Ivo Pezzuto - THE GLOBAL ANALYST JUNE 2015

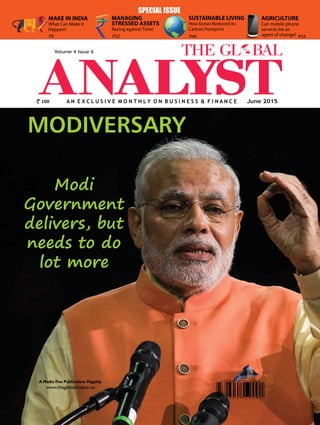

- 1. 1The Global Analyst | JUNE 2015 | A N E X C L U S I V E M O N T H L Y O N B u s i n e s s & F i n a n c e www.theglobalanalyst.co A Media Five Publications Flagship June 2015 Volume 4 Issue 6 MODIVERSARY Modi Government delivers, but needs to do lot more SPECIAL ISSUE 100 MAKE IN INDIA What Can Make it Happen? AGRICULTURE Can mobile phone services be an agent of change?P6 SUSTAINABLE LIVING How Ecova Reduced its Carbon Footprint P54 MANAGING STRESSED ASSETS Racing against Time! P32 P44

- 2. The Global Analyst | JUNE 20152 |

- 3. 3The Global Analyst | JUNE 2015 | June 2015 Vol. 4 | No. 6 managing editor - N Janardhan Rao editorial Director - Amit Singh RESEARCH TEAM Surya Prakashini (Proof Reader), Anjaneya Naga Sai Prashanth, Vijaya Lakshmi, Narasimhanan, Karthikeyan, Nagaswara Rao & MSV Subba Rao ADVISORY BOARD Dr. Paritosh Basu, Former Group Controller, Essar Group N Harinath Reddy, Advocate & Sr. Partner, H&B Law Offices (Hyd) Sanjay Banka, CFO, Landmark Group, Saudi Arabia Prashant Gupta, IIT-K, IIM-L, CEO - Edunirvana Dr David Wyss, Former Chief Economist, S&P & Visiting Fellow, Watson Institute at Brown University. NY, US Dean Baker, Economist and Co-founder, Center for Economic and Policy, Washington, US William Gamble, President, Emerging Market Strategies, US Andrew K P Leung, International and Independent China, Specialist at Andrew Leung, International Consultants, Hong Kong M G Warrier, Former GM, RBI Ivo Pezzuto, Management Consultant, Professor, and Author of the Book “Predictable and Avoidable” (Gower) Marketing Head - Amita Singh Sales Head – Mumbai - Freeda Bhati 09987421946 | fgb.tganalyst@gmail.com Sales Head – Chennai - Emmanuel Rozario 098844 91851 | emmir68@yahoo.com Subscription Payment to be made by crossed Cheque/DD drawn in favor of “MEDIA FIVE PUBLICATIONS (PRIVATE) Ltd.” Payable at Hyderabad. kNowledge partner - Target Research & Consulting advertisement enquiries Media Five Publications (P) Ltd. Swarnasri Residency, (HIG 300) 6th Phase, KPHB, Kukatpally, Hyderabad - 500085, India Mobile: +91- 9247 769 383 | 7093004234 | 9247 220795 send your feedback / articles to : editor.theglobalanalyst@gmail.com / mediafivepublications@gmail.com COVER PRICE : Rs. 100/- subscription details (See inside for discount details, p27) By Post By Courier 1 Year (12 Issues) Rs. 1200/- Rs. 1700/- 2 Years (24 Issues) Rs. 2160/- Rs. 3160/- overseas subscriptions 1 Year (12 Issues) $180 2 Years (24 Issues) $330 design & layout - Creative Graphics Designers Printed at Sai Kiran Graphics, RTC ‘X’ Roads, Hyderabad-20. Published on behalf of Media Five Publications (Private) Ltd, # 403, Swarnasri Residency, 6th Phase (HIG 300), KPHB, Kukatpally, Hyderabad 500085. • ©All rights reserved. No part of this publication may be reproduced or copied in any form by any means without prior written permission. • The views expressed in this publication are purely personal judgements of the authors and do not reflect the views of Media Five Publications (Private) Ltd. • The views expressed by outside contributors represent their personal views and do not necessarily the views of the organizations they represent. All efforts are made to ensure that the published information is correct. Media Five Publications is not responsible for any errors caused due to oversight or otherwise. Published & Edited by D Nagavender Rao It doesn’t take much to understand that all is not well with the Indian agriculture. The share of the agriculture sector in the country’s GDP has more than halved in the last two decades and a half – from 32 per cent in the 90s to about 14 per cent now. And though its contribution in the GDP has consistently been declining, more than 60 per cent of India’s population depends on agriculture A WORD From EDITOR Saving Agriculture 1The Global AnAlyst | JUNE 2015 | A N E X C L U S I V E M O N T H L Y O N B U S I N E S S & F I N A N C E www.theglobalanalyst.co A Media Five Publications Flagship June 2015 Volume 4 Issue 6 MODIVERSARY Modi Government delivers, but needs to do lot more SPECIAL ISSUE 100 MAKE IN INDIA What Can Make it Happen? AGRICULTURE Can mobile phone services be an agent of change? P6 SUSTAINABLE LIVING How Ecova Reduced its Carbon Footprint P54 MANAGING STRESSED ASSETS Racing against Time! P30 P42 for their livelihoods. Though the country has made rapid strides in technology, particularly, Information Technology, farming is done still the same old way, resulting into lower productivity and profitability for the cultivators. About 60 per cent of the country’s cultivated area is rain-fed and depend mainly on rainfall, which has been nothing but erratic. Issues like global warming, higher input costs, are posing further challenges to farmers. Growing population, rapid urbanization, changing lifestyles, growing shift to bio-fuels, etc., they have all been ensuring that supplies continue to struggle to keep pace with the rising demand. Given the plethora of challenges facing the sector, there is a need for find- ing solutions that could not only address new and emerging challenges, but which could also have long-lasting impacts. Improving productivity is one solution with GM crops offering a ray of hope, but there is a need to look for more, and perhaps, better alternatives. Against this backdrop, ‘Climate-Smart Agriculture’ emerges as the answer to the problems af- fecting the agriculture sector in the country. The World Bank defines Cli- mate-Smart Agriculture (CSA) as an approach to managing landscapes— cropland, livestock, forests and fisheries—that aims to achieve three outcomes: Increased productivity; Enhanced resilience (reduce vulnerabil- ity to drought, pests, disease and other shocks; and improve capacity to adapt and grow in the face of longer-term stresses like shortened seasons and erratic weather patterns); and, Reduced emissions. The results are already visible. In Haryana, for instance, where this latest technique was introduced five years ago, despite the slow adoption rate, the farmers who have adopted the climate-smart way are benefitting in terms of higher yields, better crop-mix and lower input costs including lower water consumption. CSA approach, according to a Inter Press Service report, not only enables lower input costs including lower water consumption, but also allows to grow better crop-mix (for example, four acres of maize needs only a fifth of the water required for paddy). It also emphasizes on direct seeding instead of sapling transplantation, thus doing away with high labour costs and a week of standing water to survive; besides it also eliminates threat of vulnerability to floods and strong winds due to a weak root system. Citing examples of farmers implementing CSA technique, the report says that the new method also gives shorter-cycle harvests and vegetables are grown as a third annual crop, translating into higher income for the farmer. These farmers also use technology like the laser land leveler, which produces exceptionally flat farmland, which ensures equitable distribution and lower consumption of water, and other tools like the Leaf Colour Chart and GreenSeeker which help farmers assess the exact fertilizer needs of their crops. Text and voice messages received on their mobile phones about weather forecasts help them to time sowing and irrigation to perfection. While adoption to this technique is slow, expectedly though, there is a need to create greater awareness and provide handholding to farmers, especially small and marginal ones, given the enormity of challenges. Editorial Director ‘Climate-Smart Agriculture’ could be the answer

