Lithuanian Economy Newsletter Analyzes Investments, Profits

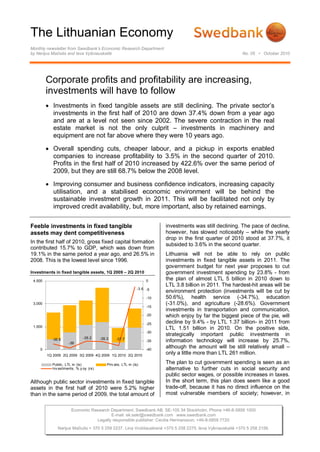

- 1. The Lithuanian Economy Monthly newsletter from Swedbank’s Economic Research Department by Nerijus Mačiulis and Ieva Vyšniauskaitė No. 05 • October 2010 Corporate profits and profitability are increasing, investments will have to follow Investments in fixed tangible assets are still declining. The private sector’s investments in the first half of 2010 are down 37.4% down from a year ago and are at a level not seen since 2002. The severe contraction in the real estate market is not the only culprit – investments in machinery and equipment are not far above where they were 10 years ago. Overall spending cuts, cheaper labour, and a pickup in exports enabled companies to increase profitability to 3.5% in the second quarter of 2010. Profits in the first half of 2010 increased by 422.6% over the same period of 2009, but they are still 68.7% below the 2008 level. Improving consumer and business confidence indicators, increasing capacity utilisation, and a stabilised economic environment will be behind the sustainable investment growth in 2011. This will be facilitated not only by improved credit availability, but, more important, also by retained earnings. Feeble investments in fixed tangible investments was still declining. The pace of decline, assets may dent competitiveness however, has slowed noticeably – while the yearly drop in the first quarter of 2010 stood at 37.7%, it In the first half of 2010, gross fixed capital formation subsided to 3.6% in the second quarter. contributed 15.7% to GDP, which was down from 19.1% in the same period a year ago, and 26.5% in Lithuania will not be able to rely on public 2008. This is the lowest level since 1996. investments in fixed tangible assets in 2011. The government budget for next year proposes to cut Investments in fixed tangible assets, 1Q 2009 – 2Q 2010 government investment spending by 23.8% - from 4,500 0 the plan of almost LTL 5 billion in 2010 down to LTL 3.8 billion in 2011. The hardest-hit areas will be -3.6 -5 environment protection (investments will be cut by -10 50.6%), health service (-34.7%), education 3,000 (-31.0%), and agriculture (-28.6%). Government -15 investments in transportation and communication, -20 which enjoy by far the biggest piece of the pie, will -25 decline by 9.4% - by LTL 1.37 billion- in 2011 from 1,500 LTL 1.51 billion in 2010. On the positive side, -30 strategically important public investments in -35.2 -35.3 -37.7 -36.8 -39 -35 information technology will increase by 25.7%, 0 -40 although the amount will be still relatively small – 1Q 2009 2Q 2009 3Q 2009 4Q 2009 1Q 2010 2Q 2010 only a little more than LTL 261 million. Public, LTL m (ls) Priv ate, LTL m (ls) The plan to cut government spending is seen as an Inv estments, % y oy (rs) alternative to further cuts in social security and public sector wages, or possible increases in taxes. Although public sector investments in fixed tangible In the short term, this plan does seem like a good assets in the first half of 2010 were 5.2% higher trade-off, because it has no direct influence on the than in the same period of 2009, the total amount of most vulnerable members of society; however, in Economic Research Department. Swedbank AB. SE-105 34 Stockholm. Phone +46-8-5859 1000 E-mail: ek.sekr@swedbank.com www.swedbank.com Legally responsible publisher: Cecilia Hermansson, +46-8-5859 7720 Nerijus Mačiulis + 370 5 258 2237. Lina Vrubliauskienė +370 5 258 2275. Ieva Vyšniauskaitė +370 5 258 2156.

- 2. The Lithuanian Economy Economic Research Department, Swedbank Nr 05 • October 2010 the long term, this will clearly have a negative The best-performing industry sectors were mining impact on the productivity and competitiveness of and quarrying, information and communication, the Lithuanian economy. professional and scientific, and real estate activities, where pre-tax profit margins were well above 10%. The reasons behind the abrupt contraction of The worst two performers – incidentally dominated investments in fixed tangible assets are well-known by state-owned enterprises – were the forestry and – the collapse of the real estate bubble and the electricity and gas supply sectors. This point to the cessation of credit have stopped almost all high level of inefficiency and dire need to reform investments in property. However, investments in these enterprises (the issue we addressed in last machinery and equipment have experienced similar month’s newsletter). contraction. One of the most important factors behind this, next to the scarcity of credit, has been Profit margins, 2Q 2010 shrinking domestic demand and uncertainty about (percent) the need of production capacities in the future. 25.5 Mining and quarry ing In the first half of 2010, total investments in 14.3 Inf ormation and communication machinery and equipment were down by 7.8% from 12.7 Real estate activ ities the same period in 2009, and by a staggering 53.2% from 2008. 8.4 Education 3.5 Manuf acturing Investments in fixed tangible assets, 2Q 2010 3.2 Wholesale and retail trade (annual growth) 3.1 Transport Acquisition of 2.3 Construction buildings -1.3 Accommodation and f ood serv ice Acquisition of -3.5 Forestry land -7.0 Electricity and gas supply Repairs of equipment -10 0 10 20 30 Construction of buildings In the manufacturing sector, pharmaceutical, Total beverage, motor vehicle, electronics and textile producers were comfortably above the industry Acquisition of average. equipment Higher profits and retained earnings are expected -50 -40 -30 -20 -10 0 10 20 to be important investment financing alternative in 2011. Furthermore, with the first onset of the crisis, the government introduced corporate income tax The first signs of recovery in the acquisition of breaks for long-term investments in machinery and equipment and machinery were visible in the equipment, computers, and software. This had little second quarter of 2010. This increase, however, effect in 2009 as companies were struggling with came from the public sector, which invested 20.1% low demand, weak cash flows, and dried credit. more in the first half of this year. Investments in Over the next few years, however, this measure will machinery and equipment in the private sector have be a significant incentive to invest in fixed tangible continued to decline and in the first half of this year assets, especially because the tax breaks expire in were 17.8% smaller than a year ago. 2013. Growing profits and retained earnings Increasing capacity utilisation and will be important sources of confidence signal that investments investment will have to increase In the first half of 2010, corporate profits increased Capacity utilisation had dropped from around 75% more than fivefold from a year ago, which, to 60% by the middle of 2009. Exhaustion of admittedly, was a very bad year. Although profits inventories in 2009 and rapidly recovering exports are below the levels seen in 2008, the growth trend have caused capacity utilisation to pick up, and is expected to continue throughout this year and some sectors have returned to pre-crisis levels. into 2011. In the 1st half of 2010 the pre-tax profit This is especially obvious in the manufacturing of margin widened to 3.5% but is still below the 2005- wearing apparel and wood sectors – capacity 2008 average of 6.2%. utilisation is already above the 2008 average. 2 (4)

