MKG Enterprises Corp 506 (c) private_placement_memorandum

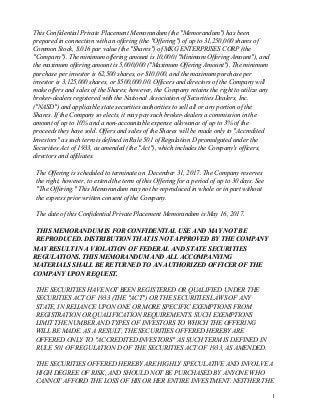

- 1. This Confidential Private Placement Memorandum (the "Memorandum") has been prepared in connection with an offering (the "Offering") of up to 31,250,000 shares of Common Stock, $.016 par value (the "Shares") of MKG ENTERPRISES CORP (the "Company"). The minimum offering amount is 10,000 ("Minimum Offering Amount"), and the maximum offering amount is 5,000,000 ("Maximum Offering Amount"). The minimum purchase per investor is 62,500 shares, or $10,000, and the maximum purchase per investor is 3,125,000 shares, or $500,000.00. Officers and directors of the Company will make offers and sales of the Shares; however, the Company retains the right to utilize any broker-dealers registered with the National Association of Securities Dealers, Inc. ("NASD") and applicable state securities authorities to sell all or any portion of the Shares. If the Company so elects, it may pay such broker-dealers a commission in the amount of up to 10% and a non-accountable expense allowance of up to 3% of the proceeds they have sold. Offers and sales of the Shares will be made only to "Accredited Investors" as such term is defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933, as amended (the "Act"), which includes the Company's officers, directors and affiliates. The Offering is scheduled to terminate on December 31, 2017. The Company reserves the right, however, to extend the term of this Offering for a period of up to 30 days. See "The Offering." This Memorandum may not be reproduced in whole or in part without the express prior written consent of the Company. The date of this Confidential Private Placement Memorandum is May 16, 2017. THIS MEMORANDUM IS FOR CONFIDENTIAL USE AND MAY NOT BE REPRODUCED. DISTRIBUTION THAT IS NOT APPROVED BY THE COMPANY MAY RESULT IN A VIOLATION OF FEDERAL AND STATE SECURITIES REGULATIONS. THIS MEMORANDUM AND ALL ACCOMPANYING MATERIALS SHALL BE RETURNED TO AN AUTHORIZED OFFICER OF THE COMPANY UPON REQUEST. THE SECURITIES HAVE NOT BEEN REGISTERED OR QUALIFIED UNDER THE SECURITIES ACT OF 1933 (THE "ACT") OR THE SECURITIES LAWS OF ANY STATE, IN RELIANCE UPON ONE OR MORE SPECIFIC EXEMPTIONS FROM REGISTRATION OR QUALIFICATION REQUIREMENTS. SUCH EXEMPTIONS LIMIT THE NUMBER AND TYPES OF INVESTORS TO WHICH THE OFFERING WILL BE MADE. AS A RESULT, THE SECURITIES OFFERED HEREBY ARE OFFERED ONLY TO "ACCREDITED INVESTORS" AS SUCH TERM IS DEFINED IN RULE 501 OF REGULATION D OF THE SECURITIES ACT OF 1933, AS AMENDED. THE SECURITIES OFFERED HEREBY ARE HIGHLY SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK, AND SHOULD NOT BE PURCHASED BY ANYONE WHO CANNOT AFFORD THE LOSS OF HIS OR HER ENTIRE INVESTMENT. NEITHER THE 1

- 2. SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS MEMORANDUM IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THESE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER FEDERAL AND APPLICABLE STATE SECURITIES LAWS. THERE IS CURRENTLY NO PUBLIC MARKET FOR THE SECURITIES, AND INVESTORS SHOULD BE AWARE THAT THEY MAY BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. THE STATEMENTS CONTAINED HEREIN ARE BASED ON INFORMATION BELIEVED BY THE COMPANY TO BE RELIABLE. NO WARRANTY CAN BE MADE THAT CIRCUMSTANCES HAVE NOT CHANGED SINCE THE DATE SUCH INFORMATION WAS SUPPLIED. THERE CAN BE NO ASSURANCE THAT THE COMPANY WILL BE ABLE TO SUCCESSFULLY IMPLEMENT ANY OF ITS PLANS, OR THAT ACTUAL FUTURE PLANS AND PERFORMANCE WILL NOT BE MATERIALLY DIFFERENT FROM THE COMPANY'S PRESENT EXPECTATIONS. ANY INFORMATION OR REPRESENTATIONS CONTAINED IN THE COMPANY'S PROMOTIONAL OR MARKETING SOURCES OTHER THAN THIS MEMORANDUM MAY NOT BE AS CURRENT OR ACCURATE AS INFORMATION OR REPRESENTATIONS CONTAINED IN THIS MEMORANDUM, AND THEIR CONTENTS ARE EXCLUDED FROM THIS MEMORANDUM. THIS OFFERING IS SUBJECT TO WITHDRAWAL, CANCELLATION OR MODIFICATION BY THE COMPANY WITHOUT NOTICE. THE COMPANY RESERVES THE RIGHT, IN ITS SOLE DISCRETION, TO REJECT ANY SUBSCRIPTION IN WHOLE OR IN PART FOR ANY REASON OR TO ALLOT TO ANY SUBSCRIBER LESS THAN THE NUMBER OF SHARES SUBSCRIBED FOR OR TO WAIVE CONDITIONS TO THE PURCHASE OF THE SHARES. PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THE CONTENTS OF THIS MEMORANDUM AS LEGAL, INVESTMENT OR TAX ADVICE. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THIS MEMORANDUM DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITY OTHER THAN THE SECURITIES OFFERED HEREBY, NOR DOES IT CONSTITUTE AN OFFER TO 2

