FOREIGN CAPITAL

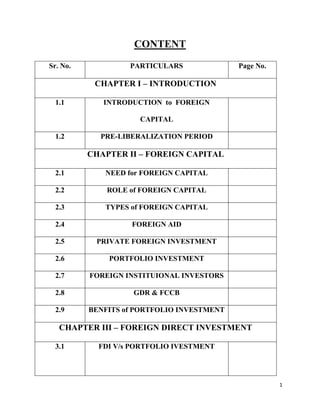

- 1. 1 CONTENT Sr. No. PARTICULARS Page No. CHAPTER I – INTRODUCTION 1.1 INTRODUCTION to FOREIGN CAPITAL 1.2 PRE-LIBERALIZATION PERIOD CHAPTER II – FOREIGN CAPITAL 2.1 NEED for FOREIGN CAPITAL 2.2 ROLE of FOREIGN CAPITAL 2.3 TYPES of FOREIGN CAPITAL 2.4 FOREIGN AID 2.5 PRIVATE FOREIGN INVESTMENT 2.6 PORTFOLIO INVESTMENT 2.7 FOREIGN INSTITUIONAL INVESTORS 2.8 GDR & FCCB 2.9 BENFITS of PORTFOLIO INVESTMENT CHAPTER III – FOREIGN DIRECT INVESTMENT 3.1 FDI V/s PORTFOLIO IVESTMENT

- 2. 2 3.2 SUPERIORITY of FDI OVER OTHER FORMS of CAPITAL INFLOWS 3.3 MACRO-ECONOMIC & MICRO- ECONOMIC ASPECTS of FDI 3.4 TYPES of FDI 3.5 DETERMINANTS of FDI 3.6 ROUTES for INWARD FLOW of FDI 3.7 FDI in DEVELOPING COUNTRIES & INDIA 3.8 SHARE of TOP TEN COUNTRIES INVESTING in INDIA 3.9 BENEFITS of FOREIGN DIRECT INVESTMENT CHAPTER IV – CONCLUSION 4.1 CONCLUSION CHAPTER V – APPENDIX 5.1 BIBLIOGRAPHY

- 3. 3 INTRODUCTION For economic and industrial development, capital is the most important factor. Such capital may be front within the country or from outside the country. When capital available within the country is not sufficient, capital from abroad is made use of. For less developed countries, capital has been provided by international organizations like World Bank and International Monetary Fund (IMF) all government led. The recent technological developments and spread of information technology have opened up the economies the world over as never in the past. This in turn has increased the multi-national role and importance of capital. It has been realized by many countries that inflow of capital from abroad is vital not only in the early stages of economic development, but also for the growth of a developing economy. Most of the countries now have been making use of foreign capital and investment. We shall first discuss about the meaning aid role of foreign capital. Later we shall examine the advantages and disadvantages. The government policy will regard to foreign investment shall also be discussed. Pre-Liberalization Period in India After independence from British colonial rule in 1947, India opted a socialist economy which was influenced by the Soviet Union, with government control over private sector participation, foreign trade and foreign direct investment. This economic policy aimed to substitute products which India imports with locally produced substitutes, industrialization, and state intervention in labour and financial markets, a large public sector, business regulation and centralized planning. Policies were protectionist in nature and the government made efforts to reduce the import to the minimum level to safeguard the interests of the domestic Industries. Plus at the time of Independence, the attitude towards foreign capital was that of fear and suspicion. The common belief was that foreign capital was “draining away” resources from the economy.

- 4. 4 As a result the Prime Minister had to give following assurance to foreign capitalists in 1949:- 1. No discrimination between foreign and Indian Capital. 2. Full opportunities to earn profits. 3. Guarantee of compensation Jawaharlal Nehru, who formulated and oversaw this economic policy, expected a favourable outcome from this strategy because it features both capitalist market economy and socialist command economy. But the outcome was unfavorable to the country and lead to liberalization and privatization in India. Government made large investments in heavy industries and expects these industries will produce enough capital for investment in other sectors of the economy. But it didn't happen. In the other hand, government has to invest more money for the survival of these companies because of poor management and low productivity. For example, the public sector steel company losses were more than its initial investment while the private sector steel company was making profit. India's average annual growth rate from 1950-1980 was 3.5%. At the same time other Asian countries like Hong Kong, Singapore, South Korea and Taiwan recorded an annual growth rate of 8%. Now 'Hindu rate of growth' is an expression to refer low annual growth rate. The failure of pro-socialist economic policy to produce an annual growth rate comparable to its neighbor‟s leads to the economic reforms going on now.

- 5. 5 FOREIGN CAPITAL The term 'foreign capital' is a comprehensive term and includes any inflow of capital in home country from abroad. It may be in the form of foreign aid or loans and grants from the host country or an institution at the government level as well as foreign investment and commercial borrowings at the enterprise level or both. Foreign capital may flow in any country with technological collaboration as well. It is interesting to note that even in Russia and East European countries foreign capital has been allowed to flow in. In countries like China, Thailand, Malaysia and Singapore contribution of foreign capital has been extremely encouraging. But in Latin America and African countries foreign capital flow has not been satisfactory. Foreign capital is useful for both developed and developing countries. Advanced countries try actively to invest capital in developing countries. In India, foreign capital has been given a significant role, although it has been changing overtime. In the early phases of planning, foreign capital has been used as a means to supplement domestic investment. Later on there were technological collaborations between foreign and Indian entrepreneurs. But since July 1991, there has been a tremendous change in government's policy (commonly called liberalization policy) about foreign investments. Foreign capital is money entering the country in the form of concessional assistance or non- concessional flows. There are many Forms of Foreign Capital Flowing into India such as banking and NRI deposits. The various Forms of Foreign Capital Flowing into India has helped to bring in huge amounts of FDI into the country, which in its turn has given a major boost to the Indian economy. Need for Foreign Capital:- 1. Inadequacy of domestic capital. 2. Foreign capital can show the way for domestic capital. 3. For speeding up economic activity in a developing country. 4. Financing of projects needed for economic development. 5. Brings in technical know-how, business experience and knowledge.

