Customer Service Relationship Marketing Strategies

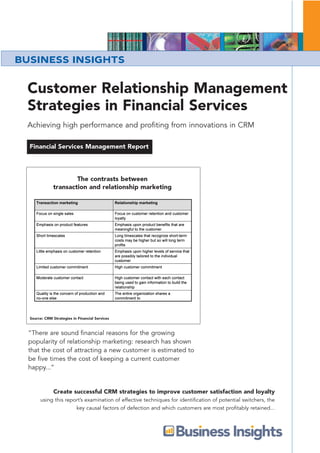

- 1. BUSINESS INSIGHTS Customer Relationship Management Strategies in Financial Services Achieving high performance and profiting from innovations in CRM Financial Services Management Report The contrasts between transaction and relationship marketing Transaction marketing Relationship marketing Focus on single sales Focus on customer retention and customer loyalty Emphasis on product features Emphasis upon product benefits that are meaningful to the customer Short timescales Long timescales that recognize short-term costs may be higher but so will long term profits Little emphasis on customer retention Emphasis upon higher levels of service that are possibly tailored to the individual customer Limited customer commitment High customer commitment Moderate customer contact High customer contact with each contact being used to gain information to build the relationship Quality is the concern of production and The entire organization shares a no-one else commitment to Source: CRM Strategies in Financial Services “There are sound financial reasons for the growing popularity of relationship marketing: research has shown that the cost of attracting a new customer is estimated to be five times the cost of keeping a current customer happy...” Create successful CRM strategies to improve customer satisfaction and loyalty using this report’s examination of effective techniques for identification of potential switchers, the key causal factors of defection and which customers are most profitably retained...

- 2. Business Intelligence for the Financial Services Industry Business Insights’ portfolio of financial services management reports are designed to help you make well informed, timely business decisions. We understand the problems facing today’s financial services executives when trying to drive your business forward, and appreciate the importance of accurate, up-to-date, incisive product, market and company analysis. We help you to crystallize your business decisions. The strength of our financial services research and analysis is derived from access to unparalleled databases and libraries of information and the use of proprietary analytic techniques. Business Insights reports are authored by independent experts and contain findings garnered from dedicated primary research. Our authors’ leading positions secure them access to interview key executives and to establish which issues will be of greatest strategic significance for the industry. Our financial services portfolio of reports can be used across a wide range of business functions to assess market conditions and devise future strategies. The order form on the back of this brochure lists titles available within the following categories: Banking, Finance, Insurance, Wealth Management, Investment and Strategy. . Examining the Key Issues • Price competition. Low rate deals are driving switching Reasons for customer preference for face-to-face contact contributing to reduced profits for mortgage lenders. This report suggests to how lenders can offer incentives for customer retention Personal/one-to-one contact Know who I am dealing with whilst avoiding price discounts. Like to see things in black and white Need advice • CRM IT solutions. Many analysts believe that often investment is Trust/advice wasted without adequate expenditure on staff training. In addition Good relationship with current provider Not treated like a number many are yet to identify their most profitable customers, those most Don't like the phone likely to switch and the key factors driving satisfaction 0% 10% 20% 30% 40% 50% 60% 70% 80% • Customer ownership. Traditional organization around business Source: CRM Strategies in Financial Services lines can prevent an holistic view of customers needs. This report “Commentators have argued that in the new Internet considers a variety of organisational structures and evaluates how age, companies can no longer rely on the traditional they relate to customer satisfaction. bricks and mortar mode, and managers need to rethink and reshape their business strategies. This • Distribution strategies. This report examines the changing role of notion may be premature. Data from MORI shows that many customers prefer face-to-face contact with routes such as branch networks for banks and intermediaries for staff...” insurance companies in the context of the growth of eCRM. Source: Customer Relationship Management Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM

- 3. Customer Relationship Management Strategies in Financial Services Achieving high performance and profiting from innovations in CRM Consumer loyalty is a major concern throughout the financial services Market Maps sector, particularly in the mortgage market. However, like many other services, financial services have characteristics that pose a number of problems for those seeking to create successful customer relationships. Customer Relationship Management Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM is a management report that provides a step-by-step guide to customer retention planning and segmentation techniques. This report will provide you with: Source: CRM Strategies in Financial Services • A research method for monitoring and developing CRM strategies “Once the company understands the market structure • Case study analysis of switching signals and rescue plans it can then take the appropriate steps for each channel and make strategic decisions about channel mix, • Segmentation techniques to identify the most profitable customers to re-channelling. It needs to develop detailed metrics of target with retention strategies. market share, sales volume and profitability throughout the market map...” Ensure you acquire and retain the most profitable customers using Source: Customer Relationship Management the most cost effective methods. Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM The Answers to Your Questions • How can potential defectors be identified, when should they be contacted and what returns can be expected from win-back programmes? • What are the key benefits associated with the retention of existing customers and the development of long-term satisfying relationships? • Which factors cause customers to switch suppliers? • What are the managerial requirements for CRM implementation? • How do customers evaluate service, and how can satisfactory levels of Source: CRM Strategies in Financial Services service quality be achieved both online and offline? “Service performance charts can be used to depict • What are the key benefits of moving online for those marketing comparisons visually. These comparison charts appear financial services? to be much more widely used in logistics and customer services than in general marketing, but have considerable potential for helping companies develop a segmented service strategy...” Source: Customer Relationship Management Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM

- 4. Key findings from this report • Almost half of all mortgagees are looking to change lender First Direct customer communication preferences because they are unhappy with their existing supplier. 180,000 4,300 • Customers switching banks cite pricing, service failures and Electronic banking inconvenience as the key factors (90% in a recent survey). customers Internet banking customers • Many customers prefer face-to-face contact with staff which has 600,000 Mobile phone banking customers WAP banking implications for those moving towards an online delivery model. 420,000 customers • Relationship marketing requires structures supporting both customers and front-line staff. New research reveals that financial service retailers may not have structures that are supportive in Source: CRM Strategies in Financial Services retaining customers and adapting to changes in the marketplace. “First Direct's service excellence is based on the simple premise of listening to what its customers want • Barclays Platinum banking launch to increase loyalty succeeded and reacting accordingly. First Direct's staff are with a 70% increase in customer income, 11% increase in customer recruited for their listening skills and take part in five weeks of training and 18 months of coaching so that satisfaction and 80% of customers stating they would strongly they understand the business inside out...” endorse Barclays. Source: Customer Relationship Management Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM The Value Proposition Benefit from over 152 pages of expert insight and analysis, enabling Consumers are more demanding than ever you to: • Implement best practices in CRM, replicate the successes of ANZ, Trust/advice Barclays, First Direct and Fidelity Investments and avoid the pitfalls. Good relationship with current provider • Improve customer retention by identifying the factors that lead to Not treated like a number attrition and actioning effective rescue strategies. Don't like the phone • Develop new acquisition and retention techniques beyond short 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% term promotions, price discounts and gimmicky advertisements. • Target and retain the most profitable customers with the help of Source: CRM Strategies in Financial Services this report’s explanation of transaction and relationship buyers. “Recent research from Henley management centre confirms that customers are more demanding than • Enhance your CRM strategy using eBusiness using the critical ever. The rise of customer complaints has been success factors detailed in this report. accompanied by a rise in the numbers who switch their service providers...” Source: Customer Relationship Management Strategies in Financial Services: Achieving high performance and profiting from innovations in CRM

