurs in this sector. ● During the Kharif season due to deficient rainfall, Kharif crop was affected in some parts of the state. He requested the bankers to finance the farmers with sincerity in time. There should not be any complain from any farmers. Bankers have to fulfill the need of the farmers. ● RRBs position is strengthened by contribution from Govt. of India, State Govt and he expected a much larger role to be played by them, otherwise, recapitalization done will not be useful. ● He expressed that, the task of completion of financial Inclusion in the state is very very important. The districts which has not yet achieved 100% Financial Inclusion has to be completed in time. Every citizen should have access to banking networks. SBI has already taken steps. He requested

- 12. other banks also to be involved, so that the transactions become smooth and transparent. ● Banks have to actively involve in implementation of all Govt. Sponsored programme. Although, there is coordination at state level, but there is no coordination at District and Block level. He expected that even at Block level, banks should have close coordination between block functionaries even with rural local bodies. Banks and Govt. Department should work jointly to achieve the desired results. HIGH LIGHTS OF SPEECH OF SHRI J. K. MOHAPATRA, IAS, PRINCIPAL SECRETARY TO GOVT. FINANCE DEPARTMENT,GOVT. OF ORISSA. While expressing happiness in coming back to SLBC forum after 1990 Shri Mohapatra noticed as follows; ● There is a larger agenda of SLBC to be discussed in a limited time, hence smaller forum should be there to take care of issues related to SLBC. ● Declining of C. D ratio is not due to reason of recession, as a matter of fact, regional variation is noticeable in district level and in many districts in the state are having significantly low C. D ratio. Major public sector and private sector banks are also having low ratio, if those things be taken care , ratio will be higher and healthy. Although the ratio is healthy due to performance of Co-operative Bank and Stronger RRB. ● Banks operating the state should come forward proactively in disbursement of credit. The state Govt. must have to play a proactive role for the purpose. We have to strengthen our mechanism to achieve the desired goal. Banks are assured of recovery, if good proposals are scouted, sanctioned and disbursed. For developing the state, two things are required.

- 13. i. State agencies are to be very very proactive, they should have maintained perfect coordination and rapport with local bank officials by visiting the bank branches frequently involving in the process of implementation of Govt. sponsored schemes. ii. Institutional support to the bank by the Govt. where ever required, for lending credit and for getting their dues back. ● Typically, in southern half of the country, C. D. ratio of the banks is found to be high, vibrant banking activities is noticed. Credit Worthiness is there in the area. Finally, he said that, Govt. sponsored is to be successfully implemented by the banks and Govt. line department targeting the poor people who is highly credit worthy. HIGHLIGHTS OF SPEECH OF SHRI KAZA SUDHAKAR, REGIONAL DIRECTOR, RESERVE BANK OF INDIA, REGIONAL OFFICE, BHUBANESWAR. While telling about poor performances of the banks in implementing SGSY during 2009-2010, and DRI lending, he observed as follows; ● Achievement of banks in SGSY scheme upto September 2009 is only 5.47% which is very very low. The performance of the banks in DRI lending is not at all satisfactory. In 2006, it was 0.15 % which has come down to 0.12% as of September, 2009. DRI advance is meant for poorest of the poor. He advised zonal heads/ regional heads to review the targets act to achieve targets which are 1% of the previous year Balance Outstanding of Advance port folio. ● He laid importance on IT Enabled financial Inclusion for payment of social security pensions and NREGS payment to

- 14. the beneficiaries. In this context, Govt. of Orissa has reached one MOU with SBI for EBT (Electronic Benefit Transfer). The scheme is doing well in Andhra Pradesh; it will do so in Orissa, Money go to the account of the beneficiary. ● He expressed that, DCC meetings has not been conducted in time. LDMs have to ensure that districts like BOUDH, KALAHANDI, NUAPADA, MAYURBHANJA, KEONJHAR, BALESORE be held in time. ● In Orissa, 100% Financial Inclusion is achieved in 13 districts, Banks takes a pride of it, but while enquiring in the villages, there are still people left to have bank accounts. The gap noticed in implementing Financial Inclusion is to be filled up. ● He said that, Governor, RBI is visiting Jalanga village in Bhadrakh Districts on 3rd December 2009 in an outreach programme as a part of RBI’s Platinum Jubilee Celebration. He requested the bankers to be present and open a stall to display theirs products to have greater Financial Inclusion and for rural development. Basically, RBI will meet the Farmers and SHG’s. ● Now, in Orissa there are 8 RSETI,s set up in 8 districts. There is a target to set up RSETI in all 30 Districts in the state. The banks which has been asked to set up RSETI’s in the districts assigned to them should open quickly, so that in each districts one RSETI will be functioning. ● In out reach programme in Dhenkanal Districts, RBI was informed that there is no cold storage in the districts, hence

