TMUS ICM November 2020 update 11.9.20

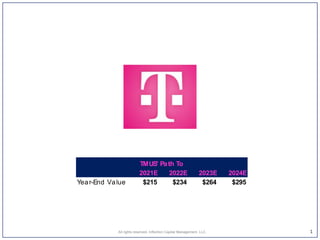

- 1. 1All rights reserved, Inflection Capital Management, LLC 2021E 2022E 2023E 2024E Year-End Value $215 $234 $264 $295 TMUS' Path To

- 2. Thesis & Returns Update on The New T-Mobile Perspective: All are going well six months into the The New T-Mobile's customer/ systems integration, synergies, network build, and financials. This significantly mitigates the risks of unexpected problems and adverse unknown-unknowns. Moreover, given the improving offerings for 5G hardware, indications of strong consumer interest for 5G (per trends in Asia), and a compelling 5G network coverage story for T-Mobile (100M POPs covered w/ mid-band spectrum by year-end), the time is nearing for T-Mobile to significantly increase their brand and customer acquisition investment--that is to be the 1H'21. As such, we expect T-Mobile to capture most of the industries growth over the near- to medium-term. Similar to LQ, analysts and PMs can now more confidently invest given that their forecasts are now more grounded (given 2 quarters of numbers) and the near-term risks narrowed. Post the release, all sell-side estimates that we observed were revised higher. Separately, for reference, we have been writing on TMUS since mid-2018 with the view that the Sprint merger would be approved and that TMUS will disrupt the entire TMT industry with the acquired spectrum and 5G. Our July '20 viewpoint is here. Our confidence in these views increased with the results from TMUS and across the industry. 2 Key Points: 1) Integration complete and the 5G network build pace ramped-up and rapidly bringing real 5G coverage to the country with >200M people to have mid-band 5G coverage by T-Mobile by the end of '21. 2) Synergies ahead: $1.2B this year and $2.4B (low-ball guidance) in '21. Synergy target to be steadily raised over the next two years. 3) T-Mobile's Financial model continues to track ahead of consensus and largely in-line with our base-case expectations. However, we have deflated our Home Run Scenario on our better understanding of the shape of the market and potential profitability. 4) TMUS' return potential is accentuated over the next few years as the potential value creation from the merger and the industry's transformation resulting from 5G unfold and the evidence for demonstrable valuation creation becomes obvious (none of what we illustrate here as our Home Run Scenario is in sell-side estimates; moreover, it is also likely largely missed by the buy-side as well). 5) We view the biggest risk to TMUS to be internal and not external. Do they execute an impeccable transition to the 5G network? Do they retain / transition / grow the Sprint subscriber base? Do they capitalize on the opportunities afforded by 5G to offer brilliant and valued services to consumer and enterprise customers, and significantly disrupt AT&T's and Verizon's legacy positions? Can they avoid hubris and stakeholder deftness? Allrightsreserved,InflectionCapitalManagement,LLC 2021E 2022E 2023E 2024E Dated 11.8.20 Year-End Value $215 $233 $264 $294 Current Price $124 $115 $115 $115 IRR 73% 37% 29% 24% The New T-Mobile Home Run Scenario

- 3. 2021E 2022E 2023E 2024E Total EBITDA-NTM $31,093 $37,778 $40,527 $43,563 Free Cash Flow $1,255 $6,362 $16,092 $18,831 Debt Paydow n $0 -$6,362 -$16,092 -$18,831 Net Debt (ex. Leases) $52,990 $46,629 $30,537 $11,706 Leverage 1.7 x 1.2 x 0.8 x 0.3 x EV/ EBITDA-FY1 8.5 x 8.3 x 8.1 x 7.8 x Enterprise Value $321,114 $335,481 $350,942 $361,539 Equity Value $268,123 $288,853 $320,406 $349,833 Diluted Shares Out 1,249 1,249 1,249 1,249 Per Share $215 $231 $257 $280 Revenue $624 $1,969 $3,521 $5,383 EBITDA ($376) $316 $1,143 $2,177 EV/ EBITDA-FY1 8.5 x 8.3 x 8.1 x 7.8 x Enterprise Value $2,614 $9,207 $17,051 Excess Cash $871 Equity Value $2,614 $9,206 $17,922 Diluted Shares Out 1,249 1,249 1,249 Per Share $2 $7 $14 2021E 2022E 2023E 2024E Dated 11.8.20 Year-End Value $215 $233 $264 $294 Current Price $124 $124 $124 $124 IRR 73% 37% 29% 24% The New T-Mobile Home Run Scenario T-Mobile's Traditional Wireless Biz New 5G Markets Explaining The New T-Mobile Home Run Scenario Part-1: Shown below is a deconstruction of the potential value creation between the traditional wireless business and the new opportunities that we foresee with 5G . As such, vs. TMUS' current valuation of $250B, we believe that Wall Street will begin to value TMUS' existing wireless business at $320B for the end of 2021 based upon robust growth customer and profit growth, and a 2022 EBITDA estimate of $31B (an estimate that will fill in during 2022); moreover, Wall Street will also begin to attach additional value for "5G optionality". Should these segments grow as we forecast, TMUS' stock price should increase to $294/sh by the end of 2024. 3 1 2 3 5 4 6 All rights reserved, Inflection Capital Management, LLC

