NDIC Cryptocurrency Regulation Training 2019

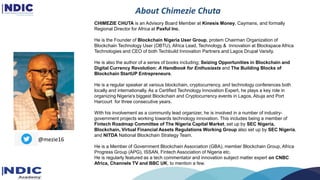

- 1. About Chimezie Chuta CHIMEZIE CHUTA is an Advisory Board Member at Kinesis Money, Caymans, and formally Regional Director for Africa at Paxful Inc. He is the Founder of Blockchain Nigeria User Group, protem Chairman Organization of Blockchain Technology User (OBTU), Africa Lead, Technology & Innovation at Blockspace Africa Technologies and CEO of both Techbuild Innovation Partners and Lagos Drupal Varsity. He is also the author of a series of books including; Seizing Opportunities in Blockchain and Digital Currency Revolution: A Handbook for Enthusiasts and The Building Blocks of Blockchain StartUP Entrepreneurs. He is a regular speaker at various blockchain, cryptocurrency, and technology conferences both locally and internationally. As a Certified Technology Innovation Expert, he plays a key role in organizing Nigeria's biggest Blockchain and Cryptocurrency events in Lagos, Abuja and Port Harcourt for three consecutive years. With his involvement as a community lead organizer, he is involved in a number of industry- government projects working towards technology innovation. This includes being a member of Fintech Roadmap Committee of The Nigeria Capital Market, set up by SEC Nigeria, Blockchain, Virtual Financial Assets Regulations Working Group also set up by SEC Nigeria, and NITDA National Blockchain Strategy Team. He is a Member of Government Blockchain Association (GBA), member Blockchain Group, Africa Progress Group (APG), ISSAN, Fintech Association of Nigeria etc. He is regularly featured as a tech commentator and innovation subject matter expert on CNBC Africa, Channels TV and BBC UK, to mention a few. @mezie16

- 2. Regulation of Digital Currencies The Nigeria Experience 2019 VIRTUAL FINANCE PROGRAMME

- 3. Outline • Bitcoin, Cryptocurrencies, and Tokens: What are they to Regulators? • Benefits of Digital Currency Regulations • Consequences of an unregulated Digital Assets Ecosystem. • Who and What should be Regulated • Four prongs of the Howey test. • Crypto Assets Regulation in Nigeria: SEC Nigeria Approach • Cryptocurrency Regulations in Different Jurisdictions • Standard Regulatory approach for Cryptocurrencies.

- 4. Introduction Digital Currencies, Virtual Financial Assets, Cryptocurrencies etc., will likely have a profound effect on the future of the Internet, financial technology, and governance systems in general. The mere fact that anyone with a computer and an Internet connection can develop and share her own currency, her own vision of the future, can be scary. The openness of this system makes it vibrant but it also can make it hazardous. Some new uses of the technology will be nothing more than scams garnished with the sort of techno-babble that inspires, confuses, and beleaguers the caution of naive investors who want to believe in the projects.

- 5. 1. Bitcoin, Cryptocurrencies, and Tokens: What are they to Regulators? Because Cryptocurrencies and tokens, broadly, are truly innovative. They present an arrangement of technological components that is so novel and varied as to defy categorization as any traditional asset, commodity, security, or currency.

- 6. How Regulation is viewed by participants Regulation is often seen as a murky word within the cryptocurrency community, especially when one considers the visionary principles outlined in the Satoshi Nakamoto’s hallmark Bitcoin whitepaper. The ideological objective was to create a financial system that relied on no third party, nor dictated by outside actors such as governments or central banks. As a result, Bitcoin enthusiasts demanded a platform that was free from outside interference.

- 7. 2. Benefits of Digital Currency Regulations Stabilize Values To help stabilize its value, cryptocurrency needs to be regulated. Eliminate Fears To eliminate or at least reduce fears about it. Ease Tax Issues If someone keeps cryptocurrency as an investment, capital gains and losses must be reported. If and when they are reported, it can be taxed. Investor Confidence Regulation will ensure that investors and user are afforded with the same safeguards as expected in the real world. Standardization and ethics There is need to create standards that encourage ethical practices that ultimately make for a fair and efficient market.

