Generali

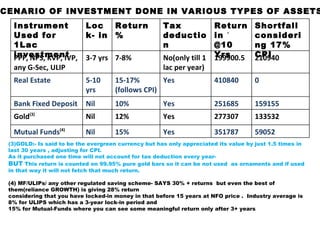

- 1. (3)GOLD:- Is said to be the evergreen currency but has only appreciated its value by just 1.5 times in last 30 years , adjusting for CPI. As it purchased one time will not account for tax deduction every year- BUT This return is counted on 99.95% pure gold bars so it can be not used as ornaments and if used in that way it will not fetch that much return. (4) MF/ULIPs/ any other regulated saving scheme- SAYS 30% + returns but even the best of them(reliance GROWTH) is giving 28% return considering that you have locked-in money in that before 15 years at NFO price . Industry average is 8% for ULIPS which has a 3-year lock-in period and 15% for Mutual-Funds where you can see some meaningful return only after 3+ years SCENARIO OF INVESTMENT DONE IN VARIOUS TYPES OF ASSETS Instrument Used for 1Lac investment Lock- in Return % Tax deduction Return in ` @10 Yrs Shortfall considering 17% CPI PPF, NPS, KVP, IVP, any G-Sec, ULIP 3-7 yrs 7-8% No(only till 1 lac per year) 199900.5 210940 Real Estate 5-10 yrs 15-17% (follows CPI) Yes 410840 0 Bank Fixed Deposit Nil 10% Yes 251685 159155 Gold (3) Nil 12% Yes 277307 133532 Mutual Funds (4) Nil 15% Yes 351787 59052

- 2. Family includes (1)Mother (2)Father (3)You (4)Your Spouse (5&6) Children's i.e 1LAC initially invested for 10 years in Equity (@19-just passive investing) will be 478544 & 410840 is needed to have same purchasing power considering 17% CPI- CLEAR SURPLUS of 67704 . OTHER TYPS OF ASSETS AR UNABLE TO MAINTAIN YR PURCHASING POWR, WHILE EQUITIES DO. Return /month /1Lac ACTIVE INVESTING Total Expense (Insurance cover for ALL) Returns after all expenses Effective yield After covering yr Family to most Financial disastrs 2 1212322 #Life insurance ( Term insurance . + ADBR & WOP riders ) @ 60 X of earning for earning member -- Now@15600(6% incr. /yr.) ---------- 393-596/month # Medical insurance For whole family ------- 1215-1936/month # Home insurance --------- 600-1100/month 251827 ~10.9 2.5 2245673 791687 ~25.85 3 4144673 1898947 ~38.68 3.5 7629289 4096686 ~51.07 4 14002344 8363063 ~63.23

- 4. ONGC GAIL BHEL STER SOURCE-INDIAINFOLINE DETAILS OF PAST PERFORMANCE Source-IndiaInfoline Source-IndiaInfoline Source-IndiaInfoline Source-IndiaInfoline NIFTY Source-nseindia TATASTEEL NIFTY 1550 6179 AMBUJA 335(spl 10:2) 7.5*144+111=1011 2x ACC 268 1033+190 div =1034 3.5x ONGC 205 1389*1.5+231=2314 10.3x RIL 345 1033*2+68=2135 5.2x GAIL 65(IPO) 492*1.5+47.25=785.25 11x BPCL 407 663+43=809 0.98x LT 597 2069*4+92.5=8368 13x ABB 262 775*5+50=3675 16.8x RANBAXY 974 447+25.5=462.5 (0.5x) BHEL 224 2498*2+133=5129 22.3x 2000 2010 Gain% SUNPHAR 1760 2047*4 +54=8242 3.6x CIPLA 1380 330*7.5+92.5=2567 0.86x TATASTEEL 148 679+81=760 4.3x HINDALCO 851 210*10+28=2128 1.5x STER 452(listed on 28-may-04) 176*40+171=7211 14.95x BHARTIARTL 44(18-feb-02) 355*2+15=732 15.4x RCOM 291(6-mar-06) 176.9 (0.4x) IDEA 121(9-mar--07) 72.8 (0.4x)

