ICICI Direct aurobindo_pharma_initiating coverage March 2011

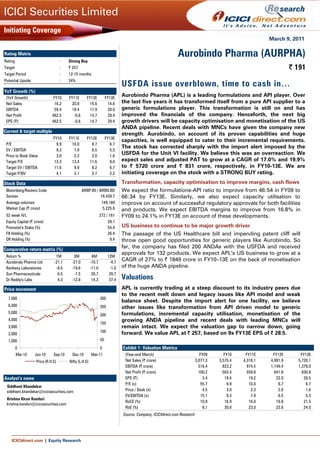

- 1. ICICI Securities Limited Initiating Coverage March 9, 2011 Rating Matrix Aurobindo Pharma (AURPHA) Rating : Strong Buy Target : | 257 | 191 Target Period : 12-15 months Potential Upside : 34% USFDA issue overblown, time to cash in… YoY Growth (%) (YoY Growth) FY10 FY11E FY12E FY13E Aurobindo Pharma (APL) is a leading formulations and API player. Over Net Sales 16.2 20.8 15.6 14.6 the last five years it has transformed itself from a pure API supplier to a EBITDA 59.4 18.4 17.9 20.0 generic formulations player. This transformation is still on and has Net Profit 462.5 -0.6 14.7 29.4 improved the financials of the company. Henceforth, the next big EPS (|) 462.5 -0.6 14.7 29.4 growth drivers will be capacity optimisation and monetisation of the US ANDA pipeline. Recent deals with MNCs have given the company new Current & target multiple strength. Aurobindo, on account of its proven capabilities and huge FY10 FY11E FY12E FY13E capacities, is well equipped to cater to their incremental requirements. P/E 9.9 10.0 8.7 6.7 The stock has corrected sharply with the import alert imposed by the EV / EBITDA 9.3 7.9 6.5 5.3 Price to Book Value 3.0 2.3 2.0 1.6 USFDA for the Unit VI facility. We believe this was an overreaction. We Target P/E 13.3 13.4 11.6 9.0 expect sales and adjusted PAT to grow at a CAGR of 17.0% and 19.9% Target EV / EBITDA 11.6 9.9 8.2 6.7 to | 5720 crore and | 831 crore, respectively, in FY10-13E. We are Target P/BV 4.1 3.1 2.7 2.2 initiating coverage on the stock with a STRONG BUY rating. Stock Data Transformation, capacity optimisation to improve margins, cash flows Bloomberg/Reuters Code ARBP.IN / ARBN.BO We expect the formulations-API ratio to improve from 46:54 in FY09 to Sensex 18,439.7 66:34 by FY13E. Similarly, we also expect capacity utilisation to Average volumes 149,189 improve on account of successful regulatory approvals for both facilities Market Cap (| crore) 5,225.6 and products. We expect EBITDA margins to improve from 16.8% in 52 week H/L 272 / 161 FY09 to 24.1% in FY13E on account of these developments. Equity Capital (| crore) 29.1 Promoter's Stake (%) 54.4 US business to continue to be major growth driver FII Holding (%) 26.4 The passage of the US Healthcare bill and impending patent cliff will DII Holding (%) 9.4 throw open good opportunities for generic players like Aurobindo. So Comparative return matrix (%) far, the company has filed 200 ANDAs with the USFDA and received approvals for 132 products. We expect APL’s US business to grow at a Return % 1M 3M 6M 12M Aurobindo Pharma Ltd -21.1 -27.0 -10.7 -4.7 CAGR of 27% to | 1849 crore in FY10–13E on the back of monetisation Ranbaxy Laboratories -8.5 -19.6 -11.0 -1.0 of the huge ANDA pipeline. Sun Pharmaceuticals 6.5 -7.5 20.7 29.7 Dr Reddy's Labs 4.3 -12.8 14.3 37.4 Valuations Price movement APL is currently trading at a steep discount to its industry peers due to the recent melt down and legacy issues like API model and weak 7,000 300 balance sheet. Despite the import alert for one facility, we believe 6,000 250 other issues like transformation from API driven model to generic 5,000 formulations, incremental capacity utilisation, monetisation of the 200 4,000 growing ANDA pipeline and recent deals with leading MNCs will 150 3,000 remain intact. We expect the valuation gap to narrow down, going 100 forward. We value APL at | 257, based on 9x FY13E EPS of | 28.5. 2,000 1,000 50 0 0 Exhibit 1: Valuation Metrics Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 (Year-end March) FY09 FY10 FY11E FY12E FY13E Price (R.H.S) Nifty (L.H.S) Net Sales (| crore) 3,077.3 3,575.4 4,318.1 4,991.9 5,720.1 EBITDA (| crore) 516.4 823.2 974.5 1,149.4 1,379.0 Net Profit (| crore) 100.2 563.4 559.8 641.8 830.8 Analyst’s name EPS (|) 3.4 19.4 19.2 22.0 28.5 P/E (x) 55.7 9.9 10.0 8.7 6.7 Siddhant Khandekar siddhant.khandekar@icicisecurities.com Price / Book (x) 4.5 3.0 2.3 2.0 1.6 EV/EBITDA (x) 15.1 9.3 7.9 6.5 5.3 Krishna Kiran Konduri RoCE (%) 10.9 16.9 16.0 19.8 21.5 krishna.konduri@icicisecurities.com RoE (%) 8.1 30.8 23.0 23.6 24.0 Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research

