QNBFS Daily Market Report April 19, 2020

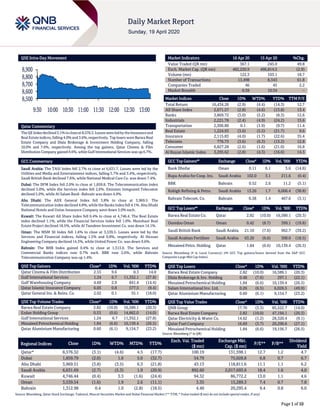

- 1. Page 1 of 10 QSE Intra-Day Movement Qatar Commentary The QE Indexdeclined 3.1%to closeat8,576.3. Losses were ledby the Insurance and Real Estate indices, falling 4.0% and 3.6%,respectively. Top losers were Barwa Real Estate Company and Dlala Brokerage & Investment Holding Company, falling 10.0% and 7.6%, respectively. Among the top gainers, Qatar Cinema & Film Distribution Company gained 9.6%, while Gulf International Services was up 6.7%. GCC Commentary Saudi Arabia: The TASI Index fell 2.7% to close at 6,631.7. Losses were led by the Utilities and Media and Entertainment indices, falling 5.7% and 3.4%, respectively. Saudi British Bank declined 7.6%, while National Medical Care Co. was down 7.4%. Dubai: The DFM Index fell 2.0% to close at 1,859.8. The Telecommunication index declined 5.0%, while the Services index fell 2.6%. Emirates Integrated Telecomm declined 5.0%, while Al Salam Bank -Bahrain was down 4.9%. Abu Dhabi: The ADX General Index fell 3.8% to close at 3,969.5. The Telecommunication index declined 4.8%, while the Banks index fell 4.1%. Abu Dhabi National Hotels and Union Insurance Company were down 5.0% each. Kuwait: The Kuwait All Share Index fell 0.4% to close at 4,746.4. The Real Estate index declined 1.1%, while the Financial Services index fell 1.0%. Munshaat Real Estate Project declined 18.5%, while Al Tamdeen Investment Co. was down 14.1%. Oman: The MSM 30 Index fell 1.6% to close at 3,539.5. Losses were led by the Services and Financial indices, falling 1.5% and 0.8%, respectively. Al Hassan Engineering Company declined 14.3%, while United Power Co. was down 9.6%. Bahrain: The BHB Index gained 0.4% to close at 1,313.0. The Services and Commercial Banks indices rose 0.7% each. BBK rose 2.6%, while Bahrain Telecommunication Company was up 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 2.53 9.6 0.3 14.8 Gulf International Services 1.24 6.7 11,352.1 (27.8) Gulf Warehousing Company 4.69 2.9 841.4 (14.4) Qatar Islamic Insurance Company 6.05 0.8 577.5 (9.4) Qatar General Ins. & Reins. Co. 2.02 0.1 55.1 (18.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Company 2.82 (10.0) 16,589.1 (20.3) Ezdan Holding Group 0.53 (0.6) 14,862.0 (14.0) Gulf International Services 1.24 6.7 11,352.1 (27.8) Mesaieed Petrochemical Holding 1.84 (6.6) 10,139.4 (26.5) Qatar Aluminium Manufacturing 0.60 (6.1) 9,154.7 (23.2) Market Indicators 16 Apr 20 15 Apr 20 %Chg. Value Traded (QR mn) 367.1 245.0 49.8 Exch. Market Cap. (QR mn) 482,220.9 496,814.5 (2.9) Volume (mn) 122.3 103.1 18.7 Number of Transactions 13,498 8,343 61.8 Companies Traded 46 45 2.2 Market Breadth 6:38 10:34 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,434.26 (2.9) (4.4) (14.3) 12.7 All Share Index 2,671.57 (2.8) (4.6) (13.8) 13.4 Banks 3,869.72 (3.0) (5.2) (8.3) 12.6 Industrials 2,221.78 (2.4) (4.9) (24.2) 15.6 Transportation 2,306.80 0.1 (1.9) (9.7) 11.4 Real Estate 1,224.93 (3.6) (5.5) (21.7) 9.6 Insurance 2,115.83 (4.0) (1.7) (22.6) 35.4 Telecoms 776.73 (3.6) (6.3) (13.2) 12.8 Consumer 6,827.28 (2.6) (1.6) (21.0) 16.8 Al Rayan Islamic Index 3,295.62 (2.8) (4.3) (16.6) 14.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bank Dhofar Oman 0.11 6.1 5.6 (14.6) Bupa Arabia for Coop. Ins. Saudi Arabia 102.0 3.1 211.6 (0.4) BBK Bahrain 0.52 2.6 11.2 (5.1) Rabigh Refining & Petro. Saudi Arabia 13.26 1.7 6,006.4 (38.8) Bahrain Telecom. Co. Bahrain 0.38 1.4 467.6 (3.1) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Barwa Real Estate Co. Qatar 2.82 (10.0) 16,589.1 (20.3) Ooredoo Oman Oman 0.42 (8.7) 399.1 (19.8) Saudi British Bank Saudi Arabia 21.10 (7.6) 962.7 (39.2) Saudi Arabian Fertilizer Saudi Arabia 63.20 (6.6) 308.0 (18.5) Mesaieed Petro. Holding Qatar 1.84 (6.6) 10,139.4 (26.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Company 2.82 (10.0) 16,589.1 (20.3) Dlala Brokerage & Inv. Holding 0.48 (7.6) 297.1 (22.1) Mesaieed Petrochemical Holding 1.84 (6.6) 10,139.4 (26.5) Salam International Inv. Ltd. 0.26 (6.5) 6,026.5 (49.9) Qatar Aluminium Manufacturing 0.60 (6.1) 9,154.7 (23.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 17.70 (3.3) 85,522.7 (14.0) Barwa Real Estate Company 2.82 (10.0) 47,194.1 (20.3) Qatar Electricity & Water Co. 14.62 (1.2) 28,320.4 (9.1) Qatar Fuel Company 16.69 (3.7) 20,290.6 (27.1) Mesaieed Petrochemical Holding 1.84 (6.6) 19,156.7 (26.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,576.32 (3.1) (4.6) 4.5 (17.7) 100.19 131,598.1 12.7 1.2 4.7 Dubai 1,859.79 (2.0) 1.6 5.0 (32.7) 54.79 75,028.8 6.8 0.7 6.7 Abu Dhabi 3,969.51 (3.8) (3.5) 6.3 (21.8) 43.13 118,811.6 11.1 1.1 6.2 Saudi Arabia 6,631.69 (2.7) (5.3) 1.9 (20.9) 892.60 2,017,693.6 18.4 1.6 4.0 Kuwait 4,746.44 (0.4) 3.3 (1.6) (24.4) 94.32 86,772.2 13.0 1.1 4.6 Oman 3,539.54 (1.6) 1.9 2.6 (11.1) 3.35 15,289.3 7.4 0.7 7.8 Bahrain 1,312.98 0.4 1.0 (2.8) (18.5) 4.40 20,295.4 9.4 0.8 6.0 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,500 8,600 8,700 8,800 8,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 10 Qatar Market Commentary The QE Index declined 3.1% to close at 8,576.3. The Insurance and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari and GCC shareholders. Barwa Real Estate Company and Dlala Brokerage & Investment Holding Company were the top losers, falling 10.0% and 7.6%, respectively. Among the top gainers, Qatar Cinema & Film Distribution Company gained 9.6%, while Gulf International Services was up 6.7%. Volume of shares traded on Thursday rose by 18.7% to 122.3mn from 103.1mn on Wednesday. However, as compared to the 30-day moving average of 135.5mn, volume for the day was 9.7% lower. Barwa Real Estate Company and Ezdan Holding Group were the most active stocks, contributing 13.6% and 12.1% to the total volume, respectively. Source: Qatar Stock Exchange (*as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2020 % Change YoY Operating Profit (mn) 1Q2020 % Change YoY Net Profit (mn) 1Q2020 % Change YoY Phoenix Power Co. Oman OMR 19.3 6.6% – – (5.3) N/A Dhofar Fisheries & Food Ind. Co. Oman OMR 2.8 -11.5% – – 0.2 125.3% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/16 US US Census Bureau Building Permits Mar 1,353k 1,296k 1,464k 04/16 US Department of Labor Initial Jobless Claims 11-Apr 5,245k 5,500k 6,615k 04/16 US Department of Labor Continuing Claims 4-Apr 11,976k 13,260k 7,446k 04/16 US Bloomberg Bloomberg Consumer Comfort 12-Apr 44.5 – 49.9 04/16 EU Eurostat Industrial Production SA MoM Feb -0.10% -0.10% 2.30% 04/16 EU Eurostat Industrial Production WDA YoY Feb -1.90% -1.90% -1.70% 04/17 EU Eurostat CPI YoY Mar 0.70% 0.70% 0.70% 04/17 EU Eurostat