Elemetal Direct Magazine

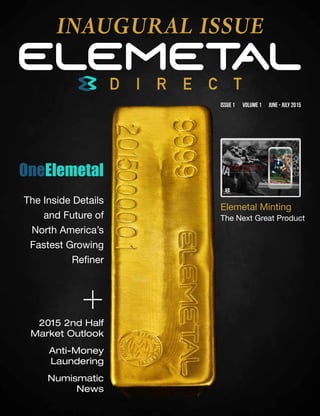

- 1. Story Name | S E C T I O N N A M E Elemetal Direct | ii OneElemetal The Inside Details and Future of North America’s Fastest Growing Refiner Elemetal Minting The Next Great Product 2015 2nd Half Market Outlook Anti-Money Laundering Numismatic News + ISSUE 1 VOLUME 1 JUNE - JULY 2015 INAUGURAL ISSUE

- 2. S E C T I O N N A M E | Story Name iii | Elemetal Direct

- 3. Story Name | S E C T I O N N A M E Elemetal Direct | 1

- 4. S E C T I O N N A M E | Story Name 2 | Elemetal Direct

- 5. Elemetal Direct | 3 REFERENCE GUIDE 4 Editor’s Note 6 One Elemetal 10 Silver Libertad Coin Series 14 Secretariat Silver Bar 18 Anti-Money Laundering 26 Elemetal Capital 2nd Half Outlook 32 A Word From Bill Numismatic News Elemetal Minting Market Update Industry Insight One Elemetal Coin Expert Louis Golino Provides a Great Review of the Silver Libertad Coin Series PAGE10 The Next Great Product is Here from the Creative Minds Behind the Silver Series T-206 Set PAGE 14 The Elemetal Capital Team Checks in the with its market outlook for 2015’s second half PAGE 26 We Provide some timely and informative Anti-Money Laundering facts and tips from one of the foremost thought leaders in the business PAGE 18 A Re-Introduction To Our Customers and an Overview of Our Core Values PAGE 6 ISSUE 1 VOLUME 1 JUNE - JULY 2015 Samer Barrage VP of Latin America & Caribbean Sales at NTR Metals

- 6. 4 | Elemetal Direct E D I T O R ’ S N O T E This new publication is both an introduction and rebirth of one of North America’s largest precious metals organizations. For a long time, you have been interacting and doing business with NTR Metals. Or maybe it was with OPM, Echo Environmental, Capital, or Provident Metals. Now, as the calendar has turned to June, we are announcing to the world not just a new brand – but a merging of synergies that position our group to provide our customers with a world-class experience at every spoke in the precious metals wheel. Welcome….to Elemetal. In this issue and subsequent ones, as well as your day-to-day dealings with our capable workforce, you’ll be introduced to Elemetal and taken back through some of our history and how we got here. We think you’ll be interested to hear it and also interested in how this affects you going forward. What will continue is the excellent service and experience you’re used to receiving from the different groups you’ve worked with over the years – that won’t change. What will change is the flexibility, increased offerings, and communication about how Elemetal can help every facet of your business and ultimately, make more money. So, take a few moments to read thorugh this magazine – it’s made for you. We’ll reintroduce who we are and focus on topical issues that focus on the important happenings in our industry. We’ll show you interesting products that our team is working on and provide communications on how we can work together better. Thank you for your business and your commitment to our company. We look forward to our re-introduction to the market and to serving you for many years to come. Elemetal, LLC Editorial Staff PRESENTED BY: Elemetal, LLC MARKETING DIRECTOR: Brad Hastedt LAYOUT DESIGN: Iain Duane Yu CONTRIBUTORS: Gabe Benson, Andrew Boyett, Louis Golino, Jason Vaile, Laura Goldzung, Bradley Yates DISCLAIMER: Elemetal Direct is 100% American owned. All contents of Elemetal Direct are for information purposes only. Elemetal Direct does not guarantee the accuracy, completeness or timeliness of the contents. None of the information contained herein constitutes a solicitation, offer, opinion, or reccomendation by Elemetal Direct to buy or sell any security or commodity, nor legal, tax, accounting, or investment advice or services regarding the profitability or suitability of any security, commodity or investment. All commentary and advice in this publication is of a general nature only, and doesn’t consider your individual circumstances or financial objectives. You should always consult a licensed financial advisor for your personal investment advice. Please do your own research. CONTACT US FOR ADVERTISING AND CONTENT Brad Hastedt bhastedt@elemetal.com PUBLICATION INFO www.elemetal.com 15850 Dallas Parkway Dallas, Texas 75248 Elemetal Direct is a bi-monthly publication only intended for Elemetal customers, vendors, and associates. JUNE / JULY 2015 Welcome to OneElemetal Samer Barrage

- 7. Story Name | S E C T I O N N A M E Elemetal Direct | 5

- 8. 6 | Elemetal Direct I N T R O & CO R E VA L U E S | One Elemetal he goal over the past 12 years has been to develop business models that cater to our customers’ needs for every step of the precious metals process from raw material to finished product. Elemetal has grown from a single location to an industry leader backed by the highest level of certifications and standards of quality. We are Comex and LBMA good delivery certified. Our network of stores and key divisions preserve the highest level of integrity as we continue to grow and find new and exciting ways to serve the precious metals industry at large. Elemetal’s dedication to our customers has made us one of the largest American-owned precious metals conglomerates. As our business continues to expand, we had to ask ourselves: why have many people—including our customers who use one or more of our services—not heard of Elemetal? The answer is simple: we haven’t told them who we are. For too long our companies have worked independently of each other, offering high quality customer service and deliverables but not efficiently marketing our entire range of services. That is changing with the move toward one Elemetal. Elemetal Core Values Integrity, Stewardship, Discipline, Collaboration and Perseverance. Elemetal began just over twelve years ago when two brothers saw enormous potential in gold. While the gold market was near the bottom, our founders saw a nascent blossoming industry ripe with potential. They knew it was only a matter of time before the market corrected. And as we all know the market did more than correct—it skyrocketed. Samer Barrage NTR Metals

