Risk&return

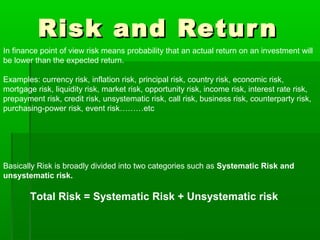

- 1. Risk and ReturnRisk and Return In finance point of view risk means probability that an actual return on an investment will be lower than the expected return. Examples: currency risk, inflation risk, principal risk, country risk, economic risk, mortgage risk, liquidity risk, market risk, opportunity risk, income risk, interest rate risk, prepayment risk, credit risk, unsystematic risk, call risk, business risk, counterparty risk, purchasing-power risk, event risk………etc Basically Risk is broadly divided into two categories such as Systematic Risk and unsystematic risk. Total Risk = Systematic Risk + Unsystematic risk

- 2. Systematic Risk Systematic risk refers to that portion of total variability in return caused by factors affecting the prices of all securities. Economic, political, and social changes are sources of systematic risk. Systematic Risk refers is due to various factors which affects the price of all securities. e.g. Recession, war etc

- 3. Systematic RiskSystematic Risk Market RiskMarket Risk IntrestIntrest--Rate RiskRate Risk Purchasing Power RiskPurchasing Power Risk

- 4. Market RiskMarket Risk Variability in return on most common stocksVariability in return on most common stocks that is due to basic sweeping changes inthat is due to basic sweeping changes in investor expectations is referred to as marketinvestor expectations is referred to as market risk.risk. Factors are political, social and economicalFactors are political, social and economical events (Tangible or real events)events (Tangible or real events) MarketMarket psycologypsycology (Intangible events)(Intangible events) e.g.e.g. Equity riEquity risk,sk, Currency riskCurrency risk,, Commodity riskCommodity risk

- 5. IntrestIntrest Rate RiskRate Risk IntrestIntrest rate risks refers to therate risks refers to the uncertainityuncertainity of future market valuesof future market values and of the size of future incomeand of the size of future income caused by fluctuations in the generalcaused by fluctuations in the general level oflevel of intrestintrest rate.rate.

- 6. Purchasing Power riskPurchasing Power risk Purchasing power risk refers to the impact ofPurchasing power risk refers to the impact of inflation or deflation in an investment.inflation or deflation in an investment.

- 7. Unsystematic Risk Unsystematic risk is the portion of total risk that is unique to a firm or Industry. As Unsystematic risk is firm-specific risk that is unique to a security and hence can be eliminated by forming diversified portfolios. Factors such as managementcapability, consumerpreferences,raw material scarcity and labour strikes cause unsystematic variability of returns in a firm.

- 9. Business RiskBusiness Risk The risk that a company will not have adequateThe risk that a company will not have adequate cash flow to meet its operating expenses.cash flow to meet its operating expenses. 1.1. Internal Business Risk e.g. managementInternal Business Risk e.g. management capability,capability, labourlabour strikestrike 2.2. External Business Risk e.g. politicalExternal Business Risk e.g. political policies, geographicpolicies, geographic distrbutiondistrbution,, demographic considerationdemographic consideration

- 10. Financial RiskFinancial Risk Financial risk is the additional risk aFinancial risk is the additional risk a shareholder bears when a company uses debtshareholder bears when a company uses debt in addition to Equity financing.in addition to Equity financing. e.g. liquidity risk, credit riske.g. liquidity risk, credit risk

- 11. Return Return on Investment (ROI) The money that a person or company earns as a percentage of the total value of his/her/its assets that are invested. It is calculated thusly: Return on investment = (Income - Cost) / Cost Return on investment is calculated by dividing net profits after taxes by total assets. Also called rate of return, return on assets. The annual return on an investment, expressed as a percentage of the total amount invested. also called rate of return.

- 12. ActualActual returnreturn actual return is what investors actually receive from their investments. the expected return can be calculated using the following equation: where •E[R] = the expected return on the stock, •N = the number of states, •pi = the probability of state i, and •Ri = the return on the stock in state i. Expected return E[R] = SUM pi * Ri The expected rate of return on a stock represents the mean of a probabilty distribution of possible future returns on the stock.

- 13. Risk-free return is the theoretical rate of return of an investmentRisk-free return is the theoretical rate of return of an investment with no risk of financial loss. The risk-free rate represents thewith no risk of financial loss. The risk-free rate represents the interest that an investor would expect from an absolutely risk-interest that an investor would expect from an absolutely risk- free investment over a given period of time.free investment over a given period of time. According to Capital Asset Pricing Model (CAPM). where: • is the expected return on the capital asset • is the risk-free rate of interest • Coefficient of volatility is the expected return of the market Risk-free return

- 14. Portfolio performance EvaluationPortfolio performance Evaluation MethodMethod 1.1. SharpeSharpe’’s Ratios Ratio 2.2. TrynorTrynor’’ss RatioRatio 3.3. JensenJensen’’s Measures Measure