- 6. 6 ROLE of FOREIGN CAPITAL In the early stages of industrialization in any country foreign capital plays an important role. Their role can he better understood under the following heads:- 1. Increase in Resources:- Foreign capital not only provide an addition to the domestic savings and resources, but also an addition to the productive assets of the country. The country gets foreign exchange through FDI. It helps to increase the investment level and thereby income and employment in the recipient country. 2. Risk Taking:- Foreign capital undertakes the initial risk of developing new lines of production. It has with it experience, initiative, resources to explore new lines. If a concern fails, losses are borne by the foreign investor. 3. Technical Know-how:- Foreign investor brings with him the technical and managerial know how. This helps the recipient country to organize its resources in most efficient ways, i.e., the least costs of production methods are adopted. They provide training facilities to the local personnel they employ. 4. High Standards:- Foreign capital brings with it the tradition of keeping high standards in respect of quality of goods, higher real wages to labour and business practices. Such things not only serve the interest of investors, but they act as an important factor in raising the quality of product of other native concerns. 5. Marketing Facilities:- Foreign capital provides marketing outlets. It helps exports and imports among the units located in different countries financed by the same firm. 6. Reduces Trade Deficit:- Foreign capital by helping the host country to increase exports reduce trade deficit. The exports are increased by raising the quality and quantity of products and by lower prices. 7. Increases Competition:- Foreign capital may help to increase competition and break domestic monopoly. Foreign capital is a good barometer of world's perception of a country's potential. It is rightly said that a satisfied foreign investor is the best commercial ambassador a country can have. To sum up, foreign capital helps three important areas that are necessary for the economic development of a country. These three areas are savings, trade and foreign exchange and technology. Foreign capital performs three gaps filling function, i.e.

- 7. 7 i. savings gap, ii. trade gap, and iii. technological gap in the recipient country's economy. It encourages development of technology, managerial expertise, and integration with other economies of the world, export of goods and services and higher growth of country's economy. TYPES of FOREIGN CAPITAL Foreign capital can be divided into two types:- 1. Foreign Aid. 2. Private Foreign Investment. Foreign aid may consist of loans and grants. Private foreign investment takes two forms:- 1. Foreign Direct Investment (FDI). 2. Foreign Portfolio Investment (FPI). In India Foreign Direct Investment may further take the form of:- 1. Wholly owned subsidiary. 2. Joint-venture. 3. Acquisitions. Foreign Portfolio Investment may be:- 1. Investment by Foreign Institutional Investors (FIIs) including Non-Resident Indians (NRIs). 2. Investment in a a) Global Depository Receipts (GDRs). b) Foreign Currency Convertible Bonds (FCCB‟s).

- 8. 8 The above classification is shown below:- Private Foreign Investment in India can be further classified as follows:- FOREIGN CAPITAL FOREIGN AID LOANS GRANTS PRIVATE FOREIGN INVESTMENT FOREIGN DIRECT INVESTMENT FOREIGN PORTFOLIO INVESTMENT

- 9. 9 FOREIGN AID:- It consists of loans and grants. Loans may be taken from individual countries or from institutional agencies like World Bank, IMF and International Financial Corporation. Usually loans are taken for medium and long term capital needs of a country. Loans impose a heavy burden on the borrower country because they are to herepaid, along with interest, called surviving of loans. Loans may be tied because of restrictions. Such restrictions may be in the form of end use or in the form of source. Grants are given by public or private charitable organizations. They are given for relief purposes and immediate use. Grants may be time bound and can be used only for specific purpose. Loans involve repayment obligations, whereas grants are not refunded. It is important to see that grants are properly utilized for the specified purpose. Any foreign capital in the form of aid should be pledged on the basis of its purpose, mode of repayment, cost to the borrower and political considerations. For it is not only uncertain, usually not extended for public sector but for consumer goods industries and do not create means for its repayment. It is therefore better to create 'trade' rather than 'aid' from a foreign country. PRIVATE FOREIGN INVESTMENT:- Foreign investment and collaboration with a foreign nation are closely inter-related, but they are different from each other. Capital investment is participation of a foreign country in capital of recipient country's enterprises. Collaboration, on the other hand, means providing technical and managerial know-how, licensing franchise, trade- marks and patents by a host country to home country. Let us now discuss the two major components of Private Foreign Investment. PORTFOLIO INVESTMENT:- Portfolio investment is an investment in a foreign country where the investing party does not seek control over the investment. It takes the form of the purchase of equity in a foreign stock market or credit or capital from private or official sources. If we analyze the above definition we find the following features of Portfolio Investment:- 1. The investor purchases the equity in a foreign stock market, i.e., he has a sort of property interest. 2. The equity includes shares (stock) and creditors capital (debentures/bonds/other securities).

- 10. 10 3. The equity purchased is of a joint stock company. 4. The investor is a non-resident. 5. If it is creditors capital, it may be from private or official sources and is invested in recipient country's Joint Stock Companies. 6. The investor does not seek control over the investment if they do not have involvement with promotion and management of joint stock company Two more characteristics may be added here:- 1. Portfolio investment can be liquidated fairly easily. 2. Portfolio investments are influenced by short term gains and are more sensitive than FDI. There are mainly two forms of portfolio investment in India a) By foreign institutional investors (FIIs) like mutual funds, b) Investment in global depository receipts (GDRs) and foreign currency convertible bonds (FCCBs). FOREIGN INSTITUIONAL INVESTORS:- Indian Stock Market was opened up to FIIs in 1992-93. FIIs include pension funds, mutual funds, asset management companies, investment trusts, nominee companies and corporate or institutional managers. The regulations on FIIs, notified on November 14, 1995 by RBI, contains various provisions relating to definition of FIIs' eligibility criteria, investment restrictions, procedure of registration and general obligations and responsibilities of FIIs. They may invest only in:- 1. Securities in the primary and secondary markets including shares, debentures and warrants of companies listed on a recognized stock exchange in India; and 2. Units of schemes floated by mutual funds including Unit Trust of India, whether listed or not. In 1996-97 the Government of India liberalized investment policy for FIIs. There is no restriction on the volume of investment and no lock-in period. Dis-investment is allowed only through stock exchanges in India. The holding of a single FII in any company would be subject to a ceiling of 10% of total equity capital. They have to pay tax on concessional rate on capital gains. They can invest in unlisted companies, in corporate as well as government securities. The greatest disadvantage of investment by FIIs is that it is not certain how long they will hold their investment, If they are allowed to acquire more of a company's equity (at 25%), they can

