Commodities - Futures Curves and Implied Volatility Surfaces - Futures and ETFs

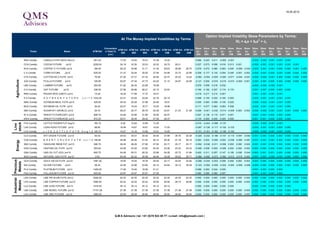

- 1. 24.09.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms IVt = atx + btx2 + ct Convenienc Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name ATM Ref e Yield (% (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - 30D 60D 90D 6M 12M 18M 24M p.a.) 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M RSA Comdty CANOLA FUTR (WCE) Nov12 608.90 16.05 16.13 15.71 16.24 16.93 0.116 -0.041 0.157 0.076 0.021 -0.004 -0.002 -0.001 -0.001 0.000 CCA Comdty COCOA FUTURE Dec12 2469.00 29.34 30.19 30.01 28.93 28.91 0.086 0.035 0.037 0.036 0.072 -0.001 0.000 0.000 0.000 0.000 KCA Comdty COFFEE 'C' FUTURE Dec12 169.30 31.67 31.18 30.11 29.38 28.91 28.42 0.046 0.093 0.096 0.064 0.010 -0.028 -0.003 -0.001 -0.001 0.000 0.000 0.000 C A Comdty CORN FUTURE Dec12 744.50 26.02 26.02 26.06 26.06 24.67 22.75 22.24 0.160 0.160 0.162 0.136 0.035 0.011 0.021 0.000 0.000 0.000 0.000 0.000 0.000 0.000 CTA Comdty COTTON NO.2 FUTR Dec12 72.92 28.21 27.92 27.57 26.09 23.27 21.86 20.34 -0.045 -0.033 -0.025 -0.009 -0.026 -0.048 -0.050 -0.002 -0.001 -0.001 0.000 0.000 0.000 0.000 Agriculture JOA Comdty FCOJ-A FUTURE Nov12 120.55 48.07 39.70 42.17 40.27 36.54 32.19 29.14 0.090 0.034 -0.068 -0.011 0.001 0.001 0.000 0.001 0.000 0.001 0.000 0.000 0.000 0.000 LBA Comdty LUMBER FUTURE Nov12 278.00 27.97 23.87 19.89 16.08 -0.047 -0.047 -0.011 -0.005 -0.005 -0.003 -0.003 -0.002 O A Comdty OAT FUTURE Dec12 370.25 26.44 26.44 25.54 23.40 23.40 0.159 0.159 0.165 0.180 0.180 -0.001 -0.001 0.000 0.000 0.000 RRA Comdty ROUGH RICE (CBOT) Nov12 15.24 17.55 16.89 16.11 17.69 0.209 0.183 0.150 0.000 -0.002 -0.002 -0.002 0.000 S A Comdty SOYBEAN FUTURE Nov12 1604.00 24.38 23.96 23.45 23.26 22.63 0.125 0.153 0.188 0.176 0.078 -0.001 -0.001 -0.002 -0.001 0.000 SMA Comdty SOYBEAN MEAL FUTR Dec12 483.20 26.02 26.03 24.29 23.91 22.88 0.188 0.187 0.150 0.133 0.073 -0.002 -0.001 -0.001 -0.001 -0.001 BOA Comdty SOYBEAN OIL FUTR Dec12 53.75 20.36 19.96 19.48 20.34 19.02 0.194 0.171 0.144 0.135 0.000 -0.002 -0.002 -0.001 0.000 0.000 SBA Comdty SUGAR #11 (WORLD) Mar13 20.28 25.21 25.52 25.37 24.95 22.11 21.28 20.74 0.071 0.051 0.045 0.007 0.006 0.000 -0.013 -0.003 -0.003 0.000 -0.001 0.000 0.000 0.000 W A Comdty WHEAT FUTURE(CBT) Dec12 891.00 30.63 29.57 29.25 28.32 26.77 0.188 0.194 0.184 0.135 0.042 -0.001 0.000 0.000 0.000 0.000 KWA Comdty WHEAT FUTURE(KCB) Dec12 918.00 23.89 29.22 