CPI MoM Mar 0.50% 0.50% 0.50% 04/17 EU Eurostat CPI Core YoY Mar 1.00% 1.00% 1.00% 04/16 Germany German Federal Statistical Office CPI MoM Mar 0.10% 0.10% 0.10% 04/16 Germany German Federal Statistical Office CPI YoY Mar 1.40% 1.40% 1.40% 04/17 Japan Ministry of Economy Trade and Industry Industrial Production MoM Feb -0.30% – 0.40% 04/17 Japan Ministry of Economy Trade and Industry Industrial Production YoY Feb -5.70% – -4.70% 04/17 China National Bureau of Statistics GDP YoY 1Q2020 -6.80% -6.00% 6.00% 04/17 China National Bureau of Statistics GDP SA QoQ 1Q2020 -9.80% -12.00% 1.50% 04/17 China National Bureau of Statistics GDP YTD YoY 1Q2020 -6.80% -6.00% 6.10% 04/17 China National Bureau of Statistics Industrial Production YoY Mar -1.10% -6.20% – 04/17 China National Bureau of Statistics Industrial Production YTD YoY Mar -8.40% -10.00% -13.50% 04/17 China National Bureau of Statistics Retail Sales YoY Mar -15.80% -10.00% – 04/17 India Reserve Bank of India RBI Reverse Repo Rate 17-Apr 3.75% – 4.00% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 29.57% 18.14% 41,960,688.80 Qatari Institutions 22.99% 15.59% 27,139,254.63 Qatari 52.56% 33.73% 69,099,943.43 GCC Individuals 0.87% 0.39% 1,737,659.65 GCC Institutions 1.99% 0.73% 4,613,044.43 GCC 2.86% 1.12% 6,350,704.08 Non-Qatari Individuals 12.93% 8.66% 15,662,719.47 Non-Qatari Institutions 31.66% 56.48% (91,113,366.97) Non-Qatari 44.59% 65.14% (75,450,647.50)

- 3. Page 3 of 10 Earnings Calendar Tickers Company Name Date of reporting 1Q2020 results No. of days remaining Status IHGS Islamic Holding Group 19-Apr-20 0 Due QIGD Qatari Investors Group 19-Apr-20 0 Due QEWS Qatar Electricity & Water Company 19-Apr-20 0 Due QGTS Qatar Gas Transport Company Limited (Nakilat) 20-Apr-20 1 Due ERES Ezdan Holding Group 20-Apr-20 1 Due ABQK Ahli Bank 20-Apr-20 1 Due MRDS Mazaya Qatar Real Estate Development 21-Apr-20 2 Due IQCD Industries Qatar 21-Apr-20 2 Due CBQK The Commercial Bank 21-Apr-20 2 Due QNNS Qatar Navigation (Milaha) 22-Apr-20 3 Due QIMD Qatar Industrial Manufacturing Company 22-Apr-20 3 Due MCCS Mannai Corporation 22-Apr-20 3 Due VFQS Vodafone Qatar 22-Apr-20 3 Due QIIK Qatar International Islamic Bank 22-Apr-20 3 Due MCGS Medicare Group 22-Apr-20 3 Due UDCD United Development Company 22-Apr-20 3 Due DHBK Doha Bank 22-Apr-20 3 Due KCBK Al Khalij Commercial Bank 23-Apr-20 4 Due DBIS Dlala Brokerage & Investment Holding Company 23-Apr-20 4 Due NLCS Alijarah Holding 23-Apr-20 4 Due MARK Masraf Al Rayan 23-Apr-20 4 Due QCFS Qatar Cinema & Film Distribution Company 26-Apr-20 7 Due MPHC Mesaieed Petrochemical Holding Company 27-Apr-20 8 Due BLDN Baladna 27-Apr-20 8 Due QAMC Qatar Aluminum Manufacturing Company 28-Apr-20 9 Due AHCS Aamal Company 28-Apr-20 9 Due IGRD Investment Holding Group 28-Apr-20 9 Due GWCS Gulf Warehousing Company 28-Apr-20 9 Due GISS Gulf International Services 29-Apr-20 10 Due MERS Al Meera Consumer Goods Company 29-Apr-20 10 Due DOHI Doha Insurance Group 29-Apr-20 10 Due ORDS Ooredoo 29-Apr-20 10 Due AKHI Al Khaleej Takaful Insurance Company 30-Apr-20 11 Due Source: QSE News Qatar QGMD announces its willingness to meet the local market of medical masks – Qatari German Company for Medical Devices (QGMD) launched its new slogan “The safety of individuals and society in the State of Qatar, is our top priority”. In coordination with the ministry of Commerce & Industry and in terms of social responsibility and the effective role played by the QGMD as a national public shareholder company, its major shareholders are representatives of government entities in the country and in response to support the supreme committee for crisis management to lead global precautionary measures taken to limit the spread of the new corona virus. The company worked to ensure a strategic stock of medical masks that reached 10mn medical masks and is ready to meet the needs of the local market. Work is underway to increase the company's productivity of all medical supplies and will be announced soon. The company also has N95 series face masks ready for delivery. (QSE) MRDS to disclose its 1Q2020 financial statements on April 21 – Mazaya Real Estate Development Company (MRDS) announced its intent to disclose 1Q2020 financial statements on April 21, 2020. (QSE) ERES to hold investors relation conference call on April 21 – Ezdan Holding Group (ERES) will hold a conference on Investor Relations by telephone to discuss the financial results of 1Q2020, on April 21, 2020 at 1:30pm Doha time. (QSE) DBIS to hold investors relation conference call on April 28 – Dlala Brokerage & Investment Holding Company (DBIS) will hold a conference on Investor Relations by telephone to discuss the financial results of 1Q2020, on April 28, 2020 at 1:30pm. (QSE) QGRI discloses QCB’s resolution on the appointment of temporary board of directors – Qatar General Insurance & Reinsurance Company (QGRI) disclosed that bases on the resolution of the Governance of Qatar Central Bank (QCB) No. (5) for the year 2020 the following has been decided – (i) Ending the tenure of the board of directors of QGRI, (ii) The appointment of

- 4. Page 4 of 10 a temporary board of directors for a tenure of one year, renewable as follows (a) Hamad Mohammad Hamad Al-Mana (Chairman of the board) (b) Sheikh Khalifa bin Jassim bin Mohammad Al Thani (Deputy Chairman) (c) Faleh Al-Nasr (Board member) (d) Ali Saleh Al Fadala (Board member) (e) Nawaf Ibrahim Al-Mana (Board Member), (iii) The temporary board of directors to carry out its responsibilities per the company bylaws and the other duties specified in the resolution No. (5) for the year 2020, (iv) The general assembly meeting will be postponed until the temporary board of directors and the relevant authorities decide on a new date, (v) All the concerned bodies must implement the said resolution as of date of issuance and all contrary decisions are cancelled. (Gulf-Times.com) BRES sees rise in occupancy levels – Barwa Real Estate Company (BRES) is expecting an improvement in occupancy levels in its investment portfolio in the short to medium term with the 2022 FIFA World Cup approaching, according to the company’s Chairman, HE Salah bin Ghanem bin Nasser Al-Ali. During the company’s Annual General Meeting (AGM) held recently, Al-Ali said that for the long term BRES believes in the Qatar National Vision 2030, which is the main drive of long-term growth. He said, “In terms of future plans, BRES aims during the year 2020 to work on various aspects which the group considers the pillar of the business. Increase in revenue is one of those aspects, which achieve sustainable growth for BRES revenues and returns for its