QNBFS Daily Market Report January 08, 2018

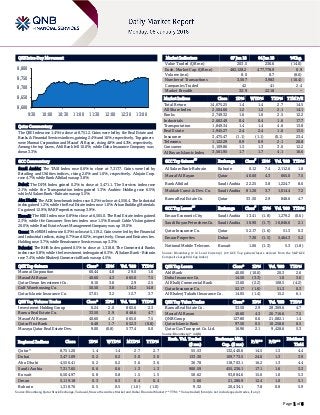

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.4% to close at 8,751.2. Gains were led by the Real Estate and Banks & Financial Services indices, gaining 2.4% and 1.6%, respectively. Top gainers were Mannai Corporation and Masraf Al Rayan, rising 4.8% and 4.3%, respectively. Among the top losers, Ahli Bank fell 10.0%, while Doha Insurance Company was down 3.3%. GCC Commentary Saudi Arabia: The TASI Index rose 0.6% to close at 7,317.7. Gains were led by Retailing and Utilities indices, rising 2.0% and 1.6%, respectively. Alujain Corp. rose 4.7%, while Bank Albilad was up 3.8%. Dubai: The DFM Index gained 0.2% to close at 3,471.1. The Services index rose 2.1%, while the Transportation index gained 1.3%. Arabtec Holding rose 6.5%, while Al Salam Bank - Bahrain was up 5.5%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,556.4. The Industrial index gained 1.2%, while the Real Estate index rose 1.0%. Arkan Building Materials Co. gained 12.9%, RAK Properties was up 3.9%. Kuwait: The KSE Index rose 0.8% to close at 6,505.0. The Real Estate index gained 2.3%, while the Consumer Services index rose 1.5%. Kuwait Cable Vision gained 20.0%, while Real Estate Asset Management Company was up 19.0%. Oman: The MSM Index rose 0.3% to close at 5,119.2. Gains were led by the Financial and Industrial indices, rising 0.7% and 0.2%, respectively. Oman and Emirates Inv. Holding rose 3.7%, while Renaissance Services was up 3.3%. Bahrain: The BHB Index gained 0.5% to close at 1,318.8. The Commercial Banks index rose 0.8%, while the Investment index gained 0.3%. Al Salam Bank - Bahrain rose 7.4%, while Khaleeji Commercial Bank was up 4.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 60.44 4.8 29.0 1.6 Masraf Al Rayan 40.60 4.3 665.0 7.5 Qatar Oman Investment Co. 8.10 3.8 2.9 2.5 Gulf Warehousing Co. 50.50 3.8 134.2 14.8 Qatar Islamic Insurance Co. 57.01 3.2 12.7 3.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Investment Holding Group 6.24 2.0 865.6 2.3 Barwa Real Estate Co. 33.50 2.9 848.6 4.7 Masraf Al Rayan 40.60 4.3 665.0 7.5 Qatar First Bank 6.48 1.7 652.3 (0.8) Mazaya Qatar Real Estate Dev. 9.00 (0.8) 577.4 0.0 Market Indicators 07 Jan 18 04 Jan 18 %Chg. Value Traded (QR mn) 203.5 236.6 (14.0) Exch. Market Cap. (QR mn) 482,128.2 477,778.9 0.9 Volume (mn) 8.0 8.7 (8.6) Number of Transactions 3,567 3,983 (10.4) Companies Traded 42 41 2.4 Market Breadth 32:9 22:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 14,675.25 1.4 1.4 2.7 14.5 All Share Index 2,504.66 1.2 1.2 2.1 14.1 Banks 2,749.32 1.6 1.6 2.5 12.2 Industrials 2,662.49 0.4 0.4 1.6 17.7 Transportation 1,849.34 1.4 1.4 4.6 13.8 Real Estate 1,945.27 2.4 2.4 1.6 13.5 Insurance 3,475.47 (1.1) (1.1) (0.1) 23.4 Telecoms 1,122.29 0.9 0.9 2.1 20.8 Consumer 5,109.86 1.3 1.3 3.0 12.2 Al Rayan Islamic Index 3,561.95 1.7 1.7 4.1 16.6 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Salam Bank-Bahrain Bahrain 0.12 7.4 2,112.6 1.8 Masraf Al Rayan Qatar 40.60 4.3 665.0 7.5 Bank Albilad Saudi Arabia 22.25 3.8 1,224.7 8.6 Makkah Const. & Dev. Co. Saudi Arabia 81.20 3.7 1,014.4 7.2 Barwa Real Estate Co. Qatar 33.50 2.9 848.6 4.7 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Emaar Economic City Saudi Arabia 13.41 (1.8) 1,279.2 (0.6) Saudi Kayan Petrochem Co. Saudi Arabia 10.90 (1.7) 16,846.6 2.1 Qatar Insurance Co. Qatar 52.17 (1.6) 51.3 0.3 Emaar Properties Dubai 7.30 (1.5) 5,464.3 5.2 National Mobile Telecom. Kuwait 1.06 (1.3) 5.3 (1.8) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ahli Bank 40.00 (10.0) 20.3 2.6 Doha Insurance Co. 14.50 (3.3) 1.0 3.6 Al Khalij Commercial Bank 13.60 (2.2) 108.5 (4.2) Qatar Insurance Co. 52.17 (1.6) 51.3 0.3 Al Khaleej Takaful Insurance Co. 14.05 (1.4) 15.2 6.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 33.50 2.9 28,369.6 4.7 Masraf Al Rayan 40.60 4.3 26,716.6 7.5 QNB Group 127.80 0.6 21,082.1 1.4 Qatar Islamic Bank 97.50 0.5 10,258.0 0.5 Qatar Gas Transport Co. Ltd. 16.96 2.1 9,428.6 5.