- 9. Elemetal Direct | 7 As gold prices began to soar, the consumer need for an integrity- driven direct buyer spurred the growth of Elemetal’s business. As the price of gold continued to rise, the need for Elemetal’s services also increased. The only option was to expand. The founders often joke that their biggest struggle was expanding fast enough to meet the booming market. As Elemetal grew, it became apparent there was opportunity to diversify. The need to vertically integrate the business led to a period of organic growth and acquisitions where Elemetal diversified into recycling, refining, minting, bullion storage and other related areas designed to help the end user. However, as Elemetal grew these newly formed companies all had separate names. As a result, many of our customers didn’t know that Elemetal could assist them in every aspect of their business. Many of our customers didn’t know that Elemetal could assist them in every aspect of their business “We realized that the best way to serve our customers was to vertically integrate our business so that our customers had the opportunity to work with one company from raw material all the way to finished product.” says Mark Wayne, Executive Vice President of Operations. This decision has allowed Elemetal to proudly announce to the world in one simple sentence who we are and what we can do: One Elemetal | I N T R O & CO R E VA L U E S Whether you’re a miner or minter, scrap buyer or seller, wholesaler or retailer, banker or broker, Elemetal is here to meet your needs. “We want to be able to serve our customers in every business that they do,” Wayne continues. “Some refining customers are also jewelers and pawn shops selling diamonds and watches. By creating one Elemetal, our goal is for our customers to know without a doubt, that we can help them manage their entire business.” “It’s a funny thing for us. When we have a sales person talking to a jeweler about refining or recycling, there is a good chance that the jeweler’s case is filled with gold and silver that we had a part in delivering to him,” said Alan Stockmeister, Chairman of the Board. “The bottom line is that currently only Elemetal has the ability to help customers on both the buying and selling side. We can also help customers buy or sell as little as an ounce, and those looking to move a ton of gold or silver. No competitor can deliver what Elemetal can to both ends of the market.” What is One Elemetal? For years, Elemetal’s customers have been dealing directly with our family of companies such as NTR, OPM, and Echo Environmental. Those customers can rest assured that with one Elemetal they’ll receive the same quality of customer service and the COMEX and LBMA good delivery standards of our previous companies. Each one of these divisions operates under Elemetal’s system of core values: Integrity, Stewardship, Discipline, Collaboration and Perseverance. These values are more than just words. They define Elemetal and established us as the market leader. ELEMETAL DIRECT - Formerly NTR Metals Our network of stores gives us the unique privilege of being in your backyard. Whether you’re in Anchorage or Honolulu, Bogota or Berlin, we have a store near you waiting to provide industry leading turnaround on your scrap. Elemetal Direct will continue to operates as NTR Metals in Europe and Latin America. ELEMETAL REFINING - Formerly OPM Metals Since 1974, Elemetal Refining has been committed to offering the best rates and the most accurate and transparent assays. Our capacity to refine and evaluate large volumes of precious metals, using the most technologically advanced processes, has kept us at the forefront of the industrial refining market for decades. Elemetal Refining sets itself apart from others in the industry by using state-of-the-art refining techniques. We can refine scrap metals from a variety of sources to 99.99% pure gold and 99.90% pure silver. We upgrade impure precious metals to fine products through an assortment of unique processes. Elemetal Refining developed many modern refining practices and perfected our pyro metallurgical, mechanical, and chemical refining circuit in-house. Samer Barrage Latin American President of NTR Metals

- 10. 8 | Elemetal Direct I N T R O & CO R E VA L U E S | One Elemetal Elemetal Refining is the only refiner in the world to have a Brinks Vaulting Service inside its refinery.The vault, independently operated by Brinks, gives Elemetal Refining clients the option to store materials within the Brinks network avoiding delays and transportation costs. ELEMETAL CAPITAL - Formerly NTR Bullion Group Created with the purpose of providing constant liquidity to our partners in the precious metals industry, Elemetal Capital has evolved into a full-service trading firm. As the wholesale distributor for the entire Elemetal family of companies, Elemetal Capital focuses on physical metal trading, metal derivatives, and foreign exchange. Elemetal Capital makes a market in all major gold, silver, platinum, and palladium products. With an inventory that includes everything from fractional gold coins to 1,000-ounce silver bars, we provide our customers with a one-stop shop for all of their bullion needs. And since our bullion trading desk is strictly wholesale, we do not compete with our customers in the retail market. ELEMETAL DIAMOND At Elemetal Diamond we deliver the highest quality service to our clients. Whether you are buying or selling, you can expect the same level of professionalism throughout your transaction process. We deliver straightforward information and lend transparency into the life cycle of diamonds. We have made a great effort toward standardizing the pricing of melee diamonds, and give fair and competitive bids on all loose individual stones. Our ability to reach out to an expansive network of diamond dealers and wholesalers provides relevant and current market pricing for all categories of diamonds. ELEMETAL VAULT Elemetal Vault was a natural step in the evolution of Elemetal. After decades of experience covering nearly every aspect of the precious metals industry, we understand what gold and silver investors want and how and why they want it. Tangible investments like precious metals are inherently secure and provide a level of comfort that paper investments and fiat currencies do not. However, storing physical gold and silver isn’t feasible for some. So what’s the solution? An exchange created for precious metal investors by precious metal investors who have access to the resources of the entire Elemetal family: A secure online trading environment with no minimums, yet capable of high volume. ELEMETAL MINT Elemetal Mint leverages deep expertise to provide reliable excellence while pushing the private minting industry to continually improve through innovation and craftsmanship. Our Dallas facility leads the market in precision and quality, maintaining the highest possible certifications. Samer Barrage

- 11. Elemetal Direct | 9 One Elemetal | I N T R O & CO R E VA L U E S ELEMETAL RECYCLING - Formerly Echo Environmental As the industry of electronics recycling continues to evolve, it’s becoming increasingly difficult to differentiate a true recycler from a typical collector. Elemetal Recycling is striving to raise the standard and redefine what it means to be a true end-of-life recycler. Our goal is to take each material type down to its most basic form and perform as much of the refining process we are capable of in the United States. As a large-scale processor of circuit boards and electronic waste, Elemetal Recycling can buy on a per-pound or refining basis depending on quality and volume. Elemetal has one of the largest networks of collection facilities in the nation with over 60 locations accepting small-volume electronic waste. Our national presence provides us the resources to offer quality service at competitive prices. Elemetal Recycling processes the electronics we receive in our R2 certified million square foot facility, located in Waverly, Ohio. Our facility is designed to process precious metal-bearing products from all types of industries. This division complies with all applicable Federal, EPA, state and local regulations and has an executive team comprised of industry experts with over 100 years of combined industry knowledge. Elemetal is refining the future. It’s key for our customers to know how these changes will effect how Elemetal does business going forward. While Elemetal has become a market leader in a short period of time, we are still an emerging company in the marketplace. Changing to one Elemetal shows one of the ways we are different than our competitors. We are able to adapt to the ever-changing marketplace by offering streamlined, vertically integrated customer centric performance. At Elemetal, our focus is on the future success of our industry. Our goal is to continue integrating divisions and services in our persistent search to find new ways to bring value to our customers. WE ARE ELEMETAL, AND WE ARE REFINING THE FUTURE. Samer Barrage - NTR Metals

