Weitere ähnliche Inhalte

Ähnlich wie Cob 20080703 1

Ähnlich wie Cob 20080703 1 (12)

Mehr von macavity_d_katt (20)

Kürzlich hochgeladen (20)

Cob 20080703 1

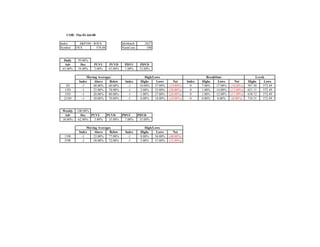

- 1. COB: Thu 03-Jul-08

Index S&P100 - $OEX IdxMatch 2627

Symbol OEX 578.06 NumCons 100

Daily 99.00%

Adv Dec PUVU PUVD PDVU PDVD

65.00% 34.00% 2.00% 63.00% 1.00% 33.00%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 40.00% 60.00% -1 18.00% 37.00% (19.00%) 0 7.00% 17.00% (10.00%) 587.50 572.49

13D -1 22.00% 78.00% -1 2.00% 32.00% (30.00%) 0 1.00% 14.00% (13.00%) 621.11 572.49

55D -1 20.00% 80.00% -1 1.00% 27.00% (26.00%) 0 1.00% 12.00% (11.00%) 658.72 572.49

233D -1 30.00% 70.00% -1 0.00% 18.00% (18.00%) 0 0.00% 8.00% (8.00%) 734.51 572.49

Weekly 100.00%

Adv Dec PUVU PUVD PDVU PDVD

38.00% 62.00% 3.00% 35.00% 7.00% 55.00%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 23.00% 77.00% -1 8.00% 56.00% (48.00%)

55W -1 28.00% 72.00% -1 5.00% 37.00% (32.00%)

- 2. COB: Thu 03-Jul-08

Index Nasdaq100 - $NDX IdxMatch 2510

Symbol NDX--X 1816.35 NumCons 99

Daily 97.98%

Adv Dec PUVU PUVD PDVU PDVD

45.45% 52.53% 0.00% 45.45% 6.06% 46.46%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 24.24% 75.76% -1 7.07% 49.49% (42.42%) 0 3.03% 27.27% (24.24%) 1874.83 1801.66

13D -1 9.09% 90.91% -1 3.03% 45.45% (42.42%) 0 2.02% 26.26% (24.24%) 1993.12 1801.66

55D -1 12.12% 87.88% -1 1.01% 30.30% (29.29%) 0 1.01% 18.18% (17.17%) 2055.82 1801.66

233D -1 25.25% 74.75% 0 0.00% 14.14% (14.14%) 0 0.00% 9.09% (9.09%) 2239.23 1668.57

Weekly 100.00%

Adv Dec PUVU PUVD PDVU PDVD

22.22% 77.78% 3.03% 19.19% 8.08% 69.70%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 12.12% 87.88% 0 3.03% 45.45% (42.42%)

55W -1 24.24% 75.76% 0 0.00% 25.25% (25.25%)

- 3. COB: Thu 03-Jul-08

Index S&P500 - $SPX IdxMatch 3354

Symbol SP-500 1262.90 NumCons 500

Daily 98.20%

Adv Dec PUVU PUVD PDVU PDVD

49.00% 49.20% 1.80% 47.20% 3.20% 46.00%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 27.20% 72.60% -1 8.20% 43.40% (35.20%) 0 2.40% 22.40% (20.00%) 1292.17 1252.01

13D -1 13.00% 87.00% -1 1.00% 38.60% (37.60%) 0 0.20% 18.80% (18.60%) 1366.59 1252.01

55D -1 14.40% 85.60% -1 0.40% 26.40% (26.00%) 0 0.20% 12.40% (12.20%) 1440.24 1252.01

233D -1 24.20% 75.80% -1 0.00% 14.20% (14.20%) 0 0.00% 7.80% (7.80%) 1576.09 1252.01

Weekly 99.60%

Adv Dec PUVU PUVD PDVU PDVD

27.80% 71.80% 4.40% 23.40% 14.00% 57.80%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 17.20% 82.80% -1 5.20% 49.20% (44.00%)

55W -1 24.00% 76.00% -1 3.20% 28.60% (25.40%)

- 4. COB: Thu 03-Jul-08

Index Russell1000 - $RUI IdxMatch 3136

Symbol RUI-X 690.92 NumCons 977

Daily 98.67%

Adv Dec PUVU PUVD PDVU PDVD

40.23% 58.44% 1.94% 38.28% 5.22% 53.22%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 19.65% 80.35% -1 6.45% 54.55% (48.11%) -1 1.84% 31.83% (29.99%) 709.12 685.11

13D -1 8.70% 91.30% -1 0.92% 49.33% (48.41%) -1 0.20% 27.74% (27.53%) 751.26 685.11

55D -1 12.28% 87.72% -1 0.51% 33.06% (32.55%) -1 0.20% 18.22% (18.01%) 788.35 685.11

233D -1 23.34% 76.66% 0 0.10% 17.09% (16.99%) 0 0.00% 10.44% (10.44%) 858.63 684.20

Weekly 100.00%

Adv Dec PUVU PUVD PDVU PDVD

20.47% 79.53% 3.79% 16.68% 13.92% 65.61%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 14.84% 85.16% -1 4.61% 48.93% (44.32%)

