How securitized lending collapsed the financial system which now exists on life-support

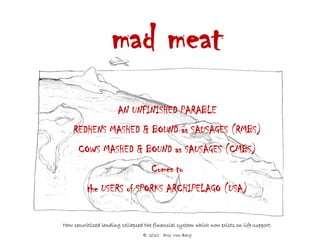

- 1. mad meat AN UNFINISHED PARABLE REDHENS MASHED & BOUND as SAUSAGES (RMBS) COWS MASHED & BOUND as SAUSAGES (CMBS) Comes to the USERS of SPORKS ARCHIPELAGO (USA) How securitized lending collapsed the financial system which now exists on life-support. © 2010 Eric Von Berg

- 2. CAST Characters & Props Played in the Real World By People of the Archipelago Money Managers (our retirement funds, insurance, etc.) Fishermen of AllSorts Island Borrowers on Student loans, Car Loans, Credit Cards, Etc. Chicken Farmers of Redhen Island Home Loans Borrowers Ranchers of Cow Island Commercial Loan Borrowers Governor Federal and State Governments Competing Regulators Treasury, Federal Reserve, SEC, FDIC, Comptroller of the Currency, Office of Thrift Supervision, Federal Trade Commission, Commodities Futures Trading Commission, National Credit Union Commission, HUD, VA, FHA, GNMA, Pension Benefit Guarantee Corporation, House Financial Services Committee, Senate Committee of Banking Housing and Urban Affairs, AND their State counterparts. Street-Vendors Banks & Insurance Companies Tinker-Traders Investment Banks Butchers Mortgage Bankers Professional Hotdog Eaters “B” Piece Buyers (buyers of the unrated tranches) Meat Mortgages and other asset backed loans Porridge T-Bills and Treasury Bonds Scrapple CD’s, Pass Book Accounts, Insurance and Annuities. Sausages Asset Backed Securities; ABS, RMBS, & CMBS

- 3. Not that long ago, in another world just as crazy as ours, was a nation made up of many islands, the Users of Sporks Archipelago (USA). Each island had a specialized economy. Three islands specialized in protein production: AllSorts Island, a fishing island that netted an assortment of small sea creatures; Redhen Island, raised and sold poultry; and Cow Island, produced beef.

- 4. Who Rated in the USA? The Governor of the USA was elected every four years. Since there were far more poultry farmer voters than fisherman or ranchers the Governor liked the poultry farmers of Redhen Island the best. The Governor supported the poultry farmers; in return the poultry farmers supported the Governor. This reinforcing cycle was a political foundation so strong it became the national creed: Every citizen felt they should strive for “the USA Dream”: Which is, “A Chicken in Every Pot”.

- 5. Why Sporks? Fig 1: Typical Street-Vendor Fig 2: Typical Tinker-Trader People of the Archipelago travelled between islands by plane. The Governor wanted to protect the Archipelago from terrorism, so decreed; “The people of the Archipelego must give up all knives to keep us safe from knife-wielding terrorists. We will from here forward eat with sporks (a combination spoon and fork). I will allow only three businesses to use knives; the Street- Vendors, the Butchers and the Tinker-Traders.” The Governor needed campaign money all the time. Each group of knife-wielders wanted special treatment from the Governor. Each class of knife-wielder competed to give the Governor the most campaign money. Tinker-Traders usually gave the most money, so the Governor liked the Tinker-Traders the best.

- 6. Never fear the Competing Regulators are here! To reassure the public that the knife-wielders would use their knives safely, the Governor named many Competing Regulators to monitor the use of knives. The Tinker-Traders told the Governor; “Using knives is complex; we use knives the best: So only we can regulate the use of knives.” This was not always true since on occasion a Tinker-Trader died of self-inflicted wounds. But, the Governor agreed and appointed various Tinker-Traders in turn to be the Competing Regulators. Why? Because, the Governor liked the Tinker-Traders the best. The Competing Regulators were sworn to follow the “Two Guiding Principles” in monitoring the use of knives: 1. Free Markets: The Competing Regulators are FREE of blame as long as they let the MARKETS do whatever they want. 2. Laissez Faire: The Competing Regulators can be LAZY as long as those who are better-off are at least doing FAIR, which is all the time. The Competing Regulators Principle: “It is the public’s job to be cautious, not the Competing Regulators jobs to be diligent.”