- 8. 3. Consequences of an unregulated Digital Assets Ecosystem. •Without clear regulations, cryptocurrency innovation will be stifled. •Most entrepreneurs will continue to sit on the sidelines for fear of innocently running foul of the law. •Institutional Investors will hang back because of uncertainty regarding valuations and market stability. •And the prosperity of Nigeria suffers, as other countries lure innovators away by creating rules that make their jurisdictions more hospitable to this growing asset class. •Fraudulent purveyors of cryptocurrencies and digital assets will drive out those with genuine/ good intentions.

- 9. 4. Who and What should be Regulated Any person, (individual or corporate) whose activities involve any aspect of blockchain- related and digital asset services should be registered by regulation and as such, will be subject to the regulatory guidelines. Such services include, but are not limited to reception, transmission and execution of orders on behalf of other persons, dealers on own account, portfolio management, investment advice, custodian or nominee services. Issuers or sponsors (start-ups or existing corporations) of digital assets shall be guided by the regulation. Foreign or non-residential issuers or sponsors will be required to establish and register a branch office within Nigeria.

- 10. 5. Four prongs of the Howey test. •Distribution •Common Enterprise: Horizontal and Vertical Commonality •Expectation of Profits •Efforts of a Third Party The Howey test provides a lucid rubric for judging the relative risks of token sales, and determining which sales warrant, from a public policy perspective, some form of oversight or regulation.

- 11. Four prongs of the Howey test. •Distribution Variability in the manner that the token is distributed should, from a public policy perspective, be the first factor contemplated in analysis of whether sales of a token are or are not securities. If the primary mode of distributing new tokens is through a sale of those tokens, particularly sales initiated and made directly between users and the developers of the network, then this prong is likely satisfied. A token that is offered in a pre-sale and developed and/or distributed to supporters only after that pre-sale is complete, appears more like an investment of money than mere sales and re-sales of tokens already mined or distributed on a network that has already been developed. Similarly, sales of pre-mined tokens by developers, particularly if accompanied by promises of future rewards or a future minimum price floor, also appear to fit well within the understanding of this prong.

- 12. Four prongs of the Howey test. •Common Enterprise: Horizontal and Vertical Commonality Horizontal commonality can be defined as the pooling of investor funds such that the fates of all investors rise or fall together, often—though not always—through a pro-rata sharing of profits. Vertical commonality requires that the fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties. As a general rule, cryptocurrency networks exhibiting strong vertical commonality between average users and a small class of creators may warrant careful scrutiny from a public policy perspective. Key factors to note include; •Scarcity •Decentralization •Profit-Development Linkage

- 13. Four prongs of the Howey test. •Expectation of Profits In many ways this prong may be the easiest for any token sale to satisfy. These technologies are very new and much of their value is speculative. Accordingly, an expectation of profits is a prime motivator for many who buy or come to hold cryptocurrency. There are two relevant variables worthy of consideration; •Distribution •Functionality

- 14. 5. Four prongs of the Howey test. •Efforts of a Third Party Whether the profits of the individual user mirror those of the promoters or issuers— whether the actions of a particular third party are substantially the cause of increased profits and, more precisely, whether buyers rely on those efforts. In discussing token projects, it is not uncommon to hear over- zealous advocates suggest that the technology is “trustless” or that it is guaranteed by “math” alone. These are unfortunate oversimplifications. A user of a token does rely on the honest efforts of others on the network. The innovation behind Bitcoin is not the removal of trust, but rather the minimization of trust through decentralization.

- 15. 6. Crypto Assets Regulation in Nigeria: SEC Nigeria Approach “The Burden of Proof” The Commission presumes that Digital Assets are securities until proven otherwise. The burden of proving that the digital assets do not constitute securities, is placed on the issuer or sponsor. All Digital Assets Token Offering (DATOs), Initial Coin Offerings (ICOs), Security Token ICOs and other blockchain-based offers of digital assets within Nigeria or by Nigerian issuers or sponsors, shall be subject to the regulation of the Commission. Existing digital assets offerings prior to the implementation of the Regulatory Guidelines will have three (3) months to either submit the initial assessment filing or documents for registration proper, as the case may be.

