Solar Cell Supply Chain

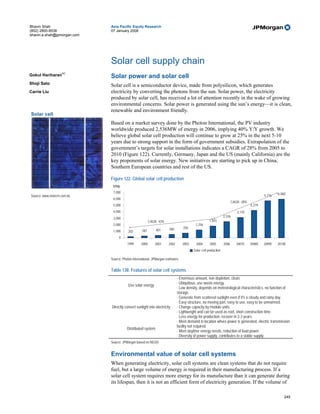

- 1. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Solar cell supply chain AC Gokul Hariharan Solar power and solar cell Shoji Sato Solar cell is a semiconductor device, made from polysilicon, which generates Carrie Liu electricity by converting the photons from the sun. Solar power, the electricity produced by solar cell, has received a lot of attention recently in the wake of growing environmental concerns. Solar power is generated using the sun’s energy—it is clean, renewable and environment friendly. Solar cell Based on a market survey done by the Photon International, the PV industry worldwide produced 2,536MW of energy in 2006, implying 40% Y/Y growth. We believe global solar cell production will continue to grow at 25% in the next 5-10 years due to strong support in the form of government subsidies. Extrapolation of the government’s targets for solar installations indicates a CAGR of 28% from 2005 to 2010 (Figure 122). Currently, Germany, Japan and the US (mainly California) are the key proponents of solar energy. New initiatives are starting to pick up in China, Southern European countries and rest of the US. Figure 122: Global solar cell production MWp 7,000 6,000 Source: www.motech.com.tw. 5,776 6,000 CAGR: 28% 5,000 4,279 4,000 3,170 2,536 3,000 CAGR: 43% 1,815 2,000 1,256 560 750 1,000 202 287 401 0 1999 2000 2001 2002 2003 2004 2005 2006 2007E 2008E 2009E 2010E Solar cell production Source: Photon International, JPMorgan estimates. Table 138: Features of solar cell systems · Enormous amount, non depletion, clean. · Ubiquitous, use waste energy. Use solar energy · Low density, depends on meteorological characteristics, no function of storage. · Generate from scattered sunlight even if it's a cloudy and rainy day. · Easy structure, no moving part, easy to use, easy to be unmanned. Directly convert sunlight into electricity · Change capacity by module units. · Lightweight and can be used as roof, short construction time. · Less energy for production, recover in 2-3 years. · Meet demand in location where power is generated, electric transmission facility not required. Distributed system · Meet daytime energy needs, reduction of load power. · Diversity of power supply, contributes to a stable supply. Source: JPMorgan based on NEDO. Environmental value of solar cell systems When generating electricity, solar cell systems are clean systems that do not require fuel, but a large volume of energy is required in their manufacturing process. If a solar cell system requires more energy for its manufacture than it can generate during its lifespan, then it is not an efficient form of electricity generation. If the volume of 249

- 2. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com CO2 emissions resulting from a solar cell system’s manufacture exceeds the reduction of emissions it achieves via electricity generation, moreover, then it is environmentally harmful in terms of global warming. The lifespan energy profitability and overall CO2 emissions are measured in energy payback time (EPT) and lifetime CO2 emission units. EPT is a measure of how many years of operation is required to generate the energy used in the manufacturing stage, and if this value is smaller than the lifespan of the system it is profitable in terms of energy. Lifetime CO2 emission units are a measure of CO2 emissions per 1kWh of electricity generation over the entire lifespan of the system, and the CO2 emission efficiency of solar cell systems can be compared with other forms of electricity generation using this value. We estimate that the EPT for household solar cell systems is approximately 1–1.5 years in Japan and 1–3 years in Europe, which are both very low values compared to the expected lifespan for solar cell systems of 20 years. Stated differently, solar cell systems can recoup the energy required for their manufacture in one to three years after their installation, and thereafter they add value by becoming net energy producers and enabling lower consumption of fossil fuels. We estimate that household solar cell systems result in 53g of greenhouse gas emissions (CO2 equivalent) per 1kWh of electricity generation, with the majority of this produced during their manufacture. We estimate that commercial power sources result in 360–378g of greenhouse gas emissions (CO2 equivalent) per 1kWh, and that thermal electricity generation on average results in 690g, which is more than 10x the volume of solar cell systems. We thus estimate that the CO2 emission reduction impact of solar cell systems is 307–637g per 1kWh of electricity generation. Figure 123: Energy production and CO2 emissions CO2 emissions/kWh g-CO2/kWh net output plant and operation fuel combustion to generate pow er 1,000 800 600 887 400 704 478 408 200 53 29 22 15 11 88 130 111 0 38 medium-sized coal-fired thermal oil-fired thermal LNG-fired thermal LNG-fired thermal power(combined) nuclear power geothermal power wind power solar power small-and- waterpower power power power Source: Sangyo-times. Government incentive for solar power The Kyoto protocol, established in 1997, sets binding greenhouse gas emission targets for countries that sign and ratify the agreement. The protocol came into force in February 2005. Country signatories to the protocol have agreed to reduce their anthropogenic emissions of greenhouse gases (CO2, CH4, N2O, HFCs, PFCs, and SF6) by at least 5% below their 1990 levels, between the commitment period of 2008 and 2012. Nevertheless, rising environmental concerns have boosted the global demand for renewable energy, due to government subsidies. 250

