Top Ten Tech Predictions for 2013

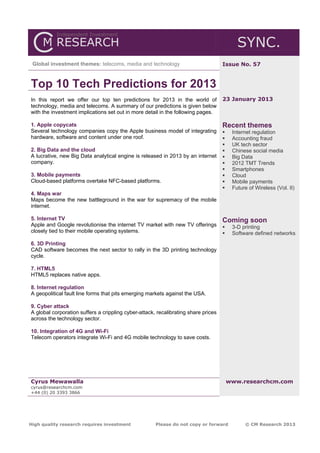

- 1. SYNC. Global investment themes: telecoms, media and technology Issue No. 57 Top 10 Tech Predictions for 2013 In this report we offer our top ten predictions for 2013 in the world of 23 January 2013 technology, media and telecoms. A summary of our predictions is given below with the investment implications set out in more detail in the following pages. 1. Apple copycats Recent themes Several technology companies copy the Apple business model of integrating Internet regulation hardware, software and content under one roof. Accounting fraud UK tech sector 2. Big Data and the cloud Chinese social media A lucrative, new Big Data analytical engine is released in 2013 by an internet Big Data company. 2012 TMT Trends Smartphones 3. Mobile payments Cloud Cloud-based platforms overtake NFC-based platforms. Mobile payments Future of Wireless (Vol. II) 4. Maps war Maps become the new battleground in the war for supremacy of the mobile internet. 5. Internet TV Coming soon Apple and Google revolutionise the internet TV market with new TV offerings 3-D printing closely tied to their mobile operating systems. Software defined networks 6. 3D Printing CAD software becomes the next sector to rally in the 3D printing technology cycle. 7. HTML5 HTML5 replaces native apps. 8. Internet regulation A geopolitical fault line forms that pits emerging markets against the USA. 9. Cyber attack A global corporation suffers a crippling cyber-attack, recalibrating share prices across the technology sector. 10. Integration of 4G and Wi-Fi Telecom operators integrate Wi-Fi and 4G mobile technology to save costs. Cyrus Mewawalla www.researchcm.com cyrus@researchcm.com +44 (0) 20 3393 3866 High quality research requires investment Please do not copy or forward © CM Research 2013

- 2. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 Here are CM Research’s top ten predictions for the global technology sector in 2013: 1. Apple copycats Several technology companies copy the Apple business model of integrating hardware, software and content under one roof Apple’s business model, centred on its ability to lock customers into its ultra-smooth ecosystem through its iOS platform, will be cloned by rivals. In 2012, four of the largest technology companies made a move to acquire the pieces of the hardware-software-content jigsaw that they didn’t currently have: Google purchased Motorola Mobility; Microsoft started manufacturing its own tablets; Amazon and Facebook poured resources into their own app stores with rumours they may launch their own smartphones too. Investment implications Platform effect: Most of what we do on the internet will gravitate towards the big internet platforms, based on Apple’s integrated model. The established internet champions will get bigger. Innovative start-ups will get acquired. The middle will get squeezed. Commodity effect (smartphones): Many hardware makers will develop (or acquire) their own mobile operating software. HP, Oracle, Huawei, ZTE fit this category. Without software, hardware makers are left with precious few means to differentiate their products, squeezing margins even further. Commodity effect (consumer electronics): Consumer electronics are fast becoming bolt-on accessories for the big internet ecosystems, reducing once great consumer electronics brands into subcontractors for Apple, Google, Microsoft and Facebook. Most at risk are consumer electronics manufacturers like Philips, Samsung, LG, Sharp, Canon, Nikon, Panasonic, attempting to compete on a hardware-only platform. Google effect: Google’s Android now has over 70% global market share of mobile operating systems by some estimates. Google’s original aim was to profit from mobile ads, but that market has proved somewhat disappointing. In 2013, we predict it will start charging royalties for Android of between $5 and $15 per handset. Apple effect: As the established market leader, Apple is likely to strengthen its lead with new offerings in the field of mobile payments, internet TV and internet watches. Those in its supply chain likely to benefit include Avago, Broadcom, Cirrus Logic, Hon Hai, LG Display, Omnivision, Qualcomm, Skyworks, TriQuint and TPK. Conflicts of interest: Google and Microsoft are now making hardware, creating conflicts for customers of their software. Apple doesn’t have this conflict because it doesn’t licence out iOS. But its main supplier, Samsung, is conflicted because it supplies Apple with critical components whilst simultaneously using its intimate knowledge of Apple’s designs to compete directly with it in the smartphone sector. Apple will likely diversify away from Samsung, though that may ultimately result in reliability and logistical problems for Apple. China effect: In China, the three big internet champions – Alibaba, Baidu and Tencent – may soon launch their own mobile operating systems and smart devices, further strengthening their iron grip on their domestic internet sector. China’s internet market is notoriously difficult for foreign technology companies to crack – just ask Google, Yahoo, Facebook or Twitter. Even Apple, with its recent surge in hardware sales may find that too many of its iPhones are jail broken – allegedly encouraged by some of Apple’s Chinese rivals – increasing the reputational risk Apple faces from unauthorised software downloads, potentially forcing Apple to rethink its China strategy completely. Software boom: Three industry trends are making life