- 4. The New T-Mobile 2020e 2021e 2022e 2023e 2024e 2025e Industry Postpay Phone 229,413 238,016 245,752 250,667 255,680 260,793 YoY # Ch 4,129 8,603 7,736 4,915 5,013 5,114 YoY % Ch 1.8% 3.8% 3.3% 2.0% 2.0% 2.0% TMUS Postpaid Phone Subs 66,894 74,144 79,944 83,424 86,904 89,688 Net Adds 7,250 5,800 3,480 3,480 2,784 TMUS Share 29.2% 31.2% 32.5% 33.3% 34.0% 34.4% TMUS Adds / Industry Adds 84% 75% 71% 69% Others 162,519 163,872 165,808 167,243 168,776 171,105 YoY % Ch 0.8% 1.2% 0.9% 0.9% 1.4% Service Revenue 54,845 60,312 65,944 71,096 74,998 79,228 EBITDA ex. Lease Revenue 22,800 22,966 31,093 37,778 40,527 43,563 Service Margin 41.6% 38.1% 47.2% 53.1% 54.0% 55.0% 2021E 2022E 2023E 2024E Total EBITDA-NTM $31,093 $37,778 $40,527 $43,563 Free Cash Flow $1,255 $6,362 $16,092 $18,831 Debt Paydow n $0 -$6,362 -$16,092 -$18,831 Net Debt (ex. Leases) $52,990 $46,629 $30,537 $11,706 Leverage 1.7 x 1.2 x 0.8 x 0.3 x EV/ EBITDA-FY1 8.5 x 8.3 x 8.1 x 7.8 x Enterprise Value $321,114 $335,481 $350,942 $361,539 Equity Value $268,123 $288,853 $320,406 $349,833 Diluted Shares Out 1,249 1,249 1,249 1,249 Per Share $215 $231 $257 $280 T-Mobile's Traditional Wireless Biz The Home Run Potential for the Existing Wireless Business Part-2: Shown below is our forecasts for the primary drivers of the existing wireless business' forecasted EBITDA. We are assigning a valuation of $320B to the business as Wall Street draws onto a $31B EBITDA # for 2022. Crucial to our forecasts are strong ongoing subscriber gains fueled by >3% industry growth and share losses by Verizon or AT&T . Verizon is at risk due to an inferior and "late" 5G network strategy. AT&T is at risk due to unruly business complexity, a history of mis-execution, and zero evidence that their content + wireless consumer strategy has consumer appeal and marketplace effectiveness. We also expect, T-Mobile to earn more 5G revenue from more devices and more data usage (i.e. higher-tier plans). Margin expansion at TMUS is also a critical driver of value creation. The forecasted margin of 55% for 2025 is far below the average of Verizon's and AT&T's, i.e. there is upside-risk. It will reach their levels in later years as growth slows. 4 1 3 4 2 All rights reserved, Inflection Capital Management, LLC

