Real Estate Wealth Part 2 - Featuring RealBay.com

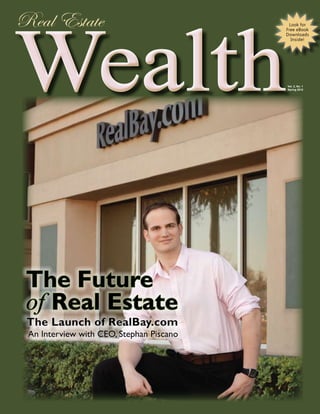

- 1. Wealth Real Estate Look for Free eBook Downloads Inside! Vol. 2, No. 1 Spring 2012 The Future of Real Estate

- 2. Secret #7 - How do I Make Money? There are several exit strategies possible with a note. National REIA elects Tim Norris 1. Settlement – borrower to settle at large discount to 2012 Board of Directors 2. Re-sale Re-sell note to a third party investor 3. Modification – Creating long term C ongratulations to Tim Norris, an investor and president of the National Real Estate Insurance Group and Affin- ity Group Management, for his recent appointment to the Na- ROI tional REIA’s Board of Directors. Norris continues his com- 4. Deed in Lieu of – Taking ownership of mitment of service to the National REIA, he is a the property former board member of the Cincinnati REIA. 5. Foreclosures – Creating leverage The National REIA (Real Estate Investor’s Asso- 6. Sell the property – Sell, refinance or ciation) is a 501(c) 6 trade association made up of short sale investment clubs throughout the United States. The interests of ap- proximately 40,000 members are represented by the National REIA. If you are looking for the best way to One of the changes that Norris is excited about is the implementation of local invest with returns of over 12% then this chapters within the organization, which he feels will help drive memberships into is for you. Notes can mature at a much the organization. Realty411/reWealth magazine is a member of the Santa Barbara higher rate. Asset Ventures doesn’t promise you ex- REIA, a club affiliate of the National REIA. traordinary returns each and every time; however, there have been returns at over 100% or more in some cases. Retire in Style, Here’s How pg. 17 from where they grew up,” Dannenfeldt If you want to learn more or invest in said. “So we feed into locations that have notes, please contact us. Feel free to visit other company-managed property. Some that kind of cultural bias where then we can our website at www.assetventuresllc.com. tenants become homeowners in a lease-to- keep people with us for the long-term and Or, if you still prefer the personal touch, own scenario. also attract their family members into our please feel free to contact our office for “It’s traditional in the areas that we do system as well.” a free consultation on all our services at rental properties that it’s very rare for peo- For more information, please visit online: 855-798-1411. ple to move more than a few blocks away PropertyPartners1.com Want to Make a Fortune in Notes? We have the Blueprint for Success sset entures LLC www.assetventuresllc.com (855) 798-1411

- 3. Buy, Hold & Rent in Cleveland M eet Sean Whalen, communities, and this greatly by Isaac Newkirk III the CEO of BH&R aided its transition. The area is (Buy, Hold & now one of the most expensive in the business and through traditional Rent) Properties in Cleveland and Whalen’s advertising. He firmly believes in the in Cleveland, Ohio. He started career was born. necessity of thinking outside the box due his company three years ago, He says the market in to the economy becoming increasingly ostensibly to take advantage of Cleveland has definitely leveled smaller and the market becoming global. the market downturn, but he’s off, as there was no bubble to The properties of BH&R are turn-key; the no rookie. Whalen has been burst in the area, as happened investors buy, BH&R re-habs the property involved in real estate for 20 years. in so many other markets (including Los from top to bottom, and then, they adver- He grew up in a depressed area of Angeles, San Francisco, and New York). tise for tenants. From there, the in-house Cleveland. His family eventually moved, All of his investors are from outside the property management component of his but his dad maintained the management area, most from outside the country (e.g. firm takes over (continuing to provide for of the property they owned (and lived in) Canada, China, Australia). Rather than the property as if it has never been sold). and eventually deeded the property to him. selling to a potential residential customer, Essentially it’s a worry-free, hands-free Whalen decided to maintain his residence Whalen specializes in selling to investors operation for the investor. there and work on the property. It was a (typically they buy more than one prop- In years past, BH&R had done substan- fortuitous decision as the neighborhood erty, he says). tial business with the government through began to transition with the influx of artists He gets his customers the old fashioned its Section 8 Housing Program. That and new restaurants. Whalen points to the way: by word of mouth from having represents a much smaller segment of their fact that the neighborhood had distinct previously done a good job for a customer. boundaries that set it apart from other He has a lot of relationships with affiliates Continued on pg. 42 True Wealth is Created by Holding Property Long Term We offer completely re-habbed 1 and 2 family homes in Northeast Ohio. Home range from $50,000 - $75,000 bringing in rent from $700 - $1,100 Enjoy a HUGE return on your investment We manage properties We have 20 years experience 3Refer a Buyer and Make $2,000! BuyHoldRent.com To learn more about us and view our inventory, visit BuyHoldRent.com or call 216-240-7363. Realty411Guide.com PAGE 26 • 2012 reWEALTHmag.com

- 4. Find Real Deals, pg. 18 them, you’ve got their undivid- Terica teaches how to Invest Out of State, pg. 15 ed attention and they are ready there is a strong element of for your solution to their need. What I’ve learned in real your money, but you have the timing involved when locating Investor Tip: Pick up a estate is that the only way you benefits of the entire asset. It’s motivated sellers. The most ef- “cheapy” dedicated cell phone learn is when you lose. And so a gold mine. fective way of getting this as- exclusively for the purpose or I would say, ride the backs of pect of timing to work for you your motivated seller market- other people so that you can Question: What are your goals is through consistent marketing. ing. Place this phone’s num- shorten your losses. for 2012? Direct mail, classified advertis- ber in all of your ads and use Terica: My personal goal for ing (both online and off) and it nowhere else. When it rings, Question: For as long as I can this year is to remain healthy. websites are the tools of the you’ll know... game on! remember, the key to personal Professionally, I want to con- trade. Use them all. Regardless In summary, a real deal de- wealth has always been real tinue making an impact in the of the “silver bullet” that was fined is a property that meets estate. Is that still the case? lives of the middle class inves- just promoted by the last guru your criteria and a seller that Terica: I think so. I think it lies tor by helping them build real that came to town, it’s still a will meet your terms. By in the diversification. When you estate portfolios that get them numbers game. The more mar- knowing, and sticking to, your compare stocks to real estate, out of the rat race. keting mediums working, the property criteria and minimum the returns are slower, but right I want to convert all of the ten- better. terms, finding deals isn’t so dif- now, you’re able to get double ants we have into home owners Step 4 - Answer the phone. ficult. Take it from someone that digit returns secured, and the so they can build a legacy for Seems simple enough, but it’s has transformed their investing tax shelter aspect [of real es- their families. I would like to this step that’s most frequent- business (0 to 60+ deals) in the tate], plus you have leverage, continue to expand into more ly missed. There are many last eighteen months adhering so you don’t have to use all markets, thus creating new schools of thought on how an to this wisdom. jobs, revitalizing more commu- investor should receive incom- It’s amazing once you know nities and doing my part to help ing calls, but in my book there’s exactly what you’re looking for fastest growing real estate in- America rebound from this de- only one way. Answer the phone and where to find it how much vesting podcast on iTunes. Visit pression. when they call you. There’s no more often it appears. To your www.EpicProfessionals.com better time to talk with a moti- success! for more information and to re- To reach Terica Kindred, prin- vated seller than when they call trieve his free real estate invest- cipal of Out Estate Investments, you. Because they called at a Matt Theriault is an author, ing course “How to Do Deals please call: 866-488-1820 or time when it was convenient for entrepreneur and host of the — No Money Required.” email Tkindred@outestate.com Closing Loans & Opening Doors Since 1960 We specialize in* 3 Investment Properties 3 Up to 10 Financed Properties Allowed 3 Credit Scores, 620 or higher 3 Direct Fannie Mae Service/Seller Please Contact Us for More Information Ph. 901.598.9458 email:GosserBighaus@guildmortgage.net Address:3500-188th Street SW,#121,Lynnwood,WA 98037 Stephen Bighaus Loan Officer Ric Jason Gosser Loan Officer With Great Service & FAST APPROVALS: Individual MLS #112825 TN MLO-57558 Individual MLS #120413 TN MLO-57820 We’ll take care of you!! WA MLO-11285 WA MLO-120413