shareholders, through achieving a balanced mix of operational projects that meets the need of the real estate market in Qatar, and lower the potential of risks linked to it.” He said reducing cost is another aspect of focus for BRES in 2020 by reviewing operational and administrative and financing costs to ensure maximum benefit and reduce cost without affecting the quality of the projects and services provided. (Gulf-Times.com) Dividend distribution for BRES for 2019 and previous fiscal years – Barwa Real Estate Company (BRES) announced to its shareholder that the cash dividend for the fiscal year 2019 and previous fiscal years, can be collected via: (i) Cash dividend collection from any branch of QNB Group as of April 19, 2020. (ii) Bank transfer to their relevant bank accounts registered with Qatar Central Securities Depository Company. (Gulf-Times.com) Moody’s: Hamad Port expansion to support Qatar’s non- hydrocarbon growth – Qatar’s plans to accelerate the Hamad Port expansion project by bringing it forward to 2020 from an initial target date of 2030 will support the country’s non- hydrocarbon growth over the next several years, Moody’s Investor Service (Moody’s) has said in an update. On completion, the Hamad Port will be one of the largest deep-water seaports in the world with a capacity of 12mn twenty-foot equivalent units (TEUs), Moody’s said. “However, these plans are likely to be delayed due to the effects of the coronavirus pandemic,” Moody’s said. In the medium term, Moody’s expects Qatar’s overall growth to accelerate during 2022-2024 because of the country’s hosting of the FIFA World Cup in 2022 and the investment spending on the expansion of LNG output capacity. During the course of 2023-27, Qatar Petroleum is targeting to increase its LNG production capacity to 110mn to 126mn tons per year from 77.5mn tpy. “We expect real hydrocarbon output to remain flat in 2020, after an unexpected decline of 1.9% in 2019, whereas we are assuming that the non-hydrocarbon sector contracts 1%, after growing 1.1% in 2019. Nevertheless, the risks to these growth projections are skewed to the downside. We expect the hydrocarbon sector to remain a drag on growth until at least 2025, when we expect the new LNG trains to start coming on stream,” Moody’s said. Moody’s has reduced its year- average assumptions for the Brent crude benchmark oil price to $40-$45 a barrel in 2020 and $50-$55 in 2021, a 33% and 17% decline from the 2019 average, respectively. Moody’s said, “The impact of lower prices will take time to filter through in Qatar as the hydrocarbon exports are mainly liquefied natural gas (LNG) sold on long-term contracts with pricing that follows oil prices with a three to six month lag. For Qatar, this means that the bulk of the fiscal impact of lower oil prices will materialize during the second half of 2020 and in 2021. We expect that lower oil prices will reduce government revenue by about 5% of GDP in 2020 and another 2% of GDP in 2021. We in turn expect Qatar to post a fiscal deficit of 1.6% of GDP in 2020, which will widen to 4.1% of GDP in 2021, compared to a surplus of 1% of GDP 2019.” (Gulf- Times.com) Moody’s: Qatar government debt mitigated by credible currency peg – Qatar’s high government debt and a relatively high share of foreign-currency debt is mitigated by a credible currency peg to the dollar, backed by its large external assets and the central bank’s foreign reserves, Moody’s Investor Service (Moody’s) has said in an update. Qatar’s ‘a1’ fiscal strength is above the initial score of ‘a3’, taking into account several considerations, it noted. According to Moody’s, government revenue is mostly denominated in foreign currency, including budgetary hydrocarbon revenue and extra-budgetary investment income from offshore assets held by the Qatar Investment Authority. Finally, entities included in its calculation of other non-financial public-sector debt have generally been profitable and the risk of their liabilities crystallizing on the government’s balance sheet is likely to be lower than the headline number would suggest. The national airline, Qatar Airways, which Moody’s expects to post losses as a result of the global coronavirus pandemic, has debt of only around 3% of GDP. “This debt is dwarfed by the QIA assets, which we estimate to be close to 180% of GDP in 2019. Our assessment of Qatar’s fiscal strength is also based on the government’s prudent budgeting, which has yielded persistent fiscal surpluses in the past while also softening the negative fiscal impact during the periods of oil price declines,” Moody’s said. The structural shift in the oil market since 2014 has eroded Qatar’s hydrocarbon income, which led to a significant fiscal deterioration in 2015-17, highlighting the degree of vulnerability to such oil price declines. “However, the fiscal breakeven oil price of around $55 per barrel implied by the 2020 budget is lower than for most other GCC sovereigns and below our medium-term oil price assumptions,” Moody’s said. The large assets accumulated during periods of high oil prices and managed by the sovereign wealth fund mostly offshore were available as a fiscal buffer since oil and gas prices fell in 2014, but the government has deliberately chosen debt financing over asset liquidation. This led to more than a doubling of Qatar’s government debt between 2014 and 2019. “We estimate that some of this additional borrowing was used to inject equity into the Qatar Central Bank and helped to boost its foreign currency reserves during 2014-15 and in 2018,” Moody’s noted. (Gulf-Times.com)

- 5. Page 5 of 10 Oxford Economics: Qatar’s real GDP growth forecast to bounce back in 2021 – Qatar’s real GDP growth has been forecast to bounce back next year with Oxford Economics saying it will grow by 5% YoY in 2021. Qatar’s real GDP growth forecast for 2021 will be well above the MENA’s average of 3.5% and among the best in the GCC region. Only Oman’s real GDP growth forecast of 5.6% will be better than that of Qatar in the region, Oxford Economics said in its latest ‘Weekly Economic Briefing’. Qatar’s current account (as a percentage of GDP) will also be in the positive territory (+2.9%) in 2021 from -2.6% this year. Oxford Economics noted the sharp oil output cuts agreed by OPEC+ countries in mid-April will cause deep recessions in oil- producing countries across the Middle East as they contend with both lower output and very weak oil prices, seen averaging just $33 per barrel in 2020. “We now see GDP contracting by 3.1% in GCC oil exporters in aggregate as oil/gas accounts for some 30%- 60% of their economies,” Oxford Economics