GAAR provisions

•

0 likes•416 views

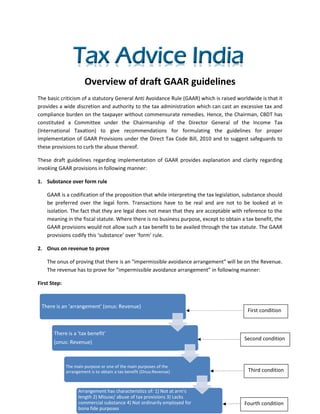

The draft guidelines for implementing GAAR provide clarity around key aspects: [1] GAAR allows looking at the substance over the legal form of arrangements. Where the sole purpose is tax benefit, GAAR prevents claiming that benefit. [2] The onus is on revenue to prove an "impermissible avoidance arrangement." [3] Monetary thresholds will apply to relieve small taxpayers.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Fast track merger and cross border merger under companies act, 2013

Fast track merger and cross border merger under companies act, 2013

What are the salient features of CFSS, 2020 and LLP Settlement Scheme, 2020?

What are the salient features of CFSS, 2020 and LLP Settlement Scheme, 2020?

Treasury notice creates need for caution for companies contemplating inversions

Treasury notice creates need for caution for companies contemplating inversions

The new Companies Law 2013 (India) - Chapter 6: Registration of charges

The new Companies Law 2013 (India) - Chapter 6: Registration of charges

Is COVID-19 a Force Majeure Event? – Legal & Statutory Position

Is COVID-19 a Force Majeure Event? – Legal & Statutory Position

Income tax appeals and Revision by abhishek murali

Income tax appeals and Revision by abhishek murali

Union Budget 2020:Clause by Clause Analysis of Direct Tax Provisions

Union Budget 2020:Clause by Clause Analysis of Direct Tax Provisions

General Anti Avoidance Rules- A Paradigm shift in Businesses

General Anti Avoidance Rules- A Paradigm shift in Businesses

Financial rehabilitation and insolvency act of 2010

Financial rehabilitation and insolvency act of 2010

Viewers also liked

Viewers also liked (8)

Similar to GAAR provisions

Similar to GAAR provisions (20)

An insight into General Anti-Avoidance Rules (GAAR) - Sandeep Jhunjhunwala

An insight into General Anti-Avoidance Rules (GAAR) - Sandeep Jhunjhunwala

20 key suggestions of Tax Reform Panel to Simplify tax provisions

20 key suggestions of Tax Reform Panel to Simplify tax provisions

Tax Planning And Compliance TPC_MA-2023_Suggested answer.pdf

Tax Planning And Compliance TPC_MA-2023_Suggested answer.pdf

Dodd-Frank Act: Corporate Governance Checklist for Commercial End-Users

Dodd-Frank Act: Corporate Governance Checklist for Commercial End-Users

Recently uploaded

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974🔝✔️✔️ Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes. We provide both in- call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease. We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us. Our services feature various packages at competitive rates: One shot: ₹2000/in-call, ₹5000/out-call Two shots with one girl: ₹3500 /in-call, ₱6000/out-call Body to body massage with sex: ₱3000/in-call Full night for one person: ₱7000/in-call, ₱10000/out-call Full night for more than 1 person : Contact us at 🔝 9953056974🔝. for details Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations. For premium call girl services in Delhi 🔝 9953056974🔝. Thank you for considering us Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Recently uploaded (20)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in Yamuna Vihar (delhi) call me [🔝9953056974🔝] escort service 24X7

Strategic Resources May 2024 Corporate Presentation

Strategic Resources May 2024 Corporate Presentation

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

2999,Vashi Fantastic Ellete Call Girls📞📞9833754194 CBD Belapur Genuine Call G...

2999,Vashi Fantastic Ellete Call Girls📞📞9833754194 CBD Belapur Genuine Call G...

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

CBD Belapur((Thane)) Charming Call Girls📞❤9833754194 Kamothe Beautiful Call G...

CBD Belapur((Thane)) Charming Call Girls📞❤9833754194 Kamothe Beautiful Call G...

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Virar Best Sex Call Girls Number-📞📞9833754194-Poorbi Nalasopara Housewife Cal...