- 15. LDM was requested to keep it as an fresh issue in next DCC meeting and take steps to set up cold storage through bank finance. ● It is observed that, most of the banks are having low C.D ratio, licenses are to be sought from RBI for opening of branches in urban area, those banks will not be permitted to open branches in urban area. Banks having better C. D ratio will be allowed to open branches in urban area. Lastly, he advised the banks to take all possible steps to increase their C. D ratio; to bridge the gap of regional imbalance. There should be a better coordination between the bank officials and officials of state government and other developmental agencies for the economic development of the state. HIGHLIGHTS OF SPEECH OF SHRI C. R. PATTNAIK,CHIEF GENERAL MANAGER, NABARD, REGINAL OFFICE, BHUBANESWAR. While recalling decision of enhancing credit flow to of credit in the last State Credit Seminar to Rs.11500 Crores during 2009-2010, he observed as follows; ● After implementation of scheme of Agriculture Debt Waiver & Debt Relief 2008 of Govt. of India, there is a enough of scope of lending to Farmers in the state of Orissa, hence, the ACP (Annual Credit Plan) target for the year was envisaged of Rs. 11500 Crores for current financial year, which was low in comparison to Andhra Pradesh. That was thought to be a good beginning.

- 16. ● As a matter of fact, a large number of people are eligible to take fresh advance after implementation of Debt Waiver Scheme, 2008 of Govt. of India. Reviews revealed that, banks in Orissa are yet to achieve the projections in a sizeable manner. ● He requested the bankers to take a challenge to achieve credit package of exceeding Rs.11500 Crores in the current year, so that the state will get a boost. Credit is a critical input for development of our agriculture. ● Commercial Banks have started Agriculture term loan by way of investment credit, they have to finance farmers/ beneficiaries for storage of agricultural produces as there is lack of storage facilities in the state. ● Reiterating the speech of Executive Director, UCO Bank for formation of Farmer Club , in the state, he told that all bank branches located in semi- urban and rural area should focus their attentions for formation of Farmers Club. He expressed that, NABARD is trying to establish 2000 Farmers Club during the current year in different districts.NABARD’s ultimate aim is to establish one Farmers Club in every village in our in the state. Farmers Club will be the focal point for all Agri related activities. ● He concluded that Financial Inclusions does not mean that banks will only restrict to opening of accounts only

- 17. that will not serve the desired goal, they should have access to bank through credit, remittances, and insurance products. Agenda Item No.1- The proceedings of the 118th SLBC meeting held on 04-09-2009 at Bhubaneswar was taken as confirmed. Agenda Item No.2 - 1. The credit flow to MSME sector must be enhanced by the Banks. The pending applications under SME sponsored by DIC to various Banks are to be disposed off at the earliest. Action: Banks/ Industries dept. Govt. of Orissa/Directorate of Textiles & Handloom 2. The Banks should finance more and more under MSME sector and take coverage under credit guarantee fund trust scheme for micro & small enterprises which help the entrepreneur to avail collateral free loan up to Rs. 100 lakhs which includes PMEGP also. It was noticed that average loan size covered under the scheme in Orissa is only Rs. 2.42 lakhs which is less than all India average of rs. 3.54 lakhs. Action : Banks/SIDBI/KVIC/KVIB/Industries Dept. Govt. of Orissa. 3. The Banks which have not yet established EDP Institute were advised to open Institute without further loss of time. As advised by Ministry of Rural Development, Govt. of India Govt. of Orissa was requested to allot the land free of cost to those Banks which will open RUDSETI in the District.Banks which have been assigned with opening of RSETI’s should open with out further delay. Action :Banks/PR Dept. Govt. of Orissa/NABARD. 4. In Orissa 13 districts i.e. Cuttack, Ganjam, Puri, Retagged, Nayagarh, Keonjhar, Kendrapara, Angul, Balasore, Kandhamal, Sambalpur, Mayurbhanja, & Dhenkanal have achieved 100% financial inclusions. Other Districts i.e. Koraput, Kalahandi, Nuapada,Bargarh, Jharsuguda,Jagatsingpur,Bhadrak,& Gajpati have to achieve 100% financial inclusion by December.2009 without fail. Financial inclusion of all thirty Districts should be completed by March 2010. The programme of financial inclusion of the Nabarangpur, Malkangiri, and Bolangir & Jajpur district is not satisfactory. LDMs of these districts are advised to take all possible steps for completion of financial inclusion within stipulated time i.e. latest by DECEMBER,2009. By opening of No-frill