- 3. The Lithuanian Economy Economic Research Department, Swedbank Nr 05 • October 2010 However, furniture, fabricated metals, and other was below expectations, but we do not think that non-metallic mineral products are still working at there are many causes for concern. Growth in capacities that only slightly exceed 50%. Furniture recent quarters is a little bit more volatile because producers were hit hard by the contraction in real of large influence from rebuilding of inventories. estate transactions, but this sector is now picking Nominal annual growth in third quarter was at up, mainly due to exports. healthy 6.7%, but real GDP was lower because of increasing prices of inventories. This was a second Capacity utilisation rates, Jan 2007 – Aug 2010 consecutive quarterly growth in GDP, indicating that (percent) recession is formally over. 80 After two years of negative profits Lithuanian banking sector has moved into a positive area in 70 third quarter of 2010 and earned LTL 44.2 million. During the first nine months of this year banks still has losses of LTL 363.9 million, but that is 60 significantly lower than LTL 1.37 billion in the same period a year ago. 50 Credit growth is still in a negative zone, but the decline has flattened out and we expect a gradual 40 pick up next year. It is possible that there will be 2007 2008 2009 2010 some rebalancing of corporate credit portfolio – a Total Wearing apparel shift from real estate sector, which currently makes Wood up more than 30% of total credit stock, into Furniture Other non-metallic mineral products manufacturing and export oriented sectors. Credit growth will largely depend on the demand from Economic sentiment has been steadily improving companies with sound investment projects. since the beginning of the year. Retail trade and Loans to non-financial institutions, Jan 2006 – Aug 2010 services indicators have moved into a positive area, indicating that optimists outnumber the pessimists. 60% 5% Not surprisingly, construction sentiment is the 50% 4% weakest, as the sector will recover slowly and probably not in the near term – inventories of 40% 3% unsold stock first need to be cleared out. 30% 2% Economic Sentiment Indicator, Jan 2007 – Sep 2010 20% 1% 10% 0% 40 0% -1% 20 -10% -2% 0 -20% -3% -20 2006 2007 2008 2009 2010 -40 monthly growth (r.s.) annual growth (l.s.) -60 -80 Similar to 2010, EU funds will likely provide one of the most significant boosts to investment: according -100 to the recently proposed budget for 2011, priority for 2007 2008 2009 2010 investments will be given to projects co-financed Ov erall sentiment Industry with EU funds, while the absolute value of funds Construction Retail trade Serv ices Consumer allocated for investments will remain similar to 2010. In addition, we are likely to begin to see the There are more positive signs of recovery in lagged direct and indirect results of government domestic demand and the overall economy. In stimulus plan measures (such as those aimed at September, retail trade turnover increased by 6.1% aiding companies to find new export partners, the over the previous year. It was the first annual co-financing of R&D investments, training, and increase since September 2008. Third-quarter GDP others) adopted this and last year. increased by 0.6% from the previous year – this 3 (4)

- 4. The Lithuanian Economy Economic Research Department, Swedbank Nr 05 • October 2010 Pre-crisis growth, fuelled by cheap and easily impact on GDP in the short term, it can also accessible credit, may have been exhilarating but increase long-term potential growth. was not sustainable. The Lithuanian economy will have to take a more sustainable path of investment Nerijus Mačiulis in tangible assets, which can boost productivity and Ieva Vysniauskaite competitiveness. Not only will this have a positive Swedbank Economic Research Department Swedbank’s monthly newsletter The Lithuanian Economy is published as a service to our SE-105 34 Stockholm customers. We believe that we have used reliable sources and methods in the preparation Phone +46-8-5859 1028 of the analyses reported in this publication. However, we cannot guarantee the accuracy or ek.sekr@swedbank.com completeness of the report and cannot be held responsible for any error or omission in the www.swedbank.com underlying material or its use. Readers are encouraged to base any (investment) decisions on other material as well. Neither Swedbank nor its employees may be held responsible for Legally responsible publisher losses or damages, direct or indirect, owing to any errors or omissions in Swedbank’s Cecilia Hermansson, +46-8-5859 7720. monthly newsletter The Lithuanian Economy. Nerijus Mačiulis, +370 5 2582237. Lina Vrubliauskienė, +370 5 268 4275. Ieva Vyšniauskaitė, +370 5 268 4156. 4 (4)