Mutual fund industry in india

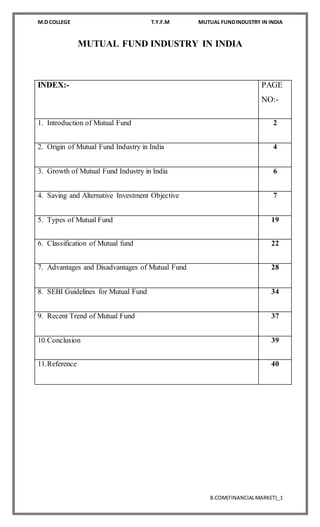

- 1. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_1 MUTUAL FUND INDUSTRY IN INDIA INDEX:- PAGE NO:- 1. Introduction of Mutual Fund 2 2. Origin of Mutual Fund Industry in India 4 3. Growth of Mutual Fund Industry in India 6 4. Saving and Alternative Investment Objective 7 5. Types of Mutual Fund 19 6. Classification of Mutual fund 22 7. Advantages and Disadvantages of Mutual Fund 28 8. SEBI Guidelines for Mutual Fund 34 9. Recent Trend of Mutual Fund 37 10.Conclusion 39 11.Reference 40

- 2. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_2 CHAPTER .1 1. Introduction of Mutual Fund Mutual Fund are very popular all the world and they play a important role in financial system of many countries. Mutual funds are the ideal medium for investment by small investor in stock market. Mutual fund pool together the investment of small investor for participation in stock market. Being institutional investor, mutual fund can afford market analysis generally not available to individual investor. Futher more, mutual fund can diversify the portfolio in better way as compared with individual investor due to the expertise and availability of funds. A Mutual fund is a type of professionally managed investment fund that pools money from many investors to purchase securities.[1] While there is no legal definition of the term "mutual fund", it is most commonly applied only to those collective investment vehicles that are regulated and sold to the general public. They are sometimes referred to as "investment companies" or "registered investment companies". Hedge funds are not mutual funds, primarily because they cannot be sold to the general public. In the United States, mutual funds must be registered with the U.S. Securities and Exchange Commission, overseen by a board of directors or board of trustees, and managed by a Registered Investment Advisor. Mutual funds are also subject to an extensive and detailed regulatory regime set forth in the Investment Company Act of 1940. Mutual funds are not taxed on their income and profits if they comply with certain requirements under the U.S. Internal Revenue Code. Mutual funds have both advantages and disadvantages compared to direct investing in individual securities. Today they play an important role in household finances, most notably in retirement planning. There are three types of U.S. mutual funds—open-end funds, unit investment trusts, and closed-end funds. The most common type, open-end funds, must be willing to buy back shares from investors every business day. Exchange-traded funds (ETFs) are open-end funds or unit investment trusts that trade on an exchange. Non-exchange traded open-end funds are most common, but ETFs have been gaining in popularity.

- 3. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_3 Mutual funds are generally classified by their principal investments. The four main categories of funds are money market funds, bond or fixed income funds, stock or equity funds, and hybrid funds. Funds may also be categorized as index (or passively managed) or actively managed. Investors in a mutual fund pay the fund’s expenses, which reduce the fund's returns and performance. There is controversy about the level of these expenses.

- 4. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_4 CHAPTER .2 2.Origin of Mutual Fund Industry in India The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank of India. The history of mutual funds in India can be broadly divided into four distinct phases First Phase - 1964-1987 Unit Trust of India (UTI) was established in 1963 by an Act of Parliament. It was set up by the Reserve Bank of India and functioned under the Regulatory and administrative control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of 1988 UTI had Rs. 6,700 crores of assets under management. Second Phase - 1987-1993 (Entry of Public Sector Funds) 1987 marked the entry of non-UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC). SBI Mutual Fund was the first non-UTI Mutual Fund established in June 1987 followed by Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up its mutual fund in December 1990. At the end of 1993, the mutual fund industry had assets under management of Rs. 47,004 crores.

- 5. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_5 Third Phase - 1993-2003 (Entry of Private Sector Funds) With the entry of private sector funds in 1993, a new era started in the Indian mutual fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund Regulations came into being, under which all mutual funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual fund registered in July 1993. The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund) Regulations 1996. The number of mutual fund houses went on increasing, with many foreign mutual funds setting up funds in India and also the industry has witnessed several mergers and acquisitions. As at the end of January 2003, there were 33 mutual funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs. 44,541 crores of assets under management was way ahead of other mutual funds. Fourth Phase - since February 2003 In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under management of Rs. 29,835 crores as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured return and certain other schemes. The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations.The second is the UTI Mutual Fund, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs. 76,000 crores of assets under management and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking. .