- 3. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com According to the European Commission’s “PV Status Report 2006”, the countries that have made key changes in government policies for solar energy are: Germany: The German feed-in law was introduced in 1999 and renewed in August 2004, resulting in a dramatic increase in PV installations. In its latest figures, the German Solar Industry Association reported systems with total of 600MW installed capacity in 2005. Other EU countries: Italy has passed new feed-in laws in 2005. According to the “PV status report 2006”, 50MW to 80MW capacity will be installed in 2006 with an upper cap of 500MW for 2012. France introduced its feed-in laws in 2006. Spain’s current cap is 150MW, which is likely to be revised up. Table 139: Feed-in tariff system in each country Effective date Feed-in tariffs (2007) Duration Remarks ~30KW: 0.492€/KWh Incentives will decrease by 5% annually 2000 effective 30KW~100KW: 0.468€/KWh Germany 20years (6.5% for other than house). 0.05 euro will 2004 revised 100KW~: 0.463€/KWh be added when set in front of the building. Except house: 0.380€/KWh 1998 effective ~100KW: 0.414€/KWh After 26 years, 80% of incentives will be Spain 25years 2004 revised 100KW~: 0.216€/KWh paid. 2001 effective ~5KW: 0.444€/KWh Incentives will finish after 15 years or when Portugal 15yearrs 2005 revised 5KW~: 0.317€/KWh total electricity reaches 21 GWh. 1KW~20KW: 0.423€/KWh Incentives will decrease by 5% annually. Italy 2005 effective 20KW~50KW: 0.437€/KWh 20years Incentives are incremented by 10% for 50KW~1000KW: 0.467€/KWh installed in new or restored buildings. 2002 effective Corsica and overseas: 0.40€/KWh 0.55 euro/KWh will be paid when installed France 20years 2006 revised Other regions: 0.30€/KWh in new or restored buildings. Incentive system is different between less For house or Business: 0.03~0.39$/KWh than 100KWh and more than 100KWh and U.S.A (California) 2007 effective Tax-free: 0.1~0.5$/KWh (more than will be united in 2010. Incentives depend on 100KWh) total electricity (10 steps) and will decrease by 10% annually. Source: JPMorgan views based on PV news. China: The Standing Committee of the National People’s Congress of China endorsed the Renewable Energy Law on 28 February 2005, which came into effect on January 1, 2006. The Chinese government targets renewable energy to contribute to the country’s gross energy consumption at 10% by 2010 and 17% by 2020—a significant increase from the current 1%. The 2010 plan includes the installation of 450MW photovoltaic systems. Also, the concept of Green Olympics for Olympic Summer Games in Beijing in 2008 will be a strong catalyst. US: The 2005 Energy Bill, aimed at increasing the demand for photovoltaics, was passed by the Senate on July 29, 2005 and was signed by President Bush on August 8, 2005. The main support mechanisms of the bill are: (1) increase in the permanent 10% business energy credit for solar power to 30% for a two-year period. The credit reverts to the permanent 10% level after two years. (2) Establishment of a 30% residential energy credit for solar for two years. For residential systems, the tax credit is capped at US$2,000. In addition, California has the “Million Roof Initiative” (SB1) for solar energy. The California Solar Initiative (CSI) adopted SB1 in January 2006. It secured a US$3.35 billion long-term solar rebate plan for California to deploy 3,000MW of solar power systems on residential, commercial and government buildings throughout the state. In June 2006, SB1 was passed by the California Assembly. 251

- 4. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Japan: In June 2004, the Japanese Ministry of Economics, Trade and Industry (METI) announced the “Vision for New Energy Business”. This strategy report aims at developing an independent and sustainable new energy business with powerful support measures for PV. Further, in a June 2005 symposium on “Photovoltaic Generating Systems” titled Beginning of the era of GW PV market”, the director of the New and Renewable Energy division of METI announced that the mid- to long- term strategy aims to reduce oil dependency by 40% by 2030. Japan Photovoltaic vision paper predicts that Japanese domestic market consumption will increase to 1,200MW and exports will increase to 1,000 MW by 2010. Table 140: Evolution of cumulative solar electrical capacities till 2030 GW 2000 2010E 2020E 2030E USA 0.14 2.1 36 200 Europe 0.15 3.0 41 200 Japan 0.25 4.8 30 205 Worldwide DCP 1.00 8.6 125 920 Worldwide AIP 1.00 14.0 200 1830 Source: Japanese, US, EPIA roadmaps and EREC 2040 scenarios. Note: DCP stands for Dynamic Current Policy Scenario, AIP stands for Advanced International Policy Scenario. Solar cell module market The 2006 shipment volume of solar cell modules expanded 35.5% Y/Y to 1,870MW. We estimate a per watt price for solar cell modules at US$3.78, and therefore estimate a market scale for solar cell modules at US$7.07 billion. Including installation costs, we estimate a market scale for the solar cell industry at around US$13 billion. We identify three drivers for the demand for solar cells. 1. The emergence of viable business opportunities owing to price declines and greater subsidies. 2. Environmental regulations and government subsidies. 3. Increased environmental awareness among individuals. The shipment volume of solar cell modules expanded at a CAGR of 49.1% between 2000 and 2006. The annual growth rate was in excess of 50% up to 2004, but growth then slowed to 29.9% in 2005 and 35.3% in 2006. We attribute the slowing to factors including: (1) a supply shortage for the main raw material, polysilicon, and (2) a decline in subsidies in Japan, which made up 24.1% of global demand in 2004. We expect the supply volume of polysilicon to expand from 2H 2008, thereby removing one factor holding back the production volume of solar cell modules. Furthermore, countries in addition to Germany have started to introduce subsidies for solar cells as part of their measures to counter global warming, including the US and European countries like Spain, Italy, France and Portugal. We expect increased supply volume for polysilicon and greater subsidies to boost shipments of solar cells, and we believe that 2010 shipments will even exceed the optimistic projection shown in Figure 125. This optimistic projection assumes that shipments of solar cell modules will expand at a CAGR of 46.7% from 2007 to reach 8,600MW in 2010. Even if the module price falls to $1.79 per watt by 2010, it would still result in a market scale of $15.51 billion in 2010, representing growth of 120% from the market in 2006. We believe that changes in the supply/demand balance for polysilicon from 2H 2008 will boost the supply of solar cell modules, and cause their prices to fall. If the price of solar cell modules falls substantially, earnings at companies involved in solar cell 252