- 4. The Global Analyst | JUNE 20154 | SMS “HOME” TO 567676 SMS “CAR” TO 567676 P12 Largely On Track With Fulfilling Poll-Time Promises P14 Low Demand, Not Policy, Biggest Problem for India Inc FINANCIAL SERVICES P30 My name is Insurance and I am not an Investment P32 Managing Stressed Assets - Racing against Time! The rule, “Prevention is better than cure” is equally applicable in the case of credit portfolios of banks, as it is for the maintenance of our own health. P58 LIC unveils new policy REALTY SECTOR P26 Real Estate Report Card 9 Impressions Indian Real Estate Stakeholders Have about Modi Government - And JLL’s Take. P34 Is Your Home Safe From Earthquakes? Over the years, increasing concerns about earthquake resistance have led scientists and engineers to invest R&D resources and considerable funding into methods to make modern buildings earthquake proof. 1The Global AnAlyst | JUNE 2015 | A N E X C L U S I V E M O N T H L Y O N B U S I N E S S & F I N A N C E www.theglobalanalyst.co A Media Five Publications Flagship June 2015 Volume 4 Issue 6 MODIVERSARY Modi Government delivers, but needs to do lot more SPECIAL ISSUE 100 MAKE IN INDIA What Can Make it Happen? AGRICULTURE Can mobile phone services be an agent of change?P6 SUSTAINABLE LIVING How Ecova Reduced its Carbon Footprint P54 MANAGING STRESSED ASSETS Racing against Time! P30 P42 EXECUTIVE SUMMARY P52 Low oil prices & monetary easing triggering modest acceleration of global recovery Low oil prices and monetary easing are boosting growth in the world’s major economies, but the near-term pace of ex- pansion remains modest, with abnormally low inflation and interest rates pointing to risks of financial instability. PERSPECTIVE : E-COMMERCE P36 Myntra’s Mantra - App-only Platform : But, Can it be the New Holy Grail? Myntra’s, India’s largest online fashion store, decisiontoembracethemobile‘app-only’model doesn’t sound too convincing, notwithstanding the hype surrounding its latest platform. BANKING : EARNINGS SEASON P38 State Bank of India P40 Punjab National Bank P40 Syndicate Bank P41 Oriental Bank of Commerce P42 State Bank of Hyderabad ENVIRONMENT & YOU P44 Sustainable Living : How Ecova Reduced its Carbon Footprint by 1.49 per cent P45 PepsiCo’s Safe Water Network How the F&B giant is delivering access to safe water? COVER STORY P8 MODIVERSARY Modi Government delivers, but needs to do lot more As Modi Government celebrates its first year in office, comparisons, criticisms, accolades and admirations have been pouring in from across the country. While PM Modi has delivered on 3G: Governance, Growth and Growing Global Presence (of India), his government faces a slew of challenges as it enters its second year in office, with the biggest being creating large-scale jobs and reviving rural economy. REGULARS P50 BUSINESS BRIEFS P56 BOOKSHELF CORPORATE WORLD P46 Junna Solar Systems - Harnessing Solar Power CONTENTS INSIGHTS P54 AGRICULTURE : Can mobile phone services be an agent of change? Yes, says a Vodafone study which identifies six mobile services with the potential to transform Indian farmers’ lives and livelihoods. The report claims that these services could increase an estimated 60 million Indian farmers’ annual incomes by an average of US$89 a year in 2020.

- 5. 5The Global Analyst | JUNE 2015 |

- 6. The Global Analyst | JUNE 20156 | The government’s role as building the arena for the ‘Make in India’ initiative, defining the rules of the game, and constructing the infrastructure (physical and digital) would be critical, going forward. SHASHANK TRIPATHI, PwC Strategy Consulting Leader ‘MAKE IN INDIA’ What Can Make it Happen? BUSINESS ENVIRONMENT SMS “HOME” TO 567676 SMS “CAR” TO 567676

- 7. 7The Global Analyst | JUNE 2015 | TGA MAKE IN INDIA P wC recently launched a marque thought lead- ership “Future of India – The Winning Leap” where we set out to understand what it would take for India to increase its GDP by 9 per cent per year to become a 10-trillion-USD econo- my over the next two decades. The last electoral man- date for development was a more immediate signal of India’s desire for growth and for the benefits of growth to be extended to all members of society. A 9 per cent GDP growth rate with a per capita income rising from US$1,500 to just under US$7,000 per year will boost qual- ity of life for more than 1.25 billion citizens. This would be the largest national development effort any democ- racy has ever attempted. One of the most significant campaigns initiated by the new Government has been the ‘Make in India’ initiative, which seeks to position India as a best-in-class manu- facturing destination, supplemented by all the support systems and investments necessary to make it a practical reality. A key point that Prime Minister Narendra Modi stressed at the time of launch was the need to restore the faith of the home-grown industrialists to invest in India. Additionally, the campaign was also originally devised to help guide foreign investors on all aspects of regula- tory and policy matters along with facilitation in approv- als and clearances. Unblocking Bottlenecks However, as history suggests, India, has a reputation of being a difficult market in which to do business. Invest- ment plans are often abandoned, not because the idea lacks merit but because the business environment pres- ents too many barriers. Regulations for tax compliance and audits, along with labor laws and constantly chang- ing government policies, create unnecessary complex- ity. India has historically performed poorly on various benchmarks gauging the business environment, as indi- cated by the World Bank’s Ease of Doing Business rank- ing. Currently, India ranks 142 out of 189 countries, be- low countries such as Indonesia, Brazil, and China. The reasons for its poor performance are straightforward: un- necessary costs, the difficulty of complying with complex regulations, and frequent delays in regulatory decisions. Areas such as starting a business, paying taxes, and en- forcing contracts significantly depress India’s overall ranking. For instance, contract risk, in India, is a problem that cas- cades through the larger economy. One of its repercus- sions is that companies often have difficulty quantifying the risk of their business relationships. New businesses must go to extraordinary lengths to prove that they would be a reliable partner, an effort that often hampers their growth and expansion. Complex business activities that require multiple, interlinked commercial agreements have also become substantially riskier. In the modern in- dustrial supply chain, there may be hundreds of service, maintenance, delivery, and other agreements between numerous companies. One minor dispute that rapidly escalates could be enough to disrupt all other companies along the supply chain. Without any guarantee that this dispute could be readily resolved, the disruption could extend for years, destroying value for all involved. This is just one example of how India’s business environ- ment puts the country at a clear disadvantage relative to other countries it competes with for foreign investment. Through ‘Make in India’ initiative, the Government could look to support an economic system that contrib- utes to development while promoting fair and effective regulation that conforms to the nation’s unique business and social climate. Learning from a few Manufacturing Success Stories Our research indicates that the countries which have boosted their per capita GDP have done so by making the shift in focus from low to high-tech industries. Take South Korea, where the per capita GDP grew 20-fold from 1963 through 2013. The nation achieved this growth in part by developing the manufacturing capabilities es- sential for high-tech industries, which now dominate its manufacturing landscape. Our analysis shows that val- ue-added manufacturing can grow to 20 per cent by 2024 and to greater than 25 per cent in 2034 if India can step up its manufacturing competitiveness. Besides removing the regulatory hurdles, strengthening manufacturing skills training will also prove crucial. Im- porting foreign technology can help Indian manufactur- ers strengthen their capabilities that will help achieve the true potential of the Make in India campaign. This has to be augmented by stepping up investments in R&D, which will have to grow from its current 0.8 per cent to 2.4 per cent of the GDP in 2034 to achieve the desired gains. Growth can also be pushed through improvements in labor productivity that translate from domestic re- forms and through opening up of the economy to foreign participation – which encourages technological spill-over from international markets to India. To achieve such un- precedented growth, the country may need to increase its annual investments to six times the figures in 2014, while the amount of FDI flowing into India would have to more than double as a percentage of GDP by 2034. Critical Factors The global community has viewed India through the twin lenses of admiration and skepticism — admiring this vast nation for its democratic values and cultural heritage while expressing concerns about pervasive cor- ruption, fickle business rules, and slow pace of change. “Make in India” is one of the pioneering initiatives that aims to marshal and channelize India’s resources toward a common vision and purpose. The government’s role as building the arena for the “Make in India” initiative, defining the rules of the game, and constructing the in- frastructure (physical and digital) would be critical go- ing forward. While the government will create the envi- ronment for this achievement; the private sector should shoulder responsibility for generating and executing the vision within that environment.

