Weitere ähnliche Inhalte

Ähnlich wie Houston Market Report February 2010

Ähnlich wie Houston Market Report February 2010 (20)

Houston Market Report February 2010

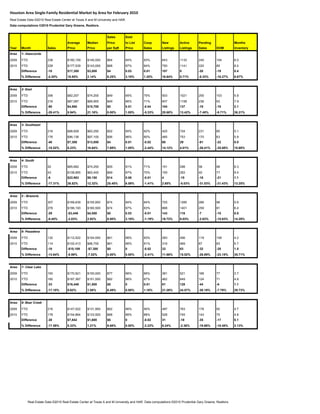

- 1. Houston Area Single‐Family Residential Market by Area for February 2010

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR.

Data computations ©2010 Prudential Gary Greene, Realtors.

Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area 1- Atascocita

2009 YTD 238 $160,159 $140,000 $64 94% 83% 643 1133 240 104 6.0

2010 YTD 228 $177,539 $143,000 $68 97% 84% 750 1141 220 85 6.4

Difference -10 $17,380 $3,000 $4 0.03 0.01 107 8 -20 -19 0.4

% Difference -4.20% 10.85% 2.14% 6.25% 3.19% 1.20% 16.64% 0.71% -8.33% -18.27% 6.67%

Area 2- East

2009 YTD 306 $82,207 $74,200 $49 95% 75% 503 1021 255 103 5.8

2010 YTD 216 $87,087 $89,900 $49 96% 71% 607 1158 236 93 7.9

Difference -90 $4,880 $15,700 $0 0.01 -0.04 104 137 -19 -10 2.1

% Difference -29.41% 5.94% 21.16% 0.00% 1.05% -5.33% 20.68% 13.42% -7.45% -9.71% 36.21%

Area 3- Southeast

2009 YTD 216 $88,828 $83,250 $52 95% 82% 425 724 231 85 5.1

2010 YTD 176 $96,136 $97,100 $56 96% 80% 485 753 170 63 5.9

Difference -40 $7,308 $13,850 $4 0.01 -0.02 60 29 -61 -22 0.8

% Difference -18.52% 8.23% 16.64% 7.69% 1.05% -2.44% 14.12% 4.01% -26.41% -25.88% 15.69%

Area 4- South

2009 YTD 52 $85,682 $74,250 $55 91% 71% 151 298 58 98 8.3

2010 YTD 43 $108,665 $83,400 $69 97% 70% 155 283 40 77 9.4

Difference -9 $22,983 $9,150 $14 0.06 -0.01 4 -15 -18 -21 1.1

% Difference -17.31% 26.82% 12.32% 25.45% 6.59% -1.41% 2.65% -5.03% -31.03% -21.43% 13.25%

Area: 5 - Brazoria

2009 YTD 307 $169,639 $155,950 $74 94% 84% 725 1285 266 96 5.6

2010 YTD 278 $166,193 $160,500 $74 97% 83% 868 1401 259 81 6.4

Difference -29 -$3,446 $4,550 $0 0.03 -0.01 143 116 -7 -15 0.8

% Difference -9.45% -2.03% 2.92% 0.00% 3.19% -1.19% 19.72% 9.03% -2.63% -15.63% 14.29%

Area: 6- Pasadena

2009 YTD 132 $112,522 $104,000 $61 96% 83% 283 406 119 108 4.2

2010 YTD 114 $102,413 $96,700 $61 96% 81% 316 469 87 83 5.7

Difference -18 -$10,109 -$7,300 $0 0 -0.02 33 63 -32 -25 1.5

% Difference -13.64% -8.98% -7.02% 0.00% 0.00% -2.41% 11.66% 15.52% -26.89% -23.15% 35.71%

Area: 7- Clear Lake

2009 YTD 193 $170,921 $150,000 $77 96% 86% 381 521 168 77 3.7

2010 YTD 160 $187,367 $151,500 $82 96% 87% 462 649 124 71 4.8

Difference -33 $16,446 $1,500 $5 0 0.01 81 128 -44 -6 1.1

% Difference -17.10% 9.62% 1.00% 6.49% 0.00% 1.16% 21.26% 24.57% -26.19% -7.79% 29.73%