- 5. Sample information from the report Chapter 2: Creating Value for the Organisation Introduction Understanding the economics of customer acquisition and retention and their The customer profitability matrix relationship with lifetime value is fundamental to the concept of customer value in this context, as is identifying opportunities for cross-selling and building customer advocacy. It is particularly important to address value from a customer segment point of view rather than taking an aggregated approach. Segmentation is perhaps the most important aspect of value creation from a relationship marketing perspective, as it provides the opportunity to tailor the offer to the need of specific segments. Carefully segmenting the market and developing an approach that maximises the value of your most desirable customer segments and the corresponding life-time value that these customer Source: CRM Strategies in Financial Services groups provide for your company lies at the heart of the value creation “The customer profitability matrix illustrated process. above provides some generalised guidance for strategic direction.” The strategies for each quadrant of the matrix are discussed below. Build: these customers are relatively cheap to service but their net value is low. Can you increase volume without increasing the costs of service? Can you direct the sales team to influence these customers' purchases towards a more profitable sales mix? Danger zone: these customers should be looked at very carefully. Is there medium to long-term prospect of a strategic reason for keeping them? Do you need them for their volume even if their profit margin is low? Cost engineer: these customers could be more profitable if the costs of serving them could be reduced. Is there any scope for encouraging this group to use cheaper online or telephone services? Protect: high net sales value customers who are relatively cheap to service are worth their weight in gold. You should seek relationships with these customers, which will make them less likely to turn to alternative suppliers. At the same time you should constantly seek opportunities to develop the volume of business that you do with these customers, while keeping strict control of costs. Order this report today to find out more...

- 6. Table of Contents EXECUTIVE SUMMARY • Delivering superior value and engaging entire • Executive Summary organisation • The origins and rationale of relationship marketing - Implications for practice • Creating value for the organisation • Demonstrating trustworthiness • How to tackle customer defections - Generalised trust • Achieving customer satisfaction through service - System trust quality - Personality based trust • The implications of eCommerce for CRM - Process based trust • Avoiding the pitfalls of CRM • Who owns the customer? - Effects of merger activity CHAPTER 1: THE ORIGINS AND RATIONALE OF - The "customer is king" CUSTOMER RELATIONSHIP MANAGEMENT - "Everyone owns the customer" • Summary - Sharing information company wide is crucial to • Introduction widening customer ownership - 21st century attitudes towards banks • “Everyone owns the customer" - How marketing oriented is your company? - Benefits of developing relationships CHAPTER 2: CREATING VALUE FOR THE - Relationship marketing Vs transactional marketing ORGANISATION - Eight major benefits of developing relationships • Summary - Long-term profitability • Introduction - Lower costs - Developing a segmented service strategy that aims - Repeat customers often cost less to service to deliver increased value to the customer and the - Opportunities for cross-selling organisation - Defection less likely - Step 2: Segment the customer base and determine - Employee retention segment value - Family influence - Step 3: Identify segments' service needs - Satisfied customers provide referrals and may be - Step 4: Implement segmented service strategy willing to pay a price premium - Finalise segment service strategy • A customer retention plan: reducing defectors and boosting retention rates CHAPTER 3: HOW TO TACKLE CUSTOMER - Measure customer retention DEFECTIONS - The crude retention rate • Summary - The weighted retention rate • Introduction • Ascertain defection motives • Case study: Abbey - Price defectors - Defection can be remedied - Market defectors - Possible reasons for customer defection • Are all customers the right customer? • What are the factors that force customers to switch? - Identifying profitable customers for CRM • Retaining customers in a competitive business - First group of customers to target • Loyalty must start to count for something - The middle group of buyers - The final, less profitable, group of customers • Implementing relationship marketing - Defining the value proposition - Case study: First Direct - Meeting consumers diverse requirements

