Bally Total Fitness 061213

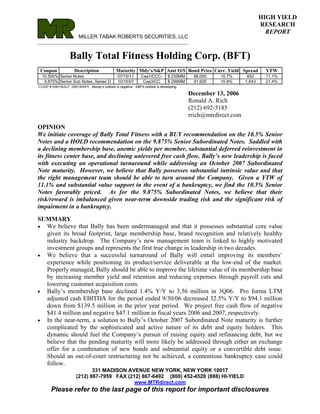

- 1. HIGH YIELD RESEARCH REPORT MILLER TABAK ROBERTS SECURITIES, LLC ________________________________________________________________________ Bally Total Fitness Holding Corp. (BFT) Coupon Description Maturity Mdy's/S&P Amt O/S Bond Price Curr. Yield Spread YTW 10.500% Senior Notes 07/15/11 Caa1/CCC- $ 235MM 98.000 10.7% 652 11.1% 9.875% Senior Sub Notes, Series D 10/15/07 Caa3/CC $ 296MM 91.625 10.8% 1,643 21.4% CUSIP # 05873KAJ7, 05873KAF5. Moody's outlook is negative. S&P's outlook is developing. December 13, 2006 Ronald A. Rich (212) 692-5185 rrich@mtrdirect.com OPINION We initiate coverage of Bally Total Fitness with a BUY recommendation on the 10.5% Senior Notes and a HOLD recommendation on the 9.875% Senior Subordinated Notes. Saddled with a declining membership base, anemic yields per member, substantial deferred reinvestment in its fitness center base, and declining unlevered free cash flow, Bally’s new leadership is faced with executing an operational turnaround while addressing an October 2007 Subordinated Note maturity. However, we believe that Bally possesses substantial intrinsic value and that the right management team should be able to turn around the Company. Given a YTW of 11.1% and substantial value support in the event of a bankruptcy, we find the 10.5% Senior Notes favorably priced. As for the 9.875% Subordinated Notes, we believe that their risk/reward is imbalanced given near-term downside trading risk and the significant risk of impairment in a bankruptcy. SUMMARY • We believe that Bally has been undermanaged and that it possesses substantial core value given its broad footprint, large membership base, brand recognition and relatively healthy industry backdrop. The Company’s new management team is linked to highly motivated investment groups and represents the first true change in leadership in two decades. • We believe that a successful turnaround of Bally will entail improving its members’ experience while positioning its product/service deliverable at the low-end of the market. Properly managed, Bally should be able to improve the lifetime value of its membership base by increasing member yield and retention and reducing expenses through payroll cuts and lowering customer acquisition costs. • Bally’s membership base declined 1.4% Y/Y to 3.56 million in 3Q06. Pro forma LTM adjusted cash EBITDA for the period ended 9/30/06 decreased 32.5% Y/Y to $94.1 million down from $139.5 million in the prior year period. We project free cash flow of negative $41.4 million and negative $47.1 million in fiscal years 2006 and 2007, respectively. • In the near-term, a solution to Bally’s October 2007 Subordinated Note maturity is further complicated by the sophisticated and active nature of its debt and equity holders. This dynamic should fuel the Company’s pursuit of raising equity and refinancing debt, but we believe that the pending maturity will more likely be addressed through either an exchange offer for a combination of new bonds and substantial equity or a convertible debt issue. Should an out-of-court restructuring not be achieved, a contentious bankruptcy case could follow. 331 MADISON AVENUE NEW YORK, NEW YORK 10017 (212) 867-7959 FAX (212) 867-6492 (800) 452-4528 (888) HI-YIELD www.MTRdirect.com Please refer to the last page of this report for important disclosures

- 2. BUSINESS OVERVIEW Bally Total Fitness (“Bally” or the “Company”) is the second largest operator of fitness centers in North America. As of September 30, 2006, the Company operated 379 fitness centers concentrated in the top 25 metropolitan areas in the United States and Canada, and served 3.6 million members. According to the International Health, Racquet and Sports Club Association, total U.S. fitness club industry revenues have increased at an eleven-year CAGR of 7.7% to $14.8 billion in 2004, while U.S. fitness club memberships have increased at a CAGR of 5.1% to 41.3 million over the same period. The fitness club industry is highly fragmented, with less than 10% of U.S. clubs owned and operated by companies that own more than 25 clubs; the two largest operators, 24 Hour Fitness and Bally Total Fitness, accounted for only 14% of 2004 industry revenues. Over the past few years, Bally has experienced extensive turnover in its senior executive suite, and has weathered substantial road bumps, including a series of changes in accounting methodology, a multi-year restatement of its financials, and recently, a change in board members and managerial control. In August 2006, Bally’s two largest shareholders, Pardus Capital Management and Liberation Investments, entered into confidentiality agreements with the goal of facilitating a “strategic transaction.” Subsequently, the new Pardus-backed management team refinanced Bally’s senior credit facility, providing the Company with more liquidity and additional time to address the October 15, 2007, maturity of its 9.875% Senior Subordinated Notes. The old facility required Bally to have a plan in place to refinance the Subordinated Notes no later than April 15, 2007; the new facility allows until October 1, 2007. We note that our access to previous and current management has been very limited and many of the assumptions that drive our analyses have been extrapolated from estimates. Business Model The fitness center business model is straightforward: maximize the lifetime value of members and minimize costs. The lifetime value of a member is a function of the annual revenue generated from the member, typically comprised of an initiation fee, monthly fees, in-center sales (all less bad debt), and the period of time over which the member is retained. Member retention is maximized by providing a superior level of product and service, and, as is especially the case with Bally, attractive pricing. (The fitness industry has historically experienced a relatively high attrition rate, ranging between 40% and 60% per year.) Critical mass is a key concept for fitness centers, both in number of members per gym and concentration of gyms in a region. Fixed operating costs are typically 70% or more of the total expenses of a gym, with each additional member yielding incremental marginal profitability. Store density is rewarded as well: people will not travel very far to go to the gym and often prefer to have a gym both near work and home. Clustering centers within a specific region also eases branding, makes advertising more efficient, increases local market expertise, and enables managerial leverage. Historically, Bally acquired and retained members through a hard-sell approach that offered lifetime memberships (usually financed by Bally) and very low monthly renewal rates (rates currently average $13 per month and were as little as $2 per month only ten years ago). While the practice facilitated member joins and provided upfront cash through initiation fees and pre- paid memberships, it also compromised the lifetime value of a member. Compared to its most comparable public competitor, Town Sports International (TSI), Bally has approximately three 2