29.50 28.00 -0.931 0.032 0.115 0.012 -0.007 -0.001 0.000 0.000 FCA Comdty CATTLE FEEDER FUT Nov12 148.70 8.68 10.32 10.70 -0.158 -0.180 -0.173 -0.007 -0.005 -0.003 stock Live LHA Comdty LEAN HOGS FUTURE Dec12 74.98 18.41 19.15 19.85 19.11 16.38 0.010 -0.032 -0.070 -0.076 -0.107 -0.003 -0.002 -0.001 0.000 0.000 LCA Comdty LIVE CATTLE FUTR Dec12 128.48 11.14 11.58 11.55 11.13 11.04 -0.152 -0.215 -0.214 -0.178 -0.122 -0.005 -0.002 -0.001 -0.001 -0.001 CLA Comdty WTI CRUDE FUTURE Nov12 91.83 29.71 31.59 32.07 32.00 29.47 27.01 24.99 -0.183 -0.150 -0.148 -0.134 -0.003 -0.081 -0.074 -0.001 0.000 0.000 0.000 0.000 0.000 0.000 COA Comdty BRENT CRUDE FUTR Nov12 109.93 28.88 29.92 30.75 30.99 29.40 27.28 25.33 -0.130 -0.129 -0.171 -0.149 -0.184 -0.099 -0.078 0.000 0.000 0.000 0.000 -0.001 0.000 0.000 Energy XBA Comdty G A S O L I N E R B O B F U T O c t 1 2 292.66 29.90 31.73 30.87 28.29 28.02 28.02 28.02 -0.028 -0.015 -0.003 -0.005 0.000 0.000 0.000 0.000 0.001 0.000 0.000 0.000 0.000 0.000 HOA Comdty HEATING OIL FUTR Oct12 310.01 24.91 26.03 26.40 26.28 26.39 26.39 26.39 -0.027 -0.022 -0.026 -0.010 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 QSA Comdty GAS OIL FUT (ICE) Nov12 964.50 24.63 24.54 25.71 26.43 25.35 22.89 21.14 -0.247 -0.189 -0.141 -0.072 -0.023 -0.050 -0.028 -0.001 -0.001 0.000 0.000 0.000 0.000 0.000 NGA Comdty NATURAL GAS FUTR Oct12 2.83 43.99 39.63 36.70 33.75 32.59 26.68 25.24 -0.178 -0.063 -0.025 -0.029 -0.028 0.000 0.001 -0.002 0.000 0.000 0.000 0.000 0.000 0.000 Precious GCA Comdty GOLD 100 OZ FUTR Dec12 1764.20 15.76 16.48 17.15 18.86 21.31 22.31 22.82 0.034 0.033 0.013 0.005 0.003 0.006 0.007 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Metals SIA Comdty SILVER FUTURE Dec12 34.02 28.56 29.39 30.00 30.98 32.69 33.16 33.51 -0.113 -0.027 -0.010 -0.054 -0.023 -0.004 -0.003 -0.004 -0.001 -0.001 -0.001 0.000 0.000 0.000 PLA Comdty PLATINUM FUTURE Oct12 1615.10 23.67 23.57 23.76 24.07 0.020 0.006 0.039 0.024 -0.001 -0.001 -0.001 0.000 PAA Comdty PALLADIUM FUTURE Dec12 639.50 23.03 23.65 24.06 24.91 0.102 0.010 0.005 0.000 -0.002 -0.002 -0.001 0.000 LAA Comdty LME PRI ALUM FUTR Oct12 2099.50 19.35 19.35 19.35 19.35 19.35 19.35 19.35 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Industrial Metals LPA Comdty LME COPPER FUTURE Oct12 8282.00 23.19 24.25 24.94 24.94 24.94 24.94 24.94 0.002 0.000 0.000 0.000 0.000 0.000 0.000 0.001 0.000 0.000 0.000 0.000 0.000 0.000 LLA Comdty LME LEAD FUTURE Oct12 2285.75 27.40 27.40 27.40 27.40 27.40 -0.011 -0.011 -0.011 -0.011 -0.011 0.000 0.000 0.000 0.000 0.000 LNA Comdty LME NICKEL FUTURE Oct12 18149.00 26.19 27.58 28.16 29.91 31.40 31.40 31.40 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 LXA Comdty LME ZINC FUTURE Oct12 2096.75 27.33 27.33 27.33 27.09 28.01 28.01 28.01 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. 