The Pentecostal Credit Union Ltd - 39th Annual General Meeting

- 1. From 6pm, 23 March 2019 At Tooting Neighbourhood Centre 28 Glenburnie Road, London SW17 7PJ The Pentecostal Credit Union Ltd 39th Annual General Meeting

- 3. AGM agenda 1. Welcome 2. Prayer 3. Song: Bless the Lord O My Soul 4. Scripture: Proverbs 16 vs. 1-16 5. Apologies 6. Minutes of last AGM: 24 March 2018 7. Matters arising 8. Directors’ report 9. Presentation from the Youth Shadow Board 10. Song: How Great is our God 11. Keynote speaker: Pastor Cornelius and Dr Christine Brown from The Mind Café: Black mental health and our young people 12. Loan report 13. Audit Committee report 14. Nominations for the Board 15. PCU Financial Statements a. Directors’ report and recommendation of dividend b. Independent auditors’ report c. Accounts 16. Appointment of auditor 17. Raffle 18. Song: Hear My Cry O Lord 19. Close in prayer

- 4. 2 Prayer: St Francis of Assisi Lord, make me an instrument of Thy peace; Where there is hatred, let me sow love; Where there is injury, pardon; Where there is error, truth; Where there is doubt, faith; Where there is despair, hope; Where there is darkness, light; And where there is sadness, joy. O Divine Master, Grant that I may not so much seek To be consoled as to console; To be understood as to understand; To be loved as to love. For it is in giving that we receive; It is in pardoning that we are pardoned; And it is in dying that we are born to eternal life.

- 5. 3 Chorus Bless the Lord oh my soul Oh my soul Worship His Holy name Sing like never before Oh my soul I’ll worship Your Holy name The sun comes up It’s a new day dawning It’s time to sing Your song again Whatever may pass And whatever lies before me Let me be singing When the evening comes Chorus You’re rich in love And You’re slow to anger Your name is great And Your heart is kind For all Your goodness I will keep on singing Ten thousand reasons For my heart to find Bless the Lord O My Soul Chorus Bless You Lord And on that day When my strength is failing The end draws near And my time has come Still my soul will Sing Your praise unending Ten thousand years And then forever more Chorus

- 6. 4 Scripture: Proverbs 16 vs. 1-16 16 We may make our plans, but God has the last word. 2 You may think everything you do is right, but the LORD judges your motives. 3 Ask the LORD to bless your plans, and you will be successful in carrying them out. 4 Everything the LORD has made has its destiny; and the destiny of the wicked is destruction. 5 The LORD hates everyone who is arrogant; he will never let them escape punishment. 6 Be loyal and faithful, and God will forgive your sin. Obey the LORD and nothing evil will happen to you. 7 When you please the LORD, you can make your enemies into friends. 8 It is better to have a little, honestly earned, than to have a large income, dishonestly gained. 9 You may make your plans, but God directs your actions. 10 The king speaks with divine authority; his decisions are always right. 11 The LORD wants weights and measures to be honest and every sale to be fair. 12 Kings cannot tolerate evil, because justice is what makes a government strong. 13 A king wants to hear the truth and will favour those who speak it. 14 A wise person will try to keep the king happy; if the king becomes angry, someone may die. 15 The king’s favour is like the clouds that bring rain in the springtime – life is there. 16 It is better – much better – to have wisdom and knowledge than gold and silver.

- 7. 5 Held on Saturday 24 March 2018 at 28 Glenburnie Road, London SW17 7JP Directors present Leslie Laniyan (Chair) Chona Labor (Vice Chair) Patricia Toussainte (Secretary) Rev. Verona Richards (Director) Tracey Connage (Director) Lorna Lynch (Director) Michael Mathura (Director) Ann Waugh (Chair, Audit Committee) Staff in attendance Mr S Bowes (Chief Executive Officer) Ms E Bowes (Executive Assistant and Minute Taker) Minutes of the 38th Annual General Meeting of the Pentecostal Credit Union 1. Welcome The AGM convened at 6.30pm. Mr Leslie Laniyan (LL), the Chair of the PCU, presided over the meeting and welcomed the members. 2-4. Prayer, hymn and scripture reading Rev. Verona Richards (VR) facilitated the ‘praise and worship’ opening session. She opened in prayer and led the membership in the hymn – ‘Here I am to Worship’. The scripture reading was taken from Ecclesiastes 11:1-6. 5. Apologies Apologies were received from Sis. Logan.

- 8. 6 6. Minutes of the last meeting Mrs Patricia Toussainte (PT), Secretary of the Credit Union, read a summary of the minutes. Joshua Maloney proposed that the minutes be accepted as a true record of events. Italia James seconded the proposal. The minutes were accepted with no changes or challenges. 7. Matters arising The Chair updated the meeting on the matters arising from the 2017 AGM as follows. • Last year, PCU management had proposed, and members agreed, that adult members would contribute the sum of £2.50 per year as an annual service charge deduction from their share accounts, towards the estimated annual costs of the PCU adopting transaction banking as part of joining the Credit Union Expansion Project (CUEP). However, with the demise of CUEP, this charge had not been levied. The Chair referred members to the CEO for further information. • Also last year, Equiano Charity trustees agreed to provide a bonus of £10 to each Youth Shadow Board (YSB) member, to be paid into their credit union accounts. In accordance with this, Equiano had paid a £10 gift to each YSB member. 8. Directors’ report to the membership The Chair presented a summary of the Directors’ Report. He commenced his presentation by stating that a successful year of trading resulted in the business making a healthy surplus at year end, and overall steady growth in terms of savings, loans, membership and capital. The PCU is in an exceptional fiscal position, as its assets, capital and loan portfolio are out of all proportion to its size and are well over and above regulatory requirements. He highlighted the following. • Lending for 2016-17 was £1.28m, increasing the loan portfolio by some £330,000 (5%), and surpassing the £250,000 annual target of loan book increase by £80,000. • During the same period, 191 new members joined the credit union, averaging 16 per month as compared with five in 2014. • In the final year of our business plan cycle for 2014-2017, we achieved all the business plan objectives set for this period. Key highlights included: – HQ Advisory rated the PCU as one of the top 10 credit unions in London in 2017 – loan book growth from £4.6m to £5.3m (on target) – membership growth of 20%, from 1,542 to 1,850, and – share deposit growth from £7.6m to £7.8m – despite two large corporate withdrawals of over £1m during the same period.