- 18. a/c it is not sufficient, those excluded people have to be given credit for doing some economic activities, bankers are advised to issue GCC (General purpose credit card) or any other finance for taking up economic activities for generation of income. Action : Banks/Govt. line Dept. 5. The services of the certificate officer posted in special certificate court i.e Cuttack, Bhubaneswar, Berhampur, Sambalpur & Rourkela should be effectively utilized for functioning of the court. Banks were requested to file as many number of certificate cases in the special certificate court and should have effective liaison with certificate officers for recovery of dues. Certificate cases pending with special certificate court to be disposed of in time. Action : Banks/Revenue Dept. Govt. of Orissa . 6. All LDMs have to submit the district wise information to Mission Shakti Dept. as well as to SLBC as of 30.09.09. Except Rayagada Sonepur, Puri Bolangir, Nuapada, Gajapati, Dhenkanal& Angul, all LDMs have to submit the District wise information on WSHG to Mission Shakti Dept. as well as to SLBC on monthly basis. The reconciliation of district wise data with the SLBC data on financing to WSHG has been a long standing issue which is to be resolved without further delay. Action: LDMs/Banks. 7. 07. Transparency in the operation of MFIs & the area of operation are to be determined. The lending institution/Banks have to share the details of information of financing to MFIs on lending to SHGs/WSHG/JLGs for monitoring their activities. Lending institutions which have financed MFIs must have to monitor about financing of MFIs for on lending to SHGs/WSHG/ JLGs. Action : Banks 8. 08. The banks are advised to achieve the target set to them under self employment mission for the year 2009-10. It may be noted that state govt. has been giving maximum importance on state employment mission. Action: Banks 9. Regarding registration equitable mortgage i.e. mortgage of deposit of title deeds to prevent fraudulent transaction with minimum charges, the matter is under consideration of Govt. of Orissa. Action : Revenue Dept. Govt. of Orissa/Finance Dept. Govt. of Orissa. 10. For stamped duty of reconveyances of waiver of charges under section 4(i) of the OACOMP (Banks) Act 1995 on landed properties, Revenue Dept. Govt. of Orissa was kindly be requested to examine the matter. Action: Revenue Dept. Govt. of Orissa

- 19. 11. Recommendation of working group of K.C. Chakraborty committee on rehabilitation of sick micro & small enterprises are to be followed by all concerned including Banks. The progress in implementation of the scheme will be reviewed in SLBC meeting to be held on quarterly basis. Action: RBI/Industries Dept. Govt. of Orissa/Banks AGENDA ITEM NO.3 FRESH ISSUES A. Issue raised by Panchayatiraj Dept.Govt. of Orissa Banks were requested to gear up their machineries to achieve physical as well as credit mobilization target for the year 2009-10. Banks have to achieve the national target of credit subsidy ratio to 3:1. Action: Banks/ Govt. line Dept. B. Issue raised by the Director of Industries, Orissa, Cuttack Banks have to achieve the PMEGP target set to them for the financial year 2009-10. KVIC/KVIB/DICs have to ensure that applications under PMEGP for the year 2009-10 have to be sponsored in time. Margin Money claims have been settled for 567cases out of 870 disbursed cases under PMEGP for the year 2008-09 by30/06/2009. Out of Rs. 451.64 lakhs utilized money at the beginning of July 2009, it was decided that Rs.424.64 lakhs will be utilized for settlement of claims of remaining 303 disbursed cases. It was decided for release of margin money for remaining 3030 undisturbed cases of 2008-09. As per guidelines, Nodal Branches of each bank has to furnish the Utilisation Certificate on Margin Money to Directorate of Industries for compilation and onward transmission. Also one set of Margin Money claim format has to be sent Directorate of Industries for record. It was also decided that the representatives of Industries Association may be invited to District Level Bankers’ Committee. Banks were advised not to insist on collateral security in contravention to RBI guidelines. Action: Banks /KVIC/LDMs C. Issue raised by Directorate of Textiles, Orissa Finance for construction of Work-shed Banks have to finance balance amount for construction of work-shed under Special Package under the State Plan. As per the Special Package of Hon’ble Chief Minister, Orissa during the year 2007-08, 400 weaver beneficiaries have been provided @ Rs.25000/- to construct their work-shed with own contribution @ Rs.12000/-. The applications for construction of Shed should be included in the

