banking practice & Law 1

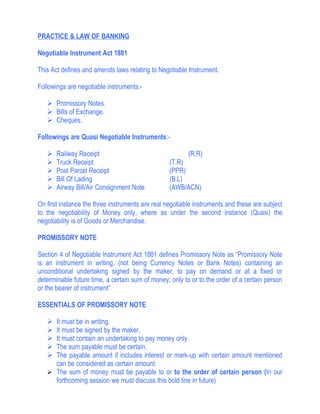

- 1. PRACTICE & LAW OF BANKING Negotiable Instrument Act 1881 This Act defines and amends laws relating to Negotiable Instrument. Followings are negotiable instruments:- Promissory Notes. Bills of Exchange. Cheques. Followings are Quasi Negotiable Instruments:- Railway Receipt (R.R) Truck Receipt (T.R) Post Parcel Receipt (PPR) Bill Of Lading (B.L) Airway Bill/Air Consignment Note (AWB/ACN) On first instance the three instruments are real negotiable instruments and these are subject to the negotiability of Money only, where as under the second instance (Quasi) the negotiability is of Goods or Merchandise. PROMISSORY NOTE Section 4 of Negotiable Instrument Act 1881 defines Promissory Note as “Promissory Note is an instrument in writing, (not being Currency Notes or Bank Notes) containing an unconditional undertaking signed by the maker, to pay on demand or at a fixed or determinable future time, a certain sum of money; only to or to the order of a certain person or the bearer of instrument” ESSENTIALS OF PROMISSORY NOTE It must be in writing. It must be signed by the maker. It must contain an undertaking to pay money only. The sum payable must be certain. The payable amount if includes interest or mark-up with certain amount mentioned can be considered as certain amount. The sum of money must be payable to or to the order of certain person (In our forthcoming session we must discuss this bold line in future)

- 2. The sum of money can be paid on demand or at a fixed or determinable future period. A promissory note payable on demand is known as Demand P/N, and that payable in future is known as Usance P/N. Another thing is that undertaking can be given by individual, jointly or Joint and Several Liability. A single person can sign P/N, two or more person jointly can sign, and if two or more person SPECIMENS Promissory Note Payable on Demand Rs. 50,000/- Lahore November 05, 2007 On Demand I promise to pay to Mr. Saeed Ahmed or the order the sum of Rupees Fifty Thousand only. STAMP (Signature of Sohrab Sheikh) (Whether word on demand is written or not, but if future time is not written, it can be considered as demand P/N. If written as “I promise to pay Mr. Saeed Ahmed or the order the sum of Rs. Fifty Thousand only”) Promissory Note Payable after Date Rs. 50,000/- Lahore November 05, 2007 One month after date I promise to pay to Mr. Saeed Ahmed or the order the sum of Rupees Fifty Thousand only. STAMP (Signature of Sohrab Sheikh)

- 3. Which of the followings are narrations of a qualified Promissory Note? I promise to pay Mr. Saeed Ahmed or order a sum of Rs. 50,000/- On demand I promise to pay eldest son of Mr. Saeed Ahmed Rs. 50,000/- On demand I promise to pay Mr. Saeed Ahmed Rs. 50,000/- I acknowledge myself indebted to Mr. Saeed Ahmed for Rs. 50,000/- to be paid on demand. I promise to pay Mr. Saeed Ahmed Rs. 50,000/- or any amount payable till next three months. I promise to pay Mr. Saeed Ahmed Rs.50, 000/- on demand after deducting my commission. I promise to pay Mr. Saeed Ahmed Rs. 50 million if he marries his daughter with me. I promise to pay Mr. Saeed Ahmed if Pakistan wins ODI match on November 08, 2007. Promissory Note can be written on plain paper and by affixing Revenue Stamp or it can be written on a Stamped Paper (Printed). There are two parties in a Promissory Note. Maker A person who promises to pay and signs it is called Maker Payee A person to whom promise is made is called Payee. While concluding it is stated that for every matter where there is need of assurance for any monetary transaction or dealing involving monetary transaction; the basic or primary document which can be referred as evidence or proof, and which could be provided to the court of law for the legal recourse is Promissory Note. For having better position it is advisable that at least two witnesses may be taken for favourable decision. Bills Of Exchange Section 5 of Negotiable Instrument Act 1881, defines, a “Bill of Exchange as an instrument writing, containing an unconditional order, signed by the maker, directing a certain person, to pay on demand or at a fixed or determinable future