- 5. Why Dallas / Ft. Worth is One of the Best Metros in the US by Tom Wilson I Are there markets that able housing of top 20 cities ($116,000 don’t recommend being a have weathered the down- median Q3 2011) real estate investor…un- turn well, are superior in •Central location in the United States at- less you have a well-de- many of the parameters tracts companies desiring time zone and fined strategy, quantitative above, and have had rela- distribution competitive advantages goals and are dedicated to go by tively calmer waters dur- •DFW airport is the third busiest in the the numbers and not by unsup- ing these past few tumultu- world ported advice or emotions. ous years? •One of lowest cost of living major MSAs, My engineering training and Indeed, my experience yet above average household income 30 years of experience manag- Tom Wilson in more than 1,800 unit •Highest millionaire growth rate in the ing high-tech profit centers in transactions, over 35 years United States Silicon Valley taught me how to analyze for has revealed that Dallas / Fort Worth is one •Strong rental market (95% occupancy Q4 the best return on investment in any mar- of the best real estate investment markets 2011 for single family homes) ket. in the United States; that is why I chose •Very landlord friendly Today, the principles of analysis remain it for most of my personal portfolio long Yes, the national economy crisis has the same. Anyone can do it, however, one term holdings. affected even DFW, but not significantly needs to be very disciplined and educated The strengths of Dallas / Ft. Worth are: compared to other MSAs. Texas is the sec- about the submarkets and products, or ride •Business and financial capital of the ond most populous state, so there are in- the coattails of someone who is. South. deed many home foreclosures, especially The primary parameters for selecting •The highest rent per invested dollar for a since there is such low housing costs and the best investment markets are: major economic center in the United States, consequently a high percentage of govern- •Rent to purchase price ratio and therefore, the highest cash flow ment backed loans, but in spite of this, the •Population growth and inward migration •One of the lowest risk and safest harbors Texas delinquency and foreclosure rate is •Employment growth and business climate in the United States for real estate relatively low compared to other states. •Housing affordability •Lowest housing price decline from peak; I believe that these factors are another •Location only US single-digit depreciation metro strong indicator of whether a metro has hit •Cost of living •Fourth largest and one of the fastest grow- bottom yet, and that many cities and states •Rental market ing MSAs (Metropolitan Statistical Area) have farther to go, so selecting the lowest •Current and projected market conditions in the United States. Projected to double risk metro is as important as seeking high Now that speculative investing for fast population to 12 million by 2030 current cash flow. profit has gone the way of the last super- •Broad-based economy that has had double During the last two decades the appre- model, the wise investor is focused on cash the employment rate growth of the United ciation average was about 5% per year. flowing assets and safe harbors. States during the past decade With a five to one leverage with 80% loans •No. 1 ranked business climate in the Unit- investors got a 25% return on their down ed States payments, in addition to the high cash •No state in- flow. Historically, the last economies to come tax slow down, are the first to go back up. •Leading I don’t know when DFW will start ap- MSA for cor- preciating significantly again, but I believe porate head- it will be before many other areas, and our quarter relo- window of opportunity to invest optimally cations and in any leading area may be shorter than we expansions think. •Second lead- In this economy, I prefer to invest in ing MSA in homes over commercial and multifamily US for For- products because homes have more liquid- tune 500 cor- ity, are generally lower risk, appreciate porate rev- faster, and one can build a “mutual fund” enue by buying in various neighborhoods rather •Most afford- than putting a lot of eggs in one address. Las Vegas Worst Dallas Best Realty411Guide.com PAGE 28 • 2012 reWEALTHmag.com

- 6. Dallas / Ft. Worth Education Field Trip, May 4-6, 2012 Multiple Speakers including Dallas Chamber, Property Managers, Product Suppliers, Lenders & 3rd Party Investment Experts P arachuting surely is a dif- ferent experience than just reading about it. Dallas/ your questions on site? That is certainly a different experi- ence indeed! Ft. Worth is a much sought- This concise, action and after investment city, one that value-packed weekend is you can certainly read up sponsored by The Real Es- about. However, how many tate Guys and it will sell out times can you see it and quickly. For information and have multiple experts teach- a special discount offer, visit ing you, touring with you, www.tomwilsonproperties. and available to answer all of com or call 408.867.1867. Even in a good region, one can vary tremendously in any must be very careful though general geographical area, and in selecting the right product, only experienced profession- neighborhood and professional als can help you minimize that service and management team. risk. Make sure you rely on resourc- I believe that the wise will es that have a lot of investment not wait and see, but act to experience in that region. grasp the best opportunities If I’ve learned anything in of our lifetime before they are investing, it is that variations in gone. performance from the median INVEST WITH CONFIDENCE I M M E D I AT E C A S H F LOW I M M E D I AT E C A S H F LOW D D iscover the lowest-risk, highest-quality residential investment properties in the iscover the lowest-risk, highest-quality residential investment properties in the country. Using sophisticated methodology, the best investment properties are carefully selected bysophisticated methodology, the best investment properties are country. Using an experienced investor and rehabbed beautifully to secure the carefully selected by an experienced investor and rehabbedinstant cash to secure the best tenants. With competent property management, and beautifully flow, your best tenants. With competent property management, and instant cash flow, your investment pays worry-free dividends from day one. investment pays worry-free dividends from day one. PROFILE OF YOUR FUTURE PORTFOLIO PROFILE OF YOUR FUTURE PORTFOLIO Price $139,000 “Contact me for a Rent $1,395 “Contact me for a Price: $110,000, Builtrenovated, built 2005 Year fully $1,195 Currently Rented for 2001 free cash flow analysis.” Price: $110,000, fully renovated, built 2005 Currently4 Bed 2.5$1,195 Rented for Baths free cash flow analysis.” TOM WILSON, President Mention REI Voice Magazine and receive one-year of free TOM WILSON, President 408-867-1867 Mention Realty411 or reWEALTH receive one-year of free Mention REI Voice Magazine andyour first purchase. property management with and receive a discount 408-867-1867 TomKWilson@earthlink.net on the May 4-6 DFW Field your first purchase. property management with Trip. Don’t Miss It! TomWilsonProperties.com TomKWilson@earthlink.net TomWilsonProperties.com Realty411Guide.com PAGE 29 • 2012 reWEALTHmag.com