- 9. 7 • One of the most important developments for the year was the crafting of our new business plan for the three-year period from 2017-2020. This business planning cycle will be a period of great change and transformation in order to achieve the PCU vision and mission. The business plan outlines how we are putting in place the processes to undergo this change and to meet our ambitions. The new strategic objectives are: Growth, Transformation and Leadership. • We have achieved excellence in customer service. An annual evaluation of our monthly independent customer survey revealed that 100% of participants to the survey would use our services again and 93% would recommend us to family and friends. • In July 2017, we launched our first business development programme for members with entrepreneurial ambitions. • On 30 January 2018, students on the business development programme got the chance to pitch their business ideas to successful entrepreneurs in the Pentecostal faith at our ‘Solomon’s Room’, Dragon’s-Den style event, which took place at The Royal Society in London, SW1. At the event, more than 100 church leaders, community influencers and Christian business owners joined us for the evening. • We are en route to launching digitally accessible services for members, which will enhance the customer journey and reduce the number of manually initiated procedures by staff. Finally LL thanked the staff team for their work in delivering the PCU objectives and also thanked his fellow Board members. The Chair then invited questions on the Directors’ report. There were no questions or comments. 9. Presentation from the PCU Youth Shadow Board (YSB) Moses Williamson (MW) introduced himself as the Chair of the YSB and thanked the Board for the opportunities that the PCU have given to the YSB. Together with his YSB colleagues, they outlined their achievements over the year. Key highlights were: • A vibrant summer programme of eight days of fulfilling leadership development activities during the August summer break. The group took part in a host of activities, including a confidence-building drama workshop and a seminar on developing their social media skills and

- 10. 8 learning how to be safe on line. The highlight of the programme was a visit to the International Slavery Museum in Liverpool, where they took a guided tour and learned about the history of the African Diaspora in the UK. The programme finale was a master class with top black chocolatier Paul Wayne Gregory, who shared with them his inspirational story. • The Gimme Dat video was shortlisted in the 2017 JUMP Music Video Awards, in the ‘Song for a Cause’ category. They didn’t win, but they had a great night out at the awards ceremony in October. • Volunteering at the New Testament Assembly (NTA) in Tooting, supporting the church’s Christmas Hamper Programme. This programme is now delivered in partnership with the PCU, and the YSB spent a busy Saturday in December helping NTA church members with shopping, packing and the distribution of hampers. 10. Key note speaker: Raising Awareness of Prostate Cancer: David Frederick from Prostate Cancer UK The Chair welcomed David Frederick (DF) to the AGM. David would be speaking about an important subject with respect to men’s health – Prostate Cancer. DF opened by commending the work of the PCU. He especially commended the YSB, commenting that they were doing great things and applauding them for their achievements. DF then told the AGM about his own background as an officer of a credit union and how important he felt that credit unions are in people’s lives today. DF’s second love after credit unions was men’s health and, in particular, black men’s health with respect to prostate cancer. David relayed his own prostate cancer journey and explained why it was important to him to bring this message to black communities – to give back. He spoke of the reluctance of black men to have health checks, especially when it comes to the area of the prostate, but he stressed the critical importance of black men going to their GP for regular checks and as soon as they feel that something is wrong. One in four black men will get prostate cancer at some point in their lives. Black men are more likely to get prostate cancer than other men, who have a one in eight chance of getting prostate cancer. The risk is increased if you are aged 45 or over, and increases as you get older, and is also increased if your father or brother has had it.

- 11. 9 DF then took questions from the floor. LL thanked DF for his frank, provocative, yet humorous presentation and encouraged all the men attending to ensure that they have regular health checks. 11. Loan report The Loan report was presented to the membership by the chief executive officer, Shane Bowes (SB). Shane reported that a total of £1,289,450 had been allocated in loans between 1 October 2016 and 30 September 2017. SB commented that this averages over £100k per month, which is remarkable performance for a credit union of this size. There were no questions. 12. Report of the Audit Committee Ms Ann Waugh (AW), the Chair of the Audit Committee, presented her report. She began by explaining the role of the Audit Committee – to safeguard the interests of the membership and to ensure that the board is compliant with legal and regulatory requirements. She further explained that the Audit Committee works with an independently commissioned auditor, Leroy Reid and Co., which audits the PCU’s operations in accordance with an agreed Audit Plan. The Audit Committee is independent of the Board and operates separately. The purpose of Ann’s report was to inform the members of: a) New developments b) Results of internal audits during 2016/17 c) Key lessons and emerging trends from internal audits d) Board’s expertise and effectiveness e) Audit Plan for 2017-2018. She summarised: • Of the 15 areas audited over the year, 12 were rated ‘substantial assurance’, which is the highest that can be achieved. • The Audit committee are pleased with these results and are able to confirm to the membership that the PCU is following its policies and procedures, and operating effectively and efficiently. • The PCU’s performance is consistently high. It is doing very well. But a recommendation would be for the PCU to seek to learn lessons about risk management, especially as we move to become a digitally enabled business

- 12. 10 • Board attendance for this period dropped from 93% to 75%, due to sickness, bereavements and also one wedding. • Finally, AW summarised the Audit Plan for 2016-17. AW invited questions from the floor. There were no questions. LL thanked AW for her report. 13. Nominations for election to the Board In accordance with Rule 103, one third of the Board had resigned and were seeking re-election. These directors were Verona Richards and Michael Mathura. Elaine Bowes (EB) proposed that they be re-elected, seconded by LL. These members were duly re-elected. LL announced the resignation of the Vice Chair, Chona Labor (CL), who was moving on to ‘greater things’ in his life. He thanked CL for his contribution to the development of the PCU over his years of tenureship on the Board and wished him the best for the future. There were no other nominations from the floor. 14. PCU financial statements Ms Lorna Lynch (Lo.L), Director, presented the financial statements. She highlighted that: • income had decreased by 20k, due to our membership of the credit union expansion project, and • total expenditure had increased as a result of increased bad debt provision. She concluded that the business was going in the right direction. Lo.L invited questions. Bishop Delroy Powell asked about investments. SB responded and explained where the credit union had made investments and why. There were no questions or challenges on the accounts. They were accepted by the membership. Dividend A dividend of 1% was recommended. Bishop Powell moved to accept the dividend of 1%. Seconded by Rev. Jones. 15. Appointment of the auditor Ms Lynch proposed that Thomas Westcott be re-appointed as our auditors for the coming year. Italia James seconded this.