- 20. Scheme which will generate income for the entrepreneurs out of the activities for paying back the loan installment. Financing to weavers trained under Self- Employment Programme Training. During the year 2006-07& 2007-08,310 &997 weaver beneficiaries have been trained respectively under the skill up-gradation training under SEP in Jacquard Weaving, Jalla & Dobby Weaving, Tie & dye & dyeing. During the training, the training under jacquard weaving have been supplied with looms and accessories and under jalla dobby weaving only accessories has been supplied. As the beneficiaries are facing shortage of working capital for continuous production of fabrics, Banks were advised to take steps for sanction of loan to the said weaver beneficiaries on priority basis as per recommendation of zonal officers DDTs/ ADTs. Bank Linkage to weaver Self Help Groups WSHGs inIHDSs Clusters: Currently, 23 Clusters Integrated Handloom Development Scheme (IHDS) Programme implementation is going on and different developmental works are taking place with financial assistance of both central & state Govt. with participation of implementing agency on payment of their share. So far, Govt. of India & Govt. of Orissa have released Rs. 335.05 lakhs and Rs. 29.70 lakh respectively. 148 number of Handloom Self Help Group have been formed in the above stated IHDS cluster (as per page no. 11 of 119 th SLBC Agenda Book.) Due to lack of linkages with financing Banks operational achievements of Self Help Groups ARE NOT satisfactory. The banks in the respective locality were advised to extend loan to SHGs to meet the Working capital requirement enabling the weavers to get regular work & employments Action: Banks/ Textile Department, Govt. of Orissa. D. Issue raised by the Orissa Sch. Caste & Sch. Tribe Development Finance Cooperative Corporation Limited. ● The last date of disbursement under the Scheme of Rehabilitation of Manual Scavengers has been extended upto 28.02.2010. Banks are requested to complete the disbursement within the schedule date. (Please treat the matter as very, very important.). ● Target set for Banks for financing SC Self Help Groups, ST Self Help Groups and individual SC/ ST has to be achieved by the banks operating in the state. The achievement of the banks is not at all satisfactory. Banks and

- 21. SC/ ST Department should take proactive steps for achievement of the target in SC/ST Sector. ● As a matter of facts, most of the Rickshaw Pullers are pulling Rickshaw on hire basis. They have not their own Rickshaw. It was decided that , OSFDC may fix specific target for each Urban Local Body and Rural areas for supply of Rickshaw on loan- cum- subsidy basis. OSFDC will pay subsidy @50% of unit cost subject to maximum of Rs. 10000/- per beneficiary and the balance 50% will be provided by financing banks as loan. Rickshaw loan to Scheduled Castes and Scheduled Tribe under OSFDC Scheme was approved in SLBC meeting to supply of Rickshaw loan during 2009-2010 in urban and rural areas, so that OSFDC may issue advertisement and collect loan applications from beneficiaries and send the applications to banks for sanction of loan. Action: Banks/ SC/ST Department, Govt. of Orissa ● Under OSFDC, towards subsidy for Income Generating Schemes, the debit- cum-Utilization Certificates are not submitted to Govt. of India. Banks are requested to submit the Debit-cum-Utilization Certificates for onward transmission to Govt. of India as pointed by OSFDC. Action: Banks/SC/ST Department, Govt. of Orissa. A. Issue raised by Director of Agriculture & Food Production Orissa, Bhubaneswar. The approved rates of agricultural machinery/implements/equipments have been communicated by the Directorate memo No. 2355 dated 14.7.09 to the Convenor, SLBC. The farm machineries include the high value ones like tractor, power tiller etc. Banks should be proactive in disbursement of loan for the implements particularly power tiller looking in to the small and marginal land holding of the Orissa farmers. In no case the Bank sanction amount shall exceed the approved rate of a particular implement with the terms and condition reflected should be maintained by the supplier. Banks should relax financing norms like minimum land requirement and land mortgage. Essential power tiller driven implements like Axial flow thresher, water pump, trailers should be included in the loan proposal for better financial viability for which Govt. of India is pressing hard. Action:-Banks/ Agriculture Department, Govt. of Orissa. G. Issue raised by Director of Fisheries, Orissa, Cuttack. ● Banks have to extend liberal short term credit to Farmers and entrepreneurs. All district level officers have been advised to sponser adequate number of proposals for the purpose. It was informed that 389