- 7. Is It Honest To Use A Land Trust? by Randy Hughes property (helps with day-to-day I management and lease renewal have been using Land Trusts for negotiations). over 30 years, but every now and 6. Co-owners want to know that then someone will challenge me as a lien or judgment or divorce of to the purpose and “honesty” in us- one owner will not affect the title ing a Land Trust to hold title to real estate to the property. investments. Let’s clear the air. 7. Out of state owners can avoid Recently I was talking to a real estate in- probate and other legal issues vestment club owner about speaking to his upon death — smooth transition club regarding land trusts. He said, “We do of succession. not believe in using Land Trusts because 8. A group of heirs can inherit a they are dishonest.” property held in a land trust with He then went on to explain how some- ease of management (by the di- one had come to his club and spoke about rector) and no need for a partner- Land Trust and that led him to believe that ship agreement and a partnership There are many legitimate reasons to use a Land Trust for privacy and asset protection. the use of a Land Trust was for deception tax return are many legitimate reasons to use a Land and taking advantage of people. 9. Co-operative housing corporations may Trust for privacy and asset protection. No I told him that I was sorry that he had elect to hold title to their land and buildings one will protect your assets like YOU will. been misinformed about Land Trusts and in a Land Trust. They could then issue ben- Learn all you can now because “old and that he should reconsider their use and eficial shares to their residents in place of cold” matters. benefits. I went on to review with the club stock certificates Ever since 9/11 R owner why it is important to NOT have —simplifying it gets harder ev- your name in the public records as owner control and re- andy is a full time real estate inves- ery year to be pri- of real property: cord keeping. tor who purchased his first rental vate and protect 10. When a Trust- house in 1969. He has purchased your assets. Do it 1. A group of investors may be purchasing ee of a Land over 200 houses and teaches other investors now! Don’t delay! several properties for a special purpose and Trust signs the how to put their properties into Land Trusts I have written a it may be that the desired result can be best mortgage (that for privacy and asset protection. Randy is a report titled, “50 accomplished if the objective is not made gets recorded in national teacher, author and mentor. Randy Reasons To Use public. the county court writes the only Land Trust Newsletter in the A Land Trust” and 2. Co-owners might desire that the interest house records) county and is the founder of the Land Trust will send it to you of each beneficiary must be kept private. the debt will not University (an institution that teaches real for FREE. Email 3. An individual owner might not want show on the bor- estate investors how to set up and adminis- me with “50 Rea- to be hassled with inquiries regarding the rower’s credit re- ter their own Land Trusts). Residing in Il- sons” in the sub- property. port. Land Trusts linois (the granddaddy state of Land Trust ject line and I will 4. A real estate investor might not want his have been used Law), Randy knows more about Land Trusts return this report competitors to copy his acquisition tech- by American citi- and how to link them to other entities than to you immedi- niques. zens for over 100 anyone else in the America today. Reach ately. My email is 5. Real estate investors do not want their years for good Randy at www.realestateforprofit.com or by randy@realestate tenants to know they are the “owner” of the reasons. There calling him at 1-866-696-7347. forprofit.com Realty411Guide.com PAGE 30 • 2012 reWEALTHmag.com

- 8. White Rock Capital Creates leaders Wealth for Investors by Lawrence Ruano W hiterock Capital, Inc., offer. Patrick leads the company efforts in started 2012 off with a the Inland Empire. BANG, This is one of the Established in Southern California, fastest-growing companies Edrosolan, who has a life-long affinity in the real estate market, and it’s one of for Arizona, and in particular the Phoenix our top picks for area, has also identified and developed 2012. What’s driv- significant business opportunities and ing the big increase expertise in the Phoenix market. in investor interest In constantly changing market surrounding this places, Whiterock Capital has the company? Whiterock Anthony Patrick and Richard Edrosolan experience and capacity to perform on Capital is aggres- multiple diverse projects simultane- extensive experience in raising capital, sively expanding into ously. Working wholesale deals, ex- arranging project funding, and creat- both the Phoenix and Richard Edrosolan ecuting multiple “fix & flip” projects, ing “win-win” financing for real estate California markets. preparing “rent ready” properties for investments. His efforts have enabled The brand-new company purchased hun- long-term hold strategies and managing Whiterock to maintain a stable source dreds of properties in the Phoenix area property are everyday activities to satisfy of ready funding for the company’s alone last year, and it’s on pace to double the needs of their many investors and joint increasing list of projects. in 2012. venture partners. Whiterock Capital, Inc. provides Whiterock Capital, Inc. was born from Many of Whiterock’s initial projects individuals and organizations interested the passion that only real estate investing were rehabilitation projects. Drawing upon can inspire. Yet, the owners are grounded years of Patrick’s experience as a prop- Continued on pg. 45 enough to accelerate company growth erty manager and by taking advantage of the many benefits home inspector, the that today’s diverse market opportunities company continues present. to focus on ways of Benefits include an ample supply of reducing and elimi- deeply discounted properties, historically nating expenses, low interest rates, and a growing demand while improving for starter homes and cashflowing rental the quality and properties. salability of the Richard Edrosolan, founder and CEO, refurbished home. met Anthony Patrick several years ago at Consistently, the a real estate investment seminar. While bottom line of each discussing their mutual interests and phi- and every project is losophies on real estate, they realized that enhanced, secur- they had much more in common than just ing the delight and investment strategies. satisfaction of their Soon thereafter, a successful business respective venture model was developed and a vital new partners. company born. Edrosolan, who Based upon the diverse and well-sea- has exceptional soned experience that each of these men expertise in various brought to the company, financial success ways of raising was attained at the earliest stage of this capital, has been relationship. Although Edrosolan has able to maintain wide experience within California and a stable source of states in the South and Southeast, Whit- ready funding for erock chose to focus initially in Southern the company’s in- California, specifically in the tremendous creasing workload. opportunities the Inland Empire has to Edrosolan provides Realty411Guide.com PAGE 31 • 2012 reWEALTHmag.com