- 12. 10 | Elemetal Direct N U M I S M AT I C S | Silver Libertad Coin Series Silver Libertad Coin Series Has Great Potential T oday’s silver coin enthusiast has many options since there is a wide and growing range of silver bullion coins being produced by mints around the world. But back in 1982, when the Mexican silver Libertad series began, the situation was different as buyers had far fewer choices. In fact, the silver Libertad is the world’s first major silver bullion coin, a product of the Casa de Moneda (Mexican National Mint) of the Banco de Mexico (Bank of Mexico). Mexico has huge silver deposits and accounts for a fifth of global silver mining output, and the Mexican National Mint is North America’s oldest, having been founded in 1535. Mexico was of course a Spanish colony back then, and the new mint was created to fill the need for currency in a growing economy. The first coins minted were the eight real and peso, which eventually became the basis for several other world currencies, including the U.S. dollar, Chinese yuan, and Japanese yen. UNIQUE FACTORS From the beginning the Libertad, which is the official sovereign bullion coin of Mexico, has been different from other world bullion coins in several respects. First, it was originally issued as a one ounce-silver coin in 1982, but over the years it has also been minted in a wider range of sizes than its competitors. In 1991 fractional coins of a half, quarter, tenth, and twentieth ounce started to be produced, and in 1996 larger coins of two and five ounces started to be minted. Second, the release of the coins usually comes several months later than do the coin’s foreign competitors, and mintages for Libertads are not set in advance or announced as they are produced, as is the case with other world silver coins. This is part of the allure or mystique of Libertads. When mintages are announced by the Banco de Mexico usually towards the end of the year, premiums often begin to rise for the coins, especially if mintages come in lower than expected. Those who acquire the coins before that happens are doing so without knowing how many exist, but they have the advantage of buying while prices are closer to their silver melt value. Third, the silver bullion coins issued by most world mints and private mints are generally not very difficult to obtain at least when they are first released, and in many cases even years later. But with Libertads the situation is different. The one ounce coin is readily available from major coin dealers and distributors, but the fractional and larger coins are much harder to source. In part this is a function of the low mintages of those coins, and it is also due to the fact that there are not a large number of primary distributors for them. Moreover, the European and Asian markets for Libertads are growing, and that further reduces the availability of these coins for U.S. buyers. In addition, silver Libertads have always been made of .999 fine silver, and that is something they share with a number of other silver bullion coins currently being minted. GREAT POTENTIAL For all these reasons silver Libertads have very strong overall potential for appreciation in value and will continue to be a favorite of silver investors and coin collectors. The combination of rising demand and small mintages, especially for many past issues that are very difficult to obtain from any source, is sure to result in increasing premiums for many issues that far outstrips the silver value of the coins. Moreover, these factors provide the investor with some protection against fluctuating spot silver prices. By Louis Golino Samer Barrage

- 13. Samer Barrage

- 14. 12 | Elemetal Direct N U M I S M AT I C S | Silver Libertad Coin Series Libertads are also issued in proof and in special sets for collectors, and in various sizes in gold in even lower mintages than the silver coins. The gold coins will not be covered in this article, but they may be discussed in the future. There are also kilo-sized silver coins issued with a proof-like finish, which have been minted since 2002. The lowest mintages in that segment of the series are the 2013 and 2014 coins with only 400 produced. These coins are housed in an impressive heavy wooden display box and are stunning works of coin art. The proof coins are issued in even smaller numbers than the uncirculated coins with many proof coins having mintages in the low thousands and some even under 1,000. RISING DEMAND Demand for Libertads comes from many sources, and according to numismatic experts it is increasing faster than for any other major silver bullion coin series. One source is undoubtedly the stunning design of the coins, which features an obverse design depicting a bare-breasted winged Victoria (the goddess of victory) from the Angel of Independence in Mexico City, which is the Mexican independence victory column built in 1910 that honors Mexico’s independence from Spain. This design is widely admired by numismatists as a modern classic and is an updated version of the winged Victoria that appears on the Centenario gold bullion coin first issued in 1921. The Libertad reverse depicts the Mexican national coat of arms and has been modified over time. A second source of appeal for these coins is their mintages, which are typically the lowest of all the major world silver coins issued each year. Mintages have ranged widely for Libertad coins with some in the hundreds, and others like the one ounce coins of some years being over a million. The one ounce-silver coin is the one that is most familiar to collectors and buyers since it is much more readily available when first issued. But older coins in the one ounce series can be quite difficult to obtain, and completing the series is not as easy as one might expect. The 1998 one ounce-coin is the key to that series with only 67,000 coins, and it sells for about $300. Many of the fractional and larger coins, especially in proof, are often simply unobtainable and not stocked by any major dealer. Overall, total mintage of one ounce-silver Libertads has so far never surpassed 2.5 million coins, which compares to tens of millions of American Silver Eagles or Canadian Maple Leafs minted annually. In 2014 this coin came in at just under 430,000, which was the lowest since 2007, and premiums have begun to rise for the coin in recent months. Third, the coins have a reputation for being of high quality and are increasing in popularity with silver investors looking to diversify their holdings. Fourth, while the market for Libertads outside of Mexico is expanding rapidly and is a key source of support for rising demand for the coins, the coins are of course also sold within Mexico. And as the Mexican middle class has risen, so has their interest in protecting some of their growing assets against inflation and currency debasement. NTR Metals