- 11. 11 pressurize courtly interests of most companies. They may engage in speculative investment, avoid tax laws due to double-taxation treaties and take undue advantage of exchange rates. This can be prevented by improving the functioning of the stock markets. The Government has to adopt a policy by which FIIs may not benefit at the cost of Indians. Investment by NRIs Non-Resident Indians are the persons not residing in India. They are of two types:- 1. An Indian citizen who a) has made his permanent home outside India or b) has proceeded abroad for employment or gainful occupation, 2. An Indian citizen who made his permanent home outside India and acquired foreign citizenship or the descendent of an Indian who had earlier migrated from undivided India. This definition has been extended and includes a foreign born husband of a citizen of India. Investment made by NRI of category (a) are allowed to invest liberally, Investment by NRI of category (b) are subject to policy guidelines framed by the Government of India. The RBI has given a general exemption to NRI for transfer of shares/ debentures/ bonds of Indian Companies through recognized stock exchange. They can gift the shares, etc. to their close relatives. They can invest funds in government securities or units of UTI. NRI‟s and Overseas Corporate Bodies (OCBs) pre-dominantly owned by NRIs can acquire listed securities of Indian Companies up to 24% of their paid up capital under Portfolio Investment Scheme. They can make direct investment up to 100% of the equity in industries mentioned in Annexure III of the New Industrial Policy 1991. There is a single window facility available to NRIs for obtaining all information about investments in India. There is automatic clearance for investment proposals of NRIs for the industries mentioned in Annexure III. GLOBAL DEPOSITORY RECEIPTS (GDRs) & FOREIGN CURRENCY CONVERTIBLE BONDS (FCCBs):- GDRs and FCCBs are investments issued by Indian companies in Euro or US markets for mobilizing foreign capital by facilitating portfolio investment. A GDR can be defined as i. an instrument, ii. expressed in dollars, iii. traded on stock exchange in Europe or US, and

- 12. 12 iv. represents a certain number of equity shares. These equity shares are, however, denominated in rupees. The procedure of GDR is as follows:- First the equity shares are issued by the company to an intermediary, called 'Depository'. The shares are registered in the name of depository. It is the depository that issues GDR‟s. The depository also has the agent and the actual possession of equity shares is with the agent. The agent is called 'custodian'. Then GDR does not figure in the books of the issuing company. FCCB‟s, are also called 'Euro Convertible Bonds'. They are quasi debt securities, i.e., they can be converted into a 'depository receipt' or local shares. The investor has the option to convert the bonds into equity shares at a fixed price after a minimum period. The exchange rate for the conversion price is fixed as is the conversion price. There are two types of options:- 'Put Option' and 'Call Option'. Put option is the right given to the investor and call option is the right given to the company. By put option the investor has a right to get his money back before maturity, either at par or at 100% basis point over the US treasury rate at the time of issue. By call option the company has a right to convert bonds into shares, if the market price of the shares exceeds a particular percentage of the conversion price. Since 1993 these bonds have become popular. BENEFITS PORTFOLIO INVESTMENT:- Foreign portfolio investment increases the liquidity of domestic capital markets, and can help develop market efficiency as well. As markets become more liquid, as they become deeper and broader, a wider range of investments can be financed. New enterprises, for example, have a greater chance of receiving start-up financing. Savers have more opportunity to invest with the assurance that they will be able to manage their portfolio, or sell their financial securities quickly if they need access to their savings. In this way, liquid markets can also make longer-term investment more attractive. Foreign portfolio investment can also bring discipline and know-how into the domestic capital markets. In a deeper, broader market, investors will have greater incentives to expend resources in researching new or emerging investment opportunities. As enterprises compete for financing, they will face demands for better information, both in terms of quantity and quality. This press

- 13. 13 for fuller disclosure will promote transparency, which can have positive spill-over into other economic sectors. Foreign portfolio investors, without the advantage of an insider‟s knowledge of the investment opportunities, are especially likely to demand a higher level of information disclosure and accounting standards, and bring with them experience utilizing these standards and a knowledge of how they function. Foreign portfolio investment can also help to promote development of equity markets and the shareholders‟ voice in corporate governance. As companies compete for finance the market will reward better performance, better prospects for future performance, and better corporate governance. As the market‟s liquidity and functionality improves, equity prices will increasingly reflect the underlying values of the firms, enhancing the more efficient allocation of capital flows. Well- functioning equity markets will also facilitate takeovers, a point where portfolio and direct investment overlap. Takeovers can turn a poorly functioning firm into an efficient and more profitable firm, strengthening the firm, the financial return to its investors, and the domestic economy. Foreign portfolio investors may also help the domestic capital markets by introducing more sophisticated instruments and technology for managing portfolios. For instance, they may bring with them a facility in using futures, options, swaps and other hedging instruments to manage portfolio risk. Increased demand for these instruments would be conducive to developing this function in domestic markets, improving risk management opportunities for both foreign and domestic investors. In the various ways outlined above, foreign portfolio investment can help to strengthen domestic capital markets and improve their functioning. This will lead to a better allocation of capital and resources in the domestic economy, and thus a healthier economy. Open capital markets also contribute to worldwide economic development by improving the worldwide allocation of savings and resources. Open markets give foreign investors the opportunity to diversify their portfolios, improving risk management and possibly fostering a higher level of savings and investment.

- 14. 14 FOREIGN DIRECT INVESTMENT:- It is also known as 'direct business investment'. Foreign direct investment (FDI), according to IMF manual on 'Balance of Payments' is "all investment involving; a long term relationship and reflecting a lasting interest and control of a residual entity in one economy in an enterprise resident in an economy other than that of the direct investor. Such investment involves both initial transaction between the two entities and all subsequent transactions between them and among foreign affiliates". Foreign affiliate means a subsidiary company or an associate in which investor owns a total of at least 10%, but not more than half of shareholder's voting power or branches. The WIR02 defines FDI as „an investment involving a long-term relationship and reflecting a lasting interest and control by a resident entity in one economy (foreign direct investor or parent enterprise) in an enterprise resident in an economy other than that of the FDI enterprise, affiliate enterprise or foreign affiliate. FDI implies that the investor exerts a significant degree of influence on the management of the enterprise resident in the other economy. Such investment involves both the initial transaction between the two entities and all subsequent transaction between them among foreign affiliates, both incorporated and unincorporated. Individuals as well as business entities may undertake FDI. From the above definition we notice the following characteristics of FDI:- 1. It is an investment made by a foreign company in a home country. 2. The foreign company may make an investment either by opening its branch or by having a subsidiary or foreign controlled company in home country. It may have wholly owned subsidiary or joint venture or may acquire a stake in the existing business. 3. Profit is the prime motive of such an investment. It may be in the form of a royalty and dividend payments. 4. Investor retains control over investment and management of the firm concerned. In FDI investor may obtain effective voice in the management through other means such as sub- contracting, management contracts, turnkey arrangements, franchising, licensing, trade- marks and patents and product sharing. 5. On the winding up of the firm, the assets may be repatriated to the country of origin.