- 9. One Company, Twice the Cashflow by Isaac Newkirk III tion, ranking 49th and 50th, achieve greater cash flow for a fraction of P respectively. Investors the cost of the investment. In high property remier Equity Group has have migrated to the value areas, to earn a positive cashflow been one of the most suc- South due to low price may require a property purchase of several cessful providers of cash- points, strong rental hundred thousand dollars. In comparison, flow investment properties markets and low prop- these two markets provide investors with in the Southeast. The company has erty taxes. Both mar- affordable cashflow opportunities. offices in Jackson, Mississippi, and kets have huge upside For example, a newly renovated 3 bed- Birmingham, Alabama. potential as big devel- room, 2 bath investment property in Bir- They are a full-service operation, opers are coming in, mingham with a purchase price of $60,000, providing turn-key investment proper- there are six different and a monthly rent of $850, minus a prop- ties, and other real estate services, for major automobile man- erty management fee of $77, minus $40 investors all over the world. ufacturing plants and insurance, minus $80 taxes, nets a monthly Birmingham and Jackson are stable modern medical facilities, cash on cash return of $653, which is an markets and are not subject to the “peaks & which serve to stabilize the rental markets. annual return of 13%. valleys” present in more speculative areas. Their mindset is to take the investors Premier believes that one of the keys to Premier Equity Group acquires properties “concerns” out of the equation, and offer the success of their company is their in- from multiple sources, including: asset a “hassle-free” investment process. That’s house property management team. managers, banks, foreclosure sources, short easier said than done, as you know. Also, transparency is very important. sales and general listings. Because they get They offer a unique product to investors, Owners have access to a web portal, get the best deals, they are able to pass on the one that simplifies buying a house, imple- online statements and can receive direct savings to their clients. Both Jackson and menting a top-quality rehab, leasing it out, deposit of rents. For these important ser- Birmingham have also been rated by vari- and placing it with their in-house property vices they charge only 9%. ous publications as Top 10 Cashflow Mar- management team. This process ultimately kets. The property taxes in Alabama and leads to steady positive cash-flow. Continued on pg. 45 Mississippi are the two lowest in the na- In the smaller niche markets, you can Justin Harrison - AL 205.616.3761 Julie Harrison - MS 601.291.0689 Realty411Guide.com PAGE 32 • 2012 reWEALTHmag.com

- 10. Is Flipping Property strategy by Kathy Fettke, CEO of the Real Wealth Network Good for Your Wealth? T V shows make have had to put down flipping houses $13,000 to buy real estate. look easy, and Today that property bootcamps would be completely paid make it seem extremely off, and would have more profitable every time. than tripled in value. But in reality, new inves- What’s more: you’d be tors often get burned on earning at least $13,000 their first few deals. rental income per year! Everyone wants to The same power of multi- make a quick buck, and plied growth is available in theory, flipping could today simply because be a way to do that. But prices are so low. please heed this warn- Real estate bought ing: Flipping is not for today could very well be everyone! worth more than three Here are some tips to times its value 20 to 30 help you decide if it’s for you. years from now. There is no other investment that delivers cash flow and The Real Costs of Flipping Property • Flipping requires hands-on involvement capital growth like long-term real estate There are many hidden costs that new and most working people don’t have the investments do. investors fail to calculate on the outset: time. Flipping is a job. Buying and holding • The cost of funds borrowed to purchase • Successful flipping requires that you property is an investment. and/or renovate the property only invest where you physically live. A • The cost to sell, including agent fees and buy & hold investor can invest anywhere, Kathy Fettke is the founder and CEO closing costs — estimate 10% have many investments working at the of Real Wealth Network “The Real • Holding costs, including on-going prop- same time, and still make money Estate Investors Resource.” erty taxes, interest charges, and insurance doing other things. Members have access to free • Cost overruns — always allow a 10% • A cash flow rental property education, resources, and cushion for the unexpected can yield over 10% return after referrals to turn-key rent- • Sales price variations — allow 10% less all expenses, without the risk of al properties around than what you’re expecting rehabbing and trying to sell the United States. • Estimated profit — 10% at a minimum at the right time. Real Wealth Network (and if this is all you’re expecting, there • Rental has over 8,000 are much lower risk investments out income is members, so the there!) much more shear power • Short-term capital gains taxes — poten- favorably of numbers al- tially 35% of your profit. Always talk to taxed, and lows the group your CPA before making any investment. capital gains can be to acquire avoided upon sale if a properties at As you can see, after you calculate all replacement property is huge discounts. repair costs, you’ll still need to be able to purchased according to Membership is acquire the property for less than 60% of IRS 1031 Exchange Rules. free. Kathy is also current market value. • Growth over time, for both host of The Real Is it possible? Yes. Is it easy? No. rental income and capital Wealth Show on KABC growth, works the same as Los Angeles and on iTunes and is Buy & Sell VS Buy & Hold compound interest; it’s one of a regularly interviewed guest ex- At Real Wealth Network, we advocate the most powerful tools in an pert on ABC, CNBC, CBS Market buy & hold investing for the following investor’s arsenal. Watch and NPR. reasons: Thirty years ago, one would

- 11. Market Spotlight: San Antonio, TX LOCATION: San Antonio, TX COMPANY: Prosperity Homes and Investments CONTACT: Clay Schlinke ph: 210.771.0861 web: ProsperitySA.com T he Texas economy and real estate market remains on fire with inves- tors from around the world flocking to top Texan cities to add rentals to their portfolio for appreciation, cashflow and added stability. San Antonio offers one of the fastest growing job markets in the coun- try with a projected 10-year job growth of 12.2%, according to Economy.com. The city also offers lower business and lifestyle Q: I understand the military bases pro- Q: Do you prefer multifamily rentals as costs than comparable areas and a well edu- vide a great tenant pool and also eco- an investor? cated productive workforce. nomic stability. A: I prefer our product because we offer To learn more about San Antonio, we in- A: Yes, all of our proj- several advantages to our in- terviewed Clay Schlinke, a master devel- ects are in close prox- vestors, which means higher oper, investor and CEO/owner of Prosper- imity — within a 15 rents and higher occupancy lev- ity Homes and Investments (ProsperitySA. minute drive to all of els. First our units are set up as com), an online resource for the San Anto- the major bases in San townhomes with a garage and nio real estate market. Antonio. backyard. Second, we have 3 bedrooms with 2.5 baths with Question: What kind of opportunities Q. What makes Pros- great amenities that include are you seeing in San Antonio? perity Homes and In- granite counter tops, concrete Answer: San Antonio has remained stable vestments unique in stained floors, crown molding during the past several years and has con- the marketplace? and built-in niches. Lastly, we tinued to add jobs and people to our city. A: We are the only also include a park and pool in Multiple companies have been moving to new home builder that our neighborhoods. As a tenant San Antonio over the past few years and specializes in building you can get everything at one of now with the discovery of the Eagle Ford townhomes, duplexes Clay Schlinke and his family our developments that an apart- Shale oil and gas reserve, it is helping with and fourplexes. ment can offer, but you also get the continued growth. We develop our a garage and yard with no neigh- own subdivisions bors above or below you. Q: What is the best part of being an in- in locations that vestor and buying in San Antonio? have high rental Q: How long have you person- A: Due to our economy and great rental demand and are ally invested in real estate? market, it is easy to cashflow in our city. in strong areas for A: I have been investing since With the cashflow and with the stability of future apprecia- graduating college in 1994. our economy, there will be future apprecia- tion. We are able I own both single family and tion of your properties, which all add up to to give the inves- multifamily properties. a great investment. tor instant cashflow and even equity when they purchase. We have also been success- Q: What do you foresee for the San An- Q: How is the rental market? ful in setting up our developments so the tonio market for 2012? A: The rental market is at an all-time high investor can purchase a fourplex building, A: Based on the last few years, San Anto- right now. The occupancy rate is 92%. but later sell them individually as town- nio has as bright of future as any city in homes if they choose to really the United States. Our government is very maximize their return. We also pro business and you can see that when you provide a full two to 10 year arrive here. In 2012, and beyond, we will warranty to the investor to pro- see continued growth and success in San tect their investment. Antonio. Realty411Guide.com PAGE 34 • 2012 reWEALTHmag.com