- 8. The Global Analyst | JUNE 20158 | As Modi Government celebrates its first year in office, comparisons, criticisms, accolades and admirations have been pouring in from across the country. While PM Modi has delivered on 3G: Governance, Growth and Growing Global Presence (of India), his government faces a slew of challenges as it enters its second year in office, with the biggest being creating large-scale jobs and reviving rural economy. COVER STORY MODIVERSARY Modi Government delivers, but needs to do lot more The Global Analyst | JUNE 20158

- 9. 9The Global Analyst | JUNE 2015 | 1YEAR OF MODI GOVT O n May 16, Prime Minister Narendra Mo- di-led NDA government completed a year in office. It was exactly a year ago that riding on the Modi wave, BJP and its allies swept the Lok Sabha elections, reg- istering a massive victory. Indeed it was the charisma of Modi which helped BJP romp home, securing an ab- solute majority in the Lok Sabha 2014 elections with a tally of 282 seats, thereby also becoming the first politi- cal party to achieve this feat in the last 30 years. Modi factor was at work again as the BJP won elections in key states of Maharashtra, Jharkhand and Haryana, besides it also successfully formed a coalition government in J&K, another first for the party. If the rise of Modi to the centre stage of the national politics was dramatic, his soaring popularity, first on the national stage, and then in the global arena, has been equally amazing. In fact, his growing stature as the world leader has been nothing short of phenomenal to say the least. Lifting sentiment, reviving economy While a year is too short a period to evaluate a govern- ment’s work, especially when it also happens to be the very first year in office, yet, there is absolutely no doubt that the Modi government has done a remarkable job in many areas. When PM Modi took the reins of the gov- ernment at the centre the economy was in bad shape. In the previous two years before the NDA government came to power in May 2014, the economic growth was stand pressure amidst a surging dollar, which has been gaining against most international currencies in re- cent times, and lower inflation too provided the much needed succor to the government to push its reforms agenda, they in no way take away the credit from the government for the massive efforts it has put in, and which are still under way, to lift the sentiment and re- vive the economy, initiate timely measures to improve situation in the hinterland and help farmers who have been hit hard by the recent bad weather conditions in- cluding unseasonal and uneven rains, and hailstorms in several parts of the country, besides taking several steps to ensure that Bharat (rural India) grows along with (urban India). But Modi is awaiting a bigger test as fears of poor mon- soon this year loom. Prices of food grains, fruits & veg- etables have already firmed up, making many of the food items beyond reach of poor and needy. Whatever official inflation indices suggest, the fact of the matter is that common man is already bearing the brunt of surg- ing food prices and the government needs to come out with remedial measures without wasting any further time. In fact, it also needs to take some robust measures in strengthening storage, pilferage-proof transportation and effective distribution of food items through PDS. Social security schemes, a huge success One program that needs special mention for its remark- able work is social security, or financial inclusion. The below par, with the GDP registered recording two successive years of below 5 per cent growth – first such instance of longest spell of below par growth in the last 25 years. In contrast, the Indian economy has grown at 7 per cent plus rate in the last two quarters – September and December – and is expected to re- peat the feat in the March quarter as well, which has also prompted many international organizations such as IMF, World Bank and Moody’s to forecast the Indian economy growth to even surpass that of China, the world’s fastest growing economy so far in the last several years. The miraculous turn- around in the Indian economy is at- tributed to the strong reforms push of the Modi government. While his government has ben- efitted from factors such as lower international crude oil prices for most of the second half of 2014 and early 2015, stronger foreign portfo- lio inflows into the domestic capital market, which helped rupee with- Source::niticentral.com

- 10. The Global Analyst | JUNE 201510 | MODIVERSARY Modi government has also em- barked on an ambitious social secu- rity program or financial inclusion mission to take banking/financial services to the door steps of the com- mon man, the unbanked people in the form of nation-wide campaigns such as PMJDY (Pradhan Mantri Jan-Dhan Yojana), PMJJBY (PRAD- HAN MANTRI JEEVAN JYOTI BIMA YOJANA), PMSBY (Pradhan Mantri Suraksha Bima Yojana), and Atal Pension Yojana (APY), which have been huge successes so far. Though critics have been quick to question the successes of these schemes, with major criticism be- ing that a majority of the accounts opened under PMJDY have hardly seen any transactions or are lying dormant, post-launch, the question is – can government be questioned for the non-transaction or non- maintenance of those accounts? The Modi government has indeed done a commendable job of tak- ing these services to the common man in perhaps no time since tak- ing over. And it is expected that his government would also take appropriate steps to address the concerns raised in some quarters in due course of time. Further, there is a need to improve the quality of service to customers at these finan- cial services organizations to help in customer retention, besides encour- aging more people to benefit from these programmes. The govern- ment has also done good work in the area of subsidy reforms. Thanks to the DBT (Direct Benefit Transfer) scheme, it has been able to ensure to a great extent that the benefits of subsidy reach the intended benefi- ciaries. Its effort in asking rich and influential to give up subsidy on their LPG connections is also a wel- come move. But where Modi gov- ernment earns more appreciation is its efforts in instilling confidence among foreign investors. Indeed, it’s the Modi effect that has seen a number of global corpora- tions lining up investments in a big way. Be it PM Modi’s vision of promoting India as a global manu- facturing hub with the launch of the famous ‘Make in India’ campaign, or Digital India, or his Smart Cit- ies project, or his hugely popular Swachh Bharat Mission, these pro- grams are not mere slogans but are well-articulated, well thought-out initiatives aimed at making India a world leader, which also have the world sit and take notice. The NDA government at the centre has also done well when it comes to improv- ing India’s ties with key interna- tional allies including its neighbor- ing nations. Improves governance, yet more steps needed Modi government’s biggest achieve- ment, however, is in the area of gov- ernance, though, there is still a lot needs to be done to ensure an open, effective and accountable adminis- tration. An important step for Good Governance, Modi had said in one of his addresses, is simplification of procedures and processes in the government so as to make the entire system transparent and faster. In a speech he made last year on December 25th, which his govern- ment declared as ‘Good Gover- nance Day’, the PM said that initia- tives like new web portals mygov.in and interact with the PM to reach to the people directly, which evoked unprecedented response, “places a large responsibility upon us, and I assure you, my countrymen that we will not let you down”. “The effort to usher in an era of Good Gover- nance has just begun, and begun on Source::mintSource::mint