uncomfortable for many traditional software companies: the move to app platforms, the move to the cloud and the move to the mobile internet. Apple’s model encourages all three. Large software groups, unable to innovate fast enough, are acquiring specialist software houses. The software boom that has resulted is set to continue into 2013. Mobile-first, app-centric start-ups: Smaller screens and lower customer patience levels mean that desktop applications have to be re-designed from scratch to have any hope of working well on the mobile internet. Mobile-first, app-centric start-ups are unseating current software leaders as the internet goes mobile. A handful of established software leaders may soon become vulnerable to mobile start-ups. Facebook’s $1bn acquisition of Instagram illustrates the threat. Squeeze on games developers: The large internet platforms are attempting to disintermediate games developers, reducing them to white label suppliers rather than customer-facing brands. Facebook’s treatment of Zynga is a case in point. In the world’s largest online gaming market, Tencent may be better way to play China’s gaming sector than individual games developers. www.researchcm.com 2

- 3. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 2. Big Data and the Cloud A lucrative, new Big Data analytical engine is released in 2013 by an internet company Big Data will soon become a mainstream investment theme. The problem for investors is that there are very few pure-play Big Data companies in which to invest. Big Data refers to unstructured data that is difficult and expensive to analyse in real time because of its “3V” characteristics: high volume, high velocity and high variety. These characteristics make it difficult for traditional relational databases to handle Big Data. To put the first of these 3V characteristics into perspective, the world created more data over two days in 2011 than “from the beginning of recorded time until 2003” according to an eBook by Rick Smolan and Jennifer Erwitt. Examples of Big Data include music, video, email, tweets, Facebook posts, credit card transactions, locational data and the cookies that form our personal digital footprints. This data can be used to answer questions that have never been asked before, such as “Who are the most likely people to buy your next product, how old are they and what kind of things are they likely to do on the weekends?” Cracking the algorithm for Big Data is like Where do the big players fit into the Big Data supply cracking the Enigma code in World War II chain? – it gives you a remarkable lead against the enemy. Of the world’s top 20 global Big Data Big Data Big Data Production Management Consumption TMT companies, we believe at least 16 are investing heavily in developing Operating system and browser software developers powerful Big Data analytical engines Social media Search engines capable of converting zettabytes of Documents Databases Social networks unstructured garble into “business Web crawlers Web robots Cloud services providers intelligence” for every industry from Sensors automobiles to advertisers to healthcare to Voice Music & video Telecom operators Marketing agencies education to retail to public sector services. Email Data centres RFID Third party Analytical engines Call records resellers Payment details But who are the leaders in Big Data GPS Hardware makers Data analytics likely to be? To answer this Cybersecurity scientists question, it helps to look at the schematic Apps developers on the right, which depicts where different Source: CM Research types of technology companies sit in the Big Data supply chain. Investment implications The leaders: Internet companies like Amazon, Google, and Facebook are the most likely ones to profit the most from the Big Data product cycle. As our schematic shows, these companies control where the data comes from and where it goes to. Each of these companies already uses Big Data engines to analyse data in-house. In 2013, some of them are likely to release these tools to the market, creating new revenue streams for their shareholders. The laggards: Meanwhile the Big Database companies like IBM, SAP and Oracle are still playing catch up in the Big Data market, reluctantly switching from their traditional relational database technology (which cannot cope with Big Data) to open source platforms like Hadoop (which were originally developed by Google and Yahoo). The niche players: As Big Data takes off, data networks will become more complex. Niche networking technology players like Brocade, Fusion IO and Riverbed Technology who can make these networks run faster, cheaper or more efficiently are likely to benefit in 2013. The cloud: The Big Data investment theme together with the cloud computing theme will form a virtuous circle of growth for investors in those sectors, with each technology feeding off the other. Cloud software companies like Amazon, Salesforce, EMC, NetApp and NetSuite could see substantially more business as demand for Big Data accelerates in 2013. So will data management companies such as Informatica and Commvault. Virtualisation software companies like Citrix Systems and VMware will also benefit from the Big Data growth cycle. www.researchcm.com 3