- 4. time, a certain sum of money only to or to the order of certain person or to the bearer of the instrument”. Essentials of Bills of Exchange It must be in writing. It must be signed by a person. It must contain unconditional Instructions or order. The Instructions must be to pay money only. The person, to whom instructions are being given, should be instructed to pay on demand, or future fixed or determinable time. The amount should be payable to or to the order of certain person or bearer of instrument. Demand bill of exchange. A bill of exchange which when presented to drawee must be paid or refused. When paid, we call that bill has been honoured, and when there is refusal we call that the bill has been dishonoured. A bill of exchange that must be honoured or dishonoured at its presentation immediately and instantly is known as demand bill of exchange. It is also known as Sight bill of exchange as it must be paid or refused at its first sight, and any delay is considered as not honoured or refused. While drawing such bill; the maker may write as: - On demand Pay Mr. Saeed Ahmed or order Rs. 50,000/- Or Pay Mr. Saeed Ahmed or order Rs. 50,000/- This shows that whether word demand is written or not, if no future fixed or determinable date is given, it is considered as demand bill of exchange. Usance bill of exchange. A bill of exchange which is to be paid at future fixed or determinable time is known as usance bill of exchange. Such bill of exchange is drawn as: - 90 days after the date pay Mr. Saeed Ahmed or order Rs. 50,000/- 06 months after the date pay Mr. Saeed Ahmed or order Rs. 50,000/- 02 years after the date pay Mr. Saeed Ahmed or order Rs. 50,000/- The date on which a usance bill of exchange becomes payable after counting the given days, months or years is known as date of maturity or due date. FOR EVERY USANCE BILL OF EXCHANGE THE MOST IMPORTANT THING IS THAT THIS BILL OF EXCHANGE MUST BE PRESENTED FIRST TO THE

- 5. DRAWEE FOR HIS ACCEPTANCE, BEFORE IT IS PRESENTED FOR PAYMENT ON MATURITY. IF THE ACCEPTANCE HAS NOT BEEN TAKEN BY THE DRAWEE AND HE REFUSES TO PAY ON MATURITY, IT COULD NOT BE CONSIDERED AS DISHONOUR, AND HE WOULD NOT BE LIABLE FOR SUCH DISHONOUR. SO USANCE BILL IS PRESENTED TO DRAWEE TWICE; FIRST FOR ACCEPTANCE AND THEN FOR PAYMENT ON MATURITY. ANOTHER THING TO BE NOTED IS THAT IF THE DRAWER OF USANCE BILL REFUSES TO ACCEPT BILL THEN IT WOULD NOT BE PRESENTED FOR PAYMENT ON DUE DATE OR MATURITY AS HE HAS ALREADY REFUSED TO ACCEPT TO PAY THEN WHY WOULD HE PAY ON DUE DATE. In above stated situation dishonour of bill would be of two types:- 1. Dishonour for acceptance; it is the situation of dishonour when drawee refuses to give acceptance to pay on maturity or due date. 2. Dishonour for payment; it is situation when drawee had already accepted the bill or gave his acceptance to pay, but on due date refuses to pay it. Again being repeated a bill not accepted or not presented for acceptance; if not paid or honoured on due date would not be considered as “Dishonour for Payment” Parties to a bill of exchange According to section 7 of NIA, there are three parties to a bill of exchange. Those are:- Drawer, a person who signs at the face of the instrument and who gives instructions is known as Drawer. Drawee, a person to whom instructions are given is known as Drawee. Payee, a person to whom or to whose order sum of money is to be paid is known as Payee. How bill of exchange is being dealt in local and International Trading? For secure and safe local and International trading; where both sellers and buyers are settled far flung from each other and both seller and buyer are reluctant to have any risk. Buyer would like to have goods first and seller the money and both are not ready to depart from their assets. Then comes any intermediary, usually the bank and acts agent of seller. Seller sends goods not to buyer but his banker and advises the banker to deliver the goods to seller: - In case of Cash Trading (non-credit) after getting money from the buyer, and in case of credit deal after taking assurance of payment from buyer.

