Ib0010 & international financial management

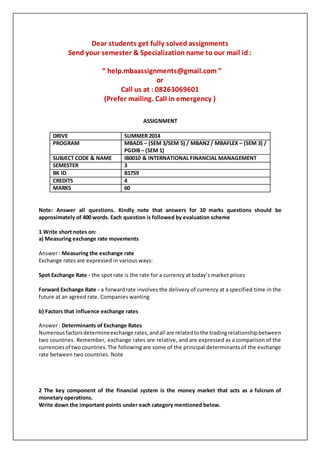

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE SUMMER 2014 PROGRAM MBADS – (SEM 3/SEM 5) / MBAN2 / MBAFLEX – (SEM 3) / PGDIB – (SEM 1) SUBJECT CODE & NAME IB0010 & INTERNATIONAL FINANCIAL MANAGEMENT SEMESTER 3 BK ID B1759 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme 1 Write short notes on: a) Measuring exchange rate movements Answer : Measuring the exchange rate Exchange rates are expressed in various ways: Spot Exchange Rate - the spot rate is the rate for a currency at today’s market prices Forward Exchange Rate - a forwardrate involves the delivery of currency at a specified time in the future at an agreed rate. Companies wanting b) Factors that influence exchange rates Answer : Determinants of Exchange Rates Numerousfactorsdetermineexchange rates,andall are relatedtothe tradingrelationshipbetween two countries. Remember, exchange rates are relative, and are expressed as a comparison of the currenciesof twocountries.The following are some of the principal determinants of the exchange rate between two countries. Note 2 The key component of the financial system is the money market that acts as a fulcrum of monetary operations. Write down the important points under each category mentioned below.

- 2. a) Functions performed by money market Answer : There are two types of financial markets viz., the money market and the capital market. The money market in that part of a financial market which deals in the borrowing and lending of short term loans generally for a period of less than or equal to 365 days. It is a mechanism to clear short term monetary transactions in an economy. Moneymarketis an importantpartof the economy.Itplaysverysignificantfunctions.As mentioned above itis basicallyamarketfor shorttermmonetarytransactions.Thus it has to provide facility for adjusting liquidity to the banks, business corporations, b) International interest rates Answer:In many industrial countriesthe domesticimpactof interestrate developments abroad has become anincreasinglysensitive question. Outside the United States the issue has centred on the possible influenceof highorrisinginterestratesona still fragile economic recovery. When inflation expectationsare unknown,interestrate levelsare,of course,difficulttointerpret,andpartlyforthis reason interest rates have come to play a smaller role as explicit objectives of monetary policy. In some - though not all - countries nominal c) Standardized Global Market regulations. Answer:The financial crisisof 2007 revealed fundamental weaknesses in the structure of financial regulation. In response, policymakers and regulators have embarked on an ambitious regulatory reformagendathat aimsto achieve asmuchglobal co-ordinationandconsistencybetween regional reform efforts as possible. How successful attemptsatinternational co-ordinationandconsistencyhave been deserves further examination. Despite most of the regulatory changes taking place under the auspices of the G20, variationsinthe approachestakenonbothsidesof the Atlantic and in Asia can be observed and are increasingly significant. The general 3 Thousands of years back the concept of bartering between parties was prevalent, when the concept of money had not evolved. Explain counter trade with examples Answer : Trading between nations has been happening since time began. In ancient time nations tradedsilk,spices,clothandanimalsof all kinds.Todaynationtrade fooditems,defense equipment, metals, electronics etc. The products might have changed but the basic concept is still the same as the underlining need which brings together two nations in a trade relationship still exists. One such method of trading between nations is called counter trade. Counter trade is an import / export relationship between nations or large companies in which good and/or services are exchangedforgoodsandservicesinsteadof money. In some cases monetary evaluations are made for accounting purposes. 4 There are different techniques of exposure management. One is the Managing Transaction Exposure and the other one is the managing operating exposure So you have to explain on both Managing Transaction Exposure and Managing Operating Exposure.

- 3. Answer : ‘Transaction Exposure’ is a risk which is faced by the organizations which are involved in international trade especiallywhentheyenterintothe financial obligations. The risk which is faced by the companies is about the changes occurring in the currency exchange rates after they have entered into trade obligations in the international market. Many companies which face such a situation adopt hedging strategy which allows them to get locked in an exchange rate by using forward rates to evade the exposure of 5 Every firm is going on concern, whether domestic or MNC. Explain the techniques of capital budgeting and the steps to determine cash flows. Answer : Capital investments are long-term investments in which the assets involved have useful lives of multiple years. For example, constructing a new production facility and investing in machineryandequipmentare capital investments. Capital budgeting is a method of estimating the financial viability of a capital investment over the life of the investment. Explanation of techniques of capital budgeting: There are several capital budgeting analysis methods that can be used to determine the economic feasibility of a capital investment. They include the Payback Period, Discounted Payment Period, Net Present Value, Profitability Index, Internal Rate of Return, and Modified Internal Rate of Return. Net Present Value The Net Present Value (NPV) method involves discounting a stream of future cash flows back to presentvalue.The cashflowscan be eitherpositive(cashreceived)ornegative (cash paid).The presentvalue of the initialinvestmentisitsfull face value because the investment is made at the beginning of the time period. The ending cash flow includes any monetary sale value or remaining value of the capital asset 6 Write short note on: American Depository Receipts(ADR) Answer : An American Depository Receipt, or ADR, is a security issued by a U.S. depository bank to domestic buyers as a substitute for direct ownership of stock in foreign companies. An ADR can representone ormore shares,or a fractionof a share,of a non-U.S.company. Individual shares of a foreign corporation represented by an ADR Global Depository Receipts(GDR) Answer:Global Depositary Receipts (GDRs) are negotiable certificates issued by depositary banks whichrepresentownershipof agivennumberof a company’sshareswhich can be listed and traded independentlyfromthe underlyingshares.Theseinstrumentsare typically used by companies from emerging markets and marketed to professional investors only. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or

- 4. Call us at : 08263069601 (Prefer mailing. Call in emergency )