- 5. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com manufacturing could suffer. A war of attrition caused by falling prices could therefore break out between 2H 2008 and around 2010. Nevertheless, lower prices for solar cell modules should boost demand, and we foresee a major opportunity for substantial earnings growth through 2020 at companies involved in solar cells that survive the war of attrition or succeed in greatly lowering their manufacturing costs. Figure 124: Solar cell module market demand by region Figure 125: Global solar cell module market demand MW MW 2,000 10,000 8,000 1,500 6,000 1,000 4,000 500 2,000 0 0 CY2000 2001 2002 2003 2004 2005 2006 CY2000 2002 2004 2006 2008E 2010E Europe Japan US/CANADA ROW DOWNSIDE UPSIDE BASE CASE Source: PV news, July 2007. Source: PV news, July 2007. Historical production volume of solar cells The global production volume of solar cells expanded 40.3% Y/Y in 2006 to 2,500MW. According to PVnews, 2007 solar cell production is expected to be 5,523 MW. In regional terms, Japan was responsible for 927.5MW or 37.1% of overall production in 2006, but Japanese production only expanded 11.3% Y/Y. In contrast, production outside of Japan, the US and Europe expanded 121.4% to 714MW in 2006, with Chinese and Taiwanese companies mainly being responsible for this growth. Among the top ranked companies, growth at Japanese companies was limited by difficulties in procuring enough silicon, and the end of government subsidies in Japan. Meanwhile, growth was very rapid at Q-Cells (Germany), Suntech (China) and Motech (Taiwan). 253

- 6. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Table 141: Top 18 solar cell production companies Company 2000 2001 2002 2003 2004 2005 2006 2007E Ranking Ranking 2007 2006 Sharp (JP) 50 75 123 198 324 428 434 710 1 1 Q-Cells (DE) 28 75 160 253 516 2 2 Suntech (CH) 28 80 158 470 3 4 Motech (TW) 35 60 110 280 4 7 Kyocera (JP) 42 54 60 72 105 142 180 240 5 3 SunPower (PH) 63 210 6 11 First Solar (US) 60 210 7 13 Gintech (TW) 15 210 8 31 E-Ton (TW) 32.5 200 9 19 Deutsche Cell/SHELL (DE) 17 28 38 86 185 10 9 JA Solar (CH) 25 175 11 24 Sanyo (JP) 17 19 35 35 65 125 155 170 12 5 GEEG Nanjing (CH) 60 160 13 14 Schott Solar 14 23 30 42 63 95 96 150 14 8 Mitsubishi (JP) 12 14 24 40 75 100 111 135 15 6 Isofoton (ES) 10 18 27 35 53 53 61 130 16 12 BP Solar 42 54 74 70 85 90 86 118 17 10 Baoding Yingli (CH) 35 118 18 18 ERSOL (GE) 40 15 Photowatt (FR) 14 14 17 20 22 24 36 16 USSC (US) 3 4 4 7 14 22 36 17 Shell Solar (US) 28 39 58 73 72 59 2 20 Total of 18 companies 232 314 451 637 1,044 1,476 2,093 4,387 Others 56 85 109 122 151 306 643 1,166 World Total 288 399 560 759 1,195 1,782 2,500 5,553 Y/Y% 38.50% 40.40% 35.50% 57.40% 49.10% 40.30% 122.13% Source: PVnews. Figure 126: Production ratio of companies in CY2007E Q-Cells (DE) Sharp (JP) 10% 13% Suntech (CH) Others 9% 40% Motech (TW) Deutsche 5% Cell/SHELL (DE) 3% Ky ocera (JP) 4% SunPow er (PH) E-Ton (TW) 4% 4% First Solar (US) Gintech (TW) 4% 4% Source: PV news, JPMorgan estimates. Figure 127: Global cell production MV 3,000 2,500 2,000 1,500 1,000 500 0 CY2000 CY2001 CY2002 CY2003 CY2004 CY2005 CY2006 US Japan Europe ROW Source: PV news, JPMorgan estimates. 254

- 7. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Types and characteristics of solar cells The most important characteristics of solar power generation systems are their usable lifespan, and the efficiency at which they convert light into electricity. Both the light conversion efficiency and the lifespan depend upon the solar cell, which is the most important part of solar power generation systems. Conversion efficiency (%) = (electrical energy output ÷ solar energy input) x 100 The module conversion efficiency value of solar cells systems currently under mass- production is usually in the range of 10–19%. The module conversion efficiency value varies according to the type of solar cell, with normal values of 15–20% for monocrystalline silicon solar cells, 12–18% for polycrystalline silicon cells, and 8– 12% for amorphous silicon cells. Solar cells can be broadly divided into silicon cells and thin-film, with 93.2% of 2006 production volume being made up of silicon cells. Figure 128: Type of solar cell and production ratio (2006) Source: PV news, JPMorgan estimates. 255