- 5. The New T-Mobile New 5G Markets 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 2029E 2030E Transformation Lifts $-m illions Fixed Broadband (i.e. home broadband w/ signal going from c ellular radio to a 5G antenee plac ed in a window) Total Broadband Sub Mkt 100,919 102,937 104,996 107,096 109,238 111,423 113,651 115,924 118,243 120,608 Market Share 1% 3% 5% 7% 8% 8% 8% 8% 8% 8% Subsc ribers 1,009 3,088 5,250 7,497 8,739 8,914 9,092 9,274 9,459 9,649 ARPU $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 Revenue $606 $1,853 $3,150 $4,498 $5,243 $5,348 $5,455 $5,564 $5,676 $5,789 Expense $750 $1,374 $2,022 $2,696 $3,069 $3,121 $3,175 $3,229 $3,285 $3,342 EBITDA (50% incremental) ($144) $479 $1,128 $1,802 $2,174 $2,227 $2,280 $2,335 $2,391 $2,447 Mobile Edge Compute MEC PaaS/SaaS per Gartner ($ B) $37 $60 $96 $114 $133 $155 $177 $199 $221 $243 US @70% $26 $42 $67 $80 $93 $109 $124 $139 $155 $170 33% Size of PaaS/SaaS $9 $14 $22 $26 $31 $36 $41 $46 $51 $56 Penetration 2% 8% 16% 32% 64% 82% 100% 100% 100% 100% US Industry ($B) $0 $1 $4 $8 $20 $29 $41 $46 $51 $56 Operator Take (30%) $0 $0 $1 $3 $6 $9 $12 $14 $15 $17 TMUS Market Share 35% 35% 35% 35% 35% 35% 35% 35% 35% 35% Revenue ($ M ) $18 $116 $371 $885 $2,065 $3,083 $4,293 $4,827 $5,360 $5,894 Expense $250 $279 $356 $510 $864 $1,169 $1,533 $1,693 $1,853 $2,013 EBITDA (70% incremental) ($232) ($163) $15 $375 $1,201 $1,913 $2,761 $3,134 $3,508 $3,881 New 5G Markets Revenue $624 $1,969 $3,521 $5,383 $7,308 $8,431 $9,748 $10,391 $11,036 $11,683 EBITDA ($376) $316 $1,143 $2,177 $3,375 $4,140 $5,041 $5,469 $5,898 $6,329 EV/ EBITDA-FY1 8.5 x 8.3 x 8.1 x 7.8 x 7.6 x 7.4 x 7.2 x 6.9 x 6.7 x 6.5 x Enterprise Value $2,614 $9,207 $17,051 $25,691 $30,597 $36,134 $37,988 $39,660 $41,148 Excess Cash $871 $2,221 $3,877 $5,893 $8,081 $10,440 $12,972 Equity Value $2,614 $9,206 $17,922 $27,912 $34,474 $42,027 $46,069 $50,100 $54,120 Diluted Shares Out 1,237 1,237 1,237 1,237 1,237 1,219 1,184 1,149 1,109 Per Share $2 $7 $14 $23 $28 $34 $39 $44 $49 Foresee that high competition in the market significantly limits pricing and TMUS' share. Assumes that MEC tracks Paas/Saas with a five year delay & that MEC is only half the size of these two. Take rate for the facilities operator for running AMZN / MSFT / GOOGL edge products. The Value for "5G optionality" for The New T-Mobile Part-3: o Shown below is our forecasts for the new markets the we foresee coming from 5G. o Both T-Mobile and Verizon were optimistic on fixed-wireless broadband. o T-Mobile spoke of expanding fixed-wireless broadband trials (to over 450 cities) during the Q3 call and one would expect the topic to be a meaningful part of its Q1 investor day. T-Mobile's focus is primarily rural and other underserved markets--those without a strong incumbent. 5 Other "Platform" and "sharing- opportunities" exist for advertising, subscriptions, VR/AR, payments, healthcare, manufacturing, autonomous, and the 5G KILLER APP. Allrightsreserved,InflectionCapitalManagement,LLC