- 15. Elemetal Direct | 13 Silver Libertad Coin Series | N U M I S M AT I C S SCRAMBLE FOR LIBERTADS In the last couple years the scramble to obtain silver Libertads reached almost a fever pitch when a combination of production delays, changes in the Mexican government, and growing demand resulted in some of the lowest mintages in years for certain sizes. This situation also contributed to several coins and sets increasing very rapidly in price on the retail market. A good example is the special proof set first issued in 2014, which included all seven sizes of silver proof coins in capsules housed in a wooden box and with a tiny mintage of just 250 sets, though each coin was also available separately. The demand for these sets was intense and virtually guaranteed an instant sell-out. They were not available until the summer, and buyers had to pre-order them in advance at $500 a set. But when they hit the secondary market a few months later, they instantly began selling for double or triple of the issue price and continue to bring about $1200. Earlier this year buyers had the opportunity to pre-order the 2015 version of this set, and once again they sold out in hours. Until 2014 the silver proof sets were issued as five-coin sets in wooden boxes without the two and five ounce coins, which have a history of being very strong secondary market performers because of their low mintages and limited availability. The two and five ounce proofs also began to be produced in 1996, which is also when their uncirculated counterparts were first issued. After what happened last year, Libertad collectors suspected the situation would only get worse in 2015. And sure enough in late April when Dallas-based Lois and Don Bailey and Son announced it was ready to begin accepting pre-orders for individual silver proof coins in late April, buyers were limited to no more than two of any version, and they were advised the coins would not be available for some time and would be released in small batches, according to Pat Stovall from the same company, a distributor for Mexican Mint coins. In addition, Mr. Stovall advised clients that many of them would not have their entire orders filled since so few coins were expected to be available from the mint. This suggested it was likely mintages for the 2015 proof coins will be low as they were last year. It is rumored though at this point, not confirmed, that the Mexican Mint will be ramping up mintages starting in 2016 to meet rising demand and enable more collectors to purchase the coins. If that proves to be the case, it should serve to further boost values for the lower mintage coins. The release of this year’s uncirculated coins was delayed in early 2015 while the mint waited for authorization to increase wholesale premiums for the first time since 1982. The premiums over silver content for the coins were increased by 25%, but that has not so far resulted in much change in retail prices, which are only a little higher than when silver was at a comparable level. The 2015 uncirculated silver coins were first available in the U.S. in late March when a couple of U.S. dealers began to sell them, and as usual the two and five ounce and most of the fractional coins sold out quickly. OUTLOOK FOR FUTURE Silver Libertads have a promising future. Investor demand for the coins is growing, and more collectors are becoming interested in the series, which should continue growing in popularity in the coming years. In order for silver Libertads to truly reach what modern coin expert Eric Jordan calls “series maturity,” the market for them will need to expand further, especially for the collector coins like the proofs and special sets. And as this happens, mintages will be increased, though they will likely remain far below that of other bullion-related world mint silver coins. In addition, it is difficult to place a value on many past issues since so many of them are no longer available from coin dealers. Often the only way an owner of many of the better-date coins can determine their current worth is if and when they come up for sale in auctions, which is generally on eBay. Many of the rarest issues are almost never offered. Finally, another factor is the growing trend of grading modern world coins, which is happening with Libertads too. Typically, the one ounce uncirculated and proof coins are readily available professionally graded, but in recent years graded-examples of the two and five-ounce silver issues and other Libertads have also appeared in the marketplace. The proliferation of graded silver Libertads is another encouraging sign of a growth market. Samer Barrage VP of Latin America & Caribbean Sales at NTR Metals

- 16. 14 | Elemetal Direct E L E M E TA L M I N T I N G | Secretariat Silver Bar SECRETARIAT:A Racehorse -- And Product -- Like No Other A s a tribute to one of the most celebrated equines in the history of horse racing, Elemetal Minting is offering an extremely limited Secretariat Silver Bar Commemorative set. Secretariat’s historic triumphs forever changed the sport of horse racing, and are celebrated on three 1 oz. colorized silver bars. In a time when the country was embroiled in the Vietnam War and the Watergate scandal, a three-year-old thoroughbred captured the attention of a weary nation. Secretariat was born on March 30th, 1970, at Meadow Stable in Dorwell, Virginia. Bred with some of the richest racehorse blood in the country, Secretariat was sure to be a beast. He was the third offspring of 1957 Preakness winner, Bold Ruler, the greatest sire of his generation. Bold Ruler was also the great-great-grandsire of 1977 Triple Crown winner, Seattle Slew. Secretariat’s mother, Somethingroyal, had only raced once but her offspring were always top quality. Secretariat was a large chestnut colt, deep-chested with the muscular quarters of a speed horse that earned him the same nickname, “Big Red,” as his famous predecessor, Man O’ War. The Kentucky Derby The first bar in the Secretariat Silver Bar Commemorative Set features an image of “Big Red” rocketing down the track in the May 5th, 1973 Kentucky Derby. Secretariat was the 3-2 favorite for the race and ran for a record time in front of 134,476 fans. He started in last place, which he tended to do. He quickly over took Sham, a top contender, at the top of the stretch. He pulled away to win the Derby by an impressive 2 ½ lengths. Secretariat still maintains the Churchill Downs record at 1:59 2/5. The most amazing thing is that Secretariat ran each successive quarter-mile time faster than the one before. The first quarter timed 0:25 1/5, the second 0:24, then 0:23 4/5, 0:22 2/5 and finally an By Jason Walter Vaile