24.09.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms 2 IVt = atx + btx + ct Convenienc Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name ATM Ref e Yield (% (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - 30D 60D 90D 6M 12M 18M 24M p.a.) 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M UNG US Equity US NATURAL GAS FUND LP 19.48 42.32 41.79 41.70 42.00 40.91 40.90 41.85 -0.043 -0.045 -0.043 -0.034 0.017 0.019 -0.026 -0.001 -0.001 0.000 0.000 0.000 0.000 0.000 HNU CN Equity HORIZONS BETA NYMEX NAT BULL 13.24 97.88 92.26 100.43 -1.216 -0.472 -1.015 0.013 0.004 0.010 SLV US Equity ISHARES SILVER TRUST 32.80 29.82 30.45 30.78 31.74 33.77 34.69 35.31 -0.109 -0.056 -0.040 -0.066 -0.062 -0.068 -0.072 -0.005 -0.002 -0.001 -0.001 0.000 0.000 0.000 HND CN Equity HORIZONS BETA NYMEX NAT BEAR 4.53 106.74 96.10 105.18 0.733 0.087 0.383 0.000 -0.001 0.001 GLD US Equity SPDR GOLD TRUST 170.66 15.93 17.14 17.62 19.08 21.48 -0.013 0.046 0.048 0.025 0.022 -0.006 -0.002 -0.002 -0.001 -0.001 USO US Equity UNITED STATES OIL FUND LP 33.98 29.83 31.75 32.14 32.78 33.00 32.72 32.43 -0.180 -0.153 -0.144 -0.135 -0.121 -0.108 -0.099 -0.005 -0.002 -0.001 -0.001 0.000 0.000 0.000 HOU CN Equity HORIZONS BETA NYMEX CRUDE BU 4.80 60.60 65.53 66.71 0.299 -0.305 -0.226 -0.010 -0.002 -0.001 IAU US Equity ISHARES GOLD TRUST 17.13 15.51 16.72 17.45 19.10 21.70 22.93 23.50 0.091 0.079 0.064 0.024 0.031 0.019 -0.010 -0.001 -0.001 -0.002 -0.001 -0.001 0.000 0.000 HOD CN Equity HORIZONS BETA NYMEX CRUDE BE 5.66 62.40 60.75 64.85 -0.241 -0.017 0.010 -0.003 -0.002 0.000 ZSL US Equity PROSHARES ULTRASHORT SILVER 41.85 36.36 88.83 238.38 64.08 63.38 0.549 -0.585 -2.440 -0.130 -0.432 -0.004 0.000 0.002 0.000 -0.001 UCO US Equity PROSHRE ULT DJ-UBS CRUDE OIL 30.99 55.03 49.16 50.16 60.00 59.36 58.16 59.25 -0.237 -0.001 0.028 -0.103 -0.116 -0.098 -0.103 -0.002 -0.001 -0.001 0.000 0.000 -0.001 0.000 DBA US Equity POWERSHARES DB AGRICULTURE F 29.46 14.02 14.68 15.26 16.85 18.52 19.57 20.55 -0.260 -0.132 -0.085 -0.026 -0.008 -0.013 -0.018 -0.002 -0.002 -0.002 -0.001 0.000 0.000 -0.001 DBC US Equity POWERSHARES DB COMMODITY IND 28.29 15.20 16.86 