- 8. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Monocrystalline silicon Semiconductors are also made from monocrystalline silicon wafers, and the respective manufacturing methods are the same in many respects. Very pure monocrystalline silicon wafers are expensive, but the purity requirements are lower for solar cell applications than for semiconductor applications, and lower-priced solar grade (SoG) silicon can therefore be used. Amorphous Silicon (a-Si) Amorphous silicon is deposited by chemical vapor deposition (CVD) using silane gas. The resulting solar cells are highly efficient even in very low levels of light, and sensitive to the shorter wavelength light produced by artificial illumination. They are therefore mainly used in electronic calculators and wristwatches. Makers have been overcoming the tendency to deteriorate in sunlight, and in recent years they have been marketed for outdoor use. Polycrystalline silicon Polycrystalline silicon is currently used in the mainstream type of solar cell, owing to lower production costs than monocrystalline silicon. Polysilicon solar cells use wafers sliced from ingots cast using silicon melted in a crucible. These ingots are not formed from a single crystal, unlike monocrystalline silicon which is slowly built up by revolving a seed crystal. The ingots can also be cast in a square shape, instead of the cylinders of monocrystalline silicon. Trends in polycrystalline silicon for solar cells Polycrystalline silicon (polysilicon) is an important raw material for solar cells, and is also used to make semiconductor wafers. Supply/demand conditions for polysilicon have remained tight since 2004, owing to rapid expansion in the solar cell market, combined with steady market growth in semiconductor applications, especially for 300mm wafers. Over the past few years, the ability to secure stable supplies of polysilicon has therefore been a decisive factor for market share and competitiveness among solar cell makers. Is this situation likely to persist? The top company in the global polysilicon market is Hemlock Semiconductor (US), where we estimate a production capacity of roughly 10,000t/year as of end-2006. We then estimate that Wacker Chemie (Germany) holds the second rank with an annual capacity of approximately 6,500t, followed by Tokuyama in third with 5,300t, and REC (Norway) in fourth with 5,250t. We estimate that the overall industry has an annual production capacity of around 37,000t. 256

- 9. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Figure 129: Market share of polysilicon (based on production units in 2006) Sumitomo Others 2.2% 4.0% Mitsubishi Materials Hemlock 8.1% 27.0% MEMC 12.7% REC 14.2% Wacker 17.5% Tokuyama 14% Source: PV news, JPMorgan estimates. Turning to the demand side, demand for semiconductor wafers appears to be around 23,000t for 2006, and demand for polysilicon used in solar cells around 17,000t, making a total of around 40,000t. This demand figure is higher than the production capacity figure we estimate above, but we surmise that part of the 23,000t of polysilicon shipped for use in semiconductor wafers becomes scrap, which is then reused for solar cell applications. Solar cell makers were very keen to secure polysilicon supplies during 2006, to the extent that a scramble for polysilicon ensued at times. The polysilicon makers have responded with aggressive and sustained capital investment. We expect the world’s biggest maker, Hemlock, to expand its production from 10,000t/year at present to 36,000t/year in 2010. We also expect Wacker Chemie to raise its production from 6,500t/year at present to 10,000t/year by end-2007. Table 142 displays the bullish plans to expand production capacity at the other leading makers. We estimate that these efforts will increase the aggregate production capacity for polysilicon at the leading makers from 37,000t/year in 2006 by 150% or so to 92,000t/year in 2010. Table 142: Production capacity plans of major polysilicon makers Tons 2006 2007 2008 2009 2010 Hemlock 10,000 10,250 14,500 19,500 36,000 Wacker 6,500 10,000 10,000 10,000 14,500 Tokuyama 5,300 5,300 5,500 7,000 8,400 MEMC 4,600 6,200 8,500 8,500 8,500 REC 5,250 5,633 6,667 10,350 13,450 Mitsubishi 3,000 3,150 3,350 3,550 3,550 Sumitomo 800 955 1,155 1,225 1,250 Others 1,500 2,000 5,500 6,000 6,500 Total 36,950 43,488 55,172 66,125 92,150 Source: PV news, JPMorgan estimates. Although they are not represented in Table 142, several companies have already declared their intention to enter the polysilicon market. If they all proceed as planned this could boost aggregate production capacity by several tens of thousands of tons by 2010, but we regard this as an uncertain prospect. The following estimates of the supply/demand balance of polysilicon are based solely on the production capacity values shown in Table 142. We therefore recommend bearing in mind that new entrants could boost the supply capacity of polysilicon beyond our estimates. 257