Area: 8- Bear Creek

2009 YTD 216 $147,022 $131,900 $62 96% 90% 497 763 178 92 4.7

2010 YTD 178 $154,864 $133,500 $68 96% 88% 528 745 143 75 4.8

Difference -38 $7,842 $1,600 $6 0 -0.02 31 -18 -35 -17 0.1

% Difference -17.59% 5.33% 1.21% 9.68% 0.00% -2.22% 6.24% -2.36% -19.66% -18.48% 2.13%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 2. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 9- The Heights

2009 YTD 180 $237,830 $227,500 $127 96% 78% 606 1133 143 98 7.2

2010 YTD 200 $240,218 $227,500 $130 96% 78% 585 1035 125 77 6.6

Difference 20 $2,388 $0 $3 0 0 -21 -98 -18 -21 -0.6

% Difference 11.11% 1.00% 0.00% 2.36% 0.00% 0.00% -3.47% -8.65% -12.59% -21.43% -8.33%

Area: 10- Hempstead East

2009 YTD 171 $160,791 $155,000 $66 96% 87% 441 752 149 91 4.9

2010 YTD 173 $167,365 $157,000 $68 96% 87% 574 777 137 75 5.2

Difference 2 $6,574 $2,000 $2 0 0 133 25 -12 -16 0.3

% Difference 1.17% 4.09% 1.29% 3.03% 0.00% 0.00% 30.16% 3.32% -8.05% -17.58% 6.12%

Area: 11-Near North

2009 YTD 111 $86,744 $78,720 $47 95% 86% 229 464 105 101 5.6

2010 YTD 123 $91,235 $85,900 $51 96% 83% 286 425 97 84 5.6

Difference 12 $4,491 $7,180 $4 0.01 -0.03 57 -39 -8 -17 0

% Difference 10.81% 5.18% 9.12% 8.51% 1.05% -3.49% 24.89% -8.41% -7.62% -16.83% 0.00%

Area: 12- North

2009 YTD 232 $95,978 $92,750 $47 97% 88% 477 883 242 90 6.0

2010 YTD 208 $98,473 $94,000 $50 97% 80% 499 690 221 69 4.8

Difference -24 $2,495 $1,250 $3 0 -0.08 22 -193 -21 -21 -1.2

% Difference -10.34% 2.60% 1.35% 6.38% 0.00% -9.09% 4.61% -21.86% -8.68% -23.33% -20.00%

Area: 13- Northwest

2009 YTD 265 $137,897 $122,000 $53 97% 87% 632 1123 252 99 5.4

2010 YTD 243 $155,257 $132,000 $60 96% 86% 705 1072 191 82 5.6

Difference -22 $17,360 $10,000 $7 -0.01 -0.01 73 -51 -61 -17 0.2

% Difference -8.30% 12.59% 8.20% 13.21% -1.03% -1.15% 11.55% -4.54% -24.21% -17.17% 3.70%

Area: 14- Far Northwest

2009 YTD 185 $177,855 $141,500 $70 96% 82% 466 823 135 101 5.7

2010 YTD 171 $192,005 $156,000 $75 96% 89% 495 792 135 88 5.8

Difference -14 $14,150 $14,500 $5 0 0.07 29 -31 0 -13 0.1

% Difference -7.57% 7.96% 10.25% 7.14% 0.00% 8.54% 6.22% -3.77% 0.00% -12.87% 1.75%

Area: 15-Montgomery County Southwest

2009 YTD 319 $251,426 $180,000 $97 95% 79% 952 1564 273 89 5.6

2010 YTD 312 $298,032 $205,520 $107 95% 85% 988 1571 283 85 5.9

Difference -7 $46,606 $25,520 $10 0 0.06 36 7 10 -4 0.3

% Difference -2.19% 18.54% 14.18% 10.31% 0.00% 7.59% 3.78% 0.45% 3.66% -4.49% 5.36%

Area: 16- Central Inner Loop

2009 YTD 70 $460,277 $367,500 $177 96% 77% 314 556 54 78 9.2

2010 YTD 65 $612,303 $432,500 $210 94% 82% 258 518 52 92 9.9

Difference -5 $152,026 $65,000 $33 -0.02 0.05 -56 -38 -2 14 0.7

% Difference -7.14% 33.03% 17.69% 18.64% -2.08% 6.49% -17.83% -6.83% -3.70% 17.95% 7.61%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 3. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 17-Southwest Inner Loop