- 3. SELL OR A SOLICITATION OF AN OFFER TO BUY SUCH SECURITIES BY ANYONE IN ANY JURISDICTION IN WHICH SUCH OFFER OF SOLICITATION IS NOT AUTHORIZED, OR IN WHICH THE PERSON MAKING SUCH OFFER OR SOLICITATION IS NOT QUALIFIED TO DO SO. IN ADDITION, THE OFFERING MATERIALS CONSTITUTE AN OFFER ONLY IF A NAME AND IDENTIFICATION NUMBER APPEAR IN THE APPROPRIATE SPACES PROVIDED ON THE COVER PAGE AND CONSTITUTE AN OFFER ONLY TO THE PERSON WHOSE NAME APPEARS IN THOSE SPACES. 3

- 4. Name of Offeree: Investor PPM Number: 5816-01 CONFIDENTIAL PRIVATE OFFERING MEMORANDUM MKG Enterprises Corp. Leading mobile tax refund technology company offering tax refund advances $5,000,000 Maximum Common Stock Shares Offered: 31,250,000 Minimum Common Stock Shares Offered: 62,500 Price Per Share: $0.16 Minimum Investment: $10,000 (62,500 Shares) MKG Enterprises Corp. (the “Company” a California “C” Corporation, is offering a minimum of 62,500 and a maximum of 31,250,000 Common Stock Shares for $0.16 per share. The offering price per share has been arbitrarily determined by the Company See Risk Factors: Offering Price. THESE ARE SPECULATIVE SECURITIES WHICH INVOLVE A HIGH DEGREE OF RISK. ONLY THOSE INVESTORS WHO CAN BEAR THE LOSS OF THEIR ENTIRE INVESTMENT SHOULD INVEST IN THESE SHARES. THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), THE SECURITIES LAWS OF THE STATE OF CALIFORNIA, OR UNDER THE SECURITIES LAWS OF 4

- 5. ANY OTHER STATE OR JURISDICTION IN RELIANCE UPON THE EXEMPTIONS FROM REGISTRATION PROVIDED BY THE ACT AND REGULATION D RULE 506 PROMULGATED THEREUNDER, AND THE COMPARABLE EXEMPTIONS FROM REGISTRATION PROVIDED BY OTHER APPLICABLE SECURITIES LAWS. Sale Price Selling Commissions (2) Proceeds to Company (3) Per Share $0.16 $0.016 $.0.14 Minimum $10,000 $1,000 $9.000 Maximum $5,000,000 $500,000 $4,500,000 The Date of this Memorandum is May 16, 2017 (1) The Company reserves the right to waive the 62,500 Share minimum subscription for any investor. The Offering is not underwritten. The Shares are offered on a “best efforts” basis by the Company through its officers and directors. The Company has set a minimum offering amount of 62,500 Shares with minimum gross proceeds of $10,000 for this Offering. All proceeds from the sale of Shares up to $100,000 will be deposited in an escrow account. Upon the sale of 31,250,000 of Shares, all proceeds will be delivered directly to the Company’s corporate account and be available for use by the Company at its discretion. (2) Shares may also be sold by FINRA member brokers or dealers who enter into a Participating Dealer Agreement with the Company, who will receive commissions of up to 10% of the price of the Shares sold. The Company reserves the right to pay expenses related to this Offering from the proceeds of the Offering. See “PLAN OF PLACEMENT and USE OF PROCEEDS” section. (3) The Offering will terminate on the earliest of: (a) the date the Company, in its discretion, elects to terminate, or (b) the date upon which all Shares have been sold, or (c) December 31, 2017 or such date as may be extended from time to time by the Company, but not later than 180 days thereafter (the “Offering Period”.) THIS OFFERING IS NOT UNDERWRITTEN. THE OFFERING PRICE HAS BEEN 5

- 6. ARBITRARILY SET BY THE MANAGEMENT OF THE COMPANY. THERE CAN BE NO ASSURANCE THAT ANY OF THE SECURITIES WILL BE SOLD. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES AGENCY, NOR HAS ANY SUCH REGULATORY BODY REVIEWED THIS OFFERING MEMORANDUM FOR ACCURACY OR COMPLETENESS. BECAUSE THESE SECURITIES HAVE NOT BEEN SO REGISTERED, THERE MAY BE RESTRICTIONS ON THEIR TRANSFERABILITY OR RESALE BY AN INVESTOR. EACH PROSPECTIVE INVESTOR SHOULD PROCEED ON THE ASSUMPTION THAT HE MUST BEAR THE ECONOMIC RISKS OF THE INVESTMENT FOR AN INDEFINITE PERIOD, SINCE THE SECURITIES MAY NOT BE SOLD UNLESS, AMONG OTHER THINGS, THEY ARE SUBSEQUENTLY REGISTERED UNDER THE APPLICABLE SECURITIES ACTS OR AN EXEMPTION FROM SUCH REGISTRATION IS AVAILABLE. THERE IS NO TRADING MARKET FOR THE COMPANY’S COMMON STOCK SHARES AND THERE CAN BE NO ASSURANCE THAT ANY MARKET WILL DEVELOP IN THE FUTURE OR THAT THE SHARES WILL BE ACCEPTED FOR INCLUSION ON NASDAQ OR ANY OTHER TRADING EXCHANGE AT ANY TIME IN THE FUTURE. THE COMPANY IS NOT OBLIGATED TO REGISTER FOR SALE UNDER EITHER FEDERAL OR STATE SECURITIES LAWS THE SHARES PURCHASED PURSUANT HERETO, AND THE ISSUANCE OF THE SHARES IS BEING UNDERTAKEN PURSUANT TO RULE 506 (C) OF REGULATION D UNDER THE SECURITIES ACT. ACCORDINGLY, THE SALE, TRANSFER, OR OTHER DISPOSITION OF ANY OF THE SHARES, WHICH ARE PURCHASED PURSUANT HERETO, MAY BE RESTRICTED BY APPLICABLE FEDERAL OR STATE SECURITIES LAWS (DEPENDING ON THE RESIDENCY OF THE INVESTOR) AND BY THE PROVISIONS OF THE SUBSCRIPTION AGREEMENT REFERRED TO HEREIN. THE OFFERING PRICE OF THE SECURITIES TO WHICH THE PRIVATE PLACEMENT MEMORANDUM RELATES HAS BEEN ARBITRARILY ESTABLISHED BY THE COMPANY AND DOES NOT NECESSARILY BEAR ANY SPECIFIC RELATION TO THE ASSETS, BOOK VALUE OR POTENTIAL EARNINGS OF THE COMPANY OR ANY OTHER RECOGNIZED CRITERIA 6