- 15. 15 According to Section 591 of the Indian Companies Act 1956, a foreign company means any company incorporated outside India which established a place of business within India after or before 1.4.1956. The Reserve Bank of India has classified foreign companies into three types:- 1. Subsidiaries in which a single foreign company holds more than 50% of the equity share capital. 2. Minority companies in which foreign company holdings are 50% or less. 3. Purely technical collaboration companies which have no foreign equity participation. They have only technical collaboration agreements. Foreign companies are also governed by Indian Income Tax Act 1961, MRTP Act 1969, Industrial (Development and Regulation) Act 1951, and Foreign Exchange Regulation Act, 1973. FDI are governed by long term considerations because these investments cannot be easily liquidated. In aiming at investment decision, a foreign investor would have to be convinced that existing comparative advantages are more than the comparative dis-advantages in a country. He will compare the improved investment climate in one country with investment markets in another country. There are many other factors that Influence FDI decisions. They are:- 1. Long-term political stability, 2. Government policy of a country, 3. Industrial and economic prospect, 4. Rules about repatriation of profits and dis-investment, 5. Treatment by officials in government departments, and 6. Taxation laws. The recipient country should be cautious that FDI may be harmful if the economy is highly protected and foreign investment takes place behind high tariff walls. Currently, India is experiencing lot of capital flow through FDI‟s. The last two decade of the 20th century witnessed a dramatic world-wide increase in foreign direct investment (FDI), accompanied by a marked change in the attitude of most developing countries towards inward FDI. As against a highly suspicious attitude of these countries towards inward FDI in the past,

- 16. 16 most countries now regard FDI as beneficial for their development efforts and compete with each other to attract it. Such shift in attitude lies in the changes in political and economic systems that have occurred during the closing years of the last century. The initial policy stimulus to foreign direct investment in India came in July 1991 when the new industrial policy provided, inter alia, automatic approval for project with foreign equity participation up to 51 percent in high priority areas. In recent years, the government has initiated the second generation reforms under which measures have been taken to further facilitate and broaden the base of foreign direct investment in India. The policy for FDI allows freedom of location, choice of technology, repatriation of capital and dividends. As a result of these measures, there has been a strong surge of international interest in the Indian economy. The rate at which FDI inflow has grown during the post-liberalization period is a clear indication that India is fast emerging as an attractive destination for overseas investors. Encouragement of foreign investment, particularly for FDI, is an integral part of ongoing economic reforms in India. Though India has one of the most transparent and liberal FDI regimes among the developing countries with strong macro-economic fundamentals, its share in FDI inflows is dismally low. The country still suffers from weaknesses and constraints, in terms of policy and regulatory framework, which restricts the inflow of FDI. Foreign investment policies in the post-reforms period have emphasized greater encouragement and mobilization of non-debt creating private inflows for reducing reliance on debt flows. Progressively liberal policies have led to increasing inflows of foreign investment in the country.

- 17. 17 FOREIGN DIRECT V/s PORTFOLIO INVESTMENT By Foreign Direct Investment (FDI) we mean any investment in a foreign country where the investing party (corporation, firm) retains control over investment. A direct investment typically takes the form of a foreign firm starting a subsidiary or taking over control of an existing firm in the country in question. FDI consists of equity capital, technical and managerial services, capital equipment and intermediate inputs and legal rights to patented or secret products, processes or trade-marks. It is the direct type of foreign investment which is associated with multinational corporations because most of FDI is transferred through firms and remains outside of ordinary, functioning markets. FDI can be done in the following ways:- 1. In order to participate in the management of the concerned enterprise, the stocks of the existing foreign enterprise can be acquired. 2. The existing enterprise and factories can be taken over. 3. A new subsidiary with 100% ownership can be established abroad. 4. It is possible to participate in a joint venture through stock holdings. 5. New foreign branches, offices and factories can be established. 6. Existing foreign branches and factories can be expanded. 7. Minority stock acquisition, if the objective is to participate in the management of the enterprise. 8. Long term lending, particularly by a parent company to its subsidiary, when the objective is to participate in the management of the enterprise. Portfolio investment, on the other hand, does not seek management control, but is motivated by profit. Portfolio investment occurs when individual investors invest, mostly through stockbrokers, in stocks of foreign companies in foreign land in search of profit opportunities. FDI flows are usually preferred over other forms of external finance because they are non-debt creating, non-volatile and their returns depend on the performance of the projects financed by the investors. FDI also facilitates international trade and transfer of knowledge, skills and technology. In a world of increased competition and rapid technological change, their complimentary and catalytic role can be very valuable.

- 18. 18 SUPERIORITY of FDI OVER OTHER FORMS of CAPITAL INFLOWS FDI is perceived superior to other types of capital inflows for several reasons:- 1. In contrast to foreign lenders and portfolio investors, foreign direct investors typically have a longer-term perspective when engaging in a host country. Hence, FDI inflows are less volatile and easier to sustain at times of crisis. 2. While debt inflows may finance consumption rather than investment in the host country, FDI is more likely to be used productively. 3. FDI is expected to have relatively strong effects on economic growth, as FDI provides for more than just capital. FDI offers access to internationally available technologies and management know-how, and may render it easier to penetrate word markets. A recent United Nations report has revealed that FDI flows are less volatile than portfolio flows. To quote, “FDI flows to developing and transition economies in 1998 declined by about 5 percent from the peak in 1997, a modest reduction in relation to the effects on the other capital flows of the spread of the Asian financial crisis to global proportions. FDI flows are generally much less volatile than portfolio flows. The decline was modest in all regions, even in the Asian economies most affected by the financial crisis.” FDI is the appropriate form of external financing for developing countries, which have less capacity than highly developed economies to absorb external shocks. Likewise, the evidence supports the predominant view that FDI is more stable than other types of capital inflows. Moreover, the volatility of FDI remained exceptionally low in the 1990s, when several emerging economies were hit by financial crisis. FDI is widely considered an essential element for achieving sustainable development. Even former critics of MNCs expect FDI to provide a stronger stimulus to income growth in host countries than other types of capital inflows. Especially after the recent financial crisis in Asia and Latin America, developing countries are strongly advised to rely primarily on FDI, in order to supplement national savings by capital inflows and promote economic development.