- 13. Phoenix Starts Recovery by Wendy Pineda with the right team, investors can still and assigning a property management P purchase investment properties that team. hoenix is a great place to in- will bring them immediate cash flow Bansal also knows that for some vest in real estate. On February and long term appreciation. However, investors hands-on research is the only 9, 2012, CNBC.com released investing in an unknown market can be way to develop a real comfort level a slideshow on the “Top 10 a huge concern for many investors. Ray when investing. That is exactly why Turnaround Towns” in the Bansal started a Phoenix nation. The slideshow placed Investment Property Tour, Phoenix at number two. so investors can meet with Two years ago, Ray Bansal, him, learn how the company president of USA Property works, the many benefits, and Investing, a company that spe- view the market first hand. cializes in turn-key property By attending the investments, had already pre- Phoenix Investment Property dicted that the Phoenix met- Tour, investors can view the ropolitan area would be one workmanship of the rehabbed of the most promising areas in properties, as well as evalu- which to invest. This has been ate the various neighbor- proven to be true partially hoods and view some of the due to the historically low commercial developments prices coupled with the state’s currently enhancing the commitment on supporting Phoenix economy. Along economic growth in key industries. Bansal understands this, and with his with the research and analysis provided In a recent article published by the 20 plus years of general construction by USA Property Investing, investors Wall Street Journal on March 13 of this and real estate experience, Bansal has can now make a truly informed choice. year, Thomas Lawler, an independent developed a turn-key investment system The team at USA Property Investing is economist declared that “Phoenix has designed to eliminate concerns and fully invested in their clients’ success hit a bottom.” The article also stated doubts for real estate investors. and can tailor the investments to suit the that the low prices in Phoenix paired Through this process investors can individual investor’s personal needs. with the upswing in the economy has choose from fully rehabbed cashflow- Don’t have all the cash needed for a led to an increased demand in hous- ing properties, some already rented, in purchase? No problem, USA Property ing, and not just from first-time home great family-oriented neighborhoods. Investing has the resources to help you buyers. Big and small investors are The turn-key system allows for USA achieve your goals. Many financing snapping up the bargains. In fact, one Property Investing to handle the whole options exist, so contact Ray Bansal at quarter of all properties sold last month transaction from beginning to end. This (888) 616-3706 to learn more. was to an out-of-state buyer. includes fully rehabbing the property, Although it may seem like the scheduling appraisals and inspections, Learn about their next tour, at: window of opportunity is almost gone, all the way through to tenant placement PhoenixInvestsmentPropertyTour.com Realty411Guide.com PAGE 36 • 2012 reWEALTHmag.com

- 14. “W “What We Can BE, motivation hat we can be, we must be,” is one of Dr. We Must BE” Maslow’s famous quotes. Abraham Maslow is the father of human- istic psychology. He is renowned for his Hierarchy of Needs and Self Actualization theories. Most of his writings are about human motivation and have put them Just so we are clear about growth ver- personality. Today, his teach- on the plus 1, but sus comfort, I’ll give a few examples of ings are successfully applied they chose to step how people choose safety over growth: in fields of business, marketing back to safety and 1. You got angry at your son and decid- and communication among oth- landed on negative ed to break off communication a while ers. Maslow was born in New 1, the difference of back. An opportunity arises to sit down York 1908 and died in 1970. two points and not and talk things over, but you take the "If you deliberately plan on just one, as com- easy way out by going into your comfort being less than what you are ca- monly believed. zone and watch the ball game. pable of being then I warn you, Here’s what’s 2. You need to get up early and take care you will be very unhappy for the worse. Every time of something important. Instead, you rest of your life.” you make such look at the clock and go back to sleep! — Abraham Maslow decisions, the gap 3. You find a good property to invest in Dr. Maslow believes human between what you but at the last minute you’re gripped by beings have an instinct (need or could have done fear and chicken out! impulse) that drives them to be and what you ac- Recognition is the half way to transfor- the best they can be. On the oth- tually did grows mation. So, first examine your own life Sam Sadat er hand, he says that the story wider. Dr. Maslow and look at moments when you could’ve of the human race is the story of men and affirms that all our regrets, anxiety, frustra- and should’ve gone for growth but you women selling themselves short. tions, unhappiness, anger, depression, etc. chose safety. Then realize that the gap So what gives? Let me give you an ex- lies in that gap which separates growth where all this negative energy resides ample. Imagine drawing a straight line that from comfort or realizing one’s full po- is dragging you down. Since there’s goes to infinity on both sides, from one end tential from settling for less (selling one- not much we can do about the past, we to another. Now think of yourself standing self short.) People take all kinds of drugs need to take action in the present to af- in the middle of this line, which we call for various mental and emotional condi- fect future. For those of us who insist to point zero. One side of the line starts with tions when all they have to do is to pick live in the past, the famous poet, Omar plus 1, plus 2, plus 3 and so on to plus in- growth over comfort and security. Speak- Khayyam has this to say: “the moving finity. On the other side of the line, you ing of which, do you really believe there’s finger writes and having writ moves on. have negative 1, negative 2, negative 3 and such a thing as security in life? If you think Nor all thy piety nor wit can lure it back so on to the negative infinity. about it, it becomes clear that “security” is to cancel half a line, nor all thy tears Dr. Maslow states that at any given mo- a myth. After all, we have very little con- wash out one word of it.” ment, when you are faced with making a trol over events and what will happen next. Once you come to terms with your past decision, you have a choice to move for- Some schools of thoughts recommend the and realize you can still do something ward in the direction of growth (plus side notion that if you want “security” it’s best about your future in the present time, of the line) or step back into the direction to seek insecurity! By that, they mean to then resolve to never again step back of safety (comfort), which is on the nega- simply allow things to take their natural into safety when you can choose growth tive side of the line. So that if you are at course. That does not mean you sit back instead. As you begin to make decisions point zero and faced with a challenge that and do nothing. Rather, you do the best you that are more growth based and less on requires a decision on your part. What will can but not get attached to the results. Only safety, you will see that the gap is get- you choose? in this way you would be able to experi- ting narrower and narrower. Soon you'll What do most people do when confront- ence a life of joy and fulfillment. gain control of your life and move in the ed with problems of life? They usually Back to our discussion of why the vast direction of self-actualization, which is, step back into safety or the negative terri- majority of people choose comfort over according to Maslow, where you can re- tory. The first such decision results in go- growth almost every time they make a de- alize your full potential and maintain a ing back to negative 1. And so they justify cision in life. Is there any hope of revers- happy and fulfilled state of being. by saying, “it’s nothing, I just went back ing this vicious cycle? And the answer one step, I can always make up for it lat- is………….. Yes! It’s possible and you To your success and life of abundance, er.” But here’s the catch that most people won’t need several lifetimes to get it done! miss. It really cost them two steps and not You surely can reverse this process but it Sam Sadat one! They could have made a decision to requires effort initially. But in the long run www.samsREclub.com move forward into growth, which would your life will be a lot more effortless! sam@samsadat.com Realty411Guide.com PAGE 37 • 2012 reWEALTHmag.com