- 3. times as many members per club, or 9,339, while monthly revenues per member ($23.26) are less than one-third that of TSI (see Figure 9). Many of Bally’s 3.6 million members are non-users and maintain their low-priced renewal membership purely as an option. Bally provides financing for the entire value of its membership contracts at an interest rate between 16% and 18% per annum. While the practice helps to drive member joins, it has also created a collections problem and produced bad will between Bally and some members. In addition, the reduced financial barriers to a Bally’s membership have led to a less active and less leveragable membership base that has limited the company’s ability to grow yield per member, which is comprised of initiation fees, monthly dues, product and service revenues, and finance charges. As lifetime memberships have been Figure 1 made unlawful in most states and BALLY TOTAL FITNESS Business Model Drivers competition has increased with the Weighted establishment of more regional chains, No. Average Member Life Annual Initial Renewal Initiation Monthly Monthly Bally’s membership fees have Membership (millions) (months) Attrition Fee Fee Fee Non-Obligatory 2.17 55 * 19.9% * $0 $0 $13 declined. Someone who joined Bally Contract (a) in 2000 typically paid an initiation fee Legacy New 1.24 NM * 39 36 26.8% * * 28.7% * 63 63 31 31 15 31 between $630 and $2,175 and monthly Monthly 0.15 * 15 56.3% * 110 NA 35 * Total 3.56 dues ranging from $3 to $20, as Source: Company reports and MTR analysis * Figure reflects MTR estimate. compared with a current average (a) Attrition rate and membership life do not include initial 30-day attrition estimated at 17%. initiation fee of $63 and monthly Totals reflect weighted average. charge of $31. With greater consumer choice in the marketplace, and none of the stickiness of its old lifetime model, Bally can retain members only through competitive service and offerings, and/or a low price. While Bally’s annual attrition rate of 32% is below the industry average, we believe its attrition rate of active members is actually higher, given that 61% of its membership base is comprised of non-obligatory members (post-contract). Membership churn not only reduces the lifetime value of the Company’s membership base, but also diminishes the potential value of the community a given center services. We think that Bally’s legacy of hard selling and compromised quality has caused the Company to burn through much of some older centers’ addressable markets, driving their cost of member acquisition higher or member yield lower. Based upon this constraint to profitability, we assume that Bally’s older club locations are less worthy of capital reinvestment and are well represented among those centers that have a high degree of deferred capital expenditures. Ultimately, we expect this dynamic may compel exiting certain locations. According to the company: 1) in the three months ended September 30, 2006, new member signups were approximately 68% value plan (Bally’s term for a contract membership comprised of an initiation fee plus monthly charge), 13% paid-in-full memberships, and 19% month-to- month (zero initiation charge, but higher monthly charges than the value plan); 2) the weighted average life of a member who signs a contract is 39 months; 3) the majority of signed contracts have a 36-month term; 4) 90% of membership contracts are financed; 5) 61% of members are post-contract and pay monthly fees on a non-obligatory basis, averaging $13.00 per month; and 6) personal training revenue per member has recently trended upward and is approximately 3

- 4. $36.00 per member per year, while retail product revenue has declined to approximately $12.50 per member per year, as Bally has reduced its allocation of center square footage to the category. CAPITAL STRUCTURE Figure 2 Bally’s capital structure is comprised Bally Total Fitness Holding of a senior credit facility, a senior note issue and a senior subordinated note Senior Credit Facility 10.5% Senior Notes issue, each of which has been 9.875% Senior Sub. Notes borrowed/issued by Bally Total Fitness Holding Corporation, the parent entity of the operating subsidiaries. Restricted Op. Subs. Unrestricted Op. Subs. Senior Credit Facility On October 16, 2006, Bally amended Collateral for Sr. Credit Facility and restated its existing credit Guarantors of Sr. Credit Facility Guarantors of 10.5% Sr. Notes agreement to provide for a $44.0 million revolving credit facility, a Source: Company reports. $205.9 million Tranche B Term Loan, and a $34.1 million Delayed-Draw Term Loan, which can be used to fund capital expenditures. The revolver and Tranche B Term Loan were drawn in full to refinance the Company’s previous credit facility and enhance liquidity. The old facility required Bally to have a plan in place to refinance the Senior Subordinated Notes due October 15, 2007, no later than April 15, 2007; the new facility extends the deadline to October 1, 2007. All borrowings under the facility bear interest quarterly at three-month LIBOR plus 425bps and mature on October 1, 2010, provided that maturity accelerates to 14 days prior to the maturity of the current Sub Notes or any replacement debt. The Delayed-Draw Term Loan can be drawn upon through April 16, 2008. The Tranche B Term Loan amortizes quarterly beginning October 31, 2007, at the rate of $2.1 million per annum. The new facility is secured by all of Figure 3 Bally’s assets except 35% of the stock of Min. Consolidated Cash EBITDA ($ millions) Min. Amt. Minimum Liquidity Min. Amt. its foreign subsidiaries. The credit 8/1/06 - 11/30/06 $ 25.0 11/30/06 $ 15.0 agreement’s covenants were constructed 8/1/06 - 12/31/06 35.0 12/1/06 - 10/31/07 25.0 8/1/06 - 1/31/07 40.0 11/1/07 and thereafter 30.0 to make it easier for Bally to refinance or 8/1/06 - 2/28/07 45.0 extend the Subordinated Notes, including 8/1/06 - 3/31/07 50.0 8/1/06 - 4/30/07 55.0 provisions allowing Bally to give Sub 8/1/06 - 5/31/07 60.0 Note holders stock, a higher interest rate, 8/1/06 - 6/30/07 65.0 7/31/07 - 6/30/08 70.0 and/or reimbursement of out-of-pocket 7/1/08 - 12/31/08 75.0 expenses. Financial covenants under the 1/1/09 - 6/30/09 80.0 7/1/09 and thereafter 90.0 credit agreement include a minimum Source: Company reports. LTM consolidated cash EBITDA and minimum liquidity maintenance tests. The Company must maintain a minimum LTM consolidated cash EBITDA for the trailing twelve months ending on the designated date (provided that, for any fiscal month prior to August 1, 2007, the period will commence on August 1, 2006) equal to or greater than the amount specified in Figure 3, and a minimum liquidity equal to or greater than the amount specified for that month as listed above in Figure 3. 10.5% Senior Notes In July 2003, Bally issued $235 million of 10.5% Senior Notes (the “Senior Notes”) to refinance its then-existing credit facility. Senior Notes are general unsecured obligations of the Company and are guaranteed by its restricted operating subsidiaries. The Senior Notes’ indenture limits 4

- 5. additional indebtedness through a consolidated fixed charge coverage ratio of 2.0 to 1.0, but allows for the incurrence of Permitted Indebtedness that includes, among other items, $50.0 million of capital lease obligations, $50.0 million of other debt, and restricted payments limited by a senior leverage ratio of 2.75 to 1.0. The Senior Notes are callable on or after July 15, 2007, at 105.25; the call price drops to 102.625 on July 15, 2008, and to par on July 15, 2009. The Senior Notes carry a change of control put at 101. 9.875% Senior Subordinated Notes In 1997 and 1998, Bally issued $300 million in aggregate principal amount of 9.875% Series B and Series C Notes and, in June 1999, it exchanged them for the presently outstanding $296 million of 9.875% Series D Senior Subordinated Notes (the “Sub Notes”). The Sub Notes are general unsecured obligations of the Company and are contractually subordinated to the Senior Notes and other Bally Total Fitness Holding Corporation senior debt (including to the extent of post-petition interest) and structurally subordinated to all operating subsidiary obligations, as those subsidiaries do not guarantee the Sub Notes. The Sub Notes’ indenture contains an “X Clause.” Additional indebtedness is limited by the Sub Notes’ indenture’s consolidated fixed charge coverage ratio of 2.0 to 1.0; the indenture provides for the incurrence of permitted indebtedness that includes, among other items, $25 million of capital lease obligations and $50 million of other debt. The Notes are currently callable at par and carry a change of control put at 101. Leverage / Liquidity We have calculated Bally’s net leverage ratio Figure 4 based on pro forma LTM adjusted cash BALLY TOTAL FITNESS Pro Forma Net Leverage * EBITDA, net of the change in deferred Figures as of September 30, 2006, pricing as of December 13, 2006 revenues and non-recurring items and adjusted Amount Net Lev Net Lev ($MM's) Thru Thru Mkt for the January 2006 sale of Crunch Fitness. Revolving Credit Facility $ 30.0 - - “Cash EBITDA” is often referenced because Term Loans 205.9 1.8x 1.8x EBITDA has been artificially inflated due to an Delayed-DrawNotes Loan 10.5% Senior Term - 235.2 1.8x 4.5x 1.8x 4.4x acceleration in revenue recognition; as attrition Other Senior Obligations 21.7 4.5x 4.4x has increased, the average life of a Bally 9.875% Senior Sub Notes Total Debt 294.5 787.3 7.6x 7.6x 7.4x 7.4x member has shortened, reducing the time Cash 70.2 period over which deferred revenue is Net Debt 717.1 amortized. We have presented Bally’s total Pro Forma LTM Adj. Cash EBITDA 94.1 debt figure pro forma for the October 16, 2006, Pro Forma LTM Adj. EBITDA 151.3 Source: Company reports and MTR estimates. refinancing of the senior credit facility, and we * Net leverage calculation is based on adjusted cash EBITDA. have assumed that $21.7 million of balance * Debt balance is pro forma for the new credit facility. * Senior Sub Note unamortized discount has been estimated. sheet “Other Obligations” are structurally * Cash EBITDA is pro forma for the Jan 2006 sale of Crunch Fitness and reflects an adjustment to adjusted EBITDA for the senior to the Subordinated Notes. As of change in deferred revenues. September 30, 2006, Bally’s pro forma net leverage ratio was 7.6x, up from 6.8x in the prior quarter. The Company’s pro forma LTM cash interest coverage ratio at quarter-end was 1.3x, down from 1.4x in the prior quarter. Net of revolver borrowings of $30 million and outstanding LC’s of $14 million, we calculate pro forma liquidity of $104.3 million at the end of the third quarter of 2006, comprised of $70.2 million of cash and $34.1 million available for capital expenditures under the Delayed-Draw Term Loan. 5

