17 November Daily market report

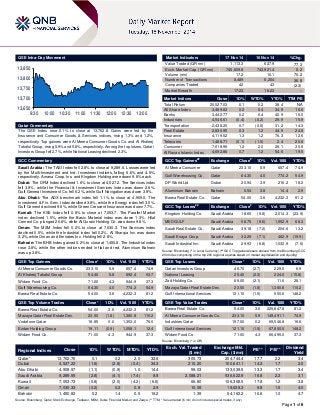

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.1% to close at 13,762.8. Gains were led by the Insurance and Consumer Goods & Services indices, rising 1.3% and 1.2%, respectively. Top gainers were Al Meera Consumer Goods Co. and Al Khaleej Takaful Group, rising 5.9% and 5.8%, respectively. Among the top losers, Qatari Investors Group fell 2.7%, while National Leasing declined 2.3%. GCC Commentary Saudi Arabia: The TASI Index fell 2.8% to close at 9,289.6. Losses were led by the Multi-Investment and Ind. Investment indices, falling 6.6% and 4.9%, respectively. Amana Coop. Ins. and Kingdom Holding were down 9.8% each. Dubai: The DFM Index declined 1.6% to close at 4,527.2. The Services index fell 3.9%, while the Financial & Investment Services index was down 2.6%. Gulf General Investment Co. fell 6.2%, while Gulf Navigation was down 3.9%. Abu Dhabi: The ADX benchmark index fell 1.1% to close at 4,909.0. The Investment & Fin. Serv. Index declined 3.8%, while the Energy index fell 3.5%. Gulf Cement declined 9.6%, while Green Crescent Insurance was down 7.7%. Kuwait: The KSE Index fell 0.8% to close at 7,053.7. The Parallel Market index declined 1.5%, while the Basic Material index was down 1.3%. Hilal Cement Co. plunged 20.8%, while Al Qurain Holding Co. was down 9.8%. Oman: The MSM Index fell 0.2% to close at 7,030.3. The Services index declined 0.5%, while the Industrial index fell 0.2%. Al Sharqia Inv. was down 3.2%, while Oman and Emirates Inv. Holding fell 2.8%. Bahrain: The BHB Index gained 0.2% to close at 1,450.8. The Industrial index rose 3.8%, while the other indices ended in flat and red. Aluminium Bahrain was up 3.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Meera Consumer Goods Co. 233.10 5.9 657.4 74.9 Al Khaleej Takaful Group 54.40 5.8 892.4 93.7 Widam Food Co. 71.00 4.3 944.9 37.3 Gulf Warehousing Co. 64.30 4.0 774.2 54.9 Barwa Real Estate Co. 54.00 3.6 4,232.3 81.2 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Co. 54.00 3.6 4,232.3 81.2 Mazaya Qatar Real Estate Dev. 23.50 (1.8) 1,380.8 110.2 Vodafone Qatar 18.85 0.0 1,353.0 76.0 Ezdan Holding Group 19.11 (0.9) 1,058.1 12.4 Widam Food Co. 71.00 4.3 944.9 37.3 Market Indicators 17 Nov 14 16 Nov 14 %Chg. Value Traded (QR mn) 1,113.3 627.9 77.3 Exch. Market Cap. (QR mn) 745,609.8 743,921.4 0.2 Volume (mn) 17.2 10.1 70.2 Number of Transactions 8,489 6,204 36.8 Companies Traded 42 43 (2.3) Market Breadth 17:23 16:23 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 20,527.03 0.1 0.2 38.4 N/A All Share Index 3,489.62 0.2 0.4 34.9 16.6 Banks 3,442.77 0.2 0.4 40.9 16.0 Industrials 4,546.61 (0.4) (0.2) 29.9 15.9 Transportation 2,438.20 0.7 (0.6) 31.2 14.3 Real Estate 2,830.95 0.3 1.2 44.9 24.8 Insurance 4,119.52 1.3 1.2 76.3 12.6 Telecoms 1,488.71 (0.1) (1.0) 2.4 20.6 Consumer 7,618.96 1.2 2.0 28.1 30.6 Al Rayan Islamic Index 4,692.86 0.7 1.2 54.6 19.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Al Meera Consumer Qatar 233.10 5.9 657.4 74.9 Gulf Warehousing Co. Qatar 64.30 4.0 774.2 54.9 DP World Ltd Dubai 20.94 3.9 216.2 18.2 Aluminium Bahrain Bahrain 0.54 3.8 14.4 2.9 Barwa Real Estate Co. Qatar 54.00 3.6 4,232.3 81.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Kingdom Holding Co. Saudi Arabia 18.65 (9.8) 2,014.3 (23.9) MEDGULF Saudi Arabia 58.75 (9.6) 1,952.9 68.3 Saudi Real Estate Co. Saudi Arabia 39.18 (7.2) 204.6 13.2 Saudi Enaya Coop. Saudi Arabia 32.29 (7.1) 462.9 (19.9) Saudi Industrial Inv. Saudi Arabia 29.93 (6.8) 1,032.9 (7.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 46.70 (2.7) 229.0 6.9 National Leasing 25.40 (2.3) 224.0 (15.8) Zad Holding Co. 89.00 (2.1) 11.6 28.1 Mazaya Qatar Real Estate Dev. 23.50 (1.8) 1,380.8 110.2 Gulf International Services 121.10 (1.5) 550.6 148.2 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 54.00 3.6 225,847.8 81.2 Al Meera Consumer Goods Co. 233.10 5.9 149,491.1 74.9 Industries Qatar 197.00 0.2 69,546.8 16.6 Gulf International Services 121.10 (1.5) 67,800.5 148.2 Widam Food Co. 71.00 4.3 66,495.0 37.