- 6. The document which authorizes the banker to get money from the buyer or to get assurance from the seller is Bill Of Exchange. The seller would draw bill of exchange on buyer and would instruct him either to pay money to the bank or give acceptance on the back of the bill that payment would be made on future fixed or determinable period. The Demand Bill of Exchange so drawn would be:- DEMAND BILL OF EXCHANGE Rs. 50,000/- November 07, 2007. On demand pay United Bank limited or order sum of Rs. fifty thousand for value received. To: - (Signature) Haji Noor Muhammad. Saleem Ahmed 281-Z, Gulberg-8, 898-Jodia Bazar. Lahore. Karachi USANCE BILL OF EXCHANGE Rs. 50,000/- November 07, 2007. Two months after date pay United Bank limited or order sum of Rs. fifty thousand for value received. To: - (Signature) Haji Noor Muhammad. Saleem Ahmed 281-Z, Gulberg-8, 898-Jodia Bazar. Lahore. Karachi In both the cases drawer is Saleem Ahmed (Seller), Drawee is Haji Noor Muhammad (Buyer) and Payee is United Bank Limited (Agent) or order. Under first bill of exchange Haji Noor Muhammad would make payment to UBL, and UBL would write at the reverse of bill “Payment Received” and would deliver

- 7. documents title to goods to Haji Noor Muhammad, and later on remit the money to Saleem Ahmed. Under second bill of exchange Haji Noor Muhammad would write at the reverse of bill of exchange “Accepted to pay on_________ or simply Accepted” ; bank would deliver the documents title to goods to Haji Noor Muhammad and would keep this bill of exchange till it paid. On maturity if it is paid, then again UBL would get the payment, would write at the reverse of bill “Payment Received” and deliver it to buyer, Haji Noor Muhammad. Later on the ,money will be remitted to seller, Saleem Ahmed. In both the cases the transaction was accomplished through a document known as Bill of Exchange. Other related Parties: - Acceptor Acceptor for honour. Drawee in case of need. Other related Parties in a bill of exchange Acceptor Acceptor for honour. Drawee in case of need. Acceptor Drawee of usance bill of exchange when accepts the bill his title is changed from drawee to acceptor Acceptor for honour In case the original drawee of a usance bill of exchange is not in a position to accept it and obviously reason being that due to his financial constraint or deficiency his cannot commit himself for the payment on due date then for the sake of honour of this original drawee any body else if accepts it he becomes acceptor for honour. In this situation the real drawee becomes free from any responsibility and acceptor for honour becomes fully liable for the payment of bill. In case acceptor for honour does not fulfill his commitment then suit can be moved against acceptor for honour and not real drawee. Drawee in case of need. Sometime when any demand or usance bill of exchange is drawn instead of one; another persons is also shown as drawee. The first one is known as drawee and the other is known as drawee in case of need. Name of real Drawee comes first and before the name of next person words “Drawee in case of need” must be written. The bill must be present to the real or

- 8. first drawee, and if he refuses to pay or accept only then it is presented to drawee in case of need. Under this situation the primary responsibility is of first drawee, and if both of them refuse to pay or accept the bill then suit could be filed against first drawee and not against drawee in case of need. But once the drawee in case of need gives his acceptance then first drawee becomes free from any liability, and if suit needs to be filed it would be against Drawee in case of need and not drawee. Again repeat that first drawee is primarily responsible in case of non payment by both, but when drawee in case of need gives his consent then he becomes liable and makes the first drawee free from any liability. SPECIMEN OF DRAWEE IN CASE OF NEED BILL OF EXCHANGE Rs. 50,000/- November 07, 2007. On demand pay United Bank limited or order sum of Rs. fifty thousand for value received. To: - Haji Noor Muhammad. 281-Z, Gulberg-8, Lahore. Drawee in case of need:- (Signature) Mr. Zahid Sheikh. Saleem Ahmed 888-F-Defence Phase 50 898-Jodia Bazar Lahore Karachi CHEQUE Section 6 of Negotiable Instrument Act 1881 defines Cheque as “Cheque is a bill of exchange, drawn on a specified banker, not expressed to be payable otherwise on demand”. In simple words; characteristically or formation wise, Cheque is similar to a bill of exchange with a difference that it can only be drawn on a banker only, and is always payable on demand.

