Vertical format for trading account, profit and loss account & balance sheet

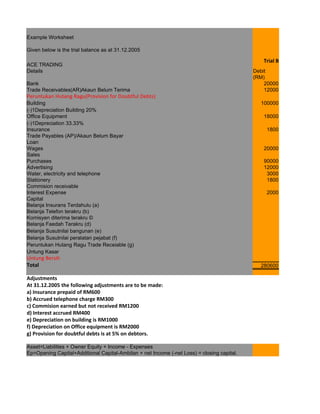

- 1. Example Worksheet Given below is the trial balance as at 31.12.2005 Trial Balance ACE TRADING Details Debit (RM) Bank 20000 Trade Receivables(AR)Akaun Belum Terima 12000 Peruntukan Hutang Ragu(Provision for Doubtful Debts) Building 100000 (-)1Depreciation Building 20% Office Equipment 18000 (-)1Depreciation 33.33% Insurance 1800 Trade Payables (AP)/Akaun Belum Bayar Loan Wages 20000 Sales Purchases 90000 Advertising 12000 Water, electricity and telephone 3000 Stationery 1800 Commision receivable Interest Expense 2000 Capital Belanja Insurans Terdahulu (a) Belanja Telefon terakru (b) Komisyen diterima terakru © Belanja Faedah Terakru (d) Belanja Susutnilai bangunan (e) Belanja Susutnilai peralatan pejabat (f) Peruntukan Hutang Ragu Trade Receiable (g) Untung Kasar Untung Bersih Total 280600 Adjustments At 31.12.2005 the following adjustments are to be made: a) Insurance prepaid of RM600 b) Accrued telephone charge RM300 c) Commision earned but not received RM1200 d) Interest accrued RM400 e) Depreciation on building is RM1000 f) Depreciation on Office equipment is RM2000 g) Provision for doubtful debts is at 5% on debtors. Asset=Liabilities + Owner Equity + Income - Expenses Ep=Opening Capital+Additional Capital-Ambilan + net Income (-net Loss) = closing capital.

- 2. Adjusted Trial Trial Balance Adjusment Trading Account Profit and Loss Balance Sheet Balance Credit Debit Credit Debit Credit Debit Credit Debit Credit Debit (RM) (RM) (RM) (RM) (RM) (RM) (RM) (RM) (RM) (RM) 20000 20000 12000 12000 200 400 600 100000 100000 20000 1000 21000 18000 18000 6000 2000 8000 600 1200 1200 14000 14000 40000 40000 20000 20000 150000 150000 150000 90000 90000 12000 12000 300 3300 3300 1800 1800 3600 1200 4800 4800 400 2400 2400 46800 46800 600 600 600 300 300 1200 1200 1200 400 400 1000 1000 1000 2000 2000 2000 400 400 400 60000 60000 20700 280600 5900 5900 285900 285900 150000 150000 64800 64800 151800

- 3. Balance Sheet Credit Analisis FSElements (RM) BS AS BS AS 600 BS BS AT 21000 BS SNT BS AT 8000 BS SNT P&L Belanja 14000 BS LS 40000 BS LJP P&L Belanja Trading Account Jualan Trading Account Belian P&L Belanja P&L Belanja P&L Belanja P&L Hasil P&L Belanja 46800 BS Owner Equity BS AS 300 BS LS BS AS 400 BS LS P&L Belanja P&L Belanja 20700 151800 0

- 4. ACE TRADING Trading Account for Year Ended 2005 RM RM RM Details Sales 150,000.00 (-) Return inwards/Pulangan Jualan 0.00 Net Sales (Jualan Bersih) 150,000.00 (Less) Cost of Sales/COGS/Kos Jualan Opening Stock/Stok Awal/Inventori awal 0 Purchasing/Pembelian 90,000.00 (-) Return Outwards/Pulangan Belian 0.00 Net Purchases/Belian Bersih 90,000.00 (+) Carriage inwards/angkutan masuk 0.00 (+) Custom duty/duti kastam 0.00 Cost of purchases 90,000.00 90,000.00 (-) Closing stock/Inventori akhir 0 90,000.00 Gross Profit/Untung kasar 60,000.00

