Cost of capital

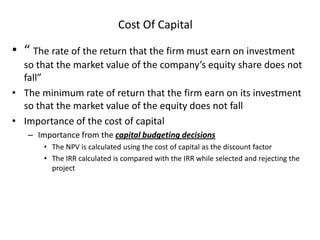

- 1. Cost Of Capital • “ The rate of the return that the firm must earn on investment so that the market value of the company’s equity share does not fall” • The minimum rate of return that the firm earn on its investment so that the market value of the equity does not fall • Importance of the cost of capital – Importance from the capital budgeting decisions • The NPV is calculated using the cost of capital as the discount factor • The IRR calculated is compared with the IRR while selected and rejecting the project

- 2. Cost of capital Cost of Debt Irredeemable Redeemable Cost of Equity Normal Equity Retained earnings Cost of Preference Share Redeemable Irredeemable

- 3. Cost Of Debt • Cost of Debt – Irredeemable • AT Par • AT Discount/Premium – Redeemable • AT Par • AT Discount/Premium

- 4. Cost Of Debt • Cost of Irredeemable Debt( issued at par) kd= (1-T) X I k = cost of capital ( to be calculated) T= tax rate I= annual interest rate to be paid to the creditor ( in percentage) – Example: A company has issued debentured worth Rs 1,00,00 of par value of Rs 1000.The coupon rate is 9%.What is the cost of debt. Tax rate is 50% – There is no mention of the maturity date – Thus this is the case of irredeemable debt – kd= (1-T)I – Kd = 0.5X9% = 4.5%

- 5. Cost Of Debt • Cost of Irredeemable Debt( issued at Premium or Discount) kd= (1-T) X I Net Proceeds k = cost of capital ( to be calculated) T= tax rate I= annual interest rate to be paid to the creditor( in Rs) Net Proceeds = Total amount raised by the company by issuing the debentures ( in Rs) – Incase of par --- It is equal to the par value – In case of discount --- it is less than par value – In case of premium--- it is more than the par value

- 6. Cost Of Debt • Cost of Irredeemable Debt(Par/Discount/Premium) • Example : A company issues the debentures worth Rs 1,00,000 at coupon rate 10%.The company is in the tax bracket of 55%.Calculate the cost of debt if the debentures are issued 1. At PAR 2. At a discount of 10% 3. At a premium of 10% kd (1-T) X I Net Proceeds – I = Rs 10,000 – T= .55 – In case of Par Net proceeds = Rs1,00,000 Kd = 4.5% – In case of Discount Net Proceeds = Rs 90,000 • Kd = 5% – In case of Premium Net Proceeds = Rs1,10,000 • Kd= 4.09% =

- 7. Cost Of Debt • Cost of Redeemable Debt – In the previous case we have assumed that the bonds are not maturing and thus are continuously going on – In case the bond matures after the certain period of time then it is called redeemable debt – The formula to be used is kd (before tax) = I + (P-Net Proceeds)/n (P + Net Proceeds)/2 – I = annual interest payment ( in RS) – Net Proceeds = Total amount raised by the company by issuing the debentures ( in Rs) – P = Par value of debenture (the value that the creditor gets at maturity) (in Rs) – n = Maturity period of the bond

- 8. Cost Of Debt • Example • A firm issues debenture of Rs 1,00,000 but is able to realize only 98,000 due to 2% commission to the broker. The debentures carry an interest rate of 10%The debentures are due for maturity after 10 years. Calculate the cost of capital kd (before tax) = I + (P-Net Proceeds)/n (P + Net Proceeds)/2 – I = 10,000, P= 1,00,000, NP =98000, n= 10 Kd ( before Tax) = 10.30% kd (after tax) =( 1-T) X kd (before tax) Calculate after tax cost of capital if the firm is in the tax bracket of 55%

- 9. Cost of Preference Capital • Cost of Preference Capital – Cost of Irredeemable Preference Capital Kp = Dp Np Dp= Total Preference dividend to be given Np = Net proceeds generated by the firm Example: A company raises the capital of Rs 1,00,000 by issuing 10000 preference share of Rs 10 each. The dividend rate on the preference share is 10%. Calculate the cost of preference share when 1. Preference share are issued at par 2. Preference shares are issued at 10% premium 3. Preference share are issued at 10% discount