- 6. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_6 CHAPTER .3 3.Growth of Mutual Fund Industry in India By the year 1970, the industry had 631 funds with combined total assets of 47.6 billion dollars in 10.7 million shareholder’s account. However from 1970 and onwards rising interest rates, stock market stagnation, inflation and investors some other reservation about the profitability of mutual funds, Adversely effected the growth of mutual fund. Hence Mutual fund realized the need to introduce new types of Mutual fund, which were in tune with changing requirements and interest of the investor. The 1970’s saw a new kind of fund innovation funds with no commission called “no load” funds. The largest and most successful no load family of funds is the vanguard funds, created by John Bogle in 1977. In the series of new product the first Money Market fund (MMMF) i.e “ The Reserve Fund” was started in November 1971. This new concept signaled a dramatic change in the Mutual fund Industry and sparked a surge of creativity in the industry. The History of mutual funds dates support to 19th century when it was introduced in Europe in particular, Great Britain. Robert Fleming set up in 1868 the first investment trust called Foreign and colonial investment which promises to manage the finances of the moneyed class of Scotland by scattering the investment over a number of different stocks. This investment trust and other investment trust which were afterward set up in Britain and the U.S resembled todays closes-ended mutual funds. The first mutual fund in the U.S Massachusetts investor’s trust was set in march 1924. This was the open-ended mutual fund.

- 7. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_7 Chapter .4 4.Saving and Alternative Investment Objective DEFINATION An investment that is not one of the three traditional asset types (stocks, bonds and cash). Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, limited regulations and relative lack of liquidity. Alternative investments contracts. Funds can be excellent vehicles for both long-term investment objectives and short-term goals. Mutual funds pool the resources of many small investors, providing those investors with the ability to buy dozens--or even hundreds—of different stocks and bonds. This serves to spread the risk inherent in the stock and bond markets, protecting investors from specific stock risk and increasing their odds of a good return over time. There are a number of mutual funds on their own financial needs the market, and it is important for investors to choose the ones that best meet their own financial needs. Objective Of Saving Term Growth :- Long-term growth is important for many reasons, and stock market mutual funds generally have long-term appreciation of capital as a major goal. The stock market can be quite volatile over the short-term, but over longer periods of time the growth rate can be quite dramatic. When choosing a mutual fund for long-term growth, it is important to look for one that is widely-diversified across many different industries. An index fund that tracks the total stock market or a broad index like the Standard and Poors 500 is a particularly good choice.

- 8. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_8 Current Income:- There are many investors who need current income as well as the prospect for long-term growth. Retirees often use mutual funds that hold dividend paying stocks and high interest bonds to supplement their pension and Social Security checks. Other investors might use current income funds to stretch their savings or pay current expenses. There are a number of mutual funds that provide current income, including bond funds and funds that hold dividend paying stocks. When choosing a fund it is important to consider safety as well as yield. For instance, high-yield bond funds generally pay more than government bond funds, but they are also riskier. Safety:- Investors who want rock solid safety and predictable returns should choose a money market fund. These funds invest in a variety of short-term instruments designed to provide safe, predictable interest income. Money market funds are a good place to hold money between investments, as well as a good place to put money aside for emergencies. When choosing a money market mutual fund, it is important to look for one with extremely low costs, under 0.10% if possible. Since these funds are designed for safety, the yields can be quite low, although they are still often higher than comparable bank money markets. Keeping your costs low means you keep more of the money you earn Diversification:- Investors are often advised that they shouldn't "put all their eggs in one basket." Investors who have too high of a percentage of their assets in one or two stocks can be severely affected if one of the companies goes belly-up. Most financial experts say investors should have at least 15 stocks in their portfolios. It takes a lot of time and effort to keep up with that many companies. Conversely, mutual funds hold a number of stocks, which gives investors instant diversification and protects them from a sharp decline in any one holding.

- 9. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_9 Growth:- Some mutual fund investors are looking for rapid growth in the value of their funds. Stocks have historically offered the best long-term returns of any asset class, though it can be an up-and-down ride. Stock funds that are labeled "growth" typically invest in companies with bright prospects, while "value" funds target stocks that seem inexpensive compared with the company's earnings. Income:- Other fund investors care more about receiving income from their investments. Numerous stock funds invest in companies with high dividend payouts. Bond funds also can provide steady income, as can funds that invest in real estate investment trusts, or REITs. All these income-focused funds pass the yields along to their investors, usually on a monthly or quarterly basis. Yields of 3 percent to 7 percent are often available with income-oriented mutual funds. International Exposure:- Some large international firms offer their shares on U.S. markets, but others don't. For example, individual investors can have a hard time getting access to shares in the fast-growing Chinese market. But international-focused mutual funds have an easier time investing in these shares. Because half the world's corporate value is outside the U.S., it's important to have some exposure to overseas stocks, and mutual funds are the easiest way to get this Low Fees:- Stock picking can be expensive thanks to broker commissions, but many "no-load" mutual funds are available that don't charge investors anything. Many other funds charge investors less than 1 percent a year for operational fees. Investors looking for especially inexpensive funds might consider index funds, which charge fees as low as 0.1 percent per year. These funds usually hold every stock or bond in a given asset class, which offers tremendous diversification at a low cost.