- 2. ICICI Securities Limited Share holding pattern (Q3FY11) Company background Shareholder Holding (%) Promoters 54.4 Aurobindo Pharma (APL) was set up by first generation entrepreneurs Institutional Investors 35.8 PV Ramprasad Reddy and K Nithyananda Reddy in 1986. Based in Other Investors 3.1 Hyderabad, APL is an integrated pharmaceutical company, which General Public 6.8 started as an API manufacturer. In 2001, it moved up the value chain by foraying into formulations while from 2007 onwards it started scaling up the formulation business. APL's manufacturing facilities are approved by several leading regulatory agencies like USFDA, UKMHRA, WHO, Health FII & DII holding trend (%) Canada, MCC South Africa, ANVISA Brazil. The company owns 16 manufacturing facilities in India and the US. Of these 16 facilities, seven 70 are for formulations, six are for APIs while three are for intermediates. It 58.7 56.9 56.2 60 54.4 54.4 also owns a distribution hub in Malta and a packaging facility in Brazil. 50 The company owns three R&D centres. The current employee strength 35.4 35.8 40 32.4 34.1 34.2 is more than 8000, which includes more than 750 scientists. APL 30 markets its products in 125 countries through a global marketing 20 network of 41 subsidiaries. 10 0 Till date, it has filled 200 ANDA with the USFDA and received approvals Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3 FY11 for 132 ANDAs (including 33 tentative approvals). It has also filed 906 Promoter FIIs & MFs dossiers in the EU market and received approvals for 351 dossiers. Exports account for ~70% of total sales. Aurobindo Pharma is vertically integrated and its product basket includes about 300+ products spread over seven major therapeutic areas encompassing cardiovascular (CVS), central nervous system (CNS), anti-infectives, anti-retrovirals (ARVs), gastroenterologicals (GIs), pain management and osteoporosis. The market potential of APL’s product pipeline of 300+ products is more than US$200 billion. The company is a leading player in APIs and has a strong presence in anti-bacterials such as semi-synthetic penicillins (SSPs) and cephalosporins (Cephs). Explanation on Unit VI import alert USFDA has imposed an import alert on drugs manufactured at the Unit VI accounts for ~3-4% of total sales company’s Unit VI facility. Unit VI manufactures cephalosporin in both oral and sterile forms. The facility was inspected by the USFDA in December 2010 and it found some deviations in cGMP of sterile products in the facility. Currently, Aurobindo has stopped shipments to US market from this facility. Currently, Aurobindo is supplying four injections cefazolin, cefotaxime, ceftazidime and ceftriaxone from this facility to Pfizer. It is also supplying five oral products cefadroxil, cefidinir, cefprozil, cefprozil oral suspension and cefuroxime axetil to Pfizer’s generics unit Greenstone LLC. Annual Pfizer will work closely with Aurobindo to sort out the issue sales to the US market from Unit VI are around US$30 million. It has filed 30 ANDAs from this facility and received approvals for 20 ANDAs so far. The company has maintained that the ANDAs filed from other manufacturing facilities will not have any impact. Pfizer has indicated that it will help Aurobindo to resolve the issue as soon as it gets clarity on the same. In all our calculations, we have considered the impact of future revenue loss from this facility. ICICIdirect.com | Equity Research Page 2