- 6. Subscribers: o T-Mobile produced solid subscriber growth in Q3, despite the discontinuation of the Sprint brand and AT&T's aggressive phone promotions to lock-in subscribers which materially decreased its churn of subscribers onto the market (a YoY delta of 500K). Additionally, we suspect that T-Mobile's customer acquisition efforts have been dialed back as it put the priorities of getting Sprint integrated and setting up to capture the merger synergies. o Looking forward to 2021, we expect the market's growth to accelerate due to consumer interest in 5G and better connectivity (similar to as why fixed-line broadband accelerated this year). o In our Home Run Scenario, we foresee T-Mobile capturing the majority of that market expansion due to the reversal of that shared in bullet-1, a step-up in business development efforts in enterprise and government (underpenetrated markets for them at only 9 pts vs. 29% overall), gains in rural markets due to more stores and better coverage (also an underpenetrated market for them), lower Sprint churn, and a significant nationwide marketing effort touting its 2.5GHz 5G coverage of >100M POPs. This campaign's objective would be to position T-Mobile as "the best network" and the "network that offered real 5G value to everywhere--not just mmW hotspots." I.e. to be the provider to subscribe to if you want 5G. Historically, "network focus / prioritization" is the more premium-end of the market; thus, T-Mobile is making a frontal assault on Verizon's and AT&T's customer base. That market share capture should continue for the next few years until Verizon deployes its CBAN 5G (vs. its current more limited and spot-specific mmW coverage). 6All rights reserved, Inflection Capital Management, LLC The New T-Mobile 1Q20 Q2'20 3Q20 4Q20 2020e 2021e 2022e 2023e 2024e Industry Postpay Phone 225,894 224,748 226,873 229,413 229,413 238,016 245,752 250,667 255,680 YoY # Ch 2,125 2,540 4,129 8,603 7,736 4,915 5,013 YoY % Ch 2.7% 2.4% 2.6% 2.7% 1.8% 3.8% 3.3% 2.0% 2.0% TMUS Postpaid Phone Subs 64,852 65,105 65,794 66,894 66,894 74,144 79,944 83,424 86,904 Net Adds 253 689 1,100 7,250 5,800 3,480 3,480 TMUS Share 28.7% 29.0% 29.0% 29.2% 29.2% 31.2% 32.5% 33.3% 34.0% TMUS Adds / Industry Adds 84% 75% 71% 69% In recent years, TMUS has captured 60-70% of the market's growth. Being the "challenger" and disruptor allowed them to do so. Over the next few years, we expect that win rate to continue because it will have the market's best network and best price, and for the reasons noted above. Key Focal Points / Drivers Over Next Year for Home Run Scenario

- 7. The New T-Mobile 2020E 2021E 2022E Service revenues $54,851 $60,363 65,995 YoY $ ch $2,824 $5,512 $5,632 Growth Factor 1.5 x 2.0 x 1.0 x % yoy growth 5% 10% 9% Equipment revenues 19,744 27,061 25,873 Legacy Other revenues 1,046 800 800 Total revenues $75,642 $88,224 $92,668 % yoy growth 3.4% 16.6% 5.0% Synergies COGS-Cumulative ($4B rgt) -600 -1,600 -4,000 SG&A-Cumulative ($2B tgt) -600 -2,000 -3,000 Total -1,200 -3,600 -7,000 Cost of equipment 17,333 24,355 23,286 % of Equipment Revenue 87.8% 90.0% 90.0% Network expense 12,911 13,729 11,950 % of Service Revenue 23.5% 22.7% 18.1% ex-Synergies 24.6% 25.4% 24.2% SG&A ex. SBC 18,887 20,331 19,805 % of Service Revenue 34.4% 33.7% 30.0% ex-Synergies 35.5% 37.0% 34.6% YoY $ ch ex. Synergies $2,844 $474 EBITDA ex SBC 28,006 30,370 38,174 Equipment Lease Rev & EBITDA -$5,331 -$7,306 -$6,986 Historic EBITDA Definition $22,675 $23,063 $31,188 YoY $ ch Adj. $389 $8,125 YoY $ Ch ex. Synergies -$2,011 $4,725 Key Focal Points / Drivers Over Next Year for Home Run Scenario 7 Allrightsreserved,InflectionCapitalManagement,LLC Equipment revenue and cost for new 5G phones will be a major driver of revenue and expense in '21, as well as the 5G network's depreciation and cost. Guidance for 2021's synergies is $2.4B. We expect that to be raised throughout the year to $2.6B given prior precedent and the "beat & raise" style of management Additionally, we expect that total synergies exceed the currently stated target of $6B, which is more and earlier than guided. Cost of Equipment relative to revenue is a critical determinant of profits and indicator of the industry's competitive intensity. We are modeling a slight increase in that intensity. We suspect that most of the near-term network synergies are going to be obfuscated by the start-up costs for the 5G network. However, as the penetration of 5G subscribers increases, eventually the duplicative 4G costs will be "decommissioned" and where the 5G network's fixed costs significantly leverage. We expect that most of the near-term SG&A synergies to be re-invested in growth, such as business development efforts in the underpenetrated sub-segments of the market and in a large nationwide marketing campaign to drive awareness of T-Mobile's 5G network and coverage and elevate the T-Mobile network's brand equity. However, in '22 the synergies should show through as investments are curtailed; that in combination with significant revenue growth, will allow for a powerful EBITDA year in '22.