- 16. Crypto Assets Regulation in Nigeria: SEC Nigeria Approach Blockchain-based securities present heightened risks related to loss and theft when compared to traditional securities, necessitating appropriate regulation for the platforms that facilitate trading or dealing in digital assets. Regulation will take into account the functions that may be performed by each platform and apply both to platforms that operate in Nigeria and those that have Nigerian participants. Therefore, any platform providing or holding itself out as providing blockchain and digital assets services in or from within Nigeria, must be licensed by the Commission.

- 17. 17 o Tokens issued as part of an ICO fall into one of the following categories: • Tokenised Shares – function as ordinary shares • Tokenised Equity Interest – Carry rights to equity style payouts • Tokenised Debt Securities – Function as plain bonds • Tokenised Funds – Units in a fund are represented by a token on a blockchain o The existing regulatory framework applies to Crypto assets that qualify as transferable securities or other types of MiFiD financial instrument o Crypto assets that are securities and/or derivatives or derivatives that are based on crypto assets would be subject to regulation and the platform on which they are traded will also be subject to regulatory requirements. o Where investor’s contractual right to the crypto assets constitute a security or derivative, securities legislation apply to crypto assets that are commodities. o No recognized or authorized platforms in Canada. o Under the US Securities Act of 1933/Securities Exchange Act of 1934, “Security” includes “investment contract” o An Investment Contract is a security if it is: • An investment of money, in a common enterprise, with expectation of profit, through efforts of others (SEC v N. J Howey & Co) o Platforms that operate as an “exchange” and offer trading of digital assets that are securities, must register with the US SEC or be exempt from registration. o Token issuers must comply with securities laws, if tokens are being marketed, issued or sold to U.S persons 7. Crypto Assets Regulation From Different Jurisdictions

- 18. 18 o The Regulatory Framework for Digital Asset Tokens Offering (DATO), in the Philippines is designed to protect investors. o The Rules consists of 3-Tiers in investment and asset in digital tokens • ≤ $5 million • Between $6million - $10 million • More than $10million o There is also a Licensed Offshore Virtual Currency Exchange (OVCE). o Final ICO Regulation yet to be released. o Trailblazing regulatory framework for ICOs, developed in 2018. o Virtual Financial Assets Act of Malta Cap 590, 2018. (VFAA) o Malta Digital Innovation Authority Act 2018 (MDIA) o Innovative Technological Arrangement and Services Act (ITAS) Crypto Assets Regulation From Different Jurisdictions

- 19. 8. Standard Regulatory approach for Cryptocurrencies. 1. Avoid promising innovations that are ill-fitted to the Howey test, presenting less risk to users: a. Highly decentralized cryptocurrencies (e.g. Bitcoin, Litecoin) because of a lack of vertical commonality or a discernible third party or promoter upon whose efforts investors rely. b. Sidechained Cryptocurrencies/Blockchains because there is no expectation of profits on the part of participants who hold tokens with a value pegged to their existing bitcoin/parent-chain holdings. c. Cryptocurrencies where initial distribution is made through open competitive mining or proof-of- burn because there is no investment of money, i.e. no risk capital is provided to an issuer or promoter. d. App-Coins or Distributed Computing Platforms (e.g. Ethereum) because participants seek access to these tokens for their use-value rather than an expectation of profits.

- 20. 8. Standard Regulatory approach for Cryptocurrencies. 2. Take action necessary to protect investors against cryptocurrencies well-fitted to the Howey test, presenting greater risks to users: a. Closed-source or low-transparency cryptocurrencies because without visibility into the operation of the technology there is no reason to believe that profits come from anything other than a promoter’s hype. b. Open but heavily marketed pre-sales or sales of pre-mined cryptocurrencies with a small and non- diverse mining and developer community when the facts indicate that profits come primarily from the efforts of this discrete and profit-motivated group. c. Cryptocurrencies with permissioned ledgers or a highly centralized community of transaction validators.