- 22. proposals having water spread area 466.84 ha amounting to Rs. 192.99 lakhs have been pending with different banks are to sanctioned and disbursed. ● Bankers were requested to clear up the pending proposals sponsored for excavation/ renovation of ponds to assist the fish farmers to develop their tanks during the financial year. ● It was decided that, one-stop Aqua shop should be promoted in every block for facilitating availability of inputs for pisciculture and extending technical support to the fish Farmers. Bankers were requested to extend finance and APICOL was requested to provide subsidy for the purpose. Action:- Banks/ Fisheries Department, Govt. of Orissa. A. Issue raised by NHB, Bhubaneswar As per the approved norms of the NHB, the project has to be completed within 2 years from the date of sanction of term loan and subsidy should be claimed immediately after successfully implementation of the Project. Bankers were requested to overview the successful implementation of the project and final claim of the subsidy. The details of the advance subsidy pending in the different banks waiting for final claim of subsidy is given in page no15 of 118TH SLBC agenda book and Bankers were requested to submit final claim of subsidy as mentioned therein. Action:-Banks/ NHB I Issue raised by Khadi & Village Industries Commission, Ministry of MSME (Govt. of India) State Office, Bhubaneswar. ● PMRY and REGP have been merged with effect from April, 2008 and PMEGP has been introduced in its place. PMEGP is the flagship programme of the Govt. of India having ample scope for employment opportunities and increasing the credit flow to MSME Sector to boost the economy. Hence, all Banks have to take proactive approach in financing PMEGP for the current financial year 2009-10. The cases pending with the Banks for the year 2008-09 may be financed after consultation with GM, DIC/ KVIC/KVIB, the sponsoring agencies of PMEGP as applicable as per the norm. The duration for submission of Margin Money claim by the beneficiary till release of Subsidy by the Nodal Bank from the date of disbursement of the 1 st Installment of the loan has been reduced by KVIC from 60 days to 30 days.

- 23. The Institutions aided by KVIC/KVIB having Interest Subsidy Illegible Certificate (ISEC) can avail loans from the Banks at the rate of 4% interest and rest of the interest charged by the Banks will be reimbursed by KVIC/KVIB as interest subsidy. Banks are advised to expedite the sanction through the above scheme for development of KVIC in Orissa. Action:-Banks/KVIB/KVIC/Industries Department, Govt. of Orissa. I. Issue raised by Reserve Bank of India, Bhubaneswar. Direct transfer of security pension into the bank accounts of beneficiaries. The Govt. of India has set up a group under the chairmanship of Secretary, Rural Development, Government of India to examine the feasibility of direct transfer of social security pension in to the Bank/Post Office accounts of the beneficiaries. The committee has pointed out the delay in transferring funds by the nodal bank to disbursing branches of the banks causing delay in payment to the beneficiaries. In order to ensure the timely credit of amount to the accounts of beneficiaries it has suggested a system to be introduced to credit the amount on scheduled date so that the beneficiary is free to withdraw the amount any day it likes. This is for the information of all concerned. All Scheduled Commercial Banks were requested to sanction and disburse DRI advances minimum to the extent of 1% of Bank’s total advance as at the end of the previous year. Banks have to give thrust in financing DRI beneficiaries. Actions:-Banks. A. Issue raised by LDM, Nabrangpur. Relaxation of Service Area Norms for Govt. Sponsored Schemes of SHGs- Banks have been financing SHGs outside the Service Area. Whenever credit linked to SHGs under SGSY Schemes comes, then applications were returned by the financing Banks as it is located outside the Service Area. This is to inform you that SERVICE AREA CONCEPT has been dispensed with except for the implementation of the Govt. Sponsored Schemes. Since the financing Banks were not able to finance to those groups under SGSY, RBI is requested to kindly take up the issue with the appropriate authority for resolvement of the issue including financing crop loan to the number of defaulter SHGs. Action:-RBI L. Issue raised by LDM, Dhenkanal. In response to issue raised by LDM, Dhenkanal, it was resolved that Private Sector Bank can participate in implementation of PMEGP and other Govt. sponsored schemes. Action:- Pvt. Sector Banks/KVIC/KVIB/Govt. Line Department. M. Issue raised by UCO Bank.

