GST Impact on Logistics

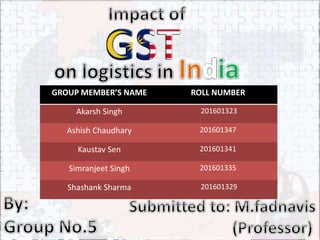

- 1. GROUP MEMBER’S NAME ROLL NUMBER Akarsh Singh 201601323 Ashish Chaudhary 201601347 Kaustav Sen 201601341 Simranjeet Singh 201601335 Shashank Sharma 201601329

- 2. The Goods and Services Tax(GST) is a value added tax that will replace all the indirect taxes levied on goods and services by the government,both central and states. The basic idea of this bill is to create a single, cooperative and undivided Indian market to make the economy stronger and powerful.

- 6. One function of logistics marketing is finding out who your customer is and how to get the product or service to the customer An organization bases pricing decisions on both internal and external factors. Marketing logistics must recognize price drivers. The profile of the customer, the product and the type of order are factors that drive the price. Promotion is another important aspect of an organization’s marketing logistics process. When bringing a product to market, the organization must coordinate the logistics of the various marketing materials. The function of place in marketing logistics allows the organization to simplify the transactions between a logistics provider and the customer.

- 9. The proposed goods and services tax (GST) will help companies reduce logistics cost by 1.5 to 2.5% as they reconfigure their supply chains and bring in three key structural changes to the logistics industry. India becomes one big market, there will be fewer and larger warehouses It will lead to a larger number of bigger trucks on road as there is greater adoption of the hub-and-spoke model These changes will lead to greater economies of scale for transport operators and lead to more companies outsourcing their logistics operations.

- 10. Warehousing gains, valuation hurdles: Currently, goods incur 2 per cent central sales tax (CST) when they are manufactured in one State and sold in another. To avoid this, industries transfer the manufactured goods to warehouses in the State from where the sale of goods takes place. This helps them avoid CST while simultaneously availing the input credit that can be obtained through value-added tax. But this makes them incur extra storage costs.

- 11. Containerisation – Major domestic freight players like AllCargo Logistics, Navkar Corporation and Container Corporation of India are expected to have a positive impact from GST implementation. Over the last three years, twenty-foot equivalent container volumes for Allcargo Logistics and Navkar Corporation grew by 17 and 12 per cent respectively.

- 12. Transit time reduction Trucks in India currently travel an average of about 280 km per day in comparison to those in the US which travel 800 km per day. The report on revenue neutral rate indicates that implementation of GST can add an additional 164 km truck distance per day, which is close to 60 per cent increase from the present day scenario.