said. Following weeks of oil price war and against the backdrop of collapsing oil demand, OPEC+ producers have agreed to slash output by almost 10mn bpd in May-June. The scale of the cuts is set to ease to 7.7mn bpd in second half (2H) and 5.8mn bpd thereafter as oil market imbalances begin to correct. However, in the near term, the oil market will remain in extreme oversupply, overwhelming storage capacity, as the standstill in global activity resulting from virus containment measures keeps oil prices severely depressed at around $30. Any price recovery beyond current levels will be conditional on a rebound in global demand, Oxford Economics said. (Gulf-Times.com) East Industrial Street Extension Upgrade Project nears completion – With the Public Works Authority (Ashghal) marching ahead with the development works, the East Industrial Street Extension Upgrade Project will be completed by mid 2020. Ashghal has completed more than 92% of the project. The project enhances movement of products and goods between Hamad Port or Hamad International Airport and the Industrial Area as well as many surrounding economic facilities such as the Asian Town, commercial centers, Free Zone and others. The project is a vital link for road users coming from southern areas such as Mesaieed, Al Wakrah and Al Wukair and help them directly reach the Industrial Area and up to Salwa Road and Al Furousiya Street to Al Rayyan and Al Gharrafa. It’s located between East Street 33 Interchange and Aba Al Seleel Interchange on G-Ring Road with a length of 2.5 kilometers and it integrates with other important projects such as G-Ring Road, Hamad Port Road and Industrial Area Road, Salwa Road and Al Furousiya Street which connects the south of the country with Doha west directly without the need to pass from the heart of Doha. Project works included expanding the road, which consisted of two lanes in each direction, to three and four lanes in each direction, development of the existing roundabout and constructing three traffic interchanges. (Gulf-Times.com) Qatari four LNG cargo headed for Belgium – Four LNG cargoes from Qatar set off for Zeebrugge, Belgium, expected to arrive April 28-May 9, ship-tracking data on Bloomberg showed. Qatar has been directing some of its LNG to Europe this month as buyers from India to South Korea is delaying purchases because inventories are full and the coronavirus is weakening demand. (Bloomberg) International World Bank says no 'free ride' for commercial creditors on debt relief – Commercial creditors need to support debt relief for the poorest countries and cannot just “free ride” on a suspension in debt payments by official bilateral creditors, World Bank President David Malpass told the Bank’s Development Committee on Friday. Malpass said the debt relief initiative agreed this week by theGroup of 20 economies and the Paris Club was a “huge achievement” to help the poorest countries deal with the health and economic impact of the new coronavirus pandemic. He said the Bank would look at ways of further extending support for the poorest countries, but cautioned that it was critical to protect the financial capacity, credit rating and low cost of funding offered by the Bank’s lending arms. (Reuters) US stalling massive IMF liquidity boost over Iran, China – US opposition to opening new avenues of funding for Iran and China is preventing the International Monetary Fund from deploying a powerful tool to help countries fight the economic impact of the coronavirus, according to two sources familiar with the matter. A massive IMF liquidity injection through issuance of new Special Drawing Rights, something akin to a central bank “printing” new money, has the backing of many finance ministers, prominent economists, and non-profit groups. It could provide hundreds of billions of dollars in urgently needed foreign exchange reserves for all of the IMF’s 189 member countries, and finance officials are debating the issue during this week’s virtual IMF and World Bank Spring Meetings. However, sources said the United States, the IMF’s dominant shareholder, actively opposed the new fundraising. The Trump administration does not want Iran and China to have access to billions of dollars in new resources with no conditions, two of the sources familiar with the IMF’s deliberations said, asking not to be identified given the sensitivity of the issue. They added that the IMF’s move would give even wealthy countries new assets that are not necessarily needed. Even embattled Venezuela would get an allocation, although the IMF has blocked Caracas’ access to its SDRs while international recognition of its government remains unclear. India also opposes a new SDR allocation, the two sources said, but New Delhi’s reasons have not been made known. A spokesman for India’s Finance Ministry did not respond to a request for comment. (Reuters) US leading indicator points to deep economic slump – A gauge of future US economic activity suffered a record decline in March, suggesting the economy could struggle to pull out of a deep slump caused by the novel coronavirus outbreak. The Conference Board said its index of leading economic indicators (LEI) tumbled 6.7% last month, the largest decrease in the series’ 60-year history. Data for February was revised down to show the index falling 0.2% instead of gaining 0.1% as previously reported. Economists polled by Reuters had forecast the index dropping 7.0% in March. “The sharp drop in the LEI reflects the sudden halting in business activity as a result of the global pandemic and suggests the US economy will be facing a very deep contraction,” said Ataman Ozyildirim, senior director of economic research at The Conference Board in Washington. States and local governments have issued “stay-at-home” or “shelter-in-place” orders affecting more than 90% of Americans to control the spread of COVID-19, the potentially lethal