- 24. Prime Minister’s New 15 Points Programme for Welfare of Minorities:- ●As per the Prime Minister’s New 15 Points programme for welfare of minorities, targets have been allocated amongst Public Sector Banks for the financial year 2009-10 (Page No. 74) of Agenda Book. Banks were requested to achieve the target set to them for financing Minorities Community. Reverse Mortgage Scheme (RML) ●It was advised by Govt. of India, Ministry of Finance, Department of Financial Services, New Delhi to make the Reverse Mortgage Loan (RML) more effective and popular, the performance of Banks in financing under RML will be reviewed in SLBC Meeting held on quarterly basis. All Banks are requested to finance under RML on priority. The member banks may also be requested to undertake awareness building programme in consultation with National Housing Bank (NHB). Special Housing Loan on account of Flood. ● As a matter of fact, large number of accounts of Special Housing Loan, sanctioned on account of flood occurred in Orissa for construction and repairing of house turned NPA which affects the recycling of funds for lending further also affect profitability of the Banks to a great extent. Hence, it was decided that Banks have to list out the names of the DDOs (Drawing and Disbursing Officer) of the various Govt. Depts. who are not deducting the Installments for remitting to the Bank branches for crediting to the Loan Account and name of the DDOs is to be furnished to DIF, Finance Department, Govt. of Orissa, so that Government may take up with the appropriate authorities. Action: All Banks/DIF AGENDA ITEM NO. 4 Banking Key Indicator of Orissa as on 31.03.09

- 25. The banks have to increase the CD ratio which is showing declining trend as compared to the previous year. The public sector banks like Canara bank, United Bank of India, Central Bank of India, Corporation Bank, Punjab National Bank, Punjab & Sind Bank, Syndicate Bank, State Bank Of Travancore, Vijaya Bank and some Private sector Banks like Axis Bank, Rajasthan Bank Ltd., Vyasa Bank, The South Indian Bank ltd., , Karur Vyasa Bank, Laxmi Vilas Bank ltd. Were having low CD ratio which is to be improved in coming days. Except Indian Overseas Bank, none of the banks have achieved national parameter under DRI i.e. 1% of total outstanding advance of previous Year. Rest of banks has to achieve the target of National parameter under DRI. The CD ratios of the districts have to be improved. LDMs of Deogarh Gajpati, Jagatsingpur, Kandhamal, Kendrapara, Malkangiri, Nuapada, Rayagada and Sambalpur should take all possible steps to improve their CD ratio. Action : Banks mentioned above / All Banks/ LDMs of Deogarh, Gajpati, Jagatsingpur, Kandhamal, Kendrapara, Malkangiri, Nuapada, Rayagada and Sambalpur AGENDA ITEM NO. 5 RECOVERY The overall recovery position as of 30/09/2009 is not satisfactory, i.e.59.60%.The percentage of recovery of IRDP/SGSY/ PMRY AS OF 30/09/2009 were 46.68 and18.33 % respectively needs improvement.Govt.machineries were requested to render adequate help and assistance in organizing recovery camps to improve the performance of recovery for better recycling of funds. Low recovery stands as a barrier for credit growth in the state. Action:-Banks/ Govt. Line Department. AGENDA ITEM NO.6 Review of performance under Annual Credit Plan. The performance of the Banks under ACP 2009-10 upto September 09 is 87%. The Performance of Banks as a whole under Crop LOAN Sector being is not satisfactory. The performance of Boudh, Dhenkanal, Ganjam, Kalahandi, needs improvement. The LDMs should take proactive steps in close coordination with