- 10. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_10 MUTUAL FUND INVESTMENT OBJECTIVES DEFINED INVESTMENT OBJECTIVE There are many ways to try to make money from investments. An investor might take on additional risk to try to profit from potential growth in the value of the shares of a stock. A retiree might prefer an investment whose chief benefit is the periodic income payments it offers. Someone else's priority might be to preserve the value of the original investment, even if that means the investment doesn't increase much in value over time. Like all mutual funds, stock funds are managed based on a specific investment objective. That objective will determine the role a specific fund will play in your portfolio, and how well it might fit with your overall investing strategy. The investment objective determines what types of stocks the fund's manager may decide to purchase. A fund may be broadly based, investing in both large- and small-cap companies in many different industries. Or it may have a much narrower focus, concentrating only on blue chips, for example, or stocks in a single industry. Typically, a stock mutual fund's objective will be either capital appreciation, income from equities, or both. For example, a stock fund might have both growth and income as objectives, or its primary objective might be capital appreciation, with income as a secondary objective. A mutual fund's investment objective is not necessarily the same thing as its investing style, though the two may overlap. In addition to pursuing a fund's investment objective, a fund manager may adhere to a particular investing style. For example, a growth fund focuses on stocks that are growing quickly and that seem to have greater than average potential for appreciation in share price. By contrast, a value-oriented fund buys stocks that appear to be undervalued by the market relative to the company's intrinsic worth. Each may have growth as its investment objective, but they pursue growth in different ways. Some managers even blend the two approaches. Like most mutual funds, a stock fund may be either passively managed, as an index fund is, or actively managed. It also may be an open-end or closed-end fund. Before investing in any fund, carefully consider its investment objectives, risks,

- 11. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_11 fees, and expenses, which can be found in the prospectus available from the fund. Read it carefully before investing. Many mutual funds combine an investment objective with a specific category of stocks. For example, a fund might be an international fund whose objective is growth, or a growth fund that specializes in small-cap stocks. Here are some common stock fund types based on their investment objectives: INVESTMENT:- Investment refers to current commitment of funds for a specified time period to derive benefits in future. The future benefits derived from an investment are known as ‘ returns ’ : with an expectation to get the principal back along with the interest at a future date /or in case of an eventuality As the reward would accrue only in future, it involves ‘risk’ (of realized return being lower than that expected) Maximization of return Minimization Hedge against inflation (if the investment cannot earn as much as the rise in price level, the ‘real’ rate of return will be negative)

- 12. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_12 INVESTMENT ALTERNATIVES o FINANCIAL ASSETS - marketable financial assets REAL ASSETS EQUITY SHARES o Represents ownership capital placed before the company proportional ownership o Risk: residual claim over income o Reward: partners in progress o The amount of capital that a company can issue as per its memorandum represents authorized capital o The amount offered by the company to the investors is called issued capital o The part of issued capital that is subscribed to by the investors is called subscribed capital / paid up capital

- 13. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_13 EQUITY SHARES o Blue chip shares impressive record of earnings and dividend o Growth shares having an above average rate of growth and profitability o Income shares opportunities and high dividend payouts o Cyclical shares o Defensive shares economic conditions o Speculative shares BONDS o They are long term debt instruments issued for a fixed time period o Bonds are debt securities issued by the government or PSUs o Debentures are debt securities issued by private sector companies o They comprise of periodic interest payments over the life of the instrument and the principal repayment at the time of redemption

- 14. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_14 o Debt securities issued by the central government , state government and quasi government agencies are referred to as gilt-edged securities o Callable bonds are the ones that can be called for redemption earlier than their date of maturity. This right to call is available with the company o Convertible bonds are the ones that can be converted into equity shares at a later date either fully or partly. This option is available with the bond holder o Coupon rate is the nominal rate of interest fixed and printed on the bond certificate. It is calculated on the face value and is payable by the company till maturity PREFERENCE SHARES o Represents a hybrid security that has attributes of both equity shares and debentures. o They carry a fixed rate of dividend . However it is payable only out of distributable profits o Dividend on preference shares is generally cumulative . Dividend skipped in one year has to be paid subsequently before equity dividend can be paid o Only redeemable preference shares can be issued NON-MARKETABLE SECURITIES o These represent personal transactions between the investor and the issuer. o Bank deposits – current, savings and fixed deposit others earn an interest features of the bank deposits

- 15. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_15 NON-MARKETABLE SECURITIES o Company deposits 58A of Companies Act, 1956 t investors would normally get from the banks of 12.5%. deposit o Post Office Monthly Income Scheme interest on a monthly basis. . MONEY MARKET INSTRUMENTS o Certificate of deposits ranging from 3 months to 1 year mutual funds of the investors o Commercial papers rity