- 7. OF VALUE. No person is authorized to give any information or make any representation not contained in the Memorandum and any information or representation not contained herein must not be relied upon. Nothing in this Memorandum should be construed as legal or tax advice. The Management of the Company has provided all of the information stated herein. The Company makes no express or implied representation or warranty as to the completeness of this information or, in the case of projections, estimates, future plans, or forward looking assumptions or statements, as to their attainability or the accuracy and completeness of the assumptions from which they are derived, and it is expected that each prospective investor will pursue his, her, or its own independent investigation. It must be recognized that estimates of the Company’s performance are necessarily subject to a high degree of uncertainty and may vary materially from actual results. No general solicitation or advertising in whatever form will or may be employed in the offering of the securities, except for this Memorandum (including any amendments and supplements hereto), the exhibits hereto and documents summarized herein, or as provided for under Regulation D of the Securities Act of 1933. Other than the Company’s Management, no one has been authorized to give any information or to make any representation with respect to the Company or the Shares that is not contained in this Memorandum. Prospective investors should not rely on any information not contained in this Memorandum. This Memorandum does not constitute an offer to sell or a solicitation of an offer to buy to anyone in any jurisdiction in which such offer or solicitation would be unlawful or is not authorized or in which the person making such offer or solicitation is not qualified to do so. This Memorandum does not constitute an offer if the prospective investor is not qualified under applicable securities laws. 7

- 8. This offering is made subject to withdrawal, cancellation, or modification by the Company without notice and solely at the Company’s discretion. The Company reserves the right to reject any subscription or to allot to any prospective investor less than the number of Shares subscribed for by such prospective investor. This Memorandum has been prepared solely for the information of the person to whom it has been delivered by or on behalf of the Company. Distribution of this Memorandum to any person other than the prospective investor to whom this Memorandum is delivered by the Company and those persons retained to advise them with respect thereto is unauthorized. Any reproduction of this Memorandum, in whole or in part, or the divulgence of any of the contents without the prior written consent of the Company is strictly prohibited. Each prospective investor, by accepting delivery of this Memorandum, agrees to return it and all other documents received by them to the Company if the prospective investor’s subscription is not accepted or if the Offering is terminated. By acceptance of this Memorandum, prospective investors recognize and accept the need to conduct their own thorough investigation and due diligence before considering a purchase of the Shares. The contents of this Memorandum should not be considered to be investment, tax, or legal advice and each prospective investor should consult with their own counsel and advisors as to all matters concerning an investment in this Offering. During the course of the Offering and prior to any sale, each offeree of the Shares and his or her professional advisor(s), if any, are invited to ask questions concerning the terms and conditions of the Offering and to obtain any additional information necessary to verify the accuracy of the information set forth herein. Such information will be provided to the extent the Company possess such information or can acquire it without unreasonable effort or expense. EACH PROSPECTIVE INVESTOR WILL BE GIVEN AN OPPORTUNITY TO ASK QUESTIONS OF, AND RECEIVE ANSWERS FROM, MANAGEMENT OF THE COMPANY CONCERNING THE TERMS AND CONDITIONS OF THIS OFFERING AND TO OBTAIN 8

- 9. ANY ADDITIONAL INFORMATION, TO THE EXTENT THE COMPANY POSSESSES SUCH INFORMATION OR CAN ACQUIRE IT WITHOUT UNREASONABLE EFFORTS OR EXPENSE, NECESSARY TO VERIFY THE ACCURACY OF THE INFORMATION CONTAINED IN THIS MEMORANDUM. IF YOU HAVE ANY QUESTIONS WHATSOEVER REGARDING THIS OFFERING, OR DESIRE ANY ADDITIONAL INFORMATION OR DOCUMENTS TO VERIFY OR SUPPLEMENT THE INFORMATION CONTAINED IN THIS MEMORANDUM, PLEASE WRITE OR CALL MKG ENTERPRISES CORP AT THE ADDRESS AND NUMBER LISTED ON THE FRONT OF THIS PRIVATE OFFERING MEMORANDUM. 9

- 10. TABLE OF CONTENTS I. Summary of the Offering A. The Company B. Operations C. Business Plan D. The Offering E. Risk Factors F. Use of Proceeds G. Minimum Offering Proceeds - Escrow of Subscription Proceeds H. Common Stock Shares I. Registrar J. Subscription Period II. Requirements for Purchasers A. General Suitability Standards B. Accredited Investors C. Other Requirements III. Forward Looking Information IV. Risk Factors A. Development Stage Business B. Inadequacy of Funds C. Dependence on Management D. Risks Associated with Expansion E. Customer Base and Market Acceptance F. Competition G. Trend in Consumer Preferences and Spending H. Risks of Borrowing I. Unanticipated Obstacles to Execution of the Business Plan J. Management Discretion as to Use of Proceeds K. Control By Management L. Return of Profits M. No Assurances of Protection for Proprietary Rights; Reliance on Trade Secrets N. Dilution O. Limited Transferability and Liquidity P. Broker - Dealer Sales of Shares Q. Long Term Nature of Investment R. No Current Market For Shares S. Compliance with Securities Laws 10