17.55 18.68 19.73 19.98 19.92 -0.282 -0.278 -0.273 -0.252 -0.139 -0.144 -0.217 -0.004 -0.002 -0.002 -0.001 -0.001 -0.001 -0.001 SCO US Equity PROSHRE U/S DJ-UBS CRUDE OIL 41.18 57.41 61.70 62.75 62.71 63.34 64.82 66.62 0.094 0.097 0.096 0.088 0.080 0.054 0.009 -0.002 -0.001 -0.001 0.000 0.000 0.000 0.000 AGQ US Equity PROSHARES ULTRA SILVER 56.21 58.87 60.04 60.74 63.30 66.28 -0.061 -0.009 -0.005 -0.058 -0.044 -0.002 -0.001 -0.001 0.000 0.000 GSG US Equity ISHARES S&P GSCI COMMODITY I 33.43 18.01 19.79 20.35 20.96 -0.380 -0.299 -0.260 -0.186 -0.002 -0.002 -0.001 -0.001 Main Commodity ETFs GAS CN Equity ISHARES NATURAL GAS COMMODIT 10.97 54.23 50.11 50.57 49.42 49.26 49.10 -0.232 -0.066 -0.115 -0.092 -0.016 0.060 -0.006 -0.003 0.000 0.000 0.001 0.002 OIL US Equity IPATH GOLDMAN SACHS CRUDE 22.21 30.14 32.44 33.06 -0.176 -0.123 -0.106 -0.005 -0.003 -0.002 RJA US Equity ELEMENTS ROGERS AGRI TOT RET 9.63 20.47 20.48 20.49 -0.169 -0.170 -0.170 -0.001 -0.001 -0.001 DJP US Equity IPATH DOW JONES-UBS COMMDTY 43.50 17.17 17.37 17.58 18.44 -0.251 -0.265 -0.277 -0.273 -0.002 -0.002 -0.002 -0.001 DBB US Equity POWERSHARES DB BASE METALS F 19.64 21.19 21.81 22.33 23.79 0.130 -0.031 -0.073 -0.084 -0.003 -0.003 -0.003 -0.001 SIVR US Equity ETFS PHYSICAL SILVER SHARES 33.51 29.58 30.27 30.64 -0.049 -0.037 -0.038 -0.005 -0.002 -0.002 RJI US Equity ELEMENTS ROGERS TOTAL RETURN 8.83 16.75 16.75 16.75 0.000 0.000 0.000 0.000 0.000 0.000 GAZ US Equity IPATH DJ-UBS NAT GAS SUBINDX 3.04 38.20 41.78 44.10 -0.004 -0.024 -0.001 0.000 0.000 0.000 JJC US Equity IPATH DJ-UBS COPPER SUBINDX 47.33 23.09 23.47 24.18 -0.207 -0.162 -0.184 -0.001 -0.002 -0.002 GLL US Equity PROSHARES ULTRASHORT GOLD 14.35 32.85 33.36 34.38 37.57 0.122 0.002 -0.032 -0.043 -0.002 -0.001 -0.001 -0.001 DBO US Equity POWERSHARES DB OIL FUND 25.90 26.10 27.13 27.54 28.16 -0.033 -0.143 -0.166 -0.127 -0.008 -0.003 -0.002 -0.001 UGL US Equity PROSHARES ULTRA GOLD 95.51 32.32 33.61 34.69 37.47 0.039 0.023 0.019 0.017 -0.003 -0.002 -0.001 0.000 USL US Equity UNITED STATES 12 MONTH OIL 40.04 27.30 28.00 28.42 29.60 29.22 0.078 -0.074 -0.117 -0.142 -0.113 -0.001 -0.002 -0.002 -0.001 0.000 CGL CN Equity ISHARES GOLD BULLION FUND 15.88 19.96 18.21 20.17 -0.252 -0.183 -0.200 -0.038 -0.021 -0.009 SGOL US Equity ETFS GOLD TRUST 173.90 15.94 16.84 17.43 0.070 0.058 0.044 -0.003 -0.002 -0.002 DBE US Equity POWERSHARES DB ENERGY FUND 27.85 24.67 24.78 24.87 25.57 -0.363 -0.230 -0.190 -0.148 0.001 0.000 -0.001 -0.001 BAL US Equity