- 16. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_16 an investment grade from credit rating agencies ize is Rs 25 lacs MUTUAL FUNDS o Also known as an instrument for collective investment o Investment is done in three broad categories of financial assets i.e. stocks, bonds and cash o Depending on the asset mix , mutual fund schemes are classified as: Equity schemes, hybrid schemes and debt schemes o On the basis of flexibility , Mutual fund schemes may be: Open ended or Close ended year or subscription only for a specified period and can be redeemed only on a fixed date of redemption o On the basis of objective , mutual funds may be growth funds, income funds, or balanced funds o NAV of a fund is the cumulative market value of the assets of the fund net of its liabilitie

- 17. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_17 FINANCIAL DERIVATIVES o Futures is a transferable contract between two parties to buy or sell an asset at a certain date in the future at a specified price and quality of underlying instrument and a standard timing of settlement transaction t requires margin payments and follow daily movements o Options are of two types: given quantity of the underlying asset, at a given price, on or before a given future date Put option gives the buyer of the option a right but not an obligation to sell a given quantity of the underlying asset, at a given price, on or before a given future date Opportunities of Mutual Funds are tremendous specially when investment is concerned. For any individual who intends to allocate his assets into proper forms of investment and want to diversify his Investment Portfolio as well as the risks, Mutual Funds can be proved as the biggest opportunity. Investors gets a lot of advantages with the Mutual Fund Investment. Firstly, they are not required to carry on intensive research and detailed analysis on Stock Market and Bond Market. This work is done by the Fund Mangers of the Investment Management Company on behalf of the investors. In fact, the professional Fund Managers who handle the mutual funds of any particular company, are able to speculate the market trend more correctly than any common individual. Good Speculation about the trends of stock prices and bond prices leads to right allocation of funds in the right stocks and bonds resulting in good rate of return. Investors also get the advantage of high Liquidity of the mutual funds. This means the investors can enjoy easy access to the funds invested in the mutual funds whenever they require the money. When the investors invest in any mutual fund, they are given some equity position in that fund. The investors can any time sell their mutual fund shares to get back the money invested in mutual funds. The only

- 18. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_18 thing is that the Rate of Return that they will get may not be favorable as the return depends on the present market condition. The greatest opportunity that the mutual funds offer is the opportunity of diversifying their investments. Investment Diversification actually diversifies the Risk associated with investment. This is because, if at a time, if prices of some stocks are declining, deceasing the Value of Investment, prices of some other stocks and bonds may tend to rise and in this way the loss of the mutual fund is offset by the strength of the stocks whose prices are rising. As all the mutual funds diversify their investments in various common stocks, preferred stocks and different bonds, the risk to be borne by the investors are well diversified and in other terms lowered.

- 19. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_19 CHAPTER .5 5. Types of Mutual Fund General Classification of Mutual Funds Open-end Funds | Closed-end Funds Open-end Funds Funds that can sell and purchase units at any point in time are classified as Open-end Funds. The fund size (corpus) of an open- end fund is variable (keeps changing) because of continuous selling (to investors) and repurchases (from the investors) by the fund. An open-end fund is not required to keep selling new units to the investors at all times but is required to always repurchase, when an investor wants to sell his units. The NAV of an open-end fund is calculated every day. Closed-end Funds Funds that can sell a fixed number of units only during the New Fund Offer (NFO) period are known as Closed-end Funds. The corpus of a Closed-end Fund remains unchanged at all times. After the closure of the offer, buying and redemption of units by the investors directly from the Funds is not allowed. However, to protect the interests of the investors, SEBI provides investors with two avenues to liquidate their positions: 1. Closed-end Funds are listed on the stock exchanges where investors can buy/sell units from/to each other. The trading is generally done at a discount to the NAV of the scheme. The NAV of a closed-end fund is computed on a weekly basis (updated every Thursday).. 2. Closed-end Funds may also offer "buy-back of units" to the unit holders. In this case, the corpus of the Fund and its outstanding units do get changed.

- 20. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_20 Load Funds | No-load Funds Load Funds Mutual Funds incur various expenses on marketing, distribution, advertising, portfolio churning, fund manager's salary etc. Many funds recover these expenses from the investors in the form of load. These funds are known as Load Funds. A load fund may impose following types of loads on the investors: 1. Entry Load - Also known as Front-end load, it refers to the load charged to an investor at the time of his entry into a scheme. Entry load is deducted from the investor's contribution amount to the fund. 2. Exit Load - Also known as Back-end load, these charges are imposed on an investor when he redeems his units (exits from the scheme). Exit load is deducted from the redemption proceeds to an outgoing investor. 3. Deferred Load - Deferred load is charged to the scheme over a period of time. 4. Contingent Deferred Sales Charge (CDSC) - In some schemes, the percentage of exit load reduces as the investor stays longer with the fund. This type of load is known as Contingent Deferred Sales Charge

- 21. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_21 No-load Funds All those funds that do not charge any of the above mentioned loads are known as No-load Funds. Tax-exempt Funds | Non-Tax-exempt Funds Tax-exempt Funds Funds that invest in securities free from tax are known as Tax-exempt Funds. All open-end equity oriented funds are exempt from distribution tax (tax for distributing income to investors). Long term capital gains and dividend income in the hands of investors are tax-free. Non-Tax-exempt Funds Funds that invest in taxable securities are known as Non-Tax-exempt Funds. In India, all funds, except open-end equity oriented funds are liable to pay tax on distribution income. Profits arising out of sale of units by an investor within 12 months of purchase are categorized as short-term capital gains, which are taxable. Sale of units of an equity oriented fund is subject to Securities Transaction Tax (STT). STT is deducted from the redemption proceeds to an investor.

