Post market-report-13th-jan-2017

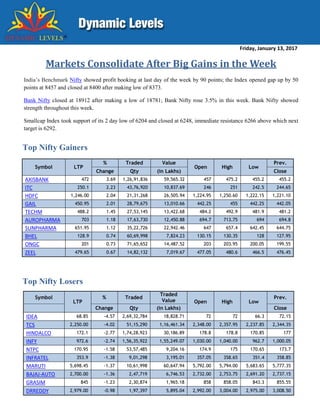

- 1. Friday, January 13, 2017 Top Nifty Gainers Symbol LTP % Traded Value Open High Low Prev. Change Qty (in Lakhs) Close AXISBANK 472 3.69 1,26,91,836 59,565.32 457 475.2 455.2 455.2 ITC 250.1 2.23 43,76,920 10,837.69 246 251 242.5 244.65 HDFC 1,246.00 2.04 21,31,268 26,505.94 1,224.95 1,250.60 1,222.15 1,221.10 GAIL 450.95 2.01 28,79,675 13,010.66 442.25 455 442.25 442.05 TECHM 488.2 1.45 27,53,145 13,422.68 484.2 492.9 481.9 481.2 AUROPHARMA 703 1.18 17,63,730 12,450.88 694.7 713.75 694 694.8 SUNPHARMA 651.95 1.12 35,22,726 22,942.46 647 657.4 642.45 644.75 BHEL 128.9 0.74 60,69,998 7,824.23 130.15 130.35 128 127.95 ONGC 201 0.73 71,65,652 14,487.52 203 203.95 200.05 199.55 ZEEL 479.65 0.67 14,82,132 7,019.67 477.05 480.6 466.5 476.45 Top Nifty Losers Markets Consolidate After Big Gains in the Week India’s Benchmark Nifty showed profit booking at last day of the week by 90 points; the Index opened gap up by 50 points at 8457 and closed at 8400 after making low of 8373. Bank Nifty closed at 18912 after making a low of 18781; Bank Nifty rose 3.5% in this week. Bank Nifty showed strength throughout this week. Smallcap Index took support of its 2 day low of 6204 and closed at 6248, immediate resistance 6266 above which next target is 6292. Symbol LTP % Traded Traded Value Open High Low Prev. Change Qty (in Lakhs) Close IDEA 68.85 -4.57 2,69,32,784 18,828.71 72 72 66.3 72.15 TCS 2,250.00 -4.02 51,15,290 1,16,461.34 2,348.00 2,357.95 2,237.85 2,344.35 HINDALCO 172.1 -2.77 1,74,28,923 30,186.89 178.8 178.8 170.85 177 INFY 972.6 -2.74 1,56,35,922 1,55,249.07 1,030.00 1,040.00 962.7 1,000.05 NTPC 170.95 -1.58 53,57,485 9,204.16 174.9 175 170.65 173.7 INFRATEL 353.9 -1.38 9,01,298 3,195.01 357.05 358.65 351.4 358.85 MARUTI 5,698.45 -1.37 10,61,998 60,647.94 5,792.00 5,794.00 5,683.65 5,777.35 BAJAJ-AUTO 2,700.00 -1.36 2,47,719 6,746.53 2,732.00 2,753.75 2,691.20 2,737.15 GRASIM 845 -1.23 2,30,874 1,965.18 858 858.05 843.3 855.55 DRREDDY 2,979.00 -0.98 1,97,397 5,895.04 2,992.00 3,004.00 2,975.00 3,008.50

- 2. A Quick View of the Sectors SECTOR % CHANGE TODAY FERTILISERS 2.75% DIVERSIFIED 2.05% FMCG-BEVERAGES 1.45% ENTERTAINMENT-HOTELS AND LEISURE 1.16% FMCG 1.15% FMCG-SUGAR 0.82% FMCG-FOOD 0.71% BANKS-PRIVATE 0.66% FINANCIAL SERVICES-NBFC 0.58% INFRA-POWER 0.36% INFRA-MACHINERY EQUIPMENT 0.34% CHEMICALS 0.28% DIVERSIFIED-SUGAR AND GAS 0.23% MEDIA 0.10% IT -0.05% AUTO-AUTO ANCL AND COMPONENTS -0.10% BANKS-PSU -0.11% DIVERSIFIED-CHEMICALS AND TEXTILES -0.24% ENERGY-OIL & GAS -0.31% AUTO-AUTOMOBILES AND AUTO PARTS -0.33% INFRA-CONSTRUCTION ENGINEERING AND MATERIALS -0.35% DIVERSIFIED-STEEL AND LUBRICANT -0.58% FMCG-PACKAGING -0.83% FINANCIAL SERVICES -0.88% DIVERSIFIED-TYRES AND FMCG AND CHEMICALS -0.88% CEMENTS -0.89% DIVERSIFIED-TEXTILES AND FERTILIZER AND CHEMICALS -1.04% AUTO-TYRES AND TUBES -1.18% INFRA-TELECOM -1.66% DIVERSIFIED-CEMENTS AND PAPER AND TEXTILE -1.90% DIVERSIFIED-TYRES & CEMENTS -1.91% FOOTWEAR -1.99% Dynamic Sector Performance – 13th January 2017 Top Sectors today which supported the markets to move up were FERTILISERS, DIVERSIFIED,FMCG-BEVERAGES, ENTERTAINMENT-HOTELS AND LEISURE & FMCG which were up by more than 1% The sectors which could not perform today were FOOTWEAR, DIVERSIFIED-TYRES & CEMENTS, DIVERSIFIED- CEMENTS AND PAPER AND TEXTILE, INFRA-TELECOM, AUTO-TYRES AND TUBES & DIVERSIFIED-TEXTILES AND FERTILIZER AND CHEMICALS which lost more than 1% in today’s trade.