- 13. 11 16. Raffle Mrs Jones presided over the raffle draw. She thanked the Board and congratulated them for the very proficient way that they were running the business on behalf of the membership. She thanked the membership for purchasing the book authored by the Founder, Rev. Carmel Jones – an autobiography of his life. She reminded the membership that the proceeds were going to the Equiano Charity. LL commented that the book was a compelling read. She also thanked the Board for inviting David Frederick to speak to the membership on such an important topic and thanked him for his presentation. Master Makhaya James drew the raffle. The winners were: • No. 89, Glenford Hill – £150 • No. 80, Mr Gordon – £100 • No. 93, Mrs Roberts – £50 Founder’s closing address Rev. Jones addressed the membership. He thanked everyone for attending. Commented that this was such a special evening and that the PCU always excited him. He commended especially David Fredericks and thanked him for his presentation on prostate cancer. He then introduced Rev. Lovel Bent. He described him as a “man who stood by me and supported me”. His church in East Dulwich is the second church that the PCU purchased. Rev. Jones also recognised the late Bishop Melvin Powell as another staunch supporter of the PCU, who had stood with him in the early days of the PCU’s development. He commented that the PCU is where it is today because of these men and others like them. Apostle Bent addressed the AGM. He thanked Rev. Jones for the journeys they had been on together and said that he owed him for the contribution to where the New Life Assembly is now. He also addressed the YSB and told them that they are involved in a great venture at the PCU. He referred especially to YSB members who are members of New Life Assembly. He reminded them that the funds to purchase the church came from the PCU. Rev. Bent then thanked everyone who supported the PCU. He said that it was important that black communities could hold up the organisation and say, “We did this”. He applauded Rev. Jones as the pioneer who founded the organisation, and finally thanked the membership for listening to him. 16. End Rev. Verona Richards led the AGM in the final song, Hallelujah, and prayed the closing prayer.

- 14. 12 Dear members September 2017 to October 2018 was one of our most important years with respect to development and transformation. A successful year of trading resulted in the business making a healthy surplus at year end, and overall steady growth in terms of savings, loans, membership and capital. The PCU is in an exceptional fiscal position, as its assets, capital and loan portfolio are out of all proportion to its size and well over and above regulatory requirements. Highlight achievements for growth are as follows. • Lending for 2017-18 was £1,638,592; increasing the loan portfolio by some £360,505 (6.7%) and surpassing the £250,000 annual target of loan book increase by £110,505. • 198 new members averaging 16 per month, as compared with five per month in 2014. The table below demonstrates the growth in membership from 2014, together with the six-month average trend. Directors’ report to the membership

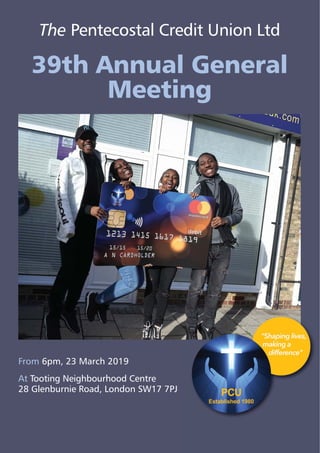

- 15. 13 Highlights from the year Digital transformation at the PCU One of the most important developments for the year was the transition to becoming a digitally enabled credit union. In July 2018, we rolled out a fully interactive website with online banking facilities. In October, we launched a mobile app which enables our customers to access their PCU accounts, pay bills, make payments and withdraw money on a mobile phone. Also in October, we launched a Mastercard debit card. Since Monday 8 October 2018, our members have been able to enjoy the convenience of making payments with a debit card and using ATMs, and enjoy the added benefits of contactless technology. The PCU debit card can be used in shops and when making online purchases, for money transfers and bill payments. In addition it can be used anywhere in the world where the Mastercard logo is displayed. We are so proud of this development. It is all about enhancing our services for our users. The PCU’s Moneywise Business Development Programme In July 2017, we launched our first business development programme for members who are either considering opening a business, have recently opened a business, or who are already business owners but needed help/support in developing their business. Steeped in biblical principles, the PCU Moneywise Business Development Programme helped and helps our participant members to attain/develop: • increased confidence in business start-up, sustainability and growth • foundations and structures to develop a successful business • a tangible business plan • a range of tools and techniques to develop and grow their business • the characteristics of a Kingdom entrepreneur and Kingdome entrepreneurship. We told members about this development at the last AGM. I am happy to report that, as a result of the success of the first programme, we launched the second programme in September 2018. Five of our members are currently being coached by Claudine Reid from PJ’s Community Services – who deliver the programme on our behalf. Solomon’s Room At the last AGM, we told you about our Solomon’s Room event, where students on our Moneywise Business Development Programme got the chance to pitch their business ideas to successful entrepreneurs from our Pentecostal faith community, in a Dragon’s-Den style affair, on 30 January 2018. We want to highlight its importance for the 2017-18 financial year, as it launched our business plan objective of promoting entrepreneurship and business ownership as a way to support the socioeconomic

- 16. 14 development of our communities in the Pentecostal church. During the year it has become clear that Solomon’s Room has opened up opportunities for the PCU to be seen as ‘thought leaders’ and influencers in this field of finance and business development in our communities. Moneywise workshops We continue to deliver our financial capability Moneywise Workshops. These are training events, which are free to our churches and associated bodies. As you may know, we are accredited by the National Skills Academy in Financial Services to provide training in financial capability. We developed the concept of ‘Moneywise’ using the government’s edict to credit unions to provide education to their members in the ‘wise use of money’. Our concept of Moneywise is based on scripture, so our workshops have a biblical foundation. We have been delivering these in a roadshow of workshops across the country. During 2017-18, we went to churches in Manchester, Birmingham, Bristol, Peterborough and Aldershot, as well as delivering a host of workshops in London and the south east. Last year, we told you that we would be hosting these events in-house, aimed at our members specifically, but not exclusively. To this end, on Saturday 27 April 2019, we will be running a half-day workshop – ”Be Moneywise at PCU: Getting the most from your credit union”. This workshop is primarily for our members, particularly new members, but anyone who attends a Pentecostal church in the UK, and is interested in joining the PCU, can also attend. We pride ourselves in offering you the best service that we can, but it is also important to us that you know and understand how to make the best use of us and the services that PCU provides. We will be sharing top tips about financial management and how to get the best from PCU services. The workshop will be held at our offices in Balham and is, of course, free. It will run from 11am until 3pm and we will provide light refreshments. There are just 10 spaces available, so, if you would like to attend, please register by emailing info@pcuuk.com or calling the office on 020 8673 2542. You can also email or call for further information. The PCU Youth Shadow Board The PCU Youth Shadow Board (YSB) continues to grow from strength to strength. You will recall that the YSB is our young leaders’ development programme for our junior savers. They’ve also had an exciting year. Highlights include the following. • A vibrant summer programme of eight days of fulfilling leadership development activities during the August summer break, jointly facilitated by the PCU and Tanya Aquaa from TIA – The Inner Attitude. The focus was on team-building skills during eight days of leadership workshops. The overall aim of the programme was to work with the young people, to develop, equip and expose them to leadership styles, traits, concepts and tasks that will promote success on their journey as PCU YSB members. • Of particular importance to us was the workshop they undertook on ‘Gangs, guns and knife crime: How to stay safe’. We are all devastated by the malevolent behaviour that is infiltrating and destroying the lives of many of our young people today – both the victims and perpetrators of gang, knife and gun crime. It is all too close to us, and we felt that we had to make an interjection with our YSB – all of whom personally know, or know of, young people in their peer group who have been victims of this type of crime. We wanted to give them