- 15. Going Global to Meet Demand Small Real Estate Company winters with little to no snowfall; Finds Success Taking its •A high rate of foreclosures, al- lowing properties to purchased Business Model to an and resold inexpensively, pro- viding an optimum product to International Audience an end buyer; •A dollar-based economy; By Robert Feol A Miller and Guenther, who few short years ago, business already held 300 rental partners Bert Miller and Hans homes between them, had no Guenther had a business that problem filing in the logisti- was primarily focused on de- cal blanks, which remained to livering retail level homes to end users in be identified for them to pro- Memphis, Tennessee. Their partnership, duce what is, today, a brilliant which has spanned over 20 years, was success story in the making. They thriving, as they realized their mission already had a licensed realty broker- to take on foreclosed, non-performing age, which was managing their portfolio real estate, revitalize it, successfully. Why not offer that service to and provide desirable investors in the scope of a truly ‘turnkey’ housing to their buyers system that provided investors who wanted while reinvigorating the real estate investors do to purchase full-service properties in Mem- tax base. when their entire target phis great investment homes that were on- Then, the credit crisis sales group evaporates line and performing hit and the two partners before their eyes? While found themselves be- any investors would tuck Going the Distance ing forced to redevelop tail and run, or become What really sets Miller and Guenther apart their business model. Hans Guenther and Bert Miller complacent in trying to is their clientele — almost 100% of their The so-called credit simply find a new way to end-user sales are to international investors. crisis has challenged today’s modern real address the problem of U.S. mortgages be- Miller and Guenther have traveled exten- estate investor in a variety of ways, but coming few and far between, the pair opted sively, spending a significant time in Sin- for investors like Miller and Guenther, the to ‘take the red pill’ and go a bit further gapore in 2011 working with their clients, fallout was a significant one — the major- down the rabbit hole, asking a hard-hitting and they are scheduled to travel to New ity of their purchasers were unable to buy and probing question — if our target mar- Zealand and the United Kingdom in the homes, period. ket has disappeared, who then IS our target early months of 2012 as keynote speakers, “It was like the hammer falling,” says market? discussing their turnkey real estate system Bert Miller. “We woke up one day, and The answer was found, interestingly to foreign investors. The early prognosis so many of our pending purchases were enough, outside of Memphis, Tennessee. for 2012 anticipates Miller and Guenther being challenged or falling apart due to Miller and Guenther had focused so in- selling about 150 homes to foreign buyers new appraisal restrictions, HVCC rules, tensely on their domestic market in their this year, not counting their domestic out- etc... Changes in credit were hamstringing resident city that they had forgotten the put and retail, and the end-user sales they families who wanted to purchase their pri- whole world was, literally, just waiting for still engage in. mary residences. We began to realize that them to show up. Establishing a truly turnkey system our only answer to the problem rested not They started to reassess the value of their wasn’t the difficult part of reinventing the in waiting and hoping things got better, product, and looked at it in its most con- business model — the difficult part, ac- but in radically revolutionizing our busi- summate and simple form. Memphis, Ten- cording to Hans Guenther, was convincing ness model. There was simply no other nessee real estate offered: investors that there wasn’t some kind of way to continue our business in its current •Incredible cashflow per square foot; hidden “angle.” incarnation.” •Low purchase points per square foot; He adds: “We had so many investors af- •A stunningly high per capita rent ter meeting us and hearing us at seminars Enter the Matrix al rate (almost 50% of the population ask us bluntly: ‘What’s the catch? What are Miller and Guenther had come to a cross- of Memphis is comprised of renters you guys hiding? This seems to good to be roads, not just metaphorically, but literally seeking rental homes); speaking. What do two ‘rehab to retail’ •A Southern climate, which had mild Continued on pg. 45 Realty411Guide.com PAGE 38 • 2012 reWEALTHmag.com

- 16. The Best Opportunities …don’t last forever A division of American Foreclosure Acquisition Services Memphis’ Finest Foreclosure Experts B u yMe mp h i s F or e cl o s ur e s. c o m i s yo ur i d e a l s o u rc e f o r p ort f o l io - b u i l di n g a n d c a s h- f l o w i ng pr o p ert i es i n Memp h i s , T e n n es se e a n d ot h er c it i es . W e p r ov id e h o u se s i n pr ef e rr e d are a s at l o w p ri c e p o in t s w it h e xc e l l e nt ca s h f l o w. O u r pr o p er t i e s ar e a lr e ad y r e nt e d a nd w e p r ov i d e ex c ep t i o na l i n - h o u s e ma n a g e me nt . B u i l d yo ur po rt f o l i o th e ri g h t w a y , f r o m a n yw h e r e , w it h a n ex p er i e n c e d a n d r el i a b l e t ea m. W e sp e c ia l i ze in c re at iv e f i n a nc i n g o f f e ri n g p r ef er re d i n st it ut i on a l, p riv at e a n d ow n e r f i n an c i ng . Visit us on the web: www.BuyMemphisForeclosures.com (901) 870-2301 Buy Memphis Foreclosures - A Division of GM Realty, Inc. 6262 Poplar Avenue, Memphis, TN 38119