- 6. Page 6 of 10 respiratory illness caused by the virus, and abruptly halting economic activity. The slump in the LEI added to a raft of dismal data published this week. At least 22mn people have filed for unemployment benefits in the last four weeks. Retail sales suffered a record drop in March and output at factories declined by the most since 1946. Homebuilding crumbled in March at a speed not seen in 36 years. Economists believe the economy contracted at its steepest pace since World War Two in the first quarter. The Conference Board’s coincident index, a measure of current economic conditions, fell 0.9% in March after increasing 0.3% in February. But the lagging index increased 1.2% last month after gaining 0.3% in February. (Reuters) Trump's coronavirus reopening plan has big holes, health experts say – The US economy has imploded in the past month amid aggressive measures to slow the spread of the novel coronavirus, with 22mn people filing for unemployment benefits and most factories, stores and other businesses at a virtual standstill. The governors of Michigan, Florida and other states outlined tentative steps on Friday to reopen their economies, a day after the White House issued guidelines to help states decide when to lift lockdown orders and allow firms to restart and workers to return to their jobs. President Donald Trump, a Republican who is running for re-election in November, touted the guidelines as a blueprint for a reawakening of the economy, saying growth would soar like a “rocket ship” after the restart. But the guidelines, and the ways in which experts say they fall short, suggest that revving activity back up to pre-pandemic levels will be anything but smooth or speedy. States may be ready to end lockdowns once infections have declined for 14 straight days, availability of tests to detect the virus is stable or rising, and if there is enough hospital capacity to treat everyone who gets sick, the guidelines say. They also call on states to be ready to test all healthcare workers and anybody with symptoms, as well as to be able to trace contacts for people who test positive for the virus. (Reuters) UK headed for historic slump as retail sales slide, firms close – Britain’s economy looks set for a widely feared record contraction after figures showed retail spending plunged by more than a quarter and one in four firms stopped trading temporarily due to the coronavirus lockdown. The British Retail Consortium (BRC) reported on Thursday a 27% YoY drop in sales in the two weeks to April 4, which included the period after the March 23 start of a lockdown that has shuttered shops other than supermarkets. “The closure of non-essential shops led to deserted high streets and high double-digit declines in sales which even a rise in online shopping could not compensate for,” BRC chief executive Helen Dickinson said. A separate survey from the Office for National Statistics showed 25% of businesses had temporarily closed or paused trading since the lockdown. In those businesses that remained open, a fifth of workers had been placed on temporary leave. Britain’s budget forecasters say the economy could be on track for an unprecedented 35% decline in the April-June period. Even if the lockdown eases and growth rebounds, annual output could still fall 13% in 2020, the biggest annual decline in over 300 years. Bank of England data, collected from March 2-20, showed lenders expect the biggest rise in business borrowing since the survey began in 2007 but for demand for new mortgages to fall by the most on record as the housing market freezes up. (Reuters) BoE's Bailey orders banks to 'put their backs into it' on COVID-19 loans – Bank of England (BoE) Governor Andrew Bailey told Britain’s banks on Friday to “put their backs into it” and speed up lending to small companies, saying the coronavirus crisis was likely to delivera historic blowto the economy. Bailey said banks needed to fix the “serious strain” from tens of thousands of applications for state-backed loans that are key to Britain’s bid to limit the impact of its coronavirus shutdown. He suggested checks on small loans were at fault. “Notwithstanding the stress that we’re all operating under in terms of the current working environment, they have got to put their backs into it and get on with it, frankly,” Bailey told reporters. Britain’s banks have provided only 1.1bn Pounds ($1.4bn) in emergency loans to small and medium-sized companies, data published this week showed. Bailey said giving 100% government guarantees to the smallest loans - compared with 80% in the plan as a whole - would speed up their disbursement, although any such decision was for Finance Minister Rishi Sunak. Bailey also said there was “nothing implausible” about a 35% fall in economic output between April and June, as laid out in a scenario by Britain’s budget forecasters this week. (Reuters) Eurozone inflation confirmed dipping to 0.7% in March – Eurozone inflation slowed sharply in March to 0.7% YoY, the European Union statistics said on Friday confirming its earlier estimates. Eurostat also confirmed its earlier estimates for core inflation figures in the 19-nation single currency bloc, whichalso point to weaker price increases last month. Overall inflation fell to 0.7% from 1.2% in February, Eurostat said, further away from the European Central Bank’s target of below, but close to 2% over the medium term. An indicator that excludes unprocessed food and energy prices, which the ECB calls core inflation and watches closely in policy decisions, showed prices grew 1.2% in annual terms, down from 1.3% in February, in line with previous estimates. An even narrower inflation measure also excluding alcohol and tobacco prices, that many market economists look at, slowed to 1.0% YoY in March from 1.2% in February, Eurostat said confirming its earlier estimates. (Reuters) Italy's firms shake lockdown using shortcut in coronavirus law – Weeks into Italy’s coronavirus lockdown, thousands of Italian entrepreneurs have been given a bureaucratic shortcut to market. The government last week extended non-essential business closures to May 3. But more than 100,000 mainly small- and medium-sized companies have applied to keep going or partially reopen. In principle, a key hurdle for companies to do business should be that they can prove they are part of a supply chain to businesses that are deemed “essential” in a government decree, such as food, energy or pharmaceutical companies. But the government, facing a backlog of applications, has clarified Italy’s lockdown laws to say no companies need to wait for government approval to go ahead. More than 105,000 firms have applied to be considered part of essential supply chains, the interior minister said on Wednesday, in a guideline on its website to clarify the lockdown rules. Of those, just over 2,000 have been turned down and told to suspend their business. More than 38,000 are being investigated and the rest are waiting to be looked at. The ministry said on Wednesday businesses that have previously submitted such requests can now “benefit from an immediate start” to their business. So unless companies have been told they are not critical, all they need to do is to inform