- 17. 15 the skills and confidence to handle themselves properly if they are ever confronted with this malevolence in all its guises. We want to thank Zoma Okpala from the Makeda Weaver Project in Hackney for delivering a frank but insightful workshop to our young leaders, and also to NTA for supporting the workshop by providing food for the teens for the day, and also by sending along some of their young people to take part. • Volunteering at the New Testament Assembly (NTA) in Tooting to support the church’s long-established Christmas Hamper Programme, which delivers food hampers to people in need in Wandsworth. The PCU officially partnered with NTA in December 2017. The NTA has delivered more than 3,600 hampers in eight years – 700 this Christmas alone. The project was initially started by Amy Rose Powell MBE in 2008. In our second year of partnership with NTA, our young people spent a Saturday last December helping NTA church members with shopping, packing and the distribution of hampers. Patricia Toussainte and David Frederick from our board and audit committee also took part. Hampers went to single parents, pensioners and households on a low income. We are immensely proud of the Youth Shadow Board. They have developed into confident young people, developing the skills to govern: to be responsible and accountable, to set goals and to monitor and achieve them, to live and work with integrity and to manage their business in an orderly and transparent fashion, and to learn and develop continually. News of their success has travelled, and they are now being invited to speak at events aimed at young people. In February 2019, they addressed a careers’ conference at Wolverhampton University and they are speaking at the COGIC International Youth Conference in May. Achieving excellence in customer services One of our most important objectives is to provide the very best services that we can to our members. In order to demonstrate that we genuinely deliver on this commitment, we commissioned the services of an independent and expert research company, called Acuity, to survey customers that use our new membership and loans services each month. We have been conducting these customer surveys now for two years and the results have been excellent. PCU survey results – February to November 2018

- 18. 16 During 2017-18, 96% of customers surveyed said our staff are courteous and professional. In all, 95% would use our services again and 76% would recommend us to family and friends. We now publish the results of our costumer satisfaction survey every three months on our website. Governance and staffing at the PCU We’ve had a few changes during the year in terms of governance and staffing at PCU. At the last AGM, our then Vice Chair, Chona Labor, resigned as a result of a new job, which resulted in increased work commitments. Two months later Michael Mathura also resigned – also as a result of new working commitments. He went to a new job in Liverpool. We want to thank both Chona and Michael for their dedication and commitment to the PCU over the years. This left two vacancies on the Board. In addition, we decided to extend the membership of the Audit Committee by one person. I would like to introduce Pastor Ron Nathan and Marcia Jones, who we have nominated for election by you. Plus David Frederick, who we have nominated for election by you to the Audit Committee. We also want to welcome Lauren Humphris back from her maternity leave. Lauren has come back to her post as Loans and Business Officer and attends work three days a week. We also want to welcome Anca Bordei, who covered for Lauren’s maternity leave and who is now with us full time. We have thus increased the staff team at the PCU, enabling us to respond even more efficiently to your needs. Growth, transformation and leadership: The PCU Business Plan 2017-2020 We are happy to report that we are on course to achieving the objectives set out in our Business Plan 2017-2020. The business plan receives constant scrutiny by the Board at each Board meeting. But we additionally meet for two days every year to focus exclusively on business plan implementation and to review progress and, if required, set new targets. The business plan summarises how the PCU is building its future. We are a financial co-operative and we believe in the economic empowerment of our membership to achieve their aspirations. We do this through the provision of high quality and relevant financial services and member development activities. The current economic environment is challenging, with Brexit creating uncertainty. Against this backdrop, we want to use our assets to maximum effect and this means ensuring that our business is managed and directed in the most efficient and effective way possible to continue to deliver an excellent level of service to you our members. Concluding comments I am proud to repeat what I said last year in the concluding comments of the Directors’ Report. The Pentecostal Credit Union is a ‘sleeping giant’, with great potential and emerging power for growth, and with the capacity to make a remarkable impact on the lives of our members. It is our responsibility to ensure that this potential is realised, and this power is unleashed. We are a serious alternative financial provider that should be your first choice when thinking about finance to meet your needs and those of your family. However, our member development programmes and general workshops show that we are more than just a provider of financial services. We also live our strapline: ‘shaping lives, making a difference’. Digital enablement and excellent customer service, including

- 19. 17 the flexible and personal approach that the PCU is so good at, are crucial elements on our journey, as well as the fact that we can demonstrate that we are a well-managed business. The future is bright. Our thanks Finally, it remains for us to thank those people to whom we owe our continued progress and success. Our staff team: Shane Bowes, our Chief Executive; Lauren Humphris and Anca Bordei, our Loans and Business Officers; and Elaine Bowes, our Marketing and Communications Manager – all of whom remain committed to providing you with the best possible service and to developing the organisation to be a beacon credit union that you can be proud of. But, most importantly, we want to thank you – the members. Your commitment, prayers and devotion continue to be a pillar of strength to us. We remain utterly committed to your best interests and to providing you with the best financial services that we can deliver. From the Board of Directors Leslie Laniyan: Chair Verona Richards: Vice Chair Patricia Toussainte: Secretary Lorna Lynch Tracey Connage Ann Waugh: Chair of the Audit Committee Footnote: Regulatory compliance In accordance with regulatory requirements, we can inform the membership that the PCU has Fidelity Bond Insurance and Public Liability Insurance in place. We are also fully compliant with Single Customer View requirements and we do not carry out any other additional activities other than those that we are approved to carry out.

- 20. 18 Loans report 1 October 2017 to 30 September 2018 Month Loans granted (£) Total (£) October 2017 95,150 95,150 November 2017 94,370 189,520 December 2017 73,700 263,220 January 2018 38,000 301,220 February 2018 239,450 540,670 March 2018 233,600 774,270 April 2018 397,500 1,171,700 May 2018 147,450 1,319,220 June 2018 88,702 1,407,922 July 2018 101,400 1,509,322 August 2018 81,620 1,590,942 September 2018 47,650 1,638,592 TOTAL 1,638,592 1,638,592

- 21. 19 Audit Committee report to the AGM 1 October 2017 to 30 September 2018 Purpose of Audit Committee Report to members The Audit Committee Report to the members at AGM 2019 has three objectives: 1. To present the results of internal audits during 2017-18. 2. To propose the internal audit schedule for 2018-19. 3. To report the attendance record of Directors for the year 2016-2017. Introduction The Audit Committee consists of two members, David Fredrick, who is currently co-opted, and myself, Ann Waugh. The Audit Committee has been represented at 100% of the Board of Directors’ meetings during the fiscal year 2017-18. The Audit Committee recognises the importance of maintaining the independence of the internal auditor. We conduct our business through the outsourced internal audit function, Leroy Reid and Company Limited. The result of internal audits during 2017-18 The Audit Committee scrutinised 20 areas of the PCU’s operations. The audit focus was in line with the annual audit schedule approved by the Board. Table 1 below summarises the assessment ratings the PCU achieved over the financial year 2017-2018. Audit focus during 2017-18 Substantial assurance Reasonable assurance 1. Loans and lending process – Q1 2. Marketing and membership – Q1 3. Treating customers fairly – Q1 4. Single customer view – Q1 5. Customer feedback – Q1 6. Governance and leadership – Q1 7. Business Plan implementation – Q2 8. Loans and lending process – Q2 9. Segregation duties – Q2 10. Digital transformation – Q2 11. Provisioning – Q2 12. Loans and lending process – Q3 13. Conduct of directors not covered by senior mgt function – Q3 14. Marketing and membership – Q3 15. Risk identification, management and control – Q3 Table 1