55W -1 23.23% 76.77% 0 3.07% 27.74% (24.67%)

- 5. COB: Thu 03-Jul-08

Index Russell2000 - $RUT IdxMatch 3139

Symbol RUT-X 665.77 NumCons 1851

Daily 97.08%

Adv Dec PUVU PUVD PDVU PDVD

32.79% 64.29% 2.11% 30.69% 4.65% 59.64%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 18.48% 81.52% -1 6.16% 53.43% (47.27%) -1 1.89% 30.69% (28.80%) 694.16 660.93

13D -1 10.21% 89.79% -1 0.92% 45.49% (44.57%) -1 0.27% 25.34% (25.07%) 742.81 660.93

55D -1 14.48% 85.52% -1 0.49% 27.98% (27.50%) -1 0.11% 15.07% (14.96%) 763.27 660.93

233D -1 18.37% 81.63% 0 0.11% 14.91% (14.80%) 0 0.00% 8.54% (8.54%) 852.06 643.28

Weekly 99.14%

Adv Dec PUVU PUVD PDVU PDVD

15.99% 83.14% 1.94% 14.05% 5.83% 77.31%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 15.67% 84.33% -1 4.21% 44.73% (40.52%)

55W -1 18.85% 81.15% 0 2.49% 26.85% (24.37%)

- 6. COB: Thu 03-Jul-08

Index Russell3000 - $RUA IdxMatch 3135

Symbol RUA-X 734.05 NumCons 2828

Daily 97.63%

Adv Dec PUVU PUVD PDVU PDVD

35.33% 62.31% 2.05% 33.27% 4.88% 57.43%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 18.85% 81.15% -1 6.26% 53.82% (47.56%) -1 1.87% 31.08% (29.21%) 754.16 727.94

13D -1 9.69% 90.31% -1 0.92% 46.82% (45.90%) -1 0.25% 26.17% (25.92%) 799.67 727.94

55D -1 13.72% 86.28% -1 0.50% 29.74% (29.24%) -1 0.14% 16.16% (16.02%) 836.41 727.94

233D -1 20.08% 79.92% 0 0.11% 15.66% (15.56%) 0 0.00% 9.19% (9.19%) 914.30 725.76

Weekly 99.40%

Adv Dec PUVU PUVD PDVU PDVD

17.50% 81.90% 2.58% 14.92% 8.63% 73.27%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 15.38% 84.62% -1 4.35% 46.22% (41.87%)

55W -1 20.37% 79.63% 0 2.69% 27.19% (24.50%)

- 7. COB: Thu 03-Jul-08

Index S&P400 - $MID IdxMatch 2370

Symbol MID--X 786.80 NumCons 399

Daily 97.99%

Adv Dec PUVU PUVD PDVU PDVD

30.83% 67.17% 2.26% 28.57% 4.76% 62.41%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 13.03% 86.72% -1 6.02% 61.40% (55.39%) -1 2.51% 40.60% (38.10%) 820.52 782.53

13D -1 6.27% 93.73% -1 0.75% 55.64% (54.89%) -1 0.25% 36.09% (35.84%) 877.07 782.53

55D -1 12.53% 87.47% -1 0.50% 33.08% (32.58%) -1 0.25% 20.55% (20.30%) 897.37 782.53

233D -1 24.56% 75.44% 0 0.25% 15.29% (15.04%) 0 0.00% 11.03% (11.03%) 924.07 731.29

Weekly 99.75%

Adv Dec PUVU PUVD PDVU PDVD

11.53% 88.22% 2.51% 9.02% 13.03% 75.19%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 14.54% 85.46% 0 3.76% 44.11% (40.35%)

55W -1 24.56% 75.44% 0 2.76% 22.31% (19.55%)

- 8. COB: Thu 03-Jul-08

Index S&P600 - $SML IdxMatch 3316

Symbol SML--X 351.95 NumCons 599

Daily 97.66%

Adv Dec PUVU PUVD PDVU PDVD

31.89% 65.78% 2.67% 29.22% 2.17% 63.61%

Moving Averages High/Lows BreakOuts Levels

Index Above Below Index Highs Lows Net Index Highs Lows Net Highs Lows

3D -1 17.03% 82.97% -1 3.84% 58.76% (54.92%) -1 1.50% 31.89% (30.38%) 367.06 349.24

13D -1 8.35% 91.65% -1 0.33% 52.75% (52.42%) -1 0.17% 27.55% (27.38%) 392.86 349.24

55D -1 14.19% 85.81% -1 0.17% 30.72% (30.55%) -1 0.00% 14.52% (14.52%) 402.07 349.24

233D -1 19.37% 80.63% 0 0.17% 14.52% (14.36%) 0 0.00% 7.68% (7.68%) 444.80 339.99

Weekly 98.50%

Adv Dec PUVU PUVD PDVU PDVD

15.03% 83.47% 2.17% 12.85% 6.01% 77.46%

Moving Averages High/Lows

Index Above Below Index Highs Lows Net

13W -1 15.69% 84.31% -1 3.51% 42.90% (39.40%)

55W -1 20.37% 79.63% 0 2.17% 23.21% (21.04%)