- 3. ICICI Securities Limited Exhibit 2: Sales have grown at 19% CAGR in FY07-FY10 Exhibit 3: Shift towards formulations 4000 3575 120 3301 3500 3077 100 3000 80 43 2441 54 46 2500 2123 69 61 60 2000 40 1500 54 57 20 39 46 1000 31 500 0 0 FY07 FY08 FY09 FY10 9M FY11 FY07 FY08 FY09 FY10 9M FY11 Formulations APIs Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research Exhibit 4: US accounts for 48% of formulation sales in 9MFY11 Exhibit 5: 9MFY11 sales break-up 120 Dossier Income 100 11 11 USA 16 14 7% 80 14 13 13 25% 20 60 27 28 33 40 40 APIs 20 49 48 EU 38 40% 24 7% 0 FY08 FY09 FY10 9M FY11 ARV ROW 15% 6% USA ARV EU ROW Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research Exhibit 6: Manufacturing facilities Manufacturing facilities Product Type Approvals Cap. Utilisation Indian Formulation Units Unit III Non-Betalactum USFDA, UKMHRA, TGA, Health Canada, MCC(SA), ANVISA (Brazil), WHO High Unit VI Cephs(Oral & Sterlie) USFDA, Health Canada, MCC(SA), ANVISA (Brazil) Moderate Unit XII SSPs (Sterile & Non-Sterile) USFDA, UKMHRA, TGA, Health Canada, MCC(SA), ANVISA (Brazil) Moderate Unit VII (SEZ) Non-Betalactum USFDA Moderate Bhiwadi Penems Sterile Waiting for approvals Low Trident Liquid injectibles Waiting for approvals Yet to Start US Formulation Units US NJ Non-Betalactum (Oral) USFDA Low Indian API Units Unit I CNS, CVS, Anti-allergic USFDA, UKMHRA, TGA, WHO High Unit IA Cephs(Non-Sterlie) USFDA, UKMHRA, TGA High Unit V SSPs (Sterile & Non-Sterile) cGMP High Unit VIA SSPs USFDA, TGA High Unit VIII GI, GRV USFDA, UKMHRA,TGA,WHO High Unit XIA ARV USFDA, UKMHRA,WHO High Intermediates Unit IX Intermediates cGMP High Unit X Intermediates cGMP High Unit XIA Intermediates cGMP High Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 3

- 4. ICICI Securities Limited Exhibit 7: Business Overview Aurobindo Pharma (| 3301 cr, 100%) Formulation (| 1753 cr, 53%) APIs (| 1319 cr, 40%) Dossiers (| 229 cr, 7%) USA (| 840 cr, 25%) SSPs (| 429 cr, 13%) Europe (| 228 cr, 7%) Cephs (| 615 cr, 18%) ARVs (| 493 cr, 15%) Others (| 275 cr, 8%) RoW (|192 cr, 6%) Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 4

- 5. ICICI Securities Limited Investment Rationale APL sales growth will be driven by the formulation business as the company is transforming itself from an API supplier to a generic formulation player. In the last three or four years, it has invested around | 1000 crore to set up and acquire formulation facilities both in India and abroad. The current capacity utilisation of formulation facilities is still low. We expect the formulation business to grow at 26.9% CAGR in FY10-13E on the back of new product launches across geographies and incremental supplies to MNCs. Sales from dossiers will trigger supply deals in future to prospective customers. API supplies to regulated markets will also support topline growth. Despite the embargo on Unit VI, we maintain our positive outlook on the company. Overall, we estimate total gross sales will grow at 17% CAGR of in FY10-13E. Exhibit 8: Sales break-up 4000 3787 3500 3037 3000 2412 2500 1852 1831 1911 2000 1647 1602 1744 1410 1500 1000 500 142 198 260 200 80 0 FY09 FY10 FY11E FY12E FY13E Formulations APIs Dossier Source: Company, ICICIdirect.com Research Change in revenue mix in favour of formulations to improve margins The company was predominantly an API supplier with close to 90% of the sales coming from APIs in FY05. Since then, it has consciously moved up the value chain by expanding into formulations. For 9MFY11, Formulations to constitute ~65% of base business by the formulations to API ratio for the base business stood at 57:43. Going FY13E forward, we believe formulations will constitute more than ~65% of the base sales and maximum APIs will be used for conversion into high margin formulations. The company, in recent years, has ramped up global filing activities and positioned itself as one of the largest generics suppliers from India. The deals with Pfizer and lately with AstraZeneca will demand incremental supply of various formulations to be launched globally. Hence, the gradual shift to formulations will take care of their requirements as well. The shift towards formulations will also improve EBITDA margins. The results are already visible. Margins have improved ~ 860 bps to 23% Margins to remain in the range of 23-24.1% in FY10-FY13E during FY08-10. Although it is true that margins got a boost from higher dossier sales, we believe the main growth will only come from this paradigm shift as the dossier income is expected to come down in the coming years. We expect margins to improve from 23.0% in FY10 to 24.1% in FY 13E. ICICIdirect.com | Equity Research Page 5