- 7. The Myth of Full Disclosure! For example, one of the Competing Regulators, the Spork Exactitude Commissioner (SEC) had broad powers, but adhered diligently to the “Two Guiding Principles” and thus chose only to focus on whether Tinker-Traders labeled products truthfully and disclosed risks and conflicts of interest. The Tinker-Traders were allowed to sell anything. And, because, they could – they did. They even put dried turds and butcher trimmings in a box and sold them to the public, which was legal because the boxes contained broad disclosures. The Tinker-Traders branded this product Cow and Chicken Dung and Offal, or “C2DO” for short. The disclosures were typically so numerous and farfetched that the real risks were overlooked. Product Disclosure: People who eat dried turds might be: hit by a meteor, struck by lightning, sit on needles in hay stacks, get sick, swallowed by sink holes, stampeded by snipes or singed by dragon’s breath. Nutritional value may vary. Sponsor Disclosure: Sponsor has various conflicts of interest. Not Printed: We set up a book-making operation taking bets as to whether you will get sick and die from this product. Are we also making bets? ”You betcha!” Which side are we betting on? According to the SEC we are allowed to tell you: “None of your business!”

- 8. Hard to Catch a Thief When Everything is Legal The Competing Regulators competed to serve the knife-wielders. The Tinker-Traders had one request of the SE Commissioner, “We need to look like honest businessmen, so, please catch a crook or two.” The Commissioner replied, “I just allowed you to make a sack of gold designing and selling risky products to the public: I allowed you to make another sack of gold running a gambling business taking bets on whether and when the public will get sick and die from that product: I allowed you to make a huge sack of gold by betting on the side of the public getting sick. Given that almost everything is legal, for what crimes do you suggest I arrest these crooks?” The Tinker-Traders replied, “Arrest them for non-disclosure!” The SE Commissioner said “Yes, Sirs! I shall listen diligently for the silence of non-disclosure!” This is harder than you think. As a result, a crook named Berney made off with a sack of gold bigger than a house.

- 9. How we got here? Let’s start with the Good Old Days The people of the Archipeligo had a simple diet, besides protein from the three islands they ate Porridge produced by the Governor. The Governor asked the Tinker-Traders to sell his Porridge to the public. Why? Because, the Governor liked the Tinker-Traders the best. The Porridge never went rancid. It was so without risk, people used a phrase “As good As Archipelago” Porridge, abbreviated to “AAA” to mean without any risk at all. However the meat, chicken and fish did come with risk. The buyers had to make sure they were not sold diseased or inferior meat or sold meat that could soon spoil. Because the people ate with sporks they needed to have their meat ground. People relied on the Street-Vendors who bought and ground the meat, poultry or fish. The Street-Vendors mixed the meat with Porridge and sold it as slabs of meatloaf called “Scrapple”. The Street- Vendors bought their meat either from a trusted Butcher or directly from the rancher, chicken farmer or fisherman. Even at a trusted Butcher’s counter a careful Street- Vendor inspected and smelt each piece of meat and asked the butcher about how and where it was raised. The Street Vender haggled with the Butcher to trim off the fat and gristle and to make sure the weight was measured properly. Even if the meat seemed fresh when purchased it might go bad before it was eaten, thus many Street-Vendors asked the ranchers, farmers or fishermen to give a guarantee. Caution is good. Fig 3: Typical Butcher selling to a Street-Vendor