IPATH DJ-UBS COTTON SUBINDX 47.93 25.17 25.18 25.66 -0.072 -0.001 0.014 -0.003 -0.002 -0.001 DBP US Equity POWERSHARES DB PREC METALS F 61.06 16.37 16.25 16.84 19.00 -0.042 -0.071 -0.049 0.039 0.000 -0.001 -0.001 -0.001 RJN US Equity ELEMENTS ROGERS ENERGY TR 6.52 29.27 29.22 29.18 -0.063 -0.062 -0.061 0.000 0.000 0.000 DBS US Equity POWERSHARES DB SILVER FUND 59.76 30.03 30.27 30.76 32.37 -0.101 -0.062 -0.050 -0.039 -0.006 -0.003 -0.002 -0.001 CORN US Equity TEUCRIUM CORN FUND 48.09 24.18 25.44 25.77 0.186 0.110 0.072 -0.004 -0.001 0.000 UGA US Equity UNITED STATES GAS FUND LP 58.14 26.72 26.85 27.07 27.75 -0.213 -0.208 -0.194 -0.140 -0.004 -0.002 -0.001 -0.001 DGL US Equity POWERSHARES DB GOLD FUND 60.60 16.21 17.07 17.62 19.03 0.163 0.076 0.050 0.029 -0.001 0.000 0.000 0.000 COW US Equity IPATH DJ-UBS LIVESTOCK SUB 28.02 17.09 17.11 17.13 18.21 0.038 0.045 0.053 0.014 -0.001 -0.001 -0.001 0.000 UNL US Equity UNITED STATES 12 MONTH NATUR 17.38 24.87 24.65 24.65 -0.098 -0.035 -0.025 0.000 -0.001 0.000 DNO US Equity UNITED STATES SHORT OIL FUND 38.05 29.73 31.31 31.96 0.248 0.150 0.139 -0.002 -0.001 -0.001 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 24.09.2012 WTI Crude Futures Term Structures & Implied Volatilities WTI Crude Oil - Forward Curve (Fair Value) WTI Crude Oil - Historical 12-Months Implied Volatilities 96 3.0% 60% 115 2.0% 110 94 50% 105 1.0% 92 40% 100 0.0% 90 95 -1.0% 30% 88 90 -2.0% 20% 85 86 -3.0% 80 84 10% -4.0% 75 82 -5.0% 0% 70 May-12 May-12 May-12 Mar-12 Mar-12 Sep-11 Dec-11 Dec-11 Jan-12 Jan-12 Jun-12 Jun-12 Jul-12 Jul-12 Aug-12 Aug-12 Sep-12 Sep-12 Feb-12 Feb-12 Apr-12 Apr-12 Nov-11 Nov-11 Nov-11 Oct-11 Oct-11 80 -6.0% May-13 May-14 May-15 May-16 May-17 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 6MTH_IMPVOL_90.0%MNY_DF 6MTH_IMPVOL_100.0%MNY_DF Term Structure - Slope (% p.a.) GOLD 100 OZ FUTR Dec12 6MTH_IMPVOL_110.0%MNY_DF PX_LAST WTI Crude Oil - 30 Days Implied VS Historical Volatility WTI Crude Oil - Implied Volatility Surface 60% 34% 50% 32% 40% 30% 28% 30% 26% 24% 20% 22% 10% 20% 0.320-0.340 24MTH IV 110% 0.300-0.320 IV 102.5% 12MTH 0% IV 97.5% 0.280-0.300 3MTH May-12 May-12 May-12 Mar-12 Mar-12 IV 90% Sep-11 Dec-11 Dec-11 Jan-12 Jan-12 Jun-12 Jun-12 Jul-12 Jul-12 Aug-12 Aug-12 Sep-12 Sep-12 Feb-12 Feb-12 Apr-12 Apr-12 Nov-11 Nov-11 Nov-11 Oct-11 Oct-11 0.260-0.280 30DAY 0.240-0.260 0.220-0.240 Historical Volatility (30 Days) 30DAY_IMPVOL_100.0%MNY_DF 0.200-0.220 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |