PRIVATE FINANCE SCHEME AND PROCEDURE.DOC (1)

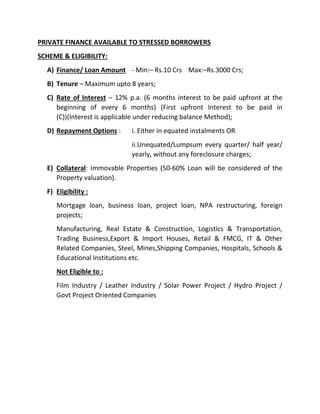

- 1. PRIVATE FINANCE AVAILABLE TO STRESSED BORROWERS SCHEME & ELIGIBILITY: A) Finance/ Loan Amount - Min:– Rs.10 Crs Max:–Rs.3000 Crs; B) Tenure – Maximum upto 8 years; C) Rate of Interest – 12% p.a. (6 months interest to be paid upfront at the beginning of every 6 months) (First upfront Interest to be paid in (C))(Interest is applicable under reducing balance Method); D) Repayment Options : i. Either in equated instalments OR ii.Unequated/Lumpsum every quarter/ half year/ yearly, without any foreclosure charges; E) Collateral: Immovable Properties (50-60% Loan will be considered of the Property valuation). F) Eligibility : Mortgage loan, business loan, project loan, NPA restructuring, foreign projects; Manufacturing, Real Estate & Construction, Logistics & Transportation, Trading Business,Export & Import Houses, Retail & FMCG, IT & Other Related Companies, Steel, Mines,Shipping Companies, Hospitals, Schools & Educational Institutions etc. Not Eligible to : Film Industry / Leather Industry / Solar Power Project / Hydro Project / Govt Project Oriented Companies

- 2. REQUIREMENT OF DOCUMENTS: i. Company & Business Profile; ii. Certificate of Incorporation iii. Proof of Address of the commercial establishment ( Corporate office as well as registered office); iv. 3 years audited financials (with tax audit report in case the Turnover is >100 Lakhs); v. 3 years ITR and computation of the Company vi. Last 6 months bank statements ( latest ); vii. KYC of the Directors/ Guarantors; viii. 3 years ITR of Directors/ Guarantors; ix. 3 photographs of the Directors/ Guarantors x. Chain of Agreement copies of the Immovable Property/ies PROCEDURE: Step 1 : Aforestated Documents to be sent to the Financer; Step 2 : Documents will be vetted by Legal & Finance Team At Chennai; Step 3 : Once Proposal is Principally Okayed, then Borrower has to visit the Financer in Chennai; Step 4 : On Successful Meeting, the financer will depute a person to Company of the Borrower for physical verification and viability of the property and also verification of the existence of the company; Step 5 : The Borrower to: a) reimburse the Airfare of the representative inspecting the property and the premise/(s); b) ACheque of Rs.1,00,000/- (as Stamp paper cost – irrespective of the quantum of Loan); c) A cheque of Rs.1,00,000/- towards the Legal Fees;

- 3. Step 6 : The Borrower alongwith the Facilitator to visit the Financer with the following for immediate disbursement: i. 4 -5 Cheques to be placed as additional collateral of the valid and active bank account in operation; ii. 3 ID Proofs of the Directors/Guarantors (Aadhar/ Pan card/ Electricity or Tel Bill) iii. Upfront Interest in (C) for the 6 months applicable on the loan amount; iv. The original papers of the property which should be title free alongwith the chain of agreements. Step 7 : The Borrower to sign all the loan agreements and other legal documents; Step 8 : Take the Demand Draft of the loan sanctioned. Direct financier Mr. Mohammed zebril 07358319704/ 08939243500 ---------------------------------------------------------x--------------------------------------------------