- 6. OWNERSHIP / MANAGEMENT Following a proxy battle at Bally’s annual Figure 5 shareholder meeting in January 2006, Bally BALLY TOTAL FITNESS Common Share Beneficial Ownership shareholders elected activist investor Pardus’s Shares (MM) % Class Filing dissident slate of board members, Barry Elson, Don Pardus Capital 6.1 14.8% 8/25/06 Liberation Investment 4.6 11.2% 8/29/06 Kornstein and Charles Burdick, who now constitute Wattles Capital 3.8 9.3% 4/13/06 a majority of the soon-to-be four-member board. At Dimensional Fund 3.1 8.2% 2/6/06 S.A.C. Capital 2.4 6.4% 2/14/06 the same meeting, Liberation Investments Everest Capital 2.4 5.8% 2/14/06 unsuccessfully attempted to oust Bally’s CEO, Paul Morgan Stanley 0.4 1.0% 10/10/06 Holders of 9.875% Senior Sub Notes Toback. However, in August 2006, Mr. Toback was Amount % Issue Filing forced out of his position as CEO, Barry Elson was Tennenbaum Capital $129.2 43.1% 3/22/06 Everest Capital 19.2 6.4% 3/22/06 appointed acting CEO and Don Kornstein was made Pardus Capital 10.5 3.5% 3/22/06 interim chairman. As of the filing dates noted in Source: Company reports and public filings as of 10/20/06. Since Bally's 10-K filing, Liberation Investment has Figure 5, investment firms accounted for a majority increased its Common holdings, while Morgan Stanley ownership of both the outstanding common shares has decreased its holdings. and the Sub Notes. FINANCIALS Recent Results Bally’s recent financial Figure 6 performance has worsened as Historical Annual Figures * member attrition has risen and 1,100 250 gross profit per member has 1,000 200 declined. These declines have been EBITDA Revenue 900 150 partially offset by improving 800 100 operating margins in the 700 50 Company’s retail product lines (see Figure 10). LTM adjusted cash 600 - EBITDA declined 32.5% to $94.1 97 98 99 00 01 02 03 04 05 M LT 19 19 19 20 20 20 20 20 20 million for the period ended Revenue Adjusted EBITDA Adjusted Cash EBITDA September 30, 2006, from $139.5 million in the prior year’s period, Source:- Company reports. 1999-2001 membership revenue and related costs from a * 2001 Company restated while LTM adjusted EBITDA * 2002 - Adjusted cash EBITDA figure is not meaningful. gross to net presentation. decreased 9.7% to $151.3 million * 2003 - Restated financials, changed accounting. over the same period. LTM * LTM through September 30,and 1Q04. * 2004 - Restated 2000-2003 2006. unlevered free cash flow decreased $20.7 million year-over-year to $39.0 million. The adjacent Figure 6 displays historical annual figures for the period from 1997 through the latest twelve months. Projections We project that fundamentals will stabilize in 2007, as cost reductions offset continued slowing in membership joins (see Figure 11). Our specific assumptions include: 1) gross member joins will continue to decline (2,909 new members per center in the twelve months ending September 30, 2007, versus 3,019 in the prior-year period), 2) monthly revenue recognized per member will increase from $19.06 in 3Q06 to $19.26 in 3Q07, 3) attrition rates will remain steady, driving negative net member joins, 4) variable and fixed operating expenses will be reduced, 5) deferred revenue will continue to be recognized at high rates, increasing the delta between cash EBITDA and EBITDA based on GAAP revenue, and 6) capital expenditures will increase as management begins center improvements. For fiscal 2006 and 2007, respectively, we project that net revenues will fall slightly to $994 million and $982 million from $1.0 billion in 2005, adjusted 6

- 7. EBITDA will decline to $146 million and $150 million from $164 million in 2005, and adjusted cash EBITDA will decrease meaningfully to $87 million and $85 million from $124 million in 2005. Bally’s new credit facility should assure sufficient liquidity to fund operations and capital expenditures through fiscal 2007. Assuming capital expenditures of $41 million and $50 million in fiscal 2006 and 2007, respectively, we project unlevered free cash flow of $33 million in 2006 and $28 million in 2007, down from $50 million in 2005. The Sub Note maturity on October 15, 2007, and the credit facility maturity it may trigger, remain significant challenges for the Company. TURNAROUND Market/Operations Going forward, Bally Total Fitness must choose between two strategies: increase pricing while continuing to deliver a mid-level product, or embrace the low end of the market: keeping prices low, reducing costs, and marketing the Company as a high-value alternative. Given Bally’s hard-sell, low-service culture and the low average yield of its membership base, we believe that the positioning of Bally at the lower end of the market better suits a large geographic footprint and the consolidating industry backdrop, and will be much easier to execute, all else equal, than a higher end strategy. Competitors such as Planet Fitness and Curves have recently shown that a profitable business can be built at the low end of the market. Garnering a monthly membership fee of $29 and less, and an initiation fee of around $50, a low-end offering entails a well-equipped, clean workout space that does not offer any extras such as fitness classes or childcare. According to our conversations with industry consultants, the model has produced lower membership churn at some chains than that of higher price point chains because of the high-value product offering and the more tolerable carrying cost of the membership to non-users. Successful implementation of the low-end strategy should result in a higher number of members per center, a higher degree of inactivity among the membership base (which is beneficial in terms of marginal contribution and less crowded centers), lower ancillary revenue per member, reduced personnel costs, and a low acquisition cost per member. (Acquisition costs will be reduced by a better return on advertising, higher lead conversion and much decreased sales commissions.) The inherent drawback with this model is that by not driving a higher yield per member, operating leverage is not maximized and profit margin is limited by the high fixed cost structure associated with a fitness center. We know that executing at the high end of the market is difficult for Bally, because it has tried and failed in the past with Bally Sports Clubs, The Sports Clubs of Canada, Pinnacle Fitness, Crunch and Gorilla Sports. In January 2006, Bally sold all twenty-one Crunch clubs, two Gorilla Sports clubs and two Pinnacle Fitness clubs to an investor group led by Marc Tascher, the former CEO of Town Sports, for $45 million, half of what the Company had paid for nineteen Crunch clubs in 2001. With ten Bally Sports Club locations, it is not readily apparent that Bally has plans to expand the sub-brand. The Company’s exit from Crunch and the other high-end clubs was probably due to their poor performance and was likely an acknowledgement by Bally’s previous management team that the Company lacked the competencies to properly execute at the high end of the market. (While the cash from the sale was doubtless welcome, it was not enough 7