- 22. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_22 CHAPTER .6 6.Classification of Mutual fund Classification of Mutual Funds in India is done on the basis of their objective and structure. Classification of Mutual Funds in India has helped to categorize them into major types such as Funds of Funds, Regional Mutual Funds, Closed- End Funds, Large Cap Funds, and Interval Funds. A glance at Mutual fund in India: Mutual fund in India is a kind of collective investment that is managed professionally. In Mutual fund in India, the money is collected from a large number of investors and then it is invested in bonds, stocks, and various other securities. The fund manager of Mutual fund in India collects the interest income which is then distributed among the individual investors on the basis of the number of units that they hold. Mutual fund's value of a share is calculated on a daily basis and is known as per share Net Asset Value (NAV) Various kinds of Mutual funds in India: Classification of Mutual Funds in India has been done on the basis of their investment objective and structure. Classification of Mutual Funds in India has be done into main types such as Income Funds, Sector- Specific Funds, Large Cap Funds, Fixed- Income Funds, Interval Funds, Closed- End Funds, and Tax Saving Funds. Income Funds in India are a kind of mutual fund whose aim is to provide to the investors with steady and regular income. They usually invest their principal in securities such as corporate debentures, bonds, and government securities. Sector- Specific Funds in India are funds that make investments in specified sectors only. They give importance to one sector only such as pharmaceuticals, software, infrastructure, and health care. Large Cap Funds in India are a kind of mutual fund that makes investment in the shares of large blue chip companies. Fixed- Income Funds in India makes investment in debt securities that have been issued either by the banks, government, or

- 23. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_23 companies. They are also known as income funds and debt funds. Interval Funds in India are a combination of both the open and close ended funds. They offer the investors flexibility for they can be sold and repurchased at the period of time that has been predetermined. Closed- End Funds in India are a kind of mutual fund that has a maturity period that has been specified and which usually varies from three to fifteen years. Tax Saving Funds in India offer tax rebates to the investor under the Section 88, Income Tax Act. They are also known as equity- linked savings scheme. Share There are different types of mutual funds in India available in the market which an investor can choose depending on his profile, risk taking capacity and time horizon. The classification of mutual funds can be done on either the investment objective or on structure of the mutual fund. Let’s go through each one of these classifications by looking at the chart below and understand what they mean. Miscellaneous Classification 1.Open and Close Ended Mutual Funds: A mutual fund can be either Open ended or Close ended. Open ended funds can buy and sell its units at any time – so an an investor, you can purchase and sell your holdings in such funds at any time. Given this, its corpus keeps changing. On the contrary, close ended funds can only be bought by investors buying the period they are up for sale – called the New Fund Offer (NFO) period. Investors can sell them either on the stock exchanges where it is listed or during special buy back periods which the AMC (Asset Management Company) schedules. 2.Growth and Dividend Mutual Funds : Funds that make your capital grow over a period of time without giving out profits/dividends to you are called growth funds. In case you received dividends from them, its called a dividend fund. Obviously, in the latter case, since the profits are paid out from the fund corpus, the NAV of the fund will be less.

- 24. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_24 3.Debt Mutual Funds These invest in commercial papers, certificates of deposits, treasury bills, corporate bonds, debentures and government bonds among others. There are other classification of such funds, depending on the maturity of the paper held, for eg, short-term and medium-term to long-term funds So these invest in predominantly debt securities and their agenda is to generate stable income for investors with less amount of risk. These shall be covered in a later lesson in more detail. 4.Equity Mutual Funds These invest primarily in stocks of companies – in a sense, you own up ending a part of the company when you buy into these. These are meant for long term investments and carry a great deal of risk. Their purpose is capital appreciation over a long period of time. a).Diversified Equity funds invest in a wide selection of stocks across different companies and market capitalizations so as to reduce the risk for the investor. b.)Index funds invest in companies that comprise the benchmark index (say NSE or BSE) and in the same proportion as the index itself. So the returns of these are in line with the index. c.)ELSS (equity linked savings schemes) or tax saving mutual funds provide tax benefit to investors under section 80(C) and also have a lock-in period of 3 years – this means that as an investor, you cannot redeem(sell) your holdings before three years of buying the mutual fund. d.)Sector or Thematic funds invest in a particular sector eg, there could be a fund investing in only the banking sector. Similarly, there could be thematic funds investing in a particular theme, example, infrastructure.