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,762.76 0.1 0.2 2.0 32.6 305.73 204,744.4 17.7 2.2 3.4 Dubai 4,527.22 (1.6) (2.8) (0.4) 34.3 210.20 100,641.1 14.2 1.7 2.0 Abu Dhabi 4,908.97 (1.1) (0.9) 1.0 14.4 59.03 133,039.5 13.3 1.7 3.4 Saudi Arabia 9,289.55 (2.8) (4.1) (7.4) 8.8 2,088.21 536,622.9 16.8 2.2 3.1 Kuwait 7,053.73 (0.8) (2.0) (4.2) (6.6) 66.80 106,368.5 17.8 1.2 3.8 Oman 7,030.33 (0.2) 0.2 0.8 2.9 10.08 19,638.3 9.8 1.5 4.0 Bahrain 1,450.82 0.2 1.4 0.5 16.2 1.39 54,162.2 10.6 1.0 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, MSM, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,65013,70013,75013,80013,8509:3010:0010:3011:0011:3012:0012:3013:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.1% to close at 13,762.8. Insurance and Consumer Goods & Services indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. Al Meera Consumer Goods Co. and Al Khaleej Takaful Group were the top gainers, rising 5.9% and 5.8%, respectively. Among the top losers, Qatari Investors Group fell 2.7%, while National Leasing declined 2.3%. Volume of shares traded on Monday rose by 70.2% to 17.2mn from 10.1mn on Sunday. Further, as compared to the 30-day moving average of 13.5mn, volume for the day was 27.5% higher. Barwa Real Estate Co. and Mazaya Qatar Real Estate Development were the most active stocks, contributing 24.7% and 8.0% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change DP World Moody’s Dubai LT IR Baa3 Baa3 – Stable – Jebel Ali Free Zone (Jafza) Moody’s Dubai CFR/PDR Ba1/Ba1-PD Ba1/Ba1-PD – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, IR – Issuer Rating, CFR – Corporate Family Rating, PDR – Probability of Default Rating) Earnings Releases Company Market Currency Revenue (mn)3Q2014 % Change YoY Operating Profit (mn) 3Q2014 % Change YoY Net Profit (mn) 3Q2014 % Change YoY National Industries Group Holding (NI Group) Kuwait KD 25.5 10.1% – – 1.6 2590.0% International Financial Advisors (IFA) Kuwait KD 5.8 58.6% – – -2.1 NA HITS Telecom Kuwait KD – – – – -1.0 NA Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/17 US Federal Reserve Industrial Production MoM October -0.10% 0.20% 0.80% 11/17 US Federal Reserve Capacity Utilization October 78.90% 79.30% 79.20% 11/17 US Federal Reserve Manufacturing (SIC) Production October 0.20% 0.20% 0.20% 11/17 EU Eurostat Trade Balance SA September 17.7B 16.0B 15.4B 11/17 EU Eurostat Trade Balance NSA September 18.5B 18.0B 8.6B 11/17 France Ministry of Economy 3M T-Bill Amount Sold 17-November EU3,996M – EU3,996M 11/17 France Ministry of Economy 3M T-Bill Average Yield 17-November -0.02% – -0.01% 11/17 France Ministry of Economy 3M T-Bill Bid/Cover Ratio 17-November 3.2 – 2.6 11/17 France Ministry of Economy 6M T-Bill Amount Sold 17-November EU1,591M – EU1,592M 11/17 France Ministry of Economy 6M T-Bill Average Yield 17-November -0.01% – -0.01% 11/17 France Ministry of Economy 6M T-Bill Bid/Cover Ratio 17-November 4.0 – 4.0 11/17 France Ministry of Economy 12M T-Bill Amount Sold 17-November EU1,596M – EU1,591M 11/17 France Ministry of Economy 12M T-Bill Average Yield 17-November -0.01% – -0.01% 11/17 France Ministry of Economy 12M T-Bill Bid/Cover Ratio 17-November 4.2 – 4.3 11/17 UK Rightmove Rightmove House Prices MoM November -1.70% – 2.60% 11/17 UK Rightmove Rightmove House Prices YoY November 8.50% – 7.60% 11/17 Spain Ministerio de Ind., Energ Trade Balance September -2,373.7M – -2,772.0M 11/17 Italy ISTAT Trade Balance Total September 2,014M – 2,060M 11/17 Italy ISTAT Trade Balance EU September 480M – 344M Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 73.29% 71.49% 20,062,563.99 Non-Qatari 26.71% 28.52% (20,062,563.99)