- 17. Story Name | S E C T I O N N A M E Elemetal Direct | 15

- 18. 16 | Elemetal Direct E L E M E TA L M I N T I N G | Secretariat Silver Bar incredible 0:22. This means Secretariat was still accelerating on the final quarter-mile of the race. No one had ever seen that before. He was also the first horse to ever win the Derby in less than two minutes. The Preakness Stakes The second bar of the Commemorative set, is from the May 19th Preakness Stakes as Secretariat took the lead on the clubhouse turn and sprinted to victory with ridiculous ease. Secretariat started the race dead last again, but then, made a huge last-to-first move by the first turn. He reached the lead with 5 ½ furlongs to go. He was never challenged and won again by 2 ½ lengths. This win came with controversy though. Not whether he had won, but how quickly he had won. The infield teletimer displayed a time of 1:55. The racecourse clockers timed him at 1:54 2/5. However, two racing form clockers claimed the time was 1:53 2/5, which would have been a track record. The Maryland Jockey Club, which managed the racetrack, stuck with 1:54 2/5 as the official time. In 2012, a special meeting was called at the Maryland Racing Commission. A forensic review was done of the videotapes of the race. After the study, the commission unanimously voted to change the time of Secretariat’s win from 1:54 2/5 to 1:53, establishing the new track record The Belmont Stakes Secretariat-mania reached a fever-pitch as he prepared for the final leg of the Triple Crown. He appeared on the cover of three national magazines: Time, Newsweek, and Sports Illustrated. No other racehorse had done that before. Secretariat had become a national celebrity. Only four other horses dared challenge Secretariat for the June 9, 1973 running of the 105th Belmont Stakes. With so few horses in the race, Secretariat was a 1-to-10 favorite to win. He carried jockey Ron Turcotte to the gate. Secretariat opened with a lightning fast pace and his leading margin only got larger and larger. CBS announcer, Chic Anderson famously described it in this way: “He is moving like a tremendous machine!” Everyone was counting on Secretariat to win and secure the Triple Crown victory. He not only delivered, but he blew away everyone’s expectations. He ran the fastest 1 ½ miles in dirt history, 2:24, which is a full two seconds faster than anything before. This averages out to be a jaw-dropping 37.5 miles per hour for the entire race. The final bar in the Secretariat Silver Bar Commemorative set features the iconic image of jockey Ron Turcotte glancing back at the astonishing 31-length lead that Secretariat took over all of his competition. This epic coronation engraved Secretariat’s legacy into the annals of racing history and was the defining moment for the sports world. Secretariat became the ninth Triple Crown winner in history and the first in 25 years. After the Triple Crown After his Triple Crown win, Secretariat’s popularity exploded. He became a household name. The William Morris Agency booked his appearances the way it would book a white-hot movie star. He was inducted into the Horseracing Hall of Fame just a year after winning the Triple Crown. In 1999, the U.S. Postal Service issued a commemorative Secretariat stamp, making him the first equine to earn that honor. In a career that spanned 16 months, Secretariat raced 21 times, won 16 and finished in the money in all but his first race. He was an odd’s on favorite 17 times, winning 13 of those races. By the time he went to stud, he had earned $1,316,808. sAMER bARRAGE.

- 19. Elemetal Direct | 17 Secretariat Silver Bar | E L E M E TA L M I N T I N G Secretariat earned even more as a stud. His breeding rights were sold for $6 million. He sired such fine champions as 1988 Preakness and Belmont winner, Risen Star, and 1986 Horse of the Year, Lady’s Secret. But none of Secretariat’s offspring ever came close to matching the standard he set. The Loss of a Great One Though horses can live as long as three decades, sadly, Secretariat wasn’t one of them. At the age of 19, the celebrated horse developed laminitis, an inflammation of the tissue that bonds the hoof to the bone. After a month of treatment did nothing to ease his pain, “Big Red” was humanely euthanized on October 4, 1989. He was buried at Claibourn Farm in Kentucky. Secretariat’s “great heart” was not just a turn of phrase to explain his dramatic come-from-behind wins on the racetrack. After his death, it was determined that Secretariat’s heart was almost twice the average size. All the chambers and valves were normal, but the heart itself was just much larger. The Secretariat Commemorative Silver Bar Set Every great win of Secretariat’s illustrious Triple Crown run is memorialized on these iconic one ounce .999 fine silver bars. Secretariat can be seen sprinting to the finish line on each individual bar in crystal clear detail, which was made possible using Elemetal’s proprietary silver imaging process. The reverse sides of the bars are imprinted with the date, city, and state in which he won, along with inscription of “Secretariat” and the Elemetal logo. Each 1 oz. silver bar is encapsulated in a clear, tamper-proof collectable holder for a lifetime of protection, and placed in a colored box that matches the flower garland that draped Secretariat in the winner’s circle on those specific dates. “Out of the gate… and into History!” is inscribed inside of the box where each bar is positioned to shine. Only 1,973 individually numbered Secretariat Silver Commemorative Sets will be produced. Each bar in the set contains .999 fine silver and pays tribute to the efforts achieved by the most well-known racehorse of any generation. Available at just $224, the price of the set matches Secretariat’s record-setting time in Elmont, New York. In front of a roaring crowd on June 9, 1973, this was the last leg of his legendary accomplishment. This remarkable set was produced by Elemetal, an ISO 9001 facility, meaning each bar was manufactured under the highest levels of quality production. Elemetal Minting encompasses three of the most trusted names in the precious metals industry: NTR Metals, Ohio Precious Metals (OPM), and Provident Metals. Using the collaborative efforts of each partner within Elemetal Minting, the goal is to produce the highest quality investment grade bullion, and offer it at the most accessible prices on the market, with both fast and affordable shipping. Secretariat was the Muhammad Ali of racehorses, a brash and charismatic champ who was always the break away winner. No other horse has ever swept through the Kentucky Derby, Preakness and Belmont Stakes with the same drama, style and flair as Secretariat. To this day, Secretariat remains one of the first names that comes to mind whenever the topic of horse racing arises. Jason Walter Vaile snuck into his first horse race when he was fourteen. He bet on a horse to show and lost his three dollars. That was the end of his illustrious gambling on horses. You can follow him on Twitter, Tumblr and Instagram as mrpenhead.