- 25. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_25 e.)Large-cap mutual funds invest in large market capitalization companies. There is no clear definition of what large capitalization means, many AMCs pick the top 100 companies (based on market cap) on the Sensex and call them large-cap. Similarly, there exists mid-cap and small-cap mutual funds – those which invest in medium market capitalization companies and small market capitalization companies respectively. Among these, large-cap carries the lowest risk while the small cap carries the most risk. Hybrid Mutual Funds Balanced Mutual Funds invest in at least 65% equities and the rest 35% in debt. The debt portion provides stability while the equity portion provides capital appreciation. Monthly Income Plans (MIPs) are plans which invest around 15%-25% in equities and the rest in debt and money market instruments. Other Types Gold Mutual Funds are those that invest in gold as the underlying assets. International Funds invest in companies outside India. Exchange Traded Funds(ETFs) are those that are traded on the stock exchange on a real time basis. Socially responsible mutual funds invest in companies that have social, environmental or moral beliefs and promote the same. Fund of Funds do not invest in any companies – instead they put in their money into other AMC’s mutual funds.

- 26. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_26 Funds: Evaluating Performance Perhaps you've noticed all those mutual fund ads that quote their amazingly high one-year rates of return. Your first thought is "wow, that mutual fund did great!" Well, yes it did great last year, but then you look at the three-year performance, which is lower, and the five year, which is yet even lower. What's the underlying story here? Let's look at a real example from a large mutual fund's performance: Last year, the fund had excellent performance at 53%. But, in the past three years, the average annual return was 20%. What did it do in years 1 and 2 to bring the average return down to 20%? Some simple math shows us that the fund made an average return of 3.5% over those first two years: 20% = (53% + 3.5% + 3.5%)/3. Because that is only an average, it is very possible that the fund lost money in one of those years. It gets worse when we look at the five-year performance. We know that in the last year the fund returned 53% and in years 2 and 3 we are guessing it returned around 3.5%. So what happened in years 4 and 5 to bring the average return down to 11%? Again, by doing some simple calculations we find that the fund must have lost money, an average of -2.5% each year of those two years: 11% = (53% + 3.5% + 3.5% - 2.5% - 2.5%)/5. Now the fund's performance doesn't look so good! It should be mentioned that, for the sake of simplicity, this example, besides making some big assumptions, doesn't include calculating compound interest. Still, the point wasn't to be technically accurate but to demonstrate the importance of taking a closer look at performance numbers. A fund that loses money for a few years can bump the average up significantly with one or two strong years. It's All Relative Of course, knowing how a fund performed is only one third of the battle. Performance is a relative issue, literally. If the fund we looked at above is judged against its appropriate benchmark index, a whole new layer of information is added to the evaluation. If the index returned 75% for the 1 year time period, that 53% from the fund doesn't look quite so good. On the other hand, if the index delivered results of 25%, 5%, and -5% for the respective one, three, and five-year periods, then the fund's results look rather fine indeed. To add another layer of information to the evaluation, one can consider a fund's performance against its peer group as

- 27. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_27 well as against its index. If other funds that invest with a similar mandate had similar performance, this data point tells us that the fund is in line with its peers. If the fund bested its peers and its benchmark, its results would be quite impressive indeed. Looking at any one piece of information in isolation only tells a small portion of the story. Consider the comparison of a fund against its peers. If the fund sits in the top slot over each of the comparison periods, it is likely to be a solid performer. If it sits at the bottom, it may be even worse than perceived, as peer group comparisons only capture the results from existing funds.

- 28. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_28 CHAPTER.7 7. Advantages and Disadvantages of Mutual Fund Advantages of Mutual Funds The Mutual Funds are one of the best financial instruments offered to the public by the finance corporations. The Mutual Funds are collective investments, and use that money as investment in various stocks, bonds, and other securities to earn interest and disburse dividends.Advantages of Mutual Funds are the primary reason for the popularity of the mutual funds. The Mutual Funds offers easy access to invest in the complex financial market. Major advantages of Mutual Funds are professional management, diversification and liquidity. Advantages of Mutual Funds-Overview 1.Flexibility: The investments pertaining to the Mutual Fund offers the public a lot of flexibility by means of dividend reinvestment, systematic investment plans and systematic withdrawal plans. 2. Affordability: The Mutual funds are available in units. Hence they are highly affordable and due to the very large principal sum, even the small investors are benefited by the investment scheme.