- 10. Cost of Preference Capital • Cost of Preference Capital ( Irredeemable) – Kp = Dp Np 1. Preference shares are issued at 10% premium 1. Dp = Rs 10,000 2. Np = 1,10,000 3. Kp = 9.09% 2. Preference share are issued at 10% discount 1. Dp = Rs 10,000 2. Np = 90,000 3. Kp = 11.11%

- 11. Cost of Preference Capital • Cost of Preference Capital ( redeemable) Kp = D + (P-Net Proceeds)/n (P + Net Proceeds)/2 – D = Dividend on preference shares – P = Principal to be paid to the creditors – Net Proceed= Amount actually received by the firm – n = Maturity period

- 12. Cost of Preference Capital Example: A firm has issued preference share of Rs 100 each generating a proceed of Rs 1,00,000.The dividend rate is 14%.The Preference shares will be redeemed after 10 years. Floatation cost is about 5%.Determine the cost of preference share. Kp = D + (P-Net Proceeds)/n (P + Net Proceeds)/2 • D ( Dividend to be paid ) = 14% of 1,00,000 = RS 14,000 – P = Principal to be paid to the creditors = 1,00,000 – Net Proceed= 95,000 – n = 10 •

- 13. Cost of Preference Capital Kp = D + (P-Net Proceeds)/n (P + Net Proceeds)/2 = 14,000+( 1,00,000-95000)/10 = 14500/97500 = 14.87% (1,00,000+95000)/2

- 14. Cost of Preference Capital Example 2: A firm 10 % redeemable shares of Rs 1,00,000, redeemable at the end of 10 years. The underwriting cost is about 2 %.Calculate the preference share cost Kp = D + (P-Net Proceeds)/n (P + Net Proceeds)/2 • D ( Dividend to be paid ) = 10% of 1,00,000 = RS 10,000 – P = Principal to be paid to the creditors = 1,00,000 – Net Proceed= 98,000 – n = 10 Kp = 10,200/99000 X 100 =10.30 %

- 15. Cost Of Capital • Cost of Equity Capital • Very difficult to calculate as there is no apparent cost involved as compared to the cost of debt • Some people argue that equity capital does not have any cost , since it is not legally binding on them to pay dividends, but this argument is wrong • People invest in the equity with an expectation of – Getting the dividends – Increase in the price of the share • If a firm is not able to meet the expectation of share holders the price falls • Thus cost of equity is defined as the “ rate of return” that the share holders expect to earn on their investment

- 16. Cost of Equity Dividend Price Approach Without Growth in Dividends New Issue of Equity Already existing equity With Growth in Dividends New Issue of Equity Already Existing Equity

- 17. Cost Of Capital • Approaches to finding the Cost of Equity • Dividend Price Approach – Without growth in dividends 1. New issue of equity 2. Already existing Equity – With growth in dividends 1. New issue of equity 2. Already existing Equity

- 18. Cost Of Capital • Dividend Price Approach – Without growth in dividends (New issue of equity) Ke = D Np • Ke = Cost of Equity • D= Dividend Given • Np = Net proceeds • Example : A company offers for public subscription the shares of Rs 10 at a premium of 10%.The commission cost for the company is 5%.The dividend rate is 20 % .Calculate the cost of equity.

- 19. Cost Of Capital • Dividend Price Approach – Without growth in dividends (New issue of equity) Ke = D X 100 % Np • Ke = To be calculated • D= Rs 2 • Np = 11- (5% of 11) = Rs 10.45 • Ke = (2/10.45)X 100 = 19%

- 20. Cost Of Capital • Existing Share ( No Dividend Growth) • Example : A company s share of face value Rs 10,has a market value of Rs 15.The expected dividend to be paid is 20% of the face value. Calculate the cost of equity. Ke = D X 100 % Mp D = Dividend given Mp = Market Price of the share • = Rs 2/15 = 0.133