- 11. T. Offering Price U. Lack of Firm Underwriter V. Projections: Forward Looking Information V. Use Of Proceeds A. Sale of Equity B. Offering Expenses & Commissions C. Corporate Application of Proceeds D. Total Use of Proceeds VI. Management VII. Management Compensation VIII. Board of Advisors IX. Dilution X. Current Shareholders XI. Common Stock SHARE OPTION AGREEMENTS XII. Litigation XIII. Description of Shares XIV. Transfer Agent and Registrar XV. Plan of Placement A. Escrow of Subscription Funds B. How to Subscribe for Shares XVI. Additional Information Exhibits: Available upon request Exhibit A – MKG Enterprises Corp. Financial Services Business Plan Exhibit B – MKG Enterprises Corp., Articles of Incorporation Exhibit C - Subscription Agreement Exhibit D - Investor Suitability Questionnaire 11

- 12. 1. THE OFFERING The Company intends to raise a minimum of $100,000.00 and a maximum of $5,000,000.00 in this Offering to fund the continued growth of our business. The Common Stock will be offered in a private placement offering pursuant to an exemption from registration under Rule 506 (c ) of Regulation D promulgated under the Securities Act of 1933, as amended, under exemptions under applicable state securities laws, and in reliance upon the representations and warranties of each of the purchasers that they are purchasing the Common Stock for investment purposes and not with a view to any resale or distribution thereof. The Offering is being made on an "minimum or maximum basis until the Minimum Offering Amount of,$100,000.00 is raised. Proceeds received prior to raising the Minimum Offering Amount will be held in an escrow account with the Company's bank. Upon raising the Minimum Offering Amount, these proceeds will be released for use by the Company and, thereafter, 100% of the proceeds raised in the Offering, up to the Maximum Offering Amount of $5,000,000.00, will keep funds in an impound or escrow throughout the entire offering. The proceeds from the sale of the Shares offered hereby will be approximately $5,000,000 if all 3,125,000 Shares are sold. The net proceeds from this offering will be used to expand marketing, sales and distribution capabilities and provide working capital. The following itemizes the intended use of proceeds: If maximum amount sold Total Proceeds $5,000,000 Less Offering Expenses $245,000 Less InventHelp/Attorney* Costs $10,000 Net Proceeds $4,745,000 Initial Public Offering (IPO) $100,000 Mobile App Development $20,100 Financing of Tax Advance Refund Anticipation Loans $1,000,000 Financing Auto Title Loans $1,000,000 Franchising Business $50,000 Administrative Costs $145,000 Operational Overhead Cost $155,096 Commercial Real Estate Investment $650,000 Debt Securities $64,300 Total Use of Proceeds $3,184,496 Remaining Capital $1,560,504 12

- 13. *Invent Help and our the Patent Attorney has agreed to package and market MKG Tax Refund to 100 companies and file utility patent and complete development of MKG Tax Refund mobile app technology development of MKG Enterprises infrastructure $10,000 SUMMARY OF THE OFFERING The following material is intended to summarize information contained elsewhere in this Limited Offering Memorandum (the “Memorandum”). This summary is qualified in its entirety by express reference to this Memorandum and the materials referred to and contained herein. Each prospective subscriber should carefully review the entire Memorandum and all materials referred to herein and conduct his or her own due diligence before subscribing for Common Stock Shares. A. The Company MKG Enterprises Corp.. (the “Company”) was formed on March 20, 2013, as a California corporation. At the date of this offering, Nine Hundred and Seventy Thousand Thousand One Hundred Thirty One (970,131) Shares of the Company’s voting Common Stock were authorized, issued and outstanding. The Company is in the business of being a reseller of PrePaid Visa CashPass Debit Cards offered by Metropolitan Commercial Bank, Auto Equity Title Loans and Tax Refund Secured Loans. Its principal offices are presently located at 3003 N Blackstone Ave Fresno, California 93703. The Company’s telephone number is (866) 675-3933. The Director or Officers of the Company are Marshawn Govan. EXECUTIVE SUMMARY MKG ENTERPRISES CORP, (hereinafter "the Business") is a corporation located at 3003 N Blackstone Ave, FRESNO, California, 93703. The Company was founded in 2013 by Marshawn Govan. It currently has a staff of 3 people, and is slated to expand further. The Company was initially capitalized late 2010 by an investment of $7,500.00 of which a sum of $7,500.00 is from Marshawn Govan. The Business's first product was introduced to the market in December 23, 2010 and has been marketed successfully till date. The break-even point was reached in February of 2015, and a profit of $100,000.00 is projected for the current years. The Company is also developing innovative packages nearing beta test stage, which can be expected to produce revenue before the end of the financing period. The Company is also 13

- 14. gearing up for introduction of its products into international markets. MKG Enterprises Corporation entity structure is a California Domestic Corporation. The objectives of MKG Enterprises are to generate a profit, grow at a challenging and manageable rate and to be a good citizen in the community. The mission of MKG Tax Consultants and MKG Insurance Agency is to provide products and services with high quality, protection and value pricing. The keys to success for MKG are a variety of business services and products, personal contact, timely and accurate service, development of one-to-one relationships, and a reputation of honesty and integrity. Objectives The main objectives of MKG Enterprises Corp. DBA MKG Insurance Agency | MKG Tax Consultants are: ● Profit - to create enough prosperity for the company and employees to have a secure and comfortable lifestyle. ● Growth - to grow the business at a rate that is both challenging and manageable. ● Citizenship - to be a social asset to the community and contribute to others who are less fortunate. Our Crusade MKG Enterprises Corp. is dedicated to providing tax preparation, refund tax loans, insurance products and business services that provide high quality, protection, and value pricing. We wish to establish a successful partnership with our clients that respects their interests and goals. Success will be measured by our clients choosing us because of their belief in our ability to meet or exceed their expectations of price, service, and expertise. Keys to Success The keys to the success for MKG Insurance Agency are: ● A wide variety of business services and insurance products that are affordable, available and understandable. ● Personal contact and service that meets or exceeds the expectations of our Clients. ● Services and products that are delivered with accuracy and timeliness. ● Relationships with our clients that fosters renewal business. ● A reputation in the community for it's Honesty and Integrity. Company Diversification Summary MKG Tax Consultants | MKG Insurance Agency - providing Income Tax Preparation, Retirement planning, Health Insurance, Dental, Annuities, Life, Auto, Home, Property & Casualty Insurance. MKG Tax Consultants IRS Electronic Filing Identification Number(s) EFIN’s 778278 and 778169 has been established since December 23, 2010. MKG Tax Consultants incorporated March 20, 2013 under the legal name MKG Enterprises Corporation. MKG Insurance Agency merged with MKG Enterprises Corporation insurance and tax division to provide world class 14