- 19. 19 MACRO-ECONOMIC & MICRO-ECONOMIC ASPECTS of FDI In judging the significance of FDI, especially from the view point of developing countries, it is useful to make a distinction between macroeconomic and micro-economic effects. The former is connected with issues of domestic capital formation, balance of payments, and taking advantage of external markets for achieving faster growth, while the latter is connected with the issues of cost reduction, product quality improvement, making changes in industrial structure and developing global inter-firm linkages. In this context, it needs to be recognized that FDI is an aggregate entity, the sum total of the investments made by many diverse multinationals, each with its own corporate strategy. The micro-economic effects of the investment made by one multinational may be quite different from that of another multinational even if the investments are made in the same industry. Also, what benefits the local economy will depend on the capabilities of the host country in regard to technology transfer and industrial restructuring. TYPES of FDI Two major types of FDI are typically differentiated:- 1. Resource-Seeking FDI is motivated by the availability of natural resources in the host countries. This type of FDI was historically important and remains a relevant source of FDI for various developing countries. However, on a world-wide scale, the relative importance of resource-seeking FDI has decreased significantly. 2. The relative importance of Market-Seeking FDI is rather difficult to assess. It is almost impossible to tell whether this type of FDI has already become less important due to economic globalization. Regarding the history of FDI in developing countries, various empirical studies have shown that the size and growth of host country markets were among the most important FDI determinants. It is debatable, however, whether this is still true with ongoing globalization. Globalization essentially means that geographically dispersed manufacturing, slicing up the value chain and the combination of markets and resources through FDI and trade are becoming major characteristics of the world economy. Efficiency-seeking FDI, i.e. FDI motivated by creating new sources of competitiveness for firms and strengthening existing ones, may then emerge as the most important type of FDI. Accordingly, the competition for FDI would be based

- 20. 20 increasingly on cost differences between locations, the quality of infrastructure and business- related services, the ease of doing business and the availability of skills. Obviously, this scenario involves major challenges for developing countries, ranging from human capital formation to the provision of business-related services such as efficient communication and distribution systems. DETERMINANTS of FDI:- To understand the scale and direction of FDI flows, it is necessary to identify their major determinants. The relative importance of FDI determinants varies not only between countries but also between different types of FDI. Traditionally, the determinants of FDI include the following:- 1. Size of the Market:- Large developing countries provide substantial markets where the consumers demand for certain goods far exceed the available supplies. This demand potential is a big draw for many foreign-owned enterprises. In many cases, the establishment of a low cost marketing operation represents the first step by a multinational into the market of the country. This establishes a presence in the market and provides important insights into the ways of doing business and possible opportunities in the country. 2. Political Stability:- In many countries, the institutions of government are still evolving and there are unsettled political questions. Companies are unwilling to contribute large amounts of capital into an environment where some of the basics political questions have not yet been resolved. 3. Macro-Economic Environment:- Instability in the level of prices and exchange rate enhance the level of uncertainty, making business planning difficult. This increases the perceived risk of making investments and therefore adversely affects the inflow of FDI. 4. Legal and Regulatory Framework:- The transition to a market economy entails the establishment of a legal and regulatory framework that is compatible with private sector activities and the operation of foreign owned companies. The relevant areas in this field include protection of property rights, ability to repatriate profits, and a free market for currency exchange. It is important that these rules and their administrative procedures are transparent and easily comprehensive.

- 21. 21 5. Access to Basic Inputs:- Many developing countries have large reserves of skilled and semi-skilled workers that available for employment at wages significantly lower than in developed countries. This provides an opportunity for foreign firms to make investments in these countries to cater to the export market. Availability of natural resources such as oil and gas, minerals and forestry products also determine the extent of FDI. The determinants of FDI differ among countries and across economic sectors. These factors include the policy framework, economic determinants and the extent of business facilitation such as macro-economic fundamentals and availability of infrastructure. ROUTES for INWARD FLOW of FDI:- 1. Automatic Route:- Companies proposing FDI under automatic route do not require any government approval provided the proposed foreign equity is within the specified ceiling and the requisite documents are filed with Reserve Bank of India (RBI) within 30 days of receipt of funds. The automatic route encompasses all proposals where the proposed items of manufacture/activity does not require an industrial license and is not reserved for small-scale sector. The automatic route of the RBI was introduced to facilitate FDI inflows. However, during the post-policy period, the actual investment flows through the automatic route of the RBI against total FDI flows remained rather insignificant. This was partly due to the fact that crucial areas like electronics, services and minerals were left out of the automatic route. Another limitation was the ceiling of 51 percent on foreign equity holding. Increasing number proposals were cleared through the FIPB route while the automatic route was relatively unimportant. However, since 2000 automatic route has become significant and accounts for a large part of FDI flows. 2. Government Approval:- For the following categories, government approval for FDI through the Foreign Investment Promotion Board (FIPB) is necessary:- Proposals attracting compulsory licensing. Items of manufacture reserved for small scale sector. Acquisition of existing shares.