- 15. SharpeSharpe’’s Reward to variability Ratios Reward to variability Ratio TheThe Share ratioShare ratio oror Sharpe indexSharpe index oror Sharpe measureSharpe measure oror rewardreward--toto--variability ratiovariability ratio is a measure of theis a measure of the excess return unit of risk in an investment asset or aexcess return unit of risk in an investment asset or a trading strategy.trading strategy. S =S = RmRm ––RfRf σσ σ→σ→ Standard deviation or variabilityStandard deviation or variability RmRm→→ Market ReturnMarket Return RfRf→→ Risk free returnsRisk free returns SS→→ SharpeSharpe’’s ratios ratio

- 16. Problems:Problems:----(Sharpe(Sharpe’’s Ratio)s Ratio) ABC and XYZ are two mutual funds. Both ABC and XYZ have sampleABC and XYZ are two mutual funds. Both ABC and XYZ have sample mean ofmean of returnsreturns are .13 and .18 respectively. The respected standardare .13 and .18 respectively. The respected standard deviations are 15% of ABC and 19% of XYZ, while the risk free redeviations are 15% of ABC and 19% of XYZ, while the risk free return isturn is 8%. The mean return for market index is .12.8%. The mean return for market index is .12.

- 17. TreynorTreynor’’ss RewadRewad--toto--volatility Ratiovolatility Ratio TreynorTreynor ratio, also known asratio, also known as TreynorTreynor Index and Reward to Volatility ratio, isIndex and Reward to Volatility ratio, is used to measure the return for risk taken.used to measure the return for risk taken. TreynorTreynor ratio uses the beta or theratio uses the beta or the volatility factor to evaluate the returns rather than the standavolatility factor to evaluate the returns rather than the standard deviation ofrd deviation of portfolio returns.portfolio returns. Reward to volatility ratio is calculated by subtracting the averReward to volatility ratio is calculated by subtracting the average risk freeage risk free portfolio market return from the average portfolio return and thportfolio market return from the average portfolio return and then dividing theen dividing the result by beta value of the portfolio.result by beta value of the portfolio. TrTr = (= (RmRm -- RfRf) / Beta) / Beta WhereWhere RmRm is the portfolio market return andis the portfolio market return and RfRf is the return from a risk freeis the return from a risk free investment like a US treasury bond.investment like a US treasury bond. TrTr→→ TreynorTreynor RatioRatio

- 18. Problems:Problems:----((TreynorTreynor’’ss Ratio)Ratio) For two portfolio A and B given market returns are 0.18 and 0.12For two portfolio A and B given market returns are 0.18 and 0.12. Beta. Beta value for portfolio A is 2.0 whereas for portfolio B is 1.5.Thevalue for portfolio A is 2.0 whereas for portfolio B is 1.5.The risk freerisk free rate is 0.07. Find the better portfolio comparingrate is 0.07. Find the better portfolio comparing TreynorTreynor’’ss ratio.ratio.

- 19. JensenJensen’’s Differential Return Measures Differential Return Measure This measure involves evaluation of theThis measure involves evaluation of the returnreturns that the fund hass that the fund has generated vs. thegenerated vs. the returnreturns actually expected out of the fund given thes actually expected out of the fund given the level of itslevel of its systematicsystematic riskrisk. The surplus between the two. The surplus between the two returnreturns iss is calledcalled alphaalpha ((άά)), which measures the performance of a fund, which measures the performance of a fund compared with the actualcompared with the actual returnreturns over the period. Requireds over the period. Required returnreturn ofof a fund at a given level ofa fund at a given level of riskrisk (Beta) can be calculated as:(Beta) can be calculated as: ERpERp == RfRf + Beta (+ Beta (RmRm -- RfRf)) Where,Where, RmRm isis averageaverage marketmarket returnreturn during the given period.during the given period. άά == ARpARp __ ERpERp HigherHigher άά represents superior performance of the fund and vice versa.represents superior performance of the fund and vice versa. Limitation of this model is that it considers onlyLimitation of this model is that it considers only systematicsystematic riskrisk notnot the entirethe entire riskrisk associated with the fund and an ordinary investor canassociated with the fund and an ordinary investor can not mitigate unnot mitigate unsystematicsystematic riskrisk, as his knowledge of market is, as his knowledge of market is primitive.primitive.

- 20. Problems:Problems:----(Jensen(Jensen’’s Measure)s Measure) Fund A has a sample mean of return 0.13 and fund B has a sampleFund A has a sample mean of return 0.13 and fund B has a sample mean of return 0.18, with the riskier fund B having double the bmean of return 0.18, with the riskier fund B having double the beta ateta at 2.0 as a fund A. The mean return for market index is 0.12, while2.0 as a fund A. The mean return for market index is 0.12, while the riskthe risk free rate on the bond market is 8%. Compute the Jensen Index forfree rate on the bond market is 8%. Compute the Jensen Index for eacheach of the funds and find theof the funds and find the performances.performances.

Editor's Notes

- Return on Investment The money that a person or company earns as a percentage of the total value of his/her/its assets that are invested. It is calculated thusly:Return on investment = (Income - Cost) / Cost

- The expected rate of return on a stock represents the mean of a probabilty distribution of possible future returns on the stock.