Unlocking Additional Value From Your Offshored Research & Analytics

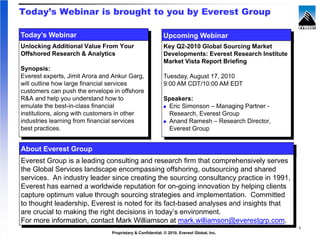

- 1. Today’s Webinar is brought to you by Everest Group Today’s Webinar Upcoming Webinar Unlocking Additional Value From Your Key Q2-2010 Global Sourcing Market Offshored Research & Analytics Developments: Everest Research Institute Market Vista Report Briefing Synopsis: Everest experts, Jimit Arora and Ankur Garg, Tuesday, August 17, 2010 will outline how large financial services 9:00 AM CDT/10:00 AM EDT customers can push the envelope in offshore R&A and help you understand how to Speakers: emulate the best-in-class financial Eric Simonson – Managing Partner - institutions, along with customers in other Research, Everest Group industries learning from financial services Anand Ramesh – Research Director, best practices. Everest Group About Everest Group Everest Group is a leading consulting and research firm that comprehensively serves the Global Services landscape encompassing offshoring, outsourcing and shared services. An industry leader since creating the sourcing consultancy practice in 1991, Everest has earned a worldwide reputation for on-going innovation by helping clients capture optimum value through sourcing strategies and implementation. Committed to thought leadership, Everest is noted for its fact-based analyses and insights that are crucial to making the right decisions in today’s environment. For more information, contact Mark Williamson at mark.williamson@everestgrp.com. 1 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 2. Q&A To ask a question during the Q&A session Click the question mark (Q&A) button located on the floating tool bar in the bottom right of your screen. This will open the Q&A Panel Be sure to keep the default set to “send to a Panelist” Then, type your question in the rectangular field at the bottom of the Q&A box and click the send button to submit 2 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 3. Introductions Jimit Arora Ankur Garg Research Director Senior Research Analyst Everest Group Everest Group Jimit.arora@everestgrp.com Ankur.garg@everestgrp.com 3 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 4. Unlocking Additional Value From Offshored Research & Analytics July 20, 2010

- 5. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 5 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 6. “Knowledge services” includes a varied set of complex and judgment-intensive services NOT EXHAUSTIVE Spectrum of knowledge services Knowledge Services Financial Business Market research research research Data analytics Legal and IP Other Equity Company Survey design Marketing Patent Regulation & research profiling and Administration analytics research compliance Credit benchmarking Data Risk analytics Legal support research Industry compilation Fund sales services Editorial Fixed-income studies and Insight analytics support research tracking generation Claims Library & KM Corporate Market entry analytics services finance studies Index research Quantitative research ‘Research and Analytics’ (R&A) Largest segment of knowledge services Source: Everest Research Institute 6 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 7. The decade old knowledge services industry is at an inflexion point and preparing for the next generation of growth and maturity Global sourcing industry maturity curve IT applications services Market value creation Contact center Finance & Accounting Human Resources Remote infrastructure services Knowledge services Pioneers Emerging rapid growth Reaching maturity Financial services is the largest contributor to offshore knowledge services market Post the economic crisis, financial institutions seek to further push the envelope in offshore R&A, and will play a lead role in the growth and evolution of the industry Source: Everest Research Institute 7 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 8. The existing US$1.0-1.2 billion offshore R&A industry represents less than 10 percent of the addressable market potential Offshore R&A market size Offshore R&A industry distribution US$ million Percentage 100% = US$1.0-1.2 billion 1,000-1,200 600-700 Others 35-45% 40-45% Financial Services 15-20% Pharma & Life sciences 2006 2009 Financial and business research are the dominant service offerings for financial institutions While capital markets players lead adoption for financial and business research, retail banks and insurance firms drive majority of the data analytics demand North America and U.K. contribute more than 75% to the total market activity; recent years have witnessed activity from other geographies such as Switzerland, Benelux, and Nordics in Europe, and Japan, Hong Kong, and Singapore in Asia Source: Everest Research Institute 8 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 9. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 9 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 10. Labor arbitrage driven direct cost-savings remains the primary driver in the adoption and growth of offshore R&A Billing rates for research and analytics Offshore US$ per hour Onshore 100-200 Offshore locations such as India provide financial institutions with access to large pools of qualified talent with advanced degrees in management, finance, or engineering at significantly lower costs 50-70 In outsourced delivery, onshore billing rates are typically 2-4x the 25-40 offshore billing rates 15-25 Market research and data Financial/business research management and data analytics Sources: Supplier inputs; Everest Research Institute 10 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 11. However, other offshoring drivers have gained notable importance from buyers Outsourcing R&A enables financial institutions to mitigate challenges of Flexibility of scale managing variations in capacity as volumes fluctuate. The flexibility allows financial institutions to scale up or down per demand fluctuations depending on the economic activity (e.g., year-end peak loads) Access to a ready pool of trained resources in offshore locations allows Reduced time to financial institutions to reduce time to market and quickly expand coverage market to newer areas and geographies Offshoring allows financial institutions to deploy similar amount of capital to Greater hire a greater number of resources to increase throughput throughput Further, exploiting time-zones advantage through global delivery, financial institutions are able to get the analysis of previous day’s market activity before the start of the next trading day Sources: Supplier inputs; Everest Research Institute 11 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 12. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 12 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 13. We analyze the evolution and maturity of the industry along three key aspects FS R&A maturity and evolution Locations maturity 13 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 14. The increased confidence in offshore R&A is resulting in a more sophisticated demand profile Locations maturity Experienced buyers of offshore R&A services are recognizing the growing Sourcing models maturity of third-party suppliers and increasingly leveraging them for core and complex work traditionally reserved for captives Encouraged by the successful experience of larger financial institutions, mid- Adoption tier players are also increasingly embracing the offshoring in R&A Contracting approaches are evolving from project-based engagements to Contracting large, multi-year engagements behavior Buyers are expanding offshoring adoption to newer and complex areas, e.g., Scope regulatory and compliance support, advanced modelling As global sourcing maturity of buyers increases, portfolio issues such as Risk mitigation location concentration risk are also impacting offshore R&A, and mature adopters are seeking delivery locations outside India Sources: Buyer discussions; supplier inputs; Everest Research Institute 14 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 15. Financial research is the most mature area for offshore R&A delivery Locations maturity Functional areas maturity for FS knowledge services Mature Credible Emerging Financial research Business research Market research Data analytics Company profiling & Equity research Survey design Marketing analytics benchmarking Industry studies and Credit research Administration Risk analytics tracking Fixed-income research Market entry studies Data compilation Fund sales analytics Corporate finance Insight generation Claims analytics Index research Quantitative research Emerging segments with high growth potential: Wealth management including fund lists and recommendations, fund manager screening and performance tracking, research and analytics activities for portfolio managers and large wealth management firms Trading and sales support including high-volume middle-office support activities such as contract reviews, trade reviews, tear-sheet preparation and other corporate functions Buy-side research for hedge funds and mutual funds (currently sell-side research dominates) Sources: Supplier inputs; Everest Research Institute 15 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 16. While India remains the most mature delivery location for offshore R&A, a number of other countries have emerged Locations maturity Locations maturity for FS knowledge services Mature Credible Emerging Poland Romania China India Philippines Costa Rica Sri Lanka Chile South Africa Argentina Source: Everest Research Institute 16 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 17. Case Study | Amba Research Client overview A global asset manager with more than US$200 billion of assets under management Over 250 investment professional across seven countries Offshoring objectives Engagement overview Structure cost-effective Starting with a short pilot with Amba, the client expanded the scope of work across multiple solutions to reduce time to areas including equity, fixed income, quantitative research, and sales and marketing market for new services and Equity Fixed income Quant Sales and marketing products and improve profitability Thematic, industry SEC 2A-7 filings Portfolio simulation RFP/RFI support The client required a research reports and optimization structured, cost-effective Idea filtering Municipal bond Performance analysis Database solution that would checklists maintenance supplement its internal team Data collection and Performance with skilled offshore presentation attribution resources Coverage support Back-testing Events and news Statistical support monitoring The client now uses Amba for 80 percent of its research support including background research, regulatory back-up, etc. It retains in house the remaining 20 percent that is considered more strategic Rationale for selecting Amba Financial services expertise Key benefits and results Synergies from having Increased focus and time spent by portfolio manager/analyst on networking, idea generation, equity, fixed income and and stock picking quantitative research Increased client coverage by ideating on new themes and providing research on themes support from one supplier where sell-side coverage was limited Improved depth of evaluation Accelerated pace of converting broad themes into actionable ideas Enabled compliance with the regulatory requirements Helped service new products 17 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 18. Case Study | Irevna Client overview One of the top-10 banks in the world, with over US$500 million of assets under management Offshoring objectives Engagement overview Research support for senior Scope spans multiple research verticals – equity, fixed income, derivatives, quantitative analysts