- 11. 11The Global Analyst | JUNE 2015 | 1YEAR OF MODI GOVT a very promising note. An open and accountable administration is what we had promised to deliver and we will do so,” Modi assured. Howev- er, it needs to be reiterated that one year is too short a time to assess the success of many big-ticket measures launched by the government in its first year in office, and that it needs to be given some time for effectively delivering on the same. Programs like Make in India and Digital India need massive efforts, investments and conducive climate. Global geo-political developments such as Greece Crisis and troubles in Euro Zone, the expectations of withdrawal of the quantitative eas- ing, which is stoking fears of a rate rise in the US by the end of the year, ongoing tensions between Russia and Ukraine and other parts of the globe, besides fears of a rise in in- ternational crude oil prices present formidable challenges to the gov- ernment. Besides, And then there are challenges on the domestic front as well. Forecast of a below average monsoon does not augur well for the economy. A below normal monsoon could only worsen situation for the ag- riculture sector and hence rural economy, which could make the job of the government tougher as it’s working hard to rein in infla- tion, particularly food inflation. It goes without saying that contain- ing inflation along with job creation remain two major challenges before the Modi-led NDA government at the centre. The government also needs to step up efforts to create more jobs, which will require it to kick start industrial growth in the country, by bringing in fresh investments, by way of cap- ital formation, by boosting exports, and so on. Its focus on skill develop- ment must be supported by creation of jobs opportunities for the youth and the unemployed. Another area that needs immedi- ate attention is social-sector spend- ing. It’s worrisome that social- sector spending as a percentage of the gross domestic product (GDP) has been in a decline, falling to its lowest levels since 2010, suggests a report in business daily Mint. The government needs to take correc- tive measures, giving it (the issue) a top priority. Education sector is another segment which needs ur- gent action on part of the central government. The paper further re- ports that spending on education sector has fallen below 3 per cent of GDP, including food subsidies. It’s much below the 6 per cent level promised by his party in its election manifesto. It’s time for bold measures There is no doubt the Modi gov- ernment faces the challenge of ‘outsize expectations’, however, it must make efforts not to get bogged down by the same, look beyond mere sloganeering, and instead focus on introducing bold reforms, taking steps to revive ru- ral economy, increase spending on infrastructure including social in- frastructure development, and de- livering the goods which reach and benefit the common man. The NDA government at the centre faces a slew of challenges as it en- ters its second year in office, with the biggest being creating large- scale jobs and reviving rural econ- omy. Surely, the second year in of- fice could be a make or break year for the Modi government. Source::niticentral.com Ushering in Reforms India is embarking on ushering in game-changing reforms through the use of Jan Dhan, Aadhar and Mobile (JAM), a unique combination of three to implement direct transfer of benefits. This innovative methodology will allow transfer of benefits in a leakage-proof, well-targeted and cashless manner. There would be cut in subsidy leakages but not in subsidy themselves. NDA Government has built a national consensus and introduced a Bill to amend the Constitution to implement the Goods and Services Tax (GST). The GST will put in place a state-of-the-art indirect tax system by 1st April, 2016. This will create a unified and common domestic market by replacing a confusing array of taxes and preventing their cascading effects. The Government has started a unique scheme called Sansad Adarsh Gram Yojana, encourage MPs to take ownership of a village in their constituency and develop this as a model village. It motivates parliamentarians to ensure holistic development of their constituency rising above specific schemes. The Government has approved the MoPNG proposal to supply pooled Natural Gas at uniform delivered price to all grid connected gas based fertilizer plants for urea production. It has also approved the scheme for utilization of stranded gas based power generation capacity which was a joint proposal from MoPNG and Ministry of Power and will help in revival of 16000 MW stranded gas based power plants. TGA Source::narendramodi.in

- 12. The Global Analyst | JUNE 201512 | Largely On Track With Fulfilling Poll-Time Promises As the Modi Government completes its first year in office, there is no dearth of bouquets and brickbats for the NaMo regime in the media. On analysing the Modi government’s electoral assurances, the actions taken so far and the respective timelines being followed to achieve these, I would say that it is reasonably on track with fulfilling its short-term, medium-term and long-term promises. I mportantly, the continuation of the previous government’s policies like Land Acquisition and Rehabilitation and Resettlement (LARR) Bill, Real Estate (Regulation and Development)Billwillhavesignificantimpact on the real estate industry once these are passed by the Parliament. India’s historically opaque real estate sector will move towards more transparency with the introduction and implementation of these key policies. It is worthwhile to reflect on the grassroots-level transformation we can expect to see when: • Millions of home buyers in towns and cities and farmers across the country (the latter being landowners affected by infrastructure projects) are empowered with the clauses in the real estate regulatory bill and LARR • Investment opportunities in office spaces open up for small retail investors thanks to REITs • The quality of life of millions of Indian citizens is upgraded when the proposed 100 smart and sustainable cities come to life. • ‘Benami’ transactions, which have for the longest time been a bane of the real estate sector, are eliminated Let us take a look at the progress on some of the promises Narendra Modi’s party made in its electoral manifesto. Specifically, we will isolate promises which have direct bearing on enhanced governance and reinforced democratic fundamentals, which are important for India’s development and future-readiness: Promises On Track Transparency: Re-auctioning of coal blocks earned the government huge revenues Efficiency: Real-time effort towards rendering the existing institutional frameworks more efficient; a good example being the change in Food Corporation of India’s food procurement and storage mechanisms. Productivity And Accountability: Narendra Modi has been directly involved in monitoring and raising the productivity as well as efficiency of his ministry officials. He is clearly bucking a chronic trend of bureaucratic unavailability and aiming to increase public access to government officials Black Money: The Black Money Bill has given a moratorium period to bring back unaccounted money into the system by paying normal tax. The ongoing dialogue with the Swiss financial authorities to disclose secret accounts of Indians abroad is reaping results Corruption: Wired (online) transactions are now being encouraged for property transactions. This is a major step forward for curtailing black money in the sector Investor Confidence: Market confidence has improved with the strengthening of the Indian equity, debt, currency markets and equal tax regime that was promised to both domestic as well as international investment companies Positioning India: Via a series of international tours, the PM is helping India rid itself of its anti- MODIVERSARY ANUJ PURI, Chairman and Country Head at JLL India

- 13. 13The Global Analyst | JUNE 2015 | investor image and is opening up new avenues of foreign business in India, especially under the ‘Make in India’ campaign Decentralisation And Cooperative Governance • Gradual increase in the financial autonomy of states • Farmers get real-time information on Minimum Support Price through digital channels and Kisan TV. Drastic price movements have been largely under control. A focus on citizen outreach programmes as well as leveraging social media have bought people closer to the governance process. Promises That May See Progress Soon • States with similar problems will be able to form councils under Niti Aayog to discuss common concerns • Niti Aayog, along with other national agencies, will help individual states in mobilisation of resources. Promises That Saw Little Or No Progress Relaxing clauses in the Land Acquisition and Rehabilitation and Resettlement Bill (LARR), Real Estate Investment Trusts (REITs) and Foreign Direct Investment (FDI) policies that investors find difficult to follow • Increased credit facilitation to start-ups • Initiation of employment exchange programmes with other countries • Obsolete laws to be scrapped or modified • Online dissemination of court cases for better monitoring and creation of specialised courts to fast-track delivery of justice. In short, the Modi Government has a fairly balanced list of hits and misses so far. The trend does seem to lean more towards action than inaction. It definitely seems that Modi has every intention of living up to the larger part of his electoral promises in the future. I agree with Reserve Bank of India (RBI) Governor Raghuram Rajan when he says that the expectations from the new government when it came to power last year were ‘probably unrealistic’, and that it has in fact taken steps to create an environment for investment and is sensitive to concerns of investors. Industry Inc. CEOs Praises Modi Government’s First Year In its first year, the Government led by Prime Minister Narendra Modi has turned around investor sentiment and taken strong action across multiple sectors for scripting a new growth narrative. - Chandrajit Banerjee, Director General, CII Modi government has been successful in putting India on the global map for investment. - Tulsi Tanti, Chairman, Suzlon Group The government in the past year has taken unprecedented and innovative steps of a scale that could not have been envisaged earlier. They have succeeded in changing the economic calculus of the country by demonstrating that 120 million bank accounts can be opened at short notice or 4 lakh toilets can be built in schools in a year and so on. - Adi Godrej, Chairman, Godrej Group The government under Mr Modi has been moving steadily and purposefully in creating a climate where it is easy to do business. We have to give them enough time and have patience. Rome wasn’t built in a day! - Venu Srinivasan, Chairman & MD, TVS Motor We are highly encouraged by the series of actions and policy reforms taken by the government in the last one year. The government has been successful in improving the state of the economy and setting the foundation for long term higher growth and development. Several path-breaking measures have been announced, notably the introduction of social security net for all citizens, rationalisation of corporate tax rates and implementation of GST by April next year. - Jyotsna Suri, President, FICCI The government has exceeded our expectations and has achieved more in the first year than any other government has achieved in their first year. The government’s emphasis on lower tax rates and introduction of GST in coming year will greatly enhance competitiveness of the Indian industry - Sumit Mazumder, President, CII Reformssofarannouncedshouldseetheirimplementation on ground level so that ease of doing business at grassroots is further facilitated. The coordination of the Centre with states needs to be cemented for which the central government alone has to take a call. - Alok B Shriram, President, PHD Chamber The NDA administration has its ears to the ground and knows well what needs to be done, but what it lacks is the acumen for execution. For instance, it knows that governance is an issue for public sector banks, which account for 70 per cent of the banking industry’s assets, and this is why it has split the top post between a chairman and a managing director to avoid concentration of power, but it has not been able to appoint any chairman so far. - Tamal Bandyopadhyay, Consulting Editor, Mint 1YEAR OF MODI GOVT