2009 YTD 63 $695,404 $607,000 $221 95% 81% 368 682 31 87 8.8

2010 YTD 94 $628,717 $514,500 $206 93% 87% 311 604 49 110 7.9

Difference 31 -$66,687 -$92,500 -$15 -0.02 0.06 -57 -78 18 23 -0.9

% Difference 49.21% -9.59% -15.24% -6.79% -2.11% 7.41% -15.49% -11.44% 58.06% 26.44% -10.23%

Area: 18- South Central

2009 YTD 40 $70,567 $67,400 $45 98% 83% 81 143 37 117 6.9

2010 YTD 13 $72,034 $73,750 $50 99% 38% 52 106 10 65 6.3

Difference -27 $1,467 $6,350 $5 0.01 -0.45 -29 -37 -27 -52 -0.6

% Difference -67.50% 2.08% 9.42% 11.11% 1.02% -54.22% -35.80% -25.87% -72.97% -44.44% -8.70%

Area: 19- Montgomery County Northeast

2009 YTD 105 $139,883 $107,990 $69 92% 60% 257 454 90 97 6.0

2010 YTD 104 $134,451 $110,900 $65 95% 77% 242 443 85 81 6.9

Difference -1 -$5,432 $2,910 -$4 0.03 0.17 -15 -11 -5 -16 0.9

% Difference -0.95% -3.88% 2.69% -5.80% 3.26% 28.33% -5.84% -2.42% -5.56% -16.49% 15.00%

Area: 20- Bellaire South

2009 YTD 100 $160,006 $125,750 $78 94% 82% 244 388 77 85 4.5

2010 YTD 76 $178,365 $162,200 $84 96% 88% 267 361 61 52 4.9

Difference -24 $18,359 $36,450 $6 0.02 0.06 23 -27 -16 -33 0.4

% Difference -24.00% 11.47% 28.99% 7.69% 2.13% 7.32% 9.43% -6.96% -20.78% -38.82% 8.89%

Area: 21-Bellaire West

2009 YTD 20 $120,516 $115,500 $61 96% 90% 75 95 25 91 5.4

2010 YTD 22 $134,023 $130,000 $68 96% 82% 57 88 15 55 4.7

Difference 2 $13,507 $14,500 $7 0 -0.08 -18 -7 -10 -36 -0.7

% Difference 10.00% 11.21% 12.55% 11.48% 0.00% -8.89% -24.00% -7.37% -40.00% -39.56% -12.96%

Area: 22 - Central West

2009 YTD 29 $717,974 $549,000 $210 93% 79% 143 331 14 108 8.6

2010 YTD 54 $663,354 $426,000 $207 94% 81% 145 300 29 97 7.8

Difference 25 -$54,620 -$123,000 -$3 0.01 0.02 2 -31 15 -11 -0.8

% Difference 86.21% -7.61% -22.40% -1.43% 1.08% 2.53% 1.40% -9.37% 107.14% -10.19% -9.30%

Area: 23- Memorial

2009 YTD 53 $672,119 $470,000 $193 93% 75% 195 343 29 87 6.9

2010 YTD 61 $765,831 $485,000 $207 94% 70% 160 277 31 123 6.0

Difference 8 $93,712 $15,000 $14 0.01 -0.05 -35 -66 2 36 -0.9

% Difference 15.09% 13.94% 3.19% 7.25% 1.08% -6.67% -17.95% -19.24% 6.90% 41.38% -13.04%

Area: 24 - Spring Branch

2009 YTD 66 $179,095 $136,250 $97 94% 82% 176 308 47 73 5.6

2010 YTD 84 $193,585 $148,400 $100 96% 83% 201 299 44 95 6.0

Difference 18 $14,490 $12,150 $3 0.02 0.01 25 -9 -3 22 0.4

% Difference 27.27% 8.09% 8.92% 3.09% 2.13% 1.22% 14.20% -2.92% -6.38% 30.14% 7.14%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 4. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 25- Far West

2009 YTD 334 $125,038 $113,750 $58 96% 90% 669 1081 318 100 4.8

2010 YTD 308 $138,968 $118,110 $62 96% 92% 800 1051 291 60 4.8

Difference -26 $13,930 $4,360 $4 0 0.02 131 -30 -27 -40 0

% Difference -7.78% 11.14% 3.83% 6.90% 0.00% 2.22% 19.58% -2.78% -8.49% -40.00% 0.00%

