Fuel Market Research Jun09

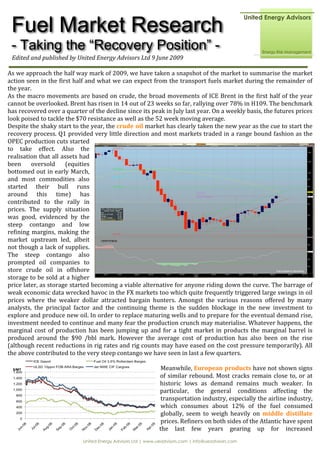

- 1. Fuel Market Research - Taking the “Recovery Position” - Edited and published by United Energy Advisors Ltd 9 June 2009 As we approach the half way mark of 2009, we have taken a snapshot of the market to summarise the market action seen in the first half and what we can expect from the transport fuels market during the remainder of the year. As the macro movements are based on crude, the broad movements of ICE Brent in the first half of the year cannot be overlooked. Brent has risen in 14 out of 23 weeks so far, rallying over 78% in H109. The benchmark has recovered over a quarter of the decline since its peak in July last year. On a weekly basis, the futures prices look poised to tackle the $70 resistance as well as the 52 week moving average. Despite the shaky start to the year, the crude oil market has clearly taken the new year as the cue to start the recovery process. Q1 provided very little direction and most markets traded in a range bound fashion as the OPEC production cuts started to take effect. Also the realisation that all assets had been oversold (equities bottomed out in early March, and most commodities also started their bull runs around this time) has contributed to the rally in prices. The supply situation was good, evidenced by the steep contango and low refining margins, making the market upstream led, albeit not though a lack of supplies. The steep contango also prompted oil companies to store crude oil in offshore storage to be sold at a higher price later, as storage started becoming a viable alternative for anyone riding down the curve. The barrage of weak economic data wrecked havoc in the FX markets too which quite frequently triggered large swings in oil prices where the weaker dollar attracted bargain hunters. Amongst the various reasons offered by many analysts, the principal factor and the continuing theme is the sudden blockage in the new investment to explore and produce new oil. In order to replace maturing wells and to prepare for the eventual demand rise, investment needed to continue and many fear the production crunch may materialise. Whatever happens, the marginal cost of production has been jumping up and for a tight market in products the marginal barrel is produced around the $90 /bbl mark. However the average cost of production has also been on the rise (although recent reductions in rig rates and rig counts may have eased on the cost pressure temporarily). All the above contributed to the very steep contango we have seen in last a few quarters. Meanwhile, European products have not shown signs of similar rebound. Most cracks remain close to, or at historic lows as demand remains much weaker. In particular, the general conditions affecting the transportation industry, especially the airline industry, which consumes about 12% of the fuel consumed globally, seem to weigh heavily on middle distillate prices. Refiners on both sides of the Atlantic have spent the last few years gearing up for increased United Energy Advisors Ltd | www.ueadvisors.com | info@ueadvisors.com