- 3. Page 3 of 6 News Qatar QNBK wins two awards – QNB Group (QNBK) has secured two prestigious recognitions at The Global Investor/ISF Middle East Summit Awards 2014 ceremony held recently in Dubai. QNB Asset Management was the recipient of “Regional Asset Manager of the Year” Award, whilst QNB Financial Services (QNBFS), a subsidiary of the QNB Group specializing in the provision of brokerage services, won “The Best Broker in Qatar” Award. The achievements continue QNB’s domination of these particular Award categories in recent years and the success is greatly valued by all concerned within the respective business lines. (QNB Group Press Release) Qatar’s first solar power station to be ready in 2016 – The Qatar General Electricity & Water Corporation’s (Kahramaa) Head of Renewable Energy Technologies Section Saleh Hamad Al-Marri said the country’s first solar power station in Duhail is expected to be functional in 1Q2016. (Gulf-Times.com) Qatari Diar develops first project in Tajikistan allowing foreign ownership – Qatari Diar Real Estate Investment Company (Qatari Diar) has launched its Diar Dushanbe Project in Tajikistan, the first development in the Asian country to grant foreign ownership. The project is being constructed in Tajikistan’s capital, Dushanbe and consists of an area around 68,000 square meters, overlooking Lake Kuli Javanon and the Presidential Palace. The first phase comprising 67 residential buildings, an administrative building, central courtyard, as well as retail stores, has already been completed and is ready to be handed over to investors. Qatari Diar currently has 49 projects underway in more than 29 countries. (Bloomberg) ORDS, Al Jazeera sign major deal on media – Ooredoo (ORDS) and Al Jazeera Media Network signed an agreement to build an exclusive global media solution, which is one of the largest ever implemented by a broadcaster. ORDS will build a global broadcast and communication infrastructure that will connect Al Jazeera’s main hubs in Europe, the Middle East, the Americas, Asia and Africa, as well as linking various bureaus around the world. ORDS will provide support as an end-to-end service provider for the implementation of the media solution and its operation. (Gulf-Times.com) VFQS partners with QNBK to install SSMs across Qatar – Vodafone Qatar (VFQS) has partnered with QNB Group to rollout self-service machines (SSMs) across its stores in Qatar. Twenty five SSMs will be installed in 19 locations. Under the first phase, 19 machines have been set up in 14 locations including City Center Mall, Industrial Area, Ezdan Mall, Al Meera West Bay, Msheireb, Landmark Mall, Al Wakrah, Al Khor, Al Furousiyah, Al Nasr, Al Shafi Street, Al Gharrafah, Old Airport, and Lulu Hypermarket on D-Ring Road. The second phase will see SSMs being rolled out in Villaggio Mall, Lulu Al Gharrafah, Hyatt Plaza, and Lulu Al Khor Mall. These SSMs will allow VFQS’ post-paid customers to settle their monthly bills through cash or credit card, and prepaid customers to recharge. (Gulf- Times.com) International US manufacturing expands; Economists trim 4Q2014 growth forecasts – Manufacturing output in the US rose modestly in October as motor vehicle production fell for a third straight month, suggesting some slowdown in economic growth at the start of 4Q2014. However, growth remains relatively sturdy, with other data showing a rebound in factory activity in New York State this month. The Federal Reserve said factory production rose 0.2% in October, while September's increase was revised down to 0.2% from 0.5%. The US economy grew at a rate of 3.5% in 3Q2014. Meanwhile, economists trimmed their forecasts for economic growth in 4Q2014, but slightly raised their expectations for the rest of 2014 based on an improved outlook for the labor market. Analysts expect the economy to grow at an annual rate of 2.7% in 4Q2014. Earlier in 3Q2014 survey, growth for this quarter was forecast at 3.1%. The full- year growth for 2014 has been forecast at 2.2%, up from the previous estimate of 2.1%. (Reuters) UK PM sees warning lights for world economy – British Prime Minister David Cameron warned that the global economy was at risk of slipping back into crisis, as the Eurozone and emerging economies slow down and geopolitical risks rise. Cameron said six years after the financial crash that brought