- 14. The Global Analyst | JUNE 201514 | LOW DEMAND, NOT POLICY, BIGGEST PROBLEM FOR INDIA INC Building blocks being put in place to raise India’s potential-growth rate, says CRISIL. Investment cycle unlikely to restart soon; growth recovery will be a slow process. CRISIL released ‘Modified Expectations’, a report on May 18, 2015, evaluating the economy-related performance of the Narendra Modi-led government as it completes one year in office. Guided by the principle of Antyodaya our government is dedicated to the poor, marginalised and those left behind. We are working towards empowering them to become our soldiers in the war against poverty. Numerous measures and schemes have been initiated: from making school toilets to setting up IIT’S, IIM’S and AIIMS. From providing a vaccination cover to our children, to initiating a people driven swachh bharat mission; from ensuring a minimum pension to our labourers to providing social security to the common man; from enhancing support to our farmers hit by natural calamities to defending their interests at WTO. - Narendra Modi, Prime Minister MODIVERSARY

- 15. 15The Global Analyst | JUNE 2015 | T he report assesses India Inc’s performance in the first nine months of fiscal 2015 using unique metrics of demand, debt and policy. The findings belie some popular narratives. It highlights how the government is putting in place building blocks that will improve India’s crucial potential-growth rate, and explains why it will take longer than expected for the investment cycle to kick-start. CRISIL analysed the results of 411 companies from the National Stock Exchange’s CNX 500 index (excluding those from the BFSI and oil & gas sectors), which together account for 90 per cent of the market capitalisation of the bourse. We compared revenue and operating profit growth with nominal GDP growth (it was 12 per cent in 2014-15), which showed that 69 per cent – or 285 companies out of 411 – underperformed. Says Prasad Koparkar, Senior Director, CRISIL Research: “Our findings are telling. For more than half the companies that underperformed, the main obstacle was poor demand. That flies in the face of the refrain that policy is the biggest bottleneck. Policy was only the No. 3 factor according to our study, affecting just 15 per cent of the companies analysed.” ‘Modified Expectations’ blends CRISIL’s unique expertise in macro- economy, corporate and banking research, and credit ratings to offer a 360-degree view on India. It uses four metrics to evaluate the government: What has worked so far; where are the signs of a pick-up; what hasn’t worked so far; and what lies ahead. The report underlines a host of steps that the government has taken or is taking to address constraints – specificallystructural–togrowth.This, we believe, will ensure that growth sustains beyond fiscal 2016. But major reforms will remain a tough task given the government’s lack of support in Rajya Sabha, and the government will have to show exceptional statecraft to cobble up consensus to pass crucial Bills. Given this, CRISIL believes growth is on a slow grind up in the short term, and will touch 7.9 per cent in 2015-16 if monsoon is normal; else it would flat- line at 7.4 per cent. Says Dharmakirti Joshi, Chief Econo- mist, CRISIL: “The government can’t push demand up in the short term be- cause there is no monetary and fiscal silver bullet. We expect private con- sumption to pick up only gradually this fiscal, which, in turn, will provide some impetus to demand. But it won’t be enough to lift extant capacity utilisa- tion to levels where the private corpo- rate investment cycle needs to be kick- started again. A meaningful recovery in capex is not seen till fiscal 2017.” In the interim, CRISIL believes the government has to pick up the 1YEAR OF MODI GOVT

- 16. The Global Analyst | JUNE 201516 | Why it will be a slow grind up? gauntlet and try to push the investment cycle through public investments. The Union Budget for the current fiscal does propose a more than 50 per cent jump in public spending in infrastructure. On the legislative side, consensus is necessary to push through leg- islations on Goods & Services Tax and land – without much dilution. This will test the gov- ernment’s resolve and statecraft, but they are critical building blocks that will raise India’s ‘potential-growth’ rate. We also look forward to steps that re-kindle agri- culture growth and ame- liorate distress in farms. India badly needs dura- ble solutions to improve farm productivity and the government needs to sustainably address distress through crop in- surance schemes rather than loan waivers. The budget for the current fiscal had announced a lot of reforms with far reaching implications for infrastructure, finan- cial sector and taxation. Progress on these will be a key monitorable. W hen the Narendra Modi-led National Democratic Alliance came to power with a resounding majority last year, it had inherited a frail economy. Twelve months on, the macros are looking better, growth is inching up, inflation has tempered and current account deficit is in the safe zone. Feverish speculation about big-bang reforms and a quick turnaround in the economy are getting the deserved reality check. The recent rise in crude oil prices, possibility of a weak monsoon amid rising rural distress, and the parliamentary logjam over two critical pieces of legislation – onland acquisition and Goods & Services Tax - are also helping rationalise expectations. Winding back, the main reasons for a sharp slowdown in India’s growth since 2012 were the discontinuation of stimulus to rein in rising fiscal deficit and inflation, and policy paralysis that slowed decision making and made it difficult to do business. The Modi government is addressing policy paralysis by energising the bureaucracy, fasttracking decision-making, and enhancing the ease of doing business. This will create enablers for growth, but cannot push demand up in the short term. There is no monetary and fiscal bazooka at hand either – which is also because of the legislative mandate to bring down fiscal deficit. And monetary policy turned mildly favourable only this year. In other words, there is little that can be done to engineer a quick revival in demand. That’s exactly why corporates are shy of undertaking fresh investments, MODIVERSARY

- 17. 17The Global Analyst | JUNE 2015 | as the report show the analysis of the results of CNX 500 companies in the first nine months of fiscal 2015 in the following analysis. The study reveals that private corporate investments picking up only in fiscal 2017. This lack of demand is also reflected in low utilisation of capacities. Net-net, we believe demand will pick up only slowly. And as is the typical progression in such a milieu, consumption demand will improve first, which then will trigger investments. Independent studies done by CRISIL Research and CRISIL Ratings conclude similarly on the outlook for consumption-driven sectors. CRISIL Research data show consumption-linked sectors have done better than investment-linked ones in the last fiscal and will continue to do so in fiscal 2016 as well. CRISIL Ratings’ data on upgrades and downgrades confirm the relative strength of consumption-linked sectors compared with investment-linked sectors. Yet capacity utilisation will be slow to pick up. As for major reforms, given the lack of numbers in Rajya Sabha, It believe the government will have to show exceptional statecraft to cobble up consensus to pass the Bills. These are reasons why we believe India is on a slow grind up. The report evaluated the Modi government’s one-year performance using four metrics: What has worked so far, where are the signs of a pick-up, what hasn’t worked so far, and what lies ahead. The study blends in CRISIL’s unparalleled expertise in macroeconomic, industry, corporate and banking analysis, to offer a 360-degree view on India. The key findings are: 1YEAR OF MODI GOVT