- 2. gasoil/diesel production to cope with anticipated increase in demand, particularly in Europe. While the Europeans opted for more diesel operated cars, American cars remain almost entirely gasoline operated. However with the new directives from the White House we expect this to change – however whether this will spark a shift towards diesel or whether newer technologies will be integrated into the US cars of the future remains to be seen. In the past although US refiners were running crude slates that yielded a gasoline rich product slate in refineries where gasoline production was the main objective, and consequentially there was a constant flow of overstock diesel from the US to tanks in ARA, and surplus European gasoline blendstock was exported to the US. Combined with reduced jet fuel consumption and reduced diesel consumption, the European middle distillate market has been over‐ supplied this year. This is evident from ARA diesel stock levels which have been growing steadily and even though there is a notch down in Jet A1 the absolute stock levels remain high. In the US the state of the economy can be seen reflected in the gasoline cracks as well. Reduced mileage driven had a notable impact on the crack ‐ prior to run reductions. The trend in refinery runs has been down since late 2006 (seasonally adjusted for the summer driving season). In the US, by September 2008, the extremely pessimistic outlook prompted the refineries to drastically cutback the gasoline production pushing the inventory level to the lowest levels since the record began in 1990. Despite the low inventory levels, the gasoline crack against WTI took a nosedive to negative figures and remained that way until beginning of this year. The recovery from this extreme condition added some spark in cracks market, including European cracks. The fuel oil market, however, has found itself in a unique situation and has remains firm compared to other products. Many modern refineries use fuel oil as major feedstock and many are actually short of it. Some use a blend of crude and fuel oil as feedstock. As OPEC began cutting crude oil production volume in 2008, the cutbacks started in the less profitable sour grade crudes which also added to the increase in demand for fuel oil as the replacement feedstock. One of the more reliable indicators for changes in global economic health are the freight indices which have started to indicate some recovery in the anticipated movement of goods. This also offers an explanation to the strong fuel oil crack. This index, as you can see, is quite volatile as it indicates an almost 5 fold recovery since January 09, following a huge collapse to about 1/18th of the highs seen last summer. The series of pirate attacks off Somalia coast has forced some traffic to avoid the Suez Canal and has prompted vessels to go around the Cape of Good Hope, adding to the temporary shortage of available tonnage and increased consumption of fuel. Furthermore, as mentioned earlier, some oil companies have taken advantage of the steep contango by storing crude oil in any storage they have access to, including large oil tankers anchored off shore. Looking ahead, global energy demand will remain well below last year for the remainder of the year as many industries concluded 2009 a lost year long time ago. According to Mr Giovanni Bisighani, CEO of IATA at recent annual general meeting in Kuala Lumpur, the air transport industry is in survival mode. They have estimated the average traffic this year is about 20% down on the same time last year. As seen above, sea freight rate is on United Energy Advisors Ltd | www.ueadvisors.com | info@ueadvisors.com

- 3. the mend but is still way below the average of past several years. To save costs, many goods will now be transported by sea, where possible. Crude oil inventories are expected to remain high as product cracks, especially in Europe will not entice refiners to operate at rates we have seen last year. The recent pick‐up in front month deliveries in crude oil futures have promoted some of the above mentioned oil companies with tanks full of crude oil to start off‐ loading. At the same time, OPEC members’ compliance with the production quota is softening, both adding pressure on the oil prices to drop. In recent years, the day‐to‐day crude oil price has been influenced by the fluctuation of the dollar to an ever greater degree. Not only are we concerned with the energy consumption by US, which consumes about a quarter of the global oil, the strength of the dollar has now become a crucial part in understanding the oil price movements. Crude oil futures are increasingly used as protection against falling dollar in addition to traditional commodities such as gold. This movement is countered by non‐dollar denominated traders who would see weak dollar as an opportunity to buy crude oil at discount. We have also seen a de‐coupling of the correlation between the US petroleum inventory report and the prices. Implied demand published by the Department of Energy each week has often provided an important clue to the energy demand of the world’s largest economy. Crude oil futures, however, has deviated away from this relationship in last several weeks. This is partially due to the fact that it is hard to determine the whereabouts of so called “floating storage” which could come in or out of the inventory volume during the week, and has produced some unpredicted figures in last several months. While there is no doubt that the world is still very much mired in a global recession, we think that it is fair to say that we have already hit or will hit the bottom soon. Investors have concluded that not all banks will go out of business and the massive infusions of liquidity have restored confidence in the banking system. Large stimulus packages have been passed by the G7 governments and despite the fact that the banks are very much not out the woods yet (operating profits are fine, but balance sheets still matter). The worrying amount of sovereign debt some of the major economies will be laden with, together with increased savings rates will cast doubt on medium to longer term real GDP growth potential and this may dampen or prolong the recovery. H209 has been very much a story of recovering ground from panic selling, but whether the monetary and fiscal actions and their ramifications will be sufficient to boost confidence back to the pre‐crisis levels is still up in the air. In terms of the massive increase in Sovereign balance sheets the question of currency valuations becomes timely. As the world has seen the sterling dive following the downturn in one of the key sectors of the UK economy, commodity ETFs have seen reasonable inflows in the past months as investors have started worrying about governments’ collective actions as soon as the economic outlook has strengthened. Since increasing taxes may stall recovery governments may choose to set real rates to sub zero to encourage spending and simultaneously inflate their way out of the new debt position. Printing presses may start running in overly indebted economies. While it will be difficult to determine the exact timing of this “bottoming out”, we have noticed that the traders’ attentions are increasingly focused on the positive news. This is manifested by more up‐beat sentiments including the recent US Consumer Confidence index. All this implies middle distillate prices remain weak but will be subject to short term spikes as refineries continue to run at lower rates until we see all or most of G7 nations come out of recession which should then lead the dependent nations out of recession. As we are now in middle of US driving season and entered the US Hurricane Season, US petroleum product prices will add seasonal support and should see mid distillate prices head for $600/MT mark. As for fuel oil, for those refineries that can crack it, it will remain a viable source of cheaper feedstock compared to crude oil. When the sour grades of crude oil from OPEC nations start to flow again, the relative strength of fuel oil price compared to other European products may begin to wane. This is unlikely though, until confidence is restored in global economy with increased energy demand. For crude oil, the story is more complex and gloomier. The biggest worry we have right now, which has been with us since last year, is that the recent freeze on new investments into oil exploration and production means we are now behind the curve in replacing maturing wells. Actual supply shortage has always been and will continue to be the biggest fear factor in oil market. The sudden disappearance of investment as we have seen in last year or so is expected to have a detrimental effect to the crude oil prices in next a few years. We also recall the huge drive in US, promoted by George Bush to wean itself from Middle Eastern crude oil which diverted major investments into “new fuels” and “green fuels”. The world was already screaming for more United Energy Advisors Ltd | www.ueadvisors.com | info@ueadvisors.com