Area: 26- Waller County

2009 YTD 27 $95,614 $74,900 $51 94% 67% 70 153 26 120 7.6

2010 YTD 18 $141,855 $93,000 $70 96% 67% 84 148 26 94 10.5

Difference -9 $46,241 $18,100 $19 0.02 0 14 -5 0 -26 2.9

% Difference -33.33% 48.36% 24.17% 37.25% 2.13% 0.00% 20.00% -3.27% 0.00% -21.67% 38.16%

Area: 28- Alief Area

2009 YTD 76 $94,166 $82,000 $50 97% 93% 218 369 73 111 6.7

2010 YTD 65 $89,393 $86,000 $47 97% 85% 210 315 74 65 5.7

Difference -11 -$4,773 $4,000 -$3 0 -0.08 -8 -54 1 -46 -1

% Difference -14.47% -5.07% 4.88% -6.00% 0.00% -8.60% -3.67% -14.63% 1.37% -41.44% -14.93%

Area: 29 - Fort Bend - Sugar Land/Stafford

2009 YTD 123 $264,113 $202,000 $94 95% 85% 343 542 87 83 4.2

2010 YTD 159 $274,236 $240,000 $94 94% 96% 419 567 103 80 4.5

Difference 36 $10,123 $38,000 $0 -0.01 0.11 76 25 16 -3 0.3

% Difference 29.27% 3.83% 18.81% 0.00% -1.05% 12.94% 22.16% 4.61% 18.39% -3.61% 7.14%

Area: 30 - Fort Bend East - Missouri City

2009 YTD 140 $197,528 $175,250 $74 94% 83% 326 616 151 103 6.3

2010 YTD 129 $201,626 $181,750 $77 94% 88% 354 589 128 80 5.6

Difference -11 $4,098 $6,500 $3 0 0.05 28 -27 -23 -23 -0.7

% Difference -7.86% 2.07% 3.71% 4.05% 0.00% 6.02% 8.59% -4.38% -15.23% -22.33% -11.11%

Area: 31-West

2009 YTD 66 $305,435 $205,950 $108 93% 95% 219 408 61 113 6.4

2010 YTD 69 $295,629 $229,000 $108 97% 86% 218 356 46 77 6.1

Difference 3 -$9,806 $23,050 $0 0.04 -0.09 -1 -52 -15 -36 -0.3

% Difference 4.55% -3.21% 11.19% 0.00% 4.30% -9.47% -0.46% -12.75% -24.59% -31.86% -4.69%

Area: 32- Far Northeast

2009 YTD 107 $179,555 $168,000 $69 96% 76% 264 419 90 99 4.8

2010 YTD 92 $213,232 $164,000 $82 95% 79% 292 440 72 87 5.1

Difference -15 $33,677 -$4,000 $13 -0.01 0.03 28 21 -18 -12 0.3

% Difference -14.02% 18.76% -2.38% 18.84% -1.04% 3.95% 10.61% 5.01% -20.00% -12.12% 6.25%

Area: 33- Galveston

2009 YTD 421 $158,481 $138,900 $73 94% 75% 988 1895 331 101 6.3

2010 YTD 345 $196,911 $165,500 $88 94% 80% 1254 2427 294 100 9.1

Difference -76 $38,430 $26,600 $15 0 0.05 266 532 -37 -1 2.8

% Difference -18.05% 24.25% 19.15% 20.55% 0.00% 6.67% 26.92% 28.07% -11.18% -0.99% 44.44%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 5. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 34- Aldine Westfield

2009 YTD 35 $61,906 $57,000 $41 89% 74% 74 202 30 95 8.3

2010 YTD 32 $74,280 $76,000 $51 98% 88% 104 195 27 71 9.1

Difference -3 $12,374 $19,000 $10 0.09 0.14 30 -7 -3 -24 0.8

% Difference -8.57% 19.99% 33.33% 24.39% 10.11% 18.92% 40.54% -3.47% -10.00% -25.26% 9.64%

Area: 35- Hempstead West

2009 YTD 146 $175,425 $154,500 $71 96% 88% 345 605 131 90 5.6

2010 YTD 149 $183,383 $154,500 $71 95% 90% 406 591 127 85 5.4

Difference 3 $7,958 $0 $0 -0.01 0.02 61 -14 -4 -5 -0.2

% Difference 2.05% 4.54% 0.00% 0.00% -1.04% 2.27% 17.68% -2.31% -3.05% -5.56% -3.57%