the world to its knees, red warning lights are flashing once again on the dashboard of the global economy. Cameron, facing a national election in May 2015, sought to contrast the situation in many struggling economies with Britain's strong growth over the past year and a half. Cameron said various factors such as the risk of a recession in the Eurozone, the slowing of emerging economies, stalled global trade talks, the Ebola epidemic and conflicts in the Middle East and Ukraine have made for an uncertain outlook for the world economy. Cameron further added that his government would stick to its plan to cut Britain's budget deficit and bring down public debt. (Reuters) Draghi: ECB stimulus gains traction, ready to do more if needed – The European Central Bank's (ECB) President Mario Draghi said stimulus is gaining traction, but should it turn out that its current efforts are not sufficient to accelerate the Eurozone recovery, the ECB is ready to do more. Draghi said Eurozone growth momentum had weakened over the summer, but the ECB's policy steps and Eurozone reforms should still lead to a moderate recovery in 2015 and in 2016. Draghi said the ECB sees early indications that its credit easing package is delivering tangible benefits, adding that more time was needed for the latest measures to unfold. The ECB is pumping more money into the banking system to unblock lending to households and companies by offering banks new long-term loans, and by buying securitized private debt off their balance sheets. (Reuters) Japan seeks to strengthen 2015 growth after recession hit – Japanese Prime Minister Shinzo Abe’s administration is taking steps to shore up economic growth for 2015 after the country slumped into its fourth recession since 2008, threatening to wreck the Abenomics reflation program. Economy Minister Akira Amari said there is a high chance of a stimulus package. Etsuro Honda, an adviser to Abe, said a 3tn yen program was appropriate and should go toward measures that directly help households such as child care support. According to the Bloomberg median estimate, Abe is also considering to postpone an October 2015 sales-tax increase until 2017 – a move that would add 0.3 percentage point to growth in the coming fiscal year. At stake for the prime minister is an assuring re-election in a likely snap vote next month that may serve as a referendum on his policies. (Bloomberg) Australian, Indian leaders target free-trade pact – Australian Prime Minister Tony Abbott and Indian Prime Minister Narendra Modi said the two countries are pushing for a free trade pact. Australia on November 17 finalized a landmark free trade deal with China, significantly expanding ties between the world's second-largest economy and one of Washington's closest allies in Asia. However, trade between Australia and India currently stands at around $15bn a year, or just a tenth of that between Australia and China. Modi, in his address to the Australian

- 4. Page 4 of 6 parliament, pledged greater cooperation on regional security, issuing a veiled swipe at China over disputes with its neighbors regarding islands in the South China Sea. (Reuters) Regional HDER to launch operations in Doha – US-based Hertz Corporation has announced that Hertz Dayim Equipment Rental (HDER) is planning to launch operations in Qatar as part of a joint venture agreement between Hertz Equipment Rental Corporation, Dayim Holdings and Phoenix Project Development of the Al-Attiyah Motors & Trading Group. Following the success of its four-year partnership in Saudi Arabia, Hertz-Dayim will now in addition, rent and sell equipment and tools to construction and industrial markets throughout Qatar. HDER is planning to open its first Qatar operations in Doha. (Bloomberg) Saudi FM: Falling oil prices will not have any direct impact on Saudi budget – Saudi Arabia's finance minister (FM), Ibrahim Alassaf said that the recent plunge in oil prices will not have any direct impact on Saudi Arabia's budget as the Kingdom takes precautions to