- 22. 22 FIPB ensures a single window approval for the investment and acts as a screening agency. FIPB approvals are normally received in 30 days. Some foreign investors use the FIPB application route where there may be absence of stated policy or lack of policy clarity. 3. Industrial Licensing in FDI Policy:- Industrial Licensing is regulated by Industries (Development and Regulation) Act 1951. Following are the sectors which require Industrial Licensing:- Industries which abide by compulsory licensing. Manufacturing of items by the larger industrial units for small sector industries Locational restrictions on the proposed sites Sectors Which Require Industrial Licensing:- Electronic aerospace and defense equipment. Alcoholics drinks. Explosives. Cigarettes and tobacco products. Hazardous chemicals such as, hydrocyanic acid, phosgene, isocyanides and di- isocyanides of hydro carbon and derivatives. 4. Restricted List of sectors:- FDI is not permissible in the following cases:- Gambling and Betting. Lottery Business. Business of chit fund. Housing and Real Estate business (to a certain extent has been opened). Trading in Transferable Development Rights (TDRs). Retail Trading. Railways. Atomic Energy. Atomic Minerals. Agricultural or Plantation Activities or Agriculture (excluding Floriculture, Horticulture, Development of Seeds, Animal Husbandry, Pisiculture and Cultivation of Vegetables, Mushrooms etc. under controlled conditions and

- 23. 23 services related to agro and allied sectors) and Plantations(other than Tea plantations). The new polices have substantially relaxed restrictions on foreign investment, industrial licensing and foreign exchange. Capital market has been opened to foreign investment and banking sector controls have been eased. As a result, India has been rapidly changing from a restrictive regime to a liberal one and FDI is encouraged in almost all economic activities under the automatic route. The Government is committed to promoting increased flow of FDI for better technology, modernization, exports and for providing products and services of international standards. Therefore, the policy of the Government has been aimed at encouraging foreign investment, particularly in core infrastructure sectors so as to supplement national efforts. FDI in DEVELOPING COUNTRIES FDI is now increasingly recognized as an important contributor to a developing country‟s economic performance and international competitiveness. After the debt-crisis that hit the developing world in early 1980s, the conventional wisdom quickly became that it had been unwise for countries to borrow so heavily from international banks or international bond markets. Rather countries should try to attract non-debt-creating private inflows (DFI). The financial advantage is that such capital inflows need not be repaid and that outflow of funds (remittance of profits) would fluctuate with the cycle of the economy. It has also been widely observed that the structural adjustment efforts of the 1980s failed to lead to new patterns of sustained growth in developing countries. In particular, structural adjustment programs failed to restore private investment to desirable levels. Again it is hoped that FDI could play an important role; the World Bank observes that FDI can be an important complement to the adjustment effort, especially in countries having difficulty in increasing domestic savings. Against this background of balance of payments problems and low level of private investment, it is probably not surprising that attitudes in developing countries towards FDI have shifted. In the 1960s and 1970s many countries maintained a rather cautious, and sometimes an outright

- 24. 24 negative position with respect to FDI. In the 1980s, however the attitudes shifted radically towards a more welcoming policy stance. This change was not so much due to new research finding on the impact of FDI but to the economic problems facing the developing world. Developing countries are liberalizing their foreign investment regimes and are seeking FDI not only as a source of capital funds and foreign exchange but also as a dynamic and efficient vehicle to secure the much needed industrial technology, managerial expertise and marketing know-how and networks to improve on growth, employment, productivity and export performance. At the global level the flows of FDI and PFI to developing countries have indeed increased. The average net inflow of FDI in developing countries had been US$ 11 billion in 1980-86, but in 1987 it started to increase, by 1991 the annual net inflow had risen to US$ 35 billion and by 2004 to US$ 233 billion. The share of developing economies in total inflow of Foreign Direct Investment in the world has been rising continuously since 1989. FOREIGN DIRECT INVESTMENT IN INDIA Since independence till 1990, the performance of Indian economy has been dominated by a regime of multiple controls, restrictive regulations and wide ranging state intervention. Industrial economy of the country was protected by the state and insulated from external competition. As a result of which, India was thrown a long way behind the world of rapid expanding technology. The cumulative effect of these policies started becoming more and more pronounced. By the year 1989-90, the situation on the balance of payment and foreign exchange reserves became precarious and the country was driven to the brink of default. The credibility reached the sinking level that no country was willing to advance or lend to India at any cost. In such circumstances, the government quickly followed a liberalized economic policy in July 1991. The main objectives of the liberalized economic policy are two-fold. At the country level the reform aims at freeing domestic investors from all the licensing requirements, virtual abolition of MRTP restriction on the investment by large houses, and a competitive industrial structure for Indian companies to achieve a global presence by becoming as competitive as their counterparts

- 25. 25 worldwide. Secondly, the focus on structural reforms intended to tap foreign investment for economic growth and development. Gradually & systematically the government has taken a series of measures like devaluation of rupee, lowering of import duties and allowing foreign investment upto 51% of the equity in a large number of industries and investment of large foreign equity (even up to 100%) in selected areas especially for export oriented products. In India, since the 1960‟s foreign investment and/or foreign collaborations by the multinationals have been principally viewed as an instrument to facilitate the much needed „transfer of technology‟. In technological as well as financial collaborations with foreign firms, the approval and extent of ownership participation had been predominantly determined by the technology component of the respective products. „Import of technology‟ as against the direct foreign investment was the main focus of the policies till mid-eighties. The New Industrial Policy (NIP) of July 1991 and subsequent policy amendments have significantly liberalized the industrial policy regime in the country especially as it applies to FDI. The industrial approval system in all industries has been abolished except for some strategic or environmentally sensitive industries. In 35 high priority industries, FDI up to 51% is approved automatically if certain norms are satisfied. FDI proposals do not necessarily have to be accompanied by technology transfer agreements. Trading companies engaged primarily in export activities are also allowed up to 51% foreign entity. A Foreign Investment Promotion Board (FIPB) has been set up to invite and facilitate investment in India by international companies. The use of foreign brand names for goods manufactured by domestic industry which had earlier been restricted was also liberalized. New sectors have been opened to private and foreign investment. The international trade policy regime has been considerably liberalized too. The rupee was made convertible first on trade and finally on the current account. Capital market has been strengthened. In spite of all these liberalization measures taken by the Indian government- foreign investments have not been up to expectations. Actual inflow of FDI has been less than the approval FDI.