- 5. ACE Trading Profit and Loss Accounts for the year ended 2005 RM RM RM Details Gross profit/Untung Kasar 60000 (Add) Revenue/Income/Hasil Discount received 4800 Rent received 0 Commision received 0 Bad debt recovered/Hutang Lapuk Terpulih 0 Total Income 64800 (Less) Expenses: Belanja Insurans 1200 Wages/Upah 20000 Belanja Iklan 12000 Belanja Utiliti 3300 Belanja alat tulis 1800 Belanja Faedah 2400 Belanja Susutnilai bangunan 1000 Belanja Susutnilai Pejabat 2000 Belanja PHR 400 Total expenses 44100 Net Profit 20700

- 6. ACE TRADING Balance Sheet as at 31st December 2005 RM RM RM Fixed Assets/Aset Tetap/Non Current Assets Building 100,000.00 (-) SNT Building 21,000.00 79,000.00 Office Equipment 18,000.00 (-) SNT Office Equipment 8,000.00 10,000.00 Current Asset/Aset Semasa Bank 20,000.00 Debtor/Account Receivable/ABT/Akaun Belum Terima 12,000.00 (-)Peruntukan Hutang Ragu 600.00 Belanja Insurans terdahulu 600.00 Komisyen diterima terakru 1,200.00 122,200.00 Debit Current Liabilities: Creditor/AP/Account Payables/ Akaun Belum Bayar 14,000.00 Belanja Telefon terakru 300.00 Belanja Faedah Terakru 400.00 Long Term Liabilities Loan 40,000.00 Owner's Equity Opening Capital 46,800.00 (Add) Net profit 20,700.00 (Less) Drawings/Ambilan 0.00 (Add) Additional Capital 0.00 Closing Capital 67,500.00 122,200.00 Credit

- 7. Vertical Form Accounting Period/Tempoh Perakaunan Trading and Profit and Loss Accounts for the year ended 31st December 2008 RM RM RM Sales/Jualan x (-) Return inwards/Pulangan Jualan x Net Sales/Jualan Bersih x (Less) Cost of Sales/COGS/Kos Jualan Cost of goods sold Opening Stock/Stok Awal/Inventori awal x Purchasing/Pembelian x (-) Return Outwards/Pulangan Belian x Net Purchases/Belian Bersih x (+) Carriage inwards x (+) Custom duty/duti kastam x Cost of purchases x x (-) Closing stock/Inventori akhir x x Gross Profit/Untung kasar x (Add) Revenue/Income/Hasil Discount received x Rent received x Commision received x Bad debt recovered/Hutang Lapuk Terpulih x x X (Less) Expenses: Discount allowed x Rent/Sewa x General Expenses/perbelanjaan am x Rates/Kadar faedah x Depreciation/Susut nilai x Provision of doubtful debt/peruntukan hutang x ragu Wages and salaries/upah gaji x Carriage outwards x x Net Profit X

- 8. Kunci Kira Kira pada Balance Sheet as at 31st December 2008 RM RM RM Fixed Assets/Aset Tetap/Non Current Assets Fixtures and Fittings/Lekapan dan lengkapan x Furniture x Vehicle (-) belanja susut nilai x Premises x x Current Asset/Aset Semasa Closing Stock/Stok Akhir/Inventori Akhir x Debtor/Account Receivable/ABT/Akaun Belum Terima x Cash x Bank x X (Less) Current Liabilities: Creditor/AP/Account Payables/ Akaun Belum x Bayar Overdarft x x Working Capital x X Owner's Equity Opening Capital x (Add) Net profit x (Less) Drawings/Ambilan x (Add) Additional Capital x Closing Capital x Long Term Liability Bank Loan Debentures x Bon X

- 9. Two column cash book Three column cash book Cash Book Date Details F Cash Bank Date Details F Cash Bank Date Details

- 10. hree column cash book Cash Book F Dis Cash Bank Date Details F Dis Cash Bank

- 11. Debit (If the amount of the account increase) Credit (If the amount of the account increase) Asset Liability Purchases Sales Return Inwards Return Outwards Expenses Revenue Drawings Capital