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,751.20 1.4 1.4 2.7 2.7 55.53 132,440.6 14.5 1.3 4.4 Dubai 3,471.09 0.2 0.2 3.0 3.0 133.30 109,773.5 24.6 1.3 3.9 Abu Dhabi 4,556.41 0.2 0.2 3.6 3.6 36.78 118,703.1 16.2 1.3 4.4 Saudi Arabia 7,317.65 0.6 0.6 1.3 1.3 900.59 455,236.1 17.1 1.6 3.3 Kuwait 6,504.97 0.8 0.8 1.5 1.5 58.62 93,884.6 15.6 1.0 5.3 Oman 5,119.18 0.3 0.3 0.4 0.4 5.66 21,286.9 12.4 1.0 5.1 Bahrain 1,318.76 0.5 0.5 (1.0) (1.0) 9.32 20,434.1 7.8 0.8 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,600 8,650 8,700 8,750 8,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 1.4% to close at 8,751.2. The Real Estate and Banks & Financial Services indices led the gains. The index rose on the back of buying support from Qatari and GCC shareholders despite selling pressure from non-Qatari shareholders. Mannai Corporation and Masraf Al Rayan were the top gainers, rising 4.8% and 4.3%, respectively. Among the top losers, Ahli Bank fell 10.0%, while Doha Insurance Company was down 3.3%. Volume of shares traded on Sunday fell by 8.6% to 8.0mn from 8.7mn on Thursday. Further, as compared to the 30-day moving average of 12.3mn, volume for the day was 35.2% lower. Investment Holding Group and Barwa Real Estate Company were the most active stocks, contributing 10.9% and 10.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/07 China National Bureau of Statistics Foreign Reserves December $3,139.9bn $3,126.8bn $3,119.3bn Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2017 results No. of days remaining Status GWCS Gulf Warehousing Company 14-Jan-18 6 Due MARK Masraf Al Rayan 16-Jan-18 8 Due QNBK QNB Group 16-Jan-18 8 Due VFQS Vodafone Qatar# 16-Jan-18 8 Due WDAM Widam Food Company 17-Jan-18 9 Due QIBK Qatar Islamic Bank 17-Jan-18 9 Due ABQK Ahli Bank 17-Jan-18 9 Due QATI Qatar Insurance Company 23-Jan-18 15 Due DHBK Doha Bank 23-Jan-18 15 Due KCBK Al Khalij Commercial Bank 24-Jan-18 16 Due CBQK The Commercial Bank 24-Jan-18 16 Due QNCD Qatar National Cement Company 05-Feb-18 28 Due Source: QSE ( # Financial Results for nine months) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 46.12% 36.64% 19,288,725.15 Qatari Institutions 24.68% 29.63% (10,073,603.45) Qatari 70.80% 66.27% 9,215,121.70 GCC Individuals 1.03% 1.28% (491,468.89) GCC Institutions 3.10% 2.58% 1,059,789.89 GCC 4.13% 3.86% 568,321.00 Non-Qatari Individuals 13.74% 13.54% 421,770.97 Non-Qatari Institutions 11.33% 16.34% (10,205,213.67) Non-Qatari 25.07% 29.88% (9,783,442.70)

- 3. Page 3 of 6 News Qatar Qatar Insurance Company to hold board meeting on January 23 to discuss the financial statements – Qatar Insurance Company announced that its board of directors will hold a board meeting on January 23, 2018 to discuss the company’s performance, the financial information at the end of 2017, the auditor’s report and the recommendation of the dividend distribution to be approved by the AGM. (QSE) KCBK to hold its board meeting on January 24 to discuss the financial statements – Al Khalij Commercial Bank (KCBK) announced that its board of directors will hold a board meeting on January 24, 2018 to discuss and approve the draft of the audited financial statements for the period ending December 31, 2017. (QSE) Vodafone Qatar changes board of directors meeting date to January 16 – Vodafone Qatar announced that the date of its board of directors meeting originally scheduled for January 18, 2018 has been changed to January 16, 2018. The board will discuss various business related items and will issue a trading update for the nine-month period ending December 31, 2017, following the conclusion of the board of directors meeting. (QSE) Doha Insurance Group to hold general assembly meeting on March 18 – Doha Insurance Group announced that its general assembly meeting will be held on March 18, 2018. In case of lack of quorum, second meeting will be held on March 25, 2018. (QSE) BofAML sees no major siege impact on Qatar – The ongoing siege imposed on Qatar by its neighboring countries is unlikely to have any major economic impact on the country, Bank of America Merrill Lynch (BofAML) stated in a recent report. “Despite the diplomatic isolation of Qatar, we do not see a major economic impact from the ongoing dispute. Intra-regional trade remains relatively low. The closure of the Qatari-Saudi Arabian land border has forced re-routing of imports to Qatar. The UAE does import gas from Qatar through the Dolphin pipeline on a commercial basis, but we do not see a discontinuation for now,” the report stated. BofAML kept its recommendation on Qatar’s external debt to ‘Market-weight’. Qatar maintains a strong balance sheet and the fiscal/external break-even oil prices