- 22. 20 Audit focus 2017-18 Substantial assurance Reasonable assurance 16. Business plan implementation – Q4 17. Loans and lending process – Q4 18. Governance and impact – Q4 19. Treasury management – Q4 20. Debt recovery – Q4 TOTAL 14/20 6/20 Table 1: Continued The Audit Committee recognises that the PCU is doing what it sets out in the Policy and Procedures Manual for the areas audited. The results for 2017-18, when compared to the past five years’ internal audits results, show that the PCU achieves substantial assurance, consistently, in many areas. These include treasury management, provisioning, loans and the lending process, and business plan implementation. The areas for improvement, or to achieve higher than reasonable assurance, include risk management, return on investment from marketing and market development activities, and governance and leadership. The internal audit schedule for 2018-19 The internal audit schedule shows how we will focus our efforts on the areas of strategic importance to PCU and where potential concerns could exist. The internal audit schedule for 2018-19 is set out below in Table 2. Audit focus for 2018-19 Q1 (Oct to Dec 2018) Q2 (Jan to Mar 2019) Q3 (Apr to Jun 2019) Q4 (Jul to Sept 2019) 1. Loans and lending process 2. Payments – HMRC, PAYE etc 3. Risk management 4. Consultants: deployment and benefits 5. Marketing: membership, digital product take-up, MI, cost/benefit process 6. HR and capacity planning process 7. Member participation 8. Treasury management and debt recovery processes 9. Strategic awayday: budget, business plan implementation, MI process 10. MI, business plan, full-year actual results, audited accounts, and full-year project Table 2 We are continuing to take a strategic, operational, financial and compliance perspective of the areas of focus, whilst ensuring fit with the PCU’s capability, size and culture. We endeavour, as usual, to understand and co-ordinate with the other risk management and control activities in

- 23. 21 PCU. We endeavour to provide good internal audit and Audit Committee recommendations and guidance, and to add value to our members’ long-term financial interests, which is why we come to you today, to approve this schedule. Board commitment and attendance Leadership matters most in times of uncertainty. Leaders guide us through adversity, hardship, disruption, transformation, transition, recovery and new beginnings. The directors’ commitment and dedication to PCU, as measured by attendance at Board meetings, has been good this year. On average, individual directors’ attendance during 2017-18 was 78%. An increase on 2016-17, which was 75%. The trend is going in the right direction – upwards. Conclusion We are living through a fundamental transformation in the way we work and conduct PCU business. For example, in the past year, the PCU has begun to offer loans, savings and member development via the website and the PCUapp. Also, the reality of BREXIT is just around the corner. Blair Sheppard, Global Leader, Strategy and Leadership Development, PwC said, “That to stay ahead, you need to focus on your ability to continuously adapt, engage with others in that process, and most importantly retain your core sense of identity and values”. By the grace and leading of God, the PCU and you as members will succeed. Ann Waugh Audit Committee Chair March 2019 Assessment rating Definition Substantial assurance Robust series of internal controls in place designed to achieve the system objectives and which are being consistently applied. Reasonable assurance Series of internal controls in place, however there are some control improvements that would assist in ensuring the continuous and effective achievement of the system objectives. Limited assurance The controls in place are not sufficient to ensure the continuous and effective achievement of the system objectives. No assurance Fundamental breakdown or absence of core internal controls. Appendix 1

- 24. PENTECOSTAL CREDIT UNION LIMITED DIRECTORS' REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C 22

- 25. 23 PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C Chief Executive Officer Mr S Bowes Directors Mr G L Laniyan Chairman Mr C M Labor (resigned 21/02/18) Mr M Mathura (resigned 10/05/18) Ms P M Toussainte Mrs T Connage Miss L Lynch Ms V Richards Audit committee members Miss A Waugh Treasurer Mr S Bowes Secretary Ms P M Toussainte Loans officer Miss L Humphris Miss A Bordei Regulators Financial Conduct Authority Prudential Regulatory Authority FCA/PRA registration number 213242 Company number IP00006C Registered office and 15 Oldridge Road Business address Balham London SW12 8PZ Auditors Thomas Westcott 26-28 Southernhay East Exeter Devon EX1 1NS

- 26. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C CONTENTS Page Directors' report 1 - 2 Independent Auditors' report 3 - 5 Revenue account 6 - 7 Balance sheet 8 - 9 Statement of changes in Retained Earnings 10 Cash flow statement 11 Notes to the financial statements 12 - 24 24

- 27. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C DIRECTORS' REPORT FOR THE YEAR ENDED 30 SEPTEMBER 2018 Page 1 The directors present their report and the financial statements for the year ended 30 September 2018. Directors The Principal activity of the directors is to be responsible for the delivery of the business of the Pentecostal Credit Union and legislative and regulatory compliance. To provide strategic direction to the staff team and to ensure the best interests of the membership are met. The directors who served during the year are as stated below: Mr G L Laniyan - Chair Mr C M Labor - Vice Chair (resigned 21/02/18) Ms P M Toussainte - Secretary Mr M Mathura - Director (resigned 10/05/18) Mrs T Connage - Director Miss L Lynch - Director Ms V Richards - Director Non- Executive Director: Miss A Waugh - Chair of Audit Committee Statement of directors' responsibilities The directors are responsible for preparing the Directors' Report and the financial statements in accordance with applicable law and regulations. Co-operative and Community Benefit Societies law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the credit union and of the surplus/deficit of the credit union for that period. In preparing these financial statements, the directors are required to: - select suitable accounting policies and apply them consistently; - make judgements and estimates that are reasonable and prudent; - prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business. The directors are responsible for keeping proper accounting records that are sufficient to show and explain the credit union's transactions and disclose with reasonable accuracy at any time the financial position of the credit union and enable them to ensure that the financial statements comply with Co-operative and Community Benefit Societies Act 2014 and the Credit Union Act 1979. They are also responsible for safeguarding the assets of the credit union and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities. 25

- 28. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C DIRECTORS' REPORT FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 2 Each of the persons who is a director at the date of approval of this report confirm that: - so far as each director is aware, there is no relevant audit information of which the credit union's auditor is unaware; and - each director has taken all steps that they ought to have taken as a director to make themself aware of any relevant audit information and to establish that the credit union's auditor is aware of that information. This report was approved by the Board on .................................... and signed on its behalf by Ms Patricia Toussainte Secretary 26