- 6. ICICI Securities Limited Exhibit 9: Shift towards formulations Exhibit 10: EBITDA margins to improve, going forward 120 30.0 100 25.0 23.0 23.0 24.1 80 42 38 34 22.6 54 46 20.0 61 60 16.8 15.0 14.4 40 58 62 66 46 54 10.0 20 39 0 5.0 FY08 FY09 FY10 FY11E FY12E FY13E 0.0 FY08 FY09 FY10 FY11E FY12E FY13E Formulations APIs Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research APL’s formulation facilities have been backed by its own API facilities. The business model is vertically integrated with ~95% of the key intermediates and APIs required for formulations made in-house. This has facilitated the company to enter into other niche segments such as cardiovascular (CVS), central nervous system (CNS) and gastroenterologicals (GI), other than its traditional segments of anti- bacterials and ARVs. Despite that, we have also observed that the To expand into niche formulations company will remain committed to anti-bacterials, especially high-end ones such as Cephalosporins (third and fourth generation) and Penems. Also, in ARVs, the company will be selective in tender selection (discussed later). Almost all formulations are meant for exports. Aurobindo has recently added two more formulations facilities (one acquired facility and one SEZ) and upgraded the New Jersey based facility. The SEZ unit VII (capex of | 270 crore), which has already gone on stream from June 2010 has the potential to clock | 1500-2000 crore of sales at the optimum level. It is expected to reach ~30% utilisation Unit VII has the potential to clock | 1500-2000 crore per by the end of FY11. This facility will cater to the non-betalactum product annum class, which is also being catered to by unit III. This unit (i.e. unit III) is already working at over 85% capacity. Hence, there is a need for new capacity. The Trident facility (acquired in 2009) is expected to start commercial production in FY12. The plant is expected to manufacture the general injectable range of formulation products. The company is also building new capacities for oral contraceptives (near Unit VII) and new multipurpose non-betalactum liquid injectable facility near Hyderabad. All these acquisitions/additions will further increase formulations share. Overall, the company has invested nearly | 1000 crore in the last five years to build up the formulation capacities. Since APIs will increasingly be used for formulations, we see the share of APIs to sales coming down to ~33-34% by FY13E. The residual APIs Incremental APIs to be used for captive purpose will more or less cater to regulated markets. We project sales from APIs will grow at 6% CAGR in FY10-13E to | 1911 crore. At the same time, we expect formulations to grow at 26.9% CAGR in FY10-13E to | 3787 crore. ICICIdirect.com | Equity Research Page 6

- 7. ICICI Securities Limited Exhibit 11: API sales to grow at 6% CAGR in FY10-13E Exhibit 12: Formulation sales to grow at ~27% CAGR in FY10-13E 2000 4000 3787 1911 3500 3037 1900 1831 3000 1800 1744 2412 2500 1852 1700 1647 2000 1602 1410 1500 1600 1000 1500 500 1400 0 FY09 FY10 FY11E FY12E FY13E FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research To augment large unused formulation capacity utilisation Aurobindo currently owns 16 manufacturing facilities - 15 in India and one in the US. The recently acquired Trident facility is yet to start commercial production. Overall capacity utilisation in case of most of the formulation plants is still below 50%. Over the years, the company has kept on building huge capacities. On account of the longer gestation period for formulation plants, the company did face certain Better capacity utilisation to improve margins balance sheet issues and cash flow constraints initially. Hence, it had to rely on borrowings, which kept on ballooning. At one point of time the debt/EBITDA stood at nearly 4.5x. However, the deal it entered into with Pfizer in 2009 was in a way a shot in the arm as the deal not only gave new strength but also provided assurances on incremental capacity utilisation. The augmented capacity utilisation will strengthen the EBIDTA margins as shown in the common-size statement. Exhibit 13: Common-size statement FY08 FY09 FY10 FY11E FY12E FY13E Net sales 100 100 100 100 100 100 Total Exp 85.6 83.2 77 77.4 77 75.9 EBITDA 14.4 16.8 23.0 22.6 23.0 24.1 Depreciation 4.1 4.1 4.2 3.8 3.9 3.7 Interest 1.8 2.7 1.9 1.4 2.2 1.8 Tax 2.2 0.7 5.3 5.5 4.3 4.8 Net Profit 9.8 3.3 15.8 13.0 12.9 14.5 Source: Company, ICICIdirect.com Research Incremental capacity utilisation will also cater to the demand from regulated markets culminating from an impending patent cliff other than commitments to large customers like Pfizer and AstraZeneca. We believe the utilisation process will go beyond FY13 as by then the newly added facilities such as Trident for injectables, oral contraceptives and liquid injectible facilities will go on stream. ICICIdirect.com | Equity Research Page 7