are lower than GCC peers. Bond issuance will be the key theme in the near-term, the report stated, adding that Qatar is expected to issue bonds worth $10bn this year particularly given the $2bn Eurobond maturity this month. “We still see value in Qatar against GCC peers, trading almost 60 basis points wide for its rating,” the report added. (Qatar Tribune) Al Kaabi: Qatargas-RasGas merger set to consolidate LNG lead – The Qatargas-RasGas merger has many benefits including that all of the country’s competencies in LNG are in one place, according to Qatar Petroleum’s President and CEO, Saad Sherida Al Kaabi. Al Kaabi said, “There are many benefits that are not talked about. For me, the number one benefit is that I have one entity in Qatar marketing Qatar’s LNG. Until this we had RasGas in India, Qatargas in China for instance, and it was nonsense. Now we have one company, one marketing arm, one operation and one finance. All of your competencies in LNG are in one place. And the savings are huge. Two billion Riyals operating costs saved annually.” (Gulf-Times.com) SAK: Qatar’s budget focuses on stability, support for diversification – Qatar’s 2018 budget focuses on strengthening stability, developing prudent financial performance, and providing support for the economic diversification strategy it started earlier on, SAK Holding Group (SAK) stated in its latest monthly report. According to the report, the 2018 budget also confirms that Qatar will provide the necessary funds to complete the implementation of significant development projects pledged by the state, especially infrastructure projects in the health, education, transportation sectors and projects related to the country’s hosting of the FIFA World Cup in 2022. Total expenditure on these projects is expected to reach QR93bn, which will lead to a boom in the real estate sector as a result of the continued flow of liquidity supporting real estate sector capabilities, and as a response to comprehensive and sustainable development requirements that will achieve the objectives of the Qatar National Vision 2030. The report stated the budget showed that expenditures will be $55.8bn and revenues will be $48.1bn, which means a deficit of about $7.7bn. It also observed 2.9% growth in expenditures and 2.4% growth in revenues, dropping deficit by 1.1%. About $14.3bn is allocated to salaries and wages at an increase of 9%. (Gulf- Times.com) Qatar growing steadily and building accelerated economy – Qatar is witnessing remarkable development towards building a fast-growing and accelerated economy, according to UK Secretary of State for Transport and Member of Parliament, Chris Grayling. The country is implementing an ambitious development program that has transformed Qatar into a workshop for a variety of projects that will make it a strong economic centre in the region and the world, he said in an interview with the official Qatar News Agency (QNA). On the ongoing siege, Grayling said, while it has been a challenging time for Qatar, he is impressed with what he has seen in the country as the economy continues to grow, while also stressing that the UK wants to see a quick resolution to the dispute. Grayling said he held constructive meetings with Qatari officials during his visit to Doha and expressed the willingness of the UK to work closely with Qatar in the implementation of major projects in the State, such as the expansion of Hamad International Airport and other infrastructure projects. Further, he noted that such projects represented a real opportunity to deepening bilateral ties between the two countries. (Gulf- Times.com) Investment migration from the UAE, Saudi Arabia cheers Qatar realty sector – The migration of real estate investments from Saudi Arabia and the UAE to Qatar significantly pushed the real estate sector upwards, according to SAK Holding Group Market Watch Report. In the eyes of those involved in traditional investments trends, which constitute a large segment of investors and savers, the Qatar real estate market still protects the initial investment value of their funds and savings and provides them with stable returns. According to the report, investors in the residential sector are upbeat about growth prospects, while investors in other areas of the realty sector are