Area: 36 - South Katy Area

2009 YTD 264 $231,863 $220,000 $82 94% 91% 594 912 248 89 4.1

2010 YTD 277 $263,074 $229,540 $89 95% 92% 672 769 250 69 3.3

Difference 13 $31,211 $9,540 $7 0.01 0.01 78 -143 2 -20 -0.8

% Difference 4.92% 13.46% 4.34% 8.54% 1.06% 1.10% 13.13% -15.68% 0.81% -22.47% -19.51%

Area: 37 - Fort Bend West

2009 YTD 230 $171,989 $154,490 $68 95% 90% 512 869 219 102 5.4

2010 YTD 168 $182,192 $151,000 $73 94% 92% 588 849 187 86 5.4

Difference -62 $10,203 -$3,490 $5 -0.01 0.02 76 -20 -32 -16 0

% Difference -26.96% 5.93% -2.26% 7.35% -1.05% 2.22% 14.84% -2.30% -14.61% -15.69% 0.00%

Area: 38 - Fort Bend East

2009 YTD 240 $143,292 $110,250 $61 95% 86% 394 648 198 93 4.3

2010 YTD 162 $159,480 $134,990 $65 96% 90% 445 681 154 73 5.6

Difference -78 $16,188 $24,740 $4 0.01 0.04 51 33 -44 -20 1.3

% Difference -32.50% 11.30% 22.44% 6.56% 1.05% 4.65% 12.94% 5.09% -22.22% -21.51% 30.23%

Area: 39 - Montgomery County Northwest

2009 YTD 132 $208,154 $155,250 $89 95% 84% 432 893 104 105 9.8

2010 YTD 120 $213,271 $169,250 $90 95% 85% 423 791 100 116 8.5

Difference -12 $5,117 $14,000 $1 0 0.01 -9 -102 -4 11 -1.3

% Difference -9.09% 2.46% 9.02% 1.12% 0.00% 1.19% -2.08% -11.42% -3.85% 10.48% -13.27%

Area: 40 - Montgomery County Southeast

2009 YTD 39 $132,827 $120,000 $64 95% 72% 171 291 50 133 7.6

2010 YTD 65 $155,799 $121,600 $75 96% 78% 192 311 53 80 7.3

Difference 26 $22,972 $1,600 $11 0.01 0.06 21 20 3 -53 -0.3

% Difference 66.67% 17.29% 1.33% 17.19% 1.05% 8.33% 12.28% 6.87% 6.00% -39.85% -3.95%

Area: 41 - Montgomery County Northwest

2009 YTD 2 $36,750 $36,750 $22 69% 0% 3 16 1 128 17.5

2010 YTD 2 $115,000 $115,000 $60 100% 0% 8 17 5 117 14.1

Difference 0 $78,250 $78,250 $38 0.31 0 5 1 4 -11 -3.4

% Difference 0.00% 212.93% 212.93% 172.73% 44.93% 0.00% 166.67% 6.25% 400.00% -8.59% -19.43%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 6. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 42 - Liberty County

2009 YTD 7 $70,314 $60,000 $46 92% 57% 39 110 8 93 16.0

2010 YTD 12 $59,708 $53,500 $46 89% 42% 26 107 8 140 14.4

Difference 5 -$10,606 -$6,500 $0 -0.03 -0.15 -13 -3 0 47 -1.6

% Difference 71.43% -15.08% -10.83% 0.00% -3.26% -26.32% -33.33% -2.73% 0.00% 50.54% -10.00%

Area: 43 - Walker County

2009 YTD 24 $110,852 $105,000 $60 90% 58% 71 158 26 98 7.5

2010 YTD 24 $155,280 $150,000 $79 93% 71% 59 161 22 85 7.5

Difference 0 $44,428 $45,000 $19 0.03 0.13 -12 3 -4 -13 0

% Difference 0.00% 40.08% 42.86% 31.67% 3.33% 22.41% -16.90% 1.90% -15.38% -13.27% 0.00%

Area: 44 - Polk County

2009 YTD 38 $120,968 $100,500 $66 91% 55% 109 288 25 122 12.3

2010 YTD 17 $135,568 $98,000 $81 93% 59% 108 350 14 123 13.8

Difference -21 $14,600 -$2,500 $15 0.02 0.04 -1 62 -11 1 1.5

% Difference -55.26% 12.07% -2.49% 22.73% 2.20% 7.27% -0.92% 21.53% -44.00% 0.82% 12.20%