- 10. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Table 143: Expected newcomers in polysilicon making (Excerpt) Company Country M. Setek Japan JSSI Germany SolarValue Slovenia Silicium Becancour US Hoku Scientific US AE Polysilicon US SolarWorld USA US Source: PV news, JPMorgan estimates. The higher prices fetched by polysilicon used for semiconductor wafers usually result in prioritization of supply for this application, with the remainder being supplied for solar cell applications. However, some of the polysilicon shipped for use in semiconductor wafers becomes scrap, which is then reused for solar cell applications. We estimate that demand for silicon used in semiconductor wafers will expand at an annual rate of 10% from the base of 23,000t/year in 2006. As such, we also estimate that the production volume of polysilicon available for solar cell applications will reach around 62,000t/year in 2010, including the polysilicon scrap recycled from semiconductor applications. Moreover, we expect the production volume of thin-film solar cells to gradually expand from 2007, further boosting the overall supply capacity in raw materials. Table 144: Polysilicon production forecasts for solar cell (excluding thin film) Tons 2006 2007E 2008E 2009E 2010E Poly Silicon Production Volume 36,950 43,488 55,172 66,125 92,150 Consumption for Silicon Wafer 23,000 25,300 27,830 30,613 33,674 Production Volume for Solar 13,950 18,188 27,342 35,512 58,476 Poly Silicon Recycled from Wafer 2,300 2,530 2,783 3,061 3,367 Total for Solar (ton) 16,250 20,718 30,125 38,573 61,843 Source: JPMorgan estimates. As mentioned earlier, a mid-range projection of solar cell demand in 2010 is in the region of 6,500MW/year. Meanwhile, the lower and upper limits of the projected range are 4,300MW/year and 8,600MW/year, respectively. When combining the supply volume of polysilicon for solar cells and thin-film solar cells, and converting into a cell basis allowing for energy conversion efficiency rates, we estimate a supply capacity in 2010 equivalent to 8,100MW. The assumption we used for conversion efficiency is that the average conversion efficiency value of 11g/W in 2006 will improve by 0.5g/W each year. Based on the foregoing, our projections of the polysilicon supply/demand balance for solar cell applications up to 2010 are illustrated in Figure 130. Given also the possibility that market entrants further boost supply capacity by 2010, we see a theoretical possibility of the supply of polysilicon for solar cell applications exceeding demand by 2010. Nevertheless, the leading makers of solar cells have responded to the current severe shortage of polysilicon by forming long-term agreements with the leading polysilicon makers, and these contracts look likely to last the next five years or so, or until around 2012. As such, even if the supply capacity of silicon for solar cells exceeds demand, we believe that effects would not emerge until the expiry of the major suppliers’ long-term contracts around 2012. 258

- 11. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Furthermore, we think that the new entrants to the polysilicon market lacking long- term supply contracts face the risk of business volatility increasing. The long-term contracts formed between the leading polysilicon makers and solar cell makers would insulate them from the affect of price fluctuations if supply/demand conditions loosen. However, these contracts would at the same time amplify the effect of looser supply/demand on the spot market inhabited by the newer polysilicon makers. Figure 130: Supply demand balance simulation of poly silicon for solar cell Ton 10,000 Total Supply Demand (Upsede) 9,000 Demand (BaseCase) 8,000 Demand (Down Side) 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 2006 2007 2008 2009 2010 Source: JPMorgan estimates. Table 145: Supply demand balance simulation of poly silicon for solar cell 2006 2007E 2008E 2009E 2010E Poly Silicon Supply (ton) 16,250 20,718 30,125 38,573 61,843 Poly Silicon Supply (Cell Eqv.) (MW) 1,477 1,973 3,013 4,060 6,871 Translation Efficiency(g/MW) 11 10.5 10 9.5 9 Solar Module Production Volume (MW) 1,211.40 1,618.00 2,470.30 3,329.50 5,634.60 Cell-Module Yield 82% 82% 82% 82% 82% Thin Film Production Volume MW) 196 463 1,115 1,894 2,496 Total Supply (MW) 1,407 2,081 3,585 5,223 8,131 Solar Module Demand MW) Downside 1,870 2,302 2,900 3,540 4,302 Base Case 1,870 2,446 3,341 4,631 6,458 Upside 1,870 2,705 3,898 5,694 8,664 (Total Supply - Base Case) -463 -365 244 593 1,673 Source: JPMorgan estimates. Scrap semi-wafers are not sustainable Solar cell manufacturers desperately seek substitutes for the standard solar silicon wafers. 6” and 8” scrap wafers from the semiconductor industry are the most sought- after items. However, according to our channel checks, 320-360k pieces of 8” scrap wafers are required to produce 1MW of annual solar cell output. This figure is similar to the annual capacity of an 8” semi-wafer fab. Therefore, the maximum worldwide annual solar cell output using scrap wafers is only 35MW, equivalent to 2% of worldwide solar cell production in 2005. In addition, it requires additional processes to make use of scrap semi-wafers and the output quality is still an issue. We believe the market has overestimated the potential of using scrap wafers as raw materials for solar cell production. 259

- 12. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Passing on the increase in material prices to customers is difficult The surging polysilicon price raised the material cost for the whole solar power supply chain, while the solar module prices have stabilized in the past three months. The spot price of an 8” ingot rose significantly from US$130/kg in early 2005 to >US$250/kg as of now, a 54% increase. The ASPs of solar wafers, cells and modules have reached US$2.1-2.3/W, US$3-3.2/W, and US$4-4.2/W, respectively, while the industry believes that the acceptable module prices should be capped at US$4/Wp due to limitations of government subsidies. China is the only exception. The module price could reach US$4.2/W because of the Chinese government’s policy. Wafer producers expect another 10% price hike in wafers in 2006, while the cell/module producers’ face severe pricing pressure from explosive competition from new entrants and limited government support. Potential of thin-film solar cells Attention is focusing on thin-film solar cells as a means of escaping the limitations of polysilicon supply capacity and high costs. The production of thin-film solar cells in 2006 at 196MW made up 8% of overall solar cell production, up substantially from 5.8% in 2005 and 5.3% in 2004. The types of thin-film solar cells include amorphous silicon (a-Si), cadmium telluride (CdTe), Copper indium gallium selenide (CIGS) compounds, and dye-sensitized cells. The drawbacks of thin-film solar cells include an energy conversion efficiency of only around 10%, compared to rates generally in excess of 15% for solar cells based on silicon wafers. Furthermore, the production equipment costs of thin-film solar cells are high. Nevertheless, we see a real possibility of thin-film solar cells becoming strongly competitive, if their conversion efficiency is improved and their manufacturing equipment costs are brought down via mass production. On the other hand, we have doubts whether thin-film solar cells would maintain an advantage over silicon wafer-based cells if the supply of polysilicon becomes abundant, or if polysilicon costs fall as a result of mass production using new methods, such as the metallurgic process, the vapor to liquid deposition process or the zinc reduction process. 260