- 8. to make a difference to the looming liquidity crunch; we suspect that Bally would have kept the assets if they hadn’t been performing poorly.) During the Company’s third quarter earnings conference call, management discussed the possibility of a joint venture as part of the restructuring of Bally’s centers. While details were not provided, we envision Bally partnering with another large player in markets that it deems non-core whereby the partner provides managerial services in exchange for a fee and a share of cash flow. One sticking point in an arrangement such as this might be the brand that these JV centers would carry; a partner may find managing centers that continue to carry the Bally name to be unhelpful to the competitive posture of their owned stores in the same market. While we believe a bankruptcy filing would provide Bally with some helpful tools for restructuring operations, an out-of-court restructuring could achieve the same ends with only modestly greater difficulty. In any event, the investment firms that own the equity will exert an extra effort to keep Bally out of bankruptcy. Deferred Capital Expenditures Industry observers mostly agree that Figure 7 Bally has underinvested in its fitness BALLY TOTAL FITNESS Deferred Capital Expenditures Analysis center base over the years. Our ($ millions) OUTPUT conversations with industry consultants Req. Annual Maint. CapEx as % Rev 4% 5% 6% have yielded estimates of fitness center Calc. Deferred Capital Expenditures $58.3 $165.3 $272.2 Inflation Adj. Calculated Actual deferred capital expenditures that vary Cum. Def. Avg Req.Maint. Up./Maint. Actual greatly, ranging from $100 million to Year Cap Ex/Club No. Clubs Cap Ex Cap Ex Cap Ex $300 million. In Figure 7, we have 1995 $ 0.12 316 $ - $ - $ - 1996 0.19 322 32.0 128.1 20.6 calculated a midpoint estimate for 1997 0.23 317 33.1 244.7 27.1 deferred capital expenditures of $165 1998 0.20 320 37.1 427.1 76.4 million, based on a required annual 1999 0.17 343 43.1 488.7 119.1 2000 0.13 376 50.4 576.3 108.4 maintenance capital expenditure level 2001 0.14 387 42.6 386.9 91.2 equal to 5% of annual revenues; the 2002 0.16 412 45.7 342.9 75.1 2003 0.23 414 47.7 191.4 47.9 cumulative total has been adjusted for 2004 0.29 416 52.4 287.4 49.7 inflation. A number of industry 2005 0.34 412 53.6 343.5 37.9 2006 0.43 382 50.0 245.0 35.0 consultants have commented that Source: Company reports and MTR analysis. Bally’s deferred capital expenditures are concentrated among the bottom third of its clubs, due to management selectively underinvesting in markets that are either too competitive or that have experienced excessive membership churn. Some of these centers should logically be exited rather than revitalized, reducing the requisite cash outlay for deferred capex. Balance Sheet Restructuring We are guardedly optimistic that Bally’s new management group will be able to refinance the Sub Notes on time, given Bally’s support level of revenue and EBITDA. The presence of a new management team is also important; it is the first truly new regime in two decades. We estimate that Pardus’s invested cost basis is in the range of $25 million, a stake likely to be greatly compromised in a restructuring. As a leading holder of the Sub Notes, we expect that Tennenbaum Capital will be a strong advocate of Sub Note holders. We doubt that the restructuring will come in the form of new straight subordinated debt from new investors, given the high senior leverage. While a combination of new straight debt and new equity is possible (with the latter supplied by investors 8

- 9. with a markedly bullish view), a subordinated convertible issue is more likely. We suspect that incumbents will have the chance to step into the deal through an exchange offer for the Sub Notes or a rights offer to one or more of the current classes of investors. VALUATION OF THE COMPANY In the following section, we value Bally on a going concern and M&A basis. We also present, as an alternative, the recoveries from a hypothetical workout process triggered by the inability to find a buyer or capital to refinance the Sub Notes before they mature. The two valuation cases and the workout all assume (the M&A case implicitly) that Bally can and will be restructured somewhat successfully: that the business will be able to sustain its capital structure, but will continue to materially underperform its competition with regard to member yield and cash EBITDA margin. Our M&A analysis is based on comparable transactions and is intended to reflect what a buyer with the resources to address the Sub Notes’ maturity and make turnaround investments would pay today. Going Concern Our base case going concern value calculation assumes that Bally 1) addresses the Sub Notes’ maturity on time, 2) exits 95 centers through sales and closures, with a portion of the members of closed centers transferring to other local Bally centers, 2) refurbishes the remaining 284 centers at a cost of $55 million and improves their management to a competitive low-end market level, enough to allow for a $4.00 increase in average monthly active membership and a $2.00 increase in the average monthly revenue of less active members, 4) grows monthly personal training revenue per active member to $7.00 from $5.00 per month, 5) increases cash EBITDA margins to 17%, 6) spends $20 million on one-time deferred information technology projects and 7) takes 42 months (3.5 years) to complete the turnaround. We note that our projected refurbishment costs are lower than our estimated total deferred capex as per our assumption that Bally will close those centers with the most disinvestment. Based upon the foregoing assumptions, we project in Figure 12 a 2010 cash EBITDA of $151 million and a 2010 enterprise value of $1.0 billion. Discounting the enterprise value 10% per annum, we arrive at a present enterprise value of $742 million, or 4.9x LTM (as of September 30, 2006) adjusted EBITDA and 7.9x LTM (same period) adjusted cash EBITDA. This discounted enterprise value fully covers current debt, and leaves $24.4 million in equity value after current net debt ($717.1 million as of September 30, 2006, pro forma for the October 2006 refinancing), or $0.59 per common share. M&A As the fitness center industry continues to consolidate, M&A valuation becomes an increasingly relevant data point. In its current state, Bally is by no means an easily sold business, as evidenced by the failed attempt to sell a large minority stake in January 2005 and the aborted sale process in March 2006. Industry watchers had speculated that during the latter process Bally would sell for between $1.0 billion and $1.6 billion. Given the Company’s declining adjusted cash EBITDA, we think a buyer would pay 80% of the revenue run-rate, or a purchase price of $796 million. This is a better valuation than Bally was able to get for Crunch, but lower than some of the other comps shown in Figure 8. The purchase price we model is 7.3% higher than our base case going concern valuation, reflecting the value of a well-capitalized buyer’s greater flexibility in addressing balance sheet and operational challenges. 9