- 20. 18 | Elemetal Direct I N D U S T R Y I N FO | Anti-Money Laundering Overview Money laundering isn’t just a worry for banks – many small businesses are touched by money launderers. Dealers in precious metals, stones or jewels are especially vulnerable. Precious gems are often smuggled, stolen and traded in the black market in countries around the world and then used in money laundering schemes. “The characteristics of jewels, precious metals and precious stones that make them valuable,” warns the U.S. Department of Treasury, “also make them potentially vulnerable to those seeking to launder money.” Anti-Money Laundering Dealers in Precious Metals, Stones, or Jewels Money laundering begins with the commission of a crime that produces ill-gotten funds. The perpetrator then processes this “dirty” money through a series of transactions intended to “cleanse” it so that it appears to have resulted from legal activities. There is no one single method of laundering money – it may involve other individuals, businesses and companies. However, one constant remains: The funds need to be washed. Dealers of precious metals, stones or jewels can be drawn into money laundering schemes, for example, by criminals who use dirty money to buy gold coins, diamonds or other gems. The money launderer then resells the coins or gems and introduces the proceeds into the financial system as supposedly clean money. By Laura Goldzung Said Kamle

- 21. Story Name | S E C T I O N N A M E Elemetal Direct | 19 Samer Barrage

- 22. 20 | Elemetal Direct I N D U S T R Y I N FO | Anti-Money Laundering It is critical to understand how it can happen to your business and how to avoid it. Here are factors that may indicate a transaction is designed to involve a dealer in money laundering: • Payment is made with large amounts of cash; multiple or sequentially-numbered money orders, traveler’s checks or cashier’s checks; or through third-parties; • The customer of supplier is unwilling to provide complete or accurate contact information, financial references, or business affiliations; • The customer or supplier attempts to maintain a high degree of secrecy about a transaction, such as requesting that normal business records not be kept; • Purchases or sales are unusual for the particular customer or supplier, or type of customer or supplier; • Purchases or sales don’t conform to industry practice. The USA PATRIOT Act and the U.S. Bank Secrecy Act requires all dealers in precious metals, stones, or jewels to have a comprehensive Anti-Money Laundering program. A dealer is defined as a person or entity that purchases at least $50,000 worth of covered goods AND sells at least $50,000 worth of covered goods during the preceding calendar or tax year. The Financial Crimes Enforcement Network (FinCEN) defines covered goods as: • Jewels • Precious metals • Precious stones • Finished goods that derive 50 percent or more of their value from jewels, precious metals or precious stones contained in or attached to the finished goods. (“Finished goods” include, but are not limited to, jewelry, numismatic items, and antiques.) In addition to AML compliance, dealers are subject to Office of Foreign Assets Control (OFAC) sanctions screening as required by the U.S. Treasury. Failure to comply with AML or OFAC requirements may result in criminal and civil penalties. Both the IRS and the state where you conduct business will perform periodic examinations, and a review of your AML compliance program will be included. Dealers are expected to have a reasonably designed compliance program tailored to their business. It should begin with a risk assessment and then meet the “four pillar” requirements: 1. Written policies, procedures and internal controls. 2. Appointment of a compliance officer. 3. Provision of ongoing AML training for appropriate personnel. 4. Independent testing on a periodic basis. Common Problems It is often difficult to understand and monitor the risks inherent to dealers in precious metals, gems and jewelry. It is critical that a risk assessment be completed to keep up with AML regulations as well as changes in the business or customer activity. A risk-based approach should be built on sound foundations; effort must first be made to ensure that the risks are well understood. As such, a risk-based approach should be based on an assessment

- 23. Elemetal Direct | 21 Anti-Money Laundering | I N D U S T R Y I N FO of threats. This is true whenever a risk-based approach is applied, at any level. Developing a risk assessment of a firm’s customer market will provide the foundation for designing the compliance program. Both the risk assessment and the compliance program should be reviewed and updated according to risk – no less than annually. Dealers in precious metals, gems and jewelry often struggle to keep up with regulatory change. It’s simply not enough to establish an AML compliance program and have a compliance officer manage it. No AML program can remain static. It is a regulatory expectation that AML compliance programs will be modified and updated in response to changes in regulations and the business of the firm. Designating a compliance officer who is familiar with the regulatory requirements will go a long way to protecting you from regulatory risk. Simply appointing personnel with no experience will not serve you well in the long run. You must protect your firm from all risk -- reputational, operational, credit and regulatory. Your AML compliance program should inform your overall risk management program. Dealers in precious metals, gems and jewelry may not be prepared to demonstrate their AML program to banks. Banks typically require their dealer-clients to provide a copy of their AML program and policies in order to continue their banking relationship. The U.S. Commerce Department has determined that the jewelry business is “high risk,” triggering certain obligations on banks, including monitoring jewelry and precious metal dealer clients for compliance. Banks will ask to see dealers’ documented AML Program and Policy and may even require the review of the dealer’s independent test report. This will ensure to them that the dealer is meeting its regulatory obligations. The AML Program fails to offer adequate training. An AML compliance program must contain four pillars, which includes policies, procedures and internal controls; designation of a compliance officer; training; and independent testing. Training is a key driver that advances the ability to detect unusual activity. Front-line personnel are often the first point of contact with potential money laundering and fraud, and it is essential they be educated on red flags common to dealers. Having controls in place that include any red flags or suspicions is the first important step to maintaining an effective AML program. Dealers in precious metals, gems and jewelry may be confused as to whether they are subject to regulations. Regulatory rules apply to “dealers” in “covered goods.” Covered goods include jewels, precious metals and precious stones, and “finished goods” (including but not limited to, jewelry, numismatic items, and antiques) that derive 50 percent or more of their value from jewels, precious metals, or precious stones contained in or attached to such finished goods. Samer Barrage Latin American President NTR Metals

- 24. 22 | Elemetal Direct I N D U S T R Y I N FO | Anti-Money Laundering Key Trends Technology advancements and innovations have increased the size and sophistication of criminal enterprise. These changes have created the need for new regulations and risk mitigation efforts by institutions and organizations subject to AML. For example, the use of international ACH transfers, remote deposit capture, mobile phone payments and the changing payments landscape, along with other technology innovations, present potential risks that require careful and thoughtful consideration. If you conduct business using advanced payment systems, for example, be sure these processes are reflected in your risk assessment and that the controls to mitigate such risk are among your AML compliance policies. Regulatory changes continue and compliant dealers must be prepared to meet the changes. Regulatory changes and modification of existing rules – whether from FinCEN, OFAC or others– require close attention and the fine tuning of systems, training personnel and other compliance program elements. FinCEN’s guidance indicates there many institutions subject to AML compliance programs that are not maintaining adequate AML programs and are subsequently facing sanctions by regulators. Dealers are facing Title 31 examinations by the IRS. The IRS is the examining authority for AML compliance programs for dealers. The IRS will notify a dealer that it plans to examine the business, a process commonly known as the Title 31 exam. Examiners will visit for a period commensurate with the size of the institution. Examiners will request documentation supporting your program including but not limited to: • AML compliance manual containing policies, procedures and internal controls;designation of and resume of compliance officer; • AML training program materials and proof of training for appropriate personnel; • Report from independent audit and testing performed; • Customer due diligence; • Reporting requirements; • Record keeping and other documentation as requested. Of particular interest will be reporting of large cash/cash equivalent transactions – those over $10,000. The IRS reviews receipts of cash payments that require the filing of the Form 8300 form. They review books and records, including bank statements, to make this determination. Failure to file the 8300 can result in fines, penalties and, in extreme cases, criminal prosecutions. When all is said and done, the IRS will submit a report of its findings and the dealer must resolve any outstanding matters while tracking any corrective actions until complete. Dealer to dealer transactions are considered low risk. It stands to reason that dealers doing business with other dealers are low risk. Why? Because each dealer, as required by law, is required to have a reasonably designed AML compliance program. As long as each has an AML program in place, each dealer can be confident that internal controls are in place to identify and mitigate any potential money laundering risk.