- 13. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Figure 131: Thin-film solar cell production (actual and forecast) MV 3,000 2,500 2,000 1,500 1,000 500 0 CY2006 2007E 2008E 2009E 2010E CdTe CIGS a-Si Emerging Source: PV news. Among the various types of thin-film solar cell, amorphous silicon (a-Si) cells are relatively established in track record and technology. The amorphous silicon film is deposited on the substrate as a result of breaking down raw material monosilane gas in plasma with a diluent gas. The thickness of the light absorption layer is only a few micrometers, meaning that a cell requires only around one hundredth of the silicon raw material used by a polysilicon solar cell. This is the biggest advantage of a thin- film solar cell. The efficiency rate for energy conversion is only around 10% because it is only sensitive to the spectrum of light between ultraviolet and visible light, resulting in a substantial transmission loss for the sun’s rays. Experiments are being conducted to improve the conversion efficiency of thin-film solar cells by using two or even three light absorption layers. The production processes involved in making amorphous silicon solar cells are plasma-enhanced chemical vapor deposition (PE- CVD), laser cutting, sputtering, edge polishing, soldering, sealing and finishing. In particular, the equipment required for PE-CVD is expensive, and this is hampering development. Among the various types of thin-film solar cells, we believe that CIS/CIGS cells exhibit the best prospects in addition to amorphous silicon cells. CIS/CIGS solar cells employ light absorption layers made of compound semiconductors based on copper (Cu), indium (In) and selenide (Se). In addition to these three core elements, gallium (Ga) or sulfur (S) is also added to the light absorption layer to control the band gap. CIS/CIGS solar cells have a higher light absorption coefficient than silicon–based cells, so that a thickness of around 2µm provides sufficient light absorption. CIS/CIGS cells thus do not rely upon the availability of silicon, and only need small volumes of raw materials. We believe there is ample scope for cost reduction, given the simple structure and manufacturing processes, and the possibility of integrated production from raw materials to the finished product. Furthermore, the conversion efficiency of CIS/CIGS cells is high compared to other types of thin-film solar cell. Some observers have voiced concerns over supplies of indium being insufficient, but only around 8–10 tons of indium are required to manufacture 1GW of CIS/CIGS solar cells, and we therefore do not expect problems unless the production volume of CIS/CIGS cells expands very rapidly. 261

- 14. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Solar power supply chain Figure 132: Solar power supply chain System & Polysilicon Ingot Wafer Cell Module Installation Source: Kyocera, Motech, Sharp, SunPower. 1. Polysilicon: A silicon raw material which is melted and re-casted to remove impurities. 2. Ingot: The cast silicon, which is stabilized in its polycrystalline form. These casts are called ingots and are cut into blocks. 3. Wafer: The ingots are sliced into wafers. P-type and n-type silicon wafers are produced depending on the sliced silicon. 4. Solar cell: Also known as PV (photovoltaic) cell. Electrodes are attached to the wafers for conducting electricity. 5. Solar module: Used to increase the power output. Many solar cells are connected together to form modules, which are further assembled into larger units called arrays. This modular nature of PV enables designers to build PV systems with various power outputs for different types of applications. 6. System and installation: An installation involves components apart from the basic module. Components include electrical connections, mounting hardware, power-conditioning equipment and batteries that store solar energy. Installations are up to 25% cheaper if installed before construction. 262

