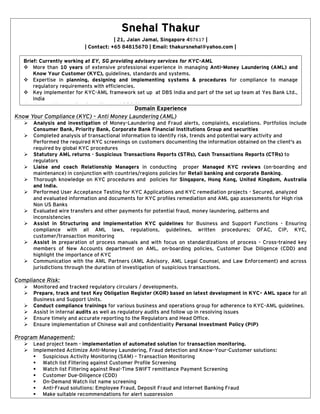

Resume - Snehal Thakur

- 1. Snehal Thakur | 21, Jalan Jamal, Singapore 457617 | | Contact: +65 84815670 | Email: thakursnehal@yahoo.com | Domain Experience Know Your Compliance (KYC) – Anti Money Laundering (AML) Analysis and investigation of Money-Laundering and Fraud alerts, complaints, escalations. Portfolios include Consumer Bank, Priority Bank, Corporate Bank Financial Institutions Group and securities Completed analysis of transactional information to identify risk, trends and potential wary activity and Performed the required KYC screenings on customers documenting the information obtained on the client's as required by global KYC procedures Statutory AML returns - Suspicious Transactions Reports (STRs), Cash Transactions Reports (CTRs) to regulators Liaise and coach Relationship Managers in conducting proper Managed KYC reviews (on-boarding and maintenance) in conjunction with countries/regions policies for Retail banking and corporate Banking. Thorough knowledge on KYC procedures and policies for Singapore, Hong Kong, United Kingdom, Australia and India. Performed User Acceptance Testing for KYC Applications and KYC remediation projects - Secured, analyzed and evaluated information and documents for KYC profiles remediation and AML gap assessments for High risk Non US Banks Evaluated wire transfers and other payments for potential fraud, money laundering, patterns and inconsistencies Assist in Structuring and Implementation KYC guidelines for Business and Support Functions - Ensuring compliance with all AML laws, regulations, guidelines, written procedures; OFAC, CIP, KYC, customer/transaction monitoring Assist in preparation of process manuals and with focus on standardizations of process - Cross-trained key members of New Accounts department on AML, on-boarding policies, Customer Due Diligence (CDD) and highlight the importance of KYC Communication with the AML Partners (AML Advisory, AML Legal Counsel, and Law Enforcement) and across jurisdictions through the duration of investigation of suspicious transactions. Compliance Risk: Monitored and tracked regulatory circulars / developments. Prepare, track and test Key Obligation Register (KOR) based on latest development in KYC- AML space for all Business and Support Units. Conduct compliance trainings for various business and operations group for adherence to KYC-AML guidelines. Assist in internal audits as well as regulatory audits and follow up in resolving issues Ensure timely and accurate reporting to the Regulators and Head Office. Ensure implementation of Chinese wall and confidentiality Personal Investment Policy (PIP) Program Management: Lead project team - implementation of automated solution for transaction monitoring. Implemented Actimize Anti-Money Laundering, Fraud detection and Know-Your-Customer solutions: Suspicious Activity Monitoring (SAM) – Transaction Monitoring Watch list Filtering against Customer Profile Screening Watch list Filtering against Real-Time SWIFT remittance Payment Screening Customer Due-Diligence (CDD) On-Demand Watch list name screening Anti-Fraud solutions: Employee Fraud, Deposit Fraud and Internet Banking Fraud Make suitable recommendations for alert suppression Performed SAR maintenance and quality assessments (SAR reviews). Brief: Currently working at EY, SG providing advisory services for KYC-AML More than 10 years of extensive professional experience in managing Anti-Money Laundering (AML) and Know Your Customer (KYC), guidelines, standards and systems. Expertise in planning, designing and implementing systems & procedures for compliance to manage regulatory requirements with efficiencies. Key implementer for KYC-AML framework set up at DBS India and part of the set up team at Yes Bank Ltd., India Managed transaction Surveillance at DBS Singapore.

- 2. Organizational Experience: Ernst and Young Advisory Pt. Ltd | February 2015 – Present Senior Associate - 3, Advisory Services Worked on PMO project for large American bank Managed team of 4 for customer onboarding project for a large American bank DBS Bank Ltd. (Singapore) | September 2011 – February 2015 Associate, Financial Crimes & Security Services - Transaction Surveillance Unit DBS Bank Ltd. (India) | July 2008 – September 2011 Sr Executive, Legal and Compliance Awarded as “Ace Performer” by the CEO, DBS India for setting and implementing AML transaction Monitoring system for DBS India. YES Bank Ltd. | June 2006 – June 2008 Senior Officer, Know Your Customer/Anti Money Laundering Unit Kotak Mahindra Bank | May 2005 – May 2006 Junior Officer, Account Opening Operations Educational Qualifications Mumbai University, 2001 - 2003 Bachelor of Commerce Professional Qualifications / Trainings Association of Certified Anti-Money laundering Specialists (ACAMS), December 2012 Certified Anti-Money Laundering Specialist COMAT Training Institute, 2012 ICDL Advanced Certification in Microsoft Excel Indian Institute of Banking & Finance, December 2007 Certificate in KYC-AML NMIMS, 2003 - 2004 Diploma in Business Management Personal Details Date of Birth : 12th February 1983 Marital Status : Single Nationality : Indian Work Status : Employment Pass Holder (Singapore),