- 10. The ability to fail is the public’s first and best defense. Since people didn’t know what went into each batch of Scrapple, they needed to find a Street-Vendor they could trust. The Street-Vendors used many devices to build trust; large impressive vending stands, conservative dress and a demeanor that radiated prudence. But what gave people the most comfort was the stand under every Street Vendor’s cart that read: I FAIL = I DIE. Any Street-Vendor would acknowledge: “If I pick too much bad meat, my guarantees will ruin me, my business will fail, and I will die.” The public knew that FAILURE = DEATH was the real reason Street-Vendors strove to be prudent. This system worked. Each class of knife-wielder did a different job that required a different personality and business style. 1. The Street-Vendors were cautious and prudent and guaranteed their products. 2. The Butchers were service oriented: (a) Serving the farmers, ranchers and Street Vendors as evenhandedly as best they could, (b) Helping the Street Vendors value and inspect the meat, and (c) Establishing today’s going price. 3. The Tinker-Traders were creative risk takers. They sold the Government’s Porridge but also were allowed to sell anything they cut up if they could find someone to buy it (of course abiding by the SEC’s disclosure rules). Unlike the Street-Vendors the Tinker-Traders guaranteed nothing. The Tinker-Traders thought of themselves as the cleverest of the knife-wielders which is a luxury you can have when you sell your products on a platform that reads: I FAIL = YOU DIE. Even though the Tinker-Traders could sell anything and guaranteed nothing, the Tinker-Traders were never satisfied. They whined to the Governor: “We are so clever! (Just ask the Competing Regulators.) Why can’t we also do what the Butchers and Street Venders do?” And, for a long time the Governor was wise and replied, “You are a Tinker-Trader. You are a risk taker. You cannot do the job of the diligent, careful and prudent.” But, wisdom does not always flow from administration to administration so eventually the Governor relented. Why? Because, the Governor liked the Tinker-Traders the best.

- 11. The Governor Guarantees Scrapple – But only one slice at a time. About 80 years earlier a pandemic infected the animals and a large quantity of diseased meat got into the Scrapple. The public got sick. The resulting Great Panic brought on a buyers’ strike that killed many Street-Vendors and ruined the economy of the USA. To calm the panic the Governor said; “As long as you eat only one slice of Scrapple from any single vendor, I certify you will not get sick. And, I will replace any rancid slice of Scrapple with an equal value of AAA Porridge.” In return for his support, the Governor required each Street-Vendor to keep one spare slice of scrapple for every 30 sold, in case they needed to replace a rancid one. The Street-Vendors were very happy with the 1/30 reserve ratio. “Make money and take almost no risk. Great! We can do that!” the Street-Vendors agreed. The Governor gave the Street-Vendors a big red AAA stamp. The Governor’s decree stopped the panic and the public’s boycott of the Street-Vendors was over.

- 12. Learning to trust someone else’s nose. The wealthy citizens were afraid; they wanted more than the one insured slice of Scrapple to be guarantee by the Governor. To calm these fears the Street-Vendors turned to a few trusted citizens known to have good noses for rancid meat: Mr. Fitch, Mr. S. N. Poors, Mr. D. N. Phelps and Mr. Moody. The Street-Vendors proposed that they pay the Sniffers to grade the meat going into the Scrapple and to put a blue stamp on the Scrapple indicating quality: AAA, AA, or A, etc. “Make money and take no risk? Great! We can do that!” Once in business the Sniffers competed to give the Street-Vendors the highest ratings. The wealthy citizens were not stupid. They knew: (a) That the Sniffers never ate the meat. (b) That the Sniffers guaranteed nothing. (c) That the Sniffers were paid by the vendors and thus would not warn that the meat was dangerous until people could see maggots crawling over it. But, they wanted to believe. And, what assured them the most was the platform under each Street-Vendor’s cart that read, “I FAIL = I DIE”. If a Vendor had been around since the time of stagecoaches and had not yet died – “Now that was reassuring!” The small & poorly rated Street-Vendors gave up and sold out to the big ones. Over time the biggest Street-Vendors got Really, Really, Big. The bigger they got the more they had the Governor’s ear. This was the start of the end of the Good Old Days.

- 13. Governor intervenes with a great invention: SAUSAGES! The system worked but it had one problem: It was inefficient. Some areas had too much meat while others had too little. So about 70 years ago, to solve this problem (and to give the Redhen Island an edge over the other islands) the Governor gave Redhen Island two fabulous, government made sausage making machines, called Ground Sausage Extruders (GSEs). To run these machines the Governor appointed his godchildren; a gal named Fannie and guy named Freddie. He made them Super Butchers. Fannie and Freddie could buy the excess meat from the Street-Vendors and sell sausages back to the Tinker/Traders who would resell these sausages to people throughout the Archipelago. Sausages were a new concept for the people of the USA. The sausages looked and smelled appealing and you can eat them with a spork. But, if you could not inspect the meat before it went into the GSE machine how could you trust the sausages? Fannie and Freddie promised that they would exchange any sausages that went bad. They pointed to their platform that read, I FAIL = I DIE*? (The asterisk read “*but I don’t worry ‘cause the Governor is my Godfather”). To cover their guarantee Fannie and Freddie promised to keep one fresh sausage for every 60 they sell (half the reserve of the most profligate Street-Vendor). The type of people who thought about such things were concerned about the 60/1 reserve ratio. But, the sausages were made on the Governor’s GSE machine, so wasn’t the Governor standing behind it? The Sniffers come in and dutifully put a blue AAA stamp on the sausages. Caution turned to excitement: The public loved the new sausages.

