Indonesia's Cashless Journey 2015

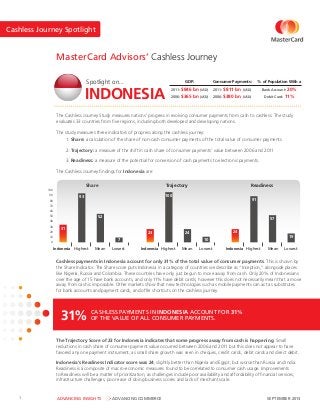

- 1. 1 SEPTEMBER 2013ADVANCING INSIGHTS ADVANCING COMMERCE Cashless payments in Indonesia account for only 31% of the total value of consumer payments. This is shown by the Share Indicator. The Share score puts Indonesia in a category of countries we describe as “Inception,” alongside places like Nigeria, Russia and Colombia. These countries have only just begun to move away from cash. Only 20% of Indonesians over the age of 15 have bank accounts, and only 11% have debit cards, however this does not necessarily mean that a move away from cash is impossible. Other markets show that new technologies such as mobile payments can act as substitutes for bank accounts and payment cards, and offer shortcuts on the cashless journey. The Trajectory Score of 23 for Indonesia indicates that some progress away from cash is happening. Small reductions in cash share of consumer payment value occurred between 2006 and 2011 but this does not appear to have favored any one payment instrument, as small share growth was seen in cheques, credit cards, debit cards and direct debit. Indonesia’s Readiness Indicator score was 24, slightly better than Nigeria and Egypt, but worse than Russia and India. Readiness is a composite of macro-economic measures found to be correlated to consumer cash usage. Improvements to Readiness will be a matter of prioritization, as challenges include poor availability and affordability of financial services, infrastructure challenges, poor ease of doing business scores and lack of merchant scale. % of Population With a Bank Account: 20% Debit Card: 11% Consumer Payments: 2011: $811 bn (USD) 2006: $380 bn (USD) The Cashless Journey Study measures nations’ progress in evolving consumer payments from cash to cashless. The study evaluates 33 countries from five regions, including both developed and developing nations. The study measures three indicators of progress along the cashless journey: 1. Share: a calculation of the share of non-cash consumer payments of the total value of consumer payments 2. Trajectory: a measure of the shift in cash share of consumer payments’ value between 2006 and 2011 3. Readiness: a measure of the potential for conversion of cash payments to electronic payments. The Cashless Journey findings for Indonesia are: MasterCard Advisors’ Cashless Journey Share Indonesia Indonesia Indonesia Trajectory Readiness Highest 0 10 20 30 40 50 60 70 80 90 100 Mean Lowest 31 93 52 7 Highest Mean Lowest 23 100 24 10 Highest Mean Lowest 24 91 57 19 CASHLESS PAYMENTS IN INDONESIA ACCOUNT FOR 31% OF THE VALUE OF ALL CONSUMER PAYMENTS.31% Spotlight on... INDONESIA GDP: 2011: $846 bn (USD) 2006: $365 bn (USD) Cashless Journey Spotlight

- 2. 2 SEPTEMBER 2013ADVANCING INSIGHTS ADVANCING COMMERCE SHIFTING SHARE WILL REQUIRE A FOCUS ON FUNDAMENTALS In Figure 1, we see Advisors’ estimates for instrument share of consumer payments by volume and value for Indonesia. Cash clearly accounts for the strong majority of both the value and volume of transactions here. In Figure 2, we see that Indonesia is reducing cash usage at a pace that is expected, given its Readiness score. China and Kenya are shifting cash at a faster pace than would be expected, given their low Readiness scores. The rapid shift in China can be attributed to a strong government focus on growing electronic payments and rapid urbanization. In Kenya, it is the disruptive solutions like M-Pesa that are removing barriers to financial inclusion, by substituting mobile phones for formal bank accounts. Spain, Taiwan, Japan and Germany are moving at slower pace than indicated by their Readiness scores. Other factors, such as cultural attitudes or economic conditions may explain why these countries are not shifting away from cash as quickly or as thoroughly as might be expected, given all the typical factors appear to be in place to do so. Cashless Journey Spotlight With a low Readiness score indicating many of the macro-economic prerequisites for going cashless are absent, Indonesia may benefit from non-traditional routes to expanded cashless payments such as those seen in Kenya. Payment providers in market are working with telecommunications providers to develop electronic wallets, which will circumvent the traditional need for a bank account to pay without cash. Other initiatives in Indonesia include prepaid programs to support the Hajj, acceptance expansion initiatives into heavy cash categories like petrol, groceries and taxis, and efforts by banks to promote use of debit cards at point of sale. Figure 2 Some Countries Are Going Cashless Despite Low Readiness, While Others Remain Cash Intensive Despite High Readiness Countries where cashless share is growing despite low Readiness Indicators Countries where cashless share is in line with Readiness Indicators Countries where cashless share is smaller than would be expected, given Readiness Indicators China Australia Belgium Brazil Canada Colombia Egypt France Greece India Indonesia Italy Korea Malaysia Mexico Germany Japan Spain Taiwan Netherlands Nigeria Peru Poland Russia Saudi Arabia Singapore South Africa Sweden Thailand UAE UK USA Kenya Source: MasterCard Advisors analysis, BIS CPSS, McKinsey Global Payments Map, World Bank Statistics For additional insights, please visit insights.mastercard.com and mastercardadvisors.com. ©2013 MasterCard. All rights reserved. Proprietary and Confidential. Insights and recommendations are based on proprietary and third-party research, as well as MasterCard’s analysis and opinions, and are presented for your information only. Mix of Consumer Payment Instruments (Value and Number of Transactions) % of Value of Consumer Payments % of # Consumer Payment Transactions Figure 1 Cash Cash Cheque Credit Card Credit Transfer Direct Debit Other Debit Card All other payment types <1% MPESADirect Debit 0% 10% 20% 60% 30% 70% 40% 80% 50% 90% 100% = CASH = CHEQUE = CREDIT CARD = CREDIT TRANSFER = DIRECT DEBIT = DEBIT CARD = OTHER