- 26. 26 SHARE of TOP TEN COUNTRIES INVESTING in INDIA Source Amount Percentage Mauritius 8059 50.99 Singapore 1605 10.15 U.S.A 478 3.03 Cyprus 415 2.63 Japan 1340 8.48 Netherlands 1700 10.76 U.K 1022 6.46 Germany 467 2.95 U.A.E 173 1.09 France 547 3.46 Total 15806 100 Mauritius Singapore USA Cyprus Japan Netherlands UK Germany UAE France

- 27. 27 1. The first rank goes to Mauritius in terms of highest inflow of foreign direct investment to India in comparison with all the other countries that make investments in India. This is due to the fact that special tax treatment is given to all those investments that come through Mauritius to India. Industries attracting FDI from Mauritius to India are: Electrical Equipment, Gypsum and Cement Products, Telecommunications, Services Sector that includes both Non-Financial and Financial, Fuels. 2. The major Singapore Government linked projects in India are the involvement of the Port of Singapore Authority in the management as well as equity of Gujarat's Pipavav Port and Singtel's joint collaboration with the company Bharti Telecom. Further the major Singapore Government linked projects in India are Singapore Technologies Telemedia's joint collaboration with the company ModiCorp and Port of Singapore Authority's contract for a period of thirty years for the management and operation of the Port of Tuticorin. Indian sectors attracting FDI from Singapore are:- Electrical Equipment‟s, Fuel, Telecommunications, Transportation industries, Services, Information technology. 3. FDI from U.S.A to India is increasing at a very fast pace over the last few years due to the several incentives that has been given by the Indian government. The huge flow of FDI from U.S.A to India has given a major boost to the country's economy. Industries attracting FDI from U.S.A to India are:- Telecommunications which includes services of basic telephone, radio paging, and cellular mobile, Food processing industries, Fuels, Service sector which includes non- financial and financial services,

- 28. 28 Electrical equipment which includes electronics and computer software. 4. FDI from Japan to India has increased over the years which in its turn have helped in the growth of the country's economy. The flow of FDI from Japan to India has increased due to the several incentives that have been provided by the Indian government. All these measures helped to attract huge amounts of foreign direct investment in India. The various sectors that have been attracting foreign direct investment in India are cement and gypsum products, fuels, transportation industry and drugs and pharmaceuticals. Various industries attracting FDI from Japan to India are:- Electrical equipment‟s which includes electronics and computer software, Transportation industry, Services sector which includes non- financial and financial services, Earth moving industry, Telecommunications which includes cellular mobile, radio paging, and basic telephone services. 5. FDI from Netherlands to India has registered significant growth over the last few years due to the several incentives that have been provided by the Indian government. The increased flow of FDI from Netherlands to India has helped in the growth of the country's economy. FDI from Netherlands to India has increased at a very fast pace over the last few years. Netherlands ranks sixth among all the countries that make investments in India. Various industries attracting FDI from Netherlands to India are:- Food processing industries, Telecommunications that includes services of cellular mobile, basic telephone, and radio paging, Horticulture, Electrical equipment that includes computer software and electronics, Service sector that includes non- financial and financial services 6. There are around 630 Indo- German joint collaborations in operation in India as on 12th October, 2005. Around one third of the total Indo- German joint ventures are in operation in the Indian state of Maharashtra. The other Indian states that have attracted FDI from Germany are Karnataka, Tamil Nadu, Andhra Pradesh, and West Bengal. Industries attracting FDI from Germany to India are:-

- 29. 29 Auto components, Electrical and electronic engineering, Chemical, Mechanical engineering, Information Technology, Glass and ceramics, Textiles, Paper, Metallurgical industries. 7. Many French companies have made investments in the Indian telecommunications sector such as France Telecom which has entered into partnership with Sema Group and BPL Mobile in Mumbai and Alcatel has made investments in the sector in Chennai, Gurgoan, and Bangalore. FDI from France to India has also come in the infrastructure sector which has gone mainly in the development of railways and roads. The French company GTMA has widened the road network between Delhi and Jaipur to four lanes in 1997. The other French companies that are active in the infrastructure sector of India are ALSTOM, CORYS TESS, and ALCATEL. The French world leader Thomson Multimedia has entered the Indian multimedia industry by setting up a subsidiary company in Chennai and it has an important share in the color tubes market of the country. Foreign direct investment from France to India has also been made in the consumer sector such as home decoration, cosmetics & perfumes, and tableware. The major French brands that have entered the Indian consumer sector are Gotier, Baccarat, Louis Vuitton, ST Dupont, Christian Dior, Ninna Ricci, Lalique, and Daum. Major sectors attracting FDI from France to India are:- Agro- industries, Power, Environment, Drugs and pharmaceuticals, Auto parts, Hydrocarbons,

- 30. 30 Telecommunications, Infrastructure, Information technology. 8. FDI from U.K to India has registered significant growth in the last few years due to the many incentives that have been given by the government of India. The increased flow of FDI from U.K to India has helped in giving a major boost to the country's economy. FDI from U.K to India has increased over the years to make U.K rank fourth among all the countries that make investments in India. The flow of FDI from U.K to India has increased over the years due to the several incentives that have been provided by the government of India. The beneficial results of FDI from U.K to India are that it has helped in creating new opportunities for employment in the country, improved the technology of the industries, and also developed the infrastructure of the country. Various industries attracting FDI from U.K to India are:- Information technology, Telecommunications which includes services of radio paging, basic telephone, and cellular mobile, Service sector which includes non- financial and financial services, Power, Oil and gas.

- 31. 31 BENEFITS of FOREIGN DIRECT INVESTMENT With its orientation to developing enterprises directly, foreign direct investment helps to strengthen economic potential. Sometimes, this is accomplished through Greenfield investment, adding new and different economic activity and consequently diversifying the economy. Other times, this will be achieved through building up existing enterprises and enhancing their potential. Both of these activities will add a new and healthy element of increased competition to an economy, which is itself a powerful force for economic development. Competition is one of the ways a foreign direct investment can have a broader effect on the economy. It spurs other enterprises to increase their own efficiency and productivity. Competition plays a major role in improving the allocation of resources, boosting the economic prospects of the domestic economy and worldwide sustainable economic development. Technology transfers and the development of human capital are often seen as two of the primary benefits of foreign direct investment. Competition has a role to play in both, as it encourages domestic competitors of the foreign investment to build up their own technological capabilities and the productivity of their labor force. They will, among other things, learn from the technology of the foreign investor and the ways in which it improves the productivity of its labor and management. The development of human capital can be one of the chief contributions of foreign direct investment. The foreign owners will bring their management skills and technology to their enterprises. In training the local workforce, they will pass on those management skills and technology. As their workers move on to other jobs in domestic firms, or start their own businesses, they will bring with them the management, working skills, and the technology that they have learned. Thus, in a very direct manner, the human capital of the host country can be developed by foreign direct investment, and the investment' technology transferred. Human capital development and technology transfer also occur through the foreign investment‟s relationships with its suppliers and the downstream users or sellers of its products. The investment will require from its suppliers a certain standard of product, perhaps a higher standard than they are accustomed to producing. In order to meet that higher standard, they will have to improve their workers‟ skill levels and their management system. They may also gain new