- 7. Page 7 of 10 their local authority that they plan to reopen. Then, without waiting for an answer, they can go ahead. (Reuters) IMF: Pandemic to bring Asia's 2020 growth to halt for first time in 60 years – Asia’s economic growth this year will grind to a halt for the first time in 60 years, as the coronavirus crisis takes an “unprecedented” toll on the region’s service sector and major export destinations, the International Monetary Fund said on Thursday. Policymakers must offer targeted support to households and firms hardest-hit by travel bans, social distancing policies and other measures aimed at containing the pandemic, said Changyong Rhee, director of the IMF’s Asia and Pacific Department. “These are highly uncertain and challenging times for the global economy. The Asia-Pacific region is no exception. The impact of the coronavirus on the region will be severe, across the board, and unprecedented,” he told a virtual news briefing conducted with live webcast. “This is not a time for business as usual. Asian countries need to use all policy instruments in their toolkits.” Asia’s economy is likely to suffer zero growth this year for the first time in 60 years, the IMF said in a report on the Asia-Pacific region released on Thursday. While Asia is set to fare better than other regions suffering economic contractions, the projection is worse than the 4.7% average growth rates throughout the global financial crisis, and the 1.3% increase during the Asian financial crisis in the late 1990s, the IMF said. The IMF expects a 7.6% expansion in Asian economic growth next year on the assumption that containment policies succeed, but added the outlook was highly uncertain. (Reuters) China's first quarter GDP posts first decline on record as virus shuts down economy – China’s economy shrank 6.8% in January-March from a year earlier, official data showed on Friday, the first such decline since at least 1992 when quarterly gross domestic product (GDP) records began. The historic slump in the world’s second-largest economy comes after efforts to contain the coronavirus, which first emerged in China late last year, shut down factories, transport and shopping malls. Similar shutdowns now in effect in major economies elsewhere have devastated global trade and suggest an immediate Chinese recovery is likely to be some way off. The decline was larger than the 6.5% forecast by analysts in a Reuters poll and reverses a 6% expansion in the fourth quarter of 2019. On a QoQ basis, GDP fell 9.8% in the first three months of the year, the National Bureau of Statistics said, which compared with expectations for a 9.9% contraction and 1.5% growth in the previous quarter. (Reuters) India toughens rules on investments from neighbors, seen aimed at China – India’s trade ministry said in a notification dated April 17 the changes to federal ruleson investment were meantto curb “opportunistic takeovers/acquisitions”. It did not mention China. Investments from an entity in a country that shares a land border with India will require government approval, it said, meaning they can not go through a so-called automatic route. “These times should not be used by other countries to take over our companies,” a senior government official told Reuters. Similar restrictions are already in place for Bangladesh and Pakistan. But up to now, they have not applied to China and India’s other neighbors including Bhutan, Afghanistan, Myanmar and Nepal. “This will certainly impact sentiment among Chinese investors. However, greenfield investments will not be impacted,” said Santosh Pai, a partner at Indian law firm Link Legal that advises several Chinese companies. Australia has also said all foreign investment proposals will be assessed by a review board during the coronavirus crisis to prevent a fire sale of distressed corporate assets. Germany has taken similar measures. A February report by research group Gateway House said Chinese foreign direct investment into India stood at $6.2bn. (Reuters) India says IMF liquidity boost may have costly side effects – India’s finance minister said on Thursday the country could not support a general allocation of new Special Drawing Rights by the International Monetary Fund because it might not be effective in easing coronavirus-driven financial pressures. Finance Minister Nirmala Sitharaman said in a statement to the IMF’s steering committee that she also was concerned that such a major liquidity injection could produce potentially costly side- effects if countries used the funds for “extraneous” purposes. Sitharaman joined US Treasury Secretary Steven Mnuchin in opposing a new SDR allocation, which would provide all 189 members with new foreign exchange reserves with no conditions. “In the current context of illiquidity and flights to cash, the efficacy of an SDR allocation is not certain, she said, adding that most countries rely on national reserves as a first line of defense. “Consequently, extraneous demands for these reserves, not related to domestic monetary and financial stability, would be costly, and hence cannot be supported,” she added. (Reuters) RBI surprises with reverse repo rate cut in bid to spur bank lending – The Reserve Bank of India (RBI) unexpectedly cut its key deposit rate on Friday, for the second time in three weeks, to discourage banks from parking idle funds with it and spur lending instead, to revive a flagging economy amid the coronavirus lockdown. This week, Prime Minister Narendra Modi extended until May 3 a lockdown of the population of 1.3bn as India’s tally of infections exceeded 10,000, despite the three- week shutdown ordered from March 24. The RBI cut its reverse repo rate by 25 basis points (bps) to 3.75% with immediate effect, Governor Shaktikanta Das told a video conference. The rate had already been cut by 90 bps on March 27. The central bank kept its benchmark lending or repo rate unchanged at 4.40% after a cut of 75 bps last month. Since his last address on March 27, Das said, India’s economic and financial landscape has “deteriorated precipitously” in some areas. Indian banks had been extremely wary of lending over the last few quarters as the economy cooled, and those fears have only increased in recent weeks as business activity collapsed. Banks have parked 4.36tn rupees ($57.02bn) on average with the RBI over the last three weeks, highlighting the extent of surplus rupee funds in the system. (Reuters) Regional OPEC says oil market undergoing ‘historic shock’ – The OPEC oil cartel said that the world market for crude is undergoing an unprecedented jolt due to coronavirus (COVID-19) mitigation measures that have decimated demand. “The oil market is currently undergoing a historic shock that is abrupt, extreme and at global scale,” said the group of producer nations in its latest monthly report. The cartel now forecasts a “historical drop” of around 6.8mn bpd in average daily demand for 2020. It sees the