- 4. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 3. Mobile payments Cloud-based platforms overtake NFC-based platforms Several mobile payments platforms are likely to be launched in 2013, dwindling down to perhaps just a couple by 2015. There are two broad technology camps competing in the mobile payments industry. The first is near field communications (NFC) – a hardware standard – and the second is cloud-based software. Each category has a different growth profile and a different risk profile for investors. NFC payments work by tapping an NFC-enabled mobile handset on an NFC reader connected to the cash register at a retailer. The customer’s payment credentials are stored in the mobile wallet software on the mobile handset. The transaction is normally very fast because it is transmitted through the NFC reader directly to the banking system in the same way credit card payments currently work. Cloud-based mobile payments involve users downloading an application. The customer’s payment credentials are stored on a server in the cloud. The transaction can be slow because authorisation is transmitted via the mobile network. Where the wireless network is overloaded or the signal is bad, cloud payments can be an unreliable or slow payment method. There are two types of mobile payment platforms – hardware based ones and software based ones Hardware: Google wallet uses NFC contactless terminals Software: Square, PayPal and AliPay are cloud-based platforms How does “Google wallet” work? How does “Pay with Square” work? 1. Download the app, create an account with your name, 1. Download the app, create an account with your password, and credit card number. name, password, and credit card number. 2. Tap your phone to an NFC terminal at the checkout in 2. The app identifies your location and suggests any shop where contactless payments are accepted. shops near you that accept Pay with Square. 3. Your phone sends payment information to the NFC 3. Select the shop you want, and open a tab. terminal linked directly to the banking system. 4. At checkout, the cashier matches your name and photo to those on the register and the purchase is allocated to your credit card. ............. Source: Google, Square, CM Research Whilst NFC payments can be fast and reliable for the user, cloud-based payments are often simpler and cheaper to adopt for the retailer. NFC requires expensive infrastructure to be in place before it can work, whilst cloud-based solutions are over-dependent on a high-quality, high-speed connection to a mobile network. Both NFC payments and cloud payments have security issues as both rely on downloadable software. Investment implications Wrong bet: The incumbent players – the telecom operators and the major credit card companies – all sponsor NFC technology. All major handset manufacturers (except Apple) also incorporate NFC chips in many of their newest models. Given the recent success of Square and other cloud-based solutions, it now looks to us as if they are betting on the wrong technology. Winning bet: The leading innovators – Square, eBay, Alibaba, Tencent, Facebook – have all gone down the cloud solution route. Apple, whose iPhone 5 does not contain an NFC chip, may be developing a cloud-based mobile payments platform using its iTunes accounts linked to customers’ credit cards. The irony: We believe that the cloud camp will win the battle because their solutions are easier, faster and cheaper to roll out. Ironically, cloud-based mobile payments are far less reliable than NFC based terminals for taking payment because of their reliance on wireless networks, which can be patchy. But that is the nature of disruptive technologies. www.researchcm.com 4

- 5. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 4. Maps war Maps become the new battleground in the war for supremacy of the mobile internet In 2007, the leading technology companies realised they needed a smartphone operating system if they were ever to dominate the mobile internet. Then, in 2008, came app stores. By 2009, many acknowledged the importance of controlling their own search function. In 2010, social networks and mobile advertising platforms became must-haves. But the truly big prize around the corner is mobile commerce. So, in 2013, the fight for mobile domination will be fought in two critical domains: mobile payments and maps. The location of a user is critical to mobile commerce, mobile Any company that wants to dominate the advertising and social networking. Knowing where someone mobile internet needs to control Maps is and where they want to go is something many businesses will pay for. Owning location information is key to owning the mobile internet. That is why Apple was so keen to get its Maps app into the market even though it didn’t quite work properly. Normally, when Apple becomes aware of a major fault in one of its apps, it is immediately withdrawn, fixed and re-released. Not the case with Maps. Apple’s management took the decision that they were running out of time in the maps war. Better to release a poor version of the Maps app early in the Source: CultofMac.com day and improve it on the go than to miss out completely on one of the most high-value, fast-moving parts of the mobile internet rollercoaster. Investment implications Leaders: Google is the clear market leader in maps. Nokia, which acquired Navteq for $8.1bn in 2007, owns the next best maps platform, in our view. Laggards: Apple, Microsoft and AOL all have their own maps platforms, but are much further behind. China factor: In China, Baidu’s maps platform puts it in a strong position to profit from the mobile internet. Whilst few analysts believe Baidu Maps are technically better than Google Maps, China’s internet market is a closed, protected market that inherently favours a home-grown maps platform. www.researchcm.com 5

- 6. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 5. Internet TV Apple and Google revolutionise the internet TV market with new offerings Newspapers, magazines, radio and other forms of traditional media have seen technology companies eat their lunch by providing digital alternatives. TV has so far resisted. As the chart below illustrates, TV still accounts for 36% of global advertising expenditure, the same percentage share it had a decade ago. As other traditional media have lost market share, TV has maintained a 36% share of global advertising dollars Share of global advertising spend 100% Business to business 90% 80% Outdoor 70% 60% Newspapers and magazines 50% 40% Radio 30% 20% TV 10% Internet 0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: PwC But it is only a matter of time before the TV industry – worth $200bn in advertising revenues (or twice the size of the internet advertising industry) – undergoes a digital transformation. So far this prize has eluded the brightest minds of the world’s greatest internet champions. Many commentators say that internet TV has already arrived, but today’s “smart TVs” are a misnomer. They are merely a box that contains two parts: one part traditional broadcast TV and the other part internet access. The two parts are not integrated in any way. In 2013, all that may change. TV viewers will routinely use dual-screens – interacting with their TV via their smartphone, talking about live TV content on social media, or using their smartphone as a remote control. Investment implications The leaders: Ownership of an operating system will be critical for internet TV makers: Apple and Google are way ahead in this regard; Microsoft is a distant third possibility, with its Xbox already in the living room in millions of homes. The content conundrum: Ownership of in-house content will be important in the internet TV age. Whilst Facebook has user-generated content, Apple and Google may decide they need to move into programming to make a success of internet TV. Sony, the only significant technology player to own its own film and music studios, has the advantage here but, as yet, no strategy to utilise it. The social conundrum: Ownership of a successful social network, through its ability to attract eyeballs, will enable players like Facebook to claim a sizeable share of internet TV advertising revenues. The Samsung conundrum: Samsung’s position in all this is unclear. It has no operating system1, no content and no social network to speak of. Yet it is the only smartphone hardware-only maker to rival Apple’s profitability levels in 2012. Much may depend on the role Apple is willing to retain for Samsung in its supply chain. The Telco conundrum: Telecom operators, which have tried to replace cable-TV with IPTV for a decade, will likely see slow progress in 2013. Korea Telecom and Chunghwa Telecom were one of the early starters back in 2003, but have only managed to acquire 3.5m and 1.2m IPTV subscribers respectively since then. Leading IPTV players in mature Asian broadband markets like Hong Kong, Korea, Singapore and Taiwan have learned that it is difficult to displace incumbent pay-TV operators without offering a larger content library. BT and SK Telecom have tried to acquire content on a large scale, but so far have not posed much of a threat to anyone. 1 Samsung’s Bada operating system is pretty much dead in the water. www.researchcm.com 6

- 7. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 6. 3D printing CAD software becomes the next sector to rally in the 3D printing technology cycle 3D printing – also known as additive manufacturing – could revolutionise the manufacturing sector. A 3D printer creates an object by laying down successive layers of material in an “additive process”. This contrasts traditional machining techniques where parts of a large block of material are selectively removed in a “subtractive process”. Today, 3D printers can produce complex shapes and 3D printer sales may take off in 2013 structures that could not easily be produced using Industrial AM systems sold worldwide traditional manufacturing methods. They can cope 7,000 with a range of materials from steel, gold, aluminium, 6,000 paper, wax and polymers (plastics). 5,000 Unit sales In 2011, 6,494 industrial 3D printers were sold in a 4,000 market worth $1.7bn growing at 30% p.a., according 3,000 to Wohlers Associates. Currently used predominantly 2,000 for prototyping, 3D printers could soon be used for 1,000 mass-market manufacturing. - 1995 1997 1999 2001 2003 2005 2007 2009 2011 Over the last 18 months, share prices in 3D Systems Source: Wohlers Associates and Stratasys, the two leading manufacturers of 3d printers, have both increased by over 200%. Investment implications 3D and Stratasys over bought: As with many technology product cycles, there is a risk that the hype may have pushed the share prices of the leading players too far too early in the cycle. Both currently trade on a 2013 P/E multiple of around 100x. CAD software underbought: 3D printers receive their instructions from computer aided design (CAD) software files, which model the object to be produced. So a better way to play the 3D printing cycle in 2013 might be via the CAD software sector. Stocks like Dassault Systeme and Autodesk are in strong position to benefit if 3D printing takes off. Impact on manufacturing sector: Leading contract manufacturers like Hon Hai will have to rethink their entire manufacturing process in light of 3D printing technology. Reshoring: 3D printing technology may aid US and European high tech companies in reshoring some of their manufacturing business. Piracy and patents: The value of patent portfolios will rise as 3D printing technology makes it easier for unscrupulous manufacturers to steal proprietary designs and quickly manufacture clones. www.researchcm.com 7