- 29. INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C Page 3 Opinion We have audited the financial statements of Pentecostal Credit Union Limited for the year ended 30 September 2018 which comprise the revenue account, the balance sheet and the related notes. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards (United Kingdom Generally Accepted Accounting Practice). In our opinion the financial statements: - give a true and fair view of the state of the credit union's affairs as at 30 September 2018 and of its income and expenditure for the year then ended; and - have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice, and with the Co-operative and Community Benefit Societies Act 2014 and the Credit Union Act 1979. Basis of opinion We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our respsonsibilities under those standards are further described in the Auditor's responsibilities for the audit of the financial statements section of our report. We are independent of the group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC's Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Conclusions relating to going concern We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where: - the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or - the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue. 27

- 30. INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C ...................continued Page 4 Other information The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. The directors are responsible for the other information. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon. In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard. Matters on which we are required to report by exception In the light of the knowledge and understanding of the credit union and its environment obtained in the course of the audit, we have not identified material misstatements in the directors' report. We have nothing to report in respect of the following matters where the Co-operative and Community Benefit Societies Act 2014 requires us to report to you if, in our opinion: - proper books of account have not been kept by the credit union in accordance with the requirements of the legislation, - a satisfactory system of control over transactions has not been maintained by the credit union in accordance with the requirements of the legislation, - the revenue account or the other accounts (if any) to which our report relates, and the balance sheet are not in agreement with the books of account of the credit union, - we have not obtained all the information and explanations necessary for the purposes of our audit. Responsibilities of directors As explained more fully in the Directors' Responsibilities statement on pages 1 to 2, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so. 28

- 31. INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C ...................continued Page 5 Auditor's responsibilities for the audit of the financial statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: www.frc.org.uk/auditorsresponsibilities.This description forms part of our auditor’s report. This report is made solely to the Credit Union's members, as a body, in accordance with the Co-operative and Community Benefit Societies Act 2014 and the Credit Union Act 1979. Our audit work has been undertaken so that we might state to the credit union's members those matters we are required to state to them in an auditors' report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Credit Union and the Credit Union's members as a body, for our audit work, for this report, or for the opinions we have formed. Shona Godefroy FCCA (senior statutory auditor) For and on behalf of Thomas Westcott Chartered Accountants and Statutory Auditors 26-28 Southernhay East Exeter Devon EX1 1NS 29

- 32. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C REVENUE ACCOUNT FOR THE YEAR ENDED 30 SEPTEMBER 2018 Page 6 2018 2017 £ £ £ £ Income Entrance fees 950 740 Income from loans to members 362,849 343,641 Interest received on investments 149,223 112,156 Sundry income 3,149 2,601 Expansion project income - 104 Total income for the year 516,171 459,242 Administrative expenses Wages and salaries 67,377 68,068 Employer's NI contributions 3,972 4,414 Staff pension costs 1,150 607 Administration expenses 96,484 98,443 Data processing expenses 8,266 6,588 Fidelity bond insurance 4,004 3,931 Consultancy fees 21,669 - FCA fees 960 3,404 Auditors remuneration 9,250 9,149 Other legal and professional 82,062 71,610 Affiliation fees 4,099 2,469 Bank charges 1,591 1,311 Investment management charges 9,323 9,148 Bad debt provision )(131,882 1,373 General expenses 1,037 1,078 Depreciation on intangible assets 544 - Depreciation of assets 18,717 15,374 Profits/losses on disposal of investments 66,644 3,728 Revaluation movement on investments 27,329 44,269 Total expenditure for the year )(292,596 )(344,964 Surplus/ (Deficit) for the year before taxation 223,575 114,278 Taxation )(27,625 )(22,596 Surplus/ (Deficit) for year before appropriations 195,950 91,682 30

- 33. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C REVENUE ACCOUNT FOR THE YEAR ENDED 30 SEPTEMBER 2018 Page 7 Appropriations: Revenue reserve 195,950 91,682 Dividend )(73,471 )(68,312 Total applied 122,479 23,370 There are no recognised gains or losses other than those included above. All figures included in the revenue account relate to continuing activities. 31

- 34. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C BALANCE SHEET AS AT 30 SEPTEMBER 2018 The notes on pages 12 to 24 form an integral part of these financial statements. Page 8 2018 2017 Notes £ £ £ £ Fixed assets Intangible assets 6 1,634 - Tangible assets 7 558,301 558,519 Investments 8 1,560,355 1,518,786 2,120,290 2,077,305 Members loans 9 5,727,563 5,371,803 Less: provision for underperforming loans )(790,746 )(904,157 4,936,817 4,467,646 7,057,107 6,544,951 Current assets Other receivables 10 30,000 - Investments 11 3,394,435 3,457,438 Cash at bank and in hand 12 80,605 92,422 3,505,040 3,549,860 Total current assets 3,505,040 3,549,860 Total assets 10,562,147 10,094,811 Liabilities Subscribed share capital Ordinary members shares 14 8,027,088 7,696,376 Junior members shares 14 130,290 123,824 Hold shares 14 190 190 8,157,568 7,820,390 Other payables 13 47,471 39,792 Revaluation reserve 297,124 297,124 Social and educational reserve 115,409 115,409 Revenue reserve 663,981 541,502 General reserve 1,280,594 1,280,594 Total liabilities 10,562,147 10,094,811 32

- 35. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C BALANCE SHEET AS AT 30 SEPTEMBER 2018 The notes on pages 12 to 24 form an integral part of these financial statements. Page 9 The financial statements were approved by the directors on and signed on its behalf by Ms P M Toussainte - Secretary Mr G L Laniyan - Director Ms L Lynch - Director 33

- 36. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C STATEMENT OF CHANGES IN RETAINED EARNINGS FOR THE YEAR ENDED 30 SEPTEMBER 2018 The notes on pages 12 to 24 form an integral part of these financial statements. Page 10 Revaluation General Revenue Social and reserve reserve reserve educational Total £ £ £ £ £ At 1 October 2016 297,124 1,280,594 518,132 115,409 2,211,259 Dividends paid - - )(68,312 - )(68,312 Appropriation of surplus - - 91,682 - 91,682 At 30 September 2017 297,124 1,280,594 541,502 115,409 2,234,629 Dividends paid - - )(73,471 - )(73,471 Appropriation of surplus - - 195,950 - 195,950 At 30 September 2018 297,124 1,280,594 663,981 115,409 2,357,108 34