- 8. Total Purchase in SEP only in equity by FII were 27+ CR IIP fell due to global recession but again was inline

- 9. At 40% of GDP, India’s savings could hit US$1 TN in 7-8 years

- 11. Since jan-09 FII has pumped ~49B in Indian Stock markets but till now it had not reached the level of ownership of FII that was reached in September-07(19%). Of this ~47Bn, 69% has gone into paper issues(48%IPO/FPO And 28% QIP), CEMENT (JAIPRAKASH, INDIACEM, MADRASCEM), AUTO (HEROHONDA, BHARATFORGE), FMCG (UNITEDSPIRITS, GODREJCP), PHARMA (SUNPHARMA, CIPLA, DIVISLAB), INFRA (HDIL, CENTURYTEX) METAL (STERLITE, TATASTEEL, HINDZINC), POWER (JSWPOWER, TATAPOWER, RPOWER, POWERGRID), ENGG (BHEL, BEL, ENGINERSIND ), REALTY (HDIL, CENTURYTEX), BFI FMCG (HINDLEVER, GODREJCP), BFSI (ICICC,PNB, KOTAK, BOB), CEMENT), PHARMA (SUNPHARMA, CADILA, PIRAMAL) MEDIA (DBCORP), REALTY (DLF, UNITECH) DII IT (TCS, OFSS, EDUCOMP), TELECOM (BHARTI, RCOM, IDEA, GTL,GTLINFRA), OIL (ONGC, IOC, CAIRN) REALTY (DLF, UNITECH, HDIL) AUTO (TATAMOTORS, HEROHONDA,EXIDE), METALS (TATASTEEL, JSWSTEEL), BFSI (SBI, HDFC, IDFC, ICICI, LICHSG, BOB, REC), PHARMA (RANBXY, LUPIN,GLENMRK, DIVISLAB), POWER (NTPC, ADANI, JPWR,TATAPWR, ONGC), FMCG (ITC, HINDLEVER, UNITDSPIRITS, DABUR) FII (ex- Adr/ Gdr) Least preferred Most preferred

- 12. The scenario for Indian Economy in general has undoubtedly improved to an extent, after political stability in country along with easing liquidity situation and the offshoots of recovery in global economy. This is done in view to connect major clusters of India and to make freight corridor for ease of transportation of manufactured goods to the end-user

- 13. P O R T S

- 16. ## I am confident to handle your financial portfolio needs effectively as I have experience in diversifying it in various instruments as per risk/return appetite of an individual. ## Have experienced in getting good return investing in equities & believes that life insurance(TERM), + Medical, Accident & Household insurance is necessary for an individual ## I am safe trader & have good grip on taking new positions in counters which are looking technically sound & am periodically wounding up position to ensure that risk taken gets diminished. ## EQUITY MARKETS INVESTMENTS give LIQUIDITY like no other assets give ## Even Gold can be considered at par (or below) with it AS whatever/whenever you sell(reasonable big quantity) legally, you get the amount in Cheque that can be reflected in your account ledger atleast after 12 hours. While stock market transactions can be made online where you can pay instantly and similarly redeem instantly through NET BANKING. . ## And since trading in scripts that are in Futures you can be assured of high liquidity and an impact cost of at-most 0.02% So 1LAC invested for 10 yrs in Equity can be compounded to 478544 & 410840 is needed to have same purchasing power at end considering 17% CPI- CLEAR SURPLUS of 67704 . Portfolio Advisory Service (PAS), as name suggests, is specialized advisory service for retail investors. Those availing service pay specific fee for professional advice given by PORTFOLIO ADVISOR , that’s ME ( ZOHAR )……..