- 8. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 7. HTML5 HTML5 replaces native apps The apps distributed through Apple’s app store are “native” to iOS. “Native apps” offer a better customer experience than web-based apps: they have greater functionality because they can seamlessly access all the functions of an iPhone or iPad, such as its camera; their performance is often faster and better than web- based apps; and one-click purchase options make it simpler to buy things within the app. But native apps have some disadvantages too. For In Q4 2012, Apple reached 40bn cumulative app developers, it can be very expensive to develop and downloads maintain apps across multiple platforms (e.g. iOS, Quarterly app downloads (bn) Android, Blackberry and Windows). Moreover, users cannot share content outside the native app with the Apple App Store Google Play rest of the World Wide Web. Worst of all for content 7 owners, revenue-generating apps must pay out up to 6 30% of any associated revenues to Apple or Google. 5 4 HTML5 technology allows developers to build web- based apps that run on any smart device using a 3 standard web browser. The technology is still a bit 2 clumsy, the user experience remains patchy at times 1 and progress could be hindered because HTML5 is 0 one of those global standards developed by Q4 2008 Q4 2009 Q4 2010 Q4 2011 Q4 2012 committee. But it has all the hallmarks of a disruptive Source: Company data, CM Research estimates technology. Users get the usual trade-off: higher cost savings in return for a slightly inferior experience. History tells us similar stories. MP3 technology, which made CDs obsolete, displayed the same characteristics. So did VoIP, which replaced PSTN voice services. During 2013 HTML5 technology is likely to improve substantially. The Internet has a distinguished record of breaking up walled gardens. HTML5 will provide the ammunition that may, eventually, tear down the walls of Apple’s App Store and Google’s Play, replacing their closed ecosystems with a global, open standard. Investment implications HTML 5 wins: HTML5 is likely to replace native apps as the developer community’s preferred apps platform because it offers app developers costs savings and improved efficiency (from maintaining just one set of code). Apple and Google weakened: If HTML5 technology supersedes native apps as the developers’ platform of choice, it will threaten the stickiness of Apple and Google’s app ecosystems, loosening their respective walled gardens. Traditional media companies strengthened: Content providers like Disney and Time Warner will find it profitable to switch to HTML5 technology because they avoid the 30% revenue cut demanded by Apple and Google. Pearson was one of the first companies to switch to HTML5 technology back in 2011. By bypassing the proprietary infrastructure of the leading app stores, HTML5 will shift the balance of power from the technology companies who own the leading app platforms to original content companies. Barriers to entry into apps market lowered: HTML5 will make it easier for the late-comers to the app revolution – Microsoft, RIM, Samsung, HTC, Sony and others – to gain app market share because HTML5 apps would work automatically on their handset browsers without having to be re-written specifically for them. www.researchcm.com 8

- 9. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 8. Internet regulation A geopolitical fault line forms that pits emerging markets against the USA In 2013, the internet may become more regulated. But this means different things in different countries. In the West, the big regulatory issues are net neutrality and data privacy. In many developing markets, the big regulatory issue is censorship of the internet. Taking one step back, the overarching problem is that there is no international body yet authorised to even discuss how the internet should be regulated. Last month the ITU (the United Nations' telecoms arm) debated whether it should extend its powers to regulating the internet. China, Russia and several other emerging markets supported ITU regulation of the internet; the US, UK and Canada vehemently opposed it. At the same time, there are growing tensions between telecom operators and internet companies over who pays for the ever increasing flows of data on telecom networks. Regulators are loathe to intervene because they want networks to be “neutral”. But “net neutrality” rules – which have allowed the big internet companies to grow fatter by passing some of their operating costs to the telecom operators – may soon become unworkable. If mobile data traffic continues to double every year and if operator revenues remain flat (because consumers are unwilling to pay more), then operator Capex is bound to remain sluggish and mobile shortages are bound to follow. That leads to bad news for everyone – consumers, internet companies and telecom operators. If broadband investment levels remain weak, regulators – whose primary role is to meet their political target of rolling out high-speed broadband networks as fast as possible – risk appearing inept. Investment implications Geopolitical tensions: China, Russia and other emerging market countries could form their own splinter group at the ITU to agree broad criteria for regulating the internet. The ITU may lobby for an alternative internet bandwidth charging model that favours telecom operators. For the foreseeable future, the US will reject the authority of the ITU over the internet. Its reasons are commercial. In many countries, the profits of the internet sector are increasingly sucked out by US internet companies because they underpay telecom operators the cost of carrying their data and they avoid local taxes. Shift in competitive advantage: By regulating the internet, Russia, China and several smaller emerging market economies will try to shift some of the profits of their respective domestic internet sectors from US internet companies to their domestic telecom operators. Net neutrality scrapped: In some countries net neutrality rules will be formally scrapped. This may include cash-strapped European governments like France's who are keen to protect their domestic telecom operators and internet start-ups from US competition, boosting their tax receipts in the process. A large chunk of the profits from running the mobile Internet will shift from internet companies like Google to telecom operators like Vodafone and France Telecom. Potentially, this profit transfer could be in the tens of billions of dollars per annum, predominantly hitting US internet companies. Net neutrality relaxed: In some countries telecom regulators will relax their commitment to net neutrality. In the UK, for example, Ofcom may well turn a blind eye to secret deals between internet companies and telecom operators where Google, say, agrees to pay Vodafone, say, for preferential access to the internet for its customers. In this scenario all consumers would have access to the whole internet, but Google’s customers would have faster access on Vodafone’s network, resulting in a two-tier internet. Telecom equipment boom: In countries where net neutrality rules are scrapped or relaxed domestic telecom equipment firms will see a boost in orders for fixed and wireless broadband equipment, benefitting the market leaders Ericsson, Alcatel Lucent, Cisco and others. Victims of new regulatory environment: New rules on data privacy, censorship and net neutrality may increase the cost of gathering personal data. Social networks in particular could see profit expectations take a hit. www.researchcm.com 9

- 10. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 9. Cyber-attack A global corporation suffers a crippling cyber-attack, recalibrating share prices across the technology sector The conditions are ideal for a cyber-attacker to bring down a critical piece of infrastructure or a large corporation: smartphones are ubiquitous and do not have anti-virus software installed as standard; the BYOD (bring your own device) trend makes it more difficult for IT department heads to control the devices that can access corporate networks; IT budgets are being cut as in-house hardware and software is replaced by cloud- based services, raising the risk of an external threat; and CEOs appear to be unaware of the true risks to their business from cyberspace. The problem is exacerbated by a lack of transparency on cyber-attacks, which tends to make us all feel safer than we perhaps should. The world’s leading financial regulators do not make disclosure of cyber-attacks mandatory (though the SEC is looking at converting its current guidelines on when companies should disclose cyber-attacks to a formalised set of rules). The conduit could be a social network, an app store, a micro-chip or a piece of telecom equipment with malware ensconced deep inside it. In 2013, we expect to see a major attack on a large corporation, app store or social network. Investment implications If a large-scale cyber-attack occurs, market sentiment for several technology sectors could change: Upgrades: Internet security companies like Checkpoint, Fortinet, Palo Alto Networks, Qihoo 360, Sourcefire, Symantec, Trend Micro and Verint Systems could get re-rated. Downgrades: Social networks like Facebook, who deliberately lower their security settings to maximise data collection, could see their sector downgraded. Sector wide downgrades: Investors may re-assess risk for several subsectors within the internet sector. Impact of disclosure: Regulators may force greater disclosure of cyber-attacks, injecting negative sentiment into companies in sectors deemed to be “at risk”. Chip design: Chipmakers who have invested more in integrating security layers into their chips – such as Intel – could gain a significant competitive advantage. National security issues: Telecom equipment makers in the West may be viewed as strategic military assets. Foreign-owned telecom equipment firms may be seen to be a national security threat. Trade wars will develop between Huawei and ZTE on one side and Alcatel Lucent, Ericsson, Cisco and Juniper Networks on the other. www.researchcm.com 10