- 37. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C CASH FLOW STATEMENT FOR THE YEAR ENDED 30 SEPTEMBER 2018 Page 11 2018 2017 Notes £ £ Cash flows from operating activities Profit for the financial year 195,950 91,682 Adjustments for: Depreciation of tangible assets 18,717 15,374 Amortisation of intangible assets 544 - (Increase) in receivables )(499,171 )(322,051 Increase in payables 7,679 3,082 Increase in subscribed share capital 337,178 721,150 Net cash outflow from operating activities 60,897 509,237 Cash flows from investing activities Purchase of intangible assets )(2,178 - Purchase of tangible assets )(18,499 )(6,192 (Increase) in investments 21,434 (706,791) Net cash (used in)/from investing activities 757 (712,983) Cash flows from financing activities Equity dividends paid (73,471) (68,312) Net cash (used in)/from financing activities (73,471) (68,312) Increase/(Decrease) in cash in the year (11,817) (272,058) Cash and cash equivalents at beginning of year 92,422 364,480 Cash and cash equivalents at end of year 80,605 92,422 35

- 38. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 Page 12 1. Accounting policies 1.1. Accounting convention The Credit Union is registered under the Co-operative and Community Benefit Societies Act 2014. The financial have been prepared under the historical cost convention in accordance with the Co-operative and Community Benefit Societies Act 2014 and the Credit Union Act 1979 and comply with financial reporting standards of the the Accounting Standards Board. In accordance with the regulatory environment for credit unions, deposits from members can be made by subscription for redeemable shares, deferred shares and interest bearng shares. At present the Credit Union only has redeemable shares. These financial statements have been prepared in accordance with FRS102, the financial reporting standard applicable in the UK and Republic of Ireland. Pentecostal Credit Union Limited is regulated by the Financial Servicies Authority as a Version 2 Credit Union. It was established for the promotion and encouragement of regular savings and the creation of credit for the benefit of the members at fair and affordable rates of interest. 1.2. Going Concern The financial statements are prepared on the going concern basis. The directors of Pentecostal Credit Union Limited believe this is appropriate despite a mismatch in the maturity of analysis of subscribed capital and loans to members, because any deficit would be covered by the investments currently held by the Credit Union. 1.3. Interest All interest payable and receivable is accounted for on an accruals basis. 1.4. Taxation Corporation tax payable is provided on investment income at the current rate which for the year ended 19.00% (2017: 19.50%). 36

- 39. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 13 1.5. Judgements and key sources of estimation uncertainty The preparation of the financial statements requires management to make judgements, estimates and assumptions that affect the amounts reported. These estimates and judgements are continually reviewed and are based on experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Accounting estimates and assumptions are made concerning the future and, by their nature, will rarely equal the related actual outcome. 1.6. Amortisation Amortisation is calculated so as to write off the cost of an asset, less its estimated residual value, over the useful life of that asset as follows: Patents - 25% reducing balance If there is an indication that there has been a significant change in amortisation rate, useful life or residual value of an intangible asset, the amortisation is revised prospectively to relfect the new estimates. 1.7. Tangible fixed assets and depreciation Depreciation is provided at rates calculated to write off the cost or valuation less residual value of each asset over its expected useful life, as follows: Land and buildings - 2% reducing balance Fixtures, fittings and equipment - 25% reducing balance Tangible fixed assets are stated at cost less accumulated depreciation. 1.8. Investments Investments held as fixed assets are revalued at mid-market value at the balance sheet date and the gain or loss taken to the profit or loss account. Current asset investments are taken at the lower of cost and net realisable value. 37

- 40. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 14 1.9. Financial assets - loans and advances to members Loans to members are financial assets with fixed or determinable payments, and are not quoted in an active market. Loans are recognised when cash is advanced to members and measured at amortised cost using the effective interest method. Loans are derecognised when the right to recieve cash flows from the asset have expired, usually when all amounts outstanding have been repaid by the member. 1.10. Impairment review The Credit Union assesses at each balance sheet date, if there is objective evidence that any of its loans to members are impaired. The loans are assessed collectively in groups that share similar credit risk characteristics, because no loans are individually significant. In addition, if, during the course of the year, there is objective evidence that any individual loan is impaired, a specific loss will be recognised. Any impairment losses are recognised in the revenue account, as the difference between the carrying value of the loan and the net present value of the expected cash flows. 1.11. Pensions The pension costs charged in the financial statements represent the contribution payable by the company during the year. The regular cost of providing retirement pensions and related benefits is charged to the profit and loss account over the employees' service lives on the basis of a constant percentage of earnings. 1.12. Financial liabilities - subscribed capital Members' shareholdings in the Credit Union are redeemable and therefore are classified as financial liabilities and described as subscribed capital. They are initially recognised at the amount of cash deposited and subsequently measured at amortised cost. 1.13. Juvenile depositors Juvenile transactions are included within the financial statements unless specially shown otherwise. 1.14. Cash and cash equivalents Cash and cash equivalents comprise cash on hand and cash and loans and advances to banks with maturity of less than or equal to three months. 38

- 41. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 15 2. Dividends paid during the period 2018 2017 £ £ Dividends paid during the year 73,471 68,312 Dividend rate: Balances less than £10,000 1.0% 1.0% Balances greater than £10,000 1.0% 1.0% Dividends are paid to members for the prior year. The dividend is formally proposed by the Directors after the year end and is confirmed at the following AGM. As a result it does not represent a liability at the balance sheet date. 3. Employees Number of employees 2018 2017 The average monthly numbers of employees (including the directors) during the year were: Office staff 3 2 Employment costs 2018 2017 £ £ Wages and salaries 67,377 68,068 Social security costs 3,972 4,414 Pension costs 1,150 607 72,499 73,089 39

- 42. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 16 4. Auditors' remuneration 2018 2017 £ £ External auditors' remuneration - audit of the financial statements 6,180 5,904 Internal auditors' remuneration - internal audit services 3,070 3,245 9,250 9,149 In common with many other Credit Unions of our size and nature we use our auditors to prepare and submit returns to the tax authorities and to assist us with the preparation of the financial statements. 5. Tax on profit on ordinary activities Analysis of charge in period 2018 2017 £ £ Current tax UK corporation tax 27,625 22,596 2018 2017 £ £ Surplus before taxation 223,575 114,278 Surplus before taxation multiplied by standard rate of corporation tax in the UK of 19.00% (2017: 19.50%) 42,479 22,284 Effects of: Expenses not deductible for tax purposes 12,662 727 Adjustments to tax charge in respect of previous periods (727) - Non-taxable surplus/(deficit) on transactions with members (26,789) )(415 Current tax charge for period 27,625 22,596 40

- 43. 41 PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 17 6. Intangible fixed assets Patents Total £ £ Cost Additions 2,178 2,178 At 30 September 2018 2,178 2,178 Amortisation Charge for year 544 544 At 30 September 2018 544 544 Net book values At 30 September 2018 1,634 1,634 Land and Fixtures, 7. Tangible fixed assets buildings fittings freehold equipment Total £ £ £ Cost At 1 October 2017 690,771 51,866 742,637 Additions - 18,499 18,499 At 30 September 2018 690,771 70,365 761,136 Depreciation At 1 October 2017 144,959 39,159 184,118 Charge for the year 10,916 7,801 18,717 At 30 September 2018 155,875 46,960 202,835 Net book values At 30 September 2018 534,896 23,405 558,301 At 30 September 2017 545,812 12,707 558,519