- 4. Page 4 of 6 expecting a gradual increase in annual growth rates, to 8% in 2019. (Qatar Tribune) International UK’s consumer spending falls in 2017 for first time in five years – British shoppers tightened their belts over Christmas, leading to the first YoY fall in spending since 2012, and leading businesses aim to do the same over 2018, two major surveys showed. Evidence of consumer slowdown in Britain has mounted since official data showed the weakest household spending growth in five years earlier in 2017 against a backdrop of high inflation and worries about Brexit that weigh on business investment. Visa stated that British consumer spending fell by 0.3% last year, after taking into account the effect of higher inflation, the first fall since 2012. Spending in December alone was 1.0% lower than in 2016, also the first fall in five years, and reflected a squeeze on household incomes from the highest inflation in nearly six years. Economists polled by Reuters expect growth this year will slow slightly to 1.3%, well below its longer-run average of just over 2%. (Reuters) China’s December foreign exchange reserves rise to $3.14tn – China’s foreign exchange reserves rose to their highest in more than a year in December and grew at a faster-than-expected pace, as tight regulations and a strong Yuan continued to discourage capital outflows. Notching up their 11th straight month of gains, foreign exchange reserves rose $20.2bn in December to $3.14tn, the highest since September 2016 and the biggest monthly increase since July. That compares with an increase of $10bn in November. Capital flight had been seen as a major risk for China at the start of 2017, but a combination of tighter capital controls and a faltering Dollar helped the Yuan stage a strong turnaround, bolstering confidence in the economy. The value of gold reserves rose to $76.47bn at the end of December, from $75.833bn at the end of November. (Reuters) Regional GCC’s Takaful outlook positive on strong underwriting profitability – The Islamic insurance (Takaful) industry in the GCC is expected to gain in terms of strong underwriting profitability, due to regulatory changes in some countries that have pushed up insurance prices, improving their profitability in 2018, according to Moody’s Analyst, Mohammad Ali Londe. The improved pricing, particularly in motor and medical cover has given the much needed push to the underwriting profitability of the region’s insurers who have been facing underwriting losses despite double-digit premium growth. Londe said, “The Takaful sector’s improved underwriting performance will help it halt capital erosion, attract fresh investor interest, and will allow it to focus on its most lucrative markets.” (GulfBase.com) Debt issuance to be a key theme in the GCC in 2018 – Debt issuance will be a key theme in the GCC region in the near-term, particularly as issuers take advantage of low longer-dated US rates, Bank of America Merrill Lynch (BofAML) stated. BofAML’s MENA economist, Jean Michel Saliba said Oman recently mandated banks for a triple-tranche deal (BofAML forecasts $8.5bn gross issuance this year) while Qatar is also expected to issue, particularly given $2bn Eurobond maturity this month (BofAML expects $10bn this year). Saudi Arabia is expected to issue $20bn worth of bond this year. Elsewhere, BofAML is underweight in respect of Kuwait and Abu Dhabi; although the balance sheets of both issuers are extremely strong (particularly given sovereign wealth assets); valuations are tight, with the search for yield likely to benefit higher- spread sovereigns. (Gulf-Times.com) Saudi Arabia to compensate about $13bn to its citizens – A package of handouts to Saudi Arabian citizens to compensate them for cost of living increases will cost the government about $13.3bn this year. Minister of Culture and Information, Awwad Bin Saleh Alawwad said, “The allocation of $13.3bn for this decree indicates the leadership’s concern for the people’s comfort and quality of living.” King Salman has ordered a monthly payment of SR1,000 to state employees over the year in compensation for the rising cost of living after Saudi Arabia hiked gasoline prices and introduced value-added tax. (Reuters) Restructuring Saudi Arabian power market to generate SR15bn in economic surplus – Restructuring Saudi Arabia’s power generation sector coupled with price reforms can deliver annual aggregate economic