- 15. financial products and services. MKG Insurance Agency CA License No. 0J03013 is a new company that launched in the fall of 2014 located in Fresno, CA, the fifth largest city in CA, providing Auto, Home, Life and Health Insurance services and insurance retirement products to individuals, families, and small businesses. Currently licensed in the following States; California Department of Insurance License No. 0J03013 Texas Department of Insurance License No. 2126837 New Mexico Partnership Corporation License No. 100014763 Florida MGA License No. W383809 MKG Money Service Business, Cash ASTRO Lender is a licensed California Finance Lender issued by the State of California Department of Business Oversight California Finance Lender License 60DB0-45224, 60DBO58213. It has developed a $2,510 proprietary (RAC) short term Look Alike Tax Refund Advance Product, that can be applied for using their mobile app that is a tax-refund related loan provided by MKG Money Service Business, (it is not the actual tax refund). Choose from $500 to $2,510 dollar tax refund advance. The amount of the advance is deducted from tax refunds and reduces the amount that is paid directly to the taxpayer. Tax returns may be filed electronically without applying for this loan. (The IRS does not guarantee that a person will be paid the full amount of an anticipated tax refund and does not guarantee that an anticipated tax refund will be deposited into a person’s account or mailed to a person on a specific date.) Eligibility for MKG Money Service Business (T-RALS’s) Tax Refund Accepted Loans requires enrollment in the Electronic Refund Disbursement Service and selection of one of the following disbursement options: CashPass Prepaid VISA Card or eCheck. https://enrollsecure.cashpass.com/mkgtaxconsultants/ eChecks are paperless checks that feature cutting-edge technology and are the only online payment solution that works for everyone. This smart addition to our tax refund advances than traditional paper checks. Features:eChecks The Security of a Check. The Speed of an eMail ● Disburse tax refund advances From Anywhere, Anytime ● Disburse tax refund advances Quickly & Easily ● Disburse tax refund advances More Securely Availability is subject to satisfaction of identity verification, eligibility criteria, and underwriting standards. California loans are made pursuant to MKG Money Service Business, Cash Advance Short Term Repayment Option Lender California Department of Business Oversight Finance Lenders Law License 60DBO-45224, 60DBO-58213 15

- 16. Refund Anticipation Check (RAC) is a tax refund-related deposit product provided by MKG Tax Refund. Fees apply. You must meet legal requirements for opening a bank account. RAC is a bank deposit, not a loan, and is limited to the size of your refund less applicable fees. You can e-file your return and get your refund without a RAC, a loan or extra fees. The Refund Transfer (RT) is a non-loan product designed for taxpayers who cannot or do not wish to pay out-of-pocket for income tax return preparation and related costs. The IRS deposits the taxpayer's federal income tax refund into a temporary account, typically in as little as 21 days, from the date the IRS acknowledges processing the federal tax return. Upon receipt of the refund from the IRS, the authorized fees are deducted and disbursed. The remaining balance is disbursed to the taxpayer via the disbursement method chosen. MKG Enterprises Corp has a permanent office that is staffed and open year round. We provide enrollment assistance to consumers as both walk-ins and appointments by being centrally located near downtown Fresno that is accessible to travel from Fresno Area Express downtown bus routes. Major highways are freeway 41 Shields exit and major cross streets intersections Shields and Blackstone that Fresno Area Express bus route 30 runs from 5:30am-1am making MKG Tax Consultants storefront an ideal location for consumers to visit for enrollment assistance traveling by bus or car. Physical location is 3003 N Blackstone Ave Ste 209, Fresno, CA 93703, Phone (559) 412-7248 or (866) 675-3933, hours of operation 10:00 am-5:30 pm Monday-Saturday. Company Ownership MKG Enterprises Corp families of companies is owned by Mr. Govan. Born and raised in the Fresno CA. Mr. Govan has been entrepreneurial for over a decade starting in Feb 25, 2005 The firm management team has over 20 years of experience in Finance, Accounting, Management, and Consulting and is a California insurance agency license for Life, Health, Property and Casualty insurance. MKG Tax Consultants has assisted thousands of tax clients and is experienced in supporting customer's health insurance needs and providing free tax education and health insurance resources in the community. The firm offers tax preparation to individual taxpayers as well as to small business clients. The client has choices in tax preparation; health insurance, auto, and property and casualty insurance enrollment center however we stand out as an affordable solution that incorporates certified industry knowledge, a professional and courteous staff and an invaluable guarantee. Management and Technical Experience MKG Enterprises Corp management experience consist of 20 years of tax experience and has prepared and filed over 2,000 individual US tax returns and distributed over 3 million dollars in customer refunds since company began operating. 16