- 44. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 18 8. Fixed asset investments Listed investments Total £ £ Cost/valuation At 1 October 2017 1,518,786 1,518,786 Additions 947,177 947,177 Disposals )(878,279 )(878,279 Revaluations )(27,329 )(27,329 At 30 September 2018 1,560,355 1,560,355 Net book values At 30 September 2018 1,560,355 1,560,355 At 30 September 2017 1,518,786 1,518,786 Historical cost at 30 September 2018 1,636,190 9. Members loans 2018 2017 £ £ At 1 October 2017 5,371,803 5,041,221 Repaid )(1,626,665 )(1,302,510 Granted 1,638,592 1,289,451 Interest charged 362,849 343,641 Loans written off )(19,016 - Gross loans and advances to members 5,727,563 5,371,803 Provision for underperforming loans )(790,746 )(904,157 At 30 September 2018 4,936,817 4,467,646 42

- 45. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 19 10. Receivables 2018 2017 £ £ Sundry receivables 30,000 - 30,000 - 11. Current asset investments 2018 2017 £ £ Cash held in investments 3,394,435 3,457,438 12. Cash and cash equivalents 2018 2017 £ £ Cash at bank and in hand 80,605 92,422 13. Payables: amounts falling due 2018 2017 within one year £ £ Trade payables 19,119 17,196 Corporation tax 28,352 22,596 47,471 39,792 43

- 46. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 20 14. Subscribed capital - financial liabilities 2018 2017 (including Juniors) £ £ Balance brought forward from last year 7,820,390 7,099,240 Shares saved and loans repaid 1,705,858 2,073,245 Dividends paid 73,472 68,312 Shares withdrawn )(1,442,152 )(1,420,407 8,157,568 7,820,390 Analysed as: Ordinary members shares 8,027,088 7,696,376 Hold shares 190 190 Junior members shares 130,290 123,824 8,157,568 7,820,390 44

- 47. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 21 15. Financial Risk Management The Pentecostal Credit Union Limited manages its subscribed capital and loans to members so that it earns income from the margin between interest receivable and interest payable (including dividends paid). The main financial risks arising from the activities of Pentecostal Credit Union Limited are credit risk, liquidity risk and interest rate risk. The Board reviews and agrees policies for managing each of these risks, which are summarised below: Credit Risk: Credit risk is the risk that a borrower will default on their contractual obligations relating to repayments to Pentecostal Credit Union Limited, resulting in financial loss to the Pentecostal Credit Union Limited. In order to manage this risk the Board approves the lending policy of Pentecostal Credit Union Limited and all changes to it. All loan applications are assessed with reference to the lending policy in force at the time. Subsequently loans are regularly reviewed for any factors that may indicate the likelihood of repayment has changed. The Credit Union also monitors its banking arrangements for Credit Risk. Liquidity Risk: The policy of Pentestal Credit Union Limited is to maintain sufficient funds in liquid form at time to ensure that it can meet its liabilties as they fall due and meet the liquidity ratios set by the regulators. the objective of the policy is to provide a degree of protection against any unexpected developments that may arise. Market Risk: Market risk generally comprises of interest rate risk, currency risk and other price risk. The main risk impacting the Credit Union are set out below: Interest rate risk: The main interest rate risk for Pentecostal Credit Union Limited arises between the interest rate exposure on loans, bank deposits and shares that form an integral part of a Credit Union's operations. Dividend rates are based on the historical results of the Credit Union and the Credit Union's strategic plans. The Credit Union does not use interest rate options to hedge its own position. Foreign Currency Risk: All transactions are carried out in sterling and therefore the Credit Union is not exposed to any form of foreign currency risk. 45

- 48. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 22 16. Interest Rate Disclosure The following table shows the average interest rates applicable to relevant financial assets and financial liabilities. 2018 2017 Average Average interest interest Amount rate Amount rate £ % £ % Financial assets Loans to members 5,727,563 6.34 5,371,803 6.40 The interest rates applicable to loans to members are fixed and range from 5.0% to 36.0% per annum. 17. Liquidity Risk Disclosure Excluding short-term other payables, as noted in the balance sheet, Pentecostal Credit Union Limited's financial liabilities, the subscribed capital, are repayable on demand. 46

- 49. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 23 18. Credit Risk Disclosure Pentecostal Credit Union Limited does not offer mortgages and as a result all loans to members are unsecured, except that there are restrictions on the extent to which borrowers may withdraw their savings whilst loans are outstanding and some loans are fully secured by members savings. The carrying amount of the loans to members represents Pentecostal Credit Union's maximum exposure to credit risk. The following table provides information on the credit quality of loan repayments. 2018 2017 £ £ Loans analysis Not past due 5,127,081 4,832,995 Up to 3 months past due 138,182 100,091 Between 3 months and 6 months due 67,238 57,740 Between 6 months and 1 year past due 120,012 10,705 Over 1 year past due 275,050 370,272 Total loans 5,727,563 5,371,803 General provision )(439,495 )(479,509 Specific provision )(351,251 )(424,648 Total carrying value 4,936,817 4,467,646 47

- 50. PENTECOSTAL CREDIT UNION LIMITED FCA/PRA REGISTRATION NUMBER 213242 COMPANY NUMBER IP00006C NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 SEPTEMBER 2018 .................... continued Page 24 19. Related party transactions Loans can be made to directors, as members of the Credit Union, in the course of business and on the same terms as are available to other members, in accordance with the requirements of the Financial Conduct Authority. During the year, 7 members of the Board, staff and their close family members (2017: 7 members) had loans with the Credit Union. These loans were approved on the same basis as loans to other members of the Credit Union. During the year £50,751 (2017: £50,087) including Employers National Insurance was paid to key management personnel in respect of remuneration. During the year, Pentecostal Credit Union paid £49,133 (2017: £49,149) in consultancy fees to the mother of a member of key management personnel. 48

- 51. Hear my cry, Oh Lord, Attend unto my prayer. From the end of the earth, Will I cry out to Thee. When my heart is overwhelmed, Lead me to the Rock, That is higher than I. That is higher than I. For Thou hast been, A shelter for me. And a strong tower, From the enemy. When my heart is overwhelmed, Lead me to the Rock, That is higher than I. That is higher than I. Hear my cry, O Lord, Attend unto my prayer. From the end of the earth, Will I cry out to Thee. When my heart is overwhelmed, Lead me to the Rock, That is higher than I. That is higher than I Hear my cry oh Lord

- 52. The Pentecostal Credit Union is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (FRN 213242). The Pentecostal Credit Union Limited 15 Oldridge Road Balham London SW12 8PL Phone 020 8673 2542 Email info@pcuuk.com www.pcuuk.com /pentecostalcreditunion @PentecostalCU