- 29. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_29 3. Liquidity: In case of Open Ended Mutual Fund schemes, the investors have the option of redeeming or withdrawing money at any point of time at the current rate of net value asset. 4. Diversification: The risk pertaining to the Mutual Funds is quite low as the total investment is distributed in several industries and different stocks. 5. Professional Management: The Mutual Funds are professionally managed. The experienced Fund Managers pertaining to the Mutual Funds examine all options based on research and experience. 6. Potential of return: The Fund Managers of the Mutual Funds gather data from leading economists and financial analysts. So they are in a better position to analyze the scopes of lucrative return from the investments. 7. Low Costs: The fees pertaining to the custodial, brokerage, and others is very low. 8. Regulated for investor protection: The Mutual Funds sector is regulated by the Securities Exchange Board of India (SEBI) to safeguard the rights Mutual funds are currently the most popular investment vehicle and provide several advantages to investors, including the following: a.)Advanced Portfolio Management you pay a management fee as part of your expense ratio, which is used to

- 30. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_30 hire a professional portfolio manager who buys and sells stocks, bonds, etc. This is a relatively small price to pay for help in the management of an investment portfolio b). Dividend Reinvestment As dividends and other interest income is declared for the fund, it can be used to purchase additional shares in the mutual fund, thus helping your investment grow. c). Risk Reduction (Safety) A reduced portfolio risk is achieved through the use of diversification, as most mutual funds will invest in anywhere from 50 to 200 different securities - depending on their focus. Several index stock mutual funds own 1,000 or more individual stock positions. d.) Convenience and Fair Pricing Mutual funds are common and easy to buy. They typically have low minimum investments (some around $2,500) and they are traded only once per day at the closing net asset value (NAV). This eliminates price fluctuation throughout the day and various arbitrage opportunities that day traders practice.

- 31. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_31 Disadvantage Mutual Funds So-Called Disadvantages of Mutual Funds? Disadvantage Mutual Funds Have Hidden Fees If fees were hidden, those hidden fees would certainly be on the list of disadvantages of mutual funds. The hidden fees that are lamented are properly referred to as 12b-1 fees. While these 12b-1 fees are no fun to pay, they are not hidden. The fee is disclosed in the mutual fund prospectus and can be found on the mutual funds’ web sites. Many mutual funds do not charge a 12b-1 fee. If you find the 12b-1 fee onerous, invest in a mutual fund that does not charge the fee. Hidden fees cannot make the list of disadvantages of mutual funds because they are not hidden and there are thousands of mutual funds that do not charge 12b-1 fees. Disadvantage 2: Mutual Funds Lack Liquidity How fast can you get your money if you sell a mutual fund as compared to ETFs, stocks and closed-end funds? If you sell a mutual fund, you have access to your cash the day after the sale. ETFs, stocks and closed-end funds require you to wait three days after you sell the investment. I would call the “lack of liquidity” disadvantage of mutual funds a myth. You can only find more liquidity if you invest in your mattress. Disadvantage 3: Mutual Funds Have High Sales Charges Should a sales charge be included in the disadvantages of mutual funds list? It’s difficult to justify paying a sales charge when you have a plethora of no-load mutual funds. But, then again, it’s difficult to say that a sales charge is a disadvantage of mutual funds when you have thousands of mutual fund options that do not have sales charges. Sales charges are too broad to be included on my list of disadvantages of mutual funds.

- 32. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_32 Disadvantage 4: Mutual Funds and Poor Trade Execution If you buy or sell a mutual fund, the transaction will take place at the close of the market regardless of the time you entered the order to buy or sell the mutual fund. I find the trading of mutual funds to be a simple, stress-free feature of the investment structure. However, many advocates and purveyors of ETFs will point out that you can trade throughout the day with ETFs. If you decide to invest in ETFs over mutual funds because your order can be filled at 3:50 pm EST with ETFs rather than receive prices as of 4:00 pm EST with mutual funds, I recommend that you sign up for the Stress Management Weekly Newsletter at About.com. Disadvantage 5: All Mutual Funds Have High Capital Gains Distributions If all mutual funds sell holdings and pass the capital gains on to investors as a taxable event, then we have a found a winner for the list of disadvantages of mutual funds list. Oh well, not all mutual funds make annual capital gains distributions. Index mutual funds and tax-efficient mutual funds do not make these distributions every year. Yes, if they have the gains, they must distribute the gains to shareholders. However, many mutual funds (including index mutual funds and tax-efficient mutual funds) are low-turnover funds and do not make capital gains distributions on an annual basis. In addition, retirement plans (IRAs, 401ks, etc.) are not impacted by capital gains distributions. There are also strategies to avoid the capital gains distributions including tax-loss harvesting and selling a mutual fund prior to the distribution . However, there are also disadvantages of mutual funds, such as the following: a.)High Expense Ratios and Sales Charges If you're not paying attention to mutual fund expense ratios and sales charges, they can get out of hand. Be very cautious when investing in funds with expense ratios higher than 1.20%, as they will be considered on the higher cost end. Be weary of 12b-1 advertising fees and sales charges in general. There are several good fund companies out there that have no sales charges. Fees reduce overall investment returns.

- 33. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_33 b.)Management Abuses Churning, turnover and window dressing may happen if your manager is abusing his or her authority. This includes unnecessary trading, excessive replacement and selling the losers prior to quarter-end to fix the books. c.)Tax Inefficiency Like it or not, investors do not have a choice when it comes to capital gain payouts in mutual funds. Due to the turnover, redemptions, gains and losses in security holdings throughout the year, investors typically receive distributions from the fund that are an uncontrollable tax event. d.)Poor Trade Execution If you place your mutual fund trade anytime before the cut-off time for same-day NAV, you'll receive the same closing price NAV for your buy .