- 3. NSE High Volumes Stock Performer List TOP GAINER TOP LOSER SYMBOL LTP %CHANGE SECTOR SYMBOL LTP %CHANGE SECTOR TRIDENT 65.35 8.6 TEXTILES AND APPAREL JKPAPER 88.25 -3.9 PAPER SREINFRA 88.25 7.6 FINANCIAL SERVICES- NBFC AIAENG 1353.1 -3.1 INFRA-MACHINERY EQUIPMENT TATACOFFEE 122.3 6.1 FMCG-BEVERAGES MRPL 107.3 -2.9 ENERGY-OIL & GAS GNFC 264.75 4.8 FERTILISERS MUKANDLTD 68.3 -2.8 METALS AND MINING KIRIINDUS 326.55 4.4 CHEMICALS BIRLACORPN 681.55 -2.7 CEMENTS CUB 141.5 3.9 BANKS-PRIVATE SOMANYCERA 513.2 -2.2 REALTY-HOUSEHOLD DELTACORP 134.1 3.9 ENTERTAINMENT-HOTELS AND LEISURE LUMAXIND 1045.9 -2.2 AUTO-AUTOMOBILES AND AUTO PARTS NOCIL 74.05 3.9 CHEMICALS CERA 2049.4 -2.1 REALTY-HOUSEHOLD RICOAUTO 62.55 3.8 AUTO-AUTOMOBILES AND AUTO PARTS UJJIVAN 327.8 -2.1 FINANCIAL SERVICES LLOYDELENG 284.35 3.7 REALTY-HOUSEHOLD ITDCEM 158.8 -2.0 INFRA-CONSTRUCTION ENGINEERING AND MATERIALS NEULANDLAB 1015.8 2.6 PHARMA SURYAROSNI 187.65 -2.0 REALTY-HOUSEHOLD OBEROIRLTY 319.25 2.4 REALTY CAPF 610.8 -2.0 FINANCIAL SERVICES MUTHOOTFIN 297.3 2.2 JEWELLERY KESORAMIND 140.9 -1.9 DIVERSIFIED-TYRES & CEMENTS UCALFUEL 186.75 2.1 AUTO-AUTO ANCL AND COMPONENTS SHARDACROP 472.1 -1.9 CHEMICALS DHAMPURSUG 167.65 2.0 FMCG-SUGAR NILKAMAL 1468.4 -1.9 REALTY-HOUSEHOLD JBMA 257.4 2.0 AUTO-AUTO ANCL AND COMPONENTS NAVINFLUOR 2778.45 -1.8 CHEMICALS GSFC 115.6 2.0 FERTILISERS UFLEX 272.35 -1.8 FMCG-PACKAGING SUPPETRO 226.15 1.8 CHEMICALS PHILIPCARB 239.4 -1.5 CHEMICALS RALLIS 211.9 1.8 CHEMICALS RAMCOCEM 604.05 -1.4 CEMENTS QUICKHEAL 257.9 1.8 IT ITI 50.05 -1.4 INFRA-TELECOM CROMPTON 157.3 1.7 REALTY-HOUSEHOLD TRIVENI 71.2 -1.3 FMCG-SUGAR MAGMA 93.85 1.6 FINANCIAL SERVICES- NBFC VISAKAIND 205.75 -1.2 CEMENTS DEEPAKFERT 243.3 1.6 FERTILISERS JMFINANCIL 70.75 -1.2 FINANCIAL SERVICES EDELWEISS 107.25 1.4 FINANCIAL SERVICES CHENNPETRO 325.95 -1.2 ENERGY-OIL & GAS