- 4. skilled technicians to maintain and replace the aging wells. Therefore, crude oil prices will be susceptible to geopolitical instabilities cantering around oil producing nations. Short term outlook for crude oil looks slightly bullish as WTI closed above $70 on 9 June 09 for the first time this year. This rally, as it is not a demand driven one, may not prove to be a sustained one, as higher prices will act as an incentive for stored oil to be released and encourage further OPEC cheating. To conclude, as the title of this report declares, we feel that this is ideal time to be preparing for economic recovery and likely oil price rally. The timing of the precise moment of “bottoming out” might vary from industry to industry and location to location, but we feel that this is just around the corner. We have all seen what 6 months can do to oil prices and we hope businesses have learned to be proactive rather than reactive. It is time to be prepared, to quantify risks, make plans and learn from past and avoid panic trading. At United Energy Advisors, there is an arsenal full of ideas and expertise to aide your business become as prepared as possible to cope with these uncertain times and more importantly, exploit the eventual return of global optimism and associated energy price movements. We are here to listen and help you implement responsible risk management solutions. Before accepting a strategy proposed by your trading counterpart, let us give you an expert and impartial advice on it. Every business is different and so our solutions. For further information, please visit www.ueadvisors.com or contact us at info@ueadvisors.com. Data Data on this report was provided by Bloomberg © Disclaimer This report is provided for information purposes only. While United Energy Advisors Ltd (“UEA”) strives to provide you with the most accurate market information, UEA gathers the above data and information from sources internal and external to UEA. UEA provides no guarantee as to the accuracy or completeness of the information provided on this report. Any opinions stated on this report are intended to be free of bias. Any copying, reproduction and/or redistribution of any of the documents, data, content or materials contained on or within this report, without the express written consent of UEA, is strictly prohibited. UEA would suggest that before you rely on this information you make your own enquiries to confirm its accuracy or contact UEA. United Energy Advisors Ltd | www.ueadvisors.com | info@ueadvisors.com