Virar Best Sex Call Girls Number-📞📞9833754194-Poorbi Nalasopara Housewife Cal...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

Call Girls Howrah ( 8250092165 ) Cheap rates call girls | Get low budget

GAAR provisions

- 1. Overview of draft GAAR guidelines The basic criticism of a statutory General Anti Avoidance Rule (GAAR) which is raised worldwide is that it provides a wide discretion and authority to the tax administration which can cast an excessive tax and compliance burden on the taxpayer without commensurate remedies. Hence, the Chairman, CBDT has constituted a Committee under the Chairmanship of the Director General of the Income Tax (International Taxation) to give recommendations for formulating the guidelines for proper implementation of GAAR Provisions under the Direct Tax Code Bill, 2010 and to suggest safeguards to these provisions to curb the abuse thereof. These draft guidelines regarding implementation of GAAR provides explanation and clarity regarding invoking GAAR provisions in following manner: 1. Substance over form rule GAAR is a codification of the proposition that while interpreting the tax legislation, substance should be preferred over the legal form. Transactions have to be real and are not to be looked at in isolation. The fact that they are legal does not mean that they are acceptable with reference to the meaning in the fiscal statute. Where there is no business purpose, except to obtain a tax benefit, the GAAR provisions would not allow such a tax benefit to be availed through the tax statute. The GAAR provisions codify this ‘substance’ over ‘form’ rule. 2. Onus on revenue to prove The onus of proving that there is an “impermissible avoidance arrangement” will be on the Revenue. The revenue has to prove for “impermissible avoidance arrangement” in following manner: First Step: There is an 'arrangement' (onus: Revenue) First condition There is a 'tax benefit' Second condition (onus: Revenue) The main purpose or one of the main purposes of the arrangement is to obtain a tax benefit (Onus:Revenue) Third condition Arrangement has characteristics of: 1) Not at arm's length 2) Misuse/ abuse of tax provisions 3) Lacks commercial substance 4) Not ordinarily employed for Fourth condition bona fide purposes

- 2. Second step: If prove to be impermissible Avoidance Arrangement then Consequences may be determined by Disregarding/ Combining/ recharacterising whole/part of the impermissible arrangement Treating the impermissible arrangement as if it had not been carried out Disregarding any accommodating party or treating them and any other party as one and the same Treating connected parties as one and the same person Reallocating accruals, expenses etc. Treating place of residence, situs of assets or of transaction different from that provided in the arrangement Looking through an arrangement by disregarding corporate structure 3. Monetary threshold There will be monetary threshold for invoking the GAAR provisions and to provide relief to small taxpayers. 4. Prescription of statutory forms: Forms are introduced for procedures for invoking the GAAR provisions: For the Assessing Officer to make a reference to the Commissioner For the Commissioner to make a reference to the Approving Panel For the Commissioner to return the reference to the Assessing Officer 5. Prescribed time limits: CIT can make a reference to approving panel within 60 days of the receipt of the objection from assessee. In case of the CIT accepting the assessee’s objection and being satisfied that provision of GAAR are not applicable, the CIT will communicate his decision to the AO within 60 days of the receipt of the assessee’s objection.

- 3. Commissioner cannot take after the period of six months from the end of the month in which the reference under sub-section 144BA(1) was received by the Commissioner. 6. Setting up approval penal: To begin with provisions, approving panel will be situated at Delhi and it will comprise of three members – 2 CCIT and 1 officer of the level of joint secretary or above from the ministry of law. Subsequently, the CBDT would review the number of Approving Panels required on the basis of the workload in the FY 2014-15. 7. Special provisions for FII’s If FII chooses not to take any benefit under an agreement entered into by India under section 90 or 90A of the Act and subjects itself to tax in accordance with the domestic law provisions, then, the provisions of GAAR would not apply to such FII. Further, Safe harbor rules could be provided to FII’s subject to the payment of taxes as per domestic law. 8. Definition of ‘connected person’ for applicability of GAAR: “Connected person” for invoking GAAR would include: definition of “associated enterprise” given in section 92A, definition of ‘relative’ in section 56 and “persons” covered u/s 40A(2)(b). 9. Applicability The provisions of GAAR will apply to the income accruing or arising to the taxpayers on or after 01.04.2013. In case of any clarification please contact us at info@taxadviceindia.com Get online Tax query solution: http://www.taxadviceindia.com/tax_online_advice(TAS).html To get latest updates on tax: Like us www.facebook.com/taxadviceindia