- 25. Elemetal Direct | 23 Anti-Money Laundering | I N D U S T R Y I N FO Before conducting business with any dealer, be sure to request an AML Certification Letter, one that states the dealer is in full compliance with the regulatory requirements under the law requiring the AML compliance program. Risks & Opportunities Risks • Criminal and civil penalties for the institution as well as for individuals • Reputational and financial risk to the institution Opportunities • Harnessing efficiencies by combining resources and IT systems to monitor for anti-money laundering and anti-fraud • Protecting the integrity of the financial system • Helping to protect your business from financial losses and reputational exposure • Protecting your customers from falling prey to criminal activity Skills • Experience working in the Compliance Department of a financial institution • Other related compliance or oversight experience • Regulatory experience • Certification from an AML association Defined Terms Bank Secrecy Act The Bank Secrecy Act of 1970 (or BSA, or otherwise known as the Currency and Foreign Transactions Reporting Act) requires financial institutions in the United States to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, and file reports of cash purchases of these negotiable instruments of more than $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities. (Source: Wikipedia http://en.wikipedia.org/wiki/Bank_Secrecy_Act) FinCEN The Bank Secrecy Act of 1970 (or BSA, or otherwise known as the Currency and Foreign Transactions Reporting Act) requires financial institutions in the United States to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, and file reports of cash purchases of these negotiable instruments of more than $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities. (Source: Wikipedia http://en.wikipedia.org/wiki/Bank_Secrecy_Act) IRS The Internal Revenue Service (IRS) is charged with examining non-bank financial institutions including Precious Gems Dealers. The examination is known as a Title 31 exam, and is conducted periodically to ensure compliance with AML obligations under the BSA and its promulgated regulations. (Source: IRS http://www.irs. gov/irm/part4/irm_04-026-005.html#d0e1657) OFAC The Office of Foreign Assets Control (OFAC) of the US Department of the Treasury administers and enforces economic and trade sanctions based on US foreign policy and national security goals against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other threats to the national security, foreign policy or economy of the United States.

- 26. 24 | Elemetal Direct I N D U S T R Y I N FO | Anti-Money Laundering OFAC acts under Presidential national emergency powers, as well as authority granted by specific legislation, to impose controls on transactions and freeze assets under US jurisdiction. Many of the sanctions are based on United Nations and other international mandates, are multilateral in scope, and involve close cooperation with allied governments. (Source: Treasury.gov website http://www. treasury.gov/about/organizational-structure/offices/Pages/Office-of- Foreign-Assets-Control.aspx) Resources – Recommended Websites • AML Audit Services, LLC http://www.amlauditservices.com • Financial Crimes Enforcement Network (FinCEN) Precious Metals/ Jewelry Industry Home http://www.fincen.gov/financial_institutions/pmj/ • Internal Revenue Service (IRS) Anti-Money Laundering Compliance Program http://www.irs.gov/irm/part4/irm_04-026-005.html#d0e1657 • Internal Revenue Service (IRS) Penalties for Form 8300 http://www.irs.gov/Businesses/Small-Businesses-&-Self- Employed/Form-8300-Penalties-Increase • Jewelers Vigilance Committee (JVC) http://www.jvclegal.org/index.php?categoryid=347 Learn More If you are a dealer in precious metals, stones or jewels, and want to learn more about the requirements and best practices to maintain an Anti-Money Laundering Compliance Program, or need information about independent testing services or custom training or keynote presentations, drop an email to info@amalausitservices.comor call 800-870-8076. About the Author Laura H. Goldzung, CFE, CAMS, CFCF, CCRP is President and Founder of AML Audit Services, LLC (“AMLAS”), a boutique consultancy specializing in independent testing for anti- money laundering compliance programs for bank and nonbank institutions, and serves as its principal examiner. In addition, her expertise includes custom training, and compliance consulting services, which includes design and development of Bank Secrecy Act/Anti-Money Laundering and Anti-Fraud compliance programs, risk assessment and analyses, remediation and corrective action programs, and expert witness services. Ms. Goldzung has worked with financial institutions that have been referred to enforcement for BSA/AML violations, helping them to bring their AML programs into compliance. In a career spanning more than more than 35 years across multiple sectors of the financial services industry, Ms. Goldzung has worked in a variety of executive leadership roles. Since founding AMLAS, she has co-created sector-specific compliance officer certification programs and tours internationally presenting various AML/Fraud topics for industry-leading organizations, and has authored a number of articles on the topic of AML. Ms. Goldzung serves on a variety of industry task forces and committees, and contributes to a number of compliance, industry and university education programs. Samer Barrage

- 27. Story Name | S E C T I O N N A M E Elemetal Direct | 25

- 28. 26 | Elemetal Direct M A R K E T U P DAT E | Elemetal Capital 2nd Half Outlook Elemetal Capital Second Half 2015 Outlook W ith the year nearly half over, it seems our outlook for mostly sideways trading is proving to be quite accurate. The macro environment focus all year has been the looming rate hikes from the US Federal Reserve. So far that event has been pushed further and further back on the calendar and markets are now largely pricing in an expected initial hike in December. We see two primary issues with this mentality: in the short term it’s likely too dovish, and in the long-term it’s certainly too US-centric a view to be taking towards the global economy. We believe the market is finally beginning to understand the patient and data-oriented nature of the FOMC voters, but prices have now perhaps compressed a bit too far as a result of anticipatory observation. US core economic data has been almost impressively bad of late, partially due to temporary seasonal and societal factors, but employment data on the whole remains quite strong. With the latest employment data factored in, it is likely we see levels quite soon that the Fed would consider to be cyclical full employment. As soon as we get even a slight uptick in wage