gains of more than SR15bn, according to King Abdullah Petroleum Studies and Research Center (KAPSARC). With the aim of helping policymakers achieve sufficient supply reliability during peak demand and reduce the inefficient consumption of energy, the study ‘Restructuring Saudi Arabia’s Power Generation Sector: Model-Based Insights’ developed a model to simulate the introduction of private generation companies in the power sector along with reforming fuel prices to an energy equivalent of $3 per MMBtu. (GulfBase.com) TADCO to acquire food business of Gulf Food Investment – Tabuk Agricultural Development Co. (TADCO) signed terms with Gulf Food Investment Co. to acquire its food business which to be transferred to new company. TADCO stated to invest up to SR30mn for 49% stake in the new company. (Reuters) Bahri Dry Bulk Company signs SR360mn Islamic credit facility – National Shipping Company of Saudi Arabia’s unit Bahri Dry Bulk Company signed SR360mn Islamic credit facility with Bank Albilad. National Shipping Company of Saudi Arabia stated that credit facility to be used to finance 80% cost of building four bulk carriers with Hyundai Heavy Industries. (Reuters) VAT on UAE banks’ fees and commissions will dent income slightly – The flourishing fees and commission business of banks and financial institutions in the UAE will be hit the hardest with the introduction of value added tax (VAT). However, the core business of lending in one of the region’s top financial hubs is exempted from the new levy. While the growth in fee and commission income business may slow down going forward, the scale of the impact will be limited. Banks usually generate only a small part of their overall revenues through this business and the impact on their bottom lines will be marginal. (GulfBase.com) Dubai’s residential property market remained stable in 2017 – Dubai’s residential property market remained stable fetching strong Returns on Investment (ROI) even as rents and sales prices softened in 2017, according to a report. The prevailing trend in Dubai property is the attractive ROI of 7% and 5% on

- 5. Page 5 of 6 apartments and villas YoY, respectively. This comes as average yearly rent in Dubai is on the decline. (GulfBase.com) REITs to fuel liquidity in Omani real estate sector – The Oman Real Estate Association (ORA), which has long campaigned for the legalization of Real Estate Investment Trusts (REITs) in Oman, welcomed announcement by the Capital Market Authority formally issuing the regulatory framework for the introduction and trading of new asset class on the Muscat Securities Market. The announcement affirmed that property owners and developers can now set up REITs based on existing, commercial, income-generating assets. (GulfBase.com) Bahrain Middle East bank increases issued and paid up capital – Bahrain Middle East Bank increased issued and paid up capital to $100mn, thereby providing the right impetus to its operations as a wholesale bank in the Kingdom, which seeks to expand and diversify its business. Bahrain Middle East Bank had successfully concluded rights issue, duly approved by its shareholders at its meeting held on October 22, 2017. (Reuters)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 QSE Index S&P Pan Arab S&P GCC 0.6% 1.4% 0.8% 0.5% 0.3% 0.2% 0.2% 0.0% 0.5% 1.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,319.35 (0.3) 1.3 1.3 MSCI World Index 2,156.60 0.6 2.5 2.5 Silver/Ounce 17.13 (0.5) 1.1 1.1 DJ Industrial 25,295.87 0.9 2.3 2.3 Crude Oil (Brent)/Barrel (FM Future) 67.62 (0.7) 1.1 1.1 S&P 500 2,743.15 0.7 2.6 2.6 Crude Oil (WTI)/Barrel (FM Future) 61.44 (0.9) 1.7 1.7 NASDAQ 100 7,136.56 0.8 3.4 3.4 Natural Gas (Henry Hub)/MMBtu 2.96 0.0 0.0 0.0 STOXX 600 397.35 0.7 2.3 2.3 LPG Propane (Arab Gulf)/Ton 94.00 0.7 (3.8) (3.8) DAX 13,319.64 0.9 3.3 3.3 LPG Butane (Arab Gulf)/Ton 91.87 (1.2) (13.0) (13.0) FTSE 100 7,724.22 0.5 0.8 0.8 Euro 1.20 (0.3) 0.2 0.2 CAC 40 5,470.75 0.8 3.2 3.2 Yen 113.05 0.3 0.3 0.3 Nikkei 23,714.53 0.5 3.6 3.6 GBP 1.36 0.1 0.4 0.4 MSCI EM 1,201.01 0.7 3.7 3.7 CHF 1.03 (0.0) (0.0) (0.0) SHANGHAI SE Composite 3,391.75 0.3 2.8 2.8 AUD 0.79 0.0 0.7 0.7 HANG SENG 30,814.64 0.2 2.9 2.9 USD Index 91.95 0.1 (0.2) (0.2) BSE SENSEX 34,153.85 0.6 1.2 1.2 RUB 56.99 0.2 (1.1) (1.1) Bovespa 79,071.47 0.4 5.9 5.9 BRL 0.31 0.2 2.6 2.6 RTS 1,219.89 0.5 5.7 5.7 89.8 89.6 84.2