- 17. B. Operations Our Mission is to help individuals, families and businesses achieve financial security and independence through the use of our world-class financial products, which protect against loss as well as increase and safeguard assets. We empower individuals with the financial knowledge to make educated decisions and plan for their future. We know people don't plan to fail, but they will if they fail to plan. C. Business Plan Portions of the MKG Enterprises Corp. Business Plan, included as a separate document, were prepared by the Company using assumptions, including several forward looking statements. Each prospective investor should carefully review the Business Plan in association with this Memorandum before purchasing Shares. Management makes no representations as to the accuracy or achievability of the underlying assumptions and projected results contained herein. D. The Offering The Company is offering a minimum of 62,500 and a maximum of 5,000,000 Shares at a price of $.016 per share, $.016 par value per share. Upon completion of the Offering between 3,500,000 and 4,000,000 Shares will be outstanding. Each purchaser must execute a Subscription Agreement making certain representations and warranties to the Company, including such purchaser’s qualifications as an Accredited Investor as defined by the Securities and Exchange Commission in Rule 501(a) of Regulation D promulgated, or Accredited Investors that may be allowed to purchase Shares in this offering. See “REQUIREMENTS FOR PURCHASERS” section. MKG Enterprises Corp Investors app is Live on Google app store. Download the Accredited Investor's app for free. 17

- 18. https://play.google.com/store/apps/details?id=com.appswiz.mkgenterprisescorpinvestors&am p;hl=en We're very excited to now be in the app store! Our app has been designed with MKG Enterprises Accredited Investors in mind - focusing on giving you a better user experience. It allows you to easily stay up to date with everything we've got going on, communicate with us at the touch of a finger, and even receive notifications from us for all the latest Regulation D 506 (c) investment to Accredited Investor, Angel Investors, Venture Capital investors and Verified Accredited Investors to buy common stocks in Early Stage Startup private equity and investments. Proposed Investments MKG Enterprises Corp private investors portal allows investors to learn more about our private placement offering and investment strategy. The Fresno DMA (Designated Market Area) size is considered California fifth largest city population of 984,541 residents. Fresno Labor force is estimated to be 442,500 source cited http://www.fresnoedc.com/siteselection/labormarket.html The IRS reported 122,164,000 million tax returns were e-filed for Tax Year 2016. We anticipate for Tax Year 2018 e-file statistics for (RT) Refund Transfer to be projected at $16,824,600,000 billion dollars tax industry to $30,541,000,000 billion dollars tax industry processing (RT) Refund Transfers. 18

- 19. According to the IRS Statistics MKG Tax Refund will need an enormous amount of capital to supply the consumer demand for Tax Advances and support the total volume of estimated return that are expected to be filed 2018 tax season. The IRS has reported that as of April 2017, more than 122,164,000 million tax returns were e-filed for Tax Year 2016. The number of tax returns safely e-filed has continued to increase each year. The increasing trend among taxpayers to e-file is shown in the charts below. Are There More Self-Preparers or e-filers Using Home Computers to e-file Their Tax Returns? United States taxpayers who self prepare and e-file their own tax returns has continued to grow. In 2017 (for Tax Year 2016), over 51,763,000 million taxpayers have prepared and e-filed their federal tax returns themselves as of April 2017. How Many Taxpayers Have Received Their Tax Refunds via Direct Bank Deposit? As of April 2017, over 81,646,000 million taxpayers have received faster federal tax refunds via direct bank deposits into bank accounts through electronic bank transfers. The average tax refund received by direct deposit is $2,932. Source cited: https://www.efile.com/efile-tax-return-direct-deposit-statistics/ E. Risk Factors See “RISK FACTORS” section in this Memorandum for certain factors that could adversely affect an investment in the Shares. Those factors include, but are not limited to unanticipated obstacles to execution of the Business Plan, general economic factors, Industry regulations and borrowers defaulting on loan, FMS debt, bankruptcy, unemployment, auto accidents losses of assets, borrower becomes deceased / pledged collateral or other Federal/State offset notices that affects (ATR) Ability To Repay. 19

- 20. Investors should consider carefully information contained in the PPM, including investment objectives, risks, charges, and expenses. Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of MKG Enterprises Corp. Private Placements are not individually redeemable directly with the exchange market NASDAQ, S&P500, Dow Jones, OTC Markets, Pink Sheet. Shares are bought and sold at par value, which may be higher or lower than the net asset value (NAV). Equity Crowd Funding Offering Memorandum: Not FDIC Insured • No Bank Guarantee • May Lose Value THESE ARE SPECULATIVE SECURITIES WHICH INVOLVE A HIGH DEGREE OF RISK. ONLY THOSE INVESTORS WHO CAN BEAR THE LOSS OF THEIR ENTIRE INVESTMENT SHOULD INVEST IN THESE SHARES. THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), THE SECURITIES LAWS OF THE STATE OF CALIFORNIA, OR UNDER THE SECURITIES LAWS OF ANY OTHER STATE OR JURISDICTION IN RELIANCE UPON THE EXEMPTIONS FROM REGISTRATION PROVIDED BY THE ACT AND REGULATION D RULE 506 PROMULGATED THEREUNDER, AND THE COMPARABLE EXEMPTIONS FROM REGISTRATION PROVIDED BY OTHER APPLICABLE SECURITIES LAWS. The expenditures projected in the foregoing list are estimates based on management projections of the operating needs of the business. Although the amounts set forth represent our present intentions with respect to proposed expenditures, actual expenditures may vary substantially, depending upon future developments such as marketing decisions, sales activity, and certain other factors. The following table sets forth the actual capitalization of the Company prior to the Offering and as adjusted to reflect receipt of the Maximum Offering Amount proceeds from the 20