Area: 45

2009 YTD 1 $32,000 $32,000 $25 92% 0% 2 1 39 12.0

Difference 0 $0 $0 $0 0 0 0 0 0 0 0

% Difference 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 200.00% 0.00% 0.00%

Area: 48

2009 YTD 2 $40,979 $40,980 $27 75% 50% 2 18 0 150 9.4

2010 YTD 3 $108,000 $95,000 $34 96% 67% 9 17 3 74 10.2

Difference 1 $67,021 $54,020 $7 0.21 0.17 7 -1 3 -76 0.8

% Difference 50.00% 163.55% 131.82% 25.93% 28.00% 34.00% 350.00% -5.56% 0.00% -50.67% 8.51%

Area: 50

2009 YTD 1 $114,000 $114,000 $77 99% 0% 0 0 0 45

2010 YTD 1 $43,000 $43,000 $35 86% 0% 1 0 1 184

Difference 0 -$71,000 -$71,000 -$42 -0.13 0 1 0 1 139 0

% Difference 0.00% -62.28% -62.28% -54.55% -13.13% 0% 0.00% 0.00% 0.00% 308.89% 0.00%

Area: 51

2009 YTD 5 $64,080 $64,900 $39 97% 80% 8 10 6 71 2.7

2010 YTD 3 $28,373 $30,000 $21 80% 100% 12 18 7 80 7.3

Difference -2 -$35,707 -$34,900 $14 -0.17 0.2 4 8 1 9 4.6

% Difference -40.00% -55.72% -53.78% 0.00% -17.53% 25.00% 50.00% 80.00% 16.67% 12.68% 170.37%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 7. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 52 - Liberty County

2009 YTD 39 $94,354 $75,000 $52 94% 49% 87 181 52 132 6.1

2010 YTD 41 $85,736 $67,750 $50 95% 51% 94 222 31 89 9.5

Difference 2 -$8,618 -$7,250 -$2 0.01 0.02 7 41 -21 -43 3.4

% Difference 5.13% -9.13% -9.67% -3.85% 1.06% 4.08% 8.05% 22.65% -40.38% -32.58% 55.74%

Area: 53 - Chambers County

2009 YTD 33 $161,482 $127,500 $76 98% 64% 60 125 24 121 6.3

2010 YTD 25 $180,458 $173,000 $78 97% 84% 77 145 24 76 6.9

Difference -8 $18,976 $45,500 $2 -0.01 0.2 17 20 0 -45 0.6

% Difference -24.24% 11.75% 35.69% 2.63% -1.02% 31.25% 28.33% 16.00% 0.00% -37.19% 9.52%

Area: 54

2009 YTD 6 $123,204 $133,910 $97 85% 50% 25 92 3 178 23.2

2010 YTD 7 $102,039 $85,000 $80 91% 57% 25 128 6 95 38.7

Difference 1 -$21,165 -$48,910 -$17 0.06 0.07 0 36 3 -83 15.5

% Difference 16.67% -17.18% -36.52% -17.53% 7.06% 14.00% 0.00% 39.13% 100.00% -46.63% 66.81%

Area: 55 - Wharton County

2009 YTD 18 $104,217 $93,750 $66 94% 44% 43 111 8 116 10.6

2010 YTD 20 $114,625 $93,500 $61 92% 55% 44 117 11 93 10.8

Difference 2 $10,408 -$250 -$5 -0.02 0.11 1 6 3 -23 0.2

% Difference 11.11% 9.99% -0.27% -7.58% -2.13% 25.00% 2.33% 5.41% 37.50% -19.83% 1.89%

Area: 56

2009 YTD 6 $122,563 $119,000 $62 89% 50% 19 53 3 95 19.1

2010 YTD 6 $111,450 $116,000 $68 92% 67% 16 44 7 116 13.5

Difference 0 -$11,113 -$3,000 $6 0.03 0.17 -3 -9 4 21 -5.6

% Difference 0.00% -9.07% -2.52% 9.68% 3.37% 34.00% -15.79% -16.98% 133.33% 22.11% -29.32%