- 14. Going Global! World - Eat our meat! About this time the Governor wanted to sell a lot more Porridge and by a related coincidence people in other countries had a lot of USA currency to buy USA porridge. The Governor asked the Tinker-Traders; “Build me a Porridge pipeline that goes overseas. Remember; put a big red AAA stamp on the pipeline.” This worked beautifully. Soon USA Porridge was pumping all over the world. The Governor had what he wanted: He could now live beyond his means Fannie and Freddie were also swimming in sausages. So to help Redhen Island, the Governor asked; “Tinker-Traders please build a second pipeline and pump GSE sausages overseas, AND, please have the Sniffers put a big blue AAA stamp on the pipeline.” The GSE pipeline started to pump sausages - slowly at first but the pace picked up over time.

- 15. RMBS - Almost as good as - The almost as good as Porridge - Sausages! The Street-Vendors on Redhen Island were jealous of Fannie and Freddie. So, about 30 years ago they asked the Tinker-Traders and Sniffers; “Can you build us our own sausage machine that produces a high percentage of AAA rated sausages? Oh, by the way, we do not want to guarantee the meat anymore.” The Sniffers said; “Without a government made GSE machine we will need some protection for the buyers of the AAA rated sausages.” The Tinker-Traders worked with the Sniffers. They modified the GSE plans and produced a sausage machine that graded the meat mostly AAA with a few lower rated sausages. The machine concentrated the worst quality meat and offal in unrated hotdogs. This machine was called RMBS (Redhens Mashed and Bound as Sausages). The Sniffers promised to put their AAA stamp on almost all of the sausages. However, without the I FAIL = I DIE platform, the public were not convinced. So a brave Street-Vendor offered; “I will eat my own hotdogs to prove each batch of sausages is good. Since this is the riskiest meat, if I don’t die – the sausages are safe.” The first brave Street-Vendor ate his own hotdogs and did not die. The other Street-Vendors followed his example. This system worked. The Street-Vendors and Tinker-Traders were now in the sausage business selling both GSE and RMBS sausages.

- 16. Can’t stop reengineering: Risk gets passed to the Professional Hotdog Eaters The problem: The Street-Vendors and Tinker-Traders can only eat so many unrated hot dogs before they take on too much risk and are likely to get sick. So they found a few Professional Hotdog Eaters and paid them handsomely, promising 20+ nutritional ratings. To cut their risk of dying, the Professional Hotdog Eaters insisted on inspecting the meat and started rejecting anything that looked or smelled bad. The Tinker- Traders didn’t like this and were angry. But the reengineered system worked. The Professional Hotdog Eaters didn’t die. The bad meat was kept out of the sausages. Farmers had an incentive to produce a quality product. Even though the Street-Vendors and Tinker- Traders were not taking any risk, the public was reassured and continued to eat RMBS sausages. Soon thereafter the AllSorts Island had a sausage machine, AllSorts of stuff Bound as Sausages (ABS). The ABS and RMBS machine was cranking out sausages for several years when the Tinker-Traders approached Cow Island suggesting they also get a sausage machine. At first Cow Island was not interested. But the Cow Island Butchers had very large cuts of meat and very small cuts of meat that the Street Venders don’t want: “Can these unwanted cuts of meat be made into sausages? “ Soon Cow Island had its very own sausage machine, named Cows Mashed and Bound as Sausages, (CMBS).