- 15. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Table 146: Solar cell major players Main Players Silicon material Hemlock (US), Wacker (DE), Tokuyama (4043), MEMC (US/IT), REC (US), Mitsubishi Materials (5711), Sumitomo Titanium (5726),M. Setek (unlisted ), JSSI (DE), Solar Value (Slovenia), Silicium Becancour (CA), Hoku Science (US), AE Polysilicon (US), SolarWorld USA (US), JFE Steel (5411), NS Solar Material (unlisted), Japan Solar Silicon (unlisted), KINOTECH (unlisted). Silicon wafer manufacturers SUMCO (3436), M. Setek (unlisted ), Kitagawa Seiki (6327), Scanwafer (NO), PV Crystalox (DE). Manufacturing equipment Ishii Hyoki (6336, Entrusted with wafer processing, equipment sales), Ulvac (6728, Thin-film CVD system, sputtering /technology equipment),Applied Materials (US, Thin-film CVD system, spattering equipment, wire saw), Mitsubishi Heavy Industries (7011, Thin-film CVDsystem), Iwasaki Electric(6924, Solar Simulation Systems), S.E.S. (6290, Wafer cleaning system), Tokyo Rope Mfg.(5981, Wire for cutting silicon ), Kiswire (Korea, Wire for cutting silicon ), Shinko Wire (5660, Wire for cutting silicon ), Toyo Advanced Technologies(unlisted, Wire saw), Meyer Burger (Swiss, Wire saw), Nippei Toyama (6130, Wafer production equipment, wire saw), Toyama Kikai(unlisted, Automated cell wiring and alignment machine), Union-Materials (unlisted, Spherical silicon production technology), Tokki(9813, Organic thin-film solar cell production equipment), Toyo Tanso (5310, Crucible), Tokai Carbon (5301, Crucible), Ibiden (4062,Crucible), Noritake (5331, Silicon fusing furnace ), Nippon Techno-Carbon (unlisted, Crucible), SGL (DE, Crucible), LCL (unlisted,Crucible), Ferrotec (6890, Single-crystal Si lifting system), Fujipream (4237, spherical Si), NPC (6255, Cell, Cell Tester), ShibauraMechatronics (6590, Thin-film system), Fujimi Incorporated (5384, Wafer polishing). Materials for cell and module Asahi Glass (5201, Cover glass, TCO circuit board ), Sumitomo Metal Mining (5713, ITO sputtering targets ), ThreeBond (unlisted,Sealants), Dai Nippon Printing (7912, Filler sheet for solar cell module), Mitsui Chemicals Fabro (unlisted, EVA sheet for encapsulating material), Bridgestone (5108, Glue film), Du Pont (unlisted, PVF film), Hitachi Metals(5486, Electrode clad material). Peripheral equipment manufacture Daihen (6622, Inverter), Laplace System (unlisted, Energy production measurement system), GS Yuasa (6674, Electrical storage device). Solar cell(silicon wafer) Sharp (6753), Q-Cells (DE), Kyocera (6971), Suntech (China), Sanyo Elec (6764), Mitsubishi Electric (6503), Motech (Taiwan),Schott Solar (DE), BP Solar (UK), Deutsche Cell/SHELL (DE), SunPower (US), Isofoton (ES), First Solar (US), CEEG Nanjing(China), ERSOL (DE), Photowatt (FR), USSC (US), Shell Solar (US), Hitachi (6501). Solar cell (spherical Si) Clean Venture 21 (unlisted), Fujipream (4237), Kyocera (6971), Kyosemi (unlisted). Solar cell (a-Si) Kaneka (4118), Mitsubishi Heavy Industries (7011), Sharp (6753), TDK (6762), Fuji Electric Systems (unlisted), Energy Conversion Devices (US), Shenzhen Topray (China), ERSOL (DE), Schott Solar (DE). Solar cell (CdTe) First Solar (US), Antec (DE). Solar cell (CIS/CIGS) Wurth (DE), HelioVolt (US), Miasole (US), NanoSolar (US), Global Solar (DE), Showa Shell Sekiyu (5002), Honda Motor (7267). Source: JPMorgan. 263

- 16. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Table 147: Key solar industry players Company Polysilicon Ingot Wafer Cell Module System Hemlock Tokuyama MEMC Wacker Mitsubishi (Material & Polysilicon) REC PV Crystalox Solar SolarWorld Schott Solar SUMCO Sharp Kyocera BP Solar Mitsubishi Electric Sanyo Q-Cells Motech SunPower Suntech Solon Evergreen Solar (String Ribbon) Conergy Sekisui Chem Source: Companies, JPMorgan. 264

- 17. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com E-Ton Solar Tech Co Ltd Company Description: E-Ton Solar Tech Co Ltd develops and manufactures single-and- multi crystalline Country: Taiwan solar cells. Ticker: 3452.TWO Analyst: Carrie Liu Rating: Underweight Price (LC): 307.5 Mkt Cap (US$MM): 586 Founded: 2001, Listed: 2006 Fiscal Year End: December Key Management: Wu Shih-Chang, Reynold Hsu, Tsai Chin-Yao No. of Employees: 317 Business Alliances/Partnerships (NT$ in billions) FY04 FY05 FY06 FY07E M.Setek—10-year solar wafer supply agreement Revenues 0.4 1.2 3.4 5.9 LDK—4-year solar wafer supply agreement Net Profit 0.1 0.3 0.7 0.9 EPS (NT$) 3.2 8.8 18.9 15.04 ROE (%) 41.1 46.5 38.1 27.8 Capital Spending -0.1 -0.2 -0.7 1.3 Research & Development 0.0 0.0 0.0 0.1 Contract Manufacturers/Production Source 100% In-house, 100% In-house Geographical Mix (2007) Product Mix (2007) Other 2% China Others 6% 2% Japan 8% Taiw an 11% Europe 73% Solar cell 98% Key Suppliers Key Customers M.Setek LDK E-Ton Solar NA Source: Company, Datastream, JPMorgan estimates. MORGAN MARKETS PAGE BIG PICTURE COMPANY WEBSITE Solar INDEX 633

- 18. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Evergreen Solar Company Description: Evergreen Solar Inc. develops, manufactures, and markets solar power Country: United States cells, panels, and systems that provide environmentally clean electric power throughout the world. Ticker: ESLR The company’s solar power products draw electricity from solar cells, which are semiconductor Analyst: Christopher Blansett devices that convert the sun's energy into electricity. Rating: Neutral Price (LC): 13.7 Mkt Cap (US$MM): 1,325 Founded: 1994, Listed: 2000 Fiscal Year End: December Key Management: Richard M Feldt, Michael El-Hillow, Terry Bailey, Jack I Hanoka, Mark a Farber No. of Employees: 330 Business Alliances/Partnerships (US$ in millions) 2004 2005 2006 2007E NA Revenues 23.5 44.0 103.1 68.2 Net Profit -19.4 -17.3 -26.7 -21.1 EPS (US$) -0.7 -0.3 -0.4 -0.26 ROE (%) -76.2 -26.9 -29.6 Capital Spending 10.9 57.7 107.7 Research & Development 4.9 11.5 19.1 21.3 Contract Manufacturers/Production Source NA Geographical Mix (2007) Product Mix (2007) United States Solar Pow er 100% Cells 100% Source: Company, Datastream, JPMorgan estimates. Key Customers Key Suppliers NA NA Evergreen Solar MORGAN MARKETS PAGE BIG PICTURE COMPANY WEBSITE Solar INDEX 634