- 18. The Global Analyst | JUNE 201518 | What has worked? • The government has not been able to effect a quick turnaround in the economy but has made prog- ress in putting in place building blocks needed to raise India’s potential growth. Initial steps at improving transparency, en- hancing the ease of doing busi- ness, improving the efficiency of the goods and labour markets, and financial sector reforms will pave way for higher growth over the medium run • Prudent tactical moves have helped keep a tab on inflation even in the bad monsoon year of 2014. Restraint in increasing minimum support prices and release of food grain stocks into the market have helped kept food inflation under control and allowed RBI to cut interest rates Where are the signs of pick-up? • Credit ratio, or the ratio of up- grades to downgrades, is ticking up • Business and consumer confi- dence is also looking up What has not worked? • Difficulty in arriving at a consen- sus carries the risk of delay and dilution of key legislations such as the Land Acquisition Bill and the Goods & Services Tax (GST) Bill • Inability to use policy tools such as interest-rate cuts and fiscal spending to stoke demand • Inability to revive manufacturing and address enhanced rural dis- tress • Our study of CNX500 companies shows that while regulatory is- sues and high leverage constrain corporate performance and in- vestment decisions, lack of de- mand is the singlebiggest factor holding back private-sector in- vestments What lies ahead • Our analysis shows that con- sumption will lead the invest- ment cycle. Lower food and fuel inflation and reduction in inter- est rates will support private consumption. Industry-level granular findings confirm the strength of consumption-linked sectors over investment-led sec- tors. Credit ratings data, too, show that consumption-linked sectors enjoy higher upgrades than investment-linked sectors • With a gradual pick-up in con- sumption demand and public investments in select infrastruc- ture sectors, private investment activity should revive by fiscal 2017 • We expect GDP growth to grind up to 7. per cent, inflation to come down to 5.8 per cent and current account deficit at 1 of GDP in fiscal 2016, given a nor- mal or near-normal monsoon What has worked so far • Macro-economic indicators have improved • Short-term issues that needed fixing are fixed • Early steps taken to improve infrastructure and institutions Macros are improving gradually Over the last one year, several steps have been initiated to unshackle binding constraints to growth. The government has cleared many infrastructure bottlenecks, speeded up decisionmaking, fast-tracked project clearances, cut red tape and sorted out mining issues. These steps, and the fortuitous kicker from a slump in global crude oil prices and the commodity complex, have engineered a moderate turnaround in the economy. Low oil prices have helped rein in inflation and tamed the beast of twin deficits – fiscal and current account. Consequently, GDP growth increased to 7.4 from 6.9 per cent in fiscal 2014, while inflation dropped to 6 from 9.5 per cent, and CAD and the government’s subsidy burden, both nearly fell by 50 basis points as a percentage of GDP, with the latter helping fiscal consolidation. And after a sweatinducing lag, monsoon caught up a lot last year to prevent sharp spikes in food prices. Steps taken to raise India’s ‘potential-growth’ rate: For long- term well-being, a country needs to raise its ability to grow faster without creating inflationary pressures. This is its ‘potential-growth’ rate. There are many factors that combine to increase the potential-growth rate and one of the important ones is competitiveness. The World Economic Forum’s Glob- al Competitiveness Index (Chart 1) shows India’s competitiveness has been continuously eroding in the last six years. Specifically, India ranks poorly in institutions, infrastructure, macroeconomic environment, health and primary education and the effi- ciency of its goods and labour mar- kets. Our assessment shows that the Modi government has identified the ma- jor issues correctly and put in place some crucial building blocks, but it will have to do a lot more. The chal- lenge will be to stay the course yet step on the gas, and get corporates to hitch their wagon to the govern- ment’s star. MODIVERSARY

- 19. 19The Global Analyst | JUNE 2015 | Improving India’s Competitiveness We use the World Economic Forum (WEF) rankings and methodology rooted in Michael Porter’s The Competitive Advantage of Nations (1990) on the stages of development and benchmark India’s growth potential/ competitiveness versus competitors. As per the WEF, the Indian economy is still in the factor- driven stage, and needs to transit from agriculture to manufacturing. For the sixth consecutive year, India’s ranking on the WEF Global Competitiveness Index saw a decline in fiscal 2015, and was the lowest among BRICS nations. Out of 144 countries, India ranks 71 on the overall index, 92 on factor-driven parameters, 61 on efficiency-driven parameters and 52 on innovation and sophistication parameters. While we rank high on innovation (49) and business sophistication (57), we are far behind our competitors on the efficacy of institutions, infrastructure, macroeconomic environment and health and primary education. These are critical for pushing our competitiveness in the factor–driven parameters and for making manufacturing India’s growth engine. It is imperative, therefore, to improve our building blocks. What has been done to raise India’s competitiveness? The Modi government has announced a slew of measures since taking the reins a year back. We analyse what these steps amount to in terms of improving India’s potential growth. We use the likeness of a speedometer to gauge the performance so far – the needle is the starting point and the arrow indicates the direction and extent of reforms. Institutions Efficiency of labour market InfrastructureInfrastructure WEF Ranking, Fiscal 2015 Source:WorldEconomicForum Source:WorldEconomicForum Note: Ranking out of 144 countries 1YEAR OF MODI GOVT

- 20. The Global Analyst | JUNE 201520 | Health & primary education Efficiency of goods market Financial market development Technological readiness Macroeconomic environment Where are the signs of pick-up • Consumption outlook is improving • Higher credit-rating upgrades in consumption- linked sectors There’s promise in higher rating upgrades Ratings data show debt remains a bone in the gullet: CRISIL Ratings’ analysis of data for the second half of fiscal 2015 shows some improvement in the credit ratio, or rating upgrades to downgrades. Almost two-thirds of the 816 upgrades seen in the second half were driven by business-related factors such as scaling-up of opera- tions, and a modicum of improve- ment in demand in consumption- linked sectors. Export-linked sectors and nondiscretionary consumer segments such as agricultural prod- ucts, textiles, packaged foods and pharmaceuticals continued to see the highest upgrade rates. But demand isn’t anywhere close to the levels re- quired to kick-start the corporate in- vestment cycle. Value of debt downgraded far more than that upgraded: On the other hand, there were 466 downgrades in the second half of which almost 60 per cent were attributable to weak liquidity. Investment-linked sectors such as capital goods, construction, engineer- ing, steel and real estate continued to log the highest downgrade rates. However, a pervasive improvement in credit quality remains elusive be- cause the value of debt seeing down- grades is far more than those seeing upgrades. This is reflected in the ra- tio of debt of upgraded firms to that of downgraded firms, which stood at 0.72 times. This proportion is even weaker for large-sized firms at 0.45 times. Also, companies with high debt continue to see more down- grades than upgrades. CRISIL believes heavy burden of debt will continue to constrain the MODIVERSARY

- 21. 21The Global Analyst | JUNE 2015 | ability of large firms to improve their credit profiles. A chunk of their debt was taken for projects/ capacity ex- pansions that haven’t been complet- ed, or are facing demand slack after completion. Essentially, a backwash of irrational expansions undertaken well before the Modi government took the reins. Business and consumer confidence is looking better: Leading and coincident indicators do show initial signs of improvement in investment outlook, especially in consumer- facing sectors. Confidence indicators are looking up, too. The RBI’s quarterly survey covering 1,565 manufacturing com- panies, released in April 2015, shows that industrial outlook has been on a steady uptrend since June 2014. And as per the latest survey, outlook is improving for production, order book, capacity utilisation, cost of raw material, profit margins and employ- ment, though it remains dismal for exports and price-setting. The indicators of private consump- tion are also showing a steady up- tick. One, the RBI’s consumer confi- dence survey results show continued improvement in future expectations on employment and spending. More than 80 per cent of the respondents in the latest survey (March 2015) ex- pect an increase in current as well as future spending perceptions on essential items, while 40 per cent expect an increase in non-essential spending. More than 50 per cent of the respondents expect improve- ment in employment situation one year ahead. Second, inflation expec- tations have eased, positively influ- encing purchase decisions. The RBI’s April 2015 survey results show that inflationary expectations are coming down. Third, retail-loan growth has been rising fast in sectors such as vehicle loans (22 per cent), consumer durables (34 per cent) and housing (18 per cent). Besides, au- tomobiles (passenger vehicles and scooters), organised retail and air- lines are also seeing improved con- sumer demand. Improving credit ratios in consumption-led sectors Business expectations survey Consumer confidence improves Inflation expectations ease Private consumption will provide fillip: We believe private consump- tion could be the bulwark this year, but it will improve only gradually. But this will depend a lot on a normal monsoon. Over the last few years, key contributors to the de- cline in private consumption – high fuel prices, inflation and interest rates – have started to turn around and will continue to do so in fiscal 2016. Lending rates are edging down, too, though by a mere 20 bps or so till now. We believe the push to con- sumption spending from easing of lending rates this fiscal will be small and gradual. Still, this will be posi- tive for interest-rate sensitive sectors such as automobiles, housing and consumer durables. Household spending power has in- creased: CRISIL estimates household spending power has increased by Rs 1.4 trillion in fiscal 2016 because of low fuel prices, benign food infla- tion and steadily improving income growth. This money could be spent on consumer discretionary items if consumers feel the gains as lasting. But if perceived as transient, it could be deployed in savings. However, with real returns on savings expected to rise only mar- ginally this year as nominal interest rates ease and inflation falls, house- holds could spend rather than save the extra money. In nominal terms, the Rs 1.4 trillion increase in the spending power of households is close to 2 per cent of their annual spending. Source:CRISILRatingsSource:RBI,CRISILResearchSource:RBI,CRISILResearchSource:RBI Note: * Current situation compared to a year ago, ** Future expectations for a year ahead Note: 3QMA=3 quarter moving average 1YEAR OF MODI GOVT

