ECB Monetary Stimulus May Avoid Eurozone Deflation

•

1 like•840 views

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

More from QNB Group

More from QNB Group (20)

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 14, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - November 06, 2023 التحليل الفني اليومي ل...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 25, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 11, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 10, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - October 04, 2023 التحليل الفني اليومي لب...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 28, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 24, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 19, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 07, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 06, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - September 06, 2023 التحليل الفني اليومي ...

QNBFS Daily Technical Trader Qatar - August 31, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 31, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 24, 2023 التحليل الفني اليومي لبو...

QNBFS Daily Technical Trader Qatar - August 24, 2023 التحليل الفني اليومي لبو...

Recently uploaded

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALLVIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Call Girls

Booking Now open +91- 9352852248

Why you Choose Us- +91- 9352852248

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 9352852248

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$s07

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• HousewifeCall Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...roshnidevijkn ( Why You Choose Us? ) Escorts

Recently uploaded (20)

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

CBD Belapur Expensive Housewife Call Girls Number-📞📞9833754194 No 1 Vipp HIgh...

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Best VIP Call Girls Morni Hills Just Click Me 6367492432

ECB Monetary Stimulus May Avoid Eurozone Deflation

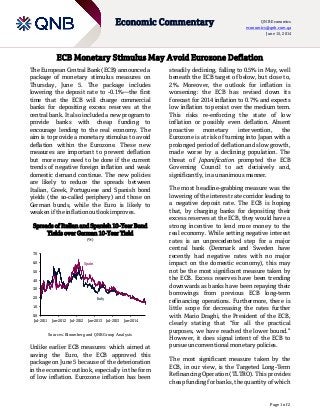

- 1. Page 1 of 2 Economic Commentary QNB Economics economics@qnb.com.qa June 15, 2014 ECB Monetary Stimulus May Avoid Eurozone Deflation The European Central Bank (ECB) announced a package of monetary stimulus measures on Thursday, June 5. The package includes lowering the deposit rate to -0.1%—the first time that the ECB will charge commercial banks for depositing excess reserves at the central bank. It also included a new program to provide banks with cheap funding to encourage lending to the real economy. The aim is to provide a monetary stimulus to avoid deflation within the Eurozone. These new measures are important to prevent deflation but more may need to be done if the current trends of negative foreign inflation and weak domestic demand continue. The new policies are likely to reduce the spreads between Italian, Greek, Portuguese and Spanish bond yields (the so-called periphery) and those on German bunds, while the Euro is likely to weaken if the inflation outlook improves. Spreads of Italian and Spanish 10-Year Bond Yields over German 10-Year Yield (%) Sources: Bloomberg and QNB Group Analysis Unlike earlier ECB measures which aimed at saving the Euro, the ECB approved this package on June 5 because of the deterioration in the economic outlook, especially in the form of low inflation. Eurozone inflation has been steadily declining, falling to 0.5% in May, well beneath the ECB target of below, but close to, 2%. Moreover, the outlook for inflation is worsening: the ECB has revised down its forecast for 2014 inflation to 0.7% and expects low inflation to persist over the medium term. This risks re-enforcing the state of low inflation or possibly even deflation. Absent proactive monetary intervention, the Eurozone is at risk of turning into Japan with a prolonged period of deflation and slow growth, made worse by a declining population. The threat of Japanification prompted the ECB Governing Council to act decisively and, significantly, in a unanimous manner. The most headline-grabbing measure was the lowering of the interest rate corridor leading to a negative deposit rate. The ECB is hoping that, by charging banks for depositing their excess reserves at the ECB, they would have a strong incentive to lend more money to the real economy. While setting negative interest rates is an unprecedented step for a major central bank (Denmark and Sweden have recently had negative rates with no major impact on the domestic economy), this may not be the most significant measure taken by the ECB. Excess reserves have been trending downwards as banks have been repaying their borrowings from previous ECB long-term refinancing operations. Furthermore, there is little scope for decreasing the rates further with Mario Draghi, the President of the ECB, clearly stating that “for all the practical purposes, we have reached the lower bound.” However, it does signal intent of the ECB to pursue unconventional monetary policies. The most significant measure taken by the ECB, in our view, is the Targeted Long-Term Refinancing Operation (TLTRO). This provides cheap funding for banks, the quantity of which 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 Jul-2011 Jan-2012 Jul-2012 Jan-2013 Jul-2013 Jan-2014 Spain Italy

- 2. Page 2 of 2 Economic Commentary QNB Economics economics@qnb.com.qa June 15, 2014 depends on the size of the banks’ loan book. Specifically, banks could initially borrow from the ECB up to 7% of their outstanding loans to non-financial private sector and households (excluding mortgages). The size of this entitlement is around EUR400bn. In addition, on a quarterly basis from March 2015 to June 2016, banks are also entitled to borrow up to three times the change in net lending in excess of a specific benchmark. The benchmark, however, is a very low one: it takes into account net lending to the nonfinancial private sector (excluding mortgages) in the 12 months prior to April 2014. During this period, JP Morgan estimates that net lending contracted by EUR150bn, which means banks will be entitled to an additional EUR450bn of cheap funding if they simply keep their loan book unchanged! Overall, TLTROs entitle banks to borrow up to EUR850bn cheaply and on very generous conditions. By way of comparison, excess liquidity at the ECB, which may be affected by the negative deposit rate, stands below EUR100bn. The aim of such large scale operation is to improve lending to the real economy. If slow lending in the Eurozone is due to supply constraints as banks are unable to obtain funding at reasonable costs, then TLTROs should help resolve the problem. However, part of the story may also be related to the need for banks to increase capital adequacy to meet higher Basel III requirements. The experience of a similar package in the United Kingdom, the Funding for Lending Scheme (of which TLTRO is a copy albeit a far more generous one), suggests that weak demand for loans and the need for banks to increase their capital adequacy might limit the effectiveness of the program. Financial markets seem to be have received the ECB’s package positively. Stock markets have rallied while the Euro was little changed after weakening by 2% against the US dollar in the run-up to the meeting. Sovereign bonds markets are where the reaction has been most aggressive, with Italian and Spanish yields declining by 30 basis point since the meeting. Going forward, we expect further declines in the spread of Spanish, Italian and periphery bonds in general over German bonds. The new measures are likely to improve the growth outlook in the Eurozone, reducing the default risk premium of periphery countries and therefore the yield they pay. Furthermore, TLTROs have no penalties for breaking the lending conditions, except an early repayment in September 2016. This still gives banks a two-year window for a carry trade by borrowing cheaply from the ECB and lending to periphery sovereigns and corporates at higher yield. The outlook for the Euro depends on whether the new measures by the ECB can provide a positive boost for inflation. If inflation improves, then the Euro is likely to weaken further on lower real interest rates. Contacts Joannes Mongardini Head of Economics Tel. (+974) 4453-4412 Rory Fyfe Senior Economist Tel. (+974) 4453-4643 Ehsan Khoman Economist Tel. (+974) 4453-4423 Hamda Al-Thani Economist Tel. (+974) 4453-4646 Ziad Daoud Economist Tel. (+974) 4453-4642 Disclaimer and Copyright Notice: QNB Group accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Where an opinion is expressed, unless otherwise provided, it is that of the analyst or author only. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. The report is distributed on a complimentary basis. It may not be reproduced in whole or in part without permission from QNB Group.