- 9. No doubt bill of exchange and Cheque are similar in formation, but with vast difference as far as the drawee and its mode of payment is concerned. Bill of exchange can be drawn on an individual, firm or corporate body, but Cheque will be drawn on banker only. As far as mode of payment is concerned, a bill of exchange can be drawn as demand and usance, but Cheque will always be drawn as demand only. No one has seen any Cheque where the account holder (drawer) has written any Cheque with instruction to pay after so many days or months. It is always assumed that either it will always be paid or dishonoured only and only when presented to the banker. In bill of exchange there are always three parties; drawer drawee and payee and all would be different persons, whereas in a Cheque there can be three or two persons. When account holders intends to make payment to other person than there are three parties, but when he himself presents Cheque for payment, then there are two parties as he himself becomes drawer and payee. Essentials of Cheque Almost same as of Bill of exchange, with the difference as stated above. SPECIMEN OF A CHEQUE HAJVERI BANK LIMITED Industrial Estate Branch. Cheque # Lahore. Date_______ PAY____________________________________________ OR BEARER RUPEES___________________________________________________ (AMOUNT IN FIGURE) SIGNATURE TYPES OF CHEQUES Relating to the Payee point of view a Cheque can be brawn as:-

- 10. BEARER ORDER Bearer A printed cheque book is provided by the banker to the customer and in addition to other contents, there is a line where the instructions from the account holder (drawer) regarding to whom payment is to be made is printed as:- PAY_____________________________________________ OR BEARER Under this instruction (remember one thing that a cheque contains instructions from account holder to pay money to whom he desires and as desires) the account holder desires that its payment to be made to a person; whose name will be written on the blank line or any person who presents this cheque to the banker. So the cheque would be drawn as: - PAY Mr. Saeed Ahmed OR BEARER When cheque is drawn in this shape, it is named as BEARER CHEQUE, which means that the payment against this cheque is to be made to Mr. Saeed Ahmed or any person who presents it. Further more the bank would not need to verify the identification of Mr. Saeed Ahmed, if he himself presents it or even who so ever presents it. ORDER CHEQUE When drawer (Account Holder) cuts words “Bearer” and either he writes “Order” or not, the cheque is supposed to be drawn as Order. Under this situation the banker would make payment to the first Payee or subsequent payee, only and only order verification that its payment must be collected by the first payee himself, and if the first payee transfers the title (After writing “Pay to________or order”) then the second or subsequent payee’s verification is done. Illustration PAY Mr. Saeed Ahmed OR BEARER PAY Mr. Saeed Ahmed OR BEARER Order This is order cheque.

- 11. If Mr. Saeed Ahmed goes for payment, bank must verify that it is being presented by Saeed himself, and also to verify identity. If Saeed transfers the title in favour of Shahid, then he has to transfer it by writing the words “Pay to the order of Shahid” or Pay Shahid or Order. So if Shahid goes to collect payment, banker would verify the identity of Shahid. How verification is done? In both cases, who so ever present cheque, bank would ask him that some one known to the bank, preferably account holder should verify his signature. That person when verify the signature, it would mean that the verifying person confirms that the signature is of the genuine payee. Later on officer of the bank would verify signature of the person who verified the signature of presenter or payee. All bankers’ cheques are drawn as “Order” and not bearer. Banker’s very common cheque is Demand Draft and Traveler’s Cheque. Theses cheques are printed in order form just to secure the ownership of the Payee. FORMS OF CHEQUE Crossed Cheque. Open Cheque. Negotiable Instrument Act 1881 defines: - Two transverse parallel lines across the instruments with or without words there in. Law is silent as where those lines can be drawn, but as per practice, in Pakistan, these lines are drawn on the upper left corner. The reason is the If drawn on upper right corner, lower left or right corner or completely across the instrument, it could destroy or interrupt the material parts of instrument. For the sake of knowledge, it is submitted that material parts are: - Date, Name of Payee, Amount in words, Amount in figure and Signature of drawer. As we already know that cheque contains instructions from drawer (Account Holder) to drawee (Banker) to pay the cheque, so these two lines known as crossing carries some additional instructions. These lines gives instructions to the ban that the payment of this cheque should not be made on counter in shape of cash, but its payment is to be made by crediting the account of payee or any other person. This payment in shape of crediting the account can be given within the same branch of the bank, other branch of the bank, in other bank within the city, within the country or outside country. What ever could be the situation but crossed