- 29. Story Name | S E C T I O N N A M E Elemetal Direct | 27

- 30. 28 | Elemetal Direct M A R K E T U P DAT E | Elemetal Capital 2nd Half Outlook inflation, we expect the Fed will be drawn to action. Though the monthly trends in data will remain the primary factor, we can’t help but pick a date on the calendar given current inputs. As it stands right now, we peg that date as September 17th. Beyond that, the view grows a bit murkier. After 7 years of extremely accommodative monetary policy in the US, capital markets have grown to love Zero Interest Rate Policy (ZIRP). Market returns post-QE have been next to nothing, so many players may see this event as a reason to trim exposure, perhaps significantly. The FOMC for their part, have been abundantly clear that the initial hike will not necessarily come packaged with a pre-determined path to rate normalization. Our base case for the pace of interest rates is that they will likely follow an initial rate by pausing for at least one meeting to give markets a beat to sort themselves out. We further believe that market sentiment is overly hawkish in terms of the back end of the curve. Nuance is clearly everything in this regard, but to simplify anyway: even when the FOMC raises rates, its pace and aggression will be exceedingly, disappointingly-- and perhaps dangerously-- mild. From a practical standpoint, we think there is likely to be a violent knee-jerk reaction when the Fed does enact its initial rate hike. Patient money is likely to be well rewarded a meeting or two after, as the debate will shift to the full shape of the yield curve. For comparison’s sake, long run averages for Fed Target rates are around 5.5%. Even the relatively low rates of 1995-2007 averaged 4.25% and these are for fed funds, not treasuries. These are obviously well-worn data points, but we feel they are necessary for perspective when there is so much hand-wringing around a jump from 25 to just 50bps on the upper bound. Even in the US, negative real interest rates will be a part of the narrative for a long time. As we see it, another error in the prevailing metals outlook is that markets are still being too US-centric. Similar to our “Sitting, Standing, Bending” research piece from earlier in the year, the US’ journey is not representative of the global economy as a whole. Mario Draghi has made it very clear that the ECB is serious about accommodative policy and has pledged not to reduce open market transactions until at least August of 2016. Combine that

- 31. Elemetal Direct | 29 Elemetal Capital 2nd Half Outlook | M A R K E T U P DAT E with impressively aggressive policies in China, Japan and much of the G-20, and the world is practically awash in central bank liquidity in contrast to possible tightening in the US as well as the United Kingdom. So far, we have only covered broad monetary and investment themes. As limited as that might seem, we are confident that monetary policy is the most influential piece of the formula and often drives the largest flows for price action in a given short term period. What is more, we don’t have much to update on jewelry demand, mining supply, official sector inventories or producer hedging, and we expect the net effect of incorporating those measurements to be just slightly bullish. Lastly, and perhaps most responsible for the near-term picture, is market sentiment. Due to a combination of factors discussed above, we believe the market to be overly bearish on the price action for gold. There are some large financial sellers of gamma (that is: traders betting the volatility of gold will drop further) on the front end of the curve, forcing options trade at a discount to what would otherwise be their natural value. Practically, this has the effect of exacerbating any breakouts from trading ranges as those players will then scramble to cover their very large liabilities. Add this bit of nitro-fuel to the fact that general positioning and even broader sentiment are currently very negative, and we could find ourselves presented with some bullish price action. Gold will continue to be a safe haven for assets in times of distress. With so much unrest surrounding calls for the next dynamic in capital markets, there is clearly some need for hard assets. Samer Barrage NTR Metals

- 32. 30 | Elemetal Direct M A R K E T U P DAT E | Elemetal Capital 2nd Half Outlook In summary, gold will continue to be a safe haven for assets in times of distress and, occasionally, a really good trade for cash investors-- especially when denominated in a weak currency. With so much unrest surrounding calls for the next dynamic in capital markets, there is clearly some need for hard assets. We would not be so bold as to presume that there isn’t producer selling on the other side of most rallies, so we expect the net effect to be somewhat contained—that said, a brief rally north of $1300 is certainly possible. For the most part, we are only doing a mild revision to our price forecasts: we expect a central tendency towards $1200 gold and some legitimate volatility to the downside around the initial rate hike, but ultimately a higher finish for the year. We are much less constructive on silver, based largely on decreasing photovoltaic and industrial demand due to an increase in efficiencies, and the much lower relative cost of production to current market rates. Taking recent pricing action into account, we have dropped our end of year price forecast slightly to $17.

- 33. Elemetal Direct | 31

- 34. 32 | Elemetal Direct Sharing Our Story T he next month will mark a big moment for our proud group at Elemetal: during the week of June 8–12, we’ll notify YOU -- our customers, vendors, and other partners about our new corporate identity. Elemetal Refining has already begun the process, and I am excited to have even more conversations with you about the power of one Elemetal. The name change is a great opportunity to explain the strength of working together, and the advantage it can have for you in your business. We are truly excited to share this news with you. Our day-to-day operations with you will remain unchanged, but using the name Elemetal creates a unified front for all the businesses that you may work with on a daily basis. This is a powerful advantage we can and are currently offering to you: Elemetal Direct’s access to Elemetal Refining gives our store managers an ability to help customers in a way that other companies cannot; Refining’s ability to hedge with Elemetal Capital provides flexibility in the market; Provident’s access to high-quality product from Elemetal Minting makes for unmatched pricing and availability. Operating as one Elemetal gives us an unmatched position in the precious metals market—there is virtually nothing we cannot do in precious metals for our customers. Please join me in sharing our exceptional story with your peers in the marketplace, vendors you work with, and your other partners over the next few weeks and months—the muscle of Elemetal will be the one-stop-shop you need for all of your metal needs. Bill LeRoy CEO Elemetal, LLC L E A D E R S H I P | A Word From Bill

- 35. Story Name | S E C T I O N N A M E Elemetal Direct | iv Samer Barrage

- 36. S E C T I O N N A M E | Story Name i | Elemetal Direct NTR Metals