- 7. Table of Contents CHAPTER 4: ACHIEVING CUSTOMER SATISFACTION • The focus for change in an international insurance THROUGH SERVICE QUALITY company • Summary - The stand-alone Internet bank • Introduction • Key factors in developing effective strategies for - Financial services characteristics and implications for eCommerce branding & relationship management - The role of senior management - Intangibility - Capabilities required in a changing environment - Implications for branding - Critical success factors - Inseparability - The threat of criminal activity on eCommerce - Implications - Ways to help customers protect themselves against - Heterogeneity fraud - Implications - Perishability CHAPTER 6: AVOIDING THE PITFALLS IN CRM - Implications for branding • Summary - Fiduciary responsibility • Introduction - Two-way information flows - Peril 1: Implementing CRM before creating a - Implications customer strategy - Impact of online delivery for service concepts - Example: Fidelity Investments - Consumer empowerment - Peril 2: Rolling out CRm before changing your - Effective separation of production and consumption organisation to match • Service quality - Peril 3: Assuming that more CRM technology is • Example: customer care at the ANZ bank better - ANZ's 'Customer Service Charter' - Peril 4: Stalking not wooing customers - Researching service quality CHAPTER 7: APPENDIX • Research objectives - The most common research objectives in financial TABLES services • Contrasts between transaction and relationship - Research methods marketing - Regular customer surveys • Customer satisfaction exercise - Customer panels • Customer management stage analysis, problems and - Transaction analysis opportunities (2 parts) - Mystery customers • Comparison of online metric collection methods - The SERVQUAL methodology • Dimensions of Internet banking service quality - What to measure • Expectations of an excellent online bank, - How to measure - Table A (4 parts) - Internet customer questionnaire - Table B (6 parts) CHAPTER 5: THE IMPLICATIONS OF ECOMMERCE FOR CRM • Summary • Introduction - How should financial firms respond? - Example: internal marketing at Barclays • How different companies are approaching eBusiness - The reluctant approach of a life insurance company - The integrated approach of a national retail banking operation

- 8. About Business Insights Business Insights appreciate the importance of accurate, up-to-date incisive FAX BACK TO: +44 (0) 207 900 6688 market and company analysis and our aim therefore is to provide a single, or scan and e-mail to off-the-shelf, objective source of data, analysis and market insight. marketing@globalbusinessinsights.com www.globalbusinessinsights.com I would like to order the following report(s)... 1 Company details 3 (Please use BLOCK CAPITALS) Company name: ________________________________________________________ 1.____________________________________________________ EU companies (except UK) must supply VAT / BTW / MOMS / MWST / IVA / FPA number: 2.____________________________________________________ _____________________________________________________________________________________________ 3.____________________________________________________ Purchase Order Number (if required)_____________________________________ Ordering Multiple reports: 2 Payment method 4 Multiple report discounts Enter total price below Please indicate your preferred currency: GB£ EUR US$ 1 report ___________________________ Total order value is ____________________________ 2 reports - save 15% ___________________________ I will forward a check payable to Business Insights Limited. 3 reports - save 20% ___________________________ Please invoice my company (please complete invoice address below) 1. Price is for a ‘Single User’ licence I would like to pay by bank transfer (email address required) 2. Discount applied to sum of total list price. Cannot be used in conjunction with other offers. 3. Contact marketing@globalbusinessinsights.com for more information on regional/global licences Debit my credit/charge card: Amex Visa Mastercard Hard Copy ‘Interactive’ Version Card No________________________________________________________________________ Please fill out recipient derails below if you wish A new, innovative way to view our publications to order a printed version of your report(s). Customize, search, translate, contrast, - Add £50/€75/$95per report manipulate and extract report content. Expiry Date _________ / _________ Signature ______________________________ - Please allow 28 days for delivery - Add £50/€75/$95per report Communications Feedback Payor details 5 Please let us know if any of the following factors influenced your purchase... Title: Mr/Mrs/Ms (Please use BLOCK CAPITALS) Email/Fax/Postal promotion Trade Press Brochure My Account Manager First Name: Last Name: Table of Contents Conference materials Colleague Recommendation Website/web search Email Job Title Recipient details (If different from Payor) Department Title: Mr/Mrs/Ms (Please use BLOCK CAPITALS) Address First Name: Last Name: Email City State/Province Job Title Country Post Code/ZIP Department Tel Address Fax City State/Province Sign here to confirm your order: Country Post Code/ZIP Tel Fax ORDERS WITHOUT A SIGNATURE CANNOT BE PROCESSED