- 10. Figure 8 BALLY TOTAL FITNESS M&A Comparables ($ millions) Purchase No. No. EBITDA Price / Price / Price / Price / Target Acquirer Date Price Centers Members Revenue EBITDA Margin Center Member Revenue EBITDA Holmes Place Virgin Active Sep-06 280 47 0.2 NA NA NA 6.0 1,474 NA NA Crunch Fitness Angelo Gordon Jan-06 45 25 0.1 71 5 7.1% 1.8 570 0.6 9.0x Equinox The Related Companies Dec-05 505 32 NA 168 NA NA 15.8 NA 3.0 NA The Sports Club Co. Millennium Partners Oct-05 80 5 NA 99 13 13.2% 16.0 NA 0.8 6.1x 24 Hour Fitness Fortmann Little & Co. May-05 1,600 345 3.0 1,100 178 16.2% 4.6 533 1.5 9.0x Gold's Gym * TRT Holdings Jul-04 158 550 2.5 NA 21 NA 0.3 NM NA 7.5x Equinox North Castle, JW Childs Dec-00 100 11 NA NA NA NA 9.1 NA NA NA Source: Company reports and MTR estimates. * At the time of the acquisition, Gold's Gym owned 37 facilities, as well as 513 franchised locations. Possible Recoveries in the Event of a Workout We believe that the Bally story is straightforward enough for its key stakeholders to structure a solution to the Sub Note maturity without resorting to bankruptcy. However, the investment climate could sour, and even if it doesn’t, stories even more straightforward than Bally’s have found their way to Chapter 11 before. In Figure 13, we analyze hypothetical recoveries from a workout triggered by a Sub Note default. As mentioned above, we continue to assume that Bally can improve cash EBITDA. Extrapolating backward from Figure 12’s 2010 projected $151 million LTM cash EBITDA, we project an LTM cash EBITDA of $120 million as of an April 2009 exit from bankruptcy. This enables us to project distributable future value of $874 million, comprised of enterprise value of $840 million, net proceeds from fitness center exits of $48 million, and excess cash build during bankruptcy of $62 million, reduced by investment in deferred capital expenditures and information technology of $75 million. This distributable value would be sufficient to fund a complete par, pre-petition and post-petition interest recovery on the Senior Notes and a recovery on the Sub Notes of 97% of par, presumably through equitization. (The Senior Notes would be able to recover post-petition interest on theories of “solvency” for the OpCos, with the Senior Note post-petition interest backstopped by the subordination clause of the Sub Note’s indenture. The Sub Notes should be able to get post-petition interest prior to any recovery to equity if there’s enough value for the holdco to be solvent.) Figure 13 gives us a fairly high degree of confidence in the Senior Notes’ recoveries. For junior classes, though, our confidence level is quite a bit lower. The sensitivity analyses in Figure 13 show that small downward variations in EBITDA or in our valuation multiple would crush Sub Note recoveries. The same forces that could compel a workout in the first place (a difficult investment climate, lack of cooperation among classes of stakeholders) could dramatically reduce the actual (or assumed normalized) EBITDA. It is also possible that the bank lenders and Senior Note holders might be able to take advantage of transitory difficulties to muscle Sub Note holders (to say nothing of shareholders) out of recoveries they might otherwise receive. A Note on Sale Values of Individual Centers All of our valuation models envision that some centers will be exited. We believe that there is potential for modest proceeds from those exits. As footnoted in Figure 12, Bally owns the real estate for fewer than 40 centers, and some of these 40 are mortgaged. However, exit value for a center also can be found in its membership list, its substantial investment in fitness equipment and leasehold improvements, and in the equity value of its long-term leases (particularly for centers that have been open for a while). It’s obviously easier to access individual center value in a bankruptcy, but even out of court we expect meaningful realizations. 10

- 11. RECOMMENDATION Buy the 10.5% Senior Notes We consider the Senior Notes favorably priced given their YTW of 11.1% (the worst-case return in our going concern or M&A scenarios) and a workout model showing the bonds quite likely to be money good. In our base case workout, we project an IRR to exit from bankruptcy of 11.4% (including post-petition interest and partial payment of the Notes’ call premium). As shown in our sensitivity analysis (see Figure 13), Senior Note recoveries don’t dip below par until we reduce projected cash EBITDA to $80 million and the valuation multiple to 6.0x. 9.875% Senior Subordinated Notes Our HOLD recommendation on the Sub Notes is based on our belief that the Sub Notes’ risk/reward at current pricing levels is unfavorable. We are somewhat optimistic that a solution to the Sub Note maturity will be reached and bondholders will have an attractive 21.4% YTW in that event. However, we believe the Sub Notes could trade down considerably in the event of a default. Additionally, our base case workout hypothetically delivers an IRR of 4.0%, with returns quickly turning negative below our base case. RISKS The principal risk to our BUY recommendation on the Senior Notes is that we are incorrect in our belief that there will be a successful operational turnaround of Bally. While we believe that there is a lot of “low-hanging fruit” for a competent management team to exploit, a turnaround of Bally will be difficult and lengthy. As for our HOLD recommendation on the Senior Sub Notes, we expect volatility as events unfold leading up to their maturity, as both positive and negative news could result in significant price movement. Volatility could be exacerbated should management choose to limit guidance leading up to the outcome. Additionally, our HOLD recommendation is at risk if in fact we have been too conservative in our assessment of company fundamentals in our base case turnaround scenario. 11

- 12. Figure 9 BALLY TOTAL FITNESS Competitor Analysis As of December 8, 2006 Bally Town Sports Life Time Sports Club Weight Equinox ($ millions) Total Fitness International Fitness Company Watchers Holdings Ticker BFT CLUB LTM SCYL WTW Private Data Through Sep '06 Sep '06 Sep '06 Mar '06 Sep '06 Sep '05 VALUATION RATIOS EV / Adjusted Cash EBITDA 8.5x 7.0x 14.2x 13.0x 13.8x NA EV / Adjusted EBITDA 5.4x 7.6x 15.0x 13.9x 14.2x NA EV / Revenue 0.8x 1.6x 4.4x 2.2x 4.5x NA EV / Club $2.1 $4.8 $41.2 $30.8 NA NA EV / Member ($) 227 1,599 5,432 5,238 3,623 NA FINANCIAL METRICS Enterprise Value $811 $689 $2,101 $123 $5,434 NA Revenue/Member/Month ($) 23.26 81.40 102.55 202.59 66.61 175.20 Membership Rev/Member/Month ($) 18.95 67.00 72.69 135.64 38.94 115.01 Prod/Ser Rev/Member/Month ($) 3.97 13.39 27.53 66.94 27.68 59.93 PT Revenue/Member/Month ($) 2.97 9.13 NA NA NA 39.36 Retail Revenue/ Member/Month ($) 1.00 4.26 NA NA NA 20.57 Revenue / Club 2.6 2.9 9.3 14.3 NA 6.7 Revenue / Club / SF 87 122 93 159 NA 224 Membership Revenue / Club 2.1 2.4 6.6 9.6 NA 4.4 Product/Services Revenue / Club 0.4 0.5 2.5 4.7 NA 2.3 Personal Training Revenue / Club 0.3 0.3 NA NA NA 1.5 Retail Products Revenue / Club 0.1 0.2 NA NA NA 0.8 Total Expenses / Club SF 75 96 74 133 NM 171 Cap Ex / Club 0.1 0.4 4.7 1.2 NM 1.5 Cap Ex as % Revenue 4.1% 15.0% 50.0% 8.4% 1.3% 22.0% LTM FINANCIAL DATA Revenue $998 $421 $476 $57 $1,199 $168 Membership Revenue 814 347 337 38 701 110 Product/Services Revenue 170 69 128 19 498 57 Personal Training Revenue 127 47 NA NA NA 38 Retail Products Revenue 43 22 NA NA NA 20 Total Expenses, excl. D&A 865 330 376 48 NM 128 Adjusted EBITDA 151 91 140 8.8 383 39 Adjusted Cash EBITDA 94 99 148 9.4 395 47 Adj. Cash EBITDA Margin 9.4% 23.5% 31.1% 16.5% 32.9% 28.0% Capital Expenditures 41 63 238 5 15 37 OPERATIONS Members / Club 9,339 3,003 7,584 5,875 NM 3,196 Club SF / Members 3.2 8.0 13.2 15.3 NA 9.4 Joining Members / Club 2,901 NA NA 1,663 NA NA Avg. No. Clubs 383 144 51 4 NM 25 Avg. Club Square Feet 30,000 24,000 100,000 90,000 NM 30,000 Avg. No. Members 3,577,000 431,000 386,792 23,500 1,500,000 79,909 Joining Members 1,111,000 NA NA 6,650 NA NA MARKET Northeast, New York, Mid-Atlantic, Midwest, Northeast, Mid- Los Angeles, California, Geographic Footprint California, Mid-Atlantic, International Atlantic New York Chicago, Florida, Southwest Florida Midwest Price Level Low Mid Mid High Low High Product / Service Level Mid Mid High High Mid High Source: Company reports and MTR analysis. 12