handle all possibilities in terms of planning its finances. The Kingdom's 2015 budget plan is expected to be announced in late December. Its original 2014 budget projected spending would rise a modest 4.3% from the 2013 plan to SR855bn, the slowest rate in a decade, suggesting the Kingdom was already starting to curb expenditure after years of huge increases. (Reuters) Central Bank: Stable inflation expected in Saudi Arabia in 4Q2014 – Saudi Arabia's central bank expects inflation to remain relatively stable in 4Q2014 due to the strengthening dollar and easing food price pressures. Inflation in the Kingdom, which pegs its riyal currency to the dollar, eased to an annual 2.6% in October from 2.8% in September. (Reuters) Asharq al-Awsat: Saudi to open stock market to foreigners before April – Asharq al-Awsat newspaper reported that foreign institutional investors are expected to begin direct trading of Saudi Arabian stocks before April 2015. According to the newspaper, the Saudi Capital Market Authority is preparing to announce the final list of foreign direct investment (rules) before the end of 2014, which enhances the opportunity by allowing foreign investors to directly buy and sell in the local stock market before April. (Reuters) US DoC: UAE exports to US jump by 17% – According to data released by the US Department of Commerce (DoC), the UAE exports to the US jumped by around 17% to AED7.85bn in 9M2014 as compared to around AED6.72bn in 9M2013, while imports from the US dropped by around 14% to AED58.54bn in 9M2014 as compared to AED68.63bn in 9M2013. The total value of trade between the two countries reached AED66.43bn in the 9M2014, falling by 11% from the same period of 2013 when the total value of trade between the two countries reached AED74.87bn. The robust growth of the UAE exports and the drop of its imports caused the deficit in the UAE’s balance of trade with the US dropping by around 17.5% to AED50.68bn in the 9M2014 as compared to AED61.44bn in the corresponding period of 2013. (GulfBase.com) UAE Central Bank: Bank lending within prudential ratios – The UAE’s Central Bank Governor, Mubarak al-Mansouri said that bank lending in the UAE remains within prudential ratios set by the central bank, with the ratio of loans & advances to stable resources of banks reaching 86%. The loan book on a gross basis has increased by an annual average rate of around 5% during the 2010-2013 period and around 8% during 9M2014, while bank deposits increased by an average of around 7% and 11%, respectively. The gross YoY bank lending growth in the UAE climbed to 8.6% in September 2014 from 7.2% in August 2014. (Reuters) DPR signs MoU with Emirates – Dubai Parks & Resorts (DPR), a subsidiary of Meraas Holding, has signed a MoU with Emirates to collaborate as a key partner in its leisure and entertainment development taking shape in Dubai. As part of the agreement, the two organizations will exchange knowledge and expertise specifically around marketing coordination and destination management. The MoU will also allow DPR and Emirates to explore areas where synergies can be developed. The collaboration will further support Dubai Tourism Vision 2020 that seeks to double the number of annual visitors from 10mn to 20mn. (GulfBase.com) UAB inks agreement with NDDSF – United Arab Bank (UAB) has signed an agreement with the Nationals’ Defaulted Debts Settlement Fund (NDDSF), to settle the debts of Emirati customers incapable of fulfilling their liabilities to the bank. The initiative, targeted at Emirati borrowers with debts less than AED5mn, will reduce the burden of personal loans of defaulters. UAB agreed to waive 50% of debtors’ loans. The other half will be settled by NDDSF, to be reimbursed by deducting payments from the debtor’s salary. (ADX) Al Rai: Kuwait to let banks trade derivatives – Kuwaiti daily, Al Rai reported that the central bank has informed treasury managers at banks that it no longer objects to Kuwaiti banks dealing in derivatives with foreign banks, as long as