- 8. ICICI Securities Limited Exhibit 14: Debt/EBITDA to go down further Exhibit 15: Fixed asset turnover ratio to improve gradually 6.0 2.40 5.4 2.35 2.37 5.0 4.5 2.30 2.28 4.0 2.25 2.24 2.24 2.20 3.0 2.16 2.6 2.7 2.15 2.0 2.10 2.12 1.8 1.4 2.05 1.0 2.00 0.0 1.95 FY08 FY09 FY10 FY11E FY12E FY13E FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research It recently offloaded majority stake (from 100% to 19.5%) in its Chinese manufacturing facility that was a fermentation unit manufacturing 6 APA, a derivative of Penicillin-G. The entire production is consumed by APL India. Since the company intends to focus on high margin anti- bacterials, this step indicates a step by step plan to defocus on semi synthetic penicillins (SSPs) where the competition is intense and, hence, realisation is low. We observe a gradual defocus on SSPs from Offloaded majority stake in Chinese facility to prune losses 23% of sales in FY09 to ~11% of sales by FY13E. Since it was a loss of ~| 20-25 crore per year on a consolidated basis making unit, the company is expected to prune ~ | 20-25 crore of losses in the consolidated financials. Thanks to this offloading, the company expects to strengthen the overall cash flow and operating margins. It has also received | 104 crore as repayment of loan from the Chinese entity. Monetisation of ANDAs in the US Aurobindo was a relatively late entrant in the US market. The strategy in the US market is - 1) to get a hold of huge generic opportunities that would be available in this post patent /drying pipeline era by aggressive USFDA approvals - Therapeutic break-up ANDA filing 2) to exploit and optimise the commercial value of products on hand and 3) to fast track the launch of products and increase the Therapy Final Tentative ARVs 24 25 product pipeline. The company has already established strong Anti Bacterials 16 0 relationships with marketing and distribution channels in the US such as CNS 21 5 McKesson, Riteaid, Amerisource, Kaiser, Cardinal Health, Walgreen, CVS 18 1 Wal-Mart, etc. The deal with Pfizer also augurs well as it covers the US Others 20 2 market for both exclusive and non-exclusive launches. Total 99 33 So far, it has filed 200 ANDAs with the USFDA and received approvals for 132 ANDAs (99 final and 33 tentative). Till date, it has commercialised 80 products in the US. In the next three years, the company is planning to file another 100-125 ANDAs. Besides, it has filed 154 DMFs cumulatively for APIs to USFDA. In July 2006, Aurobindo acquired a US-based FDA compliant cGMP facility for oral dosages in the state of New Jersey from Sandoz for | Filed 10 ANDAs from New Jersey facility 250 crore. This facility has been upgraded to undertake R&D and warehousing requirements. This facility caters to the US institutional demand. The company has already filed 10 ANDAs from this facility. ICICIdirect.com | Equity Research Page 8

- 9. ICICI Securities Limited Exhibit 16: ANDA pipeline trend 250 200 200 172 147 150 128 132 113 94 100 82 63 51 50 35 21 0 FY06 FY07 FY08 FY09 FY10 9M FY11 Filed Approved Source: Company, ICICIdirect.com Research We expect the US business to grow at ~27% CAGR to | 1849 crore in FY10-13E on the back of monetisation of the huge ANDA pipeline. The contribution from US to the overall sales is expected to grow from 17% Strong ANDA pipeline to drive growth in the US market in FY09 to ~32% in FY13E. Exhibit 17: Sales from US market to grow at 27% CAGR in FY10-13E 2000 1849 1800 1600 1445 1400 1135 1200 1000 912 800 558 600 400 236 200 0 FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Pfizer deal In May 2009, APL entered into a licensing and supply agreement with Pfizer Inc. to sell over 100 products in the US, 30 countries in the EU, Canada, Australia-New Zealand and almost 110 rest of world (ROW) countries. The deal is mostly non-exclusive in nature. Supplies to Pfizer have already started in FY10. Pfizer will remain the biggest customer for the company. AstraZeneca deal APL recently signed a licensing and supply agreement with AstraZeneca Sales from AstraZeneca deal would start from FY13 to supply solid dosage and sterile products for emerging markets. These onwards products will cater to therapeutic segments of anti-infectives, CVS and CNS. We expect the sales from this deal to start from FY13 onwards. ICICIdirect.com | Equity Research Page 9

- 10. ICICI Securities Limited EU and ROW businesses shaping up Currently, the European formulation business constitutes 7% of sales. To centralise the European operations, the company has created a hub at Malta to cater to different European customers. This hub operates as a centralised quality control and packaging warehouse. As of on So far, it has filed 906 dossiers with EU regulatory December 31, 2010, the company has filled 906 dossiers (including authorities multiple registrations), received approvals for 351 dossiers and received certificate of suitability for 85 products. Similarly, the company has filled as many as 1224 DMFs cumulatively for APIs in the EU. In February 2006, the company acquired UK based Milpharm Ltd, which is engaged in selling formulations in the UK market. Milpharm owns over 100 approved marketing authorisations (MAs) by Medicines and Healthcare Products Regulatory Agency, UK (UK MHRA). The MAs are well diversified into various segments – CNS, CVS, GI, anti-fungal, anti- bacterial, oncology, cephs and SSPs, anti-diabetic, NSAIDS, etc. In December 2006, it made another acquisition in Europe, of a Dutch company Pharmacin International BV. Pharmacin owns several product dossiers/market authorisations and intellectual property rights (IPRs). Pharmacin has a broad product portfolio in three key segments – CNS, CVS and GI and the dossiers support over 100 product registrations for 63 customers in the Netherlands and Europe. In March 2008, it acquired the third company in Europe, by taking over the Italian operations of German pharmaceutical major TAD Pharmaceuticals. The acquisition has given Aurobindo access to more than 70 ready-to-market products, which will speed up its entry into the Italian generic market. We expect Europe to grow to | 537 crore, at ~31% CAGR in FY10-13E, boosted by 1) acquired businesses, 2) focus on new markets such as Italy, Portugal, Spain and some Eastern European countries and 3) Acquisition and dossier filings to drive EU growth supply agreements with MNCs. The traction will also come from scaling up of the company’s own product portfolio as it intends to leverage on the marketing network from its three acquisitions. Exhibit 18: Sales from EU to grow at ~31% CAGR in FY10-13E Exhibit 19: Sales in ROW markets to grow at ~32% CAGR in FY10-13E 600 537 600 479 500 430 500 400 400 368 331 283 300 237 300 201 192 195 207 200 200 158 100 100 0 0 FY08 FY09 FY10 FY11E FY12E FY13E FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 10

