Gbu video class (2)

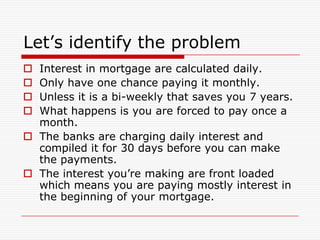

- 1. Let’s identify the problem Interest in mortgage are calculated daily. Only have one chance paying it monthly. Unless it is a bi-weekly that saves you 7 years. What happens is you are forced to pay once a month. The banks are charging daily interest and compiled it for 30 days before you can make the payments. The interest you’re making are front loaded which means you are paying mostly interest in the beginning of your mortgage.

- 2. The mortgage account is a close end loan meaning that once you make a payment, you can not take it out. The graph looks like this: We want to change the way it is being done.

- 3. We will use the banks system against them. It is legal to do and it only requires a complex calculations that will examine every aspect of your finances. Everybody can do it. It’s really easy and I’ll show you how’s its done. And of course, depending on your unique financial situation, your graph can look like this

- 4. If you continue to use that monthly mortgage for this long, based on my example on the website, you can save up to ______ by the 30th year comes. Now, you do not only own a house with a mortgage, but you could also have a house that can fuel your retirement account. That’s why they call it Real Estate because it is a real asset building tool. You just need to change the way you look at money.

- 5. The Solution We are going to use a very simple money principles: Savings Checking Mortgage Credit Cards

- 6. Savings Discretionary income are saved here for emergency or unexpected expenses. Discretionary income are what is left at the end of the month from your income after you have paid all your bills and expenses. Checking Direct deposit your income here. Used to pay bills and expenses. Credit Cards Used to pay daily expenses. Used to buy miscellaneous items. Mortgage This is your house loan. You pay a set amount every month to the bank.

- 7. Once you received your paycheck, it goes directly to your checking account as direct deposit. And for some of you, it stays there for a couple of days.

- 8. Then you start paying your bills from your checking account. If there is anything left, we call it discretionary income, we put it to our savings account.

- 9. We save the discretionary income so it is available to pay for unexpected expenses, emergencies, or for the large screen TV that you’ve always wanted. But we all hope that the money we put into the savings account will be used for retirement. But does it ever happens? Now, how are we going to use the banks system to our advantage? We’ve already identified the tools that we need Savings Checking Credit Cards Mortgage

- 10. I want to add a very powerful tool. It’s called a Facilitating account or Home Equity Line of Credit or Financial Forecast Report account or Any Savings account that can act like a Facilitating account. This account is the hybrid of all the other accounts. It is a combination of Savings Checking Credit Cards Mortgage

- 11. This account started in other countries like Australia and Europe and just now slowly coming in to America. I’ve heard this program in 2006 and still, a lot of people has not heard of this programs. It is because the banks don’t want you to know this! If this sounds interesting to you, well This is the time to pay more attention. Because the next segment will be the explanation on how it works.

- 12. The Technique So, now you know that there is a hybrid account that combines all the tools we’ve identified Let’s change the picture of your old graph FROM To this

- 13. You will need a Facilitating account which will be your Hybrid account. This could be a Savings account HELOC PLOC Any LOC

- 14. The best one to use is the HELOC This HELOC will combine the power of your: Checking Savings Mortgage Credit Cards Used to pay for daily expenses and or other bills like: Insurance Utilities Telephone Miscellaneous Grace period of up to 28 days. If you pay off the balance before the grace period ends, there will be no interest charges made.

- 15. Ok, this is how it works. This is your mortgage, you have all the money owed waiting for you to release them/pay them But the banks only give you one chance to pay every month.

- 16. So let’s say that you made the complex calculations and you’ve come up with a specific amount of money to be used as a Floating money. In this case $5,000. If you are using a HELOC, you don’t have to come up with your own money. Use the banks money to cancel interest on your first mortgage. See, this is the beauty of this Hybrid account because you can open one up using your home equity. Remember, your house is called Real Estate. Meaning that it has a real value and not an imaginary value.

- 17. You can use that value to get money from the bank and use it against them. It’s not your money but it’s your real property used as a collateral. Now, what we have to do is fight the bank in our own arena or our own capabilities. Our own arena/capabilities is your $5,000 HELOC account and your income. If you can get a higher HELOC the better. But we don’t have to use anything above $5,000 with this example regardless of how much credit you acquire. You can just leave it there for emergency. Use it so you don’t have to keep a huge savings on the side.

- 18. So, we are going to take money from the big mortgage and put them into the HELOC. MORTGAGE HELOC

- 19. So, we are going to take money from the big mortgage and put them into the HELOC. MORTGAGE HELOC

- 20. Once the small amount of mortgage is in our arena/HELOC We are going to start attacking that mortgage with full power. You see, our money is small compare to the banks. BANKS OURS

- 21. That’s why we have to break it down to smaller portions so we can effectively attack them. By doing this system, we are utilizing all our tools very effectively. If your HELOC has $5,000 credit limit, the system has to try and maintain that available credit as high as possible. Thus, depositing our income and leaving our discretionary income into the HELOC. Now, we can cancel 6% of mortgage interest on the amount that we have in there and still have the ability to take some money out when we need it. Remember, we are only going to use $5,000. No more, maybe less. HELOC

- 22. Ok, now its time to pay some bills. This process requires a sophisticated software that will examine all your debts and all your expenses versus your income to tailor a plan that will best reduce the amount of interest you will be paying. It will strategically transfer a specific amount of money from your cash account or Facilitating account and pay off a specific debt that is costing you the most. HELOC

- 23. Once this process is accomplished, it will then fuel the Facilitating account until the balance is low enough that it will not cause the interest being charge on the Facilitating account to be counter productive in paying the interest that is costing you the most. HELOC

- 24. After this process, it will select and pay off the next specific debt that is costing you the most. This will go over and over and pay one debt at a time so you can use that payment from the old debt to pay the next debt like a snowball effect. HELOC

- 25. The more debt you can pay off, the bigger snowball you can use to pay for the next debt and the faster you’ll pay everything off.

- 26. You can do it yourself. The only problem is, it requires a complex calculations on how much you can pay on a specific debt. This ensures that the money from the Facilitating account that you are going to use to pay your debts will not charge you more on interest than the debts you are trying to pay off.

- 27. This system will not only pay off your mortgage in 1/3 of the time, but all your debts will be paid off one by one in a records time. Let’s use our example from the webpage. HELOC with a credit balance of $5,000. Currently, you’ve used $4,700. HELOC $5,000 CREDIT LIMIT $4,700

- 28. As soon as you received your income from Job Rental income From Savings we are going to deposit that income towards the Facilitating account.

- 29. This is what it looks like: Deposit $2,000 from Savings to Facilitating account. Facilitating account will have a new balance of $2,700. Started from $4,700

- 30. This process will occur until the balance is zero. Then the remaining balance will be available in your checking or cash account. Full Credit Limit of $5,000

- 31. Of course, we have to pay bills. So let’s see how are we going to pay them. Utility bill of $400. Since we have money available on our checking account, we will utilize it first. We don’t have to pay interest on this account.

- 32. We are going to continue paying all our bills until we exhausted our cash/checking account. Then, we will borrow again from our Facilitating account to pay the difference.

- 41. - END OF LESSON -