Basic accounting unit8

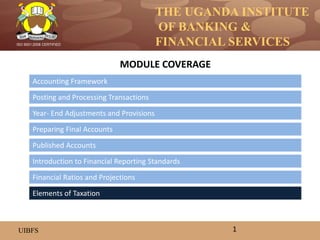

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Accounting Framework Posting and Processing Transactions Year- End Adjustments and Provisions Preparing Final Accounts Introduction to Financial Reporting Standards Published Accounts MODULE COVERAGE 1 Financial Ratios and Projections Elements of Taxation

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Elements of Taxation What is a tax? It is a charge or payment obligation levied by the state or other public/civil authority on its citizens. Governments fund their operation through the collection of taxes. Taxes have gone by many names throughout the centuries, including such phrases as levies, duties, tariffs, tribute and tithes, but they all amount to the same thing; payments collected from the governed to the ruling body in exchange for certain services and benefits. By history and international convention, taxes can be broadly categorized into two types: direct and indirect taxes. In the general sense, a direct tax is one paid directly to the government by the persons (corporate or natural) on whom it is imposed (often accompanied by a tax return filed by the taxpayer). Examples include some income taxes, some corporate taxes, and transfer taxes such as estate (inheritance) tax and gift tax. An indirect tax or "collected" tax, on the other hand, is one which is collected by intermediaries who turn over the proceeds to the government and file the related tax return. Examples are sales tax, value added tax (VAT), customs duty and excise duty. Overview of taxation in Uganda In Uganda, like in many other countries, taxes can be levied on different aspects like: • Trade/ business related movement of goods like imports or exports 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED • Wealth related aspects like property possession or asset transfer • Income related aspects like profits or turnover/ sales of goods and services • Production related aspects like manufacturing • Consumption related aspects like payment for certain goods and services which attract Value Added Tax Main taxes in Uganda Business Income Tax Uganda also levies income tax on the worldwide income of resident businesses. As with personal income taxes, non-resident companies are taxed only on income sourced in Uganda. The tax rate for all businesses other than mining companies is 30 percent. Income tax for mining companies is calculated using a formula and is dependent upon the chargeable income and gross revenue of the company, but the tax rate must be at least 25 percent and at most 45 percent. Uganda has determined special tax rates for small businesses with annual sales between five million and fifty million Ugandan shillings. These special rates are determined based upon the gross income of the business. The normal income tax for banks is the corporation tax, which is levied on the net operating profit after certain adjustments. The current corporation tax rate is 30% of the taxable profit annually. 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Taxation of Partnerships Income tax assessments for a partnership can be made either in respect to individual partners or in the partnership's name. The profits of a partnership, including a firm carrying on a trade or profession are taxable. Taxation of Sole Proprietorships A sole proprietor is taxed in the same way as an individual. Taxation of Trusts The income tax rate applicable to trusts is 30% of the chargeable trust income for the year of income. A trust is exempt from income tax where income of the trust is paid directly to the beneficiary without passing through the hands of the trustee; or where a trustee relies on the ground that a share or part of income to be assessed accrues or arises for the benefit of the beneficiary. Personal income Tax This is income tax payable by individuals. It is calculated on the individual's net assessable income after making allowance for deductible expenses. The sources of assessable income for individuals include employment, business and property. Different tax rates apply depending on whether the individual is a resident or non- resident of Uganda for tax purposes. 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED A special type of personal income tax is the Pay as You Earn (PAYE), which is tax on employment benefits. • PAYE is not a separate tax. It is an installment income tax system under which employers are required to deduct tax installments from their employees' salary or other employment income. • The installments so deducted are remitted to the Uganda Revenue Authority (URA) and based on the PAYE tax return lodged by the employer; the total amount deducted from the individual employee is offset against the employees' tax liability upon the lodgement of the annual tax return by the employee at the end of the tax year. • Every employer must, therefore, register for PAYE as well as be familiar with the rules relating to filing of PAYE returns and the computation of PAYE. • Penalties apply where the employer fails either to deduct or remit PAYE, or deducts and remits incorrect amounts. For example, the URA can require the Employer to pay any PAYE shortfalls. Value Added Tax Value added tax (VAT) is required on every taxable supply made by a taxable person, every imported good and the supply of any imported services by any person. Taxable supplies are goods or services made under the business activity of a taxable person. 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED • Taxable persons are people who make, or expect to make, taxable supplies valued at one-quarter of the annual registration threshold during three calendar months of the year. Taxable persons must register. As of July 2010, the annual registration threshold is fifty million Ugandan shillings. The standard rate for VAT in Uganda is 18 percent. • VAT as a consumption tax is payable by individuals and firms. The business sales turnover threshold for VAT is Shs 50,000,000 per year. Individuals and firms whose business sales turnover is below UGX 50,000,000 are exempt from VAT. It does not matter whether the business is profitable or not. Individuals and firms with annual sales/ turnover above UGX.50,000,000 must register for VAT with URA. • A person or business that has registered for VAT can charge VAT on customers as an output tax. When a VAT payer buys goods and services he pays VAT as an input Tax. When the output tax (what a person registered for VAT pays) exceeds the input tax (what he charges customers as VAT), a refund of the difference can be claimed from the URA. • On the other hand when the input tax is greater than the output tax, the difference is payable to URA within 15 days after the end of the month in which the transaction took place. • Certain goods and services are exempt from VAT. A person registered for VAT cannot claim an input tax on exempt goods and services. Similarly, such person cannot charge VAT (as an output tax) on goods and services exempt from VAT. 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED All imported goods attract VAT of 17% or the Zero rate except if they fall in the exempt category. VAT on imports is paid at the time of clearing the goods and is calculated on the CIF (cost Insurance, Freight) value of the imports. VAT on exports is Zero-rated. Investors interested in export trade are however advised to register for VAT. This is helpful in that the inputs, which are used to produce the exports, might be attracting VAT. Once registered as a VAT payer, one can claim input tax and in order to claim input tax on exports, the Customs Certified copy of the Export entry must be attached to the VAT return. Stamp Duty Stamp duty is an indirect tax levied on a number of commercial transactions. Taxation of Rental Income Rental income of an individual is segregated from other income and is taxed at a rate of 20% (after allowing 20% of the total rental income expenses) of gross rental income in excess of Shs.1,560,000 per year. 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Withholding Tax Certain payments are liable to withholding tax. Any payment to a person in Uganda from the Government of Uganda, a Government institution, a local authority, any company controlled by the Government of Uganda or any person designated in a notice issued by the Minister responsible for finance of an amount in aggregate exceeding one million shillings for the supply of goods or materials of any kinds or any service is subject to a 6% withholding tax. The Minister for Finance has powers to exempt companies from paying withholding tax. Tax filing in Uganda All registered business organizations are under obligation to send a provisional return of income for any year of income as follows; Individuals Not later than three months from the commencement of the 12 months ending in such year of income for which such individual makes up his or her accounts and in any other case of an individual, not later than March 31 of such year of income. 8