- 4. Hot Picks of the Day Nifty Pharma- the Pooper of Nifty Party Yesterday Yesterday, Nifty breached the key 8,400 mark, stimulated by Power, Information Technology (IT), and Banking stocks, but the gains were restricted by battered Pharma counters. Shares of power, IT, utilities, and capital goods strengthened up on good buying enquiries, while those of Pharma, FMCG, automobile, and realty declined on selling pressure. Among laggards, Pharma stocks were worst-hit, following US president-elect Donald Trump’s strong remarks on pricing of medicines, signifying tougher working environment for Indian drug firms going ahead in the US. Lupin was battered the most, falling two per cent. Nifty Pharma Index declined by 0.60 per cent while Nifty FMCG Index remained the top loser after declining 0.97 per cent yesterday. Lumax Industries dips after Making Record High Last Day Lumax Industries share price slipped by more than 5 per cent in today’s trading session after hitting a life time. Yesterday Lumax Industries share price touched a life time of Rs 1089.50 (also its 52 week high). The life time low of the share is Rs 13.25 made on 17th September 2001 and the 52 week low of the share is Rs 352.60 made on 12th February 2016. Lumax has taken Automotive lighting to an entirely new level. Today Lumax accounts for over 60 per cent market share in the Indian Automobile Lighting Business, catalyzed by its over two decades strong technical and financial collaboration with Stanley Electric Company Limited, Japan, a world leader in Vehicle Lighting and illumination products for Automobiles. Goa Carbon posts loss for December Quarter, Stock Tanks Today, Goa Carbon Posted its Q3 result for the quarter ended December 30th 2016. The company has posted a net loss of Rs. 1.09 crores as compared to the net profit of Rs. 4.62 crores in the previous quarter and a loss of Rs. 0.90 crores in the corresponding quarter of the last financial year. On posting the loss for the quarter, Goa Carbon share price tanked 9 per cent in the trade today at NSE. The company’s net sales have come down to Rs. 71.88 crores from the previous 79.04 crores in the September quarter and Rs. 89.77 crores from the same quarter in the previous financial year, registering a decline of 9 per cent Quarter on Quarter and approximately 20 per cent in the yearly basis.

- 5. IPMA Energy Conservation Award – 2015-16 for Paper division Barnal has been presented to Trident Limited by the Indian Paper Manufactures Association (IPMA). This award adds lots of motivation and drive in the company's endeavor to continue with its product innovation, quality excellence and commitment towards energy conservation. Paper constitutes 21.46 per cent of total sales of Trident. On receiving the Award, Trident share price gained over 7 per cent and traded at the new lifetime high of Rs. 64.50 at NSE. At 10:34 AM, Trident share price was trading at Rs. 63.65, up by 5.82 per cent. Also, The Chennai-based investor Dolly Khanna purchased over 1% stake in Trident in the December quarter. She bought 52.49 lakh shares in the towel and paper maker, as per a stock exchange revelation. The stock surged 15 per cent during the quarter. Analysts said Trident has specially made capacities for manufacturing terry towel and bed linen which are likely to lead to improved product mix in favor of the high margin home textiles. Trident is scheduled for a re-rating on change in sales mix towards higher margin businesses of terry towels and bed linen, and also due to its presence across textiles manufacturing. Currently, the Company’s stock is trading at 4.6 times its estimated earnings for FY19. RPP Infra share price made a new life time high of Rs 273.40, and from there it dropped more than 9 per cent at a stretch. The share made this new high after breaking the high of Rs 263.00 it made yesterday. In today’s trading session, RPP Infra share price was seen trading at Rs 234.45, down by 9.32 per cent or 24.10 points at 3.25 PM. A total of 15,77,549 shares of the company have been traded by that time against the 20 days daily average trading volume of 5,31,108, thereby marking an approximate spurt of about 3 times. The total traded volume today was Rs 3,911.53 lacs. The Upper Price Band is 310.25 and the Lower Price Band is 206.85. Trident Trades at New Lifetime High On Receiving the Award . re Price Surges 13% over Q2 RPP Infra Share Price dips after Making New Record High re Price Surges 13% over Q2 RPP Infra Profit & Loss- Standalone(in Cr.) Particulars Mar-16 Mar-15 Mar-14 Mar-13 Mar-12 12 mths 12 mths 12 mths 12 mths 12 mths Revenue From Operations [Gross] 314.69 263.14 232.92 256.11 237.09 Revenue From Operations [Net] 314.69 263.14 232.92 256.11 237.09 Other Operating Revenues 0 0 0 1.06 3.87 Total Operating Revenues 314.69 263.14 232.92 257.17 240.97 Other Income 5.03 4.45 6.2 2.05 2.22 Total Revenue 319.72 267.59 239.12 259.22 243.18 Total Expenses 291.82 252.24 224.26 243.96 224.86 Profit/Loss Before Exceptional, ExtraOrdinary Items And Tax 27.9 15.35 14.86 15.26 18.33 Profit/Loss Before Tax 27.81 21.63 14.86 15.16 19.14 Profit/Loss After Tax And Before ExtraOrdinary Items 20.67 17.27 11.31 10.85 13.85

