Forensic Loan Audit

- 2. Do Not Lose Your Home, Fight Back!!! Forensic Loan Audit is a comprehensive loan fraud/predatory lending investigation report which will identify infractions and violations committed by your lender and/or broker when they originally funded your loan. Obtaining an audit should be the first step on your quest to successfully modify your home loan. If you are behind on your mortgage payments, facing default or foreclosure the audit is a critical tool that will be used as leverage to argue your case with your Lender(s). Again, it will highlight the laws that were broken, if any, by your broker or by your lender.

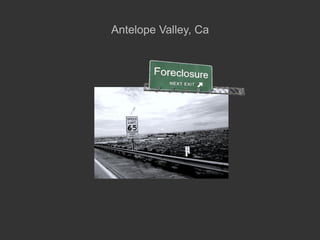

- 3. Stop Illegal Foreclosures and Evictions Loans with illegal terms or conditions are not enforceable. Foreclosures resulting from illegal loans are also not enforceable. The foreclosure process is stopped when litigation on a questionable loan begins. Mortgage payments are not required during the foreclosure or litigation process. Lenders will choose the most rational and fiscally sensible response when presented with the legal facts. When facing their legal options: modifying your loan, foreclosing your home, paying some high- priced attorneys to litigate, or risk stiff federal fines and penalties, many lenders will choose the most financially sensible option. Don't wait, time is of the essence. A Forensic loan audit will reveal one or more of the following:

- 4. Mortgage Fraud Is a term used to describe a broad variety of criminal actions where the intent is to materially misrepresent or omit information on a mortgage loan application in order to obtain a loan or to obtain a larger loan than would have been obtained had the lender known the truth. mortgage fraud is prosecuted as wire fraud, bank fraud, mail fraud and money laundering, with penalties of up to thirty years imprisonment.

- 5. False Stated Income Fraud A stated income loan is a loan where the income that is put on Form 65, Uniform Loan Application, is not fully verified. A falsely stated income loan is any loan originated under a program in which the borrower's income has been misstated for qualification purposes. The borrower may or may not be aware of the fraudulent income on their Form 65. In other instances, the borrower may know he is being qualified for a stated income loan, but does not thoroughly inspect the final Form 65 at closing to ensure the accuracy of the information on it. Employment Fraud This occurs when a borrower claims self-employment in a non-existent company or claims a higher position (e.g., manager) in a real company, in order to provide justification for a fraudulent representation of the borrower's income.

- 6. Occupancy Fraud This occurs where the borrower wishes to obtain a mortgage to acquire an investment property, but states on the loan application that the borrower will occupy the property as the primary residence or as a second home. Fraud for Profit A complex scheme involving multiple parties, including mortgage lending professionals, in a financially motivated attempt to defraud the lender of large sums of money.

- 7. Appraisal Fraud An appraiser who knowingly and willingly tweaks the numbers is committing fraud. People in the mortgage industry acknowledge that appraisal fraud is very common. The way appraisal fraud works is really quite simple. When somebody approaches a mortgage lender about refinancing their home, they receive a "good faith" estimate for the loan. This estimate includes a value for their home. This value is the minimum amount needed to complete the loan. Appraisers are hired by the very lenders who need the number. Rather than being independent in doing their jobs, appraisers are really in a situation where they work for the lender. There are lots of other appraisers that a lender can turn to when they need to meet their number. An appraisal that comes in too high or too low can wreak havoc for both borrowers and lenders. For example, suppose that an appraiser tweaks their number to show that a home that is worth $300,000 is worth $350,000. The borrower can then decide to cash out some of this false equity. Then, if they decide to sell the property, when they will only get a price that the market will bear, they won't be able to sell the property for what they owe on it. From the lender's point of view, they can end up with the short end of the stick should they have to foreclose on the property. In the same situation, they too may not be able to get the amount of money that they lent for the property.

- 8. Fair Lending Violations Truth in Lending Act (TILA) Real Estate Settlement Procedures Act (RESPA) Equal Credit Opportunity Act (ECOA) Home Ownership Equity Protection Act (HOEPA) and more...

- 9. Z E R O F R A U D T O L E R A N C E A V E N U E S Mortgage Document Auditing Services We report all suspicious activity to the following: FBI- White Collar Crimes Supervisor (Mortgage Fraud Division) IRS-CID (Internal Revenue Service- Criminal Investigation Division) Los Angeles County District Attorney's Office Bureau of Investigation Major Fraud Division Department of Justice Department of Corporations Department of Real Estate Enforcement Department of Financial Institutions Office of the Federal Housing Enterprise Oversight – HUD Federal Trade Commission Your Lender's Regulatory Bank (OCC, OTS, FDIC) What we offer: Forensic analysis of your mortgage loan documents for fraud and predatory lending. Consumer education and assistance in report preparation. Refer you to an Attorney with the highest level of Integrity, Empathy and Affordability. We do not: Negotiate a Short Sale with Client's current mortgage lender. Negotiate a Deed in Lieu of Foreclosure with Current mortgage lender. Attempt to negotiate a modification of Client's current mortgage loan including but not limited to reduction in principal balance, reduction in interest rate, reduction in monthly payments, re-amortization of loan for longer term. Provide Legal advice, only your Attorney can represent you in a Court of Law. Give any guarantees whether expressed or implied. We are not: A mortgage elimination Company A law office or credit repair facility Legal professionals nor claim to be one.

- 10. Avenue S Forensic Mortgage Loan Auditing http://www.avenue-s.us http://avenue-s.info (661)860-4978 (661)860-4950