- 34. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_34 CHAPTER .8 8. SEBI Guidelines for Mutual Fund SEBI Regulation Act 1996 Establishment of a Mutual Fund: In India mutual fund play the role as investment with trust, some of the formalities laid down by the SEBI to be establishment for setting up a mutual fund. As the part of trustee sponsor the mutual fund, under the Indian Trust Act, 1882, under the trustee company are represented by a board of directors. Board of Directors is appoints the AMC and custodians. The board of trustees made relevant agreement with AMC and custodian. The launch of each scheme involves inviting the public to invest in it, through an offer documents. Depending on the particular objective of scheme, it may open for further sale and repurchase of units, again in accordance with the particular of the scheme, the scheme may be wound up after the particular time period. 1. The sponsor has to register the mutual fund with SEBI 2.To be eligible to be a sponsor, the body corporate should have a sound track record and a general reputation of fairness and integrity in all his business transactions

- 35. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_35 Means of Sound Track Records The body corporate being in the financial services business for at least five years application of registration. capital of the AMC. year. 3. The sponsor should hold at least 40% of the net worth of the AMC. 4. A party which is not eligible to be a sponsor shall not hold 40% or more of the net worth of the AMC. 5. The sponsor has to appoint the trustees, the AMC and the custodian. 6. The trust deed and the appointment of the trustees have to be approved by SEBI. 7. An AMC or its officers or employees can not be appointed as trustees of the mutual fund. 8. At least two thirds of the business should be independent of the sponsor. 9. Only an independent trustee can be appointed as a trustee of more than one mutual fund, such appointment can be made only with the prior approval of the fund of which the person is already acting as a trustees.

- 36. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_36 LAUNCHING OF A SCHEMES Before its launch, a scheme has to be approved by the trustees and a copy of its offer documents filed with the SEBI. 1. Every application form for units of a scheme is to be accompanies by a memorandum containing key information about the scheme. 2. The offer document needs to contain adequate information to enable the investors to make informed investments decisions. 3. All advertisements for a scheme have to be submitted to SEBI within seven days from the issue date. 4. The advertisements for a scheme have to disclose its investment objective. 5. The offer documents and advertisements should not contain any misleading information or any incorrect statement or opinion. 6. The initial offering period for any mutual fund schemes should not exceed 45 days, the only exception being the equity linked saving schemes. 7. No advertisements can contain information whose accuracy is dependent on assumption. 8. An advertisement cannot carry a comparison between two schemes unless the schemes are comparable and all the relevant information about the schemes is given. 9. All advertisements need to carry the name of the sponsor, the trustees, the AMC of the fund. 10. All advertisements need to disclose the risk factors. 11. All advertisements shall clarify that investment in mutual funds is subject to market risk and the achievement of the fund’s objectives can not be assured.

- 37. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_37 CHAPTER .9 9. Recent Trend of Mutual Fund India is at the first stage of a revolution that has already peaked in the U.S. The U.S. boasts of an Asset base that is much higher than its bank deposits. In India, mutual fund assets are not even 10% of the bank deposits, but this trend is beginning to change. Recent figures indicate that in the first quarter of the current fiscal year mutual fund assets went up by 115% whereas bank deposits rose by only 17%. (Source: Thinktank, the Financial Express September, 99) This is forcing a large number of banks to adopt the concept of narrow banking wherein the deposits are kept in Gilts and some other assets which improves liquidity and reduces risk. The basic fact lies that banks cannot be ignored and they will not close down completely. Their role as intermediaries cannot be ignored. It is just that Mutual Funds are going to change the way banks do business in the future.

- 38. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_38 Comparison of investment in Banks V/S Mutual Funds PARTICULAR BANKS MUTUAL FUNDS Returns Low Better Administrative exp. High Low Risk Low Moderate Investment options Less More Network High penetration Low but improving Liquidity At a cost Better Quality of assets Not transparent Transparent Interest calculation Minimum balance between 10th. & 30th. Of every month Everyday

- 39. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_39 CHAPTER.10 10. Conclusion The Indian economy is second largest economy in the world, but on 2008 and first quart of 2009 was international financial liquidity and global fund crisis. USA economy affect by sub- prime crisis that creates problem of international financial market, commodity market and foreign exchange market. But Indian economy less affects due to fast moving for consumer durable, growth of capital expenditure projects and service sector, Indian government easily attract foreign investors. Foreign Institutional Investors invest on Indian capital market, it is continuous growing.

- 40. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_40 CHAPTER .11 11. bibology www.investopedia.com www.rbi.com www.sebi.com

- 41. M.D COLLEGE T.Y.F.M MUTUAL FUNDINDUSTRY IN INDIA B.COM(FINANCIALMARKET)_41