- 6. Atlas name is equivalent to the cycling revolution in India. Since sixty years, the Company has enjoyed a position of distinction and leadership in the Bicycle industry. An eye for detail, continuous upgradation of products and services, employee empowerment and above all customer centric approach has made Atlas a very respected and commended brand across regions. Atlas logo has been derived from Greek God portraying the legendary hero holding the world on his shoulders. Thus Atlas incorporates in itself ambitions of the millions in their progress and evolution through various phases in their lives. Today, Atlas Cycle share price gained 20 per cent to trade at the new lifetime high of Rs. 644.20. Previous to this, the stock had traded at the lifetime high values on 6th , 9th , 10th and 11th of January 2017. Intraday on Friday, Jubilant Industries share price zoomed up by 16 per cent to touch a new high of Rs. 344.95. The stock opened at Rs. 293.80 as compared to its previous closing at Rs. 291. The stock touched the days low at Rs. 286.00. Approximately 7,95,874 shares are traded in the counter with a traded value of Rs. 2,616.36 lacs, as per NSE. Jubilant Industries Limited is involved in the business of manufacturing of Indian-made foreign liquor (IMFL) products for the different brands in India, engaged in liquor business. The Company's segments are Performance Polymer, Agri Products and Retail. The Performance Polymer segment includes adhesives and wood finishes, food polymer (solid Polyvinyl Acetate (PVA)) and latex. The Agri Products segment constitutes single super phosphate, sulfuric acid and agro chemicals for crop product. The Retail segment is engaged in running and maintaining hypermarket cum malls. Its agribusiness offers a range of products in Crop Nutrition, Crop Growth Regulator and Crop Protection categories under the brand Ramban. It is associated with the manufacturing of organic manure granules and trading of agrochemical products. The Company has a product portfolio which covers a range of products for both business-to- business (B2B) and business to consumer (B2C) customers. DEN is India's top cable TV distribution company reaching an estimated 13 million households in over 200 cities across 13 key states in India and is existing in Delhi, Uttar Pradesh, Karnataka, Maharashtra, Gujarat, Rajasthan, Haryana, Kerala, West Bengal, Jharkhand, Bihar, Madhya Pradesh and Uttarakhand. DEN has a principal presence across the economically important Hindi Speaking Markets (HSM) belt and has a leading market share in the cities that it operates in. Today, Den Networks share price gained over 13 per cent at NSE to trade at the intraday high of Rs. 82.20. Atlas Cycle trades at New Lifetime High Yet Again re Price Surges 13% over Q2 Jubilant Industries Basks In the Glory of Making a New High re Price Surges 13% over Q2 Den Networks Gain Over 13% at NSE re Price Surges 13% over Q2 Recently, Den Network had posted it Q2 result for the September quarter, displaying the shrink in its net loss as compared to that of the corresponding quarter in the last financial year. The company has also posted its shareholding pattern for the December quarter.

- 7. Disclaimer The investment advice or guidance provided by way of recommendations, reports or other ways are solely the personal views of the research team. Users are advised to use the data for the purpose of information and rely on their own judgment while making investment decision. Dynamic Equities Pvt. Ltd - SEBI Investment Advisory Reg. No.: INA300002022 Disclosure Dynamic Equities Pvt. Ltd. is a member of NSE, BSE, MCX SX and a DP with NSDL & CDSL. It is also engaged in Investment Advisory Services and Portfolio Management Services. Dynamic Commodities Pvt. Ltd., associate company, is a member of MCX & NCDEX. We declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of our knowledge and belief of Dynamic/ its Associates/ Research Analyst: DYNAMIC/its Associates/ Research Analyst/ his Relative: Do not have any financial interest / any actual/beneficial ownership in the subject company. Do not have any other material conflict of interest at the time of publication of the research report Have not received any compensation from the subject company in the past twelve months Have not managed or co-managed public offering of securities for the subject company. Have not received any compensation for brokerage services or any products / services or any compensation or other benefits from the subject company, nor engaged in market making activity for the subject company Have not served as an officer, director or employee of the subject company Report Prepared By: Mayank Jain - NISM-201500086427 Vikash Kandoi - NISM-201500086430