they deal in products approved by the central bank regulations. The central bank clamped down on derivatives trading in 2008 as Kuwaiti banks were hit hard by the debt problems of local investment firms during the global financial crisis. (Reuters) NBK: Kuwait's trade surplus retreats in 2Q2014 – According to a report released by National Bank of Kuwait (NBK), Kuwait's trade surplus narrowed slightly for the third consecutive quarter in 2Q2014, to KD5.7bn. The surplus has been coming off its peak in 3Q2013 on the back of softer oil export growth and the continued decline in non-oil exports (mostly petrochemical products). However, with the trade surplus projected at 47% of its GDP in 2014, it remains one of the largest by global standards. Oil exports declined 2.4% YoY, while non-oil exports fell 3.2% YoY in 2Q2014. Meanwhile, imports grew 5.4% YoY in 2Q2014. (Reuters) Omani companies enter into contracts worth OMR44mn – Business opportunities forum, an event held at the Oman International Exhibition Center, witnessed contracts worth OMR44mn being signed between large corporate houses and small and medium enterprises (SMEs). As many as 45 companies engaged in various fields such as oil & gas, construction, railway, power generation, metal, logistics, port and aluminum have inked agreements for awarding contracts to 160 SMEs. (GulfBase.com) GFH unveils new identity in major push for growth – Gulf Finance House (GFH) is implementing major changes to its business strategy as it turns from being an investment bank to a financial group. The company will change its brand, logo and colors in line with the new plan, and to reflect its new ambitions. (DFM, GulfBase.com) Mumtalakat to price benchmark-sized Sukuk – According to a document from lead arrangers, Mumtalakat is aiming to price an Islamic bond issue of benchmark size with seven years duration. The benchmark size is typically understood to mean upwards of $500mn. (Reuters) Oman TRA: Omantel gradually restoring services – Oman’s Telecommunications Regulatory Authority (TRA) said that Oman

- 5. Page 5 of 6 Telecommunications Company (Omantel) services are being restored gradually through its own network. Explaining about the breakdown of the services, TRA said that it received a notification from Omantel on 17th November 2014, about the interruption of telecommunications services all over the Sultanate (both mobile and fixed line). Later TRA announced that it is facilitating Oman Qatar Telecommunication Company (Ooredoo) the activation of national roaming with Omantel. This arrangement is expected to be in force till the resolution of Omantel's network outage. (Bloomberg)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Stock Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg, *$ adjusted returns. 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Oct-10 Oct-11 Oct-12 Oct-13 Oct-14 QSE Index S&P Pan Arab S&P GCC (2.8%) 0.1% (0.8%) 0.2% (0.2%) (1.1%) (1.6%) (3.2%) (2.4%) (1.6%) (0.8%) 0.0% 0.8% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,186.55 (0.2) (0.2) (1.6) DJ Industrial 17,647.75 0.1 0.1 6.5 Silver/Ounce 16.14 (1.0) (1.0) (17.1) S&P 500 2,041.32 0.1 0.1 10.4 Crude Oil (Brent)/Barrel (FM Future) 79.31 (0.1) (0.1) (28.4) NASDAQ 100 4,671.00 (0.4) (0.4) 11.8 Natural Gas (Henry Hub)/MMBtu 4.22 4.5 4.5 (2.9) STOXX 600 337.25 (0.0) (0.0) (7.3) LPG Propane (Arab Gulf)/Ton 79.25 (1.9) (1.9) (37.4) DAX 9,306.35 0.0 0.0 (12.1) LPG Butane (Arab Gulf)/Ton 107.13 (1.6) (1.6) (21.1) FTSE 100 6,671.97 0.1 0.1 (6.7) Euro 1.25 (0.6) (0.6) (9.4) CAC 40 4,226.10 0.03 0.0 (11.2) Yen 116.65 0.3 0.3 10.8 Nikkei 16,973.80 (3.1) (3.1) (6.0) GBP 1.56 (0.2) (0.2) (5.5) MSCI EM 985.88 (0.5) (0.5) (1.7) CHF 1.04 (0.6) (0.6) (7.5) SHANGHAI SE Composite 2,474.01 (0.1) (0.1) 15.5 AUD 0.87 (0.5) (0.5) (2.3) HANG SENG 23,797.08 (1.2) (1.2) 2.1 USD Index 87.93 0.5 0.5 9.9 BSE SENSEX 28,177.88 0.3 0.3 33.2 RUB 47.20 (0.2) (0.2) 43.6 Bovespa 51,256.99 (1.2) (1.2) (9.8) BRL 0.38 (0.3) (0.3) (9.4) RTS 1,004.13 0.4 0.4 (30.4) 197.8 147.4 134.0