- 12. cheque’s payment will be done by crediting the account and not paying cash on the counter. (Students should know how lines were drawn and what was written between lines when we had session in class. Those not attended must consult with other students) Open Cheque Cheque which is not crossed is known as open cheque. Its payment is not prohibited to be paid on counter. The payee may collect payment in the shape of cash from counter or can get its credit in his account. Please remember on thing that it not necessary that its payment must be made on counter only. It depends upon payee what he desires. TYPES OF CROSSING Simple Crossing. When nothing is written between two lines or words “& Co” is written, the crossing is known as simple crossing. Significance of simple crossing. When cheque is crossed with simple crossing, the purpose is that it cannot be paid on counter and can be credited in any person account. Bearer cheque with simple crossing can be credited in any person’s account and no words are to be written at the back of instrument if credited in the account of person other than the payee. Order cheque with simple crossing can also be credited in any person’s account, but if not credited in the account of first payee, then its title must be transferred by the first payee by writing the words “Pay ________ or order” When the title is once transferred it cannot be credited in the account of first payee, but MUST be credited in the account of second or any subsequent Payee. Restrictive Crossing. In between two lines, when words “Payee’s Account Only” or “Payee’s A/C Only” or “Account Payee Only” or “A/C Payee Only” are written the cheque is known to have restrictive crossing. Significance of Restrictive Crossing. As it appears from name, the only and only purpose of this crossing is that it prohibits or restricts transfer of title from first Payee to any next payee. When cheque bears such crossing the instructions are that the cheque should not be paid on counter, but in the account of first payee only. First payee cannot transfer its title in favour of any else payee.

- 13. We must remember that we had known that bearer cheque’s payment can be collected by any person, but once the cheque is crossed with restrictive crossing, it must be credited in the account of payee only and bearer or order becomes meaningless and insignificant. Special Crossing. In between two lines when name of bank and its branch name are written, or only bank’s name is written, the crossing is termed as special crossing. Before we discuss the purpose or significance of this crossing, let us have knowledge of two basic terms related to this crossing and those are: - Collecting Banker. When a customer deposits his cheque to his banker, which is drawn on other branch of that bank within the city, out of city or country, or other bank within the city, out of city or outside country, to collect its payment and credit his account; the bank where such instrument is deposited is termed as collecting banker. Collecting banker means it collects instrument from its customer to get payment on his behalf against the instrument he deposited, and credit his account. Bank after collecting that instrument sends it to the bank or branch, where it has been drawn, gets payment from there and credits the account of his customer. Paying Banker. When collecting bank collects an instrument, it sends it to the bank on which the cheque is drawn, so that it may get payment from it. The bank on which the instrument is drawn is known as paying banker. It is the bank that has to make the payment against the cheque sent or lodged by the collecting banker. Now we can proceed to the purpose and significance of Special Crossing. The first purpose of such crossing is that as soon as such crossing stamp is affixed, it establishes the ownership and possession of collecting banker. Any cheque that bears special crossing shows that the ownership lies with the bank and branch whose name is written between two lines. In case it is lost or stolen, no one else can claim its payment, unless such crossing is cancelled. The other and ultimate purpose is that it is direction from collecting banker to the paying banker, not to make payment to other than the bank that has its special crossing. Who can cross a cheque? Who can cancel crossing and how crossing can be cancelled? Who can cross? Cheque drawn by an Account Holder can be crossed by himself when written and before to be delivered to payee.