- 17. N’ Values so low, you could starve: The Public grows desperate. For many years the people of the Archipeligo stayed healthy eating porridge. When the Porridge had high nutritional value, say an N’Value above 5, even if Porridge was stored for a long time, it only fell to an N’Value of about 2, low but still enough to keep people healthy and without hunger. However, the Governor learned he could save money if he added water to the Porridge and created gruel. When the Governor sold gruel with a nutritional value under 3, the Governor got fat and the public got thin. The Street- Vendors realized that their Scrapple only needed an N’ Value slightly higher than Governor’s Porridge. So when the Governor watered down his Porridge they added sawdust to their Scrapple. When this happened the Street-Vendors made huge bags of gold. But, the people went hungry. Not that long ago, the Governor added so much water to the Porridge the nutritional value was an all-time low – N’Value1! The Street-Vendors cut the N’ Value of Scrapple to just above that of Porridge. The public became desperate! They turned to the Tinker-Traders willing to buy anything that promised a higher N’ Value. RMBS and CMBS promised a high N’Value and so these sausages flew off the shelves. The foreign pipeline wanted even more. To keep up with the high demand for sausages the Sniffers put clothespins on their noses and started stamping their high ratings on any and everything.

- 18. A Great Idea for the Vendors, a Bad Idea for the Public. The Tinker- Traders resented the Professional Hotdog Eaters: “Why do they have to be so picky? The Tinker-Traders approached the Professional Hotdog Eaters and said, “Look the Sniffers all have clothespins on their noses. We think we can design a way so that you won’t have to eat another hotdog again. If we do, will you stop being so picky?” The Professional Hotdog Eaters replied. “Make money and take no risk? Great! We can do that! Glad to stop being picky.” So the Tinker-Traders told the Sniffers: “We want to take the hotdogs and offal left over from making sausages (plus various other unmentionables) and run it through the grinder again. We will package and sell this product as “C2DO” (chicken and cow dung and offal). The public is so starved for the promise of High N’ Value, they will eat anything. Can we pay you to put your AAA stamp on C2DO as well?” The Tinker-Traders were smart. They did not ask the Sniffers as a group but asked each one individually. Each Sniffer was proud of his own sniffing ability but had a low opinion of his brethren. Each one believed if he did not drop his standards one of his competitors would. So one by one, the Sniffers agreed to highly rate the C2DO product. (But, they were very thankful they had clothespins on their noses.) The Tinker-Traders rejoiced! They stopped the Professional Hotdog Eaters from being picky!

- 19. When no vendor can die, the public can. Given the low nutritional value of Porridge and Scrapple, meat shot up in value. The Tinker-Traders said to the butchers, farmers and ranchers; “We need meat! Why not sell that diseased cow, that rotting chicken and why not throw in the feathers, hair and horns as well?” At this point in our tale it is time to grieve for the people of the Archipelago. For in the Archipelago with the hotdogs being reground and fed back to the public, no vendor was at risk. When no vendor can die, the public can – and eventually will. With packages of C2DOs selling, the sausage cart ran downhill with no brakes, running past the Competing Regulators (who may have gone blind from reading all the fine print on the Tinker-Traders’ disclosures). The SEC and all the other competing regulators pretended they did not notice. Now there was no one between the farmer and the public who would suffer if bad meat ran through the sausage machines - No one with a working nose - No one who really cared, who would suffer if the people suffered. So, the people suffered.

- 20. mad meat ? AGHH ! ! Help! Governor - You didn’t protect us, but can you, please, SAVE US ! ! Since the Competing Regulators were otherwise disengaged; “Shit happened!” RMBS sausages and C2DO went bad first. People got sick. “What have we been buying? False Promises! Dangerous sausages! Who’s been watching our meat?” An almost total buyers’ strike ensued. The value of all meat collapsed. A Second Great Panic to rival the First Great Panic started to feed on itself. The new panic killed many a knife- wielder; Butchers, Street-Vendors and a few Tinker-Traders. The Governor moved fast. To help the Street-Vendors he expanded his guarantee of Scrapple from one slice to almost a full loaf; He dropped the nutritional value of porridge to near ZERO, allowing in turn the Street-Vendors to add as much sawdust as they wanted to Scrapple. To help the Tinker-Traders he made them honorary Street-Vendors so he could guarantee their products as well. The combination Tinker-Traders-Street-Vendors began to do better.