- 8. Page 8 of 10 worst contraction of about 20mn bpd in April. Those forecasts are less severe than those released on Wednesday by the International Energy Agency, a Paris-based organization that advises major energy-consuming nations. It forecast the drop in demand in April to be around 29mbd, and 9.3mbd overall in 2020. (Peninsula Qatar) MENA M&As total $14.8bn in first quarter – The mergers and acquisitions (M&As) in the Middle East and North Africa (MENA) totaled $14.8bn in the first quarter of this year. Investment banking fees in the MENA reached an estimated $188.8mn in 1Q2020, up 11% from last year’s slow start, with triple digit gains recorded across M&As advisory and equity underwriting fees, said Refinitiv, a global provider of financial market data and infrastructure. The value of M&As in the review period was however 8% lower YoY. The number of deals has increased 4% over the same period. The monthly M&A has increased in value for the third consecutive month, with March 2020’s $6.1bn marking the highest monthly total in 11 months. Deals in theindustrials sector accounted for 43% of MENA target M&A activity in 1Q2020. Barclays topped any MENA involvement in the announced M&A financial advisor league table in 1Q2020 with a 49% market share. The MENA equity and equity-related issuance was $782.9mn in 1Q2020, more than four-times the value recorded in the year-ago period, despite a 50% decline in the number of deals. (Gulf-Times.com) Fitch: New Sukuk issuance is expected to rise – After witnessing strong market activity during the first two months of 2020, the coronavirus pandemic has put new international Sukuk issuance almost at a standstill in March, Fitch Ratings said. The pandemic has triggered major uncertainties in markets and many jurisdictions are facing an unprecedented combination of challenges, including health issues, reduced oil revenues, economic disruption, severe financial market dislocation and changes in liquidity and investor sentiment. While major uncertainties remain, once the financial landscape has settled and issuers and investors have readjusted, new sukuk issuances are expected to rise, led by high-rated sovereigns funding budget deficits, followed by financial institutions and corporates. Borrowing needs and fiscal deficits are set to expand in sukuk- issuing countries, like the GCC countries and Malaysia, which are net oil exporters, due to the oil price fall and the large economic stimulus packages launched to mitigate the coronavirus's fallout. (Zawya) Saudi Arabia to sell 600,000 barrels of oil per day to US in April – Saudi Arabia is set to sell about 600,000 barrels of crude per day to the US in April, which will be the highest volume in a year, Bloomberg reported, citing a Saudi industry official familiar with allocations to US refiners. The report comes as crude prices have plummeted since global demand collapsed on the coronavirus outbreak while Saudi Arabia and Russia produced oil flat out in race for market share. Global oil producers recently came to an agreement to reduce oil output by a record 20mn bpd. (Reuters) Saudi Aramco to supply full May crude volumes to some in Asia – Saudi Arabia, the world’s largest oil exporter, has notified some refiners in Asia that it will supply full contractual volumes of crude in May, sources said. State-run Saudi Aramco said on Friday it would supply customers in the Kingdom and abroad with about 8.5mn bpd of crude, reducing output in line with a global pact on reducing production to cope with falling demand. OPEC and allies including Russia, a group known as OPEC+, have agreed to cut output by 9.7mn bpd in May and June after oil prices hit 18-year lows amid a supply glut due to the coronavirus outbreak. Aramco has allocated about 4mn bpd of crude to Asian customers, about 2mn bpd lower than its full contractual volumes in the region, said a Saudi oil source familiar with the company’s plans. Although there has been no change in the volume of oil supplied to some Asian customers, Aramco has altered the ratio among its crude grades by increasing Arab Light quantities and reducing those of Arab Heavy, the first four sources said. Saudi Arabia, the world’s top oil exporter, is expected to cut production by 2.5mn bpd in May and June from a baseline of 11mn bpd, under terms of the supply deal. Saudi Aramco has made deep price reductions for crude it sells to Asia in May after fuel demand and complex refining margins in Singapore slumped. (Reuters) Saudi Arabia faces coronavirus crisis with strong reserves, low debt – Saudi Arabia is facing the global crisis from a position of strength, given its strong financial position and reserves, with relatively low government debt, its Finance Minister, Mohammed Al-Jadaan said, referring to the impact of the coronavirus outbreak. The Saudi government’s priorities are necessary resources for the health care system and financial and economic support to those affected by coronavirus, the minister was quoted as saying in a state news agency SPA report published early on Friday. It is also taking into account the re- prioritization of spending under the current circumstances, he said. The Finance Minister expected the global economy to fall into ‘the worst recession’ this year, saying it would be much worse than during the global financial crisis. The minister also stressed the need to adapt time-bound and transparent financial and monetary measures that will help lead to a rapid economic recovery and contain financial risks. He reiterated the Kingdom’s readiness to provide further support if necessary, saying they are closely monitoring the overall situation. (Reuters) Russia, Saudi Arabia ready to take actions on oil markets if necessary – Russian Energy Minister, Alexander Novak and his Saudi Arabian counterpart, Prince Abdulaziz bin Salman, held a phone talk on Thursday and said in a joint statement they were ready to take measures with other OPEC+ members on the oil market if necessary. They also said both Russia and Saudi Arabia were committed to the global oil cuts deal. OPEC and other large oil producers led by Russia, a group widely know as OPEC+, have agreed to reduce their combined oil production by 9.7mn bpd in May and June. (Reuters) G20 chair Saudi Arabia pledges $500mn to combat coronavirus – Saudi Arabia, the current G20 chair, said on Thursday it has pledged $500mn to support global efforts to combat the coronavirus pandemic and urged other countries and organizations to help bridge an $8bn financing gap. Riyadh said it would allocate $150mn to the Coalition for Epidemic Preparedness and Innovation, $150mn to the Global Alliance for Vaccines and Immunizations, and $200 million to other health organizations and program. In a statement, it called on all countries, non-governmental organizations, philanthropies and

