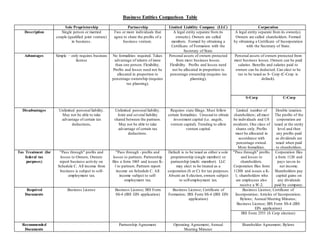

Business entity chart

•Download as DOCX, PDF•

2 likes•2,288 views

Summary of different startup legal entities

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

What is a tax audit, procedure and objectives of tax audit

What is a tax audit, procedure and objectives of tax audit

Anti money laundering and combating the financing of terrorism (AML/CFT) REGU...

Anti money laundering and combating the financing of terrorism (AML/CFT) REGU...

Similar to Business entity chart

Similar to Business entity chart (20)

Accounting Basic for Attorney - Accounting for Different Business Entities

Accounting Basic for Attorney - Accounting for Different Business Entities

M4A1 Keno Enriquez posted Mar 5, 2018 1146 AMC CorporationsC .docx

M4A1 Keno Enriquez posted Mar 5, 2018 1146 AMC CorporationsC .docx

More from Ken Berkun

More from Ken Berkun (9)

Recently uploaded

Recently uploaded (20)

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

CASE STYDY Lalman Shukla v Gauri Dutt BY MUKUL TYAGI.pptx

Sangyun Lee, Duplicate Powers in the Criminal Referral Process and the Overla...

Sangyun Lee, Duplicate Powers in the Criminal Referral Process and the Overla...

Cyber Laws : National and International Perspective.

Cyber Laws : National and International Perspective.

A SHORT HISTORY OF LIBERTY'S PROGREE THROUGH HE EIGHTEENTH CENTURY

A SHORT HISTORY OF LIBERTY'S PROGREE THROUGH HE EIGHTEENTH CENTURY

judicial remedies against administrative actions.pptx

judicial remedies against administrative actions.pptx

Business entity chart

- 1. Business Entities Comparison Table Sole Proprietorship Partnership Limited Liability Company (LLC) Corporation Description Single person or married couple (qualified joint venture) in business. Two or more individuals that agree to share the profits of a business venture. A legal entity separate from its owner(s). Owners are called members. Formed by obtaining a Certificate of Formation with the Secretary of State. A legal entity separate from its owner(s). Owners are called shareholders. Formed by obtaining a Certificate of Incorporation with the Secretary of State. Advantages Simple – only requires business license No formalities required. Takes advantage of talents of more than one person. Flexibility. Profits and losses need not be allocated in proportion to percentage ownership (requires tax planning). Personal assets of owners protected from most business losses. Flexibility. Profits and losses need not be allocated in proportion to percentage ownership (requires tax planning). Personal assets of owners protected from most business losses. Owners can be paid salaries. Benefits and salaries paid to owners can be deducted. Can elect to be tax to be taxed as S- Corp (C-Corp is default). S-Corp C-Corp Disadvantages Unlimited personal liability. May not be able to take advantage of certain tax deductions, Unlimited personal liability. Joint and several liability shared between the partners. May not be able to take advantage of certain tax deductions. Requires state filings. Must follow certain formalities. Unusual to obtain investment capital (i.e. angels, venture capital). Trending to allow venture capital. Limited number of shareholders; all must be individuals and US residents. One class of shares only. Profits must be allocated in accordance with percentage owned. More formalities. Double taxation. The profits of the corporation are taxed at the entity level and then any profits paid as dividends are taxed when paid to shareholders. Tax Treatment (for federal tax purposes) "Pass through" profits and losses to Owners. Owners report business activity on Schedule C. All income from business is subject to self- employment tax. "Pass through - profits and losses to partners. Partnership files a form 1065 and issues K- l to partners. Partners report income on Schedule C. All income subject to self- employment tax. Default is to be taxed as either a sole proprietorship (single member) or partnership (multi -member). LLC may elect to be treated as a corporation (S or C) for tax purposes. Absent an S election, owners subject to self-employment tax. "Pass through" profits and losses to shareholders. Corporation files form 1120S and issues a K- 1; shareholders who are employees also receive a W-2. Corporation files a form 1120 and pays taxon its net income. Shareholders pay capital gains on any dividends paid by company. Required Documents Business License Business License; IRS Form SS-4 (IRS EIN application) Business License; Certificate of Formation; IRS Form SS-4 (IRS EIN application) Business License; Certificate of Incorporation; Articles of Incorporation; Bylaws; Annual Meeting Minutes; Business License; IRS Form SS-4 (IRS EIN application) IRS Form 2553 (S Corp election) Recommended Documents Partnership Agreement Operating Agreement; Annual Meeting Minutes Shareholder Agreement; Bylaws