- 17. BiggerPockets Real Estate Investing Summit & Expo 2012 Denver, CO March 23 - 24 The No-Nonsense, No Upsell Real Estate Investment Conference Join Us At The BiggerPockets Summit! BiggerPockets is at it again. The company that changed the How to invest in real estate while way real estate investors network, learn, and do business via its website, is announcing it inaugural live conference and trade show. an accidental landlord, if you’re an experienced pro, or if you’re a service pro- fessional in the real estate investment industry, our BiggerPockets Summit will - Investments sible for as many people as possible from around the country.” And much more! Don’t Get Shut Out -- Space IS Limited -- Buy Early and Save! Sponsors: BiggerPockets http://www.biggerpockets.com/conference

- 18. diversification Trading Stocks VS Investing in Stocks by Tyrone Jackson a company whose annual and A trader takes a different C quarterly earnings are rising. approach to stocks. A trader an you really earn Historically, increased earnings is in the game of taking small $8,000 profit per creates pressure on the stock quick profits. Let’s take a look month trading stocks price to increase. Stocks that at a company like eBay (ticker online? Yes you trade above $100 per symbol EBAY). eBay is cur- can. There’s a reason share have in- rently trading around $37 dol- the really rich own creasing earn- lars per share. Maureen, a and trade stocks ings. In the smart, intelligent and attrac- AND buy real We a l t h y tive real estate investor and estate. The Inves- entrepreneur, understands that stock market tor pro- to create real wealth she needs has always gram we to be diversified. That means been a place refer to owning stocks and real estate. to earn fast, t h e s e She likes investing in Dow sexy money compa- components like MacDonalds, for those that nies as AT&T and IBM for the long Wednesday, two days af- have a financial “good dates.” term and using a small portion ter Maureen purchased her education. So what’s As an inves- of her investment capital for eBAY shares, the stock’s the problem? Most tor, you’re hoping trading others. One of her fa- price reaches $38 shortly af- Americans never seek to be fi- that the company continues to vorite stocks to trade is eBAY. ter the market opens at 9:30 nancially educated themselves, have success and earning in- On Monday shortly after the a.m. eastern time. The soft- Isn’t it time you added stock market trading to your list of revenue streams? therefore they are locked out creases over a long period of stock market opens, Maureen ware inside of Maureen’s of the greatest game in the time, let’s say two to five years. logs into her online brokerage account automatically trig- world… investing and trading When XYZ’s stock price in- account and purchases 1,000 gers a sell while she is at stocks. For way too long the creases from $100 to $110 shares of eBay at $37. That’s the gym. When she returns stock market has been an ex- and you own the shares, your a total investment of $37,000. home, Maureen gets an email clusive playground for the up- investment has increased in She’s willing to sell the shares and discovers she has just per class. Today stock research value ten percent. That means the second they reach $38 dol- earned a $1,000 profit from and the ability to trade is just a your $10,000 is now $11,000. lars and capture a quick profit. the sale of eBay shares. How click away. In the above scenario you only Maureen is not day trad- did that happen? Let’s re- There are two major ways have a paper profit. An actual ing. Day trading requires that view. Monday Maureen pur- to earn money in the financial profit results from selling your you sit at a computer while the chased 1,000 shares of eBay markets. They are investing, shares. stocks are trading and buy and at $37. Her total investment (purchasing shares and letting Once a stock price has in- sells stocks when they increase was $37,000. When the share them increase in value over the creased, you have several inter- five to ten cents above your price reached $38 her 1,000 long term), and trading (buying esting choices, you can: purchase price. Most people shares were sold. Maureen’s and selling shares very quick- 1. Sell XYZ stock for a profit, who attempt day trading lose initial investment of $37, 000 ly). The real estate equivalent and enjoy your ten percent money. was returned to her account to stock trading is buying a return. Instead, Maureen prefers to plus a one dollar per share house, fixing it up, and then 2. Purchase more shares and volatility trade because the free profit. One dollar multi- selling it for a profit as soon as ride the wave of success. software in her brokerage ac- plied by one thousand shares possible. 3. Find another company to count will trigger a sell of her equals $1,000. As a stock investor, your in- invest in using the same crite- eBay shares while she’s out in If Maureen can buy and tention is to purchase shares of ria that led you to XYZ. the world enjoying her life. Continued on pg. 46 Realty411Guide.com PAGE 41 • 2012 reWEALTHmag.com

- 19. RealBay.com, pg. 11 Spring has Sprung, pg. 9 price, square footage, cap rate, asset specif- extremely valuable. 3. New Infrastructure Improvements, ics, etc. Having thousands of connections on 4. Easy Affordability, 5. Opportunity for The platform lists the assets for auction, sites such as LinkedIn.com personally Pis- Appreciation, 6. Tightening Vacancy, and people are able to deal directly with cano knows the value of an online network 7. Sales Inventory is Turning. each other. and wants to allow RealBay’s members Based on these seven factors, I then as- “I’m allowing the buyer and seller to talk to truly capitalize on the exposure the site sess the area’s median rent prices. It is im- with each other direct and connect without will allow them to have to potential clients portant to analyze the median sales price, any regulation – This greatly increases the as well. The site will have several varia- quality and quantity of the houses in a given chances of getting a deal done – The other tions on the style of listings and auctions area. The areas offer at least a 1.25% or bet- sites won’t do this because they afraid of users may use. “Own it now” and “Best ter rent ratio (monthly rent/sales price) get being cut out of the loop and not getting Offer” selections will be available to peo- a second look. When it’s time to buy, I look their fee after the transaction.” according ple, according to Piscano. for houses that will cashflow at just under to Piscano. Currently, the website is open for the the area’s median rent. Buying the right This helps with the buyer and sellers public to create accounts at no cost. It is property is only a small step in investing coming to an executed transaction faster. a traffic-based website and sponsored op- success. The biggest factor of profitability The website attracts global buyers and portunities will be available soon to spe- is keeping your property rented. A lower each buyer and seller is different and the cific service providers that would like to be rent range will expose your properties to personal relationship of direct contact is showcased to members when those mem- the largest group of potential renters in the bers need them the most. area and let you select the best tenants. Buy, Hold & Rent, pg. 26 “In the future, we envision a site where So, going back to the question — “ Is it users pay nothing and we truly become time to buy real business at present, primarily due the in- a free real estate marketplace and social estate and if so, creased difficulties of potential clients get- network, driven by our members activity where?” — Yes ting financing. Many Section 8 properties similar to Facebook,” Piscano explains. it is the right time have been located in neighborhoods that The site will allow for networking con- to buy. Where? have added to the problems in acquiring nections between REALTORS®, investors In a market that buyer-financing. BH&R determined that and different types of real estate service will provide you buying in the more upscale neighborhoods providers in a busy and exciting online stable, depend- significantly increased the prospects of a marketplace. able cash flow for the long term. positive return for investors. The much lower turnover rate in these neighborhoods For additional information, be sure to Contact Lori Greymont at 888-298-0652 was greatly aided by the tenant base. It’s visit www.RealBay.com Lori@SummitAssetsGroup.com the age-old real estate mantra of “location, location, location.” Whalen believes that if you focus your efforts in areas where Rapid Property Analyzer (RPA), pg. 22 people want to live, you’ll get a different client and a different tenant base. They’re tematic process to help you evaluate then evaluate any property he looks at only buying out in the suburbs these days. potential property for investment pur- against the same criteria. Hence the con- BH&R’s investors don’t usually worry poses. sistent, repeatable results all profession- about the need to get financing. Almost By using this software the investor als look for to evaluate their work. all deals are sealed with cash; with many evaluates each property the same way Just like the serious golfer who buys clients using savings and retirement funds. using the same criteria. This approach the best set of clubs he can, savvy inves- BH&R remains aware of the com- allows the investor to identify his return tors need decision-based tools that assist petitive marketplace, but Whalen puts a on investment (ROI) using a standard them in making fast, comprehensive and 20-year plus career on the line. Having set of rules for evaluating all properties. accurate assessments of a potential prop- only specialized in the Cleveland area, As shown in the table and the charts erty’s value. he knows the area like the back of his on page 22, multiple properties are Gary Geist is a seasoned real estate in- hand. It’s a people-oriented business and displayed side-by-side in numerous il- vestor with over forty years experience. he proudly points to the fact that he’s on lustrations comparing the performance He has owned property in several states a first-name basis with all the people that metrics of each. This enables the inves- in the Midwest and currently has large matter. He recognizes that the over $5 bil- tor to quickly grasp the relative value of property holdings in Ohio, Indiana, and lion in construction taking place in Cleve- one property over another. Pennsylvania. He is the owner of Hom- land will attract investors from the world As an investor, this is what you need eReplay, LLC, which is based in the over. He wants potential investors to know to be focusing on, relative rates of return Midwest and provides tools and turn-key that he’s there to serve their interests. and values set on the same criteria. investment solutions to investors world- RPA allows the investor to tailor the wide. For more information about RPA Visit online at: www.BuyHoldRent.com software to his individual market and visit online at: www.homereplay.com Realty411Guide.com PAGE 42 • 2012 reWEALTHmag.com