- 32. 32 technological expertise needed for the required product standard from the foreign investment. The current trend toward outsourcing and closer collaboration along the supply chain means that there will be a greater tendency to pass management, production and technology know-how to suppliers, enhancing the transfer of technology and skills. Enterprises that are downstream in the supply and sales chain will receive similar benefits, although less obviously and perhaps less frequently, both through the direct use of a higher standard product incorporating technological improvements, and through efforts by the foreign investment to maximize the value of its product. Foreign enterprises often incorporate foreign trade, either with the parent company or with customers, or both. Thus, another benefit that foreign direct investment brings is increased opportunities and avenues for trade. Trade and investment are increasingly integrated, as are their benefits. Foreign direct investment can also provide environmental and social benefits. Often, international investors will operate at higher environmental and social standards than their domestic competitors. Although they may not bring standards up to the highest level possible, they will have the effect of raising the standards above existing levels. These standards may also be adopted over time by domestic companies, further raising the country‟s environmental and social standards. Foreign Direct Investment has the following potential benefits for less developed countries. 1. Raising the Level of Investment:- Foreign investment can fill the gap between desired investment and locally mobilized savings. Local capital markets are often not well developed. Thus, they cannot meet the capital requirements for large investment projects. Besides, access to the hard currency needed to purchase investment goods not available locally can be difficult. FDI solves both these problems at once as it is a direct source of external capital. It can fill the gap between desired foreign exchange requirements and those derived from net export earnings. 2. Upgradation of Technology:- Foreign investment brings with it technological knowledge while transferring machinery and equipment to developing countries. Production units in developing countries use outdated equipment and techniques that can

- 33. 33 reduce the productivity of workers and lead to the production of goods of a lower standard. 3. Improvement in Export Competitiveness:- FDI can help the host country improve its export performance. By raising the level of efficiency and the standards of product quality, FDI makes a positive impact on the host country‟s export competitiveness. Further, because of the international linkages of MNCs, FDI provides to the host country better access to foreign markets. Enhanced export possibility contributes to the growth of the host economies by relaxing demand side constraints on growth. This is important for those countries which have a small domestic market and must increase exports vigorously to maintain their tempo of economic growth. 4. Employment Generation:- Foreign investment can create employment in the modern sectors of developing countries. Recipients of FDI gain training of employees in the course of operating new enterprises, which contributes to human capital formation in the host country. 5. Benefits to Consumers:- Consumers in developing countries stand to gain from FDI through new products, and improved quality of goods at competitive prices. 6. Resilience Factor:- FDI has proved to be resilient during financial crisis. For instance, in East Asian countries such investment was remarkably stable during the global financial crisis of 1997-98. In sharp contrast, other forms of private capital flows like portfolio equity and debt flows were subject to large reversals during the same crisis. Similar observations have been made in Latin America in the 1980s and in Mexico in 1994-95. FDI is considered less prone to crises because direct investors typically have a longer- term perspective when engaging in a host country. In addition to risk sharing properties of FDI, it is widely believed that FDI provides a stronger stimulus to economic growth in the host countries than other types of capital inflows. FDI is more than just capital, as it offers access to internationally available technologies and management know-how. 7. Revenue to Government:- Profits generated by FDI contribute to corporate tax revenues in the host country.

- 34. 34 CONCLUSION To characterize portfolio investment as “bad” and direct investment as “good” oversimplifies a much more complex situation. Both bring risks, and both require their own policy approaches. There seems to be a certain fear attached to foreign portfolio investment, due perhaps to its complexity and the central economic role of the financial system. (At one time there was a fear of foreign direct investment.) Does foreign portfolio investment engender greater concern? Certainly, financial disturbances have not been confined to foreign investors. If you take “foreign” out of foreign portfolio or direct investment, most policy makers would acknowledge that domestic portfolio and direct investment are both necessary for healthy economic growth and development. Portfolio investment and the financial system it is part of are central to any healthy economy. Put “foreign” back in and you have effectively increased the quantity and diversity of investment to even greater effect. As shown above, both portfolio and direct investment can bring powerful benefits to the economy, and together the benefits are increased. The best answer is not to shut either type of investment out – not to label one “bad” and the other “good.” Instead, both should be welcomed within the proper regulatory structure to maximize the benefits, and to manage the drawbacks and potential negatives. Both portfolio and direct investment bring value for economic growth. They are not intrinsically good or bad, but they are different. Economic reforms in India have deregulated the economy and stimulated domestic and foreign investment, taking India firmly into the forefront of investment destinations. The Government, keen to promote FDI in the country, has radically simplified and rationalized policies, procedures and regulatory aspects. Foreign direct investment is welcome in almost all sectors; expect those strategic concerns (defense and atomic energy). Since the initiation of the economic liberalization process in 1991, sectors such as automobiles, chemicals, food processing, oil and natural gas, petrochemicals, power, services, and telecommunications have attracted considerable investments. Today, in the changed investment climate, India offers exciting business opportunities in virtually every sector of the economy. Telecom, electrical equipment (including computer software), energy and transportation sector have attracted the highest FDI. Despite its market size and potential, India has yet to convert considerable favourable investor sentiment into substantial net flows of FDI. Overall, India remains high on corporate investor

- 35. 35 radar screens, and is widely perceived to offer ample opportunities for investment. The market size and potential give India a definite advantage over most other comparable investment destinations. India‟s investment profile, however, is also conditioned by factors that affect the flow of FDI, which are bureaucratic delays, wide spread corruption, poor infrastructure facilities pro-labour laws, political risk and weak intellectual property regime. A perceived slowdown in the process of reforms generates doubts about the market‟s long-term potential. To capitalize on its potential for FDI, would seem that India needs to accelerate efforts to institutionalize government efficiency and advance the implementation of promised reforms. Other strategic efforts should include focusing the market on India‟s relatively higher rates of return on existing investments and long-term potential, addressing the issue of transforming the country into a viable export platform and encouraging strategic alliances with foreign investors. In short, this means accelerating India‟s integration with the global economy.

- 36. 36 BIBLIOGRAPHY:- 1. www.imf.org 2. www.economicshelp.org 3. www.rbi.org.in 4. www.dipp.gov.in 5. www.business.mapsofindia.com 6. Foreign Direct Investment in India: 1947 to 2007, Dr. Nitin Bhasin