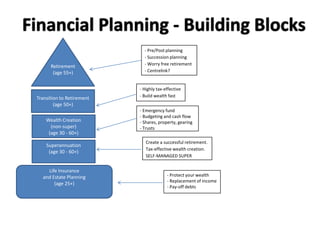

Financial planning building blocks

•Download as PPTX, PDF•

2 likes•1,666 views

Charter Plan's advice process

Report

Share

Report

Share

More Related Content

What's hot

What's hot (20)

Financial Planning - Helping You Sail Successfully into the Future

Financial Planning - Helping You Sail Successfully into the Future

Investing by members of co operatives-a presentation to Saccos

Investing by members of co operatives-a presentation to Saccos

Financial Management PowerPoint Presentation Slides

Financial Management PowerPoint Presentation Slides

Similar to Financial planning building blocks

Similar to Financial planning building blocks (20)

Without Planning - Failure is a Complete Surprise.

Without Planning - Failure is a Complete Surprise.

Adviser information evening australia october 2013 c

Adviser information evening australia october 2013 c

Lwl write a successful business plan [compatibility mode]![Lwl write a successful business plan [compatibility mode]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Lwl write a successful business plan [compatibility mode]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Lwl write a successful business plan [compatibility mode]

Entrepreneurship and startups (Post Covid19 world)

Entrepreneurship and startups (Post Covid19 world)

Recently uploaded

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...Call Girls in Nagpur High Profile

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

Recently uploaded (20)

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

Financial planning building blocks

- 1. Financial Planning - Building Blocks Retirement (age 55+) - Pre/Post planning - Succession planning - Worry free retirement - Centrelink? Transition to Retirement (age 50+) - Highly tax-effective - Build wealth fast Wealth Creation (non-super) (age 30 - 60+) Superannuation (age 30 - 60+) - Emergency fund - Budgeting and cash flow - Shares, property, gearing - Trusts Create a successful retirement. Tax-effective wealth creation. SELF-MANAGED SUPER Life Insurance and Estate Planning (age 25+) - Protect your wealth - Replacement of income - Pay-off debts

- 2. FINANCIAL PLANNING What’s Important To You? Strategy Emotions and behaviour Risk Tolerance Portfolio Management Taxes and other costs

- 3. FINANCIAL PLANNING HUMAN SIDE OF FINANCIAL PLANNING LOGIC SIDE OF FINANCIAL PLANNING What’s important to you - What are your goals (financial and lifestyle)? - What are your values? - What do you want to achieve? - What is your timeframe? Strategy - How should you optimally use your financial resources? - How can you take advantage of superannuation rules? - What structures should you use? - What timing should you apply? Emotions / Behaviour - How do you feel about your options? - What is a good and a bad outcome? - How much help do you need to ‘stay the course’? - We become your ‘financial partner’. Investment Selection & Management - What asset class(es) should you invest in? - Strategic asset allocation or Dynamic/Tactical? - Should you invest directly, or indirectly? - Do you need the help of a specialist? - Do you prefer ‘buy & hold’ or more active management? Risk Tolerance / Attitude - What is your experience with risk and uncertainty - What is your capacity for risk? - How much risk do you wish to bear and how much would you like to offset? Taxes and Costs - How can we help you to reduce your taxes? - How can we keep your investment costs low? WHAT WE DO WHAT WE DON’T DO - Short-term market predictions - Speculation / short-term trading - Promises to ‘beat the market’

- 4. Financial Planning is a journey, not a destination Your Goals & Values Analayse Plan Implement Review We start Here