- 22. The Global Analyst | JUNE 201522 | What hasn’t worked so far • Inability to pump-prime constrains manufacturing • Investment cycle in limbo, agriculture remains stressed • Consensus to pass key legislations elusive The tyranny of inheritance Inability to pump-prime, having in- herited high fiscal deficit and infla- tion: Typically, a slowing economy is accelerated through deep interest- rate cuts and increase in government spending. But fiscal profligacy of the past and inflationary concerns pre- clude such steps. Public spending is also restrained by the legislative mandate to bring down India’s fiscal deficit-to-GDP ratio. On its part, the Reserve Bank of India (RBI) has cut interest rates by 50 basis points so far in 2015, to 7.5 per cent, but this has not benefited the economy much be- cause the banking sector’s bad-loan mountain increases risk aversion, restricts transmission of interest rate cuts and subdues credit growth. Fis- cal and monetary restraint entails sacrificing growth in the short run, but will eventually foster macro sta- bility and improve India’s ability to sustain higher growth rates in future. Slack demand – and not policy – holding back private investments, especially in manufacturing: De- spite some macros turning green, the investment cycle in India is stuck and demand for a number of consumer goods remains subdued.. CRISIL Research analysed the per- formance of 411 of the CNX 500 com- panies (the rest belong to BFSI and oil & gas sectors, which were exclud- ed), accounting for 90 per cent of the market capitalisation of the National Stock Exchange, and compared their revenue and operating profit growth in the first nine months of fiscal 2015 to nominal GDP growth. It showed 69 per cent, or 285 companies, have performed below par, while 126 com- panies, or 31 per cent, outperformed. While regulatory issues and high leverage are constraining corporate performance, our analysis shows that it is demand slowdown that’s hurting India Inc the most. This is especially true of manufacturing companies. A good 126 companies, or 56 per cent of the 285 underper- formers, are impacted by a demand slowdown (also see Chart 8 on ca- pacity utilisation). The No. 2 factor was intensifying competition, which impacted 45 – or 16 per cent -- of the laggards. Policy was only the No. 3 factor, affecting 42 – or 15 per cent -- of the companies, while high debt or leverage was the No. 4 factor, affecting 29 – or 10 per cent -- of the companies. But from a banking sector perspective, the contribution of highly leveraged companies to total outstanding debt is very high at about 22 per cent. Stagnant manufacturing, stress in agriculture: The ‘Make in India’ programme will take a long while to make a difference to India’s manufacturing sector. But improving growth in the sector is crucial because one million Indians are Poor demand curbs corporates, not so much policy entering the workforce every month and to boot, there is also labour spillover from farms. The agriculture sector, employing close to 50 per cent of the workforce, continues to battle low productivity and a raft of other inefficiencies. Damage due to unseasonal pre-summer rains on the back of a sub-normal monsoon last fiscal has aggravated farm distress (see The criticality of monsoon for hinterland). Consensus to pass key legislations elusive, risking dilution of reforms: The government lacks majority (having only 63 out of 244 seats) in the Rajya Sabha, and the situation is unlikely to change anytime soon. The government will, therefore, need do the hard yards, show statecraft and build political consensus to pass crucial Bills on land and GST that will spawn structural reforms. Consequently, there is a risk the eventual legislations are watered down. Deft political management and effective communication will be essential if the government has to take forward the economy. MODIVERSARY

- 23. 23The Global Analyst | JUNE 2015 | What lies ahead • Debt pile in infra, bad loans will curb speed of recovery • Private consumption growth crucial to investment cycle • Normal monsoon a critical need Expect a slow recovery in fiscal 2016 If monsoon delivers, we expect a 50 bps uptick in GDP growth: We fore- cast India’s GDP growth to touch 7.9 per cent in fiscal 2016, from an esti- mated 7.4 per cent in 2015. The re- covery, as we see it, will be triggered by a lift in private consumption and a mild pick-up in public sector-led infrastructure projects. The key risk to watch out for in the immediate term is a sub-normal monsoon. It can depress rural de- mand and delay the consumption- led recovery that we envisage. The headroom in capacity utilisa- tion needs to close first: We believe that given the current macro-eco- nomic pace, it could be 12-18 months before headroom in capacity utilisa- tion in the manufacturing sector gets closed, and private investment cycle is set in motion. That’s because, despite underlying optimism, companies are chary of putting money where their mouth is; they are seeking affirmations that growth triggers are well-pulled and will stay so. The path growth could take Closing in on a goldilocks spell: We believe a gradual upturn has begun, and indications are there should be steady progress this time (Table 4). And if inflation remains under leash – as it seems now – at least a goldi- locks spell can be had. But with lim- ited counter-cyclical tools available to pump the prime, unlike in 2009, and covenants of fiscal consolidation shackling government spending, the speed of rebound will be limited. Speed will also depend on how do- mestic consumption shapes up. The trifecta of lower food inflation, drop in oil prices – which have left more money in the hands of people in the last 10 months -- and mild easing of interest rates could stoke private consumption that, in turn, will im- prove sales in the automobiles, retail, consumer durables and fast-moving consumer goods sectors. But there is unlikely to be a dramatic change in the wealth effect such that demand would overwhelm extant capacities in the current fiscal. On the infrastructure side, invest- ments will start much earlier – in- deed, in the current fiscal itself – fol- lowing a government-led push to spending in sectors such as roads, railways, irrigation and urban infra- structure. But for private corporate investment in infrastructure to start, resolution of policy bottlenecks, more equitable sharing of risks and rewards with private sector (for PPP projects) and improved demand visi- bility are critical. That will take time, and could turn favourable only after the current fiscal. Highly leveraged corporates, especially in the infra- structure space, would also be averse to taking risks and therefore, the government will have to bear more risks, till private sector cash flows and confidence levels improve. Exports offer no ballast: The global economy is expected to navigate a mild and uneven recovery path in 2015. Muted world trade growth will restrict exports. The World Trade Organisation expects world trade to grow at 3.3 per cent in 2015 and 2016 compared with over 5 per cent recorded since 1990. Also, an appre- ciation in the rupee in real terms has hurt India’s competitiveness. Investment revival is the biggest challenge We do expect a minor uptick in in- vestments in select sectors, especially infrastructure, where government role is dominant. But in manufactur- ing, which is dominated by the pri- vate sector, revival will depend on the speed at which private consump- tion demand improves. Also, some push to investments this year will come from unclogging of projects. Investment revival is inarguably the single-biggest challenge for the Modi government. Over the last few years, investments have trailed GDP growth and the overall investment rate has slipped to 29.8 per cent in It will take 12-18 months for private investment cycle to revive : *Measurement from beginning of fiscal 2016 Source:CRISILResearch 1YEAR OF MODI GOVT

- 24. The Global Analyst | JUNE 201524 | fiscal 2015 from 33.6 per cent in fiscal 2012. The reasons are well known. In the manufacturing sector, swathes of under-utilisation (Chart 8) and poor visibility on demand have slowed the pace of investments. In the infra- structure sector, high leverage and interest costs (the sector’s interest cost to operating income ratio rose to 11.5 per cent in fiscal 2014 from 4.6 per cent in fiscal 2010), falling returns on investment due to delays in proj- ect implementation, and lack of vis- ible demand pick-up are deteriorat- ing private-sector investment. Good thing is, ease of doing busi- ness is improving: Since taking over, the Modi government’s emphasis has been on reviving the investment climate by improving the ease of do- ing business. A number of steps have been taken in this regard. However, the nature of these mea- sures is such that immediate gains would be less than what will accrue in the medium-to-long term. Such steps include launch of online por- tals and monitoring of timelines for providing project clearances and providing licences, consolidation of ministries to ensure faster decision- making and taking the ordinance route to push through the Bills. Re- sults are most visible in the roads sector where debottlenecking has significantly improved the pace of paving. Public spending in infrastructure re- ceived a significant boost in the Bud- get announcements for fiscal 2016 with spending allocation for roads, railways, irrigation and urban infra- structure increasing nearly 1.5 times. However, overall capex spending has not gone up much and hence, only a few sectors are set to benefit from higher government spending. But the private sector will go full tilt on investments only once the de- mand picks up and other factors con- straining it are addressed, so remov- ing them in double-quick time is an imperative. Growth in investment-linked sectors has lagged consumption-driven sec- tors in the past few years. And we believe this gap will widen further in fiscal 2016. Source:CSO,RBI,CRISILResearch Note: F=CRISIL forecast Better-looking colours of the macro-economy The capacity utilisation picture Revenue growth to be higher for consumption-linked sectors Note: Utilisation rate for automobiles is the average for passenger cars, two-wheelers, commercial vehicles and tractors Source:CRISILResearch Note: F=CRISIL forecast Source:CRISILResearch The criticality of monsoon for hinterland Our views are predicated on a par monsoon: The IMD has predicted a 7 per cent rainfall deficiency (south- west monsoon) in 2015, and going by international weather forecasters, El Nino conditions – which typically distorts spatial distribution of mon- soon – have emerged. An important assumption in our growth estimates is that rainfall will be normal or near- normal this fiscal. Deficient monsoon will cull 50 bps from GDP growth: According to our calculations, a deficient monsoon will take away 50 basis points from our GDP forecast of 7.9 per cent for fiscal 2016. This is the worst-case scenario. But, we go by the assumption that al- though some monsoon deficiency is predicted in 2015, spatial distribution of rainfall could still be normal, lead- ing to a normal agriculture year, as past experience shows. For instance, in the last 15 years, there were two years when rainfall deficiency was 7-10 per cent - similar to the Indian Meteorological Department’s (IMD) MODIVERSARY