and front office research, and commodities traders Key services provided by Irevna include: Flexibility of large people- Building valuation models intensive projects Writing research reports Expand coverage into new Performing periodic and event-driven updates and emerging areas Initiating coverage Writing thematic reports Generating research and trade ideas Participating in investor and management calls Multi-lingual delivery – English, Japanese, German, Spanish, and Mandarin – from three global locations – India, Poland, and Argentina The relationship has evolved into an intellectual partnership with Irevna supporting strategic initiatives, generating trade ideas, expanding coverage, and designing new products Rationale for selecting Irevna Quality of talent Key benefits and results Demonstrated domain Revenue enhancement though new trading and product ideas and tools to monetize research expertise Expansion of coverage Output quality Improvement in analyst rankings and increased broker votes Transparent engagement Flexibility of scale allowing to manage and implement large organization-wide initiatives model Significantly reduced time to market Improvement of client’s systems and evaluation of new methods of delivering research work through “thought-partnership” with Irevna 18 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 19. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 19 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 20. The supplier landscape has evolved significantly to include suppliers from multiple categories NOT EXHAUSTIVE Supplier landscape Diversified IT/BPO Specialist R&A Specialist research and analytics suppliers pioneered the market in early 2000s IT and BPO suppliers also expanded their play in this space and have scaled significantly. Acquisitions have been a key component of the growth strategy of these large IT and BPO suppliers In some cases, the financial services practices of the specialist R&A players are meaningfully larger than those of the diversified IT and BPO players, justifying their positioning as R&A leaders for the FS sector Source: Everest Research Institute 20 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 21. Supplier profile | Amba Research (page 1 of 2) Company overview Number of FS R&A FTEs ` Established: 2003 440 Delivery locations: 360 340 Bangalore, India Colombo, Sri Lanka San Jose, Costa Rica Client profile: Over 70 clients 6 of the top 15 investment banks 6 of the top 15 asset managers 2007 2008 2009 Industry segments for FS R&A Functional areas for FS R&A Percentage Percentage Data/index providers Insurance (2%) Business research 3% Sales and Investment 7% marketing support 8% banking 20% Asset 40% management Analytics 11% 74% 35% Brokerage Financial research Sources: Company inputs; Everest Research Institute 21 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 22. Supplier profile | Amba Research (page 2 of 2) Key growth themes and investment areas Amba is witnessing an uptick in demand for emerging markets research coverage, Emerging primarily driven by the outperformance of emerging markets compared to U.S. and markets European capital markets and the reduced headcount in research firms post the downturn Amba expects further push to come from domestic demand expansion and rising consumer spending in emerging markets High yield and Since the credit crisis Amba has seen a high demand for high-yield and distressed distressed debt debt analysis analysis Also, with the recent rise in the issuance of high-yield bonds, there is greater demand for monitoring these freshly issued securities, not only in the U.S. and Europe but also in emerging markets where corporate disclosures, corporate governance, and bankruptcy laws are not as sophisticated Talent transformation and maintaining differentiation with the best capital markets Talent talent is a key focus area at Amba Over the last several years, Amba invested in building a top-notch training team, which now has over 55 man-years of experience and comprises several CFA charter-holders The firm recently created a proprietary Skill Competency Framework that identifies real technical and behavioral skills of the employees, accordingly assigns them to roles suited to their skills, and also plans career moves and rotations around their capabilities Sources: Company inputs; Everest Research Institute 22 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 23. Supplier profile | Evalueserve (page 1 of 2) Company overview Number of FS R&A FTEs ` Established: 2000 Delivery locations: 820 760 Gurgaon, India Shanghai, China 579 Valparaiso, Chile Cluj, Romania Client profile: 7 of the top 12 investment banks 5 of the top 10 UK and U.S. retail banks 2 of the top 10 asset managers 2007 2008 2009 2 of the top 10 insurance firms Industry segments for FS R&A Functional areas for FS R&A Percentage Percentage Regulation/ Insurance (2%) compliance support Asset management (2%) Market research (3%) (1%) Brokerage (2%) Credit cards Editorial, library, KM services Data/index providers 6%4% 6% Analytics 12% Retail banking 9% Investment 13% 62% Business research 17% 61% Financial banking FS consultants research Sources: Company inputs; Everest Research Institute 23 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 24. Supplier profile | Evalueserve (page 2 of 2) Key growth themes and investment areas This largely untapped area involves providing R&A services to firms with a large Wealth network of brokers or financial advisors management The key support activities are manager research, portfolio construction and monitoring, operational support, and compliance support Another upcoming area is analytics, which involves activities such as data retrieval, data analysis, internal reporting, campaign management, and predictive modeling Clients are various research teams (equity, derivatives, fixed income, commodities, Quantitative