- 11. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 10. Integration of 4G and Wi-Fi Telecom operators integrate Wi-Fi and 4G mobile technology to save costs In 2012, data traffic on the world’s mobile networks rose by over 110%. To stay in the game, mobile operators need to invest heavily in 4G networks. Yet revenues for telecom services operators for 2012 in Western Europe, Japan and the USA were flat – even Asia ex-Japan saw only a 2% rise in revenues. Unless revenue models change, operators will have to find ways to cut costs. Deploying more Wi-Fi radio cells to off-load mobile data traffic will help mobile operators’ profitability Mobile data traffic is doubling every year But telecom revenues are flat outside of Asia Global mobile data traffic by application type Telecom services revenues 12000 1,600 1,400 10000 1,200 8000 Asia ex‐Japan PB/month Video 1,000 $bn 6000 Data 800 Japan File sharing 600 4000 USA Other 400 2000 W. Europe 200 0 ‐ 2008 2010 2012 2014 2016 2007 2008 2009 2010 2011 2012 2013 2014 Source: Cisco, CM Research New technologies allow seamless roaming between 3G or 4G cells and Wi-Fi. This allows operators to rapidly offload heavy data users from their expensive 4G networks onto cheaper Wi-Fi networks quickly, cutting operating costs in the process. In addition, Gigabit Wi-Fi (also known as the 802.11ac standard or 5G Wireless) could increase Wi-Fi speeds to 1 Gbit/s and beyond. Investment implications Combined cells: Wi-Fi and LTE technologies will integrate. The market for these combined cells could grow substantially in 2013. Cost savings: Telecom operators who deploy this 4G/Wi-Fi integrated cell technology will see bottom line improvement. Vodafone and KDDI are expected to be one of the first carriers to deploy the new technology. SK Telecom, which already has 7m 4G subscribers and a large Wi-Fi network is also likely to use the new technology. Chip beneficiaries: Qualcomm, Broadcom and Marvell Technology will likely benefit on the wireless chip side. Hardware beneficiaries: Cisco has already indicated it sees this integrated technology as a growth area for its Wi-Fi cell business. www.researchcm.com 11

- 12. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 Recent publications from CM Research December 2012 Internet regulation: A geopolitical fault line is forming that will pit emerging markets like Russia and China against the USA. The catalyst is a dispute over the regulation of the internet. Will the balance of power in the internet sector shift from US internet companies to national telecom operators under the watchful eye of the United Nations' telecom arm, the ITU? Tips from a Forensic Accountant: In the wake of the HP/Autonomy accounting scandal, how do investors protect themselves from the risk of accounting fraud? We provide a forensic accountant's ten-point checklist on what to look for. November 2012 UK tech stocks to watch: Four UK technology companies that may be going places. Four tech megatrends: Mobile, Cloud, Social and Big Data are the four biggest investment trends sweeping across the global technology sector. (Presentation at Bloomberg) October 2012 Chinese social media: How will China's booming social media sector - including heavyweights such as Tencent, Sina, Renren and Baidu - perform if the incoming political regime clamps down on censorship? Big Data beginners' guide: Ten things investors need to know about Big Data as an investment theme. September 2012 2013 TMT Trends: A sector by sector analysis of the big technology trends we are likely to see in 2013 together with predictions on the winners and losers in 24 subsectors of the global TMT industry. Global Investment Outlook for Telecom Operators: Global sector outlook for data centres, cable and satellite operators and telecom operators. August 2012 Global Investment Outlook for Software: Global sector outlook for five software services sectors, including applications software, infrastructure software, security software, video game software and IT services. Global Investment Outlook for Internet and Media: Global sector outlook for five media sectors, including internet companies, social networks, advertising companies, film and TV companies and publishers. July 2012 Global Investment Outlook for Technology Hardware: Global sector outlook for six hardware sectors, including PCs/Servers/Storage, smartphones, consumer electronics, electronic component makers, semiconductors and telecom equipment. June 2012 Smartphone sector trends: We identify 10 emerging trends in the smartphone sector and devise a scorecard system to rank the major players. May 2012 Facebook overvalued: Why Facebook is too expensive? The Cloud: How will the shift from the PC generation to the Cloud generation impact the major players in the global technology sector? April 2012 Big Data: How will Big Data impact the major players in the global technology, media and telecom sectors? March 2012 Future of Wireless (Vol. III): Mobile payments will take off soon, but investors should be careful which technology platform they invest in. February 2012 Internet advertising: Google is undervalued and Baidu is overvalued. Future of Wireless (Vol. II): A mobile bandwidth shortage is coming. This will change the pricing equilibrium dynamics of the internet, forcing regulators to intervene. LTE, spectrum auctions, software defined networks and new internet pricing models are all potential solutions. www.researchcm.com 12