- 11. ICICI Securities Limited Dossier filings & approvals with various counties Similarly the ROW business, which currently forms 6% of sales, will get a boost from MNC deals, aggressive regulatory filings and growing Country Filed Approved demand for branded generics. Till date, APL has filed 233 dossiers in South Africa 124 47 Canada 27 11 South Africa, Canada, Australia and Brazil. Of this, it has received Australia 23 5 approvals for 91 dossiers. Also, it has filed 415 DMFs in various Brazil 59 28 countries. We expect the ROW business to grow at 32% CAGR in FY10- 13E to | 479 crore. ARV segment is tender based The company follows extensive participation in major global tenders. The tenders are for specific programmes such as President's Emergency Plan For AIDS Relief (PEPFAR/Emergency Plan) Clinton Foundation, etc. and country specific tenders. Going forward, we see the company following a measured path for growth by demonstrating greater bidding discipline in global government tenders. We see good Global tenders are major ARV drivers potential in these tenders, given that the US government has spent nearly US$19 billion between 2006 and 2010 for PEPFAR and committed another US$6 billion in 2010 for AIDS programmes. With nearly 33 million people living with HIV/AIDS, this business will remain a steady cash generator for the company in the coming years. This vertical is slated to grow at a CAGR of ~23% to | 921 crore in FY10-13E. Exhibit 20: ARVs to grow at 23% CAGR in FY10-13E 1000 921 900 794 800 662 700 600 495 464 500 404 400 300 200 100 0 FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Dossier sales to trigger supply agreements APL sales dossiers are detailed monographs of non-infringing processes of bio-equivalents, approved sights of manufacturing and procurement of raw materials, which are required to be submitted to Dossier filing will trigger future supplies different regulatory authorities. In Europe, the time taken for filing these dossiers and getting marketing approval (MAs) can be at least 24 months. Once the customer gets marketing approvals, it may approach APL to supply raw materials or finished products. For 9MFY11, dossier income stood at | 229 crore in 9MFY11 compared to | 174 crore in 9MFY10. This income will go down going forward but is expected to tap many potential clients for supply arrangements. ICICIdirect.com | Equity Research Page 11

- 12. ICICI Securities Limited Exhibit 21: Dossier income expected to come down 300 260 250 198 200 200 142 150 100 80 50 11 0 FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research Changing industry dynamics In 2010-2016, drugs worth ~US$110 billion will lose marketing exclusivity worldwide, of which ~US$90 billion will be in the US alone. Although price erosion and increase in competition will be a matter of concern, we believe Indian players, on account of a vertically integrated Impending patent cliff (US$ billion) model and proven capabilities and capacities, are well placed among others. The generic pharmaceutical companies are expected to grow on the back of strong filing momentum and increased volume growth and also drying pipelines from innovators. The stricter norms adopted by 28 28 27 30 the USFDA for generic companies along with rising pricing pressure in 20 20 20 the regulated markets will enable only the stronger and established players to retain their market dominance. Companies with a strong 10 presence in branded formulations, chronic segments, novel delivery 0 systems and backing of own raw material sourcing would be able to 2008 2009 2010 2011 2012 gain sizeable market share and protect their margins at the same time. With close to 120 USFDA approved facilities (second only to the US) Source: ICICIdirect.com Research Indian generic payers will be the major beneficiaries of the so-called impending patent cliff. CY11 will be a year of major turmoil when drugs worth ~US$20-25 billion will lose patents in that year itself. We believe Indian generic players have already smelled the opportunity and we could see the expediting of ANDA filings even in spite of delays in getting approvals from the USFDA. From big players like Ranbaxy and Sun to smaller players like Natco, all are preparing themselves for this opportunity. New facility addition and additional capex APL to add two more formulations facilities- • The new multipurpose liquid injectable facility (Unit IV) near Hyderabad specialises in manufacture of general injectable range including glass vials for lyophilised sterile powder and liquids and ampoules. The facility is expected to get commercialised in FY12 • Oral contraceptive facility near Hyderabad The additional two facilities are expected to go on-stream by FY12-13. This will further boost the formulations basket. It intends to spend an additional | 700-750 crore on capex in FY12 & FY13. ICICIdirect.com | Equity Research Page 12