Area: 57 - Austin County

2009 YTD 24 $102,231 $83,000 $66 92% 63% 63 150 21 79 10.7

2010 YTD 14 $144,162 $138,500 $80 92% 43% 49 175 13 250 15.5

Difference -10 $41,931 $55,500 $14 0 -0.2 -14 25 -8 171 4.8

% Difference -41.67% 41.02% 66.87% 21.21% 0.00% -31.75% -22.22% 16.67% -38.10% 216.46% 44.86%

Area: 58

2009 YTD 13 $186,223 $150,500 $83 95% 38% 30 51 11 84 8.8

2010 YTD 8 $147,219 $133,380 $86 96% 88% 18 43 4 110 8.4

Difference -5 -39004 -17120 3 0.01 0.5 -12 -8 -7 26 -0.4

% Difference -38.46% -20.94% -11.38% 3.61% 1.05% 131.58% -40.00% -15.69% -63.64% 30.95% -4.55%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 8. Sales Sold

Average Median Price to List Coop New Active Pending Months

Year Month Sales Price Price per Sqft Price Sales Listings Listings Sales DOM Inventory

Area: 60

2009 YTD 12 $59,552 $44,000 $40 89% 42% 38 60 8 137 10.4

2010 YTD 10 $107,590 $70,000 $65 88% 20% 18 47 12 106 8.0

Difference -2 $48,038 $26,000 $25 -0.01 -0.22 -20 -13 4 -31 -2.4

% Difference -16.67% 80.67% 59.09% 62.50% -1.12% -52.38% -52.63% -21.67% 50.00% -22.63% -23.08%

Area: 61

2009 YTD 6 $154,046 $71,890 $75 94% 100% 13 14 11 81 2.9

2010 YTD 8 $158,300 $172,450 $86 99% 88% 26 29 9 32 5.0

Difference 2 $4,254 $100,560 $11 0.05 -0.12 13 15 -2 -49 2.1

% Difference 33.33% 2.76% 139.88% 14.67% 5.32% -12.00% 100.00% 107.14% -18.18% -60.49% 72.41%

Area: 62

2009 YTD 1 $29,400 $29,400 $27 92% 0% 5 30 11 13

2010 YTD 5 $103,400 $82,000 $52 95% 40% 11 27 9 227 11.5

Difference 4 $74,000 $52,600 $25 0.03 0.4 6 -3 9 216 -1.4

% Difference 400.00% 251.70% 178.91% 92.59% 3.26% 0.00% 120.00% -10.00% 0.00% 1963.64% -10.85%

Area: 63

2009 YTD 2 $139,450 $139,450 $63 92% 0% 1 19 2 248 20.7

2010 YTD 4 $55,625 $63,750 $35 89% 25% 21 40 1 79 31.0

Difference 2 -$83,825 -$75,700 -$28 -0.03 0.25 20 21 -1 -169 10.3

% Difference 100.00% -60.11% -54.28% -44.44% -3.26% 25.00% 2000.00% 110.53% 0.00% -68.15% 49.76%

Area: 64 - San Jacinto County

2009 YTD 23 $98,509 $67,500 $65 89% 30% 57 139 16 116 9.0

2010 YTD 23 $120,524 $72,120 $83 92% 43% 62 179 10 108 13.1

Difference 0 $22,015 $4,620 $18 0.03 0.13 5 40 -6 -8 4.1

% Difference 0.00% 22.35% 6.84% 27.69% 3.37% 43.33% 8.77% 28.78% -37.50% -6.90% 45.56%

Area: 66

2010 YTD 2 $182,500 $182,500 $60 92% 50% 7 23 156 37

% Difference 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.

- 9. Area: 69

2010 YTD 1 $220,000 $220,000 $120 88% 0% 3 21 55 36.0

% Difference 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Area: 77

2009 YTD 1 $132,500 $132,500 $65 100% 0% 2 14 1 12 8.0

2010 YTD 3 $80,667 $103,000 $56 97% 33% 9 12 3 224 7.8

Difference 2 -$51,833 -$29,500 -$9 -0.03 0.33 7 -2 2 212 -0.2

% Difference 200.00% -39.12% -22.26% -13.85% -3.00% 0.00% 350.00% -14.29% 200.00% 1766.67% -2.50%

Real Estate Data ©2010 Real Estate Center at Texas A and M University and HAR. Data computations ©2010 Prudential Gary Greene, Realtors.