- 21. issuance and sale of all 31,250,000 Shares in the Offering. The total shareholder's equity is $152,221 with a total Company capitalization of $4,847,779 The following description of certain matters relating to the securities of the Company does not purport to be complete and is subject in all respects to applicable California law and to the provisions of the Company's articles of incorporation ("Articles of Incorporation") and bylaws (the "Bylaws"). Each share of Common Stock entitles the holder thereof to one vote on all matters submitted to a vote of the shareholders. The holders of Common Stock do not have preemptive rights or rights to convert their Common Stock into other securities. Holders of Common Stock are entitled to receive, pro rata, such dividends as may be declared by our Board of Directors out of legally available funds. Upon liquidation, dissolution or winding up of the Company, and after payment of creditors and the liquidated preference to preferred stockholders, if any, the assets will be divided pro-rata on a share-for-share basis among the holders of the shares of Common Stock. All shares of Common Stock now outstanding are fully paid, validly issued and non-assessable The certificates representing the Shares being offered hereby will bear a legend to the effect that the Shares represented by the certificate are not registered under the Act, or under the securities laws of any state, and therefore cannot be transferred unless properly registered under the Act or pursuant to an opinion of counsel satisfactory to counsel to the Company that an exemption from the Act is available. The following table sets forth certain information, as of July 24, 2017 and as adjusted to give effect to the Offering, regarding the beneficial ownership of the Common Stock by (i) each beneficial owner of more than 5% of the outstanding shares of Common Stock, (ii) each director of the Company, and each executive officer of the Company, and (iii) by all executive officers, directors of the Company as a group. The founder Marshawn Govan on March 20, 2013 who formed the company. He has already invest $155,221 at $0.016 per share and get 970,131 shares of common stock. He also has the option to issue 625,000 options as upside, for his work and contributions to the business. 21

- 22. Invested Common Options Warrants Fully Diluted Percent Founder Stock $155,221 @ $0.16 per share Founder/CEO $155,221 970,131 625,000 0 1,595,131 100.00% TOTALS $155,221 970,131 625,000 0 1,595,131 100.00% The Company currently intends to retain its earnings for future growth and, therefore, do not anticipate declaring any dividends in the foreseeable future. The Company would expect that determinations to pay dividends on its shares would be based primarily upon the financial condition, results of operations, regulatory and business capital requirements, any restrictions contained in financing or other agreements binding upon the Company, and other factors that the board of directors deems relevant. 2. BUSINESS PLAN The company strategy is to: Invented mobile software application concept and the needs it fulfill. The app that is suggested to allow a customer to more easily apply for and receive a short term loan that would be based upon customer's expected Federal Tax Refund as collateral and repayment provided by MKG Enterprises Corp. and its affiliate's MKG Money Service Business, Cash Advance Short Term Repayment Option Lender, MKG Tax Consultants. In regards to the New IRS Tax Law passed the PATH ACT delaying tax refunds until Feb 15 CASH ASTRO Lender as having the potential to generate loan reviews for banks, tax businesses, finance lenders, credit lenders a green product/service that could eliminate physical paperwork and reduce the related processing and overhead efforts. The marketing strategy is to: During the tax filing process, the consultants were collecting their customers’ critical income data and relevant financial information through paper based questionnaires manually and taking them back to their offices, for calculations and computations. This process was time consuming and led to data entry errors as well. The tax consultancy felt a pressing need for more efficient operations by reducing the consultant turnaround time and decreasing data entry errors. They were looking for a mobile solution which would work even from remote locations so that the data collection process was not hampered while visiting localities with poor connectivity. Solution Mobile Forms solution was an ideal fit for our client as they could submit their income information directly to their back-end system and the tax evaporators could quickly calculate the tax to be paid, thus shortening the tax collection process. Moreover, the offline data capture facility enabled them to access these forms at remote locations, and then sync their data to their back-end systems once they had network access. 22

- 23. Features • Data validations and pre-populated fields • Complex computations and calculations • Strong back-end integration • Image capture & E-signature • Automated workflows • Offline data capture Results • Entire data calculations and information can be filled in 30% lesser time than paper based forms • Reduced overall turnaround time of development by 20 - 25% (approx.) • Acquiring 20% incremental customers and similar surge in number of transactions (approx.) 3. MANAGEMENT The following table sets forth each director, principal director, and other control person: Name Position/Title Marshawn Govan President, CFO Bio: Marshawn Govan Founder & Incorporator of MKG Enterprises Corp family of companies was born and raised in Fresno CA since 1977. Currently he has been a licensed tax professional for 7 years IRS PTIN P01043971, California Tax Education Council CTEC No. A180059 as well as a licensed insurance agent California Insurance License No. 0I72129, New Mexico Insurance License 428869 since 2014. Mr Govan is passionate about preparing taxes and providing quality insurance services in the community. License Verification PTIN Directory: https://www.ptindirectory.com/write-client-review.cfm?cpa_dir_id=513613 CTEC website: https://www.ctec.org/Payer/FindVerifyPreparer/ CA Department of Insurance: http://www.insurance.ca.gov/0200-industry/0008-check-license-status/index.cfm Mr. Govan has been entrepreneurial for over a decade starting in Feb 25, 2005. In December 2010 Mr Govan became a franchisee and purchased a Liberty Tax Franchise in Clovis CA and was in the top 50 list of single operators. In early 2012 he expanded his franchise location to open his second location and went on to open a kiosk in Walmart Neighborhood Market open 24 hours. Past trials and tribulations faced: Mr Govans also defended his franchise in US Federal Court under equal protection laws against the City of Clovis the banned his sign wavers from holding a sign, restricting his advertisement and commercial freedom of speech. Mr Govan was later 23