- 20. BiggerPockets Hosts a Ate you a Target for a Lawsuit? pg. 23 ing any payments pre- GroundBreaking Summit suming he could buy another couple years of free rent. This T time, we waited for six months (listening he most sophisticat- Geraldine Barry, the head to his empty promises ed investors in the of SJREI Association whose and excuses). real estate industry club was winner of the 2010 Bill Gatten When we were finally are flocking to Denver, Award of Excellence from able to effect foreclosure, as per our agree- CO on March 23rd and National REIA; and Tah- ment, the lis pendens (Notice of Legal Ac- 24th for the first annual ani Aburaneh a self-made tion) hit the newspaper, immediately luring BiggerPockets Real estate multi-millionaire real estate the so-called “Consumer Advocates” out Investing Summit 2012. Joshua Dorkin developer and author of Real from under their respective rocks by the The event, produced by the Estate Riches. dozens. The particular “extortionist” that nation’s most popular online real estate “Our goal is creating this unique con- Mr. Williams selected agreed to sue us network, will take place at the Colorado ference is to provide experienced inves- for “equity stripping” and taking uncon- Convention Center. tors, and those trying to learn, with a scionable advantage of the poor, gainfully Over 200 years and thousands of no pressure, no nonsense, and no upsell employed man who earned approximately deals worth of real estate investment environment,” says Joshua Dorkin, Big- $10,000 per month but refused to pay his experience will be available to those gerPocket.com’s founder and CEO. $3,500 monthly mortgage payment (for attending. Scheduled speakers include Tickets for the two day event, which two and a half years by this time). some of the most renowned investors includes access to all conference ses- At the settlement conference in court the in the industry, including: Bruce Nor- sions, are $250. For more information, two opportunists (client and attorney) sug- ris of the Norris Group, best known for please visit: http://www.biggerpockets. gested they would settle with us for an even his California Market Timing Report; com/conference. $1 million dollars. When we insisted on a trial, the attorney decided that he’d now settle for an even $40,000. We countered with an offer for him to stick his head in More Cashflow, Less Cash a bucket and requested a jury trial. That turned the tables on Mr. Lawyer, since he was basically broke (as many are), and not L getting paid by his client, hoping for a set- ooking for a way to With all the negative me- tlement and payday. Since he would have had to front his client’s court costs, he just jump into real estate dia coverage, many investors gave up (i.e., Williams vs. Land Partners of by utilizing leverage? wrongly assume that investor American, Va. Est. January 2007). Then talk to the Gosser loans are impossible to get, but The basic lesson to be learned here? Be- Bighaus Team at Guild that assumption is false. Take a Mortgage. The team is Jason & Steve look at some of their numbers: cause the property in question was held by a third-party, bona fide, properly structured led by Steve Bighaus and Jason Gos- Gosser Bighuas weekly average: title-holding land trust, all claims of Eq- ser, who specialize in rental property Total Amount Funded: $330,725 uity and Unlawful Eviction and Wrongful financing. Equity Partners: $130,275 Foreclosure fell on deaf ears. Without the “We have techniques and loans that Cash Flow: $1,931.99 land trust, everything would have turned many lenders do not offer, and usual- Gosser Bighuas monthly average: out completely differently, and in addition ly don’t even know about it,” Bighaus Total amount funded: $1,124,087 to our $96,000 and $25,000 court costs to explains, and adds that they work with Equity partners: $468,913 date, we would have lost the house and many out-of-state investors. Positive Monthly Cash Flow: $8,983 been sued for a couple extra hundred thou- sand dollars to boot. Regarding real estate ownership in par- ticular, some legal advisors will tell you start with a Land Trust first, then bring in stead vested in an entity that is designated that you do not need to use a Land Trust. the LLC secondarily as the (or “a”) benefi- to serve as a trustee for the beneficiaries They’ll often suggest that you hold title to ciary of the land trust. (not for a trust). Land Trusts are essential- your real property in an LLC instead. This So, what is a Land Trust? Unlike most ly privacy tools for real estate asset protec- is not necessarily bad advice by any means; trusts, the Illinois-type land trust isn’t a tion. In other words, they are structured so it’s just not great advice. If you are interest- trust per se at all. Despite the terminology, as to obfuscate discovery by the public of a ed in setting up the BEST structure to pro- the corpus of a “land trust (the entrusted property’s ownership control. tect you and your real estate assets you’ll property)” is not vested in a trust: it is in- Realty411Guide.com PAGE 43 • 2012 reWEALTHmag.com