etc.) and sales and trading functions within investment banks. The activities include: support Sales support including tear sheets, pitch books, market commentary Structuring including back-testing of new trading strategies, creation and maintenance of databases of historical prices, implied volatilities, correlations Trading support including preparing daily economic statistics, market sentiment, tracking weekly/monthly performance of bespoke client portfolios and middle-office support This involves use of advanced statistical tools like SAS and SPSS to analyze a large Advanced amount of internal customer data to gain insights into customer behavior and internal analytics operational data to enable better decision making. Key client segments are marketing and business managers Another area of significant interest is risk analytics relating to BASEL II and Solvency II (actuarial support) Sources: Company inputs; Everest Research Institute 24 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 25. Supplier profile | Irvena (page 1 of 2) Company overview Number of FS R&A FTEs (estimated) ` Established: 2001 Delivery locations: 1,300 1,200 Chennai & Mumbai, India 1,000 Buenos Aires, Argentina Wroclaw, Poland Client profile: Multiple Fortune 500 financial services companies 2007 2008 2009 Industry segments for FS R&A Functional areas for FS R&A Percentage Percentage Others 16% Others 29% Analytics 10% 55% Investment banking Asset 16% 74% Financial research management Sources: Company inputs; Everest Research Institute 25 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 26. Supplier profile | Irevna (page 2 of 2) Key growth themes and investment areas Expansion of Given the growth potential in the offshore R&A market, Irevna is focusing on making coverage and inroads into this untapped market, both within and outside the financial services sector offerings The firm plans to continue focusing on enhancing the range of its services as well as its delivery model. It considers leveraging technology as central to this initiative Expansion of Expanding the footprint across geographies will continue to be an area of focus for geographic Irevna. This is intended to enable Irevna to diversify its talent base and have access to footprint a much wider range of skill sets. Irevna plans to simultaneously continue to expand its business development presence to get closer to its clients Irevna expects that these initiatives will enable it to enhance its client value proposition in terms of local relationship managers, nearshore support, access to unique skill sets, multiple language support, real-time support, and business continuity Sources: Company inputs; Everest Research Institute 26 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 27. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 27 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 28. Key implications for buyers Larger financial institutions that are already offshoring knowledge services can benefit by Potential to unlock doing more – either through expanded volumes within existing scope (e.g., more value by doing more coverage, newer markets) or by adding newer and more complex process areas Newer adopters, especially the mid-sized financial services players, can draw confidence First-time adopters from the experiences of their larger counterparts and begin with relatively larger can start big engagements, especially in the more mature process areas Unlike a few years ago where financial institutions favored their internal captives for Improved supplier judgment-intensive knowledge services, the growth in scale, delivery capability, and credibility experience of the suppliers creates a credible set of options for FS firms First-time adopters of offshore R&A delivery can more quickly establish offshore operations through the use of these specialist third-party players Need to differentiate Knowledge services are different from transactional BPO services and they need to be between R&A and sourced and managed differently. The people model, the operating model, and the value BPO creation themes tend to be different across BPO and R&A: Nuances related to the quality and background of the labor force, compensation levels, approaches to people development, career management, and retention need to be understood and managed differently in R&A The operating models require a high degree of client-specific customization and interaction, and differ from the industrialized and SLA-driven BPO service delivery Finally, value created through offshored R&A extends beyond direct cost savings and needs to be adequately weighed by business impact 28 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 29. Agenda Overview of offshore Research and Analytics Value proposition of offshore R&A in Financial Services Evolution of demand and service maturity Supplier landscape Summary and implications Q&A 29 Proprietary & Confidential. © 2010, Everest Global, Inc.

- 30. Q&A Attendees will receive an email enabling them to download today’s webinar presentation. To access a recorded audio version of this webinar, please contact Mark Williamson, mark.williamson@everestgrp.com For advice or research on research and analytics in financial services, please contact : Jimit Arora, jimit.arora@everestgrp.com Ankur Garg, ankur.garg@everestgrp.com For background information on Everest, please visit: www.everestgrp.com www.everstresearchinstitute.com Thank you for attending today To ask a question during the Q&A session Click the question mark (Q&A) button located on the floating tool bar in the bottom right of your screen. This will open the Q&A Panel Be sure to keep the default set to “send to a Panelist” Then, type your question in the rectangular field at the bottom of the Q&A box and click the send button to submit 30 Proprietary & Confidential. © 2010, Everest Global, Inc.