- 14. If not drawn by the account holder it can be crossed by the payee or any subsequent payee or holder of cheque. Suppose Imran Khan has drawn a cheque and has written as:- Pay to Saeed Ahmed or bearer Here Imran Khan before delivers it to Saeed Ahmed can cross himself; in this case it may be considered as crossed by the drawer or account holder. If Imran does not cross it and delivers it to Saeed Ahmed and Saeed Ahmed for his own protection put these two lines himself then we may say that it has been crossed by the payee. If Saeed Ahmed himself does not want to cash the cheque, but delivers it to Sohail uncrossed and Sohail puts crossing then the crossing is done by the subsequent payee or holder of cheque. All above crossings those can be done by account holder, payee, subsequent payee or holder; those would be simple crossing or restrictive crossing. Concluding, we can say that Simple crossing can be done by the drawer (Account holder), first payee and subsequent payee or holder. Special Crossing can be done only and only by a banker and the banker would be collecting banker. (For the students not aware of collecting banker must refer previous notes) Who can cancel simple and restrictive crossing. Simple and restrictive crossing, no doubt can be drawn by any one, but for cancellation, it must be cancelled by the drawer only. The drawer would cancel it on the face of the cheque and would put his full signature. If drawer has not crossed it, even then the cancellation must be done by him. Who can cancel special crossing? And how? Since special crossing is drawn by collecting banker, its cancellation can also be done by the collecting banker. Collecting banker needs to cancel crossing only and only when cheque is returned unpaid from the paying banker and it has to be returned to the account holder, who deposited the cheque. Sometime account holder may request the collecting banker to return him the cheque before it is sent to the paying banker. Under every situation collecting banker should cancel the crossing before it is delivered to the account holder. Unlike simple and restrictive crossing, special crossing is cancelled in a way that the crossing remains on the face of the instrument (cheque), bit at the back of the cheque banker would affix a stamp “Our all stamps stand cancelled” or “Our

- 15. Crossing stands cancelled” below this writing officer of the bank would put his signature to authenticate the cancellation. NON-INTEREST BANKING. Before Non-interest banking in Pakistan, our banking system as it is prevailing in other countries was based on Interest. Interest was paid to the depositor and interest was charged or taken from the borrower. Bank’s funds are collected from the depositor and bank later on lends it to the borrower. Bank has to pay to the depositor for keeping his money, and has to charge or collect from the borrower for using the money. As stated above before non-interest based system of banking what we would pay to the depositor used to be interest and what we used to collect from the borrower was interest. Since interest is against Islamic system; so a system was developed that bank had not to pay interest to the depositor and not to charge interest from the borrower. Now, what we pay to depositor is Profit, and what we charge from the borrower is Mark-up or Mark-down. In Pakistan, every bank; either incorporated in Pakistan or outside Pakistan (Foreign Based Banks) they are maintaining accounts of depositors on Profit and Loss Sharing Basis. No doubt the rate of profit is pre-determined, but the condition stands that these funds are being kept on the basis of Profit and Loss sharing. If the banks would earn profit, it would be shared with the depositor, and in case of loss too, it would be shared by the depositor. But fact is that no bank has ever shown such loss and never shared any loss with the depositors, reason being if it ever happens; it would be the last day of the bank. Recent history shows that after the introduction of Profit and Loss sharing banking, there has been tremendous decline in the rate of return that was being paid to the depositor. An account where public used to deposit there small savings, known as Saving Bank Account, and now named as PLS. S. B. Account (Profit and Loss Sharing Saving Bank Account) has shown drastic decline in the rate of return. Before PLS, it used to be 7.5% to 10%, at that time the word interest was used. But now in the same type of account the rate ranges from 0.75% to 2%, and interest is not paid but “Profit” Other type of account which is mostly meant for commerce class, for business purpose, the account is called current account and principally no profit id paid in that type of account. With operation point of view, banks are maintaining two types of accounts. Multiple operational accounts. Single Transaction accounts. Saving bank accounts and current accounts are multi transactional accounts. Cheque book is provided to the account holder, and account holder can deposit and