- 21. Cost Of Capital • Dividend Price Approach – With growth in dividends (New issue of equity) Ke = D + g Np • Ke = Cost of Equity • D= Dividend • Np = Net proceeds • g = expected growth in dividends

- 22. Cost Of Capital Example: A company issues new equity with each share at Rs 150. The underwriting cost is 2%. Following is the dividend history of the company. The expected dividend on the new share is Rs 14.10 .Find the cost of equity. Calculate the cost of equity? Year Dividend per share ( in Rs) 1994 10.50 1995 11 1996 12.50 1997 12.75 1998 13.40

- 23. Cost Of Capital • Dividend Price Approach – With growth in dividends (New issue of equity) – So formula to be used is Ke = D + g Np • Ke = Cost of Equity • D= Rs 14 .10 • Np = 98% of Rs 150 = Rs 147 • g = expected growth in dividends??? Can be calculated from the table

- 24. Cost Of Capital • Rs 10.50 is invested for 4 years and becomes Rs 13.40. • 10.50(1+g)4 = 13.40 (1+g)4 = 13.40/10.50 Calculate g Easier way :>>>> – Divide the latest dividend by the first dividend – Look in the compound value table for 4 year row for the above calculated factor to find g. • From both ways g= 6%. • Put in the formula to calculate Ke = 14.10/147 + .06 = 15.6%

- 25. Cost Of Capital • Dividend Price Approach – With growth in dividends (Existing equity) – So formula to be used is Ke = D + g Mp • Ke = Cost of Equity • D= Dividend given • Mp = Market price of the share • g = expected growth in dividends

- 26. Cost Of Capital • Example: A company's share has a market price of Rs 20.The company pays a dividend of Rs 1 per share. The shareholders expect a growth rate of 5 % per year. Calculate the cost of equity. – So formula to be used is Ke = D + g Mp • Ke = Cost of Equity • D= Rs 1 • Mp = Market price of the share = Rs 20 • g = expected growth in dividends = 5% Ke = 10%

- 27. Cost Of Retained Earnings • Cost of Retained earnings – The net Profit after tax that is not distributed by the company to the share holders is called retained earnings. – Such earnings are used by the companies for the future expansions – Some people think that these earnings are free of cost and does not cost anything to the company, WHICH IS ABSOLUTLEY WRONG! – Because if theses earnings were given to the share holders then they would have invested them somewhere and in turn have earned on that investment. – Thus the cost of the retained earnings is the “ Earnings Sacrificed “ or the “Opportunity Lost” by the investors, if they were given the earnings retained by the company.

- 28. Cost Of Retained Earnings • Adjustment Required in Retained earnings – The money retained by the company is not equal to that given to the investors. • Investors pay tax on the money given as dividends • They also incur brokerage cost on making adjustment – This means if the company has 50,000 Rs as retained earnings and it decides to give it to the investors then the investors will have less than 50,000 to invest while the company will have Rs 50,000 to invest.

- 29. Cost Of Retained Earnings • ABC limited is earning a net profit of Rs 50,000 per annum. The shareholders require a rate of return of 10%.It is expected that the retained earning if distributed among the shareholders can be invested in a security of similar type carrying a rate of return of 10% per annum. It is further expected that the shareholders will incur a brokerage cost of 2% on the dividend received to make the new investment. The shareholders are in the tax bracket of 30%.Calculate the cost of retained earnings for the company. Solution: In order to calculate the cost of retained earning we should first calculate the net dividend available to the share holders net of tax and other costs.