- 21. You get a bail-out! And, you get a bail out! And, you get a bail out! (But, not you.) Fannie and Freddie ran back to the Governor and hid behind his legs and whispered; “Godfather, the GSE pipeline stopped flowing overseas.” The Governor declared, “I have never done this before, but I will eat the GSE sausages myself.” The Governor saw the Redhen Island was still failing: To rescue his favorite island, the Governor started eating RMBS sausages as well. In fact, he ate over 80% of all the Redhen Island sausages. In a blink of an eye, he also bailed out AllSorts Island, buying or guaranting most of the Allsorts Island’s sausages. The Cow Island asks, “What about us?” The Governor was so full of the other islands’ sausages; he pretended not to hear. People wondered if the Governor could eat all the sausages himself forever. They knew it was not the end of the story. The people tightened their belts, but living on Porridge and Scrapple with little or no Nutritional Value was beginning to feel like normal. Calm returned to the Archipelago. It seemed catastrophe was diverted; for now. . . .

- 22. - THE MORAL - Why a Parable? To Deflate Cultural Myths. Parables shift the context of cultural blindness. Under a new light common sense can breathe and cultural myths can be deflated. If any other industry in our country, beside Wall Street, sold products that the vendors knew were dangerous, that cost the public their fortunes, jobs and dreams – that industry would be so regulated it would feel like a gentleman with a turban going through DHS screening on RED alert. Yet, at this time, more than a year after Lehman’s demise – NO MEANINGFUL NEW REGULATIONS ARE IN PLACE! And, the too-big-to-fail banks are vastly bigger. The wisdom of our forefathers that separated depository institutions and investment banks was proven to be correct, yet our government to save the I-Banks merged the two industries. The Cultural Myths that Need Deflating. “The Free Market Knows Best”: In our minds the free market is a buyer and seller each knowing the product, facing each other haggling over price: It usually works: To try to regulate it would allow either side to attempt to game the system. BUT, when the market is controlled by a re-packager and re-labeler of the product who keeps buyer and seller apart – WATCH OUT. IT IS NOT A FREE MARKET. IT IS A FREE LICENSE TO DISORIENT AND GAME BUYER OR SELLER OR BOTH. A lack of transparency calls for regulation. If your daughter’s idiot fiancé bought a rhinestone from a jeweler who marketed it with a label from a third party rating agency (paid by the jeweler) saying it was almost as good as a diamond but sells for 0.25% less than a diamond, you would not mark it up to the free market. You would call the cops. (The AAA rated tranches of RMBS and CMBS sold for as little as 0.25% extra yield to T-Bills.) “In Time the Just Will Prevail”: Each of the vendors of CDO and Subprime-backed securities knew they were selling unsafe, if not poisonous investments. The investment banks that survived were those who kept the least inventory or who bought more of the antidote (credit default swaps) than the companies that went toes up. Why was AIG bailed out in the blink of an eye? They sold the antidote! The most cynical I-Banks prevailed. In fact, the vendor flying highest today, designed and sold several CDO’s, in fact, 3 are within the top 5 highest default ratios. This I-Bank established a book-making operation taking bets on whether these products would default. They convinced their own clients to buy positions betting the bonds would perform. They then reaped huge profits betting their own funds against their clients, betting the CDO securities would default or be down-rated, which of course happened. “These were Sophisticated Buyers Who Knew the Risks”: Who runs the investment desk at a company’s pension plan? Usually, it is the new hire or somebody’s niece. If she was a real hotshot she would be managing the company’s finances not the employee’s retirement money. In the face of a commission-incentivized Wall Street Investment Banker that pension investor is cannon-fodder. “Only Fat Cats are harmed by Wall Street”: We know today, this is not true. We are all victims. This is everyman’s retirement money. Dreams melted into despair. We will each be working 5 to 10 years longer because our Government let this happen. “All it takes is Full Disclosure”: So you read those inserts with your prescription medicine in 6 point type? They’re ‘bout the same. “The World of Finance is too complicated to Regulate”: Nuclear power is complicated – We regulate that. Why? Because it can blow up in OUR FACES! But finance is not that complicated. Ask a kindergartner: What is a loan? If you lend a classmate a dollar, you expect him to pay it back. What is loan underwriting? If that classmate is unlikely to pay it back, do not lend him the dollar. Explain a credit default swap to a kindergartner? You offer a quarter to the friend of the kid to whom you lent the dollar, if he guarantees his friend will pay you back. A derivatives’ market? You go to your fellow kindergartners and take bets on whether the borrower-classmate will or won’t pay his debt. It is not that complicated. It should not be that hard to regulate. We cannot afford to let this happen again. ‘NUF, SAID.