- 26. officials of Govt. line Departments and bank officials to improve the performance of the districts. Under ACP-2009-10. Action:-Banks/ LDMs/Govt. line Department. AGENDA ITEM NO. 7 Progress under Women Self Help Groups (Mission Shakti). ● Banks operating in the state allotted with the target of financing WSHG during 2009-10 have to achieve the target and should give top priority in financing WSHG for improvement of women as our social objectives. ● LDMs have to submit the monthly data on WSHG bank wise of their district to Mission Shakti Dept., Govt. of Orissa as well as to SLBC by 10th of the succeeding month. ( Very very important) ● MFIs operating the state have been financing WSHGs in large numbers which are to be monitored by the financing banks. ● Banks which have financed MFIs Must share their information to SLBC as well as to Mission Shakti Dept., Govt. of Orissa. Action : Banks/ LDMs/ Govt line dept. AGENDA ITEM NO. 8 Review of performance under PMEGP and SGSY been allocated under PMEGP for the year 2009-10. All Banks in Orissa should take proactive steps to achieve 100% target during the financial year 2009-10. SGSY. All Banks and Govt. line Dept. should work together to increase subsidy credit ratio and per capita investment under SGSY. Action : Banks /Govt. line Dept. AGENDA ITEM NO. 9 Credit Flow to Handloom & Handicraft Sector In order to enhance the credit flow to Handloom & Handicraft sector, Banks have to extend hassle free loan to Handloom Weavers on priority. Banks should take proactive steps to issue ACCS to Handloom Weavers. Hanks have to finance SHGs promoted by Department of Directorate of Handicraft and Village & Cottage Industries, Orissa.

- 27. Action : Banks/Govt. Line Department. AGENDA ITEM NO. 10 Progress under SJSRY Banks are requested to implement the scheme with all sincerity and commitment to uplift the Urban poor above the poverty line and target set for 2009-10 under SJSRY has to be achieved. Action : All Banks/LDMs. AGENDA ITEM NO. 11 The performance of banks under SC/ST/Scavengers/ITDA. The applications sponsored by OSCSTDFCC Ltd./OSFDC under SC/ST/Scavengers/ITDA should be financed with utmost sincerity as an objective of increasing credit flow to women as well as SC/ST sector. Action: All Banks/Govt. line Department. AGENDA ITEM NO. 12 Performance under KCC/SCC/ACC The Commercial Banks have to issue KCC to all eligible farmers. Banks were requested to take all possible measures to achieve the targets under ACC/SCC/KCC for the year 2009-10. Action : Banks/LDMs AGENDA ITEM NO. 13 Performance under Pisciculture

- 28. All the pending eligible proposals under Pisciculture should be sanctioned and disbursed on priorities. Banks should sanction short term credit just like crop loan in agriculture to fish farmers to increase the production in the State. Action : Banks/Govt. line Departments. AGENDA ITEM NO. 14 National Housing Loan, Home Loan, Rural Housing Finance, Finance to Ex- servicemen, Finance to Minority Community. Banks have to improve their performance and correct reporting should be made by the Banks in respect of National Housing Loan, Home Loan, Rural Housing Finance, Finance to Ex-servicemen and finance to Minority Community. Action : All Banks. AGENDA ITEM NO. 15 Education Loan Banks should give priority to Education Loan and finance more and more to this sector. Action : All Banks. AGENDA ITEM NO. 16 Progress under National Horticulture Board Banks should give emphasis to provide more and more credit under this sector. Action : All Banks/NHB AGENDA ITEM NO. 17 Financial Inclusion The cent percent Financial Inclusion have to be completed as soon as possible. Lead District Managers are requested to take all possible measures for completing Financial Inclusion of the State.

- 29. Action : All LDMs. At the end Mr. C.P. Das, Chief Officer, SLBC, UCO Bank proposed vote of thanks to the Chair as well as participants.