- 13. SYNC, Issue 57 Top 10 Tech Predictions for 2013 23 January 2013 About CM Research CM Research is an independent research provider with a blue chip list of institutional clients. We analyse emerging trends in the technology, media and telecom sectors and develop them into global investment themes, highlighting the winners and losers. Our focus is on disruptive technologies. Our clients include institutional investors, corporations, consultancies and governments. At a time when many of our competitors have had their reputations mired by conflicts of interest, we fiercely guard our independence. Our business model is based on independence, exclusivity and experience. Contact CM Research Office: 22 Upper Grosvenor Street, London W1K 7PE Tel: +44 20 3393 3866 Email: info@researchcm.com Web: www.researchcm.com Important Disclosures This document is issued by CM Research (“CMR”) solely for our clients. This document may not be reproduced, redistributed or passed to any other person in whole or in part for any purpose without our written consent. This document is provided for information purposes only and should not be regarded as an offer, solicitation, invitation, inducement or recommendation relating to the subscription, purchase or sale of any security or other financial instrument. This document does not constitute, and should not be interpreted as, investment advice. It is accordingly recommended that you should seek independent advice from a suitably qualified professional advisor before taking any decisions in relation to the investments detailed herein. All expressions of opinions and estimates constitute a judgement and, unless otherwise stated, are those of the author and the research department of CMR only, and are subject to change without notice. CMR is under no obligation to update the information contained herein. Whilst CMR has taken all reasonable care to ensure that the information contained in this document is not untrue or misleading at the time of publication, CMR cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. This document is not guaranteed to be a complete statement or summary of any securities, markets, reports or developments referred to herein. No representation or warranty either expressed or implied is made, nor responsibility of any kind is accepted, by CMR, its directors, officers, employees or analysts either as to the accuracy or completeness of any information contained in this document nor should it be relied on as such. No liability whatsoever is accepted by CMR, its directors, officers, employees or analysts for any loss, whether direct or consequential, arising whether directly or indirectly as a result of the recipient acting on the content of this document, including, without limitation, lost profits arising from the use of this document or any of its contents. This document is provided with the understanding that CMR is not acting in a fiduciary capacity and it is not a personal recommendation to you. Investing in securities entails risks. Past performance is not necessarily a guide to future performance. The value of and the income produced by products may fluctuate, so that an investor may get back less than he invested. Investments in the entities and/or the securities or other financial instruments referred to are not suitable for all investors and this document should not be relied upon in substitution for the exercise of independent judgment in relation to any such investment. The stated price of any securities mentioned herein will generally be the closing price at the end of any of the three business days immediately prior to the publication date on this document. This stated price is not a representation that any transaction can be effected at this price. The material in this document is not intended for distribution or use outside the United Kingdom. This material is not directed at you if CMR is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. CMR and its analysts are remunerated for providing investment research to professional investors, corporations, other research institutions and consultancy houses. CMR, its directors, officers, employees and clients may have or take positions in the securities or entities mentioned in this document. Any of these circumstances could create, or be perceived as creating, conflicts of interest. CMR analysts are not censored in any way and are free to express their personal opinions. As a result, CMR may have issued other documents that are inconsistent with and reach different conclusions from, the information contained in this document. Those documents reflect the different assumptions, views and analytical methods of their authors. No director, officer or employee of CMR is on the board of directors of any company referenced herein and no one at any such referenced company is on the board of directors of CMR. “CM Research” is a trading name of CHM Research Limited. CHM Research Limited is registered in England, under company No. 07251947 and registered address Amaris, Hill Close, Harrow-on-the-Hill, Middlesex HA1 3PQ, United Kingdom. CHM Research Limited is authorised and regulated by the Financial Services Authority (Firm Reference Number: 579360). © CHM Research Limited 2013. This document, including the text and graphics, is subject to copyright protection under English law and, through international treaties, other countries. No part of the contents or materials available in this document may be reproduced, licensed, sold, hired, published, transmitted, modified, adapted, publicly displayed, broadcast or otherwise made available in any way without the prior written permission of CHM Research Limited. All rights reserved. Analysts’ Certification The analysts involved in the production of this document hereby certify that the views expressed in this document accurately reflect their personal views about the securities mentioned herein. The analysts point out that they may buy, sell or already have taken positions in the securities, and related financial instruments, mentioned in this document. www.researchcm.com 13