- 19. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Motech Industries Inc. Company Description: Motech Industries Inc. manufactures and markets solar cells as well as testing and Country: Taiwan measuring instruments. Ticker: 6244.TWO Analyst: Carrie Liu Rating: Underweight Price (LC): 282.0 Mkt Cap (US$MM): 1,794 Founded: 1981, Listed: 2003 Fiscal Year End: December Key Management: Cheng Fu-Tien, Jeery Su, Simon Tsuo No. of Employees: 914 Business Alliances/Partnerships (NT$ in billions) FY04 FY05 FY06 FY07E Renesola—Three-year solar wafer supply Revenues 2.5 4.3 8.1 15.6 Agreement AE Polysilicon—Five-year polysilicon supply Net Profit 0.6 1.2 2.3 2.6 Agreement REC—Five-year solar wafer supply Agreement EPS (NT$) 2.0 7.27 13.24 13.45 ROE (%) 58.1 60.3 56.0 26.0 Capital Spending -0.5 -0.4 -1.8 0.9 Research & Development 0.0 0.0 0.0 0.1 Contract Manufacturers/Production Source 100% in-house, 100% in-house Geographical Mix (2007) Product Mix (2007) Others other 23% 1% Solar Pow er Europe Sy stem 40% 3% USA 11% China Solar cell 26% 96% Key Suppliers Key Customers Scanwafer Deutsche Solar Motech Industries Aleo Atersa Renesola LDK Siliken Tenesol Solar Glass Source: Company, Datastream, JPMorgan estimates. MORGAN MARKETS PAGE BIG PICTURE COMPANY WEBSITE Solar INDEX 635

- 20. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com SunPower Corporation Company Description: SunPower Corporation designs and manufactures silicon solar cells. The Country: United States cells generate electricity from sunlight. Ticker: SPWR Analyst: Christopher Blansett Rating: Overweight Price (LC): 117.4 Mkt Cap (US$MM): 9,503 Founded: 2002, Listed: 2005 Fiscal Year End: December Key Management: Thurman J Rodgers, Thomas H Werner, Richard Swanson, Emmanuel T Hernandez, No. of Employees: 1,752 Panemangalore Pai, Brad Davis Business Alliances/Partnerships (US$ in millions) 2004 2005 2006 2007E NA Revenues 10.9 78.7 236.5 766.6 Net Profit -28.9 -15.8 26.5 17.3 EPS (US$) -0.7 0.4 0.2 ROE (%) 7.1 Capital Spending 26.9 71.6 108.3 199.0 Research & Development 13.5 6.5 9.7 Contract Manufacturers/Production Source NA Geographical Mix (2007) Product Mix (2007) United States Germany 32% 49% Asia Solar Cell Others 7% 100% 12% Source: Company, Datastream, JPMorgan estimates. Key Customers Key Suppliers NA NA SunPower Corporation MORGAN MARKETS PAGE BIG PICTURE COMPANY WEBSITE Solar INDEX 636

- 21. Bhavin Shah Asia Pacific Equity Research (852) 2800-8538 07 January 2008 bhavin.a.shah@jpmorgan.com Suntech Power Holdings Co.,Ltd Company Description: Suntech is involved in the design, development and manufacture of photovoltaic Country: China cells/modules, BIPV, and thin-film technology. It is the fourth largest solar cell maker globally with 6.3% global STP market share in 2006. Its products are used for both on-grid and off-grid generation of solar power for commercial Ticker: and residential applications. Analyst: Carrie Liu Rating: Neutral Price (LC): 38.9 Mkt Cap (US$MM): 5,867 Founded: 2001, Listed: 2005 Fiscal Year End: December Key Management: Shi Zhengrong No. of Employees: 3,284 Business Alliances/Partnerships (US$ in millions) FY05 FY06 FY07 FY08E NA Revenues 226 598.8 1,390 2,305 Net Profit 30.5 103.6 182 324 EPS (US$) 0.3 0.7 1.2 2.1 ROE (%) 14.2 19.3 22.9 28.8 Capital Spending 27.9 79.6 141 242 Research & Development 3.4 8.4 17.3 Contract Manufacturers/Production Source NA Geographical Mix (2006) US Product Mix (2006) 3% Rest of World PV sy stem PV cells Rest of Europe 3% integrations 21% 0% 7% Germany Spain 43% 21% Japan 1% South Africa PV modules China 0% 79% 22% Key Customers Key Suppliers Conergy AG Atersa Deutsche Solar AG LDK Suntech IBC Solar AG SolarWorld AG MEMC Shanghai Comtec Ibesolar Energia S.A REC Sunlight Group Hoku Materials Source: Company, Datastream, JPMorgan estimates. MORGAN MARKETS PAGE BIG PICTURE COMPANY WEBSITE Solar INDEX 637