- 24. defeated by the City but the court upheld his claim to his fourteenth amendment right for equal protection. From past experience in the franchise business Mr. Govan has incorporated his past and future experience to become the innovator of MKG Tax Refund. Directors will hold office until their successors have been elected or qualified at an annual shareholders' meeting, or until their death, resignation, retirement, removal, or disqualification. Vacancies on the board will be filled by a majority vote of the remaining directors. Officers of the Company serve at the discretion of the Board of Directors. We may establish an informal Executive Advisory Board with appointments made by the Board of Directors. The role of the Executive Advisory Board will be to assist our management with general business and strategic planning. We intend to compensate Executive Advisory Board member include many large companies that have substantially greater market presence and financial, technical, marketing and other resources than we do. There can be no assurance that we will be have the financial resources, technical expertise or marketing and support capabilities to compete successfully. Increased competition could result in significant price competition, which in turn could result in lower revenues, which could materially adversely affect our potential profitability. Over Reliance on Management We depend on our senior management to work effectively as a team, to execute our business strategy and business plan, and to manage employees and consultants. Our success will be dependent on the personal efforts of key personnel. Any of our officers or employees can terminate his or her employment relationship at any time, and the loss of the services of such individuals could have a material adverse effect on our business and prospects. Our senior management team has worked together for only a very short period of time, and may not work well together as a management team. Forward Looking Statements This Memorandum contains forward-looking statements that are based on our current expectations, assumptions, estimates, and projections about our business, our industry, and the industry of our clients. When used in this Memorandum, the words "expects," anticipates," "estimates," "intends," "believes," and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. The cautionary statements made in this Memorandum should be read as being applicable to all related forward-looking statements wherever they appear in this Memorandum. ADDITIONAL INFORMATION As a prospective investor, you and your professional advisors are invited to review any materials available to us relating to our Company, our plan of operation, our management 24

- 25. and financial condition, this Offering and any other matter relating to this Offering. We will afford you and your professional advisors the opportunity to ask questions of, and receive answers from, our officers concerning such matters and to obtain any additional information (to the extent we possess such information and can acquire it without unreasonable expense) necessary to verify the accuracy of any information set forth in the Memorandum. All such information and materials may be requested from Marshawn Govan at (559) 309-3260. Investment in the Shares involves significant risks and is suitable only for persons of adequate financial means who have no need for liquidity with respect to this investment and who can bear the economic risk of a complete loss of their investment. The Offering is made in reliance on exemptions from the registration requirements of the Securities Act and applicable state securities laws and regulations. The suitability standards discussed below represent minimum suitability standards for prospective investors. The satisfaction of such standards by a prospective investor does not necessarily mean that the Shares are suitable investment for such prospective investor. Prospective investors are encouraged to consult their personal financial advisors to determine whether an investment in the Shares is appropriate. The Company may reject subscriptions, in whole or in part, in its absolute discretion. The Company will require each investor to represent in writing, among other things, that (i) by reason of the investor's business or financial experience, or that of the investor's professional advisor, the investor is capable of evaluating the merits and risks of an investment in the Shares and of protecting its own interests in connection with the transaction (ii) the investor is acquiring the Shares for its own account, for investment only and not with a view toward the resale or distribution thereof, (iii) the investor is aware that the Shares have not been registered under the Securities Act or any state securities laws, (iv) the investor is aware of, and has executed and delivered, the subscription agreement to be entered into in connection with the purchase of the Shares, (v) the investor is aware of the absence of a market for the Shares, and (vi) unless otherwise approved by the Company, such investor meets the suitability requirements set forth below. Except as set forth below, each investor must represent in writing that he or she qualifies as an "accredited investor," as such term is defined in Rule 501(a) of Regulation D under the Securities Act, and must demonstrate the basis for such qualification. To be an accredited investor, an investor must fall within any of the following categories at the time of the sale of the Shares to that investor: (1)A natural person whose individual net worth, or joint net worth with the person's spouse, at the time of such person's purchase of the Shares exceeds $1,000,000; excluding primary residence. (2)A natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person's spouse in excess of $300,000 in each of 25

- 26. those years and has a reasonable expectation of reaching the same income level in the current year; (3)A bank as defined in Section 3(a)(2) of the Securities Act, or a savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or fiduciary capacity; a broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934; an insurance company as defined in Section 2(13) of the Securities Act; an investment company registered under the Investment Company Act of 1940 or a business development company as defined in section 2(a)(48) of that Act; a Small Business Investment Company licensed by the United States Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivision, for the benefit of its employees, if such plan has total assets in excess of $5,000,000; an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of that Act, which is either a bank, savings and loan association, insurance company, or registered investment advisor, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan with the investment decisions made solely by persons that are accredited investors; (4)A private business development company as defined in Section 202(a)(22) of the Investment Advisors Act of 1940; (5)An organization described in Section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the Shares, with total assets in excess of $5,000,000. 6)A director or executive officer of the Company; (7)A trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) of Regulation D; and (8)An entity in which all of the equity owners are accredited investors (as defined above). As used in this Memorandum, the term "net worth" means the excess of total assets over total liabilities. In computing net worth for the purpose of (1) above, the principal residence of the investor must be valued at cost, including cost of improvements, or at recently appraised value by an institutional lender making a secured loan, net of encumbrances. In determining income, an investor should add to the investor's adjusted gross income any amounts attributable to tax exempt income received, losses claimed as a limited partner in any limited partnership, deductions claimed for depletion, contributions to an IRA or other retirement plan, alimony payments, and any amount by which income from long term capital gains has been reduced in arriving at adjusted gross income. Any person or entity who meets the suitability standards set forth herein and who desires to 26

- 27. purchase Shares offered hereby shall be required to deliver all of the following to the Company prior to such purchase: (a) Signed original copies of the Subscription Agreement. On each signature page, the subscriber must sign, print his, her or its name, address, and social security number or tax identification number where indicated and print the number of Shares subscribed for and the date of execution. The Subscription Agreement will be used by the Company to determine whether the prospective purchaser is an "accredited investor," whether he or she has the requisite knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of a purchase of the Shares, and to determine whether state suitability requirements have been met. All questions must be answered in full. If the answer to any question is "no" or "not applicable," please so state. The last page of the Subscription Agreement must contain the printed name of the subscriber, the required signature and the date of execution. (b) A check or money order equal to the total purchase price of the Shares being purchased. The Company reserves the right to accept or reject any subscription for Shares in whole or part for any reason whatsoever. If a subscriber is rejected by the Company, all funds tendered for investment will be returned to the subscriber, without interest or deduction, promptly after such rejection, along with notice thereof. 27