- 13. Figure 10 BALLY TOTAL FITNESS Adjusted Historical Quarterly Operating Statement (In Millions of Dollars) INCOME STATEMENT 1Q05 2Q05 3Q05 4Q05 (a) 1Q06 2Q06 3Q06 2004 (a) 2005 (a) LTM Net Revenues Membership $ 207.1 $ 211.5 $ 202.6 $ 193.0 $ 208.8 $ 207.3 $ 204.5 $ 850.5 $ 814.2 $ 813.6 Personal Training 29.1 31.8 30.1 34.4 30.9 32.2 29.8 125.4 125.4 127.3 Retail Products 13.3 12.6 11.5 9.5 11.9 11.5 10.2 53.3 47.1 43.1 Miscellaneous 4.3 3.6 3.7 3.4 3.6 3.6 3.9 18.7 15.0 14.5 Total Net Revenues 253.8 259.6 247.9 240.3 255.2 254.6 248.3 1,048.0 1,001.6 998.5 Membership Services 167.6 170.7 165.9 165.6 171.1 170.2 167.3 732.7 669.9 674.3 Retail Products 12.8 13.4 12.6 10.8 11.0 10.7 10.5 54.5 49.7 43.0 Advertising 17.1 14.6 12.9 8.7 18.9 16.2 13.0 61.6 53.4 56.8 Information Technology 5.3 5.5 5.2 3.5 5.1 5.3 4.9 18.3 19.5 18.8 Other G&A 12.9 16.1 14.0 20.9 16.5 15.9 18.7 57.7 63.9 72.1 Depreciation and Amortization 14.9 15.0 14.9 10.0 14.2 13.2 13.4 69.8 54.9 50.9 Total Operating Expenses 230.7 235.4 225.6 219.6 236.9 231.5 227.7 994.6 911.4 915.8 Operating Income 23.1 24.2 22.3 20.7 18.3 23.1 20.6 53.4 90.2 82.7 Addbacks: Depreciation and Amortization 14.9 15.0 14.9 10.0 14.2 13.2 13.4 69.8 54.9 50.9 Non-recurring Items 0.9 4.7 4.3 8.9 3.6 (0.2) 5.4 - 18.8 17.7 Change in Deferred Revenues 3.0 (14.4) (9.9) (18.5) (6.2) (14.8) (17.6) (22.7) (39.7) (57.1) ADJUSTED CASH EBITDA $ 41.9 $ 29.6 $ 31.6 $ 21.1 $ 29.9 $ 21.4 $ 21.8 $ 100.4 $ 124.2 $ 94.1 LTM Adjusted Cash EBITDA - - - 124.2 112.1 103.9 94.1 Net Sales Growth, Y/Y NM NM NM NM 0.6% -1.9% 0.2% - -4.4% - Membership Services as % Membership+P/T Revenue 71.0% 70.1% 71.3% 72.8% 71.4% 71.1% 71.4% 75.1% 71.3% 71.7% Retail Products Operating Margin 4.0% -6.2% -9.7% -13.7% 7.8% 6.9% -3.0% -2.2% -5.7% 0.3% Adjusted EBITDA Margin 15.3% 16.9% 16.7% 16.5% 14.1% 14.2% 15.9% 11.8% 16.4% 15.2% Adjusted Cash EBITDA Margin 16.5% 11.4% 12.7% 8.8% 11.7% 8.4% 8.8% 9.6% 12.4% 9.4% LTM Adjusted Cash EBITDA Margin - - - 12.4% 11.2% 10.4% 9.4% SOURCES AND USES OF CASH Cash EBITDA $ 41.0 $ 24.9 $ 27.3 $ 12.2 $ 26.3 $ 21.6 $ 16.4 $ 100.4 $ 105.4 $ 76.4 Cash Interest Expense (16.8) (18.9) (18.0) (22.2) (18.5) (21.4) (15.1) (62.3) (75.9) (77.1) Cash Income Taxes (0.1) 0.1 (0.2) (0.0) (0.1) (0.2) (0.4) 1.0 (0.2) (0.7) Change in Operating Assets/Liabs (2.0) 2.9 (20.8) 2.6 4.8 (3.0) 0.0 (2.5) (17.3) 4.5 Capital Expenditures (8.4) (6.0) (10.2) (13.2) (11.6) (7.3) (9.1) (49.7) (37.9) (41.2) Total Uses of Cash (27.3) (21.9) (49.2) (32.8) (25.4) (31.8) (24.5) (113.5) (131.2) (114.5) FREE CASH FLOW $ 13.7 $ 3.0 $ (22.0) $ (20.6) $ 0.9 $ (10.2) $ (8.1) $ (13.1) $ (25.9) $ (38.1) LIQUIDITY Cash Balance $ 33.3 $ 29.5 $ 12.8 $ 17.5 $ 16.0 $ 15.2 $ 30.2 $ 19.2 $ 17.5 $ 30.2 Revolving Credit Facility Availability 86.3 90.3 66.0 51.4 60.9 55.9 24.6 91.3 51.4 24.6 TOTAL LIQUIDITY $ 119.7 $ 119.8 $ 78.7 $ 68.9 $ 76.9 $ 71.0 $ 54.9 $ 110.5 $ 68.9 $ 54.9 Revolver Borrowing Capacity 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 Amount Drawn 4.0 - 20.0 35.0 25.0 30.0 60.0 - 35.0 60.0 LC's Outstanding 9.7 9.7 14.0 13.6 14.1 14.1 15.4 8.7 13.6 15.4 Revolving Credit Facility Availability 86.3 90.3 66.0 51.4 60.9 55.9 24.6 91.3 51.4 24.6 CREDIT METRICS Based on Adjusted Cash EBITDA: Net Leverage Ratio NM NM NM 6.1x 6.3x 6.8x 7.6x Net Senior Leverage Ratio NM NM NM 3.6x 3.6x 3.9x 4.4x Cash Interest Coverage NM NM NM 1.7x 1.5x 1.4x 1.3x Source: Company reports and MTR estimates. (a) Income statement figures for 4Q05 and YE05 have been estimated to reflect the January 2006 sale of Crunch Fitness; Uses of Cash Flow figures for these periods have not been adjusted. YE04 figures have not been adjusted. 13