- 3. SAVE $3900 if you book a team of 3! DRIVING GROWTH & PROFITABILITY BY HUMANISING PAYMENTS 13-14 AUGUST 2015 JAKARTA CONFERENCE www.arcmediaglobal.com/payments Online Payment Gateway Partner Marketing Partner In 2015, the pressure is on to drive growth and profitability. There’s a lot of distracting trends. So it’s critical to filter through and focus on solutions that will work in your context. Growing your payments business and making it profitable are the main objectives during the 5th annual Payments, Settlements and Remittances Asia on 13-14 August 2015 in Jakarta. Register today! Co-Chaired by: Dr Moekti Prasetiani Soejachmoen Head of Mandiri Institute Bank Mandiri FINTECH PAYMENTS for E-commerce Case Study Michael Gethen CEO Sprooki International Bank Innovation Caroline Lacocque SVP, Global Payments HSBC Online Payment Gateway John Tan Business Dev Manager Telr Follow @PaymentsAsia Organised by Promoted by Retail Banking Insight Gerald Ferguson General Manager for Asia RFi Group Co-Chaired by: Carl Clump Chairman Stanfield Funds Management Do you have a credible FinTech offering relevant to daily life? Sponsor the conference. CALL +65 6809 3910 FAX +1 646 513 4296 payments@arcmediaglobal.com 2015 ASIAN FINANCIAL STABILITY LEADER OF THE YEAR The Honorable Agus Martowardojo, Governor, Bank Indonesia 2015 ASIAN BANKING LEADERSHIP AWARD Mr Budi Sadikin, CEO, Bank Mandiri 2015 ASIAN MARKET MAKER OF THE YEAR AWARD John Riady, Director, Lippo Group CBFS presents

- 4. Dear Colleagues, Driving profitability and growth in the midst of big trends in technology, risk of tighter liquidity, currency volatility and new regulations is going to be the banking sector’s great challenge in 2015. For some, upgrading their FinTech for payments seems to be the convenient solution and everybody seems to put a check on the following: • Interest in user and customer experience • Security breaches • Mobile, mobile, mobile • Regulatory compliance demands/expense • Handwringing about the branch network/transformation, and • Adopting big data projects with expected ROI However, at the back of your mind, you ask: Is this really what will maximise the value of my networks? It’s not about blindly following the trends—big data, e-commerce, m-commerce, so many—it’s about building what works with the networks you already have, technologies that can help you leapfrog and the actual context of use in your ecosystem and by your customers. In this rapidly changing banking business and regulatory environment, we have designed Payments, Settlements and Remittances Asia 2015 to provide you a focused FinTech for payments platform, help you set up a balanced payments channel infrastructure and facilitate growth and profitability. Thank you and I hope to see you once again in Jakarta for a profitable meeting. Sincerely yours, Frank Mercado Director Center for Banking and Financial Services DRIVING GROWTH & PROFITABILITY IN 2015 Telr is more than a payment gateway. We provide services critical to the growth of businesses of online merchants in emerging markets. Telr provides the best of breed 100% in-house payment gateway solution to online merchants in Middle East, Africa, and Southeast Asia. Our transaction processing services are secure, easy to integrate, rich in features, and accessible at competitive pricing. Most importantly, by owning our technology we have complete control of the functional development roadmap, and that allows us to rapidly respond to our customers needs Visit https://telr.com/english/company.php to enquire. Frank Mercado The Payments & Cards Network is dedicated to innovating Executive Search, Recruitment & RPO services by fostering personal relationships with clients, knowing where the very best Payment Jobs are and providing valuable insights and talent pools without compromising service or confidence. With a global database of over 40,000 professionals, you have the largest Payments & Cards focused Network in the world. Visit http://paymentsandcardsnetwork.com/ to enquire. ONLINE PAYMENT GATEWAY PARTNER MARKETING PARTNER PSRA is the boutique conference for FinTech professionals in Asia. The insights are globally current with local relevance, the agenda design is upscale and the discussions are action- focused, genuine and intimate, Mr. Helal Ahmed Chowdhury, CEO, Pubali Bank Register 3 delegates and gain a speaking session on a first come, first serve basis. Hurry! CALL +65 6809 3910 FAX +1 646 513 4296 EMAIL payments@arcmediaglobal.com WEB arcmediaglobal.com/payments FOLLOW @PaymentsAsia 13-14 AUGUST 2015 | JAKARTA 2 WHY ATTEND PSRA 2015? Grow payments income 1. Drive growth and profitability by growing your income from payments amidst tight liquidity and volatile Rupiah and be introduced to the international banking community New currency regulation 2. Understand the new regulations in currency requirements and e-commerce and how you can manage financial risks from e-business Innovative competition 3. Understand why customers are choosing alternative payments solutions and how you can quickly adapt to your customers’ changing requirements