Voluntary compliance encouragement scheme under service tax laws

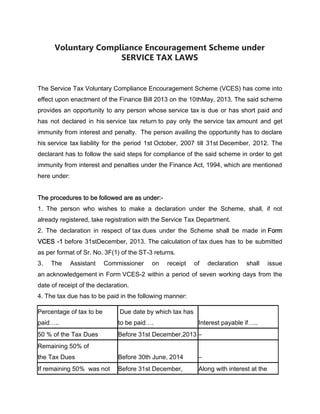

- 1. Voluntary Compliance Encouragement Scheme under SERVICE TAX LAWS The Service Tax Voluntary Compliance Encouragement Scheme (VCES) has come into effect upon enactment of the Finance Bill 2013 on the 10thMay, 2013. The said scheme provides an opportunity to any person whose service tax is due or has short paid and has not declared in his service tax return to pay only the service tax amount and get immunity from interest and penalty. The person availing the opportunity has to declare his service tax liability for the period 1st October, 2007 till 31st December, 2012. The declarant has to follow the said steps for compliance of the said scheme in order to get immunity from interest and penalties under the Finance Act, 1994, which are mentioned here under: The procedures to be followed are as under:- 1. The person who wishes to make a declaration under the Scheme, shall, if not already registered, take registration with the Service Tax Department. 2. The declaration in respect of tax dues under the Scheme shall be made in Form VCES -1 before 31stDecember, 2013. The calculation of tax dues has to be submitted as per format of Sr. No. 3F(1) of the ST-3 returns. 3. The Assistant Commissioner on receipt of declaration shall issue an acknowledgement in Form VCES-2 within a period of seven working days from the date of receipt of the declaration. 4. The tax due has to be paid in the following manner: Percentage of tax to be paid….. Due date by which tax has to be paid…. Interest payable if….. 50 % of the Tax Dues Before 31st December,2013 – Remaining 50% of the Tax Dues Before 30th June, 2014 – If remaining 50% was not Before 31st December, Along with interest at the

- 2. paid before 30th June,2014 2014 rate 15 % or 18% as the case may be from 1st July, 2014 till the date of payment. 5. The Assistant Commissioner shall issue an acknowledgement of discharge under in Form VCES- 3.Theacknowledgement of discharge shall be issued within a period of seven working days from the date of furnishing of details of payment of tax dues in full along with interest, if any, by the declarant. Some FAQ on the said Schemes: Reference : Circular No. 169/4/2013 dated 13/05/2013. 1. Whether a person who has not obtained service tax registration so far can make a declaration under VCES? Ans: Yes, any person who has tax dues can make a declaration in terms of the provisions of VCES; he will be required to take registration before making such declaration. At the time of registration a form of declaration has to be filled up by every person. In case where a person is taking registration for VCES, kindly attach a covering letter to the service tax unit Superintendent that the person is taking registration for declaration in VCES. 2. Whether a declarant shall get immunity from payment of late fee/penalty for having not taken registration earlier or not filed the return or for delay in filing of return. Ans: Yes. It has been provided in VCES that, beside interest and penalty, immunity would also be available from any other proceeding under the Finance Act, 1994 and Rules made there under. 3. Whether an assessee to whom show cause notice or order of determination has been issued can file declaration in respect of tax dues which are not covered by such SCN or order of determination?

- 3. Ans: The assessee to whom show cause notice is issued can declare his other tax dues under the Scheme which are not the subject matter of the SCN or Order or which is not covered under any SCN or order issued to him. 4. Whether CENVAT Credit can be availed for payment of service tax under this Scheme? Ans: No, The CENVAT credit shall not be utilised for payment of tax dues under the Scheme. 5. Whether this Scheme can be availed in case a search or audit or an inquiry is initiated against the assessee. Ans. No, the assessee cannot avail the benefit of the said scheme if any inquiry or investigation initiated against the assessee and is pending as on the 1st day of March, 2013. 6. Whether a communication from department seeking general information from the declarant would lead to rejection of declaration? Ans: No merely receiving a letter seeking general information from the declarant would not lead to rejection of the application. Unless said letter is issued: i. Under section 14 of the Central Excise Act as made applicable to service tax vide section 83 of the Finance Act,1994. ii. Under section 72 of the Finance Act, 1994 iii. Under rule 5A of the Service Tax Rules, 1994 Other communication from the department would not lead to rejection of the declaration. 7. Whether there is any limit regarding the amount of declaration? Ans: No, there is no monetary limit specified in the Act or rules made under in this behalf.

- 4. 8. If the application made by the declarant is rejected, can an inquiry against the declarant be initiated by the department? Ans: Yes, an inquiry can be initiated if the declaration is rejected as there is no restriction in this regard. The information furnish by the declarant can form the basis of initiation of inquiry against the same. CREATED BY TEAM PGC PROGLOBAL CORP WWW.PROGLOBALCORP.COM Proglobalcorp.wordpress.com Email:proglobalcorp@gmail.com