- 14. Figure 11 BALLY TOTAL FITNESS Projected Quarterly Operating Statement (In Millions of Dollars) DRIVERS 4Q06 1Q07 2Q07 3Q07 4Q07 2006 2007 No. of Centers, EOP 379 379 379 379 379 LTM Join.Members/LTM Avg Centers 2,900 2,900 2,900 2,900 2,900 Avg. No. of Members (MM's) 3.52 3.52 3.55 3.53 3.48 Avg.Mo.Recognized Rev. / Member $ 18.39 $ 19.54 $ 19.41 $ 19.26 $ 18.59 Deferred Revenue Balance 810.3 802.7 787.9 768.0 745.8 INCOME STATEMENT Net Revenues Membership $ 194.3 $ 206.4 $ 207.0 $ 204.1 $ 194.0 $ 814.9 $ 811.5 Personal Training 29.3 29.3 29.6 29.4 29.0 122.2 117.4 Retail Products 8.4 10.6 10.3 9.3 7.9 41.9 38.1 Miscellaneous 3.7 3.7 3.7 3.7 3.7 14.8 14.8 Total Net Revenues 235.7 250.0 250.6 246.6 234.6 993.8 981.7 Membership Services 162.9 168.3 168.1 166.8 162.5 671.5 665.6 Retail Products 10.2 9.9 9.6 9.3 9.0 42.3 37.7 Advertising 10.0 15.7 15.7 15.7 10.0 58.0 57.0 Information Technology 5.0 5.0 5.0 5.0 5.0 20.3 20.0 Other G&A 14.5 14.3 14.1 13.9 13.7 65.7 56.0 Depreciation and Amortization 12.9 12.9 12.9 12.9 12.9 53.8 51.6 Total Operating Expenses 215.5 226.1 225.3 223.5 213.0 911.6 887.8 Operating Income 20.2 23.9 25.2 23.1 21.6 82.2 93.9 Addbacks: Depreciation and Amortization 12.9 12.9 12.9 12.9 12.9 53.8 51.6 Non-recurring Items 1.0 1.0 1.0 1.0 1.0 9.8 4.0 Change in Deferred Revenues (20.3) (7.6) (14.8) (20.0) (22.1) (58.9) (64.5) ADJUSTED CASH EBITDA $ 13.8 $ 30.3 $ 24.4 $ 17.0 $ 13.3 $ 86.8 $ 85.0 LTM Adjusted Cash EBITDA 86.8 65.5 68.5 85.5 85.0 Net Sales Growth, Y/Y -1.9% -2.0% -1.6% -0.7% -0.5% -0.8% -1.2% Membership Services as % Membership+P/T Revenue 72.8% 71.4% 71.1% 71.4% 72.8% 71.7% 71.7% Retail Products Operating Margin -21.7% 7.1% 6.7% 0.7% -13.5% -1.0% 1.2% Adjusted Cash EBITDA Margin 5.9% 12.1% 9.7% 6.9% 5.7% 8.7% 8.7% LTM Adjusted Cash EBITDA Margin 8.7% 8.8% 9.3% 8.7% 8.7% SOURCES AND USES OF CASH Cash EBITDA $ 12.8 $ 29.3 $ 23.4 $ 16.0 $ 12.3 $ 77.0 $ 81.0 Cash Interest Expense (19.8) (17.8) (19.9) (17.7) (20.0) (74.7) (75.5) Cash Income Taxes (0.1) (0.1) (0.1) (0.1) (0.1) (0.8) (0.4) Change in Operating Assets/Liabs (4.4) 1.6 (0.6) (0.7) (2.6) (2.5) (2.3) Capital Expenditures (12.5) (12.5) (12.5) (12.5) (12.5) (40.5) (50.0) Total Uses of Cash (36.7) (28.8) (33.1) (31.1) (35.2) (118.5) (128.1) FREE CASH FLOW $ (23.9) $ 0.5 $ (9.8) $ (15.0) $ (22.8) $ (41.4) $ (47.1) Revolving Credit Facility (60.0) - - 7.9 20.7 (35.0) 28.6 Term Loans 70.0 - - - (0.5) 70.0 (0.5) 9.875% Senior Sub Notes - - - - (292.0) - (292.0) Net Proceeds from Sale/Leaseback 10.0 - - - - 10.0 - Other - - - - - 5.3 - NET CHANGE IN CASH $ (3.9) $ 0.5 $ (9.8) $ (7.1) $ (294.6) $ 8.9 $ (311.0) Beginning Cash Balance 30.2 26.3 26.9 17.1 10.0 17.5 26.3 Ending Cash Balance 26.3 26.9 17.1 10.0 (284.6) 26.3 (284.6) LIQUIDITY Cash Balance $ 26.3 $ 26.9 $ 17.1 $ 10.0 $ (284.6) $ 26.3 $ (284.6) Revolving Credit Facility Availability 28.6 28.6 28.6 20.7 - 28.6 - Delayed-Draw Term Loan Facility 34.1 34.1 34.1 34.1 34.1 34.1 34.1 TOTAL LIQUIDITY $ 89.1 $ 89.6 $ 79.8 $ 64.8 $ (250.5) $ 89.1 $ (250.5) Revolver Borrowing Capacity 44.0 44.0 44.0 44.0 44.0 44.0 44.0 Amount Drawn - - - 7.9 28.6 - 28.6 LC's Outstanding 15.4 15.4 15.4 15.4 15.4 15.4 15.4 Revolving Credit Facility Availability 28.6 28.6 28.6 20.7 - 28.6 - CREDIT METRICS Based on Adjusted Cash EBITDA: Net Leverage Ratio 8.4x 8.3x 8.1x 8.7x NM 8.4x NM Net Senior Leverage Ratio 4.9x 4.9x 4.8x 5.2x NM 4.9x NM Cash Interest Coverage 1.2x 1.2x 1.2x 1.1x 1.1x 1.2x 1.1x Source: MTR estimates. 14

- 15. Figure 12 BALLY TOTAL FITNESS Going Concern Analysis ENTERPRISE VALUE Future ($ millions) Current Low Base High No. of Fitness Centers 379 284 284 284 Avg Net Proceeds per Exited Center (a) - $ - $ 0.5 $ 1.0 Members per Center 9,393 9,500 9,500 9,500 No. of Members (MM) 3.56 2.70 2.70 2.70 No. of Active Members (MM) 2.11 1.60 1.60 1.60 No. of Inactive Members (MM) 1.45 1.10 1.10 1.10 ($) MONTHLY MEMBER YIELD (b) Active Membership © 23.08 25.00 27.00 29.00 Personal Training 5.02 5.00 7.00 9.00 Retail 1.70 1.25 1.25 1.25 Total 29.81 31.25 35.25 39.25 Inactive Membership 13.15 14.00 15.00 16.00 Personal Training - - - - Retail - - - - Total 13.15 14.00 15.00 16.00 ($ millions) GOING CONCERN CALCULATION Annual Revenue (incl. Misc.) $ 998.5 $ 799.1 $ 889.1 $ 979.1 Cash EBITDA Margin 9.4% 12.0% 17.0% 22.0% Cash EBITDA 94.1 95.9 151.2 215.4 Multiple 6.0x 7.0x 8.0x Enterprise Future Value 575.4 1,058.1 1,723.3 Net Proceeds from Center Exits (a) - 47.5 95.0 Deferred Cap Ex / IT (75.0) (75.0) (75.0) Net Enterprise Future Value 500.4 1,030.6 1,743.3 WACC 6.5% 9.9% 14.4% Turnaround Period (yrs) 3.5 3.5 3.5 Present Going Concern Value $ 401.4 $ 741.5 $ 1,088.8 Current Net Debt 717.1 717.1 717.1 Current Equity Value - 24.4 371.7 Current Equity Value per share - 0.59 9.02 Source: MTR analysis. (a) Net proceeds from center exits is estimated and is loosely extrapolated from Bally's 4Q06 sale/leaseback of four centers for net proceeds of $10 million. Bally owns fewer than 40 clubs, some of which have mortgages. (b) Current figures are estimated. (c) Includes membership financing fees. 15

- 16. Figure 13 Recovery Analysis (In Millions of Dollars) Distributable Value (see right) 874.4 Exit Enterprise Value (Base Case) LTM Cash EBITDA at Exit $ 120.0 VALUE ALLOCATION Multiple 7.0x Revolving Credit Facility $ 15.0 Enterprise Value at Exit $ 840.0 Term Loans 205.9 Delayed-Draw Term Loan 15.0 Distributable Value Capital Lease Obligations 2.1 Exit Enterprise Value $ 840.0 Other Secured Debt, estimated 6.9 Net Proceeds from Center Exits 47.5 Total Secured Claims 244.9 Deferred Cap Ex / IT (75.0) Value Remaining for Unsecured Claims 629.4 Cash Build (detailed below) 61.9 Total Distributable Value 874.4 General Unsecured Claims 10.5% Senior Notes plus pre- and post- Cash Build / DIP Financing petition interest + partial call premium 279.2 Filing Date 10/15/07 Trade Payables (non-priority) 9.5 Length of Bankruptcy (months) 18 Membership Rejection Claims 10.6 Rejected Lease Claims 35.5 Beginning Cash Balance $ 10.0 Other Unsecured Debt, estimated 6.9 Working Capital - Upfront (detail below) 19.0 Total Senior Unsecured Claims 341.7 Ongoing Cash Build (detail below) 29.4 Value Remaining for Subs 287.7 Subtotal 58.4 Interest Income less DIP Interest Expense 3.5 Subordinated Unsecured Claims Total Cash Build / (Burn) $ 61.9 9.875% Senior Sub Notes plus pre- and post-petition interest 351.3 Annual Cash Build / (Burn) (Notional) Value Remaining for Equity (63.6) Avg Near-Term Cash EBITDA $ 105.0 Post-Petition Interest, secured debt (22.8) BOND RECOVERIES Professional Fees (20.0) 10.5% Senior Notes Capital Expenditures (42.6) Initial Value Allocation $ 279.2 Working Capital - Value Allocaton from Sub Notes - Annual Cash Build / (Burn) $ 19.6 Total Recovery 279.2 FV recovery as % of face value 118.7% Working Capital - Upfront Breakdown Days Beginning Payables 25 9.875% Senior Subordinated Notes Payables Post-Paydown 5 Net Value Allocation $ 287.7 Payables Rebuild 30 FV recovery as % of face value 97.2% Change in Cash RECOVERIES SENSITIVITY ANALYSIS EBITDA: $ 80 $ 90 $ 100 $ 110 $ 120 $ 130 $ 140 $ 150 Senior Notes 6.0x 91% 113% 119% 119% 119% 119% 119% 119% Multiple 7.0x 119% 119% 119% 119% 119% 119% 119% 119% 8.0x 119% 119% 119% 119% 119% 119% 119% 119% Sub Notes 6.0x 0% 0% 16% 36% 57% 77% 97% 117% Multiple 7.0x 3% 26% 50% 74% 97% 119% 119% 119% 8.0x 30% 57% 84% 111% 119% 119% 119% 119% Equity (Notional) 6.0x (342) (282) (222) (162) (102) (42) (64) (4) Multiple 7.0x (262) (192) (122) (52) (64) 6 76 146 8.0x (182) (102) (22) (24) 56 136 216 296 Source: MTR analysis 16