- 30. Cost Of Retained Earnings Now the available money in the hands of the investor is Rs 34,300.Expected earnings = 10% of Rs 34,300 = Rs3430 Dividend Given 50,000 Less Income tax @ 30% 15,000 After tax dividend 35,000 Brokerage cost@2% 700 Net dividend available for investment 34,300

- 31. Cost Of Retained Earnings Thus the expectation of the investors is to earn Rs 3430 from the retained earnings. Which in other words mean if the money is not distributed to the share holders the company need to earn Rs 3430 but on 50,000. Therefore Kr = 3430/50,000 = 6.86% In general Kr = Ke X (1-T)(1-B)

- 32. Weighted Average Cost of Capital The capital of the company consists of various components. Thus the company wants to calculate the total cost of the capital. This total overall or the total cost of capital is calculated based on the “weights” of each component on the total capital. Thus the total cost of capital is also called the “weighted cost of capital “ Steps involved in calculating the weighted average cost of capital. 1. Calculate the cost of different capital components like cost of debt, cost of preference shares, cost of equity, cost of retained earnings etc. 2. Assign weights to each components. Ways to calculate the weights 1. Weights based on the book value of the capital ( Book value Weights) 2. Weights based on the basis of Market value of the capital ( Market Value weights) Both of the above together is called the “HISTORICAL WEIGHT METHOD” of calculating the weight

- 33. Weighted Average Cost of Capital Example: From the following capital structure calculate the overall cost of capital by 1. Book Value method 2. Market Value method After tax cost of different components is as follows cost of equity capital =14%, Cost of Debt = 5%, cost of Preference shares = 10%, Cost of retained earnings = 13%. Source Book Value Market Value Equity Share Capital ( Rs 10 pr share) Rs 45,000 90,000 Retained earnings 15,000 Preference Share 10,000 10,000 Debenture 30,000 30,000

- 34. Weighted Average Cost of Capital Steps: ( Book Value Method) 1. Calculate the weights of different components 2. Multiply diff weights with after tax cost of capital. 3. Add all to get the weights average cost of capital Source Weights After cost of capital Weights cost Equity Share Capital ( Rs 10 pr share) Rs 45,000/1,00,000 0.45 14% 6.30 Retained earnings 15,000/100,000 = 0.15 13% 1.95 Preference Share 10,000/1,00,000 = 0.10 10% 1 Debenture 30,000/1,00,000 =0.30 5% 1.5 TOTAL 10.75%

- 35. Weighted Average Cost of Capital Example: Excel industries ltd has the assets of Rs 1,60,000 which have been financed by Rs 52,000 of debt, Rs 90,000 of equity and a general reserves of Rs 18,000.The forms Profit after tax for the firm has been Rs 13,500.It pays 8% interest on the borrowed funds .It has 900 equity shares of FV Rs 100 each, selling in the market at a price of Rs 120 per share. Calculate the weighted average cost of capitalboth by market value method and book value method. Tax Rate is 50%. Steps( by Market Value Method) 1. Calculate the weights 1. Total capital =MV of Debt + MV of Equity 1. Rs 52,000+108,000 = 1,60,000 2. Wt of debt = 52,000/1,60,000 =0.325 3. Wt of Equity = 0.675 2. Calculate the cost of various components 1. Kd =4% 2. Ke= Not given so need to be calculated. EPS/MPPS = Ke 3. Calculate the total cost of capital = .325X4% +0.675X12.5% = 9.74%

- 36. Weighted Average Cost of Capital Exercise : Calculate the Overall cost of capital from book value method • Hint : – In the absence of any specific cost of retained earning the cost equity calculated can be used as the cost of retained earnings – From Book Value perspective total equity base = Reserves + share capital at face value ( = 18,000+90,000 = 1,08,000) • ANS WACC ( Book Value Method) = 9.74%

- 37. Weighted Average Cost of Capital Example: A limited company has the following capital Structure 1. Equity Share Capital = Rs 40,00,000 ( 2,00,000 shares) 2. 6% preference shares = Rs 10,00,000 3. 8% debentures = Rs 30,00,000 The MPPS = Rs 20. It is expected that the company will give a current dividend of Rs 2 per share which will grow at a rate of 7% forever. Tax rate is 50%. Find the weights average cost of capital based on 1. Existing capital Structure 1. 10.75% 2. The new weighted average cost of capital if the company raises an additional debt of Rs 20,00,000 by issuing 10% debenture his would result in and increase in the expected dividend to Rs 3 and will leave the growth rate unchanged, but the price of the share will fall to Rs 15 per share 1. 13.60% 3. The total cost of capital in in (2) the growth rate increase to 10% 1. 14.80%