- 16. withdraw in that account with unlimited number of times, and there would br no restriction. All such transaction would be done in that single account right from the day it was opened till it is closed. Account holder can deposit money even more than 100 times in a day and can withdraw through 1000 or more times through cheques in a single day. Cash and cheques both can be deposited in that account. So these accounts are multi transactional accounts. Notice Deposit Accounts, Term Deposit Account, Fixed deposit accounts are single transactional accounts. Cheque book is not provided, but certificate or receipt is issued for every deposit, and when withdrawal is done the account is to be closed. For every deposit separate account is to be opened and for every withdrawal account is to be closed. These accounts are single transactional accounts. Notice deposit accounts are those accounts, where depositor deposit money with the condition that before withdrawing the funds, prior notice must be given to them bank as when those funds are to be withdrawn. One is called 7 days notice deposit account and other is 30 days notice deposit account. For 7 days notice deposit account, bank must be informed in writing 7 days prior to withdrawal, and for 30 days notice deposit account, bank is to be informed 30 days before. Rate of profit is higher for 30 days deposit account than 7 days notice account. For 7 days notice account, funds must remain more than 7 days with the bank; otherwise no profit would be paid. For 30 days notice deposit funds must remain more than 30 days; otherwise funds would be returned without profit. Other single operational accounts are term deposit or fixed deposit accounts, where notice is not required before withdrawal, but it is pre-determined that the funds would be kept for a certain term i.e. 03 months, 06 months, 01 year, 05 years 10 years etc. Rate of profit for term deposit is more than notice deposit, also more is the period higher would be the rate of profit. Rate of profit for 03 months be least, and rate of profit for 10 years would be the highest. (For students those would study the money market in future, I must state that is phenomena depends nature of money market that prevails. It is the present condition of Pakistan, but may be in other countries where money market behaves in different way, the rate of return would be higher for lesser period and less for the maximum period) ANSWER TO A CHEQUE When a cheque is presented to the banker, it has got only two options; either to pay it or to return it and both options are available instantly. It means the payment cannot be delayed if not paid. When cheque is not paid from the banker the term used is dishonour of cheque or return of cheque.

- 17. But when cheque is to be dishonoured or returned unpaid, the banker must give the reason in writing and the reason is to be authenticated by the officer of the branch from where the cheque is being returned. We must also know that for a banker; two blunders are never forgiven and are subject to be sued by the account holder and those two events are:- Not keeping secrecy of account holder. Wrongful dishonour of cheque. Wrongful dishonour means that cheque was supposed to be paid but was dishonoured, and if account holder sues the bank for damages, and if it is proved then banker would be in hot waters and has to pay the damages; what so ever claimed by the account holder. The amount claimed is not necessarily to be matched with the amount of cheque returned wrongfully. Even a customer may sue for damages in million if his cheque is returned having figure in thousands. Only the account holder knows how much damage has been done to his reputation or business for a cheque wrongly returned. So much care is to be taken before returning and also giving proper reason for the return. The reason to be given while returning a cheque is now named as “Answer to a Cheque”. The reason could be any and please note that for return of cheque it is not necessary that funds are not available in the account, but there could be numerous other reasons. But the reason should be genuine and true. Some of the reasons are: - Refer to Drawer. (Now not in practice in Pakistan) Insufficient Balance. Not arranged for. Exceeds arrangements. Effects not clear, may be presented again after 02 days or after ____ date. Cheque not properly drawn. Cheque is mutilated. Cheque is post dated. Cheque is stale dated. Cheque is anti-dated. Cutting requires drawer’s authentication. Cheque is crossed. Cheque crossed to two banks. Collecting bankers crossing required. Not drawn on us. Account deceased. Account attached. Account frozen. Cheque contains extraneous matter.

- 18. Drawer’s signature differs. Drawer Signature required. Payment stopped by the drawer. (TO EXPLAIN THEM IN DETAIL IS ASSIGNMENT FOR ALL STUDENTS)