- 17. Figure 14 BALLY TOTAL FITNESS Historical Quarterly Balance Sheet (In Millions of Dollars) 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 Cash $ 33.3 $ 29.5 $ 12.8 $ 17.5 $ 16.0 $ 15.2 $ 30.2 Deferred Income Taxes - - - 0.2 0.3 0.2 0.9 Prepaid Expenses - - - 20.8 18.4 18.3 17.8 Other Current Assets 34.4 30.7 34.0 17.4 13.9 13.2 12.2 Current Assets Held for Sale - - - 0.3 - - - Total Current Assets 67.8 60.2 46.7 56.2 48.7 47.0 61.1 PP&E, net 353.2 340.9 335.2 314.7 311.1 303.1 294.1 Goodwill, net 41.7 41.7 41.7 19.7 19.7 19.7 19.7 Trademarks, net 9.8 9.7 9.5 6.9 6.9 6.9 6.8 Intangible Assets, net 7.5 7.0 6.7 2.9 2.7 2.5 2.4 Deferred Financing Costs, net - - - 29.5 50.6 41.2 34.9 Other Assets 27.4 27.7 46.2 10.3 12.4 10.5 10.2 Non-current Assets Held for Sale - - - 39.9 - - - TOTAL ASSETS $ 507.4 $ 487.2 $ 486.1 $ 480.1 $ 452.1 $ 430.9 $ 429.3 Accounts Payable 49.7 43.3 47.4 57.8 49.8 49.2 48.2 Income Taxes Payable 1.5 1.6 1.7 1.7 1.7 2.0 1.8 Deferred Income Taxes 0.5 0.6 0.7 - - - - Accrued Liabilities 106.7 111.4 97.4 96.4 126.9 100.9 99.8 Current Maturities of LT Debt 20.2 18.0 15.7 13.0 9.3 180.4 8.1 Deferred Revenues 332.4 327.4 325.4 299.4 290.6 279.2 279.8 Current Liabilities Assoc. w/Assets Held for Sale - - - 7.8 - - - Total Current Liabilities 511.0 502.4 488.3 476.2 478.3 611.6 437.8 Long-Term Debt 731.9 727.4 743.8 756.3 713.3 542.8 739.2 Deferred Rent Liability 108.8 105.9 102.9 87.3 90.0 89.9 89.1 Deferred Income Taxes 0.8 0.8 0.8 1.4 1.7 1.7 2.4 Other Liabilities 29.1 28.1 29.9 28.1 29.9 29.6 28.4 Deferred Revenues 598.3 588.6 583.8 566.5 569.0 565.6 550.7 Non-current Liabs Assoc. w/Assets Held for Sale - - - 28.0 - - - Stockholders' Equity (1,472.5) (1,466.1) (1,463.4) (1,463.7) (1,430.0) (1,410.3) (1,418.3) TOTAL LIABS. AND STOCKHOLDERS' EQUITY $ 507.4 $ 487.2 $ 486.1 $ 480.1 $ 452.1 $ 430.9 $ 429.3 Source: Company reports 17

- 18. Miller Tabak Roberts Fixed Income/Convertible Important Disclosures General Disclosure Miller Tabak Roberts Securities, LLC observes the fixed-income securities research rules of the NASD, SEC, Ontario Securities Commission, and Investment Dealers Association of Canada. The firm does no investment banking or investment management business with any person; however, the firm may from time to time act as broker or dealer on the account of companies covered in its research reports. Neither the firm nor the author of this report is aware of any factors or relationships with respect to any personnel of the firm or its affiliates which would reasonably be expected to indicate a potential conflict of interest, including, without limitation to matters of compensation, ownership and service as an officer, director or adviser, except as set forth in detail below. SRO Disclosures Compensation Disclosure The firm and its affiliates have not received compensation from the subject of this report, or persons known by this firm to be affiliates of the subject, in the prior twelve months for the performance of services. Neither the authoring analyst, nor any supervisory or executive person with the ability to influence the content of this report, nor any member or principal officer of the firm, nor any of their respective households or immediate families, has received compensation from the subject of this report in the prior twelve months. Ownership Disclosure Neither the author of this report, nor any member of the author's household or immediate family, has any financial interest in any of the securities of the subject(s) of this report. Neither the firm nor its affiliates beneficially owns in excess of 1% of any class of the common equity securities of the subject(s) of this report. Officer/Director Disclosure Neither the author of this report nor any member of the author's household or immediate family, has served or serves as an officer, director or advisory board member of the subject(s) of this report. Valuation Methods Please see page 9,10 of this report for an explanation of the methods of valuation utilized by the analyst. Risk Factors Please see page 11 of this report for an explanation of the risks utilized by the analyst. Dissemination of Research The firm distributes research by electronic mail and U.S. mail, and at meetings with customers. Our research distribution lists include only employees and our customers, and are segregated by market segment (convertible, high yield and distressed, and emerging market). From time to time we provide research to prospective customers and employees. We do not provide, or authorize the redistribution, of our research to the general public. We do not seek retail investors as customers. Market Making As of the date of this report, firm makes a market in some or all the fixed income and convertible securities (if any) of the subject(s) of this report. The firm reserves the right to stop, or start, making markets in any securities (including, without limitation, securities subject of this report), at any time, without notice. Suitability and Reliability Although the information contained herein has been obtained from sources Miller Tabak Roberts Securities, LLC believes to be reliable, its accuracy and completeness cannot be guaranteed. This report is for information purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Additional information is available upon request. Research Ratings and Distribution BUY describes a security that we expect to provide a total return (price appreciation plus yield and any distributions) in excess of securities with a similar risk profile. HOLD describes a security that we expect to provide a total return (price appreciation plus yield and any distributions) comparable to securities with a similar risk profile. SELL describes a security that we expect to provide a total return (price appreciation plus yield and an distributions) below that of securities with a similar risk profile. NO RECOMMENDATION describes a security in which we believe there is insufficient information to support a specific opinion or we have expedited publication to address near- term customer needs for factual information. Absence of an opinion should not be inferred to mean a HOLD. Percentage of Securities Covered by the Firm Receiving this Recommendation since 1/1/04: (MTR undertakes no investment banking operations.) BUY 51.6% HOLD (5.9%)/No Recommendation (24.7%) 30.6% SELL 17.8% Other Disclosure Visits The author of this report has visited locations that may or may not be representative of a typical Bally fitness center. b Analyst Certification I, Ronald A. Rich, hereby certify that the views expressed in this report accurately reflect my personal views about the subject company(ies) and its securities. I also certify that I have not been, am not, and will not be receiving direct or indirect compensation for expressing the specific recommendation(s) in this report.