- 9. Page 9 of 10 the private sector to help close a financing gap estimated at over $8bn to combat the COVID-19 pandemic. (Reuters) Saudia airline sees flight disruption until year-end – State- owned Saudi Arabian Airlines does not expect flight operations to return to normal until the end of the year and is asking some cabin crew employees to suspend their contracts until then, according to internal emails seen by Reuters. Saudi Arabia has suspended international flights and pilgrimages to the Muslim holy cities of Mecca and Medina, a major source of foreign visitors to the kingdom. “Flight operations shall not be returning to normal, until December 2020, expectedly,” the airline said in two separate emails to cabin crew in which they were requested to suspend their contracts from this month until the end of the year. It was not immediately clear how many cabin crew employees were being asked to suspend their contracts. (Reuters) Saudi Electricity sees lower costs offsetting 2020 revenue loss – Saudi Arabian government requires 30% discount on electricity bills for two months for commercial, agricultural and industrial customers, state-controlled Saudi Electricity stated. Commercial, industrial customers need to pay only 50% of bills for April, May, June; dues to be settled in six monthly installments starting 2021 with an option to delay payments. It expects lower operating costs to offset loss in 2020 revenue and also expects no impact from coronavirus measures in 2020 profit. (Bloomberg) MASQ's net profit falls 28.3% YoY to AED450.3mn in 1Q2020 – Mashreqbank (MASQ) recorded net profit of AED450.3mn in 1Q2020, registering decrease of 28.3% YoY. Net interest income and net income from Islamic products net of distribution to depositors fell 16.5% YoY to AED781.6mn in 1Q2020. Operating income fell 3% YoY to AED1,523.0mn in 1Q2020. Total assets stood at AED162.6bn at the end of March 31, 2020 as compared to AED159.4bn at the end of March 31, 2019. Loans and advances measured at amortized cost stood at AED62.8bn (+1.8% YoY), while customers’ deposits stood at AED78.0bn (+2% YoY) at the end of March 31, 2020. EPS came in at AED2.54 in 1Q2020 as compared to AED3.54 in 1Q2019. (DFM) Petrofac says Abu Dhabi National Oil Co ends $1.65bn Dalma gas contracts – Oilfield services provider Petrofac said on Thursday Abu Dhabi National Oil Company (ADNOC) has terminated the $1.65bn worth of contracts it had awarded to its Emirati unit for the Dalma gas development project. The contract was awarded to Petrofac Emirates two months ago and Petrofac said on Thursday it was “committed to working” with state-owned ADNOC in the coming weeks to explore alternative options. ADNOC had earlier said it would cut output as part of the OPEC+ deal. Shares of the company, which have been battered since a bribery probe into dealings in Saudi Arabia and Iraq, were down 11% in morning trade. (Reuters) Etihad has full support of state owner, will resume flights in May – Abu Dhabi’s Etihad Airways has the full support of its state shareholder as it plans a partial resumption of passenger flights from May 1, its Chief Executive, Tony Douglas said on Thursday. Several states have stepped in to assist airlines after the coronavirus outbreak virtually halted all international air travel, though the oil rich Abu Dhabi government has so far not said whether it would help the airline it owns. “The cumulative gains achieve by our ongoing transformation, and the unwavering support of our shareholder, has left us in a relatively strong position to withstand any instability,” Douglas said in a statement. (Reuters) Exemption for 1Q2020 financial results preparation and publication – Reference to Central Bank of Bahrain’s (CBB) circular no. OG/124/2020 dated March 30, 2020, in which all listed companies and financial institutions are exempted from the preparation and publication of the first quarter 2020 financial results, companies which have issued notice regarding the same include Bahrain Islamic Bank, National Bank of Bahrain (NBB), Bahrain Kuwait Insurance Company have announced the adoption of this exemption. (Bahrain Bourse) BKMB's net profit falls 27.4% YoY to OMR33.3mn in 1Q2020 – Bank Muscat (BKMB) recorded net profit of OMR33.3mn in 1Q2020, registering decrease of 27.4% YoY. Net interest income and income from Islamic financing rose 3.1% YoY to OMR81.2mn in 1Q2020. Operating profit fell 4.0% YoY to OMR65.0mn in 1Q2020. Net loans and Islamic financing stood at OMR9.0bn (- 1.2% YoY), while customer deposits and Islamic deposits stood at OMR8.2bn (+2.0% YoY) at the end of March 31, 2020. Net impairment for credit and other losses came in at OMR25.73 in 1Q2020 as compared to OMR13.46 in 1Q2019. (MSM)

- 10. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L.(“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the QatarFinancial Markets Authority and the QatarExchange.Qatar National Bank (Q.P.S.C.) is regulated by theQatarCentral Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 10 of 10 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 QSE Index S&P Pan Arab S&P GCC (2.7%) (3.1%) (0.4%) 0.4% (1.6%) (3.8%) (2.0%) (4.0%) (3.0%) (2.0%) (1.0%) 0.0% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,682.82 (2.0) (0.8) 10.9 MSCI World Index 2,017.51 2.7 2.3 (14.5) Silver/Ounce 15.18 (2.1) (2.5) (15.0) DJ Industrial 24,242.49 3.0 2.2 (15.1) Crude Oil (Brent)/Barrel (FM Future) 28.08 0.9 (10.8) (57.5) S&P 500 2,874.56 2.7 3.0 (11.0) Crude Oil (WTI)/Barrel (FM Future) 18.27 (8.1) (19.7) (70.1) NASDAQ 100 8,650.14 1.4 6.1 (3.6) Natural Gas (Henry Hub)/MMBtu 1.70 6.9 (2.3) (18.7) STOXX 600 333.47 2.9 (0.1) (22.4) LPG Propane (Arab Gulf)/Ton 38.50 9.2 20.8 (6.7) DAX 10,625.78 3.5 (0.1) (22.3) LPG Butane (Arab Gulf)/Ton 38.00 11.3 16.5 (42.8) FTSE 100 5,786.96 3.3 (0.6) (27.7) Euro 1.09 0.3 (0.6) (3.0) CAC 40 4,499.01 3.7 (0.8) (27.2) Yen 107.54 (0.4) (0.9) (1.0) Nikkei 19,897.26 3.3 2.8 (14.9) GBP 1.25 0.3 0.4 (5.7) MSCI EM 901.31 1.9 1.5 (19.1) CHF 1.03 0.3 (0.1) 0.1 SHANGHAI SE Composite 2,838.49 0.7 1.0 (8.4) AUD 0.64 0.6 0.3 (9.3) HANG SENG 24,380.00 1.6 0.4 (13.1) USD Index 99.78 (0.2) 0.3 3.5 BSE SENSEX 31,588.72 3.6 0.5 (28.8) RUB 73.97 (0.3) 0.3 19.3 Bovespa 78,990.30 1.6 (2.0) (47.8) BRL 0.19 0.1 (2.4) (23.2) RTS 1,078.69 1.1 (5.5) (30.4) 103.9 98.4 86.0