- 25. 25The Global Analyst | JUNE 2015 | forecast for 2015 - but in these years agriculture production did not suffer because rainfall was timely and well distributed. Also, the latest forecast is the IMD’s first forecast and more reliable ones will only be available in June. Angst in rural India: Last fiscal, monsoon deficiency was 12 per cent, with some regions facing acute short- age of rains. In March and April 2015, unseasonal, pre-summer rains dam- aged crops in regions already reeling from inadequate monsoon. A second straight year of weak monsoon will decrease the efficacy of India’s irri- gation ecosystem and hit agriculture output and farmers severely. Al- ready, rural wage growth has plum- meted to around 8 per cent in latest count, from a peak of 18-20 per cent in 2012. Therefore, a weak monsoon will also completely wipe off gains in other sectors of the economy. For details, see our report titled, ‘Clouds over rain’ released in April. Mitigato- ry and pre-emptive steps by the gov- ernment are therefore an imperative. Focus areas for government: Given the current situation of agriculture and its importance in both employ- ment and growth, the government needs to go on mission-mode to find solutions, such as to reduce systemic dependence on rainfall by exponen- tially increasing the drip irrigation ecosystem, improving skillsets at the farm-gate through many more tar- geted initiatives, bringing sea-change in the farm-to-fork trans action chain Monsoon and agriculture GDP Note: Years when monsoon deficiency was 7 to 10 per cent, *first forecast issued in May Source:IMD,CSO and rapidly ramping up warehous- ing and cold storage infrastructure with win-win revenue models. Banking hobbled, bad-loan millstone hangs heavy Exposure of banks to vulnerable sectors remains high: While credit growth should pick up from the lows of fiscal 2015, continued deterioration in the asset quality of banks and the resultant risk aversion will remain a headwind in fiscal 2016. Gross non- performing assets (GNPAs) of banks shot up from 3.9 per cent as of March 31, 2014, to 4.3 per cent by the end of the previous fiscal. Growth in slippages are expected to decelerate in the current fiscal, but reported GNPAs will still remain at elevated levels as some of the as- sets restructured in the previous 2-3 years, especially in the infrastruc- ture, construction, and textiles sec- tors, degenerate into NPAs again. We forecast GNPAs to edge up 20 basis points to around 4.5 per cent of advances -- or rise by Rs 600 billion to Rs 4 trillion -- by March 31, 2016 (Chart 10). Indeed, overall weak as- sets of the banking sector could cross Rs 5 trillion. Worryingly, exposure of banks to vulnerable sectors is expect- ed to remain high (65 per cent to the medium- and high-risk sectors), just the way it was in fiscal 2015. Bad loans are seen rising mainly be- cause of the withdrawal of regulato- ry forbearance on restructuring, and high slippages from restructured as- sets. As much as 40 per cent of assets restructured between fiscals 2012 and 2014 have degenerated and be- come NPAs again. CRISIL believes the government’s stance to provide capital only to PSBs meeting its performance thresholds – even as they reel under asset qual- ity and profitability pressures – will force many to grow at a significantly slower pace and spawn capital stress for many weak banks. Dirty picture Note: F = forecast. According to CRISIL’s definition, weak assets include gross NPAs + 30% of restructured assets (excluding those of state power utilities) + 75% of security receipts Source:CRISILRatings 1YEAR OF MODI GOVT

- 26. The Global Analyst | JUNE 201526 | Leverage pain will continue in infrastructure: Debt piling up in the books of infrastructure companies is a major roadblock to reviving investments. In infrastructure, especially for companies engaged in road and power-generation projects, accumulated debt is so high their interest cost threatens to go off the charts. Their ratio of interest cost to operating income galloped to 11.5 per cent in fiscal 2014 from 4.6 per cent in fiscal 2010. In the past, many private developers have bid aggressively for projects, especially in roads and power. However, most projects have seen execution delays due to issues such as fuel availability, land acquisition and environmental clearances; resulting in significant cost overruns. Also, volume growth for operational The debt-wish saga Source:CRISILResearch projects has been below expectations on account of slowdown in economic activity. As a result, poor operational cash flows coupled with rising debt burden have led to a sharp deterioration in the debt-servicing ability of many companies. Banks, too, are wary of lending to the sector. Many private infrastructure companies have either sold or are in the process of selling their operational assets on lender pressure to pare debt even as they need to find funds to bid for new projects. Many others have resorted to restructuring of debt and assets. We believe it will take time for companies to clean up their balance sheets and a significant pickup in private infrastructure investments looks at least a couple of years away. Till then, the public-sector has to carry the can. Courtesy: CRISIL Real Estate Report Card 9 Impressions Indian Real Estate Stakeholders Have about Modi Government - And JLL’s Take JLL India’s Research team is releasing a whitepaper on the first year of Modi government. A survey of the Indian real estate community, done as part of the research, reveals nine impressions, or misimpressions, of this government that exists in the minds of Indian realty’s stakeholders. The report also provides research team’s own views on each of these: Read on. ANUJ PURI, Chairman and Country Head at JLL India CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services. MODIVERSARY SMS “HOME” TO 567676 SMS “CAR” TO 567676

- 27. 27The Global Analyst | JUNE 2015 | 1YEAR OF MODI GOV 1. Much has been said, but little has been delivered JLL’s view: Modi has taken several initiatives, the outcomes of which will be seen only in the medium-to- long term (i.e. 2-3 years). Initiatives such as developing affordable residential projects, robust infrastructure, financial inclusion of the LIG segment into the banking sector, etc., are important initiatives but require time to fructify. Critical evaluation of success at this stage may be premature. 2. Power is too concentrated JLL’s view: This fear loomed large in the minds of several political and market analysts since the time Modi came to power. The highly centralised appearance of the government has moderated in recent times with decentralisation of power to cabinet members and states’ chief ministers. We agree that power should be further de-centralized to the grassroots level (i.e. district and panchayat level authorities) and this further downward percolation of power may take another year or two. 3. Land Acquisition and Rehabilitation and Re- settlement Bill not progressing as expected JLL’s view: There has not been much progress on the bill since the time it was first approved by the previous Congress government, and even after the recent amendments made in the Bill by the Modi government. Modi’s grand vision to build superior infrastructure, affordable housing projects and smart cities is related to the success of this Bill, which could be cleared by the Parliament after recommendations by the Joint Committee of Parliament come through in the monsoon session. 4. Clarity needed on ‘Housing for all by 2022’ scheme JLL’s view: After having announced the scheme during the first Budget in June 2014, the government has remained silent on details. The market expected fine prints to come by in subsequent communications. The task of constructing 2.34 million homes every year as against an actual delivery of 1.2 million homes during the 11th five-year plan period (ending March 2012) is humungous. As of now, matters definitely do not look upbeat on this front, and the doubts being expressed are justified. 1YEAR OF MODI GOVT