- 13. ICICI Securities Limited Debt Redemption of FCCBs due in May 2011 Exhibit 22: FCCBs FCCBs Conversion FCCB Fx Rate Underlying Coupon Rate Price O/S 1$=| Shares O/S on Redemption US$ 50 million | 175.8 US$ 33 million 45.15 8.5 million 46.99% US$ 150 million | 202.8 US$ 106 million 45.15 23.5 million 46.29% Source: Company, ICICIdirect.com Research The company will redeem both FCCBs in May 2011. It will require US$ 139 million for FCCB repayment and another US$65 million for YTM and Debt as on December 31, 2010 withholding tax. Aurobindo will repay around US$100 million through Debt Amount internal accruals and roll over the remaining short fall by the FCNR (B) Secured Loans 350 route. As far as unprovided premium on redemption i.e. ~| 291 crore is Working Capital Finance & Unsecured Loans 1210 concerned, the company has maintained that the same will be adjusted Sales Tax Deferment 70 against share premium account. Foreign Currency Covertible Bonds 620 Total Debt 2250 We believe the company’s debt position would improve significantly as incremental capacity utilisation takes place. The FCCBs form ~ 28% of the total debt. We expect the D/E ratio to come down from 1.2x in FY10 to 0.6x by FY13E. Exhibit 23: Debt/equity to ease further 2.0 1.9 1.8 1.7 1.6 1.4 1.2 1.2 1.1 1.0 0.8 0.8 0.6 0.6 0.4 0.2 0.0 FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 13

- 14. ICICI Securities Limited Risk & concerns cGMP related issues to be major threat for future earnings The recently issued embargo on Unit VI will not have much of an impact financially. However, the company will now have to tread cautiously in future as any further deviation from compliance of good manufacturing practices (cGMP) will bring the company in serious trouble. Little presence in domestic formulations market Unlike leading generic peers, the company does not have a strong domestic cushion. All the peers derive ~20-40% sales from domestic branded formulations whereas most of Aurobindo’s domestic revenues come from APIs. Political agitation may hit manufacturing activities at AP facilities Since most of the plants (10 plants) are located in Andhra Pradesh, any escalated turmoil in the state on account of the Telangana agitation will impact the smooth functioning. Pricing pressure on account of competition As more and more players are concentrating on advanced countries like the US and EU, the competition for generics will intensify, thus putting pressure on prices. ICICIdirect.com | Equity Research Page 14

- 15. ICICI Securities Limited Financials Sales to grow at 17% CAGR in FY10-13E With robust growth expected from the formulation business, we project APL’s total sales will grow at ~17% CAGR to | 5720 crore in FY10-13E. Consequently, we project the share of formulation sales in gross sales will increase to 65% in FY13E (vs. 51% in FY10). Topline growth will be supported by steady growth in API sales (CAGR of ~6% in FY10-13E) and dossier income. Exhibit 24: Formulation business to drive overall sales growth 7000 5720 6000 4992 5000 4318 4000 3575 3077 3000 2441 2000 1000 0 FY08 FY09 FY10 FY11E FY12E FY13E Source: Company, ICICIdirect.com Research EBITDA margins to increase in FY10 -13E We expect the company’s EBITDA margins to increase from 23% in FY10 to 24.1% in FY13E mainly driven by strong growth in the formulation business in general, and the US in particular. We project the EBITDA will grow at 18.8% CAGR to | 1379 crore in FY10-13E. Exhibit 25: EBITDA margins to improve, going forward 1600 30.0 1379 1400 114923.0 24.1 25.0 1200 23.0 22.6 975 20.0 1000 823 16.8 800 14.4 15.0 600 516 352 10.0 400 5.0 200 0 0.0 FY08 FY09 FY10 FY11E FY12E FY13E EBITDA EBITDA Margins Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 15

- 16. ICICI Securities Limited Return ratios to improve, going ahead With improved profitability and incremental fixed asset-turnover ratio, we estimate APL will continue to generate high return ratios in FY10-13E. RoCE is projected to increase by ~460 bps in FY10-13E to 21.5%. Exhibit 26: Return ratios trend 25.0 35.0 30.8 21.5 30.0 20.0 19.8 16.0 24.0 25.0 16.9 23.6 15.0 21.2 20.0 23.0 10.0 10.9 15.0 8.3 10.0 5.0 8.1 5.0 0.0 0.0 FY08 FY09 FY10 FY11E FY12E FY13E ROCE RONW Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 16