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Corporate bodies Not later than six months from the commencement of the period of 12 months ending in such year of income for which the body prepares the accounts and in any case not later than 30th of June in the year of income. The returns are based on income of the year immediately preceding the year of income in respect of which the provisional return is made or on the last assessment which has by then become final and conclusive, whichever is greater, or a considered estimate of income liable to tax if the former two are inappropriate. A final return of income is due within four months from the end of the accounting period together with any further tax due. 9

- 10. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED END 10

Hinweis der Redaktion

- ByIf all adjusting entries have been made, and a trial balance done, preparing financial statements is really just a matter of putting the trial balance amounts onto properly formatted statements. As already discussed, financial statements prepared by most banks are; The Balance Sheet Income Statement (Statement of comprehensive Income) Cash Flow Statement Portfolio Report (optional but important) the end of this unit, the students should be able: Explain the end of period adjustments that are made to the various accounts. Pass the end of period adjustments Close off the ledger accounts To extract the account balances after closing of the accounts Prepare the trial balance

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.

- A moratorium on new commercial bank licenses was declared in 2004, with the passage of the Financial Institutions Act 2004 by Parliament, which established new banking institution classification guidelines, shifting the focus and modality of supervision from forensic to risk-based, and introduced robust, tight rules for management and governance of banks in Uganda. The moratorium on new banks was lifted in July 2007. During the eighteen (18) months that followed the lifting of the moratorium, several new commercial banks were licensed. These included Kenya Commercial Bank, Equity Bank and Fina Bank, all from Kenya. Global Trust Bank and United Bank for Africa which trace their roots from Nigeria were also licensed during this period. The others were Ecobank; headquartered in Togo and Housing Finance Bank an indigenous bank. Between 2008 and 2009, several of the existing banks went on an accelerated branch expansion either through mergers and acquisitions or through new branch openings. As of October 2010[update], there were twenty-two (22) licensed commercial banks in Uganda, with nearly four hundred (400) bank branches and a total of almost six hundred (600) ATMs. In November 2010, Bank of Uganda directed that all commercial banks in Uganda, must raise their minimum capital to UGX 10 billion (approximately US$4.34 million) by March 2011 and to UGX 25 billion (approximately US$11 million) by March 2013. Any new commercial bank entering the Ugandan market effective November 2010 had to have a minimum capitalization of UGX 25 billion. Today (June 2012), most of the banking activity is concentrated around Kampala and other urban centers, leaving most Ugandans out of the formal financial sector.