- 17. ICICI Securities Limited Valuation The revenue mix transformation augurs well for the company that in the past was stamped as predominantly commoditised API business model. Incremental capacity utilisation will also act as an operating leverage to improve the overall profitability. Its foray into niche segments like CNS, CVS and proposed entry into oral contraceptives and high end Penems will optimise the product offerings in the formulation space. The Pfizer deal has come as a shot in the arm at a time when the company is scaling up its capacities. It will infuse steady and incremental cash flows, going forward, besides improving margins. APL is currently trading at steep discount to industry peers on account of the recent meltdown and legacy issues like API model and weak balance sheet. Despite import alert for one facility, we believe other issues such as transformation from an API driven model to niche formulations, incremental capacity utilisation, monetisation of the growing ANDA pipeline and recent deals with leading MNCs will remain intact. We expect the gap in valuation to narrow down, going forward. We have valued the stock at | 257, based on 9x FY13E EPS of | 28.5. Exhibit 27: P/E band chart 450 400 350 300 250 (|) 200 150 100 50 0 Mar-05 Dec-05 Sep-06 Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 Price 11.5x 18.3x 8.9x 6.2x Source: Company, ICICIdirect.com Research Exhibit 28: EV/EBITDA band chart 16000 14000 12000 10000 (| crore) 8000 6000 4000 2000 0 Mar-05 Dec-05 Sep-06 Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 EV 14.2x 12.2x 8.3x 4.4x Source: Company, ICICIdirect.com Research Exhibit 29: Peer valuation (FY12E) M Cap (| cr) EV/Sales EV/E P/BV Base PE RoCE RoNW Aurobindo 5575 1.5 6.5 2.0 12 19.8 23.6 Dr Reddy's Labs 27173 2.9 12.7 4.3 19 17.9 25.7 Ranbaxy Labs 19203 2.1 10.7 2.9 18 10.2 18.8 Sun Pharma 43893 5.7 19.4 4.0 23 18.1 17.3 Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 17

- 18. ICICI Securities Limited Exhibit 30: Profit & loss account (|crore) FY09 FY10 FY11E FY12E FY13E Net Sales 3077 3575 4318 4992 5720 Growth (%) 26 16 21 16 15 Total Operating Expenditure 2561 2752 3344 3843 4341 EBITDA 516 823 975 1149 1379 Growth (%) 47 59 18 18 20 Depreciation 128 150 165 195 211 Interest 84 68 62 110 101 Other Income 18 39 25 32 40 PBT before Exceptional Items 323 645 773 876 1108 Less: Forex & Exceptional Items 201 -109 -26 20 0 PBT 122 754 799 856 1108 Total Tax 21 190 239 214 277 PAT 100 563 560 642 831 Adjusted PAT 266 482 542 657 831 Growth (%) 26 81 12 21 26 EPS (|) 3.4 19.4 19.2 22.0 28.5 EPS (Adjusted) (|) 9.1 16.5 18.6 22.6 28.5 Source: Company, ICICIdirect.com Research Exhibit 31: Balance sheet (| crore) FY09 FY10 FY11E FY12E FY13E Equity Capital 27 28 29 29 29 Reserve and Surplus 1,214 1,801 2,409 2,691 3,436 Total Shareholders funds 1,241 1,829 2,438 2,720 3,465 Secured Loan 988 864 714 814 714 Unsecured Loan 1,345 1,291 1,891 1,291 1,241 Deferred Tax Liability 79 95 95 95 95 Minority Interest 3 4 4 4 4 Source of Funds 3,656 4,083 5,142 4,924 5,520 Gross Block 1,855 2,263 2,808 3,208 3,683 Less: Acc. Depreciation 554 664 810 984 1,170 Net Block 1,301 1,599 1,998 2,224 2,514 Capital WIP 536 570 425 350 150 Net Fixed Assets 1,837 2,169 2,423 2,574 2,664 Net Intangible Assets 98 112 118 121 220 Liquid Investments 0 0 0 0 0 Inventory 878 1,102 1,264 1,198 1,466 Cash 128 73 441 177 157 Debtors 890 956 1,124 1,231 1,410 Loans and Advances 387 371 579 619 753 Total Current Assets 2,289 2,506 3,404 3,229 3,784 Creditors 543 673 769 957 1,097 Provisions 27 35 38 48 55 Total Current Liabilities 570 708 807 1,005 1,152 Net Current Assets 1,719 1,798 2,597 2,224 2,632 Deferred Tax Assets 2 4 4 4 4 Application of Funds 3,656 4,083 5,142 4,924 5,520 Source: Company, ICICIdirect.com Research ICICIdirect.com | Equity Research Page 18